(FR40) Index to hit 4600 EUR Pretty SoonFirst off, please don't take anything I say seriously or as financial advice. As always, this is on opinion based basis and not meant to be taken seriously. That being said, let me get into my opinion. FR40 which is a French stock index for the Euronext Paris, have been hit pretty significantly as a result of Covid19 after being on a bullish recovery for almost a year prior. Now, as the markets are weighting in and people are starting to "panic sell less", I believe it is about to pass the 4600 euro threshold and likely to go on a stable price recovery trend. The 4600 EUR threshold crossing is likely within a week or so at most, but the recovery process is more of a long afterwards.

Euronext

Return of Pharnext buyer volumesHere is my analysis of the Pharnext action;

volumes stert to inflate, an increase is very likely with the figure of cup with handle.

The cup with handle patern would give us from 3,700 to 6,000 with a stop at 3,150 which would invalidate this figure.

I see a second increase in the long term with the recovery of the gap that we can see on the left we would go in from 7,500 to 12,000 with a stop at 6,500.

Feel free to comment, like and follow me! :)

Corona Virus #ALO Bearish sentiment We wait for the price to reach for the around 27.00. Then we can prepare for the BUY.

It's to late to get ride in the bearishness. Don't chase the price, We wait for the price to come to US.

Then we can take the next turn-over and ride with the trend "Bullish". Watch the news coming for the ALO may be GOOD.

For the price to climb ASAP this #coronavirus has to controlled. But BIG move is underway to make amount of profits.

MT Buy Opportunity LoadingCommodities have remained very cheap against the recent rise in Major World Indexes.

This includes iron ore.

And this cheapness can create opportunities in the iron and steel industry.

The price can get even cheaper.

The analysis does not contain a very high quality risk / reward ratio, but I think it is possible to make very profitable trades based on this idea in lower time frames.

Parameters

Risk/Reward Ratio : 1 / 1.68

Stop-Loss : 13.632

Goal : 20.43

Double if not triple bottom in HAL-Trust sharesShares in HAL Trust have been going down since mid 2017, form a high of around EUR 180 to currently around EUR 130. I think we might have seen a short term double bottom at EUR 127, and a longer term double bottom when you look at the same level lows from December 2018.

The shares still trade at a nice but not huge discount of around 4% to NAV, and the stock throws of a modest dividend of around 2.15% currently.

HAL Trust is the listed investment vehicle of a Roterdam based business family. It contains listed investments and lots of private equity type of ositions. It has a stellar track-record and as far as I am concerned a bright future.

The current portfolio, the discount to NAV and the potential double bottom make me think this is a nice entry point for long term investors.

ADYEN WILL GROW IN THE FUTURE 2018 to 2022this can be a great opportunity to step in into shares now. Adyen will continue to grow for years to come and become a player of paypal. In the future how I have made the graph will take something higher or slightly lower, but always remember WIN IS PROFIT !!!!!

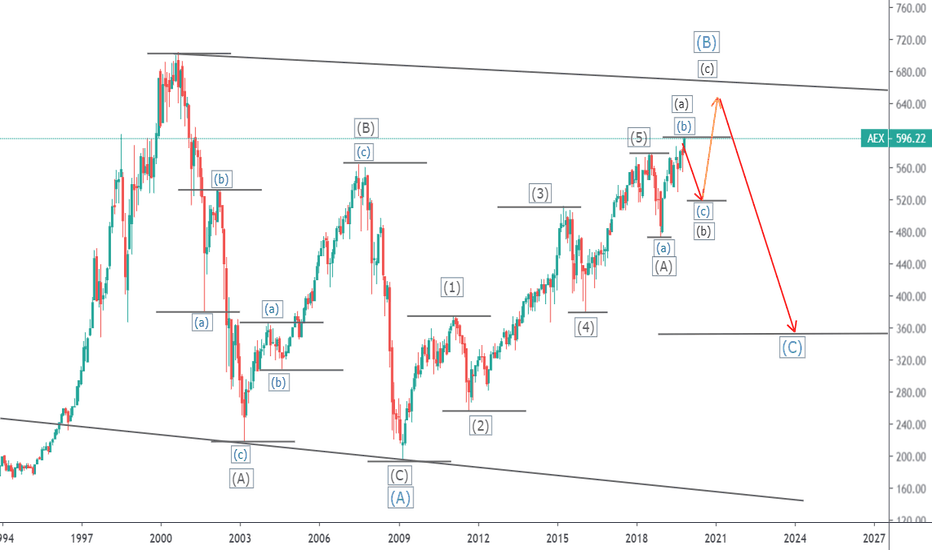

AEX Bearish, YES We've Reached The Top!Hi Guys,

Normally I do Cryptocurrencies, but today my country's AEX Index. I strongly believe we've already reached the top. And after a 10 year long bull market, it's time to take profits.

I haven't bought any stocks, only bonds. But I will short when AEX drops under the 500 points. I already opened a short when it dropped below 500 points. But I had to take my loss when the price moved up again.

According to the emotional cycle, we are just in Denial phase. So you're doing good to take your profits and short the down side.

Happy Trading!

Rare gem: long on this belgian stock.Hello, I spotted an inconsistence in "the force". Some stocks that have gone down because of the US stock market being bearish in novmber. The news were positive, the company was supposed to be bullish in my opinion, but the general fear due to us tech stocks being way overvalued has forced this company in particular to fall. I am expecting a severe bounce soon.

Umicore is a belgian multinational materials technology and recycling group, in particular they specialize in zinc and advanced products, such as batteries for electric vehicles.

Some technical facts:

- This company has a market cap of 9 billion euros.

- We visited the liquidity pool during the day and rejected that price, the daily candle closed in a hammer.

- We can see bullish divergence on the oscillators, here I am showing macd and rsi because they look good.

- It has a volume of 800.000 shares daily on average, no problem getting filled big orders (for retail at least).

I just want add the cci, looks good too :)

The US stock market also gapped up, and is not looking like it will crash immediatly and drive everything down.

The news are good:

"Insight: Stung by Asian dominance, Germany pours cash into EV battery ventures" - November 9, at the start of the downtrend.

"Germany has earmarked 1 billion euros ($1.2 billion) to support a consortium looking to produce electric car battery cells and plans to fund a research facility to develop next-generation solid-state batteries, three sources told Reuters." - November 9.

"About 500,000 electric vehicles (EVs) were sold globally in 2016, a figure that is expected to jump sevenfold by 2022, according to the U.S. Energy Information Administration." - November 16.

"German chemicals giant BASF (BASFn.DE) is betting on a new recipe for electric car batteries which stretches the time between charges while cutting dependence on nickel to help shave costs and grab more of a growing market." - November 23.

Same boat as this other company I was watching:

Actually all the companies I had my eye on are highly correlated... (while all stocks in the world are "only" moderatly correlated) Probably all move for the same reasons. Interesting area for sure.

These companies are the future, the news is good... I wonder how wise would investing in those be...

But for the shorter term (next couple of weeks) here are my conclusions:

Umicore price SHOULD have gone up. So I believe the news did not get priced in yet (because of global economy/us tech stocks), better, the price actually went below the previous low (unlike BASF) and the potential bounce is even bigger. And now we are getting a hammer candle? Count me in!

ADYEN Long FTWThe Entry

The break of $600 a key resistance point as a nice whole number and as the Fibs 0.61 point

ADL has been gradually rising and RSI is nicely at a 53%

Will look to enter 1 hour after London opens today

The R/R so far looks like a 1:1.5 ratio

The Situation

With the close of Oct, money seems to be flowing back in the the markets

Midterms are over and it seems like the increased in democrats splitting congress will make radical policy changes less likely. Thus giving some certainly to investors

Adyen also recently announced that it has entered Canada and this aligns nicely with the rising Cannabis industry situated in Canada.

Issues/Risks

The risk that this rally is short term, if the price retreats to $553.9 breaking the Fib 0.786 point then we are certain. This is an estimated 9.2% Risk

To be safe I will be leveraging 5k Margin across the full trade and will enter at 50% first, once the price breaks the fib 0.382 point I’ll enter the remaining 50%

EU Fib Support and Resistance Zones: EURUSD zones of interestThese are price zones that Fibonacci analysis show to be important points.

Chart is expanded vertically to reduce overlap in price labels.

There are zones above and below currently display, drag chart around.

-

-

See the Related Ideas below for ideas on how I use such zones.

Penny stocks: Accsys (2/5) Education + Spread your investments! Risk: Medium

Please be advised that this is only an idea, so you are responsible for any losses yourself.

Dear followers,

First of all, many thanks for following and liking my ideas. As promised I provide you with some penny stocks today, but for the most part I keep focusing on the crypto analyses.

Education:

Do you know people who had to leave their home because they could no longer pay their mortgage after losing a job? I do. No matter how bad it is for them, these people have made a mistake at an earlier stage. Probably out of ignorance. Did you hear the stories about people who lost their money in the stock market in 2002 and went to drugs? I do. What if the crypto market crashes? Have you lost all your money? Then you have made exactly the same mistake.

The trick is to create multiple cash flows. A job, maybe two or trhee jobs, cryptos, currencies, interest, stocks, dividends, et cetera. When one or two cash flows are lost, you can still continue to live in your house. Otherwise you have still made a mistake by buying an overpriced house that you actually could not afford.

This is why I provide you today with 5 penny stocks that are technically right, about to break out and have a great profit potential for the coming years. Imagine one of these companies is a sleeping giant? Two shares rise a little, one falls and one company goes bankrupt? By spreading your investments you still have the jackpot and you have perhaps made a 1000% return or more!

Stock

The second penny stock is Accsys Technologies. Accsys Group is an intellectual property and chemical technology group focused on the sustainable transformation of wood through acetylation.

Accsys is waiting for a breakout. We have seen some false breakouts already. Since the 1st of january, the tick size is changed, what we see is a higher support level since this date. The new tick size might work positively on the breakout. If we close with a candle above the blue trendline a breakout is confirmed. (Click the play button on the chart to look for confirmation) Our first target will be 0.97, but I've this stock in my long-term portfolio.

Buy: Now or if it breaks out.

Please, follow and like for more trading ideas.

Questions? Feel free to ask and your feedback is welcome!

Penny stocks: Pharming (3/5) Education + Spread your investmentsRisk: Low

Please be advised that this is only an idea, so you are responsible for any losses yourself.

Dear followers,

First of all, many thanks for following and liking my ideas. As promised I provide you with some penny stocks today, but for the most part I keep focusing on the crypto analyses.

Education:

Do you know people who had to leave their home because they could no longer pay their mortgage after losing a job? I do. No matter how bad it is for them, these people have made a mistake at an earlier stage. Probably out of ignorance. Did you hear the stories about people who lost their money in the stock market in 2002 and went to drugs? I do. What if the crypto market crashes? Have you lost all your money? Then you have made exactly the same mistake.

The trick is to create multiple cash flows. A job, maybe two or trhee jobs, cryptos, currencies, interest, stocks, dividends, et cetera. When one or two cash flows are lost, you can still continue to live in your house. Otherwise you have still made a mistake by buying an overpriced house that you actually could not afford.

This is why I provide you today with 5 penny stocks that are technically right, about to break out and have a great profit potential for the coming years. Imagine one of these companies is a sleeping giant? Two shares rise a little, one falls and one company goes bankrupt? By spreading your investments you still have the jackpot and you have perhaps made a 1000% return or more!

Stock

The third penny stock is one of my favorites, Pharming Group. I already made a lot of money with this stock, because I'm in since 0.20 and I just increased my position. Pharming Group N.V. is committed to the development of innovative products for the treatment of unmet medical needs. It focusses on the development and production of human therapeutic proteins to provide life-changing solutions to patients.

Pharming is ready to break out. Fundamentally, their turnover increases exponentially! If we close with a candle above the blue trendline a breakout is confirmed. (Click the play button on the chart to look for confirmation) Our first target will be €1,80 but I've this stock in my long-term portfolio. I put the risk on low, because I did a lot of research to this company and I know their products and numbers very well.

Buy: Now or if it breaks out.

Please, follow and like for more trading ideas.

Questions? Feel free to ask and your feedback is welcome!

Aegon shortWe are currently seeing higher lows and comperable highs with the RSI moving towards overbought, around the 5.4 i expect there to be a short term pullback.Mid to long term still seems good, as aegon is undervalued (shown by their P/E ratio) in relationship to other parties in the same industry and the positive MA ribbon. As such my proposition is to hold long and buy short turbo/put options to cover short term movements.

For the exit strategy of the short position a filter rule should be applied. If the movement doesnt complete within 7 days of buying the short/put or if aegon breaks throught the next resistance level for more then circa 2 days the short should be sold.