Is the Euro's Stability a Mirage?The Euro Currency Index stands at a crossroads, its future clouded by a confluence of political, economic, and social forces that threaten to unravel the very fabric of Europe. Rising nationalism, fueled by demographic shifts and economic fragility, is driving political instability across the continent. This unrest, particularly in economic powerhouses like Germany, triggers capital flight and erodes investor confidence. Meanwhile, geopolitical realignments—most notably the U.S.'s strategic pivot away from Europe—are weakening the euro's global standing. As these forces converge, the eurozone's once-solid foundation appears increasingly fragile, raising a critical question: is the stability of the euro merely an illusion?

Beneath the surface, deeper threats loom. Europe's aging population and shrinking workforce exacerbate economic stagnation, while the European Union's cohesion is tested by fragmentation risks, from Brexit's lingering effects to Italy's debt woes. These challenges are not isolated; they feed into a cycle of uncertainty that could destabilize financial markets and undermine the euro's value. Yet, history reminds us that Europe has weathered storms before. Its ability to adapt—through political unity, economic reform, and innovation—could determine whether the euro emerges stronger or succumbs to the pressures mounting against it.

The path forward is fraught with complexity, but it also presents an opportunity. Will Europe confront its demographic and political challenges head-on, or will it allow hidden vulnerabilities to dictate its fate? The answer may reshape not only the euro's trajectory but the future of global finance itself. As investors, policymakers, and citizens watch this drama unfold, one thing is clear: the euro's story is far from over, and its next chapter demands bold vision and decisive action. What do you see in the shadows of this unfolding crisis?

Euro

Bears give the USD a break, EUR/USD pullback may not be overThe retracement higher for the US dollar is finally underway, which also shows further upside potential. And this is why I am wary of being long EUR/USD over the foreseeable future, even if I suspect it is poised to break to new highs in the coming weeks.

Matt Simpson, Market Analyst at City Index and Forex.com

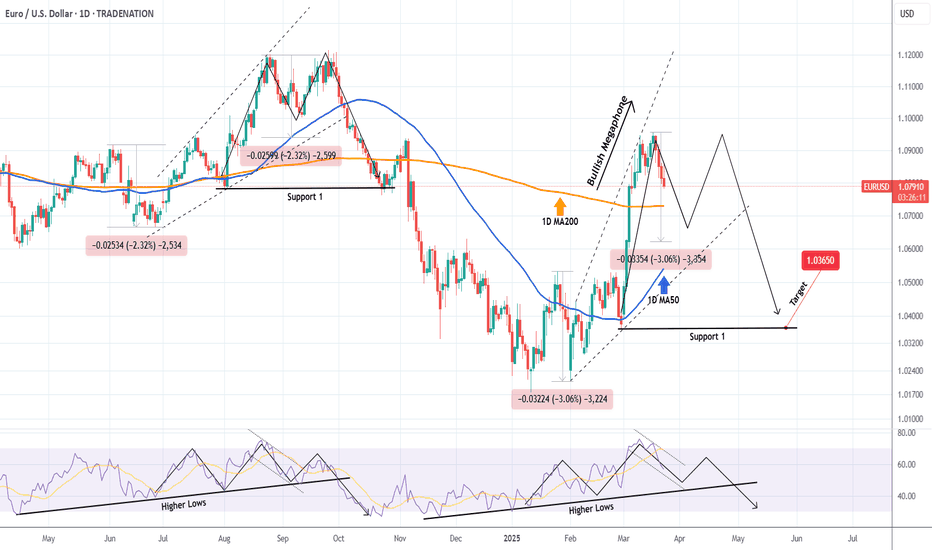

EURUSD Forming the new long-term Top.The EURUSD pair continues to trade within a Bullish Megaphone pattern and is about to complete today the 4th straight red 1D candle.

This is technically a top formation as the 1D RSI went from overbought (above 70.00) to below 60.00. Technically a downtrend gets confirmed when the price breaks below the 1D MA50 (blue trend-line) so until it does, the probability for another short-term bounce there isn't small. This is what took place in September 2024.

Once the 1D MA50 breaks though, we expect a test of Support 1 at 1.03650, as it happened on October 23 2024.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EURO - Price can break support level and continue to move downHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Some time ago price reach and broke $1.0800 level and started to grow inside a rising channel pattern.

It reached the resistance level, bounced down, made correction to support and then rose up once again.

Euro touched $1.0920 level second time and turned around, after which exited from this rising channel.

Then price dropped fast and formed falling channel, breaking through $1.0920 level and reaching $1.0800 level.

After that it bounced up a little, but stayed inside the bearish channel without breaking resistance line.

Now price moves between support and resistance, but in my mind it can decline to $1.0715 support line.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Behind the Curtain The Economic Pulse Behind Euro FX1. Introduction

Euro FX Futures (6E), traded on the CME, offer traders exposure to the euro-dollar exchange rate with precision, liquidity, and leverage. Whether hedging European currency risk or speculating on macro shifts, Euro FX contracts remain a vital component of global currency markets.

But what truly moves the euro? Beyond central bank meetings and headlines, the euro reacts sharply to macroeconomic data that signals growth, inflation, or risk appetite. Using a Random Forest Regressor, we explored how economic indicators correlate with Euro FX Futures returns across different timeframes.

In this article, we uncover which metrics drive the euro daily, weekly, and monthly, offering traders a structured, data-backed approach to navigating the Euro FX landscape.

2. Understanding Euro FX Futures Contracts

The CME offers two primary Euro FX Futures products:

o Standard Euro FX Futures (6E):

Contract Size: 125,000 €

Tick Size: 0.000050 per euro = $6.25 per tick per contract

Trading Hours: Nearly 24 hours, Sunday to Friday (US)

o Micro Euro FX Futures (M6E):

Contract Size: 12,500 € (1/10th the size of 6E)

Tick Size: 0.0001 per euro = $1.25 per tick per contract

Accessible to: Smaller accounts, strategy testers, and traders managing precise exposure

o Margins:

6E Initial Margin: ≈ $2,600 per contract (subject to volatility)

M6E Initial Margin: ≈ $260 per contract

Whether trading full-size or micro contracts, Euro FX Futures offer capital-efficient access to one of the most liquid currency pairs globally. Traders benefit from leverage, scalability, and transparent pricing, with the ability to hedge or speculate on Euro FX trends across timeframes.

3. Daily Timeframe: Key Economic Indicators

For day traders, short-term price action in the euro often hinges on rapidly released data that affects market sentiment and intraday flow. According to machine learning results, the top 3 daily drivers are:

Housing Starts: Surging housing starts in the U.S. can signal economic strength and pressure the euro via stronger USD flows. Conversely, weaker construction activity may weaken the dollar and support the euro.

Consumer Sentiment Index: A sentiment-driven metric that reflects household confidence. Optimistic consumers suggest robust consumption and a firm dollar, while pessimism may favor EUR strength on defensive rotation.

Housing Price Index (HPI): Rising home prices can stoke inflation fears and central bank hawkishness, affecting yield differentials between the euro and the dollar. HPI moves often spark short-term FX volatility.

4. Weekly Timeframe: Key Economic Indicators

Swing traders looking for trends spanning several sessions often lean on energy prices and labor data. Weekly insights from our Random Forest model show these three indicators as top drivers:

WTI Crude Oil Prices: Oil prices affect global inflation and trade dynamics. Rising WTI can fuel EUR strength if it leads to USD weakness via inflation concerns or reduced real yields.

Continuing Jobless Claims: An uptick in claims may suggest softening labor conditions in the U.S., potentially bullish for EUR as it implies slower Fed tightening or economic strain.

Brent Crude Oil Prices: As the global benchmark, Brent’s influence on inflation and trade flows is significant. Sustained Brent rallies could create euro tailwinds through weakening dollar momentum.

5. Monthly Timeframe: Key Economic Indicators

Position traders and institutional participants often focus on macroeconomic indicators with structural weight—those that influence monetary policy direction, capital flow, and long-term sentiment. The following three monthly indicators emerged as dominant forces shaping Euro FX Futures:

Industrial Production: A cornerstone of economic output, rising industrial production reflects strong manufacturing activity. Strong U.S. numbers can support the dollar, while a slowdown may benefit the euro. Likewise, weaker European output could undermine EUR demand.

Velocity of Money (M2): This metric reveals how quickly money is circulating in the economy. A rising M2 velocity suggests increased spending and inflationary pressures—potentially positive for the dollar and negative for the euro. Falling velocity signals stagnation and may shift flows into the euro as a lower-yield alternative.

Initial Jobless Claims: While often viewed weekly, the monthly average could reveal structural labor market resilience. A rising trend may weaken the dollar, reinforcing EUR gains as expectations for interest rate cuts grow.

6. Strategy Alignment by Trading Style

Each indicator offers unique insights depending on your approach to market participation:

Day Traders: Focus on the immediacy of daily indicators like Housing Starts, Consumer Sentiment, and Housing Price Index.

Swing Traders: Leverage weekly indicators like Crude Oil Prices and Continuing Claims to ride mid-term moves.

Position Traders: Watch longer-term data such as Industrial Production and M2 Velocity.

7. Risk Management

Currency futures provide access to high leverage and broad macro exposure. With that comes responsibility. Traders must actively manage position sizing, volatility exposure, and stop placement.

Economic indicators inform price movement probabilities—not certainties—making risk protocols just as essential as trade entries.

8. Conclusion

Euro FX Futures are shaped by a deep web of macroeconomic forces. From Consumer Sentiment and Oil Prices to Industrial Production and Money Velocity, each indicator tells part of the story behind Euro FX movement.

Thanks to machine learning, we’ve spotlighted the most impactful data across timeframes, offering traders a framework to align their approach with the heartbeat of the market.

As we continue the "Behind the Curtain" series, stay tuned for future editions uncovering the hidden economic forces behind other major futures markets.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

EURUSD: Detailed Support & Resistance Analysis For Next Week

Here is my latest structure analysis for EURUSD;

Resistance 1: 1.0944 - 1.0955 area

Support 1: 1.0804 - 1.0834 area

Support 2: 1.0598 - 1.0630 area

Support 3: 1.0515 - 1.0533 area

Support 4: 1.0359 - 1.0377 area

Support 5: 1.0727 - 1.0290 area

Support 6: 1.0717 - 1.0240 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Ultimate 2025 Forex Prop Trading FAQ + Strategy Guide🧠 Forex Prop Trading: What Is It?

Prop trading (proprietary trading) is when a trader uses a firm’s capital to trade the markets (instead of their own), and keeps a share of the profits – usually 70–90%.

✅ Low startup cost

✅ No personal risk (firm takes the loss)

✅ Big upside potential with scaling plans

📋 Step-by-Step Action Plan to Get Started (2025)

🔍 1. Understand the Prop Firm Model

🏦 Prop firms fund skilled traders with $10K to $500K+

🎯 You pass a challenge or evaluation phase to prove your skills

💵 Once funded, you earn a profit split (70%–90%)

🧪 2. Choose a Top Prop Firm (2025)

Look for reliable and regulated firms with transparent rules:

FTMO 🌍 – Trusted globally, up to $400K scaling

MyFundedFX 📊 – Up to 90% profit split, no time limit

E8 Funding ⚡ – Fast scaling and instant funding

FundedNext 💼 – 15% profit share during challenge phase

The Funded Trader 🏰 – Up to $600K with leaderboard bonuses

🔎 Compare features: fees, drawdown limits, trading style freedom

💻 3. Train & Master Your Strategy

🧠 Pick a clear, rule-based strategy (e.g. trend following, breakout, supply/demand)

📅 Backtest over 6–12 months of data

💡 Use AI tools & trade journals like Edgewonk or MyFXBook

🎯 Focus on:

Win rate (above 50–60%)

Risk-reward ratio (1:2 or better)

Consistency, not wild profits

🧪 4. Pass the Evaluation Phase

🔐 Follow risk rules strictly (daily & max drawdown)

⚖️ Use proper risk management (0.5–1% risk per trade)

🧘♂️ Trade calmly, avoid overtrading or revenge trades

📈 Most challenges:

Hit 8–10% profit target

Stay under 5–10% total drawdown

Trade for at least 5–10 days

🧠 Tip: Pass in a demo environment first before going live!

💵 5. Get Funded & Start Earning

🟢 Once approved, you trade real firm capital

💰 You keep up to 90% of profits, with withdrawals every 2 weeks to 1 month

🚀 Many firms offer scaling plans to grow your account over time

💬 FAQ – Prop Trading in 2025

❓ How much can you make?

🔹 Small accounts ($50K): $2K–$8K/month with 4–8% returns

🔹 Large accounts ($200K+): $10K+/month possible for consistent traders

💡 Many traders start part-time and scale as they build trust with the firm

❓ How much do I need to start?

💳 Challenge fees range from:

$100 for $10K

$250–$350 for $50K

$500–$700 for $100K+

⚠️ No need to deposit trade capital – just the challenge fee

❓ What are the risks?

You can lose the challenge fee if you break rules or over-leverage

You won’t owe money to the firm

The biggest risk is psychological – many fail from overtrading or emotional decisions

🚀 Final Tips to Succeed

✅ Trade like a robot, think like a CEO

✅ Journal every trade – self-awareness is key

✅ Avoid over-leveraging and gambling mindset

✅ Stick to one strategy and master it

✅ Focus on consistency over quick wins

EURUSD Channel Down bottomed. Short term buy.EURUSD is trading inside a (1h) Channel Down pattern, which just reached its bottom.

Last time that happened, the market rallied by 1.25%.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 1.09200 (+1.25%).

Tips:

1. The RSI (1h) is trading on higher lows, which is a bullish divegernce in contrast to the price's lower lows. Standard bottom signal.

Please like, follow and comment!!

HelenP. I Euro will decline to 1.0710, breaking support levelHi folks today I'm prepared for you Euro analytics. Euro recently tested the Support Zone, but buyers couldn't push the price higher. After a weak reaction, the price started to decline, showing that sellers are still strong. Now, it is trading near this support area, and I expect further downward movement. If sellers maintain pressure, EUR could break below the Support Zone and decline toward 1.0710 points, which coincides with the trend line. This level will be crucial—if the price bounces, we might see a local rebound, but if it breaks, a deeper drop could follow. Looking at past price action, we can see that the trend line has acted as strong support multiple times. However, each test weakens the level, increasing the chances of a breakdown. If the price reaches 1.0710 points, I will watch how it reacts. A clear breakdown could push EUR/USD lower, potentially toward 1.0425 (Support 2). For now, I anticipate a decline to 1.0710 points, where the price will decide its next move. My goal remains at 1.0710 points. If you like my analytics you may support me with your like/comment ❤️

Euro can rebound from mirror line and start to move upHello traders, I want share with you my opinion about Euro. This chart illustrates how the price started trading within a range, where it initially corrected to the buyer zone and reached the mirror line. After that, it began to rise and, in a short time, moved up to the upper boundary of the range, which coincided with both the support level and the support area. Next, the price reversed and dropped back to the buyer zone, breaking through the mirror line. However, EUR soon resumed its movement within the range and eventually reached the upper boundary again. After consolidating near this area for a while, it made a slight correction before rebounding to the mirror line. Later, the Euro broke out of the range and eventually breached the mirror line, reaching the current support level, which aligned with the seller zone. Although it briefly rose after breaking this level, it recently reversed and fell back into the seller zone. At this point, the Euro might test the mirror line before starting to move upward, exiting the seller zone. Based on this, my TP is set at 1.1050. Please share this idea with your friends and click Boost 🚀

Fundamental Market Analysis for March 21, 2025 EURUSDFederal Reserve (Fed) Chairman Jerome Powell downplayed the danger to the economy from US President Donald Trump's tariff threats, which seem to exist in a quantum state where they both exist and don't exist at the same time. According to Fed Chairman Powell, downside risks have certainly increased thanks to repeated tariff threats, but Fed policymakers continue to insist that US economic data remains strong, albeit off recent highs.

The Federal Reserve Bank of Philadelphia's (Fed) manufacturing activity survey for March fell to 12.5 m/m, down from the previous reading of 18.1 and down for the second month in a row, but held the brakes and fell less than the median market forecast of 8.5. US weekly initial jobless claims also rose less than expected at 223,000 new jobless claimants, up from 220,000 the previous week. Investors had expected the figure to be 224k. Sales of existing homes in the US also rose by almost a third of a million transactions more than expected, rising to 4.26 million units in February from a revised January figure of 4.09 million. Market watchers had expected a slight slowdown to 3.95 million.

With little in the way of economic data on Friday, investors will have a week's worth of events to digest. Traders will also keep an eye on any social media developments from President Trump.

Trade recommendation: SELL 1.0850, SL 1.0930, TP 1.0760

EURUSD Sell Position - 21 March 2025 Hello everyone, dzhvush here !

I am looking for selling position on FOREXCOM:EURUSD chart. I think we will close the price below the LL level. At 05:00 AM (GMT -4), we have current account new for Euro. I am waiting that the price is going up in Asia Range.Then at London Range, waiting for taken liquidity.

Notes for me being better trader:

You don't need to look the chart every single minute.

You are doing well, just keep in simple and no reaction.

Believe

See you next week !

Best Regards

dzhvush

EUR, setting up for another MASSIVE rise from 1.085... SEED NOW!TRADE SEED SIGNAL: FX LONG EURUSD.

EU doing some familiar dance steps. It did the same thing before the huge run up from 1.04 season before it tap 1.09 zone (+500 pips).

Now EU is doing the same formation again for that next massive RISE.. I call this the 1-2 punch signal, when this show -- some wonderful things is about to transpire.

We are at the elusive basing zone now. A rare opportunity to Seed at the current discounted range.

Spotted at 1.0850

Interim at 1.11 / 1.12.

TAYOR. Trade safely.

EURUSD Bulls Eyeing FOMC–Will Powell’s Dovish Tone Fuel a Rally?As we approach the much-anticipated FOMC rate decision and Powell’s press conference , market sentiment is shifting, and EURUSD ( FX:EURUSD ) traders are closely watching for clues on the Federal Reserve’s next move . With recent economic data pointing to signs of slowing growth and cooling inflation, the Fed might adopt a more dovish tone , fueling further upside for EURUSD .

Key Factors Driving the Bullish Outlook :

Inflation & Economic Data : CPI and PPI data indicate a gradual cooling of inflation, which strengthens the case for a potential rate cut later this year. If Powell acknowledges this shift, it could weigh on the dollar.

Market Pricing of Rate Cuts : Investors are already pricing in multiple Fed rate cuts for 2024. A dovish Powell could accelerate these expectations, weakening USD and pushing the EURUSD higher.

------------------------------------------------------------------

Now let's take a look at the EURUSD chart on the 2-hour time frame .

EURUSD is moving near the Resistance zone($1.0983-$1.0916) and Yearly Resistance(1) .

Regarding Elliott Wave theory , it seems that EURUSD has managed to complete the main wave 4 . The structure of the main wave 4 is the Double Three Correction(WXY) .

The main wave 5 is likely to complete near the upper line of the ascending channel(possible) and Monthly Resistance(4) .

I expect EURUSD to rise in the coming hours to the targets I have indicated on the chart, although the Federal Reserve Conference could create long shadows , but I think the supply and demand zones will still work but still pay more attention to money management today .

Note: If EURUSD can break below the Potential Reversal Zone(PRZ) , there is a possibility of further decline in EURUSD.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S. Dollar Analyze (EURUSD), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EURO - Price can decline to support level and then bounce upHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Some time ago price started to grow inside a rising channel, where it at once bounced down from $1.0415 level.

Then it turned around and rose to the resistance line of the channel in a short time, but soon fell back, making a gap also.

Euro rose to $1.0415 level and broke it, after which some time traded near it and then made an upward impulse.

Price exited from a rising channel and reached $1.0825 level, broke it, and started to grow inside another channel.

In this channel, price reached resistance line, after which it corrected to support level and then continued to grow.

So, in my opinion, Euro can decline to support level and then it bounce up to $1.1050

If this post is useful to you, you can support me with like/boost and advice in comments❤️

EURCHF LongHi Everyone,

Hope you are all well and enjoyed my gold signal that hit all TP's

Here is our EURCHF Signal. wait for the 15 minute candle to close above the entry, and then for price to respect the entry, then we can enter. Here are the numbers.

EURCHF Buy

📊Entry: 0.95727

⚠️Sl: 0.95176

✔️TP1: 0.96349

✔️TP2: 0.97141

✔️TP3: 0.98148

Stick to the rules

Hope you all earn lots of profit.

Best wishes,

Sarah

EURUSD: Big Bearish Divergence on 4H.EURUSD is bullish on its 1D technical outlook (RSI = 66.538, MACD = -0.013, ADX = 29.911) but just crossed under the 4H MA50 for the first time since the March 3rd 2025 breakout when the parabolic rally started. The strongest sell signal is nonetheless given by the 4H RSI which, while the price is on a Channel Up, it has been on a Channel Down, i.e. a Bearish Divergence. The previous time an uptrend broke below its 4H MA50 on the same RSI Bearish Divergence was on the September 30th 2024 High. The result was a strong bearish breakdown to the S1 level. Consequently, we can turn bearish here and aim a little higher than S1 (TP = 1.0400).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

EUR/JPY Market Analysis: Potential Reversal at Key Resistance LeThe EUR/JPY pair, on the 4-hour chart, exhibits a strong bullish impulse that recently peaked around 163.64 , aligning with a key Fibonacci extension level (1.618). This area marks a critical resistance zone, where price action has shown signs of rejection.

The Harmonic pattern, such as the b]Crab , suggest potential exhaustion of the uptrend. The latest leg upward reached a 2.618 extension , reinforcing the possibility of a corrective move. Support levels to monitor include ** 162.23 ** (BC) and ** 160.59 ** (T1), which could serve as downside targets if bearish momentum gains traction.

For traders, a decisive break above **163.64** could invalidate the short-term bearish bias, paving the way for further upside. Conversely, sustained rejection from this level may trigger a deeper retracement towards key Fibonacci and harmonic support zones.

Conclusion : The pair is at a critical inflection point, where price action and confirmation of rejection signals will determine the next directional move. Traders should watch for price action at resistance and key support levels to assess trade opportunities.

Euro will rebound from support area and continue to move upHello traders, I want share with you my opinion about Euro. This chart illustrates how the price entered an upward channel and immediately broke below the 1.0500 support level. After trading for some time within the buyer zone, it dropped to the support line. Following this move, the Euro reversed and started climbing, eventually reaching the 1.0500 level again, breaking above it, and making a retest. The price then continued to rise and later reached the current support level, which coincided with the support area and the channel's trend line, where it traded for a while. Soon after, the Euro broke through the 1.0805 level and remained within the support area for an extended period before climbing to 1.0945. At that point, it reversed and started declining. The Euro quickly dropped to the support line of the channel and then bounced back up. However, it recently fell again to the support line of the channel, where it has been gradually moving higher since. Given this setup, I expect the Euro to decline to the support area before rebounding and continuing its upward movement within the channel. Based on this, my TP is set at 1.1150. Please share this idea with your friends and click Boost 🚀

EURO - Price can bounce from support line of wedge to $1.1045Hi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Some time ago, the price declined to the $1.0475 level and broke it, after which it declined to $1.0360 points.

Then price turned around and started to grow inside the wedge, where it soon reached $1.0475 level and broke it again.

Next, Euro made a retest, after breakout and then continued to move up, and later it reached $1.0835 level.

Price has some time traded below this level, and then it broke it and reached the resistance line of wedge.

After this, EUR long time traded near $1.0835 level and not long time ago it bounced and started to grow.

In my mind, Euro can bounce from the support line and then rise to $1.1045 resistance line of the wedge pattern.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Market Analysis: EUR/USD (1H Chart)The EUR/USD pair is currently consolidating following a Break of Structure (BoS) to the upside, suggesting a potential shift in market sentiment. The price action indicates a corrective phase after a strong bullish impulsive move.

Key Levels:

- Resistance: **1.09322** (target zone)

- Support: **1.08622** (H1 demand zone)

- Current Price: **1.08854**

- Market Structure & Outlook :

- The price recently formed a **BoS**, signalling a possible bullish continuation.

- There is an **order block** within the highlighted demand zone, which could act as a strong support level.

- The grey risk-reward box suggests a long position setup, with a stop-loss below **1.08622** and a target near **1.09322**.

- Trading Consideration:

- If the price retests the **H1 demand zone** and shows bullish confirmation, a long position could be favourable.

- A break below **1.08622** could invalidate the bullish bias, shifting momentum to the downside.

Overall, the market is currently at a decision point, with bullish continuation likely if key support holds.

EUR/USD Dips Amid U.S.-EU Trade TensionsEUR/USD is slightly down, hovering near 1.0915 in early Asian trading. The Euro faces pressure from rising U.S.-EU trade tensions after Trump announced new tariffs on European goods. Washington imposed duties on steel and aluminum, prompting Brussels to prepare countermeasures, while Trump threatened a 200% tariff on European wine and spirits, adding downside risks for the Euro.

However, losses may be limited by Germany’s fiscal policy shifts. The Green Party supports debt restructuring, and incoming Chancellor Friedrich Merz proposed a €500 billion infrastructure fund with borrowing rule adjustments. The measures expected to be passed this week could support the Euro.

Weak U.S. Retail Sales data also weigh on the Dollar. February sales rose just 0.2% vs. the expected 0.7%, while January’s figures were revised lower to -1.2%. Annual sales growth slowed to 3.1% from 3.9%, fueling concerns about consumer spending and offering near-term support for EUR/USD.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0880, with further levels at 1.0800 and 1.0730.