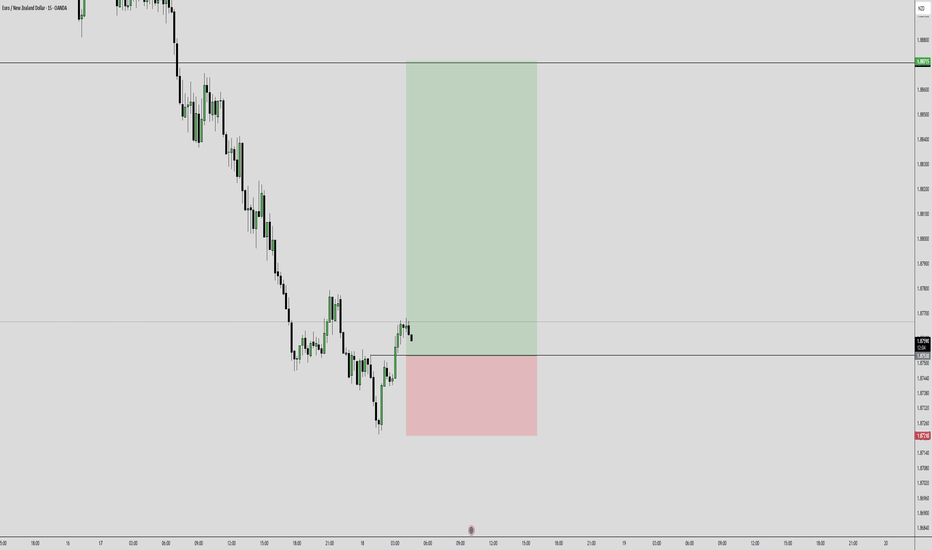

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Eurnzdlong

EURNZD Bearish Rejection from Range High – Eyes on 1.8805EURNZD is showing signs of a clear rejection from the 1.9150 resistance level, which has held firm over the past few weeks. The pair has remained range-bound between 1.9150 and 1.8800, and the recent bearish candlestick formation near the top of this range suggests renewed selling pressure. Unless price breaks above 1.9150 with strong momentum, the path of least resistance appears to be to the downside, with the next key support target at 1.8805. Traders should watch for follow-through below 1.8900 to confirm bearish continuation.

Technical Overview:

Structure: Price has formed a clear range between 1.9156 resistance and 1.8805 support.

Current Price: 1.8974 (as of chart capture).

Pattern: A potential bearish move is forming after rejection near the range high. The price has begun pulling back from the resistance zone.

Key Levels:

Resistance: 1.9156 (recent swing high).

Support: 1.8805 (horizontal level, tested multiple times).

Downside Target: If bearish momentum continues, the price may revisit 1.8805.

Breakout Potential: A close below 1.8805 may lead to acceleration toward 1.8725 or even 1.8600.

Fundamental Context:

Euro (EUR):

ECB is maintaining a cautious stance; inflation is moderating, but core pressures persist.

Risk of a pause or cut in rates in H2 2025, depending on inflation data.

New Zealand Dollar (NZD):

RBNZ is maintaining hawkish bias amid sticky inflation.

Recent data on NZ retail sales has been stable, but growth remains fragile.

Conclusion:

Bias: Bearish below 1.9156.

Setup: Look for a confirmed lower high and strong bearish candle close for potential short entries toward 1.8805.

Confirmation: Break and retest of 1.8900 zone would add conviction.

Epic EUR/NZD Forex Heist Plan - Join the Thief Trading Crew!Greetings, wealth chasers and market bandits! 🌍👋

Welcome to the ultimate EUR/NZD "Euro vs Kiwi" Forex Bank Heist, crafted with the slick Thief Trading Style, blending razor-sharp technicals with game-changing fundamentals. 📊💸 Follow the strategy mapped out on the chart for a long entry, aiming to cash out near the high-stakes Red Zone—a risky, overbought area with potential consolidation, trend reversals, or traps where bearish bandits lurk. 🏴☠️💪 Score big, take your profits, and treat yourself—you’ve earned it! 🎉

Entry Plan 📈: The heist is live! Wait for the price to break past the previous high (1.91600) to jump in for bullish gains. For precision, set buy stop orders above the moving average or place buy limit orders within a 15- or 30-minute timeframe near recent swing lows/highs for pullback entries.

📌 Pro Tip: Set an alert on your chart to catch the breakout moment!

Stop Loss 🛑: Listen up, crew! If using a buy stop order, hold off on setting your stop loss until the breakout confirms. Place it at the nearest swing low on the 4H timeframe (1.89300) for day trades, adjusting based on your risk, lot size, and number of orders. Play it smart, or you’re gambling with fire! 🔥

Target 🎯: Aim for 1.95700—let’s hit the jackpot!

Scalpers, Eyes Here 👀: Stick to long-side scalping. Got deep pockets? Dive in now. Otherwise, join the swing traders and execute the heist with a trailing stop loss to lock in your loot. 💰

Why EUR/NZD is Hot 🔥: The "Euro vs Kiwi" pair is riding a bullish wave, fueled by key market drivers. Dive into fundamentals, macroeconomics, COT reports, sentiment, intermarket analysis, and future trends for the full scoop. Check the linkkss for details! 🔗🌎

Trading Alert 🚨: News releases can shake up prices and volatility. Protect your positions:

Skip new trades during news events.

Use trailing stop-loss orders to secure profits.

Join the Heist 💥: Hit the Boost Button to power up our Thief Trading Crew! Together, we’ll swipe profits daily with ease. Stay sharp, stay tuned, and get ready for the next heist! 🤑🐱👤🚀

See you at the next big score! 🤝🎉

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURNZD Analysis: Bounce & BreakoutHello traders!

EURNZD is in a 1h range and is offering two trading scenarios.

The first scenario suggests the pair may react bearishly from the resistance zone, setting up a bounce opportunity that could drive price lower toward the 1.90000 area.

The second scenario anticipates a breakout above the resistance zone, followed by a retest, which could present a strong opportunity for continuation toward the 1.92000 area.

Discretionary Trading: Where Experience Becomes the Edge

Discretionary trading is all about making decisions based on what you see, what you feel, and what you've learned through experience. Unlike systematic strategies that rely on fixed rules or algorithms, discretionary traders use their judgment to read the market in real time. It's a skill that can't be rushed, because it's built on screen time, pattern recognition, and the ability to stay calm under pressure.

There's no shortcut here. You need to see enough market conditions, wins, and losses to build that intuition—the kind that tells you when to pull the trigger or sit on your hands. Charts might look the same, but context changes everything, and that's something only experience can teach you.

At the end of the day, discretionary trading is an art, refined over time, sharpened through mistakes, and driven by instinct. It's not for everyone, but for those who've put in the work, it can be a powerful way to trade.

eurnzd analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURNZD Short Term Buy Trade Update!!!Hi Traders, on May 8th I shared this idea "EURNZD - Expecting Bullish Continuation In The Short Term"

I expected retraces and bullish continuation higher from the marked Fibonacci support zones. You can read the full post using the link above.

Price reached the first Fibonacci support zone, respected it and bounced higher as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURNZD I Technical Analysis & Forecast Welcome back! Let me know your thoughts in the comments!

** EURNZD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

EURNZD - Expecting Bullish Continuation In The Short TermM15 - Strong bullish move.

No opposite signs.

Expecting further continuation higher until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURNZD to find buyers at the current market price?EURNZD - 24h expiry

Offers ample risk/reward to buy at the market.

Buying posted close to the previous low of 1.8911.

1.8911 has been pivotal.

A Morning Doji Star formation has been posted at the low.

Price action continued to range between key support & resistance (1.9000 - 1.9250) and we expect this to continue.

Daily signals are mildly bullish.

We look to Buy at 1.8957 (stop at 1.8875)

Our profit targets will be 1.9205 and 1.9265

Resistance: 1.9047 / 1.9147 / 1.9265

Support: 1.8911 / 1.8850 / 1.8800

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

EURNZD strong daily demand level at 1.89. Long biasSupply and demand imbalances are the driving forces behind price movements in the Forex market. By identifying these key zones or imbalances, traders can anticipate high-probability reversal or continuation setups. Today, we’ll analyze the EURNZD cross pair, which has recently formed a strong demand imbalance at $1.89—the most significant impulse in months.

The Power of Supply & Demand Imbalances

Supply and demand trading revolves around identifying areas where price has made a strong, impulsive move (demand or supply zone) and then waiting for a retracement into that zone for a potential reversal or continuation.

Key Characteristics of a Strong Imbalance:

✅ Extended Range Candles (ERC): Strong, wide-bodied candles indicate institutional buying/selling.

✅ Strong Imbalance: A clear shift in market structure after a strong rally or drop.

✅ Fresh Zone: The imbalance has not been tested yet or has only been tested once.

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EUR/NZD BUY SETUP – BULLISH OUTLOOK! EUR/NZD BUY SETUP – BULLISH OUTLOOK! 📈

🔹 Pair: EUR/NZD

🔹 Bias: Bullish ✅

🔹 Entry Zone:

🔹 Stop Loss (SL): 🔴

🔹 Take Profit (TP): 🏆

🔍 Market Analysis:

✅ Strong bullish structure with higher highs & higher lows

✅ Institutional order flow supporting buyers

✅ Liquidity grab before the move up

✅ Confluence with key support zone

📊 Chart shows a high-probability buy setup. If price holds above support, expect bullish continuation. 🚀

💬 What’s your outlook on EUR/NZD? Comment below! 👇🔥

#ForexTrading #EURNZD #SmartMoneyConcepts #TradingView #FXSignals #ForexAnalysis

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade