EURNZD

Falling towards pullback support?EUR/NZD is falling towards the pivot which lines up with the 50% Fibonacci retracement and could bouncer to the pullback resistance.

Pivot: 1.91015

1st Support: 1.87490

1st Resistance: 1.97643

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR-NZD Bullish Bias! Buy!

Hello,Traders!

EUR-NZD is approaching a

Wide horizontal support

Level of 1.9240 so as the

Pair is trading in a local

Uptrend we will be expecting

A local bullish rebound

After the pair retests the

Support on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_NZD LOCAL LONG|

✅EUR_NZD is going down

Now but a local horizontal

Support level is ahead at 1.9300

So after the retest a local

Bullish rebound is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bullish bounce off pullback support?EUR/NZD has bounced off the pivot which has been identified as a pullback support that lines up with the 38.2% Fibonacci retracement and could rise to the 1st resistance.

Pivot: 1.94887

1st Support: 1.82716

1st Resistance: 1.97446

CAD/JPY is falling towards the pivot which is a pullback support and could bounce to the pullback resistance.

Pivot: 102.61

1st Support: 101.62

1st Resistance: 103.68

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR/NZD Wave Structure Shift: 4th Wave Correction in ProgressThe 3rd wave in EUR/NZD appears to have been completed, and the market seems to be entering the 4th wave. There is a possibility that the 4th wave could take support near the Fibonacci 0.5 level (1.19164). After that, the 5th wave of the impulse phase may move upward.

If the market falls below 1.98303, it would confirm the beginning of the 4th wave. In that scenario, the first target could be around 1.95907 .

Long EURNZD – Seasonal, Fundamentals & Technical ConfluenceWe are entering a long position on EURNZD, capitalizing on a powerful confluence of:

Seasonal EUR strength + NZD weakness (April 10 – May 15)

A clear bullish market structure (CHoCH, HH/HL)

A clean Fibonacci retracement entry at 0.5

Strong macro divergence, with NZD exogenous conditions deteriorating

Macro & Seasonal Context

EUR enters a strong seasonal uptrend from April 10 to end of month

NZD shows seasonal weakness from April 15 onward

NZD’s exogenous model score worsened to -12 in April

While NZD LEI and endo improved, it remains structurally weak

Timing

Best execution: on pullback to 1.9373 zone, ideally between April 10–15, aligned with seasonal entry window.

EURNZD: Bearish Continuation is Expected! Here is Why:

The price of EURNZD will most likely collapse soon enough, due to the supply beginning to exceed demand which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EUR/NZD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

EUR-NZD uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 1.885 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the EUR/NZD pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

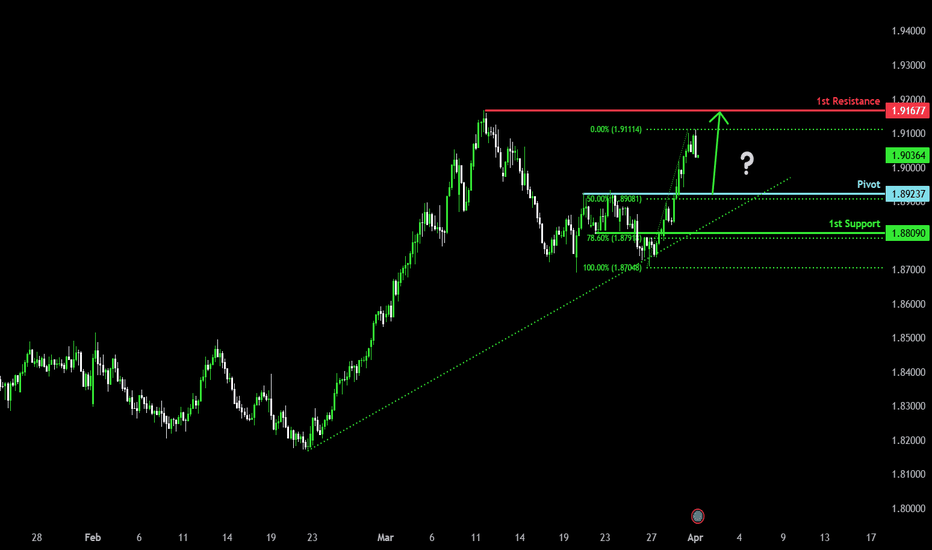

Falling towards 50% Fibonacci support?EUR/NZD is falling towards the pivot which has been identified as a pullback support and could bounce to the pullback resistance.

Pivot: 1.89237

1st Support: 1.88090

1st Resistance: 1.91677

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR-NZD Strong Resistance Ahead! Sell!

Hello,Traders!

EUR-NZD keeps growing

In a strong uptrend but a

Wide horizontal supply

Area is above around 1.9170

So after the pair retests

This level we will be expecting

A local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURNZD - Short Term Sell Trade Update!!!Hi Traders, on March 18th I shared this idea "EURNZD Bearish Trend Structure Indicates Potential Continuation"

We expected to see bearish continuation after retraces. You can read the full post using the link above.

The bearish move delivered, as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURNZD Downtrend in Play – Key Breakdown & Bearish OutlookThe 4H chart of EURNZD shows a descending trendline resistance, indicating a sustained bearish trend.

Price is rejecting the 1.8850 resistance level, aligning with the 38.2% Fibonacci retracement, reinforcing the bearish bias.

A potential breakdown could lead the pair towards the 1.8726 support level (50% Fibonacci), followed by the 1.8200 key demand zone.

Trade Setup & Levels:

Entry Zone: Below 1.8820 after a confirmed rejection.

Target 1 (TP1): 1.8726 – mid-support level

Target 2 (TP2): 1.8200 – major demand zone & 100% Fibonacci extension

Stop Loss (SL): Above 1.8987 to avoid false breakouts.

Bearish Confirmation Factors:

✅ Lower highs and trendline rejection, confirming downward momentum.

✅ Breakdown of support zones, leading to extended selling pressure.

✅ Fibonacci confluence, reinforcing downside targets.

Conclusion:

A break below 1.8726 will accelerate selling momentum, with 1.8200 as the ultimate bearish target. Traders should watch for confirmation signals before entering short positions. 📉

Bearish reversal?EUR/NZD is rising towards the resistance level which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.89747

Why we like it:

There is a pullback resistance level that line sup with the 61.8% Fibonacci retracement.

Stop loss: 1.90810

Why we like it:

There is a pullback resistance level that lines up with he 78.6% Fibonacci retracement.

Take profit: 1.8743

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

WHY EURNZD IS BULLISH AGAING ?? DETAILED ANALYSISEUR/NZD is currently trading at approximately 1.886, having completed a retesting phase following a bullish breakout. This technical development suggests the potential for a renewed upward movement toward the target price of 1.9300. With strong bullish momentum building, traders are closely watching for confirmation signals to enter long positions.

Fundamentally, the Reserve Bank of New Zealand (RBNZ) recently implemented a 50 basis point rate cut, reducing the benchmark rate to 3.75%, with indications of further easing to stimulate the economy. This dovish monetary policy stance tends to exert downward pressure on the New Zealand dollar, thereby supporting the EUR/NZD pair. Meanwhile, the Eurozone has maintained a more stable monetary policy, contributing to euro strength relative to the New Zealand dollar. This divergence in central bank policies enhances the bullish outlook for EUR/NZD.

Technical indicators further reinforce this perspective. The pair has been in a downward channel since mid-February; however, recent bullish candles indicate a potential short-term reversal or correction. The price has swiftly moved from the lower Bollinger Band to the upper band, breaking through the middle band in a strong bullish move. Additionally, EUR/NZD is currently testing the 50% Fibonacci retracement level, a key decision point for traders.

Considering these technical and fundamental factors, the EUR/NZD pair appears poised for a bullish wave toward the 1.9300 target. Traders should monitor key resistance levels and employ appropriate risk management strategies to capitalize on this potential upward movement. If momentum continues, this setup could present a profitable long trade opportunity in the coming sessions.

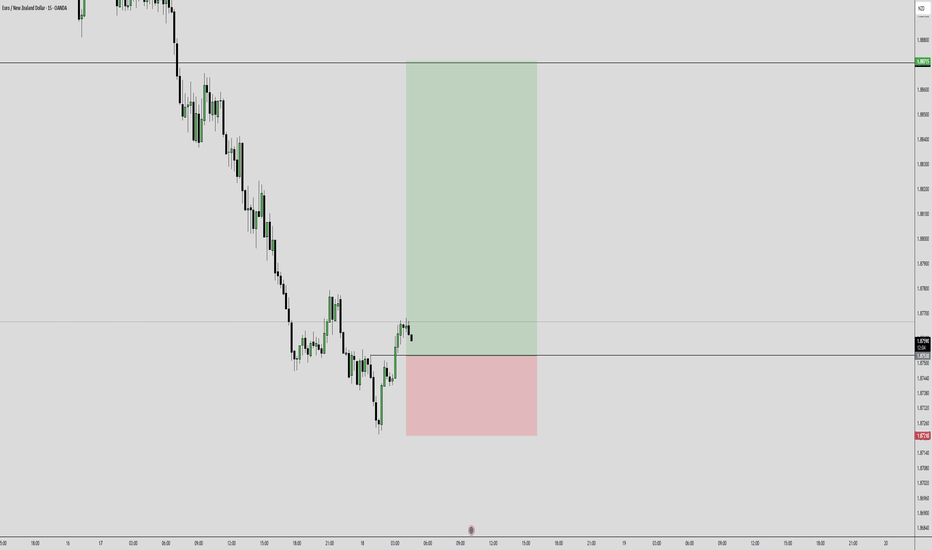

EUR/NZD BEST PLACE TO BUY FROM|LONG

EUR/NZD SIGNAL

Trade Direction: long

Entry Level: 1.881

Target Level: 1.888

Stop Loss: 1.876

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/NZD BUY SETUP – BULLISH OUTLOOK! EUR/NZD BUY SETUP – BULLISH OUTLOOK! 📈

🔹 Pair: EUR/NZD

🔹 Bias: Bullish ✅

🔹 Entry Zone:

🔹 Stop Loss (SL): 🔴

🔹 Take Profit (TP): 🏆

🔍 Market Analysis:

✅ Strong bullish structure with higher highs & higher lows

✅ Institutional order flow supporting buyers

✅ Liquidity grab before the move up

✅ Confluence with key support zone

📊 Chart shows a high-probability buy setup. If price holds above support, expect bullish continuation. 🚀

💬 What’s your outlook on EUR/NZD? Comment below! 👇🔥

#ForexTrading #EURNZD #SmartMoneyConcepts #TradingView #FXSignals #ForexAnalysis

Bearish drop?EUR/NZD has rejected of the pivot which is a pullback resistance and could drop to the 1st support.

Pivot: 1.88951

1st Support: 1.86727

1st Resistance: 1.89710

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop?EUR/NZD is rising towards the pivot and could drop to the 50% Fibonacci support.

Pivot: 1.88686

1st Support: 1.86727

1st Resistance: 1.89710

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURNZD Bearish Trend Structure Indicates Potential ContinuationH1 - Bearish trend pattern

Strong bearish momentum

Potential drop if the resistance levels will not be broken.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.