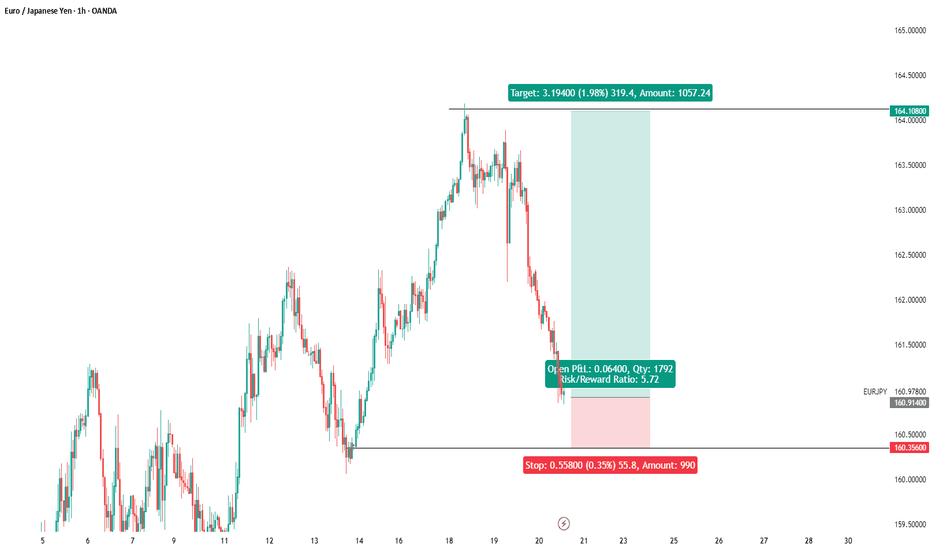

EURJPY Setup IdeaLooking for a long entry, limit order set....

Here is my logic from left to right: we have an short term "double top" forming inside a higher time frame up trend, I'm looking for a run on the stops of traders going short.

We found support at a bullish liquidity pocket (bottom red spot) = Bullish sign

Price completed a bullish harmonic (that grey double top structure is a harmonic) = Bullish sign

Price gave me entry signal with H1 break of structure (blue zone) = Bullish sign

We have equal lows sitting just above the blue line (X's) = Bullish sign

My target is the next red zone even though im projecting this pair to go much higher.

Earlier this week in my newsletter, I gave two zones to look for buy reactions in for EURJPY.

(the huge purple zone on the left, and the bottom red zone within it which currently has a +75 pip reaction.)

Feel free to check it out, the link is in my post signature, and profile bio.

Cheers 🍻

Eurjpyshort

eurjpy analysis ellio. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurjpy buy signal

Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURJPY - Expecting Retraces Before Prior Continuation HigherHi Traders, on March 12th I shared this "EURJPY Short Term Buy Idea"

We expected to see correction prior to the bullish continuation. You can read the full post using the link above.

Price is moving as per the plan!!!

Based on the current scenario my bullish view still remains the same here.

We have bearish divergence in play based on the moving averages and histogram of the MACD and I expect to see retraces now before further continuation higher.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

---------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.-

EURJPY sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURJPY forming a top?EURJPY - 24h expiry

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

There is no sign that this bullish momentum is faltering but the pair has stalled close to a previous swing high of 162.36.

This is negative for short term sentiment and we look to set shorts at good risk/reward levels for a further correction lower.

Preferred trade is to sell into rallies.

Although the anticipated move lower is corrective, it does offer ample risk/reward today.

We look to Sell at 162.30 (stop at 163.22)

Our profit targets will be 159.68 and 157.60

Resistance: 164.15 / 166.70 / 169.90

Support: 160.75 / 159.35 / 157.60

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

EUR/JPY Weekly Forecast – Liquidity Grab Before Bullish Move 🔍 Market Overview:

EUR/JPY is currently approaching a key weekly sell-side liquidity zone. We anticipate that institutions will sweep this liquidity before driving price higher for a long-term bullish trend.

🎯 Trade Plan:

✅ Wait for Liquidity Grab: Look for price to take out the weekly sell-side liquidity (SSL) before considering long positions.

✅ Confirmation Zone: Watch for a strong reversal signal near demand zones after the liquidity sweep.

✅ Bullish Targets:

Target 1: First supply zone after BOS (Break of Structure).

Target 2: Higher timeframe order block for extended bullish move.

📊 Key Market Confluences:

🔹 Liquidity Sweep: Institutions may clear weak buy-side traders before reversing.

🔹 Smart Money Concept (SMC): We need a clear Change of Character (ChoCH) for bullish confirmation.

🔹 Institutional Order Flow: Watch for high-volume rejections & price absorption signs.

🚀 Best Trading Sessions to Monitor:

📌 London & New York Overlap – High volatility expected for entry confirmation.

⚠️ Risk Management:

Patience is key! Wait for the liquidity grab and a strong bullish reaction before entering long positions. No FOMO!

💬 Do you see EUR/JPY flipping bullish after liquidity sweep? Comment below! 👇🔥

EUR/JPY – High-Probability Short Setup 1️⃣ Market Overview – Bearish Bias Confirmation

EUR/JPY remains in a strong downtrend, forming lower highs and lower lows. Currently, the price is retracing into a critical Fibonacci resistance zone, making this a prime opportunity to short the pair in line with institutional sentiment and seasonality trends.

2️⃣ Fibonacci Levels – Identifying Key Resistance

The Fibonacci retracement is drawn from the most recent bearish impulse.

Resistance Zone: 0.5 (156.888) to 0.786 (157.107) – a high-probability rejection area.

If price fails to break above this zone, a continuation to the downside is expected.

Prime Seasonality Insights – Historical Data Supports the Short Bias

📊 Seasonality trends over 15 years indicate that EUR/JPY historically declines in late February and early March.

🔻 February seasonality performance: -0.7% average return

🔻 Next 3-5 day forecast: Bearish probabilities (-0.06% to -0.21%)

🔻 Seasonality prediction candles show a short-term retracement, followed by downside continuation.

💡 This aligns with the technical setup, reinforcing a short bias.

4️⃣ Retail Sentiment – Smart Money Edge

🚨 79% of retail traders are LONG on EUR/JPY – a contrarian signal for a short trade.

🔻 Institutions (Smart Money) are aggressively shorting EUR/JPY, as seen in COT data.

🔻 Commitment of Traders (COT) Report shows increased institutional short positioning.

🔻 Retail traders trapped in longs will likely get stopped out, fueling further downside.

5️⃣ Technical Confirmation – Trendline & Indicators

✅ Price is below all major EMAs (6, 24, 72, 288) on the 4-hour chart.

✅ Supertrend remains bearish on the 4-hour timeframe.

✅ A downward sloping trendline aligns with the Fibonacci resistance zone.

💡 I will wait for confirmation (rejection wick, bearish engulfing candle) before entering a short position.

6️⃣ Conclusion – Trade Plan for EUR/JPY

🔹 Bias: Bearish due to downtrend, Fibonacci resistance, seasonality, and institutional short positioning.

🔹 Trade Setup:

Sell EUR/JPY at 156.88 - 157.10 (Upon rejection)

Stop Loss: Above 157.26

Take Profit Targets: 156.30, 156.04, 156.00

🔹 Key Confirmation: Retail traders are trapped in longs, seasonality supports further downside, and institutions are short.

🚀 This is a prime example of how combining Seasonality, Smart Money Positioning, and Technicals can create a powerful trade setup.

📌 What’s your outlook on EUR/JPY? Let’s discuss in the comments!

eurjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURJPY buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURJPY SHORTS My initial thoughts were to look for buy entries as we hit a low, with a double bottom on the 15-minute chart showing potential signs of upside movement. I entered a buy position but was stopped out in profit due to the formation of a double top, indicating that the overall daily downtrend could still be in play. This reinforces the importance of risk management.

Let me know your thoughts in the comments

eurjpy. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurjpy analysis. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

I'm waiting for a good drop on the chart.It is at a historical ceiling where resistance is very strong. I expect a return to the 170 range and a market decline. Our main target is 9%. There is a possibility of a decline of up to 20% in the long term. The decline is probably as low as 20%. I am taking profit with a stop.

1- Break of the uptrend line

2- Start of the bearish phase

3- Retracement to the 86% Fibonacci line in the bearish phase

4- Start of our short position and receive 9% of the chart

OANDA:EURCAD

Scenario on EURJPY 13.2.2025As far as EURJPY is concerned, if I wanted to take a short, the first target is the sfp above the level of 161.95-162.3, then around the main resistance with longs, I would see it as follows, and the first possible target is the sfp below the monthly level, which is located in the price zone of 157.917, then below the current sfp.

Eur/Joy sell setup UsdJpy gave confluence to this. I'll be looking to go short from 159.788 you can wait for H4 rejection of the zone before looking for sell opportunities or you go aggressive, it depends on the kinda trader you are.

Taking the 159.5 as Inducement my point of interest looks valid and I'll be anticipating what price would do at that level.

Kindly boost if you find this insightful 🫴

EURJPY analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade