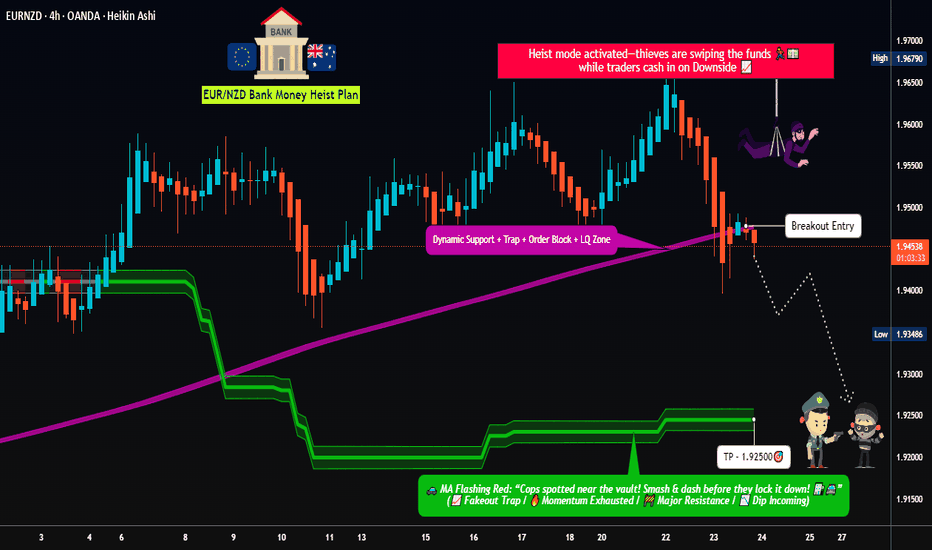

Dynamic Entry Alert – EUR/NZD Bearish Heist Execution!💣 EUR/NZD Robbery Blueprint: The Kiwi Vault Bearish Heist Plan 💰🕵️♂️

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

This ain't your usual trading tip — it’s a Thief Trading Masterstroke 🎯. We're gearing up for a high-stakes heist on the EUR/NZD forex market. Time to crack open the Kiwi vault and rob those bullish bandits blind! 😼💣

🧠 Strategic Mindset:

🔍 We're targeting the oversold consolidation zone. Bullish traders think they’re safe? Think again. This area is a trap — the perfect bait for our bearish ambush. Expect trend reversal vibes, layered with juicy liquidity grabs.

🕵️♂️ Entry Plan:

🎯 Sell Entry: The vault is wide open! Swipe the Bearish loot at any price - the heist is on!.

💣 Setup:

Sell Limit Orders at nearest swing highs (15m or 30m timeframe)

Use DCA / Layering Method for multiple entries (scalp or swing tactics)

📌 Set your Alert 🚨 — no breakout, no entry. Patience pays.

🛑 Stop Loss Strategy (SL):

No premature moves! Don’t place that SL till we get the confirmed break.

🔥 SL Recommendation:

Just above 1.95400 (4H candle wick swing high)

Adjust based on lot size and number of layers

📍 Remember, the market’s a jungle — stay sharp or get sliced.

🎯 Take Profit (TP):

💵 Target Zone: 1.92500

(But hey, escape early if the vault starts shaking. Protect your gains like a pro.)

📊 Macro Intel – Why This Works:

This isn’t random — it's backed by our 🔥 combo of:

COT Reports

Sentiment Analysis

Quant/Algo Bias

Intermarket Correlation

Fundamental + Technical Confirmation

📌 You can dig deeper — but trust me, this setup’s been scouted like a pro job.

⚠️ Risk Protocols:

Avoid entries during high-impact news

Use Trailing SLs to lock in the loot

Adjust position size to suit your personal bankroll & risk appetite

🔥 Final Word from the Thief:

Smash that 💥Boost Button💥 if you're vibing with the heist plan!

Support the squad, stay profitable, and rob the market — legally, of course.

We don’t trade, we infiltrate.

We don’t predict, we execute.

📡 Stay tuned… More robbery blueprints coming soon!

🤑🐱👤🚨💸💪 #ThiefTrader #ForexHeist #EURNZDShortPlan

Eurnzdsignal

Euro vs Kiwi Bull Raid: High Reward Target Strategy🏴☠️EUR/NZD Heist Plan: "Robbing the Kiwi Vault with Thief Trading Style" 💰🔥

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Dear Money Makers, Chart Bandits & Market Strategists! 🤑💸✈️

Here’s the EUR/NZD (Euro vs Kiwi) blueprint crafted using the signature 🔥Thief Trading Style🔥 — a blend of bold technicals, insightful fundamentals, and pure tactical precision. We’re setting our sights on a potential bullish breakout — targeting the high-security resistance zone where big money hides.

💡The Robbery Plan (Thief Entry Setup):

🟢 Entry Point:

"The vault is wide open — time to extract the bullish loot!"

⚔️ Entry can be taken at market price, but the smarter thieves use a layered Buy Limit strategy at pullback zones (near swing lows/highs on the 15-30 min TF) to snipe the best entries with reduced exposure.

🔁 Scaling in = DCA-style Thief Method: split entries for efficiency, just like robbing in waves.

🔻 Stop Loss Plan (Escape Route):

🔒 Place SL below the recent swing low using 3H timeframe (1.94000 for scalpers/day traders).

🛡️ Adjust based on risk appetite, lot size, and number of entries in play.

🎯 Take Profit Target:

🏁 Exit the heist near 1.97700, where strong resistance awaits. That’s the Danger Zone — the edge of our mission.

🔍EUR/NZD Outlook Snapshot:

This pair is flashing bullish vibes due to:

🏛️ Macro & Fundamental tailwinds

📊 COT positioning & Sentiment readings

🔗 Intermarket influences

📈 Price structure & liquidity zones

For more depth: dive into external analysis tools, COT reports, and sentiment dashboards to fine-tune your view. The direction is clear — the bulls are assembling.

⚠️ Trading Alerts & Risk Management Reminders:

🚨 News releases = volatility mines.

Before entering, make sure to:

Avoid new positions near red-flag economic events

Protect your open trades with trailing SLs or partial exits

Stay alert — the market shifts fast, adapt faster

💬 Final Word from the Vault Boss:

📢 Smashing likes = boosting the crew. 💥

Support the Thief Trading Style by hitting the BOOST button and keep the robbery crew rolling strong 💪💸

We're here to outsmart the market — one clean chart raid at a time.

Stay tuned for the next master plan. Until then, rob smart, rob safe. 🧠🔐💥

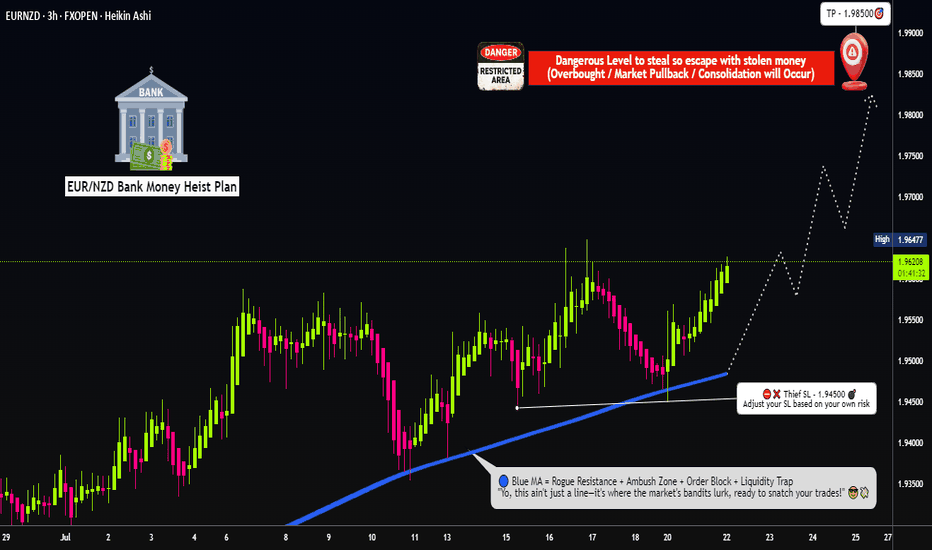

Euro vs Kiwi Bull Raid: High Reward Target Strategy🏴☠️EUR/NZD Heist Plan: "Robbing the Kiwi Vault with Thief Trading Style" 💰🔥

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Dear Money Makers, Chart Bandits & Market Strategists! 🤑💸✈️

Here’s the EUR/NZD (Euro vs Kiwi) blueprint crafted using the signature 🔥Thief Trading Style🔥 — a blend of bold technicals, insightful fundamentals, and pure tactical precision. We’re setting our sights on a potential bullish breakout — targeting the high-security resistance zone where big money hides.

💡The Robbery Plan (Thief Entry Setup):

🟢 Entry Point:

"The vault is wide open — time to extract the bullish loot!"

