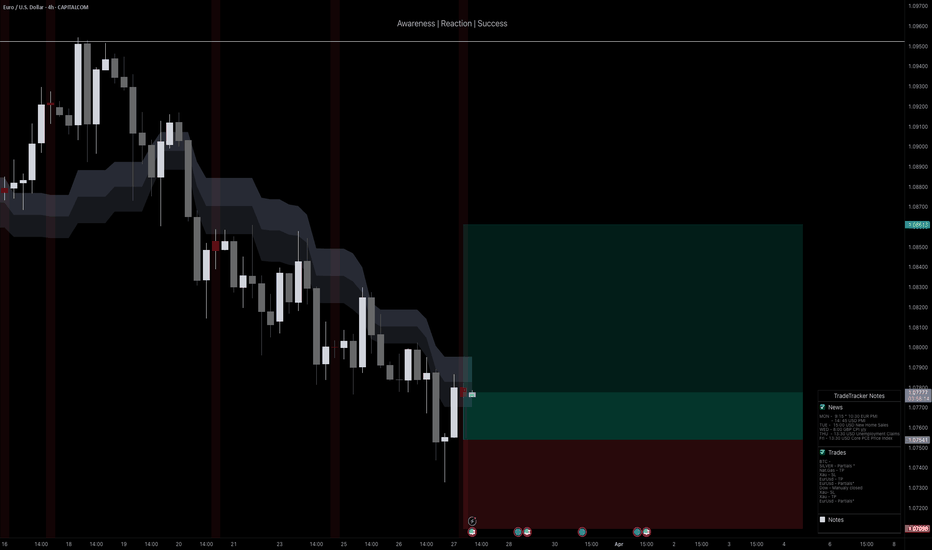

Euro at Critical Demand – Is the Trend About to Flip?Euro reached an important zone for my setup, triggering a long position. Although it’s still trending below the fibcloud on the 4H timeframe, we’ve seen a solid 0.5% recovery from the recent low. I’m looking for this area to hold as support, with defined risk in case the setup invalidates.

Technicals:

• Price tapped into a major 4H support level where liquidity historically steps in.

• The current move marks a 0.5% bounce from the low, showing early signs of demand.

• Still trading below the fibcloud, but a reclaim of that zone would open the path toward 1.0850.

• Setup includes a stop-loss below the most recent wick low, with a clear structure to build a higher low.

Fundamentals:

EUR-side strength:

• ECB maintains a slower pace of rate cuts compared to the Fed.

• Growth and inflation in the Eurozone are still challenges, but the ECB’s hawkish stance continues to support medium-term EUR strength.

• The ECB may hike another 150 bps to reach a 4% terminal rate, which favors EUR upside.

USD-side risks:

• Trump announced plans to impose a 25% tariff on all car imports, including from the EU-adding geopolitical and trade uncertainty.

• Traders remain cautious around further escalation in US-EU trade tensions.

• US Initial Jobless Claims later today could bring weakness to the dollar if the data disappoints.

In short, while the USD remains resilient, the EUR fundamentals and the current technical zone make this a compelling spot for a bounce.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Eurodollarlong

EUROUSD 4H LONG (3 Targets DONE)Re-opening in the specified block after confirmation of the level of $1.03744 brings 3 targets for the position.

Considering the current formations on the 1D TF, the probability of price growth to the current maximum increases multiple times. Locally, I expect to see a price correction (a rollback next week) and preferably with a depiction of a bullish imbalance. After which, you can work long for a whole month until 1.12758

EUROUSD 4H LONG (Results)Due to inattentive study of the rules of the tradingviews platform, the trading idea was blocked (sorry)

I apologize to those who used this idea in their trading system due to the blocking, I will be more careful in the future.

Result: EUROUSD 4H LONG reaches the first key zone for taking profits.

I move my stop into profit and wait for new variables from the market.

EURUSD BULLISHNESS CONTINUESHello guys i still see bullishness on the euro dollar this is the low of the new monthly candle . i think price is going up higher for the previous years high please view my previous ideas for extra informations.

if we break that Monthly FVG The Idea is Invalidated.

next week we should see a hammer looking like candle and the monthy candle close should look like a hammer if we are going higher otherwise the idea is invalidated.

AW Euro Dollar Long Trade Buy Setup Chart...Check out the explanation for this chart in the video linked below.

The expected risk\reward ratio at a minimum is 18:1

Entry: 1.09297.

Stop: 1.08518.

Target: 1.23436.

Things that invalidate this idea include: Price breaking support before the entry level is reached or if entry is reached and price reverts and breaks support.

Remember to use Disciplined Money Management Principles to ensure longevity as a trader.

If you don't know the long term pattern shouldn't you be doing your research instead of just following the crowd?

Just remember: I am not a financial adviser; I suggest using this only as a guide. Always do your own research.

***AriasWave is not the same as Elliott Wave so your counts may differ to mine if you happen to use it.***

EUR/USD Trade IdeaToday (24/01/2023) we saw E/U retrace ~70% of yesterday's range with a large institutional sponsored move to the upside during the London close. Looking at daily objectives for this pair, they have not yet been met so I expect bullish E/U. We may see swing to the upside during London Open to take Asia highs then a drop retracing ~70% of yesterday's low before going higher and possibly taking out the major high.

AW Euro Dollar Analysis - It's Time to Get Serious...Using the conclusions from all of the analysis from the past week, it's time to understand what is happening at the smaller degree.

I have been wanting to post a Euro idea so badly in recent times, but I felt like I couldn't do it justice until now.

So here we are, and I have a really in-depth video about what the waves are doing here.

I have carefully sifted and sorted through all the possibilities in order to make this video awesome.

In a nutshell, we are long the euro from current levels but in order to trade Wave 5 of Wave E you will need to stay tuned.

We are currently in Wave (C) of a Wave 3 zig-zag for Wave E which is the last wave in this Wave 2 correction to the upside.

Try and say that fast 10 times.

Remember to use Disciplined Money Management Principles to ensure longevity as a trader.

If you don't know the long term pattern shouldn't you be doing your research instead of just following the crowd?

Just remember: I am not a financial adviser; I suggest using this only as a guide. Always do your own research.

🟢 EUR-USD - 1D (21.09.2022)🟢 EUR-USD

TF: 1D

Side: Long

Pattern: Falling Wedge

Leverage: 5x

Entry: Between $0.97974 and $0.99063

SL: $0.97974

TP 1: $1.00816

TP 2: $1.02164

TP 3: $1.03253

TP 4: $1.04342

I think this down trend will come to an end soon.

4H has double bottomed and monthly giving buy signal.

EURUSD Idea/ Forecast |euro buy signal2 scenarios for the EURUSD.

1st scenario, with a 60% probability, decline to the channel support line in the price range of 1.01930.

Entry around 1.01930, with the first target of 1.02450 and the 2nd target of 1.02785.

In the 2nd scenario, upward movement with high acceleration,

The first target is 1.02785 and the second target is monthly resistance at 1.03850

Goodluck

$EURUSD | Model Eyes New HighsHello Traders,

Model eyes the targets defined on the chart.

The model tries to identify pressure points in any given market. The pressure points themselves identify the breadth and strength of the move to come. It exists in all time frames and can be applied to any market. The targets are printed as data is fed into the algorithm. The further away from the pressure point, the lower probability it has of attaining such levels and the higher the probability of a correction/reversal.

If and when the targets are hit, I would refer to the related chart that points to targets defined on the monthly time frame.

Call for Economist Comments: Eurodollar At all Time HighThis is post 10 on the Eurodollar and the effect on the market. This is a monumental event. The eurodollar is the largest and most important market that one can understand to begin to make conclusions on all other markets. When it moves sideways then it is basically a "new normal" and things can move as we think they should when it comes to inflation, interest rates (real and nominal of course) and so on. When the eurodollar begins to impulse either up or down we find ourselves in a complete different environment. We had the a crisis as the "plumbing" of the financial/banks got clogged up earlier this year and I believe that was due to moves in the eurodollar. Not becauce I have access to any data from inside the banks but because I don't think most bankers have the vision to understand the eurodollar market and how it forces the hands of the central bankers. Economist and conspiracy theorist alike, please comment on that.

I have been using and updating this chart for over a year. It is one of the main reasons I have been named a perma-bear and it is a very real cause of me being deeply unable to hold my longs for too long. We had a bump and run bottom, one of the most reliable formations in all of technical analysis and we see that it performed beautifully. The only Bump and Run Bottom that comes anywhere near as close to the technical beauty of this bottom is the one that formed on bitcoin.

The targets on the main chart are pretty simple. The purple target cones from the Hight of the top in March to the automatic reaction of the rejection at the BARR target (the Hight of the lead in trend line) added to the neckline of what appears to be an ascending triangle with the smallest of second and third lows.

That would take us to negative interest rates on the Eurodollar and therefor the LIBOR, or London Interbank Offer Rate. The question remains who is the dog, who is the tail, and who wags who. A very complicated metaphor for my belief that the the various interest rates of the world are controlled more by the free market interactions in the Eurodollar than most central banks chairs (mouthpieces) would publicly admit.

It appears that this is a clear flagpole and so I have shown the full performance target on the flagpole. I would not be surprised if we get 60-70% performance of this flagpole or even some over-performance on the candle wick. This leads to lots of questions of economic fundamentals with the free market dictating negative interest rates, with inflation, and the response of the central banks. Once again, Economist and conspiracy theorist alike, please comment on that.

My main hypothesis is that during any impulsive uptrend in the eurodollar futures we will see damn near every other market take a stropping to the downside. Equities, Anti-fiats, all will be slammed by the credit crunch or new clog in the market.

My secondary hypothesis is that Consolidation 3 will cause anti-fiats to go absolutely crazy and explode to the upside. Negative interest rates and inflation should practically guarantee that, as much as one can guarantee anything in this world

Final hypothesis: The wedge shown below will ultimately perform. It would be very very painful for the world if it performs to the upside. Even more so if then it snaps to the downside. This would be in keeping for the Maximum Pain Theory, which is often reserved for options trading but appears to be very real, given all the bites it has taken out of me in other non-option markets.

Even more than normal comments would be greatly appreciated. We should find out very shortly, days to weeks, if I am right. It will require the eurodollar to continue to impulse upward after this break out. Please see the linked ideas for top ideas in this series. The last idea is when I called the bottom of the SPX dump.