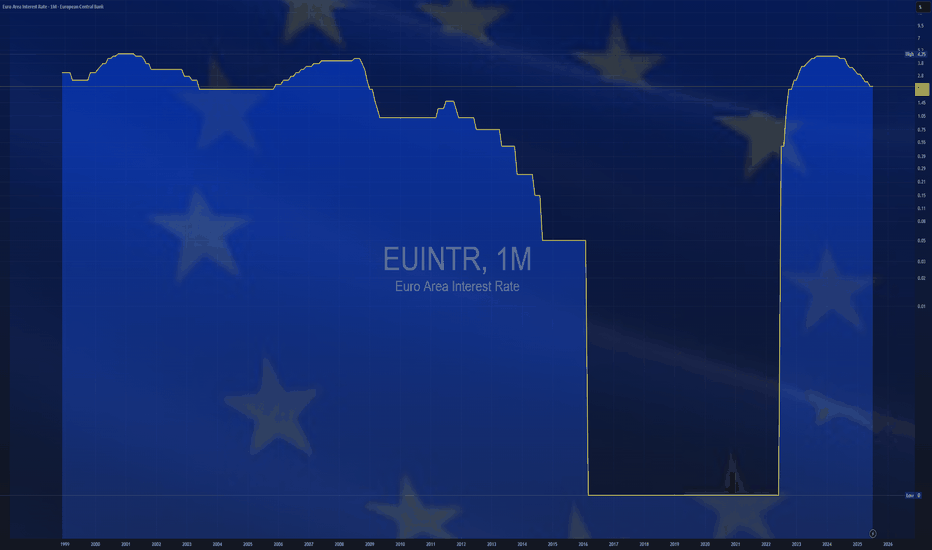

$EUINTR - Europe Interest Rates (July/2025)ECONOMICS:EUINTR

July/2025

source: European Central Bank

- The ECB kept interest rates unchanged in July, effectively marking the end of its current easing cycle after eight cuts over the past year that brought borrowing costs to their lowest levels since November 2022.

The main refinancing rate remains at 2.15%, while the deposit facility rate holds at 2.0%. Policymakers struck a wait-and-see stance, as they evaluate the impact of lingering trade uncertainty and the potential fallout from proposed US tariffs on economic growth and inflation.

Inflation hit the ECB’s 2% target in June, adding to the case for a pause in policy adjustments. Speaking at the ECB press conference, President Lagarde said the central bank is “in a good place” but acknowledged the difficulty in assessing how tariffs will affect price outlooks, given the mix of both inflationary and disinflationary pressures.

On the recent euro appreciation, Lagarde reiterated that the ECB does not target exchange rates directly but considers them when forecasting inflation.

Europe

$DHER to $40- XETR:DHER i.e Delivery Hero is working towards profitability and exiting markets where it doesn't want to burn on operations.

- Company is becoming leaner, meaner and strategic in areas where it operates and dominates.

- Region MENA is growing (31% YoY)

- It has nice free cash flow per share growth. XETR:DHER posted ~227% YoY growth in free cash flow, putting it in the top 10% of its peers, well above its 3‑year average of ~32% .

$EUIRYY - Europe CPI (June/2025)ECONOMICS:EUIRYY 2%

June/2025

source: EUROSTAT

- Eurozone consumer price inflation rose slightly to 2.0% year-on-year in June 2025, up from May’s eight-month low of 1.9% and in line with market expectations, according to a preliminary estimate.

The figure aligns with the European Central Bank’s official target.

Among major economies, inflation in Germany unexpectedly declined, while France and Spain saw modest increases and Italy’s rate held steady.

$EUINTR - Interest Rates Cut (June/2025)ECONOMICS:EUINTR

(June/2025)

source: European Central Bank

- The ECB cut key interest rates by 25 bps at its June meeting,

based on updated inflation and economic forecasts.

Inflation is near the 2% target, with projections showing 2.0% in 2025 (vs 2.3% previously), 1.6% in 2026 (vs 1.9% previously), and 2.0% in 2027.

Core inflation (excluding energy and food) is seen at 2.4% in 2025, then easing to 1.9% in 2026–2027.

GDP growth is forecast at 0.9% in 2025, 1.1% in 2026 (vs 1.2% previously), and 1.3% in 2027, supported by higher real incomes, strong labour markets, and rising government investment, despite trade policy uncertainties weighing on exports and business investment.

Scenario analysis shows trade tensions could reduce growth and inflation, while resolution could boost both.

Wage growth is still high but slowing, and corporate profits are helping absorb cost pressures.

President Lagarde said that the central bank is approaching the end of a cycle, suggesting a pause may be on the horizon following today’s reduction.

$EUIRYY - Europe CPI below 2% Target (May/2025)ECONOMICS:EUIRYY 1.9%

May/2025

source: EUROSTAT

- Eurozone CPI eased to 1.9% year-on-year in May 2025,

down from 2.2% in April and below market expectations of 2.0%.

This marks the first time inflation has fallen below the European Central Bank’s 2.0% target since September 2024, reinforcing expectations for a 25 basis point rate cut later this week and raising the possibility of additional cuts.

A key driver of the deceleration was a sharp slowdown in services inflation, which dropped to 3.2% from 4.0% in April, its lowest level since March 2022.

Energy prices continued to decline, falling by 3.6% year-on-year, while inflation for non-energy industrial goods held steady at 0.6%.

In contrast, prices for food, alcohol, and tobacco accelerated, rising 3.3% compared with 3.0% the previous month.

Meanwhile, core inflation, which excludes volatile food and energy components, slipped to 2.3%, the lowest reading since January 2022. source: EUROSTAT

EURUSD CRACK!I first turned bullish on the EUR back in November 2024 after the disastrous election results.

I have always felt the 105 area was a good area to go long, fundamentally going back all the way to 2017. Here is an example.

After 17 years of data, we can all agree that the 105 area was a great value to get long the EUR. Now we see a major CRACK! in the chart with the fundamentals to back it up.

Again, I remind you I am a MACRO Trader. So my trades hold for a long, long time unless the facts change. I don't do 3 pips and i am out crap!

Let this be a WARNING! To the dollar bulls!

Click Boost, follow, subscribe! Let's get to 5,000 followers so I can help them navigate these crazy markets, too. ))

Czech Republic: A Dividend HeavenThe Prague Stock Exchange (PSE) PSECZ:PX is characterized by a concentration of mature, dividend-paying companies, particularly in sectors such as energy, banking, and heavy industry. Unlike growth-focused exchanges in the U.S. or Asia, the Czech market offers relatively few stocks with high reinvestment or expansion trajectories.

Preference for Payouts

Over the past two decades, Czech listed companies have consistently distributed a significant share of profits as dividends. This reflects both limited reinvestment opportunities in a relatively saturated domestic market and a shareholder preference for cash returns. For example, CEZ and Komercni banka have maintained payout ratios above 70% in most years.

Structural Support & Tax environment

The Czech Republic provides a structurally supportive environment for dividend-oriented investors. One key advantage is the tax framework. Czech residents are exempt from capital gains tax if they hold an investment for more than three years. This strongly favors long-term investing.

For non-residents, a 15% withholding tax on dividends applies—unless the investor resides in a country outside the EU/EEA that does not have a tax treaty or tax information exchange agreement with the Czech Republic.

Key Dividend-Paying Companies

CEZ (CEZ) PSECZ:CEZ

Industry: Energy (Electricity generation and distribution)

Dividend History (Gross per Share) / Dividend Yield (%)

2020: CZK 34 10.1%

2021: CZK 52 5.8%

2022: CZK 48 18.83%

2023: CZK 145 5.43%

2024: CZK 52 5.9%

Dividend Growth:

2020 to 2021: +52.9%

2021 to 2022: -7.7%

2022 to 2023: +202%

2023 to 2024: -64.1%

Komercni banka (KOMB) PSECZ:KOMB

Industry: Banking and financial services

Dividend History (Gross per Share) / Dividend Yield (%)

2020: CZK 23.9 3.63%

2021: CZK 99.3 10.62%

2022: CZK 60.42 9.22%

2023: CZK 82.7 11.41%

2024: CZK 91.3 10.76%

Dividend Growth:

2020 to 2021: +315.6%

2021 to 2022: -39.2%

2022 to 2023: +36.9%

2023 to 2024: +10.4%

Moneta Money Bank (MONET) PSECZ:MONET

Industry: Banking and financial services

Dividend History (Gross per Share) / Dividend Yield (%)

2020: CZK 0 (dividend suspended)

2021: CZK 3 10.67%

2022: CZK 7 10.53%

2023: CZK 8 12.82%

2024: CZK 9 8.08%

Dividend Growth:

2020 to 2021: N/A

2021 to 2022: +133.3%

2022 to 2023: +14.3%

2023 to 2024: +12.5%

Europe’s Center is CRUMBLING: VGK on the Brink? 🚨 Europe’s Center is CRUMBLING: VGK on the Brink? 🚨

Europe’s elections just lit a FUSE! 💥 Poland (May 18), Portugal (May 18), and Romania (May 4 & 18) held off populists, but the center’s hanging by a thread—50% in Poland went right-wing, Portugal’s Chega is shaking things up.

Immigration and globalization fury could rattle EU trade & policy. 📉 VGK ($75.53) is inches from its yearly high ($75.56)—ready to crash or soar?

💡 Trade Idea: Plot VGK price action with election dates (May 4, May 18, June 1, 2025) to spot volatility breakouts. Watch for support near $70 or resistance at $76.

❓ Your Move? Will VGK tank or rally on Europe’s chaos? Drop your trade below! 👇

Europe’s Political Powder Keg: Markets on Edge!🔥 Europe’s Political Powder Keg: Markets on Edge! 🔥

Europe’s elections just dropped a BOMB! 💣 Poland (May 18), Portugal (May 18), and Romania (May 4 & 18) rejected far-right surges, but the center’s crumbling. 🇪🇺 Poland’s pro-EU Trzaskowski barely leads—June 1 runoff could flip it! Portugal’s Chega is shaking the old guard, and Romania’s Nicușor Dan rides an anti-corruption wave.

Why care? Political chaos = market volatility. 📉 EUR/USD is wobbling, DAX could tank, and defense stocks (🇺🇦 ties) are in play.

💡 Trade Idea: Overlay EUR/USD with election dates (May 4, May 18, June 1) to catch volatility spikes.

❓ What’s your move? Will Europe’s turmoil crash markets or spark a rally? Drop your take below! 👇

DEFENSE EU vs USEU defense massively outperforming the US up 50% from the lows.

Lockheed Martin is forced to console American allies, convincing them not to abandon the US Defense industry as Trump completely destroys it with his pro-Russia behavior.

I don't see any way back to NATO normal. Trump has weaponized the US defense industry against our (former allies?) allies and that is unacceptable. The US defense industry mostly sells $107 billion annually to NATO, EU nations.

This win-win EU-US relationship between our allies has made it possible for the US to develope and sustain military technology we would otherwise not have been able to afford alone.

So America first? Not really. More like America last!

At any rate, should a downturn occur and need to be long. #EUAD is a good place to be.

$EUIRYY -Europe CPI (April/2025)ECONOMICS:EUIRYY

April/2025

source: EUROSTAT

- Consumer price inflation in the Euro Area remained steady at 2.2% in April 2025, slightly exceeding market expectations of 2.1% and hovering just above the European Central Bank’s 2.0% target midpoint, according to a preliminary estimate.

A sharper drop in energy prices (-3.5% vs. -1.0% in March) was offset by faster inflation in services (3.9% vs. 3.5%) and food, alcohol, and tobacco (3.0% vs. 2.9%). Prices for non-energy industrial goods rose by 0.6%, unchanged from March.

Meanwhile, core inflation, which excludes food and energy, climbed to 2.7%, up from March’s three-year low of 2.4% and above the forecast of 2.5%.

On a monthly basis, consumer prices increased by 0.6% in April, matching March’s rise.

Europe Vs US Break Out!This chart suggests huge long-term implications after breaking for the 2nd time this 16-year downtrend. EU since Trump took office has outperformed the US by 23%!

More than half of that has occurred since the ambush on Zeleneskyy in the Oval Office.

While no new high has been made yet to confirm, it is noteworthy that money may be flowing toward the EU more than the US for a decade or more.

EU has a much lower debt to GDO at 80% than the US at 125%. Stock valuations are much more attractive than in the US. So much so that I labeled the EU as a value trap. Not anymore!

The biggest obstacle right now is how much would a US recession impact the EU. Even if it does, I expect the EU to perform much better than the US. As such this chart should continue to outperform.

I have another post up you may want to follow.

$EUINTR - ECB Lowers Interest Rates by 25bps (April/2025)ECONOMICS:EUINTR - ECB Lowers Interest Rates by 25bps (April/2025)

ECONOMICS:EUINTR

April/2025

source: European Central Bank

- The European Central Bank lowered interest rates by 25 basis points on Thursday, as expected, marking the sixth consecutive cut since June and bringing the key deposit rate down to 2.25%.

Policymakers noted that the disinflation process is progressing well and dropped previous references to a "restrictive" policy stance, while cautioning that the growth outlook has worsened amid escalating trade tensions.

Non-US ETFs outperform during trade warNon-US markets are showing resilience during this year's remarkable volatility.

While NASDAQ:QQQ and AMEX:SPY are down more than 10%, AMEX:VEA (non-U.S. Developed Markets ETF) is up nearly 5%...

AMEX:IEMG (tracking Emerging Markets) is negative so far, but less severe than others. Will Trump's volatile trade war lead to further outflow from the U.S. financial system?

Meanwhile, gold has been rallying to record highs as the world seeks an alternative to the dollar.

US Tariffs Global Stock Market Crash and International Reactions

Hello, I am Forex Trader Andrea Russo and today I am talking to you about what happened yesterday, Liberation Day. Yesterday, US President Donald Trump announced new "reciprocal" customs duties against several countries, including the European Union, China, the United Kingdom and many others. This announcement, called "Liberation Day" by the White House, has triggered a series of chain reactions on global markets.

The new tariffs, ranging from 10% to 46%, have been justified as a measure to rebalance international trade practices and protect the American economy. However, the immediate impact has been a significant collapse of global stock markets. Investors, worried about possible retaliation and the escalation of trade tensions, have reacted by massively selling their shares.

In Europe, European Commission President Ursula von der Leyen said the EU was ready to respond with appropriate measures, while Italian President Sergio Mattarella called the new tariffs a "profound mistake." The oil market also took a hit, with the price of WTI falling to $69.87 a barrel.

The impact on financial markets was devastating. On Wall Street, the Dow Jones closed down 3.5%, while the Nasdaq lost 4.2%. European stocks were not far behind, with London's FTSE 100 losing 3.8% and Frankfurt's DAX falling 4.1%. Asian stocks also suffered sharp declines, with Japan's Nikkei closing down 3.7%.

For forex traders, these dynamics represent both a challenge and an opportunity. Market volatility can offer opportunities for profit, but it also requires careful risk management. It is essential to closely monitor geopolitical news and market reactions to make informed decisions.

In conclusion, the global economic landscape is in a phase of great uncertainty. As a trader, it is essential to stay updated and ready to react quickly to changes. Keep following my updates for more analysis and trading tips.

Happy trading everyone!

$EUIRYY -Europe CPI (March/2025)ECONOMICS:EUIRYY

March/2025

source: EUROSTAT

- Annual inflation in the Euro Area eased to 2.2% in March 2025,

the lowest rate since November 2024 and slightly below market expectations of 2.3%.

Services inflation slowed to a 33-month low (3.4% vs. 3.7% in February),

while energy costs declined (-0.7% vs. 0.2%).

However, inflation remained steady for both non-energy industrial goods (0.6%) and processed food, alcohol & tobacco (2.6%), and unprocessed food prices surged (4.1% vs. 3.0%).

Meanwhile, core inflation, which excludes volatile food and energy prices, fell to 2.4%, slightly below market forecasts of 2.5% and marking its lowest level since January 2022.

On a monthly basis, consumer prices rose 0.6% in March, following a 0.4% advance in February.

2 April Liberation Day: USA-Europe War Impact on ForexHi, I'm Forex Trader Andrea Russo and today I want to talk to you about an event that is shaking global markets: the tariff war between the United States and Europe.

Sunday, April 2, we started in force and new American news, celebrating "Liberation Day" by President Donald Trump. These data, which include 25% tariffs on your steel, aluminum and automobiles, look to rebalance the trade deficit of the United States. However, Europe is not ready to be saved. Ursula von der Leyen, president of the European Commission, has said that Europe has not started this matter, but is ready to defend its interests with a strong plan for control2.

The tension between the economic power has caused a significant impact on the market. The European stock exchange has not recorded consistent losses, with Milan having lost 16.4 million euros. Europe has responded with tariffs to its strategic American products, such as whiskey, motorcycles and legumes, and is evaluating further measures to protect its own industry4.

Forex Impact

This commercial war will bring about repercussions directly on the Forex market. Here's what to expect:

Removal of the American Dollar (USD): Protectionist tariffs tend to reforce the dollar, as they reduce the command of foreign currencies for imports. In addition, the increase in the price could lead the Federal Reserve to modify its own monetary policy, increasing interest rates.

Volatility of European Currencies: The euro (EUR) may rise in pressures due to economic uncertainties and European constraints. Also the value of the Swedish crown (SEK) may be negatively influenced.

Opportunity for the Trader: The volatility generated by these tensions offers opportunities for the Forex trader. Significant movements and exchange rates can be completed with trading strategies soon, but fundamentally adopt rigorous risk management.

Conclusion

The tariff war between the United States and Europe represents a significant loss for the global economy and the Forex market. Tomorrow will be a crucial day, and the trader will not carefully monitor the resources to adapt their own strategy. Always advise me to do my own analysis and operate with prudence.

Happy trading everyone!

Invest in Europe's defence renaissanceMany said it could not be done and would never happen. But the European defence industry is undergoing a paradigm shift. The geopolitical landscape has shifted dramatically, and delayed action is no longer an option. With rising global instability and the return of President Trump to the White House, European leaders must act decisively to ensure security, strategic autonomy, and industrial resilience in defence. This is not just a short-term response—it marks the beginning of a multi-year investment cycle poised to benefit European defence industries over their US counterparts.

A game-changer: The European Defence Industrial Strategy

For decades, Europe has relied too heavily on US defence capabilities, leaving its defence industry fragmented and dependent on non-EU (European Union) suppliers. However, with uncertainty surrounding US military commitments, European nations are fast-tracking plans to build a stronger, more self-reliant defence industry that can meet the security challenges of today and the future.

The European Defence Industrial Strategy (EDIS) is Europe’s most ambitious attempt yet to transform its defence capabilities1. The strategy aims to unify and strengthen Europe’s defence sector by prioritising joint procurement, innovation, and collaboration among member states.

The urgent measures driving this transformation include:

Rebuilding European defence manufacturing: by 2030, at least 50% of EU defence procurement must come from European manufacturers, rising to 60% by 2035. This is essential to reduce reliance on non-EU suppliers, particularly the US.

Enhancing intra-European defence trade: the EU is aiming to boost defence trade within the bloc to 35% of the total defence market value, fostering a stronger, more integrated industrial base.

Collaborative procurement surge: currently, only 18% of EU defence equipment is procured jointly. By 2030, this must rise to 40%, ensuring lower costs, better interoperability, and a more resilient supply chain.

Redirecting defence budgets toward Europe: governments are being pushed to shift their defence spending away from external actors (like the US) and toward European manufacturers, mitigating risks associated with foreign dependency.

Incentives to accelerate investment: the EU is exploring joint procurement tax incentives and VAT waivers to encourage faster and larger-scale European defence collaborations.

These measures collectively aim to build a more self-reliant and resilient European defence industry while reducing dependency on non-EU suppliers.

Policy-driven capital allocation towards European defence companies

While the US defence industry has been a strong performer in the past, European defence stocks are now positioned for superior long-term growth due to this sustained investment cycle and structural policy shift. The US defence budget is already near record highs, limiting future upside for stocks. Not to mention, DOGE2 is looking to cut costs with defence spending increasingly targeted. In contrast, Europe is at the start of a multi-year rearmament cycle, with significant upside for European contractors. European defence firms are experiencing record-high order books, ensuring stable, long-term revenue growth. Rheinmetall posted a 1.8x book-to-bill3, on top of its 1.7x ratio in 2023, reflecting robust demand for its portfolio of munitions and combat vehicles4. Saab's order intake totalled 79.2 bn krona, or a book-to-bill of 1.8x, with international customers accounting for 80%2. In comparison, order activity for US defence contractors is less heated but still healthy, averaging 1.2x5.

The shift in European defence spending is not temporary—it is structural. With Europe entering a multi-year defence upcycle, investors have a rare opportunity to participate in one of the most significant industrial transformations of our time, but the choice of investment vehicle will be critical for unlocking that potential.

Sources:

1 European Commission: Joint communication to the European Parliament, the Council as of August 2024.

2 Department of Government Efficiency.

3 Book-to-bill is a key metric used in the defence and manufacturing industries to measure the strength of incoming orders relative to completed sales.

4&5 Company Filings, WisdomTree, Bloomberg as of 31 December 2024.

6 WisdomTree, FactSet as of 28 February 2025.

7 P/E = price-to-earnings.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Repaying the Italian debt in 40 years. The method.

Hello, I am Trader Andrea Russo and today I want to talk to you about an ambitious, innovative and potentially revolutionary idea for the management of the Italian public debt. A strategy that, in theory, could heal the enormous accumulated debt and bring Italy to a stronger and more stable financial position. Let's find out together how it could work.

The basic idea

Italy, with a public debt that amounts to about 2,900 billion euros, pays 70 billion euros in interest annually to its creditors. However, imagine an alternative scenario in which those 70 billion, instead of being paid for the payment of interest, are invested in index funds with an estimated average annual return of 10%. Furthermore, the profits generated would be reinvested annually. It is a solution that is based on the power of compound interest.

From the second year, Italy would also have the 70 billion euros available annually no longer tied to the payment of interest. These funds could be used in strategic ways to support economic recovery.

Agreements with creditors

To make this proposal feasible, Italy would have to negotiate an agreement with creditors. The agreement would include a temporary suspension of interest payments, with the promise that the State will repay the entire debt within 40 years, also guaranteeing a compensatory interest of 10% as a "disturbance".

This implies that creditors must accept a long-term vision, trusting in the profitability of investments and the ability of the Italian State to honor the final commitment.

Simulation: how it could work

If the 70 billion were invested from the first year in index funds with an average annual return of 10%, the capital would grow exponentially thanks to compound interest. Over 40 years, the investment would accumulate over 3,241 billion euros, a sum sufficient to repay the public debt of 2,900 billion and to provide a surplus to satisfy the extra interest promised to creditors.

Meanwhile, from the second year, Italy would have at its disposal the 70 billion annually previously earmarked for interest payments. Over 40 years, this figure would represent a total of 2,800 billion euros, which could be used to:

Strengthen strategic infrastructure in the transport, energy and digital sectors.

Reduce the tax burden and encourage economic growth.

Improve social services, such as healthcare, welfare and education.

Further reduce the residual debt, strengthening the country's financial stability.

Conclusion

With this strategy, Italy would not only repay its public debt, but would also start an unprecedented phase of economic recovery. The combination of compound interest and the reallocation of freed funds represents an innovative vision to solve one of the main economic challenges of our time.

However, the implementation of such an ambitious plan would require financial discipline, political stability and careful management of investments. Furthermore, it would be essential to negotiate a transparent and advantageous agreement with creditors, ensuring trust and credibility in international markets.

Whether this is a utopia or a real opportunity will depend on the ability to imagine and adopt bold solutions for the good of the country.

Trump Zelensky and Putin Phone Calls

Hi, my name is Andrea Russo and I am a Forex Trader. Today I want to talk to you about how the recent phone calls between Donald Trump, Volodymyr Zelensky and Vladimir Putin have had a significant impact on the financial markets, especially the Forex market.

In recent days, US President Donald Trump has had crucial phone conversations with Ukrainian President Volodymyr Zelensky and Russian President Vladimir Putin. These talks have mainly focused on finding a truce in the conflict in Ukraine and stabilizing international relations.

Trump-Zelensky Phone Call

The call between Trump and Zelensky was described as "very good" by both leaders. During the conversation, Trump promised support for strengthening Ukraine's air defense, with a focus on the resources available in Europe. In addition, the possibility of the United States taking a role in managing Ukraine's energy infrastructure, such as nuclear power plants, to ensure greater security was discussed2. This has opened up hope for a partial truce, with technical negotiations expected in the coming days in Saudi Arabia.

Trump-Putin Call

The conversation between Trump and Putin, which lasted about three hours, touched on key issues such as the ceasefire and the need for lasting peace. Both leaders agreed on a path that includes a partial ceasefire on energy infrastructure and negotiations to extend the truce to the Black Sea. In addition, they discussed improving bilateral relations between the United States and Russia, with a focus on economic and geopolitical cooperation5.

Impact on the Forex Market

These developments had an immediate impact on the Forex market. The prospect of a truce strengthened the Russian ruble (RUB) and the Ukrainian hryvnia (UAH), while the US dollar (USD) showed slight volatility due to the uncertainties surrounding the negotiations. Investors reacted positively to the possibility of geopolitical stabilization, increasing demand for emerging market currencies. However, the market remains cautious, awaiting further details on the negotiations and the actual implementation of the measures discussed.

Conclusion

The phone calls between Trump, Zelensky and Putin represent a significant step towards resolving the conflict in Ukraine and stabilizing international relations. For Forex traders, these events offer opportunities but also risks, making it essential to closely monitor geopolitical developments and their implications on financial markets.