EUR/USD Technical Analysis – Potential Reversal SetupThe EUR/USD 1-hour chart displays a recent downtrend with a series of lower highs and lower lows, forming a bearish market structure. The Harmonic patterns such as the Bat suggest potential areas of reversal, aligning with Fibonacci retracement levels.

A Change of Character (ChoCh) at the latest low (XA 0.7872) signals a possible shift in trend. The presence of bullish reaction points, marked by green triangles and yellow circles, suggests buying pressure is increasing. Additionally, the projected upward trendlines indicate possible price targets at 1.08476 (T1) and 1.08885 (T2) .

The oscillators at the bottom indicate oversold conditions, reinforcing the likelihood of a bullish correction. However, confirmation via price action and volume is necessary before entering long positions. A break above key resistance levels would further validate the upside potential.

Eurodollar

US PMI Strength Drives Dollar HigherEUR/USD is trading at $1.08 as the U.S. dollar strengthens on solid U.S. services PMI data, which signaled economic resilience and pushed yields higher. Confidence in the dollar was further enabled by Trump’s remarks suggesting not all April 2 tariffs will be implemented, with possible exemptions for some countries. Meanwhile, the euro is under pressure as its recent rally fades and Eurozone economic signals weaken, keeping EUR/USD on a downward path driven by dollar strength.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0730, with further levels at 1.0660 and 1.0600.

Yields Weigh on EUR/USD: Euro at 1.0820EUR/USD is trading around 1.0820 on Monday, rebounding slightly from last week’s low of 1.0795. The euro has pulled back from its recent high of 1.0955 with uncertainty over Germany’s fiscal policy and rising global trade tensions.

Caution persists before the April 2 announcement of new U.S. tariffs, which could weigh on the eurozone. Despite the modest recovery, the euro remains under pressure from stronger U.S. Treasury yields and demand for the dollar.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0800, with further levels at 1.0730 and 1.0670.

EUR/USD Daily Chart Analysis For Week of March 21, 2025Technical Analysis and Outlook:

As indicated in the analysis conducted last week, the Euro has initiated a downward trend following a successful retest of the Mean Resistance level at 1.093. It is currently trending downward toward the Mean Support level at 1.078, potentially declining further to the Mean Support level at 1.061. Conversely, should the anticipated downward trend not materialize, the Eurodollar will retest the Mean Resistance level at 1.087, with an additional resistance level marked at 1.095.

Lagarde Flags Slower Growth from U.S. TariffsThe euro fell below $1.085, retreating from its March 18 high of $1.0954, after ECB President Christine Lagarde warned of slower growth risks. Speaking to European lawmakers, she said a proposed 25% U.S. tariff on EU goods could cut eurozone growth by 0.3 percentage points in the first year, or 0.5 points if the EU retaliates. Lagarde added that the main impact would be front-loaded, with limited inflation pressures, suggesting the ECB is unlikely to raise rates in response.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0800, with further levels at 1.0730 and 1.0670.

Fundamental Market Analysis for March 21, 2025 EURUSDFederal Reserve (Fed) Chairman Jerome Powell downplayed the danger to the economy from US President Donald Trump's tariff threats, which seem to exist in a quantum state where they both exist and don't exist at the same time. According to Fed Chairman Powell, downside risks have certainly increased thanks to repeated tariff threats, but Fed policymakers continue to insist that US economic data remains strong, albeit off recent highs.

The Federal Reserve Bank of Philadelphia's (Fed) manufacturing activity survey for March fell to 12.5 m/m, down from the previous reading of 18.1 and down for the second month in a row, but held the brakes and fell less than the median market forecast of 8.5. US weekly initial jobless claims also rose less than expected at 223,000 new jobless claimants, up from 220,000 the previous week. Investors had expected the figure to be 224k. Sales of existing homes in the US also rose by almost a third of a million transactions more than expected, rising to 4.26 million units in February from a revised January figure of 4.09 million. Market watchers had expected a slight slowdown to 3.95 million.

With little in the way of economic data on Friday, investors will have a week's worth of events to digest. Traders will also keep an eye on any social media developments from President Trump.

Trade recommendation: SELL 1.0850, SL 1.0930, TP 1.0760

EUROUSD TRADING POINT UPDATE > READ THE CHAPTIAN Buddy'S dear friend

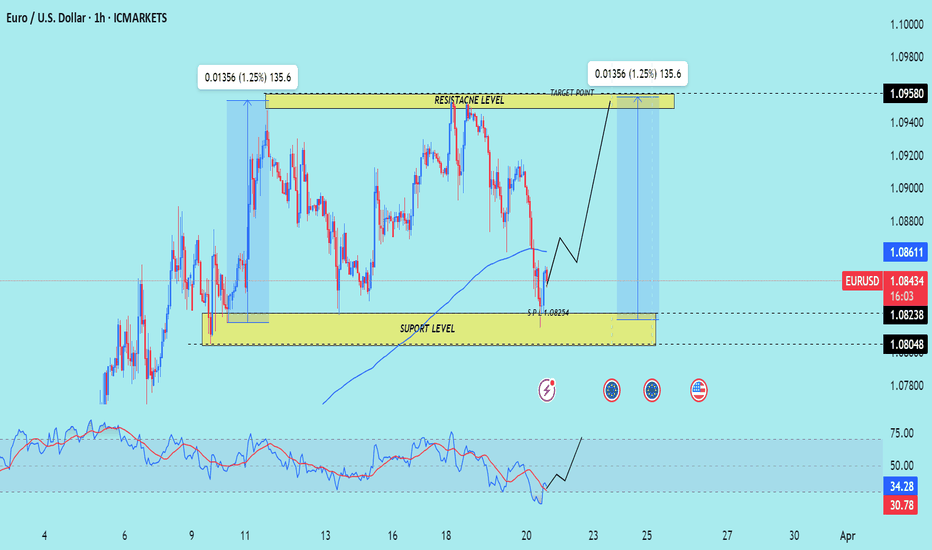

SMC Trading Signals Update 🗾🗺️ Euro USD Traders SMC-Trading Point update you on New technical analysis setup for Euro USD ) Euro USD Technical patterns support level pullback up trend 📈🚀 1.08254 strong 🪨 support level target 🎯 point Resistance level 1.09580 good luck 💯💯

Key Resistance level 1.09580

Key Support 1.08254

Mr SMC Trading point

Palee support boost 🚀 analysis follow)

EURUSD Bulls Eyeing FOMC–Will Powell’s Dovish Tone Fuel a Rally?As we approach the much-anticipated FOMC rate decision and Powell’s press conference , market sentiment is shifting, and EURUSD ( FX:EURUSD ) traders are closely watching for clues on the Federal Reserve’s next move . With recent economic data pointing to signs of slowing growth and cooling inflation, the Fed might adopt a more dovish tone , fueling further upside for EURUSD .

Key Factors Driving the Bullish Outlook :

Inflation & Economic Data : CPI and PPI data indicate a gradual cooling of inflation, which strengthens the case for a potential rate cut later this year. If Powell acknowledges this shift, it could weigh on the dollar.

Market Pricing of Rate Cuts : Investors are already pricing in multiple Fed rate cuts for 2024. A dovish Powell could accelerate these expectations, weakening USD and pushing the EURUSD higher.

------------------------------------------------------------------

Now let's take a look at the EURUSD chart on the 2-hour time frame .

EURUSD is moving near the Resistance zone($1.0983-$1.0916) and Yearly Resistance(1) .

Regarding Elliott Wave theory , it seems that EURUSD has managed to complete the main wave 4 . The structure of the main wave 4 is the Double Three Correction(WXY) .

The main wave 5 is likely to complete near the upper line of the ascending channel(possible) and Monthly Resistance(4) .

I expect EURUSD to rise in the coming hours to the targets I have indicated on the chart, although the Federal Reserve Conference could create long shadows , but I think the supply and demand zones will still work but still pay more attention to money management today .

Note: If EURUSD can break below the Potential Reversal Zone(PRZ) , there is a possibility of further decline in EURUSD.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S. Dollar Analyze (EURUSD), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

ECB Rate Cut Hopes Fade, EUR/USD Nears 1.0900EUR/USD fell for a second day, nearing 1.0900 in the Asian session. The pair found support as the dollar weakened on falling Treasury yields after the Fed reaffirmed plans for two rate cuts. However, uncertainty over Trump’s tariff policies kept sentiment cautious.

In Europe, German lawmakers approved a debt plan by likely Chancellor Friedrich Merz to increase growth and defense spending. A shift from Germany’s conservative fiscal stance could drive inflation and influence ECB policy.

Investors await ECB President Lagarde’s speech on economic and monetary affairs in Brussels on Thursday.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0880, with further levels at 1.0800 and 1.0730.

EUR/USD Dips Amid U.S.-EU Trade TensionsEUR/USD is slightly down, hovering near 1.0915 in early Asian trading. The Euro faces pressure from rising U.S.-EU trade tensions after Trump announced new tariffs on European goods. Washington imposed duties on steel and aluminum, prompting Brussels to prepare countermeasures, while Trump threatened a 200% tariff on European wine and spirits, adding downside risks for the Euro.

However, losses may be limited by Germany’s fiscal policy shifts. The Green Party supports debt restructuring, and incoming Chancellor Friedrich Merz proposed a €500 billion infrastructure fund with borrowing rule adjustments. The measures expected to be passed this week could support the Euro.

Weak U.S. Retail Sales data also weigh on the Dollar. February sales rose just 0.2% vs. the expected 0.7%, while January’s figures were revised lower to -1.2%. Annual sales growth slowed to 3.1% from 3.9%, fueling concerns about consumer spending and offering near-term support for EUR/USD.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0880, with further levels at 1.0800 and 1.0730.

Fundamental Market Analysis for March 18, 2025 EURUSDThe escalating trade war with further tariffs on European Union goods by US President Donald Trump is having a negative impact on the Euro (EUR).

The US has imposed tariffs on steel and aluminium, the EU has drawn up plans to retaliate, and Trump has promised to impose retaliatory 200% tariffs on European wines and spirits. Any signs of an escalation in the tariff war between the US and EU could put pressure on the euro.

German Chancellor Friedrich Merz has agreed to a €500bn infrastructure fund and radical changes to borrowing rules, or stretching the so-called ‘debt brake’. That should ensure the package is approved in Germany's lower house of parliament on Tuesday and in the upper house on Friday. This, in turn, could boost the common currency against the US dollar (USD) in the near term.

In addition, weaker-than-expected US retail sales data has heightened concerns about a slowdown in consumer spending. This report could put pressure on the USD and serve as a tailwind for the major pair. US retail sales rose 0.2% month-on-month in February, compared to a 1.2% drop (revised from -0.9%) in January, the US Census Bureau reported on Monday. The figure was weaker than market expectations, which had expected a 0.7% rise. On a year-over-year basis, retail sales rose 3.1% compared to 3.9% (revised from 4.2%) previously.

Trade recommendation: BUY 1.0920, SL 1.0840, TP 1.1040

EUR/USD Daily Chart Analysis For Week of March 14, 2025Technical Analysis and Outlook:

As indicated in the analysis from the previous week, the Euro has commenced an upward trend, successfully retesting the completed Inner Currency Rally at 1.086 and advancing toward the Mean Resistance level at 1.093. Consequently, the currency is currently experiencing a retreat and is directing its focus toward the Mean Support level at 1.078, possibly declining further to the Mean Support level at 1.061. Conversely, should the anticipated downward trend fail to materialize, it is plausible that the Eurodollar will retest the Mean Resistance level at 1.093 and subsequently aim for the completed Outer Currency Rally level of 1.124, traversing Key Resistance at 1.119 along the way.

NETH25/NL25 "Netherland 25" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NETH25/NL25 "Netherland 25" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (936.00) swing Trade Basis Using the 3H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 900.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Sentimental Outlook:

NETH25/NL25 "Netherland 25" Indices Market is currently experiencing a Neutral trend (Slightly Bearishness)., driven by several key factors.

🎇🎆Fundamental Analysis

Earnings: Q4 2024 strong for Dutch firms (ASML, Shell), reported Jan 2025; Q1 2025 prelims suggest tech/energy resilience—bullish.

Rates: ECB at 2.5% (ECB Data Portal)—low yields support equities—bullish.

Inflation: Eurozone 2.8% (Eurostat, Jan 2025)—above target, mixed impact.

Growth: Netherlands GDP ~1.5% (Eurostat Q4 est.)—steady, mildly bullish.

Geopolitics: U.S.-China tariffs shift trade to Europe (ECB projections)—bullish.

🎇🎆Macroeconomic Factors

U.S.: PMI 50.4, Fed 3-3.5%—USD softness aids Eurozone equities—bullish.

Eurozone: PMI 46.2 (Eurostat, Feb 2025)—stagnation, bearish; ECB easing helps—bullish.

Global: China 4.5%, Japan 1% (ECB forecasts)—slowdown, risk-off—bearish.

Commodities: Oil $70.44—stable, neutral

Trump Policies: Tariffs (25% Mexico/Canada, 10% China)—trade benefits Europe—bullish.

🎇🎆Commitments of Traders (COT) Data

Speculators: Net long ~25,000 contracts (down from 30,000)—cautious bullishness.

Hedgers: Net short ~30,000—stable, locking in gains.

Open Interest: ~60,000 contracts—steady global interest, neutral.

🎇🎆Market Sentiment Analysis

Retail: 50% short (global X posts)—balanced, mild upside risk—neutral.

Institutional: Bullish on tech (ASML), cautious on growth (ECB forecasts)—neutral.

Corporate: Dutch firms hedge at 935-940—neutral.

Social Media Trends: Mixed—bullish to 950, bearish to 910—neutral.

🎇🎆Positioning Analysis

Speculative: Longs target 940-950, shorts aim for 910-900 (global consensus).

Retail: Shorts at 930-935—squeeze risk if price rises.

Institutional: Balanced, tech-driven optimism.

🎇🎆Quantitative Analysis

SMAs: 50-day ~885, 200-day ~860—price above both, bullish.

RSI: 58 (daily)—bullish momentum, not overbought.

Bollinger: 910-930—price at upper band, breakout potential.

Fibonacci: 61.8% from 950-800 at 900—support below holds.

Volatility: 1-month IV 13%—±10-point daily range.

🎇🎆Intermarket Analysis

EUR/USD: Below 1.0500—EUR weakness, neutral for AEX.

DXY: 106.00, softening—supports equities—bullish.

XAU/USD: 2910—gold rise, risk-off—bearish.

DAX: ~19,000, stable—correlated support—neutral.

Bonds: Eurozone 2.2% (ECB)—low yields aid equities—bullish.

🎇🎆News and Events Analysis

Recent: Eurozone GDP flat (Eurostat Q4 2024)—bearish; tariffs shift trade (ECB)—bullish.

Upcoming: U.S. PCE (Feb 28)—hot data lifts USD/yields, pressures AEX; soft data rallies equities—mixed.

Impact: Bullish short-term, PCE reaction key.

🎇🎆Next Trend Move

Technical: Support 910-900, resistance 940-950. Below 910 targets 900; above 940 aims for 960.

Short-Term (1-2 Weeks): Up to 940-950 if risk-off eases; dip to 900 if PCE strengthens USD.

Medium-Term (1-3 Months): Range 900-970, tariff-driven.

🎇🎆Future Prediction

Bullish: 950-970 by Q2 2025 if USD softens (DXY to 105), tariffs boost exports, or risk-on strengthens.

Bearish: 900-890 if PCE lifts USD (DXY to 107), growth stalls, or risk-off intensifies.

Prediction: Bullish short-term to 950, then sustained to 970 by mid-2025.

🎇🎆Overall Summary Outlook

Netherlands 25 at 928.00 rides bullish fundamentals (tech earnings, ECB support, trade shifts) against bearish risks (Eurozone stagnation, PCE-driven USD strength). COT shows cautious longs, quant signals bullish momentum, and intermarket trends (DXY softness) support gains. Short-term rise to 940-950 likely, medium-term to 970 if PCE softens and trade benefits grow.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURUSD Faces Resistance zone – Will Bears Take Over?The EURUSD ( FX:EURUSD ) has reached the Resistance zone($1.0983-$1.0916) as I expected in my previous post . Can the EURUSD break the Resistance zone($1.0983-$1.0916) ?

EURUSD is moving near the Resistance zone($1.0983-$1.0916) , the Resistance line , and Yearly Resistance(1) .

According to the Elliott Wave theory , EURUSD seems to have completed 5 impulse waves and we can expect Corrective Waves .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks .

I expect the EURUSD to decline to at least the Support zone($1.0817-$1.0760) in the coming hours after breaking the lower line of the ascending channel . One of the EURUSD targets could be as wide as the ascending channel .

Note: If EURUSD breaks the Resistance zone($1.0983-$1.0916), we can expect more pumps.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S. Dollar Analyze (EURUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Euro Weakens Against USD Ahead of Key Economic DataThe EUR/USD pair declined to around 1.0835 during Friday’s Asian session, as the Euro (EUR) weakened against the US Dollar (USD) amid rising trade tensions between the U.S. and the European Union. Later in the day, market focus will shift to key economic releases, including Germany’s February Harmonized Index of Consumer Prices (HICP) and the preliminary Michigan Consumer Sentiment Index for March.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0800, with further levels at 1.0730 and 1.0650.

EUROUSD 4H LONG (ALL Targets DONE)This position worked perfectly.

Now it is important to wait for the correction structure, as it was indicated in the previous update post:

Considering the current formations on the 1D TF, the probability of price growth to the current maximum increases multiple times. Locally, I expect to see a price correction (a rollback next week) and preferably with a depiction of a bullish imbalance. After which, you can work long for a whole month until 1.12758

EUR/USD Drops, Awaits US PPIEUR/USD fell to around 1.0880 in Thursday’s Asian session, pressured by rising US-EU trade tensions. Market focus is on key US data, including February’s PPI and weekly jobless claims.

Trump warned of retaliation against the EU’s response to his 25% steel and aluminum tariffs. The European Commission announced €26 billion ($28.4 billion) in counter-tariffs on US goods, effective April 1, with more expected mid-April.

Despite trade risks, EUR/USD’s downside may be limited as concerns over Trump’s policies fueling a US recession weigh on the dollar. Inflation data came in lower than expected, easing market fears but keeping sentiment fragile.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0800, with further levels at 1.0730 and 1.0650.

EUR/USD: The Euro Stays in Overbought TerritoryThe pair has been rising for the last five sessions, gaining approximately 1.4% , as expansionary policies in European countries have restored confidence in the euro. In contrast, the U.S. dollar continues to struggle with maintaining consistent demand due to the ongoing tariff battle led by the White House.

Accelerated Movement:

Since March 3rd, EUR/USD has experienced growth of over 5%, driven by strong short-term bullish momentum. Currently, the price is slowly approaching a key resistance zone, but recent price oscillations suggest that bullish momentum is fading, which could lead to short-term bearish corrections.

RSI Indicator:

The RSI line has started oscillating above the 70 level, which is the official overbought zone of the indicator. This suggests that the balance between buying and selling pressure has been lost, with bullish momentum fully dominating the market. The increasing speed of demand for EUR/USD may indicate a potential emergence of bearish corrections in the short term.

MACD Indicator:

The MACD histogram remains at its highest levels of the year, suggesting that buying pressure may be entering a phase of constant exhaustion. In the long run, this could also open the possibility of selling corrections in the upcoming sessions.

Key Levels:

1.1000 – Tentative Resistance: A potential psychological barrier that the price may face in its prolonged bullish streak. Oscillations above this level could confirm sustained buying pressure and signal the beginning of stronger upward movements in the chart.

1.07944 – Near-term Support: A neutral zone where the price has shown stability in the short term. This level may be important for potential selling corrections in the next trading sessions.

1.06173 – Distant Support: A key level corresponding to the highs reached in December 2024. Bearish oscillations reaching this level could jeopardize the current strong bullish trend.

By Julian Pineda, CFA – Market Analyst

EUR/USD – Bullish, But Time to Breathe!🚀 EUR/USD – Bullish, But Time to Breathe! 🚀

“Momentum is strong, but even the best trends need to take a breath before the next leg up.”

🔥 Key Insights:

✅ Bullish Structure Intact – No reason to fight the trend.

✅ Overextended Move – Markets don’t go up in a straight line; pullbacks create better entries.

✅ Healthy Retracement = Stronger Continuation – Chasing here is risky, waiting for a dip is smart.

💡 The Plan:

Wait for a Pullback Before Longs – Let price reset, don’t rush in.

Watch Volume Profile & CDV for Buyer Confirmation – Smart money leaves clues.

Ideal Entry = Lower Support Levels Holding – We want a strong base for the next move up.

“Patience is key. Let the market give you the perfect entry—not every green candle is a buy!” 🚀💶

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Eur/Usd (Mar/12) Weekly Analyzehello everyone.

a you can see price touched weekly cloud res ( same as monthly cloud ) so i expect price go down from here.

.......................................

( This is an idea and entry-tp-sl placed for my own trade , you can change entry-tp-sl depends on your risk management )

EURUSD’s Pullback in Play: Next Stop $1.0934?The EURUSD ( FX:EURUSD ) has managed to break through the Resistance zone($1.0817-$1.0760) and has been on a good upward trend with good momentum in the past week.

The EURUSD appears to be completing a pullback to the Resistance zone (broken) .

According to the Elliott Wave theory , the EURUSD appears to have completed wave 4 , which is a Double Three Correction(WXY) .

I expect EURUSD to rise to the Resistance zone($1.0983-$1.0916) after completing the pullbac k.

Note: If EURUSD goes below $1.0755, we can expect more dumps.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S. Dollar Analyze (EURUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EurUsd ShortEUR/USD Short Idea

The EUR/USD pair is approaching the 1.09700--1.09940--1.10204 resistance level, which aligns with a significant supply zone and a potential area for bearish reversal.

Key Analysis:

Resistance Zone:

The 1.09700--1.09940--1.10204 levels marks a critical resistance where selling pressure has previously emerged.

Technical Indicators:

RSI is approaching overbought conditions, indicating limited upside potential.

Bearish divergence may form if momentum weakens near this level.

Fundamental Context:

A stronger USD due to hawkish Fed sentiment or economic data could pressure EUR/USD downward.

Eurozone economic uncertainties may add to bearish bias.

Entry: Short positions around 1.09700--1.09940--1.10204

This setup offers a favorable risk-reward opportunity in a high-probability reversal zone.

EUR/USD Flat Amid Market Uncertainty and Recession FearsThe EUR/USD pair remained stable on Tuesday, showing little movement as traders entered a data-heavy week in the U.S. markets. On Monday, global equities experienced a sharp sell-off, driven by rising recession fears, leading to broad market declines. However, EUR/USD traders are taking a cautious approach, awaiting key U.S. inflation data before committing to any major moves.

Key resistance is at 1.0850, followed by 1.0900 and 1.0950. Support stands at 1.0730, with further levels at 1.0700 and 1.0650.