⚔️ Entry can be taken at market price, but the smarter thieves use a layered Buy Limit strategy at pullback zones (near swing lows/highs on the 15-30 min TF) to snipe the best entries with reduced exposure.

🔁 Scaling in = DCA-style Thief Method: split entries for efficiency, just like robbing in waves.

🔻 Stop Loss Plan (Escape Route):

🔒 Place SL below the recent swing low using 3H timeframe (1.94500 for scalpers/day traders).

🛡️ Adjust based on risk appetite, lot size, and number of entries in play.

🎯 Take Profit Target:

🏁 Exit the heist near 1.98500, where strong resistance awaits. That’s the Danger Zone — the edge of our mission.

🔍EUR/NZD Outlook Snapshot:

This pair is flashing bullish vibes due to:

🏛️ Macro & Fundamental tailwinds

📊 COT positioning & Sentiment readings

🔗 Intermarket influences

📈 Price structure & liquidity zones

For more depth: dive into external analysis tools, COT reports, and sentiment dashboards to fine-tune your view. The direction is clear — the bulls are assembling.

⚠️ Trading Alerts & Risk Management Reminders:

🚨 News releases = volatility mines.

Before entering, make sure to:

Avoid new positions near red-flag economic events

Protect your open trades with trailing SLs or partial exits

Stay alert — the market shifts fast, adapt faster

💬 Final Word from the Vault Boss:

📢 Smashing likes = boosting the crew. 💥

Support the Thief Trading Style by hitting the BOOST button and keep the robbery crew rolling strong 💪💸

We're here to outsmart the market — one clean chart raid at a time.

Stay tuned for the next master plan. Until then, rob smart, rob safe. 🧠🔐💥

Dynamic Entry Alert – EUR/NZD Bearish Heist Execution!💣 EUR/NZD Robbery Blueprint: The Kiwi Vault Bearish Heist Plan 💰🕵️♂️

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

This ain't your usual trading tip — it’s a Thief Trading Masterstroke 🎯. We're gearing up for a high-stakes heist on the EUR/NZD forex market. Time to crack open the Kiwi vault and rob those bullish bandits blind! 😼💣

🧠 Strategic Mindset:

🔍 We're targeting the oversold consolidation zone. Bullish traders think they’re safe? Think again. This area is a trap — the perfect bait for our bearish ambush. Expect trend reversal vibes, layered with juicy liquidity grabs.

🕵️♂️ Entry Plan:

🎯 Sell Entry Trigger: Wait for a clean break below 1.94500.

💣 Setup:

Place Sell Stop Orders below the MA Support Breakout

Or... go stealth: Sell Limit Orders at nearest swing highs (15m or 30m timeframe)

Use DCA / Layering Method for multiple entries (scalp or swing tactics)

📌 Set your Alert 🚨 — no breakout, no entry. Patience pays.

🛑 Stop Loss Strategy (SL):

No premature moves! Don’t place that SL till we get the confirmed break.

🔥 SL Recommendation:

Just above 1.95700 (4H candle wick swing high)

Adjust based on lot size and number of layers

📍 Remember, the market’s a jungle — stay sharp or get sliced.

🎯 Take Profit (TP):

💵 Target Zone: 1.92500

(But hey, escape early if the vault starts shaking. Protect your gains like a pro.)

📊 Macro Intel – Why This Works:

This isn’t random — it's backed by our 🔥 combo of:

COT Reports

Sentiment Analysis

Quant/Algo Bias

Intermarket Correlation

Fundamental + Technical Confirmation

📌 You can dig deeper — but trust me, this setup’s been scouted like a pro job.

⚠️ Risk Protocols:

Avoid entries during high-impact news

Use Trailing SLs to lock in the loot

Adjust position size to suit your personal bankroll & risk appetite

🔥 Final Word from the Thief:

Smash that 💥Boost Button💥 if you're vibing with the heist plan!

Support the squad, stay profitable, and rob the market — legally, of course.

We don’t trade, we infiltrate.

We don’t predict, we execute.

📡 Stay tuned… More robbery blueprints coming soon!

🤑🐱👤🚨💸💪 #ThiefTrader #ForexHeist #EURNZDShortPlan

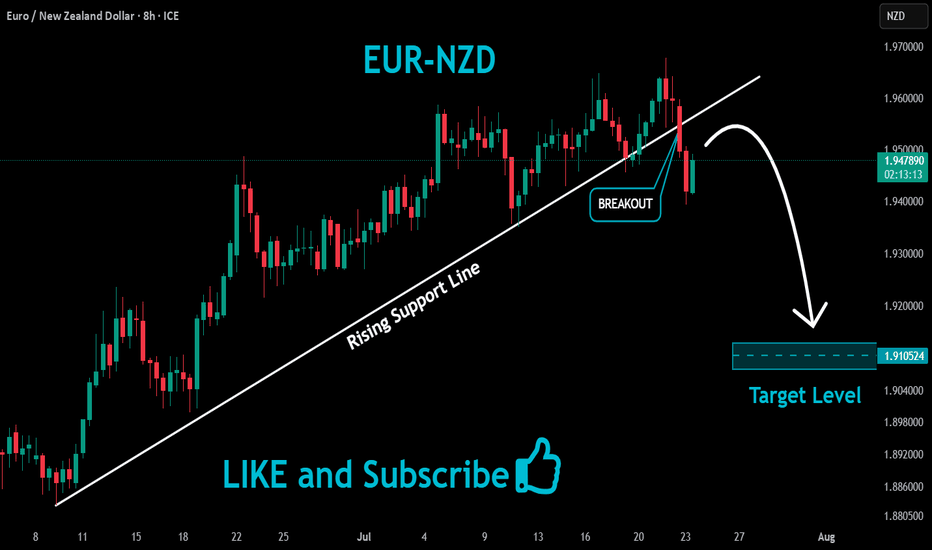

eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

#EURNZD:Price accumulated now time for distribution! Price completed accumulated and now we expecting a strong bullish price distribution. Next week we can see price going and crossing our target with strong bullish volume kicking in the market. Price may go beyond 2.20 region; let's see how it goes.

Good luck and trade safe!

Team Setupsfx_

"Euro vs Kiwi Heist - Bullish Loot Opportunity!🔥 EURNZD BULL HEIST! Euro vs Kiwi Raid Plan (Swing/Day) 🚨💰

🌟 Attention, Market Bandits! 🌟

"The vault is cracked—time to grab the loot!"

🔮 Thief’s Intel (TA + FA):

EURNZD is flashing BULLISH signals, but beware—overbought traps & police (bears) lurk near resistance!

🎯 ENTRY POINTS (Where to Strike!)

🟢 LONG RAID (Bullish Thieves):

"Swipe the loot on pullbacks!"

Buy limit orders (15-30min TF) near swing lows/highs.

Aggressive heist? Enter any price—but watch for traps!

🛑 STOP-LOSS (Escape Plan)

📍 SL at recent swing low (2H TF) = 1.93500 (Adjust based on risk!)

💰 TAKE-PROFIT (Cash Out Before Cops Arrive!)

🎯 TP = 1.98500 (Or escape early near red zones!)

⚠️ WARNING: Police (Bears) Ahead!

Overbought + Consolidation = Reversal risk!

News = High alert! Avoid new trades during volatility.

Trailing SL = Your getaway car!

📡 FUNDAMENTAL BACKUP (Why This Heist Works)

Bullish momentum from COT data, macro trends & sentiment.

Check full analysis for targets & intermarket clues!

💥 BOOST THIS HEIST! 💥

Like & Share to strengthen our crew! More alerts = More profits!

🚨 Next raid coming soon… Stay tuned, thieves! 🚨

EUR/NZD Robbery Blueprint – Targeting Pink Zone Profits💰EUR/NZD Robbery Setup: The Bullish Breakout Blueprint for Euro vs Kiwi Heist! 🚨📈

(Targeting High-Risk Zones With Dynamic Entry & Exit Tactics – Long Setup Explained)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Market Pirates & Chart Bandits, 🏴☠️💸📊

Ready to rob the Kiwi vaults with precision? Based on our 🔥Thief Trading Strategy🔥 (technical + fundamental), here’s the grand blueprint for the EUR/NZD Long Heist. We’ve scoped the market, sniffed out consolidation traps, and locked eyes on that Pink Zone of high-risk, high-reward. The bulls are regrouping. This is our moment. 📍

🎯 ENTRY PLAN – “The Breakout Is The Lock Pick”

📈 Strike Price: 1.93900

Wait for a clean candle close above the Major Dynamic Resistance (MA level).

Once breached, place buy stop orders above the MA line — entry must align with breakout rules.

🔁 Optional: For early robbers, place buy limits on the nearest swing low within the 15M or 30M timeframe (confirmation from wick rejections).

📌 Set alerts (📳) at breakout zones. Stay sharp. Opportunity doesn't knock—it smashes doors.

🛑 STOP LOSS – “Protection Is Power”

Set your SL near the previous swing High/Low wick (4H chart zone), aligning it with your personal lot size, risk %, and number of trades.

📍“SL is your vault lock. Set it smart, not soft. You’re not gambling — you’re robbing with logic.”

🔥 Reminder: No premature SL on pending orders—wait for breakout validation.

🧨 TARGET – “Escape Plan”

🎯 Profit Target: 1.97500

Or dip out early if resistance alarms start ringing. 🏃♂️💨

⚖️ OVERVIEW – “The Scoreboard”

The EUR/NZD is currently in a neutral chop, but multiple trend reversal signs are emerging.

🔥 Oversold zones, squeeze structure, and a potential bull charge all support this heist-worthy long setup.

📚 BONUS INTEL

Unlock the deeper story:

🧠 Sentiment Analysis

💼 COT Report Data

🌍 Macro Insights

🔍 Intermarket Correlations

📊 Quant Metrics

👉 Followw the 🔗 in the idea for more details and thief-style scoring!

🚨 NEWS ALERTS & POSITION MANAGEMENT

🗞 Avoid new trades during high-impact news. Use trailing SL to protect and lock in gains as the plan moves. Stay adaptive — markets shift fast.

💥 FINAL WORD – “Boost The Gang, Fuel The Plan”

If this heist plan fuels your trading journey, smash the Boost button 💥💖

Help more traders rob the market, not each other.

We operate clean, with precision and thief-style logic.

Let’s get this bag. 💰💼🎉

🧠 Stay tuned for the next operation. Till then — rob smart, rob safe. 🐱👤🤑📈

EURNZD analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURNZD buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURNZD "Euro vs Kiwi" Forex Bank Money Heist Plan (Bearish)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EURNZD "Euro vs Kiwi" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk GREEN Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.92500) Day trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.88000

💰💵💸EURNZD "Euro vs Kiwi" Forex Market Heist Plan (Scalping/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURNZD Bearish Rejection from Range High – Eyes on 1.8805EURNZD is showing signs of a clear rejection from the 1.9150 resistance level, which has held firm over the past few weeks. The pair has remained range-bound between 1.9150 and 1.8800, and the recent bearish candlestick formation near the top of this range suggests renewed selling pressure. Unless price breaks above 1.9150 with strong momentum, the path of least resistance appears to be to the downside, with the next key support target at 1.8805. Traders should watch for follow-through below 1.8900 to confirm bearish continuation.

Technical Overview:

Structure: Price has formed a clear range between 1.9156 resistance and 1.8805 support.

Current Price: 1.8974 (as of chart capture).

Pattern: A potential bearish move is forming after rejection near the range high. The price has begun pulling back from the resistance zone.

Key Levels:

Resistance: 1.9156 (recent swing high).

Support: 1.8805 (horizontal level, tested multiple times).

Downside Target: If bearish momentum continues, the price may revisit 1.8805.

Breakout Potential: A close below 1.8805 may lead to acceleration toward 1.8725 or even 1.8600.

Fundamental Context:

Euro (EUR):

ECB is maintaining a cautious stance; inflation is moderating, but core pressures persist.

Risk of a pause or cut in rates in H2 2025, depending on inflation data.

New Zealand Dollar (NZD):

RBNZ is maintaining hawkish bias amid sticky inflation.

Recent data on NZ retail sales has been stable, but growth remains fragile.

Conclusion:

Bias: Bearish below 1.9156.

Setup: Look for a confirmed lower high and strong bearish candle close for potential short entries toward 1.8805.

Confirmation: Break and retest of 1.8900 zone would add conviction.

Epic EUR/NZD Forex Heist Plan - Join the Thief Trading Crew!Greetings, wealth chasers and market bandits! 🌍👋

Welcome to the ultimate EUR/NZD "Euro vs Kiwi" Forex Bank Heist, crafted with the slick Thief Trading Style, blending razor-sharp technicals with game-changing fundamentals. 📊💸 Follow the strategy mapped out on the chart for a long entry, aiming to cash out near the high-stakes Red Zone—a risky, overbought area with potential consolidation, trend reversals, or traps where bearish bandits lurk. 🏴☠️💪 Score big, take your profits, and treat yourself—you’ve earned it! 🎉

Entry Plan 📈: The heist is live! Wait for the price to break past the previous high (1.91600) to jump in for bullish gains. For precision, set buy stop orders above the moving average or place buy limit orders within a 15- or 30-minute timeframe near recent swing lows/highs for pullback entries.

📌 Pro Tip: Set an alert on your chart to catch the breakout moment!

Stop Loss 🛑: Listen up, crew! If using a buy stop order, hold off on setting your stop loss until the breakout confirms. Place it at the nearest swing low on the 4H timeframe (1.89300) for day trades, adjusting based on your risk, lot size, and number of orders. Play it smart, or you’re gambling with fire! 🔥

Target 🎯: Aim for 1.95700—let’s hit the jackpot!

Scalpers, Eyes Here 👀: Stick to long-side scalping. Got deep pockets? Dive in now. Otherwise, join the swing traders and execute the heist with a trailing stop loss to lock in your loot. 💰

Why EUR/NZD is Hot 🔥: The "Euro vs Kiwi" pair is riding a bullish wave, fueled by key market drivers. Dive into fundamentals, macroeconomics, COT reports, sentiment, intermarket analysis, and future trends for the full scoop. Check the linkkss for details! 🔗🌎

Trading Alert 🚨: News releases can shake up prices and volatility. Protect your positions:

Skip new trades during news events.

Use trailing stop-loss orders to secure profits.

Join the Heist 💥: Hit the Boost Button to power up our Thief Trading Crew! Together, we’ll swipe profits daily with ease. Stay sharp, stay tuned, and get ready for the next heist! 🤑🐱👤🚀

See you at the next big score! 🤝🎉

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EUR/NZD Forex Heist: Thief Trading Style Strikes! Greetings, Profit Hunters & Market Raiders! 🤑💰✈️

Prepare to plunder the EUR/NZD Forex Market with our slick Thief Trading Style, fusing razor-sharp technicals with savvy fundamental insights! 📊🔥 Our mission? Dive in for a bearish score, targeting the high-risk Green MA Zone where oversold conditions, consolidation, or a bullish reversal could trap the unwary. Let’s grab the loot and slip away like pros! 🏆💸

📈 The Forex Heist Blueprint

Entry Point 🚪:

🏴☠️ Bearish Strike: The vault’s open—pounce on the bearish move at any price! For precision, place Sell Limit Orders at the nearest 15M/30M swing high/low for pullback entries.

Tip: Set a chart alert to snag the perfect entry! 🔔

Stop Loss (SL) 🛑:

Place your Thief SL at the nearest 5H swing high (1.91000) for swing trades.

Adjust SL based on your risk, lot size, and number of orders. This is your escape hatch—use it wisely! ⚠️

Take Profit (TP) 🎯:

Aim for 1.85000 or exit early for safety if the Green MA Zone shows reversal signs.

Escape Plan: Watch for bullish strength or consolidation to avoid getting caught! 🚨

📡 Why EUR/NZD?

The EUR/NZD market is in a bearish trend 🐻, fueled by:

Fundamentals: Eurozone economic struggles vs. NZD resilience.

Macroeconomics: Weak Eurozone data contrasts with NZ’s export strength.

COT Data: Speculative bets lean bearish on EUR.

Intermarket: NZD gains from commodity correlations; EUR lags on energy costs.

Quantitative: Technicals (RSI, MA crossovers) signal bearish momentum.

🧠 Sentiment Outlook

Retail Traders:

🟢 Bullish: 38% 😊 (Eyeing EUR rebound on oversold signals)

🔴 Bearish: 50% 😟 (NZD strength and Eurozone woes dominate)

⚪ Neutral: 12% 🤔

Institutional Traders:

🟢 Bullish: 25% 💼 (Hedging for EUR recovery)

🔴 Bearish: 65% ⚠️ (NZD favored on trade and yield flows)

⚪ Neutral: 10% 🧐

⚠️ Trading Alert: News & Risk Management 📰

News can flip the market like a switch! Protect your haul:

Avoid new trades during high-impact news releases.

Use trailing stop-loss to secure profits and limit losses.

Stay alert—volatility is our ally, but only with a plan!

💪 Join the Thief Trading Squad!

Tap the Boost Button to supercharge our Thief Trading Style and make this heist legendary! 🚀 Every boost strengthens our crew, letting us raid profits daily with ease. Let’s dominate the EUR/NZD market together! 🤝

Stay locked in for the next heist! 🐱👤 Keep your charts primed, alerts set, and trading spirit wild. See you in the profits, raiders! 🤑🎉

#ThiefTrading #EURNZD #ForexHeist #TradingView #GrabThePips

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade