EURJPY-Short#EURJPY

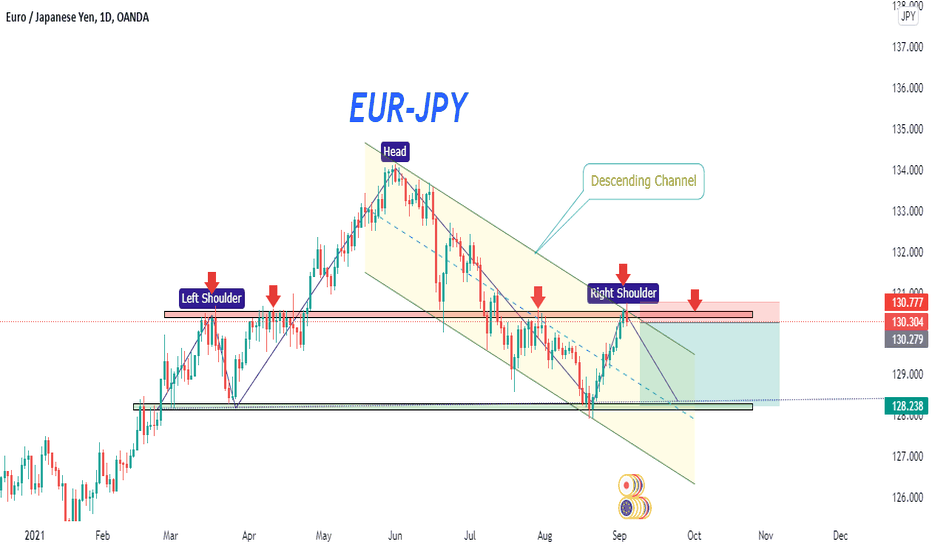

Market has pushed back from resistance level.

In daily timeframe market is repeating history.

Looking forwad that pair will form Heada&Shoulder pattern.

At the same spot i am seeing descending channel and currently market has pulled back into it from resistance.

So all things supporting strong sell. Don't miss opportunity.

Eurjpytrade

EUR/JPY:DOWNTREND|FIBO PULLBACK|PRICE ACTION+NEXT TARGET|SHORT🔔Like a photocopy of EUR/USD, thanks to the principle of correlations, we have a very strong positive correlation of these two pairs and so we can see how EUR/JPY consistently follows the chart of its Major EUR/USD which is the reason why in recent sessions we have seen YEN take breath on the EURO having sessions with bullish impulse. Nevertheless it is obvious to say, just look at the chart, notice the pair a bearish moment, within a Bearish channel with the further confirmation of 21 Jul. by the crossing of the two simple mediums 50+200 "Death Cross ". The Stochastic indicator is in Overbought with divergence. A further sign is the presence of the Fibonacci retracement level that acts as a dynamic resistance in the last sessions with the 61.8% level acting as a key Pullback for the price. In our opinion, the price, noting all the attention described above, will continue to fall immediately.

Can bears gather enough power to force the EUR/JPY into its horizontal support area?

EURJPY: Ready to drop?EURJPY D1: A strong downtrend, with bearish breaks of structure, LHs and LLs. (See Updates)

Now, price finds a bearish order block. Looking for the next LH to form there.

4H: Expecting price to continue to maintain the bearish momentum, form the LH, follow with a BOS to grab the liquidity at the relative equal lows, and form the LL.

265 PIP EURJPY Short Analysis Setup In this trade we see price at a key resistance zone with price breaking out uptrend on the largest time frames. We now treat the Bollinger band like a descending channel. Within this channel we watch price go previous areas of liquidity. Drop A comment saying literally anything to support thank you! Stay tuned for more big boy trades

EurJpy- Continuation to the down side?Since the beginning of June, EurJpy has started to drop, putting in lower highs and lower lows on our daily chart.

At this moment the pair is consolidating in a symmetrical triangle and we can expect continuation.

127 could be a good target for swing traders and only sustained buying pressure above 130.50 would put a pause to this scenario.

EUR/JPY:DOWNTREND|PRICE ACTION+FIBO ANALILYS|SHORT 🔔Welcome back Traders, Investors, and Community!

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button

Traders, if you like this idea or have your own opinion about it, please write your own in the comment box . We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

Have a Good Day Trading !

EURJPY positionThis entry was simply based on the trendline violation principles. of course other confluences had to be adapted before making an entry.

*Disclaimer*

This is not financial advice. Forex trading is a risky business. Trade at your own risk. Patience and risk management are always key

#Trade_Like_A_Magnate

EURJPY After analyzing this pair starting from monthly time frame, Price has nicely completed 38% Fibo level. Basically price was completing corrections of last bullish impulse. After rejection from 38% Fibo on monthly we have some more confluences on lower time frames. On Daily Time frame price has made beautiful descending wedge pattern. Now waiting for a double bottom pattern on recent structure level to go for long opportunity.

EURJPY ANALYSISAlthough price had been in a downtrend, we have now seen price break above this key level and has already come back to retest it.

We will now move to the smaller time frames to find ourselves some long entries.

Since this might be the start of a new trend, we'll keep targets at a new high that could form along with this trend.

EurJpy- Sell rallies for 130 breakEurJpy has had a strong 7 months bull run lasting till the beginning of June

After breaking under trend line support, on 25th of June retested and confirmed the break and has started to roll back down.

At this point the pair is trading just above psychological 130 support and above 129.70 technical one and I expect a break under and continuation.

I will look to sell rallies for a 127 target and only EurJpy above 131.50 would negate my bearish outlook