$EUIRYY -Europe CPI (July/2025)ECONOMICS:EUIRYY

July/2025

source: EUROSTAT

- Eurozone consumer price inflation held steady at 2.0% year-on-year in July 2025, unchanged from June but slightly above market expectations of 1.9%, according to preliminary estimates.

This marks the second consecutive month that inflation has aligned with the European Central Bank’s official target.

A slowdown in services inflation (3.1% vs 3.3% in June) helped offset faster price increases in food, alcohol & tobacco (3.3% vs 3.1%) and non-energy industrial goods (0.8% vs 0.5%).

Energy prices continued to decline, falling by 2.5% following a 2.6% drop in June.

Meanwhile, core inflation—which excludes energy, food, alcohol, and tobacco—remained unchanged at 2.3%, its lowest level since January 2022.

Europeanunion

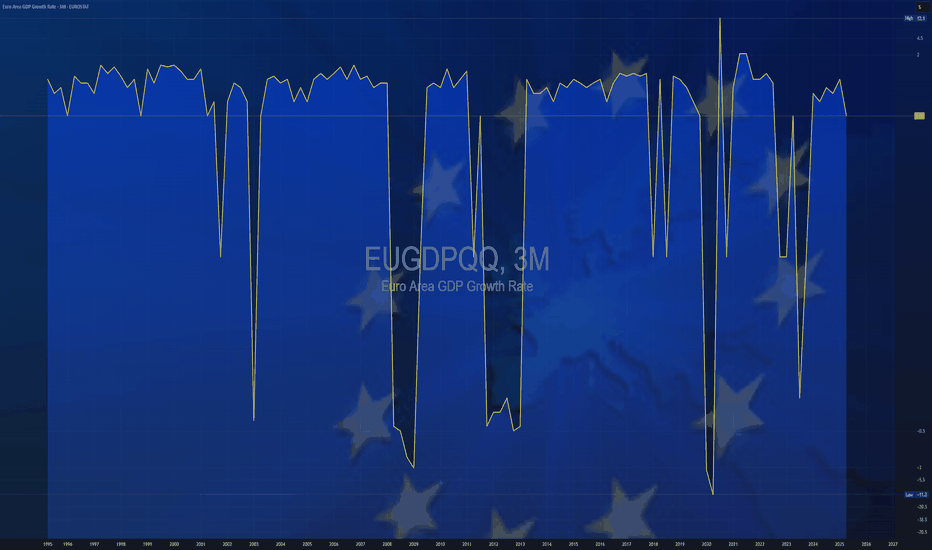

$EUGDPQQ -Europe GDP (Q2/2025)ECONOMICS:EUGDPQQ

Q2/2025

source : EUROSTAT

- The Gross Domestic Product (GDP) In the Euro-Area expanded 0.10 percent in the second quarter of 2025 over the previous quarter.

GDP Growth Rate in the Euro Area averaged 0.37 percent from 1995 until 2025, reaching an all time high of 11.60 percent in the third quarter of 2020 and a record low of -11.10 percent in the second quarter of 2020.

$EUINTR - Europe Interest Rates (July/2025)ECONOMICS:EUINTR

July/2025

source: European Central Bank

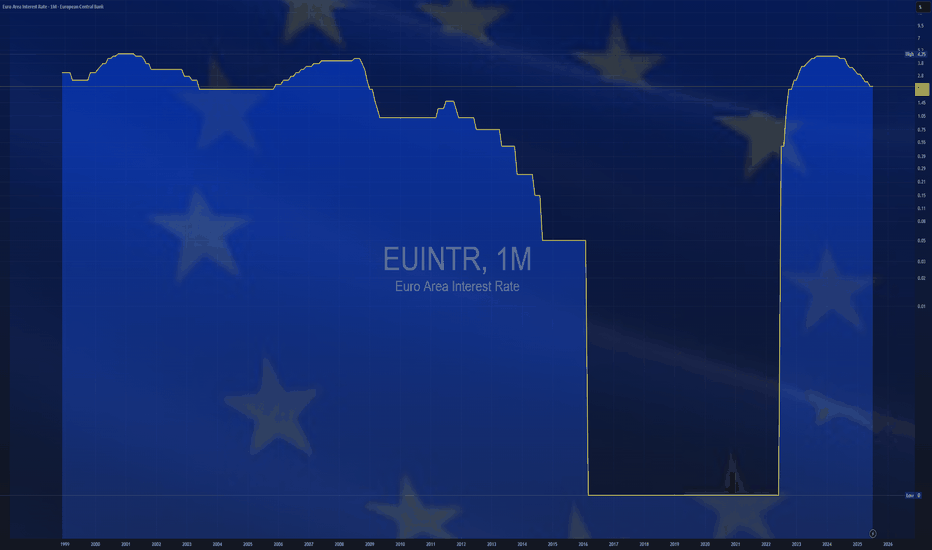

- The ECB kept interest rates unchanged in July, effectively marking the end of its current easing cycle after eight cuts over the past year that brought borrowing costs to their lowest levels since November 2022.

The main refinancing rate remains at 2.15%, while the deposit facility rate holds at 2.0%. Policymakers struck a wait-and-see stance, as they evaluate the impact of lingering trade uncertainty and the potential fallout from proposed US tariffs on economic growth and inflation.

Inflation hit the ECB’s 2% target in June, adding to the case for a pause in policy adjustments. Speaking at the ECB press conference, President Lagarde said the central bank is “in a good place” but acknowledged the difficulty in assessing how tariffs will affect price outlooks, given the mix of both inflationary and disinflationary pressures.

On the recent euro appreciation, Lagarde reiterated that the ECB does not target exchange rates directly but considers them when forecasting inflation.

$EUINTR - Interest Rates Cut (June/2025)ECONOMICS:EUINTR

(June/2025)

source: European Central Bank

- The ECB cut key interest rates by 25 bps at its June meeting,

based on updated inflation and economic forecasts.

Inflation is near the 2% target, with projections showing 2.0% in 2025 (vs 2.3% previously), 1.6% in 2026 (vs 1.9% previously), and 2.0% in 2027.

Core inflation (excluding energy and food) is seen at 2.4% in 2025, then easing to 1.9% in 2026–2027.

GDP growth is forecast at 0.9% in 2025, 1.1% in 2026 (vs 1.2% previously), and 1.3% in 2027, supported by higher real incomes, strong labour markets, and rising government investment, despite trade policy uncertainties weighing on exports and business investment.

Scenario analysis shows trade tensions could reduce growth and inflation, while resolution could boost both.

Wage growth is still high but slowing, and corporate profits are helping absorb cost pressures.

President Lagarde said that the central bank is approaching the end of a cycle, suggesting a pause may be on the horizon following today’s reduction.

Is Europe's Decline Grounding Airbus's Ascent?Europe's economic situation presents a complex picture of modest growth juxtaposed with significant challenges, creating uncertainty for major players like Airbus. In 2024, the European Union's GDP growth was projected to be below 1%, with only a slight acceleration anticipated for 2025. This sluggish economic expansion, when coupled with persistent inflation and ongoing geopolitical tensions, lays an unstable foundation for sustained economic prosperity.

The cohesion of the European Union itself is increasingly in question, influenced by the rise of nationalist sentiments and the potential for increased trade protectionism. The EU faces structural challenges, including economic disparities, political divisions, and growing Euroscepticism, which could precipitate its disintegration. Should this occur, individual countries would be forced to navigate complex economic and geopolitical landscapes independently, generating significant implications for multinational corporations like Airbus.

Concurrently, Airbus is navigating a highly competitive environment, most notably with its enduring rivalry with Boeing, which is actively seeking to overcome its recent operational and reputational hurdles. While Airbus has recently secured a larger market share, Boeing's inherent resilience, combined with the potential entry of new competitors, may challenge Airbus's current market dominance.

To sustain its competitive edge, Airbus must not only effectively manage the economic uncertainties and potential fragmentation within Europe but also maintain its commitment to technological innovation and efficient production. The company's ability to nimbly adapt to these multifaceted challenges will be crucial in determining its long-term success and continued leadership in the global aerospace industry.

$EUINTR - ECB Lowers Interest Rates by 25bps (April/2025)ECONOMICS:EUINTR - ECB Lowers Interest Rates by 25bps (April/2025)

ECONOMICS:EUINTR

April/2025

source: European Central Bank

- The European Central Bank lowered interest rates by 25 basis points on Thursday, as expected, marking the sixth consecutive cut since June and bringing the key deposit rate down to 2.25%.

Policymakers noted that the disinflation process is progressing well and dropped previous references to a "restrictive" policy stance, while cautioning that the growth outlook has worsened amid escalating trade tensions.

OVH Group – Beneficiary of EU-US Decoupling?OVH Group – Positioned to Benefit from Europe’s Digital Decoupling from the US

We are seeing a clear push toward reducing Europe’s dependency on American when it comes to the Blocks National Security. US cloud firms like Microsoft, Amazon, and Google are increasingly viewed as sovereignty risks, given the reach of US laws like the CLOUD Act.

This shift is creating strong political and regulatory support for European alternatives. OVH Group, as the leading European-owned cloud infrastructure provider, could stand out as a key beneficiary, should this trend prevail. The company is well positioned to take on new demand from both public and private sector clients looking for a sovereign, EU-based solution that aligns with data protection and national security goals.

OVHcloud is actively involved in providing cloud infrastructure services to European public sector entities, including those with stringent security requirements. While specific government security contracts are not publicly detailed, OVHcloud has positioned itself as a trusted provider for sensitive data hosting. The company emphasises its commitment to data sovereignty and compliance with strict data security and confidentiality requirements, operating exclusively within the European Union and not subject to extraterritorial laws like the U.S. CLOUD Act.

OVHcloud has built data centers within the EU dedicated to storing sensitive data, ensuring that services hosted in these "zones of confidence" are operated entirely within EU territory. These services comply with the highest standards and possess necessary security and data protection certifications.

Furthermore, OVHcloud has obtained the SecNumCloud 3.2 qualification for its highly secure cloud platform, Bare Metal Pod. This certification, awarded by the French Cybersecurity Agency (ANSSI), acknowledges the platform’s adherence to stringent security standards, supporting OVHcloud’s efforts in providing secure cloud solutions for public and private sector organisations.

These initiatives align with the European Union's push for digital sovereignty, positioning OVHcloud as a key player in providing secure, compliant cloud infrastructure for government and public sector clients.

If European governments follow through on this digital decoupling, OVH could see a significant increase in contract wins and strategic importance—both of which could materially improve its valuation.

$EUIRYY -Europe CPI (March/2025)ECONOMICS:EUIRYY

March/2025

source: EUROSTAT

- Annual inflation in the Euro Area eased to 2.2% in March 2025,

the lowest rate since November 2024 and slightly below market expectations of 2.3%.

Services inflation slowed to a 33-month low (3.4% vs. 3.7% in February),

while energy costs declined (-0.7% vs. 0.2%).

However, inflation remained steady for both non-energy industrial goods (0.6%) and processed food, alcohol & tobacco (2.6%), and unprocessed food prices surged (4.1% vs. 3.0%).

Meanwhile, core inflation, which excludes volatile food and energy prices, fell to 2.4%, slightly below market forecasts of 2.5% and marking its lowest level since January 2022.

On a monthly basis, consumer prices rose 0.6% in March, following a 0.4% advance in February.

EUROUSD TRADING POINT UPDATE >READ THE CHAPTIAN Buddy'S dear friend

SMC Trading Signals Update 🗾🗺️ Euro USD Traders SMC-Trading Point update you on New technical analysis setup for Euro USD ) 4 Time Frame Candle 🕯️ close below 👇 key Support level too top 🔝 looking. For. Bearish trand. 0.97016 - .095550.

Key Resistance level 1.05613

Key Support level 0.97016 - .095550

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

Breaking: Backpack Acquires FTX EU in $32.7M DealIn a major development for the European crypto market, Backpack Exchange has acquired the bankrupt European unit of FTX for $32.7 million. This strategic move positions Backpack as a key player in regulated crypto derivatives, aiming to restore trust and innovation in the sector following the FTX collapse.

The Acquisition: A New Chapter for FTX EU

FTX EU, previously part of Sam Bankman-Fried’s defunct crypto empire, operated under a MiFID II license from the Cyprus Securities and Exchange Commission (CySEC). The acquisition by Backpack marks a significant step in reviving the platform’s operations. According to Armani Ferrante, CEO of Backpack Exchange, the company plans to offer a full suite of crypto derivatives throughout Europe, starting with regulated perpetual futures—a product currently unavailable in the EU.

Backpack’s entry comes at a time when major players like Bitstamp and Coinbase have secured MiFID II licenses, with other firms like D2X preparing to deliver USD-denominated futures and options. Backpack’s MiCA notification has already been submitted, and Ferrante expects operations to commence in Q1 2025.

Rebuilding Trust and Innovation

The acquisition not only secures Backpack’s foothold in the European market but also provides an opportunity to repair the damage caused by FTX’s collapse. Ferrante emphasized the company’s commitment to returning FTX EU customers’ funds as a priority. Once this process is complete, Backpack aims to launch its regulated perpetual futures product, further solidifying its market position.

Backpack’s founders, known for their contributions to the Solana ecosystem and success in the wallet and NFT business, raised $17 million in funding last year. This financial backing underscores the company’s capability to execute its ambitious plans.

Technical Outlook: TSX:FTT Price Analysis

Despite the acquisition news, TSX:FTT , the native token of the FTX platform, has shown a weaker trend channel, down 2.14% at the time of writing. The Relative Strength Index (RSI) stands at 46, indicating a neutral momentum but leaning towards bearish sentiment due to selling pressure.

Key Technical Levels:

- Support: The 65% Fibonacci retracement level serves as immediate support. A breakdown below this level could trigger a selling spree, potentially driving TSX:FTT to its one-month low.

- Resistance: If TSX:FTT manages to rebound, traders should watch for a move above the current trend channel to confirm a bullish reversal.

While the acquisition provides a positive fundamental backdrop, traders remain cautious, awaiting clarity on how the settlement of affected FTX customers will unfold. The resolution of these issues could act as a catalyst for TSX:FTT ’s recovery.

The Road Ahead

Backpack’s acquisition of FTX EU represents a turning point for regulated crypto derivatives in Europe. With plans to launch a full suite of products and restore customer trust, the company is poised to make significant strides in the market. For TSX:FTT , the path forward depends on both the broader market sentiment and the successful implementation of Backpack’s ambitious plans.

Investors and traders should monitor both technical indicators and fundamental developments closely as Backpack reshapes the narrative around FTX EU and its role in the European crypto landscape.

$EUIRYY -Europe CPI (November/2024)ECONOMICS:EUIRYY

November/2024

source: EUROSTAT

Euro Area Inflation Rate Rises to 2.3% as Expected

-The annual inflation rate in the Eurozone accelerated for a second month to 2.3% in November from 2% in October, matching market expectations, preliminary estimates showed.

This year-end increase was largely expected due to base effects,

as last year’s sharp declines in energy prices are no longer factored into annual rates.

Prices of energy decreased less but inflation slowed for services.

$EUIRYY -Europe's Inflation Rate (October/2024)ECONOMICS:EUINTR 2%

(October/2024)

+0.3%

source: EUROSTAT

-Annual inflation in the Euro Area accelerated to 2% in October 2024, up from 1.7% in September which was the lowest level since April 2021, and slightly above forecasts of 1.9%, according to preliminary estimates.

This year-end increase was largely expected due to base effects, as last year’s sharp declines in energy prices are no longer factored into annual rates.

Inflation has now reached the European Central Bank’s target.

In October, energy cost fell at a slower pace (-4.6% vs -6.1%) and prices rose faster for food, alcohol and tobacco (2.9% vs 2.4%) and non-energy industrial goods (0.5% vs 0.4%).

On the other hand, services inflation steadied at 3.9%.

Meanwhile, annual core inflation rate which excludes prices for energy, food, alcohol and tobacco was unchanged at 2.7%, the lowest since February 2022 but above forecasts of 2.6%. Compared to the previous month, the CPI rose 0.3%, following a 0.1% fall in September.

Meta and Spotify Criticize EU’s AI Decisions Stock up 3.53%On Thursday, Meta (NASDAQ: NASDAQ:META ), along with Spotify and several other tech companies, voiced strong criticisms against the European Union’s approach to data privacy and artificial intelligence (AI) regulation. In an open letter, these firms, along with researchers and industry bodies, claimed that the EU's decision-making has become "fragmented and inconsistent," warning that Europe risks falling behind in the global AI race.

The Regulatory Clash: Meta and GDPR Tensions

Meta (NASDAQ: NASDAQ:META ), which owns Facebook, Instagram, and WhatsApp, has been at the center of data privacy controversies in Europe, especially under the General Data Protection Regulation (GDPR). Recently, Meta (NASDAQ: NASDAQ:META ) halted its plans to collect data from European users to train its AI models due to pressure from privacy regulators. This followed a record-breaking fine of over one billion euros for breaching privacy rules.

The company, along with other tech giants, has delayed the release of AI products in the European market, seeking clarity on legal and regulatory frameworks. For instance, Meta delayed the launch of its Twitter alternative, Threads, in the EU, while Google has also held back on AI tool rollouts in the region.

The open letter signed by Meta, Spotify, and others calls for "harmonized, consistent, quick, and clear decisions" from data privacy regulators to enable European data to be used in AI training. The companies argue that without a coherent regulatory framework, the EU could lose its competitive edge in the global AI landscape, falling behind regions like the U.S. and China, which have been advancing rapidly in the field.

Meta’s AI Ambitions and Strategic Moves

Meta’s criticisms of the EU regulations come at a time when the company is heavily investing in AI technologies to enhance its social media platforms and introduce new products. AI is at the heart of Meta’s push toward the metaverse and other cutting-edge innovations. The company’s reluctance to release certain AI products in Europe is a direct result of the regulatory uncertainty, which hampers its ability to fully capitalize on its technological advancements.

With the EU’s AI Act coming into force this year, it aims to curb potential abuses in AI usage, but this stringent regulation may slow down innovation and delay product launches in the region. Meta and other tech giants believe that clearer rules will help unlock the potential of AI while protecting user privacy.

Technical Outlook: A Bullish Meta Stock Poised for Continued Growth

From a technical perspective, Meta’s stock ( NASDAQ:META ) has been on a stellar upward trend since November 2022, and it doesn't show signs of slowing down. As of the time of writing, the stock is up 3.66% and has entered overbought territory with an RSI (Relative Strength Index) of 70.54. This indicates that the stock may be poised for a temporary cool-off.

The stock's rise has been bolstered by broader market optimism, including the recent decision by the Federal Reserve to cut interest rates. This move is expected to benefit the tech sector, with Meta standing to gain significantly. With lower borrowing costs, tech companies like Meta (NASDAQ: NASDAQ:META ) can continue their aggressive expansion into AI and metaverse-related technologies.

Meta’s stock (NASDAQ: NASDAQ:META ) also exhibits a gap-up pattern that hasn’t been filled, suggesting a potential correction or consolidation period. Additionally, the stock has been consolidating since February 2024, indicating a potential bullish continuation pattern. However, with the RSI in overbought territory, investors should watch for a short-term pullback to cool off the stock before resuming its upward trajectory.

Meta’s AI Potential Amid Regulatory Uncertainty

Meta (NASDAQ: NASDAQ:META ) is navigating a complex regulatory environment in the EU while continuing to make strides in AI and technological innovation. Despite the challenges posed by GDPR and the AI Act, Meta remains well-positioned for long-term growth, with its stock reflecting strong momentum. However, short-term volatility due to regulatory decisions and technical factors may present buying opportunities for investors. As Meta (NASDAQ: NASDAQ:META ) continues to push the envelope in AI and the metaverse, the company’s future success will largely depend on its ability to navigate these regulatory waters while maintaining its innovation edge.

Euro-Zone GDP Quarterly *3M (QoQ)ECONOMICS:EUGDPQQ (+0.3 %)

Q1/2024

source: EUROSTAT

The Eurozone’s economy expanded by 0.3% in the first quarter of 2024, the fastest growth rate since the third quarter of 2022, to beat market expectations of a marginal 0.1% expansion and gain traction following muted readings since the fourth quarter of 2022.

The result added leeway for the European Central Bank to refrain from cutting rates to a larger extent this year should inflationary pressures prove to be more stubborn than previously expected.

Among the currency bloc’s largest economies, both the German and the French GDPs expanded by 0.2%, while that from Italy grew by 0.3% and that from Spain expanded by 0.7%, all above market estimates.

Compared to the same quarter of the previous year ECONOMICS:EUGDPYY ,

the Eurozone’s GDP grew by 0.4%, beating market expectations of 0.2%, and gaining traction after two straight quarters of 0.1% growth.

$EUIRYY -EU YoY (CPI) source: EUROSTAT

The inflation rate in the Euro Area declined to 2.9% year-on-year in October 2023,

reaching its lowest level since July 2021 and falling slightly below the market consensus of 3.1% .

Meanwhile,

The Core Rate, which filters out volatile food and energy prices,

also cooled to 4.2% in October;

marking its lowest point since July 2022.

However, both rates remained above the European Central Bank's target of 2%.

The energy cost tumbled by 11.1% (compared to -4.6% in September), and the rates of inflation eased for both food, alcohol, and tobacco (7.5% compared to 8.8%) and non-energy industrial goods (3.5% compared to 4.1%).

Services inflation remained relatively stable at 4.6%, compared to 4.7% in the previous month. On a monthly basis, consumer prices edged up 0.1% in October, after a 0.3% gain in September.

EU's Digital Dominance Crackdown: Apple's iPad Added to RadarThe European Union (EU) has extended its regulatory reach to encompass Apple Inc.'s iconic iPad. This expansion, under the auspices of the Digital Markets Act (DMA), underscores the EU's commitment to fostering fair competition and curbing potential monopolistic tendencies among Big Tech giants.

The decision marks a significant juncture for Cupertino-based Apple, as it faces a new set of stringent rules aimed at ensuring a level playing field in the digital arena. The DMA, which recently came into full force, targets six tech behemoths deemed as digital "gatekeepers," including Apple ( NASDAQ:AAPL ), Meta Platforms Inc., Alphabet Inc.'s Google, Amazon.com Inc., Microsoft Corp., and ByteDance Ltd., the parent company of TikTok.

Under the DMA's purview, designated firms are compelled to adhere to a series of preemptive measures aimed at thwarting anti-competitive practices before they can take root. Notably, Apple ( NASDAQ:AAPL ) now has a six-month window to align its iPad ecosystem with the regulatory framework outlined by the EU. This entails a gamut of obligations and prohibitions, including allowing users to download apps from sources beyond Apple's ecosystem and granting them the ability to uninstall preloaded applications.

Margrethe Vestager, the EU's Competition Commissioner, emphasized the rationale behind bringing iPadOS under the DMA's umbrella, citing its pivotal role as a gateway for numerous companies to reach their customers. She underscored the EU's commitment to preserving fairness and competition in the digital marketplace, signaling a proactive stance against potential monopolistic behaviors.

Apple's ( NASDAQ:AAPL ) response to the regulatory encroachment reflects a delicate balancing act between catering to European consumers' needs and addressing the new privacy and data security risks posed by the DMA. The company remains steadfast in its commitment to delivering value to European users while navigating the evolving regulatory landscape.

The inclusion of the iPad in the DMA's ambit signifies a broader trend of regulatory scrutiny confronting tech giants worldwide. With regulators increasingly scrutinizing digital platforms' market dominance and their impact on competition and innovation, the tech industry faces a paradigm shift in regulatory oversight.

The ramifications of the EU's digital dominance crackdown extend far beyond Apple ( NASDAQ:AAPL ), reverberating across the tech ecosystem and prompting industry-wide reflection on business practices and market dynamics. As regulatory pressures mount, tech companies are compelled to reassess their strategies and business models to navigate the evolving regulatory terrain while maintaining their competitive edge.

In this era of heightened regulatory scrutiny, the EU's move to bring the iPad under the DMA's purview underscores the imperative of fostering fair competition and innovation in the digital marketplace.

Despite the regulatory scrutiny, Apple Inc. ( NASDAQ:AAPL ) stock is up 4% trading with a moderate Relative Strength Index (RSI) of 58.85 indicating further room for growth.

Macro Monday 38 ~ The EU & German ZEW Economic Sentiment IndexMacro Monday 38

The Euro Area ZEW Economic Sentiment Index &

The German ZEW Economic Sentiment Index

(Released this Tuesday 19th Mar 2024)

ZEW is the German acronym for the Zentrum für Europäische Wirtschaftsforschung, which translates to the Centre for European Economic Research.

There are two releases from the Centre for European Economic research we will cover today both being released this coming Tuesday;

1. The Euro Area ZEW Economic Sentiment Index

(Reading of 25 for Feb 2024)

2. The German ZEW Economic Sentiment Index

(Reading of 19.9 for Feb 2024)

EURO AREA ZEW INDEX

This index is derived from 350 economists and analysts that operate from and represent the overall European Area. They include economists and analysts from different countries in the Eurozone that are using the Euro as their currency (20 countries out of the 27 members). In summary, while the EU ZEW index provides a broader perspective for the entire eurozone than the German ZEW Index discussed below, the exact methodology for distributing the surveys and their apportionment across individual countries within the eurozone is not explicitly disclosed. Historically, this index has proven very useful as a leading indicator of sentiment for the European Economy and it is closely monitoring for gauging economic sentiment in the EU by market participants.

EURO AREA ZEW CHART - SUBJECT CHART ABOVE

How to read the chart

The index ranges from -100 (pessimism) to +100 (optimism). 0 is neutral however the historical average reading for the EU chart is 21.39 which is the point where the red area meets the green area on the chart. We show on the chart if we are above or below the average levels of optimism.

The current reading of 25 indicates current optimism among analysts for the next 6 month

The Trend

Sentiment made a recovery from -60 in Sept 2022 to +25 in Feb 2024. We have moved from deep in negative sentiment territory to just above the historical average of the chart which is 21.39.

GERMAN ZEW INDEX

The German ZEW Index data is not derived from all the countries in Europe, it is derived from the views of collection of 350 economists and analysts that operate from and represent the German economy. As Germany is the largest economy within the Euro Area, its performance significantly impacts the overall region and this this metric could be considered the economic sentiment spearhead of Europe. Germany is also the 4th largest economy in the world by nominal GDP. As of 2023, its nominal GDP stands at approximately $4.43 trillion. This index could be monitored as a measure of not only European sentiment but as an important global sentiment gauge.

GERMAN ZEW INDEX CHART

How to read the chart

The index ranges from -100 (pessimism) to +100 (optimism). 0 is neutral however the historical average reading for the German ZEW chart is 20.79 which is the point where the red area meets the green area on the chart. We show on the chart if we are above or below the average levels of optimism.

The current reading of 19.9 indicates current optimism among analysts for the next 6 months, however we are below the historical average of 20.79 thus a definitive move above this level this coming Tuesday could be a confirmation step into potential sustained optimism.

The Trend

Sentiment made a recovery from -61 in Sept 2022 to +19.9 in Feb 2024. We have moved from deep in negative sentiment territory into positive numbers but we are not above the historic average of 20.79 yet.

Lets see how both perform this coming Tuesday. The beauty of these charts is that you can review both on my Trading View at any stage, press play and it will update with the most recent release. This way you will have a full explainer of what this dataset is and can keep yourself up to date on its direction with the color coded map, the average line and the neutral line, all of which will at a glance give you a good indication of where we stand in terms of trend and sentiment. I'll keep you informed here too

Thanks for coming along

PUKA

Macro Monday 39 - Euro Area Economic Sentiment Indicator (ESI)Macro Monday 39

Euro Area Economic Sentiment Indicator

(Next Release is this Wednesday 27th March 2024)

Last week we covered the the Euro Area ZEW Economic Sentiment Index (the "ZEW Index") and learned that the sentiment data for the ZEW Index comes from 350 economists spanning the Euro Area (20 of the 27 EU member states that use the Euro currency). The ZEW Index attempts to provide a sentiment lead with economists factoring in their 6 month forward projections into the sentiment data.

This week we look at a different more current sentiment indicator, the Euro Area Economic Sentiment Indicator (ESI). The data for the ESI is derived from the businesses and consumers of all 27 EU Member States. The ESI therefore has a larger data set to the 20 countries covered in the ZEW Index. The ESI is closer to the truth of what businesses and consumers are currently experiencing on the ground across Europe. The ESI is not forward looking like the ZEW index, the ESI should be considered a coincident indicator presenting the current state of economic sentiment among businesses and consumers across the EU. In any event we can still use the ESI data and the chart to identify trends and to know where sentiment stands when it is released each month.

Interestingly, at present the ESI figure is more negative than the ZEW Index. The ZEW is in positive sentiment territory (forward looking) whilst the ESI is firmly in negative sentiment territory (current outlook). Based on each data sets objective, you would think that the ESI would move into positive territory over the coming 6 months based on the forward looking positive ZEW Index. No guarantees of course. We can watch this as it plays out in real time and see if the ESI follows the ZEW Index.

Lets have a closer look at the ESI

The Euro Area Economic Sentiment Indicator (ESI) is a measure created by the European Commission to gauge economic confidence across the Euro Area.

The survey data for the Economic Sentiment Indicator (ESI) is initially collected at the national level for each country within the Euro Area. These individual country results are then aggregated to create the overall ESI, which reflects the economic sentiment for the entire EU (all 27 countries). The data is also seasonally adjusted to account for regular seasonal variations and provide a clearer picture of the underlying economic trends.

The data is derived from survey responses from the following economic sectors in each country (with weightings);

1. Industry (40%)

2. Services (30%)

3. Consumers (20%)

4. Retail (5%)

5. Construction (5%)

Balances are constructed as the difference between the percentages of respondents giving positive and negative replies.

The ESI data is scaled to a long-term average of 100 with a standard deviation of 10. This means that the average sentiment over time is set at 100.

As the ESI’s scale centers around a mean of 100 values above this suggest higher-than-average confidence, while those below indicate lower confidence. It’s seasonally adjusted to reflect consistent economic trends.

The Chart (above subject chart)

The chart follows the structure discussed above and we have split the chart by color as follows:

>100 = Above Average Economic Sentiment🟢Green

<100 = Above Average Economic Sentiment🔴 Red

▫️ As you can see on the chart we made a record low in pessimism in May 2020 at 58.7 which was closely followed by a record high in optimism in Oct 2021 at 119.5.

▫️ The chart has arrows that are 17pts in length. You will see the arrows across the chart whereby if there was a greater than 17pt drop from the green zone into red the red zone, this historically has coincided with recession

▫️ The most recent drop from🟢119.5 in Oct 2021 to 🔴93.9 in Oct 2023 is a drop of 25.6pts, greater than the 17pt typical recession drop. "This time might be different" may actually apply because we had all time highs in sentiment in Oct 2021, however that does not detract from the fact we are currently firmly in negative economic sentiment sub 100 at 95.4.

▫️ You can see that any time we have fallen below the 85 level (red dotted line) we have confirmed a recession. This does not mean that you need a sub 84 reading for a recession, only that when this has occurred in the past, it only occurred during some of the deeper recessions.

A quick note on the Euro Area terminology as this was bugging me as the ESI covers all 27 EU member states

Euro Area Terminology?

The term “Euro Area Economic Sentiment Indicator” can be somewhat misleading because the ESI indeed covers all 27 EU Member States, not just those in the 20 in the Euro Area or Eurozone. The name likely persists because the ESI is particularly significant for the Euro Area, where economic policies are closely aligned and the shared currency means that economic sentiment has direct implications for monetary policy. However, the ESI’s broader EU-wide scope allows for a comprehensive view of economic sentiment across the entire European Union, which is valuable for comparative analysis and policy-making at the EU level.

Thank for coming along again, if you like the content and find it informative please let me know

PUKA

Macro Monday 39 (Part B) - Predictive Power (EU ZEW Vs EU ESI)Macro Monday 39 (Part B)

This chart is a summary of the past two weeks of work in Macro Mondays on the EU Sentiment

The Chart illustrates the forward looking Euro Area ZEW Sentiment Index (red line) and the current sentiment outlook via the Euro Area Economic Sentiment Index (the "ESI", the blue line).

In the chart I have used thick orange lines to illustrate when the forward looking ZEW Index moved negative ahead of the ESI Index. I have used thick green lines to inform of us of when the ZEW Index moved into optimism ahead of the ESI Index. The Chart demonstrates that the ZEW Index is actually a moderately decent forward looking indicator. Hats off to those 350 economists that complete the surveys in the ZEW Index. Whilst it has been great at providing some leads, the ZEW Index is not always accurate and does not always offer the correct lead direction however historically we can see that it certainly has had predictive power at certain junctures and thus its a useful data set to monitor for EU sentiment.

▫️ At present the forward looking ZEW Index has moved into optimism whilst the current outlook via the ESI is in pessimism.

▫️ If the ZEW Index gets above the 38-42 level, it would really help concrete the sentiment shift to optimism. This is not disregarding the fact we are firmly in positive forward looking sentiment territory already. Historically there have been many rejections lower from this 38 -42 level, thus getting above it would be a real conclusive move. Furthermore, the ESI is at 95.4, if the above were to occur with a move above 38 - 42 on the ZEW Index and the ESI was to move above 100 into positive territory, we could really start to lean firmly positive for the present and into the future.

The beauty of this chart is that you can go onto my TradingView Page and press update, and the chart will update you with both metrics, informing you at a glance with how these metrics are performing collectively with a nice visual guide.

Thanks again for coming along and I hope this chart helps you in your current and future understandings of EU Economic Sentiment, which is an important global economic lead.

Bottom line is, economic sentiment appears to be leaning optimistic for the immediate future, however we await more readings for a conclusive trend direction.

PUKA

Crypto Regulations: How MiCA Will Affect EU TradersIn the rapidly evolving world of cryptocurrency, the European Union has taken a significant and important step forward with the introduction of the Markets in Crypto-Assets Regulation (MiCA). This groundbreaking regulatory framework marks a pivotal moment for the crypto market within the EU, promising to bring much-needed clarity and stability to an industry that has long been likened to the Wild West due to its volatility and lack of standardization.

The European Union is a leader in creating legislation for emerging technologies. This became clear with the introduction of GDPR, which protects internet users’ personal data, the AI Act that aims to protect citizens of the EU from malpractice, such as cognitive manipulation of people and social scoring, and now - MiCA. Paving the way forward for others, the EU is evolving its digital legislation frameworks faster than other unions or countries.

This article delves into how MiCA will reshape the landscape for EU traders, impacting everything - from the way they interact with crypto assets to the broader market dynamics they navigate daily.

Why do we need regulations like MiCA?

If there are no regulations, markets can run wild and experience giant increases, however when the fun is over and people lose money to fraud and even large-scale bankruptcy of exchanges - investors, especially institutional ones, will not dare place their money in crypto projects and companies. And since for investors, money is trust - the cryptocurrency market is doomed without proper regulation.

On the flip side, extremely stringent and disorganized legislation can lead to the same outcome. Countries struggle with the abstract nature of cryptocurrencies, and many have expressed an outright desire to ban them, seeing as it is the easier option. That is why MiCA is a well-devised framework for others to follow - It is focused and comprehensive.

Some may argue that cryptocurrencies are meant to be decentralized, unregulated and follow a laissez-faire approach. While this is possible, more so for some cryptocurrencies than others, there can be no growth in these markets as new projects need to have banking and investors behind them to realize their blockchain-based ideas. It is also unrealistic to think that such a clandestine financial system will never cross paths with the regular banking system.

What exactly is MiCA?

The inception of the Markets in Crypto-Assets Regulation (MiCA) is rooted in the European Union's recognition of the growing significance of cryptocurrencies and the associated risks in an unregulated environment. The primary catalyst for MiCA's development was the need for regulatory clarity in the burgeoning crypto market, which had been expanding rapidly without a standardized regulatory framework since the birth of Bitcoin in 2009. This lack of regulation posed risks such as fraud, market manipulation and financial instability.

These concerns were heightened by incidents like the surge in initial coin offerings (ICOs), the capitulation of multiple large exchanges and the ironic instability of stable-coins.

MiCA was proposed to provide a harmonized regulatory framework for crypto-assets that are not covered under existing EU financial legislation. The objective was to safeguard investors, maintain financial stability, and promote innovation within a secure and transparent environment. By introducing clear rules, MiCA aims to legitimize the crypto market, making it safer and more attractive for investors and consumers while mitigating the potential for financial crime and market manipulation.

This move towards regulation reflects a global trend of governments and financial authorities worldwide striving to balance the benefits of innovation in the digital asset space with the need for consumer protection and market integrity. As such, MiCA represents a significant step by the EU in establishing a comprehensive regulatory regime for crypto-assets, setting a precedent that could influence global standards in cryptocurrency regulation.

Key Points of MiCA

MiCA introduces several key provisions that are set to transform the crypto-asset landscape in the European Union. The areas that are discussed and regulated the most are the areas where incidents have happened and people have lost their funds. It is important not to make the same mistakes as before.

Exchanges & Brokerages

One of the primary aspects of MiCA is the establishment of stringent authorization requirements for crypto-asset service providers. Under MiCA, any entity aiming to offer services related to crypto-assets, including trading, custody, or advisory services, must obtain authorization from one of the EU's national financial regulators. This process is designed to ensure that providers adhere to high standards of operational conduct, governance, and consumer protection outlined in the legislation. Crypto exchanges have gone bankrupt, been hacked or shut down abruptly in crypto’s short history. The aim of legislatures is to prevent these collapses or stop them in their tracks.

Initial Public / Coin Offerings

Another fundamental component of MiCA is the regulation of public offerings of crypto-assets. Companies intending to offer crypto-assets to the public are required to publish a detailed white paper. This document must provide clear, fair, and comprehensive information about the risks involved, ensuring that potential buyers are well-informed. The regulations aim to prevent misleading practices and enhance transparency in the market. Until now, many ICOs do publish white papers, however they can be purely fictional, written to trick the untrained eye into thinking the project is professionally done. Furthermore, this official process of submitting a white paper will ensure that the people behind the project are known. This will prevent people from faking their identities in order to anonymously scam their clients.

Stablecoins

MiCA also specifically addresses the regulation of stablecoins, which are categorized as either e-money tokens (EMTs) or asset-referenced tokens (ARTs). EMTs are stablecoins pegged to the value of a fiat currency, such as USDT, USDC and BUSD. ARTs are linked to other assets, such as WETH, WBTC. MiCA mandates that stablecoins must maintain adequate reserves and adhere to governance standards. Furthermore, there are stringent rules for stablecoins not pegged to EU currencies, including a cap on the number of transactions per day, aimed at preventing these assets from undermining the Euro. This approach to stablecoins is a response to concerns about their potential impact on financial stability and monetary policy. These concerns are justified, following the collapse of a few large market cap stable-coins during 2022.

Through these provisions, MiCA aims to establish a secure and transparent environment for the trading and use of crypto-assets, ensuring that the rights of investors are protected while fostering innovation in the sector.

Conclusion

The introduction of MiCA by the European Union represents a watershed moment for the crypto-asset market. By establishing a harmonized regulatory framework, MiCA seeks to provide clarity, enhance market integrity, and protect investors, all while fostering an environment conducive to innovation. For EU traders, these regulations offer a more secure and transparent trading landscape, albeit with increased compliance obligations.

The provisions on stablecoins, in particular, demonstrate a nuanced approach to different types of crypto-assets. As MiCA comes into full effect, its influence is expected to extend beyond the EU, potentially setting a precedent for global crypto-asset regulation. For traders and investors, staying informed and adapting to these regulatory changes will be key to navigating the evolving crypto market landscape.

The ECB balance sheet vs the FEDThe head of the European Central Bank #ECB Madame Lagarde claims the #ECB is at a different point in time to the Federal Reserve #FED. She claims it is premature to talk about winding down the Quantitative Easing (#QE) as the Fed has indicated a schedule to roll back liquidity. The graph indicates otherwise interestingly the EUD USD liquidity indicates the Fed continues to fund the ECB balance sheet therefore QE inflation has no end during 2022.

Unraveling the NYSE Enigma: The Matrix of US EconomyNavigating the Matrix: The US Economy's Fractal Future Unveiled

In the intricate dance between mathematical laws, global events, and the echoes of a 15-year financial cycle , the US economy stands at a crossroads. As financial analysts, we often find ourselves immersed in technical tools, resistance zones, and support levels, but perhaps it's time to step back and perceive the larger canvas.

Michael Burry's ominous warning about a potential stock market crash has shuffled the cards, prompting us to question not just if, but when. The unfolding narrative forces us to reconsider the true value of a safe-haven asset—Digital Gold, aka Bitcoin. Recent news, including the surge in Bitcoin's value and its best day since August 2023 , as reported by Reuters, signals a seismic shift in the global financial landscape, with giants like BlackRock entering the scene.

The emergence of a new world order, led by BRICS , alongside the strengthening of the Euro and the weakening of the USD, mirrors a plot that seems torn from Orwell's playbook. The question has transcended the realm of ETFs; it now echoes in the chambers of the world's financial future.

As we step into this unknown terrain, a confluence of factors shapes the economic narrative. Inflation, like a rising tide, threatens to engulf us. Interest rates, akin to a tempest, soar to new heights. The capital congestion in consumer hands, unaccounted for and potent, adds complexity. Blue-chip stocks skillfully sidestep taxes, while government structures weaken. Amidst this symphony of financial discord, the political instability of influential nations like Russia and Israel looms large, their ripples creating a butterfly effect on the American economy.

The matrix of economic forces is shifting, and the rules of engagement are evolving. In this amalgamation of financial philosophy and stark reality, we must decipher the patterns, anticipate the shocks, and navigate the unknown. The road ahead is uncertain, but one thing is clear—the US economy is on the brink of a profound transformation, and it's time to read between the fractals.

Euro Shorts at 11 Months High: A Hedge Fund's Hilarious TakeIntroduction:

Hold onto your hats because we've got some juicy news straight from the hedge fund world. Brace yourselves for a rollercoaster ride as we delve into the wild world of euro shorts, as reported by a certain hedge fund that knows how to tickle our funny bones. Get ready to chuckle and, of course, take some action!

The Hedge Fund Report:

Picture this: it's been a whopping 11 months since our dear hedge fund buddies decided to take on the mighty euro. And boy, have they been having a laugh! According to their recent report, the euro shorts have been quite the spectacle, providing us with a comedy show we never knew we needed.

Call-to-Action: Join the Comedy Show and Short Euro!

Now that we've had our fair share of laughter, it's time to take action, my fellow traders! The hedge fund report has given us a golden opportunity to join the comedy show and potentially make some handsome profits. So, here's our call-to-action: jump on the bandwagon and consider shorting the euro!

But remember, trading is no laughing matter. Do your due diligence, analyze the market, and make informed decisions. Take advantage of this hilarious situation, but also stay vigilant and manage your risks wisely. After all, laughter is great, but profits are even better!

Conclusion:

In a world where trading can sometimes feel like a serious affair, it's refreshing to find humor in the markets. The euro shorts, as highlighted by our hedge fund friends, have given us a reason to smile and, more importantly, take action. So, traders, buckle up, embrace the comedy, and consider joining the euro shorting extravaganza. Happy trading, and may the laughter be with you!

www.hedgeweek.com