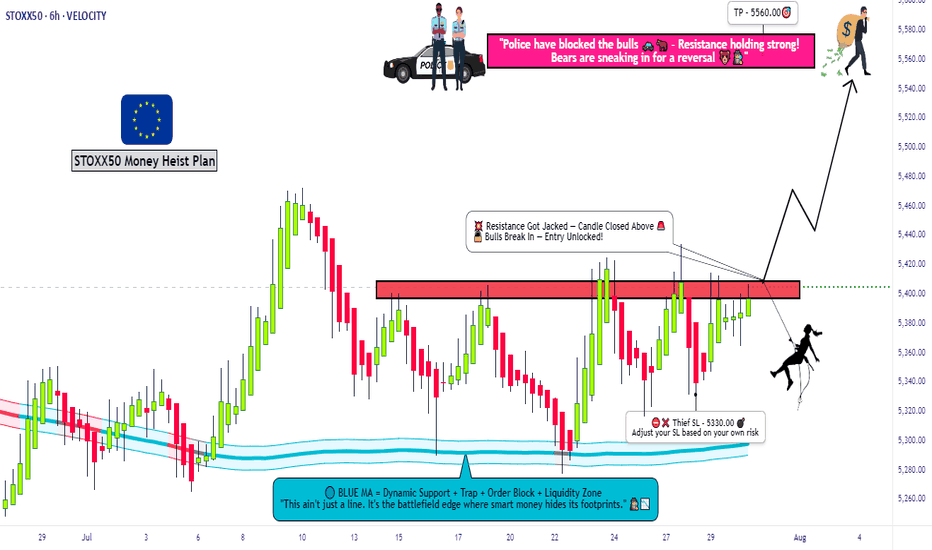

Greed Alert: STOXX 50 Momentum Signals But Caution Needed🚨 STOXX50 RESISTANCE BREAKOUT PLAY! 💥 | THIEF TRADER STYLE 🔓📈

🧠 Thief Trader Master Plan: BULLISH ATTACK

🎯 Entry: Breakout above 5420 (Major RESISTANCE WALL 🧱)

🛑 Stop Loss: 5330 — Strict risk control, no funny business 😤

🚀 Target: 5560 — Smart money aims high 💰

👀 We spotted a strong momentum brewing — bulls are charging to break through the ceiling. Once 5420 cracks, it's game on.

🔥 Watch the levels, respect the trade, and let’s rob the market clean 💼💸

🧠 Market Sentiment Outlook

Retail Traders

🐂 Bullish: 55%

🐻 Bearish: 35%

😐 Neutral: 10%

Institutional Traders

🐂 Bullish: 60%

🐻 Bearish: 30%

😐 Neutral: 10%

😨😍 Fear & Greed Index

Score: 69/100 → Greed 🤠

Insight: Market tilts toward optimism — but tread carefully; overvaluation risks are real.

📈 Fundamental Strength Score

Score: 72/100

Drivers:

💰 Earnings Surge – AB InBev (+8.7%), Munich RE (+4.8%)

📉 Stable Eurozone Data

🚀 Momentum Building – STOXX 50 approaching all-time highs

🌍 Macro Economic Score

Score: 65/100

Factors:

⚖️ Tariff Delays – U.S. tariffs on Canada/Mexico pushed to April 2

📅 Eurozone PMI Preview

🌎 Tensions Rising – U.S.–Iran geopolitical friction

🔎 Key Highlights

🧠 Sentiment Check: Greedy mood – watch for pullbacks

💼 Earnings Season: Q2 winners driving index higher

⚠️ Volatility Triggers: Geopolitics + tariff policy

📉 Opportunity Alert: Fear score <20? Historically undervalued zone

📊 Technical Signal: STOXX 50 >125-day MA = uptrend confirmed

🧭 Always combine real-time data with sound technical and fundamental insights.

📌 Stay informed. Stay sharp. 🚀

💬 Drop your thoughts below.

❤️ SMASH that like button if this helped you.

👥 Support the Thief Trader team — we're in this to help you win.

📡 Stay sharp. Stay ruthless. Stay profitable.

— Thief Trader 🔐📊

Eurostoxx50

EUR/USD BULL RAID: Quick Profit Heist Before the Drop!🏴☠️ EUR/USD "The Fiber" HEIST ALERT: Bullish Loot Before the Trap! 🚨💰

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

Hola! Oi! