+400 pips EURUSD swing trade setup V-shape recovery BUY LOW🏆 EURUSD Market Update

📊 Technical Outlook

🔸Short-term: BEARS 0680

🔸Mid-term: BULLS 1180

🔸Status: pullback in progress

🔸0660/0680 normal pullback

🔸BULLS still maintain control

🔸Price Target Bears: 0660/0680

🔸Price Target BULLS: 1160/1180

📊 Forex Market Highlights – April 2nd, 2025

🚨 Traders await Trump’s “Liberation Day” tariff

reveal at 20:00 GMT – markets holding breath

as global trade tensions escalate.

💷 GBP/USD Sluggish Above 1.2900

📉 Cable struggles to gain upside as USD

safe-haven demand kicks in pre-announcement.

🇪🇺 EUR/USD Pressured Below 1.0800

🔽 Euro weakens amid risk aversion and strong

dollar flows — key support at 1.0760 in focus.

🥇 Gold Shines Bright

🚀 Hits ATH above $3,100 amid rising risk-off

mood & global uncertainty. Safe haven demand surging.

🔔 Stay sharp — volatility ahead.

Euro

EUR/AUD H1 | Bearish downturn to extend further?EUR/AUD is rising towards a pullback resistance and could potentially reverse off this level to drop lower.

Sell entry is at 1.7133 which is a pullback resistance.

Stop loss is at 1.7160 which is a level that sits above a pullback resistance.

Take profit is at 1.7055 which is a multi-swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

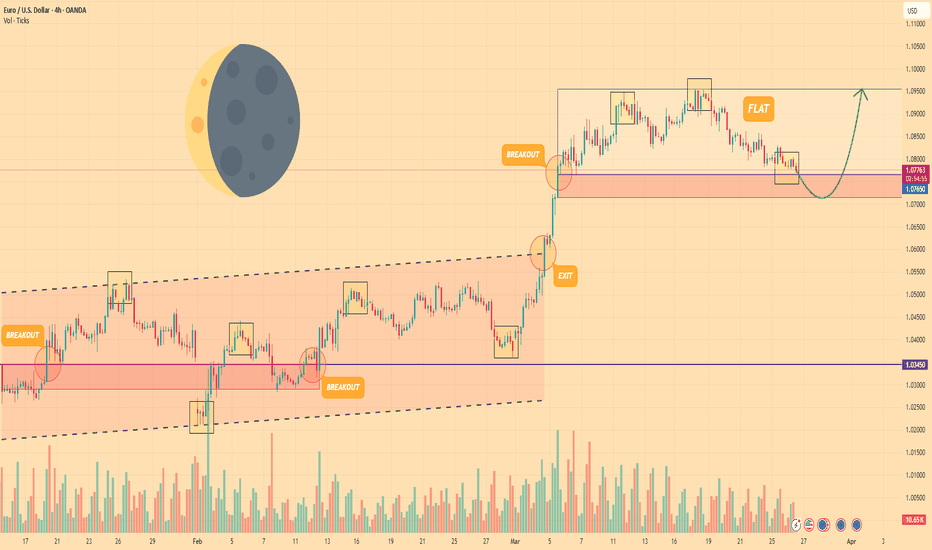

Euro may bounce up from support area to 1.0950 pointsHello traders, I want share with you my opinion about Euro. Analyzing the chart, we can observe how the price initially reached the support level that aligned with the buyer zone and broke through it. After that, the Euro moved into a wedge pattern, where it reversed near the resistance line and started to decline sharply toward the support line, forming a strong gap and breaking the support once again. Soon after, the price reversed direction and began to climb, breaking through the 1.0360 level again and rising to the resistance line of the wedge. A brief correction followed, bringing the price back down to the support level. From there, the market made a strong upward impulse, breaking out of the wedge and reaching the current support area. After the breakout, the price started moving within a triangle pattern. It broke above the 1.0785 level and climbed to the resistance line of the triangle. Then, a correction took place down to the support area, followed by a quick bounce back up to the resistance, from where the price recently started to decline. Given this structure, I expect the price to complete its correction at the support area and then bounce upward, breaking out of the triangle pattern. If this plays out, I anticipate further upward movement, with my target set at 1.0950 points. Please share this idea with your friends and click Boost 🚀

EUR/AUD H4 | Pullback support at 38.2% Fibonacci retracementEUR/AUD is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 1.7237 which is a pullback support that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 1.7155 which is a level that lies underneath a pullback support and the 61.8% Fibonacci retracement.

Take profit is at 1.7417 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

EURO - Price can exit from pennant and drop to $1.0650 pointsHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Some time ago price made strong upward impulse and broke several resistance levels on its way to the top.

Then it started to consolidate and formed a pennant pattern with a series of lower highs and higher lows.

Price touched upper boundary of the pattern and bounced down, showing weakness near resistance zone.

Recently Euro broke through the pennant support and tested $1.0790 level from above with no strength.

Now it trades slightly above the breakout point and stays below key trendline and local resistance area.

In my opinion, Euro can continue to decline and reach $1.0650 support level, exiting from pennant in the coming days.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

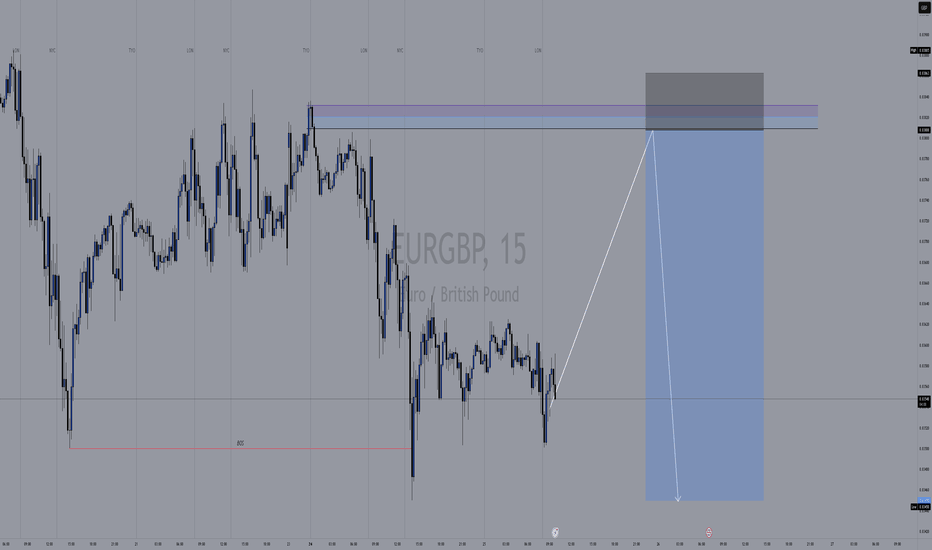

Euro in trading range awaiting breakoutAs can be seen in the chart, the Euro is fluctuating within the trading range on the 15-minute timeframe. We wait for a breakout with a strong candle from either side and enter the trade in the direction of the breakout with a target equal to the width of the trading range and a stop loss behind the breakout candle.

EURUSD 4H Bearish Cross starting the peak formation.The EURUSD pair posted a strong rebound last week, which is along the lines of our long-term bearish structure estimate, similar to the September 2024 Top.

The 4H MA50/100 Bearish Cross that was formed on Thursday, simply confirms that the pattern goes according to plan as on September 06 2024, the price got rejected after its completion and then rebounded to test Resistance 1 before the ultimate market peak.

We still expect a similar development, with our ultimate long-term Target being 1.03650, just above Support 1.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EURUSD Weekly FOREX Forecast: BUY IT!In this video, we will analyze EURUSD and EUR Futures for the week of March 31 - April 4th. We'll determine the bias for the upcoming week, and look for the best potential setups.

The bias is bullish for now, but the April 2nd tariffs can flip the markets upside down. Be careful. Let the market tell you which direction it's going, and trade accordingly. Allow the markets to settle on a bias before you jump in.

NFP on Friday, btw.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

ICT Concepts for FX and GOLD traders: 2025 edition🔍 ICT (Inner Circle Trader) is a trading methodology developed by Michael J. Huddleston. It focuses on market structure, smart money concepts (SMC), and how institutions manipulate liquidity to trap retail traders.

📚 It's not about indicators or over-complication — it's about reading the price action like a pro, understanding where liquidity is, and trading with the banks, not against them.

📐 1. Market Structure

Understand Highs & Lows: Identify break of structure (BOS) and change of character (CHOCH)

Follow the macro to micro flow: D1 > H4 > M15 for precision entries

🧱 2. Order Blocks (OBs)

An order block is the last bullish or bearish candle before a major price move.

Banks and institutions place large orders here.

Smart traders look for price to return to these areas (mitigation), then enter with tight stop losses.

👉 Think of OBs as institutional footprints on the chart.

💧 3. Liquidity Zones

Equal highs/lows, trendline touches, support/resistance — these are liquidity traps.

ICT teaches that price often hunts liquidity before reversing. That’s why many retail traders get stopped out.

Learn to trade into liquidity, not off it.

🔄 4. Fair Value Gaps (FVGs)

Also called imbalances — when price moves too fast and leaves gaps.

Price often retraces to "fill the gap" — a key entry point for ICT traders.

🥇 ICT for Gold & Forex in 2025

💰 Why It Works for XAUUSD & Majors:

Gold is a highly manipulated asset, perfect for ICT-style trading.

It responds beautifully to liquidity grabs, order blocks, and Asian–London–New York session transitions.

Forex majors (EUR/USD, GBP/USD, etc.) are also ideal since they’re heavily influenced by institutional flow and news-driven liquidity hunts.

🕐 Timing Is Everything

Trade Killzones:

📍 London Killzone: 2AM–5AM EST

📍 New York Killzone: 7AM–10AM EST

These are high-volume sessions where institutions make their moves.

📈 Typical ICT Setup

▪️Spot liquidity zone above or below recent price

▪️Wait for liquidity sweep (stop hunt)

▪️Identify nearby order block or FVG

▪️Enter on a pullback into OB/FVG

▪️Set tight SL just past the recent swing

Target internal range, opposing OB, or next liquidity level

👨💻 Why FX/GOLD Traders Love ICT

✅ It’s clean, no indicators, and highly logical

✅ Great for part-time trading — 1 or 2 trades a day

✅ Feels like "leveling up" your understanding of the market

✅ Perfect for backtesting and journaling on platforms like TradingView or SmartCharts

✅ Easy to integrate into algo-based systems or EAs for semi-automation

If you’re tired of indicators and guessing, and want to trade like the institutions, ICT is a game changer. In 2025, more prop firms and traders are applying ICT concepts to dominate markets like gold, forex, and even crypto.

🧭 Master the method. Understand the logic. Ride with the smart money.

🔥 Welcome to the next level of trading.

HelenP. I Euro drops to $1.0650 points, breaking support levelHi folks today I'm prepared for you Euro analytics. After analyzing this chart, we can see that the price spent some time within a consolidation range. During this period, the price tested the lower support zone and made a strong reaction from this level, moving upwards. This move showed strong buying pressure as the price quickly reversed from the support zone, signaling that buyers were ready to push higher. The price then broke above the trend line, continuing to rise and establishing a bullish momentum. It reached the upper resistance zone before encountering resistance and starting to consolidate. This consolidation happened within a narrow range, confirming that the market was unsure about the next move but still held above the important support 1. Now, the price is trading near the trend line and is testing the support zone. A reaction from this support will be crucial for determining the next move. Given the current price action, I expect a potential continuation of the move towards my goal at 1.0650, where the price may encounter further support and the previous price action. If you like my analytics you may support me with your like/comment ❤️

Euro can exit from pennant and rebound up from support areaHello traders, I want share with you my opinion about Euro. The price was previously trading inside an upward channel, where it consistently rebounded from the support line and moved toward the resistance line. After a final bounce from the lower boundary, EUR made a strong breakout and exited the channel, triggering a powerful bullish impulse. This move brought the price directly to the current support level at 1.0745, which overlaps with the support area. After reaching the local high, the price turned around and entered a correction phase, forming an upward pennant pattern. Inside this structure, we can see how EUR respected both the resistance line and the rising support line of the pennant. Recently, the price rebounded from the support line again, showing signs of strength near the support area, and is now consolidating at the edge of the pennant. This setup often signals an upcoming breakout. I expect the price to break above the resistance line of the pennant and continue its bullish move toward TP1, which is set at 1.0950 points. Please share this idea with your friends and click Boost 🚀

EUR/USD analysis – two Key Scenarioshello guys.

The EUR/USD pair has witnessed a strong bullish surge, breaking through key resistance levels. However, two possible scenarios emerge from this critical point:

🔴 First Scenario (Bullish Continuation):

Price could retrace to the 1.07-1.072 demand zone before resuming its upward trajectory.

If support holds, the pair may climb towards the 1.10-1.105 resistance zone, aligning with the upper boundary of the ascending channel.

🔵 Second Scenario (Bearish Reversal):

If bullish momentum fades, a deeper correction may follow, breaking below the key support zone.

This could lead the price toward the 1.04-1.043 area, marking a retest of previous lows and reinforcing bearish sentiment.

-------------------

Conclusion:

The current level serves as a critical decision point. If price sustains above support ($1.072-$1.068), bullish momentum may continue. However, a break below could signal a bearish correction, shifting market sentiment. Traders should watch key levels for confirmation of either scenario.

EURO - Price can correct to support area and rise to $1.0955Hi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Some days ago price started to grow inside a rising channel, where it broke the $1.0345 level and then it reached the resistance line.

Next, price made correction to support line of channel and then it quickly reached $1.0345 level and broke it again.

After this, price continued to grow in the channel, and later, it exited from it and rose to $1.0765 level.

Soon, price broke this level and started to trades inside flat, where it reached top part of flat and some time traded near.

Then it started to decline, so, now I expect that Euro can bounce up from support area and rise to $1.0955 points.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Eur/Usd Mar/24 Weekly analyzeHello eveyone.

Price reject at W200 ma for 2 weeks and Closed below W 200 MA also this w open below W pivot so i'm gonna sell for this week

..............................

( This is an idea and entry-tp-sl placed for my own trade , you can change entry-tp-sl depends on your risk management )

Euro can drop to 1.0650 points, breaking support levelHello traders, I want share with you my opinion about Euro. Earlier, the price was moving inside a range, bouncing between the boundaries and forming a buyer zone near the lower support area. After several rebounds, EUR started to grow and eventually broke out from the range, making a strong upward impulse. The growth continued with a breakout through the support level, which later turned into a support area. From there, the price continued its bullish trend, but after touching the resistance line, it turned around and entered a correction phase. Over the last few sessions, Euro has been forming a pennant pattern, trading between the resistance line and the support line. Now the price is consolidating near the apex of the pennant, showing weak momentum. I expect a false breakout to the upside, followed by a sharp decline from the resistance line. In this scenario, the price would likely break through the current support area and move toward the 1.0650 points - this is my TP1. Given the recent price structure, the correction phase, and the weakening bullish pressure, I remain bearish and anticipate further decline. Please share this idea with your friends and click Boost 🚀

EURUSD Short IdeaTrade entered. Entry rules met.

Confluences:

✅ Bearish overall bias

✅ Bearish demand zone

✅ Bearish impulse crab pattern

✅ Bearish divergence

✅ Bearish break of structure

✅ Entering London close zone

✅ Price is in entry zone

✅ Required risk:reward met

⭐ I shared this watch zone in my weekly forex outlook this week, you can subscribe by clicking the link in my bio.

Why eurgbp will sell this newyork session!!In my analysis, we are observing signs of weakness in the Euro, as indicated by recent candlestick formations that reflect a notable lack of buying pressure. This behavior appears to be aligning with key Fibonacci retracement levels, suggesting a potential transition towards lower price levels. I anticipate that in the pre-New York session, we may witness a temporary fake-out before a subsequent downward movement. Traders should exercise caution and consider these factors in their decision-making process

Follow me for more breakdown!!

EUR/USD Technical Analysis – Potential Reversal SetupThe EUR/USD 1-hour chart displays a recent downtrend with a series of lower highs and lower lows, forming a bearish market structure. The Harmonic patterns such as the Bat suggest potential areas of reversal, aligning with Fibonacci retracement levels.

A Change of Character (ChoCh) at the latest low (XA 0.7872) signals a possible shift in trend. The presence of bullish reaction points, marked by green triangles and yellow circles, suggests buying pressure is increasing. Additionally, the projected upward trendlines indicate possible price targets at 1.08476 (T1) and 1.08885 (T2) .

The oscillators at the bottom indicate oversold conditions, reinforcing the likelihood of a bullish correction. However, confirmation via price action and volume is necessary before entering long positions. A break above key resistance levels would further validate the upside potential.

EURGBP SELLTracking EUR/GBP on the 15-minute timeframe, we see a potential short opportunity from a key supply zone.

Key Zones & Setup:

🟣 Bearish Order Block (Supply Zone): 0.83800 - 0.83830

This area acted as strong resistance, where institutional traders likely positioned sell orders.

Expecting price to push into this zone before reversing lower.

Break of Structure (BOS) on lower timeframes (M5/M1) is needed for confirmation.

🔵 Target Area (Demand Zone): 0.83450

If the supply zone holds, price could drop toward this key demand level.

This zone aligns with previous BOS levels and price reactions.

Trade Plan:

📈 Waiting for price to push into the supply zone (0.83800 - 0.83830).

🔎 Looking for BOS on lower timeframes (M5/M1) before shorting.

✅ Entering a sell position upon confirmation.

🎯 Targeting the 0.83450 demand zone.

⚠️ Stop-loss above 0.83830 to manage risk.

Market Outlook:

If price fails to break structure, we avoid shorts and reassess.

This setup follows smart money concepts (SMC) with a focus on BOS and order blocks.

💬 What do you think? Are you seeing the same setup? 🚀🔥

USDJPY BUY📊 EUR/JPY - Order Block & Break of Structure (BOS) Strategy 📊

Tracking EUR/JPY on the 15-minute timeframe, we see a potential bullish setup based on order blocks (OBs) and smart money concepts (SMC). However, confirmation via Break of Structure (BOS) on lower timeframes will be key before entering a trade.

Key Zones:

Bullish Order Block (Demand Zone): 161.000 - 160.700

Expecting price to drop into this area, where institutions previously showed strong buying pressure.

Looking for BOS on lower timeframes (M5/M1) to confirm bullish intent before entering a buy position.

Bearish Order Block (Supply Zone): 163.500 - 163.700

A strong resistance level where price previously sold off.

If price reaches this area, we could see a reaction or potential reversal.

Trade Plan:

📉 Wait for price to enter the demand zone (161.000 - 160.700).

🔎 Look for a Break of Structure (BOS) on lower timeframes (M5/M1) to confirm bullish reversal.

✅ Enter a long position upon confirmation.

🎯 Targeting the supply zone at 163.500 - 163.700.

⚠️ Stop-loss below 160.700 to manage risk.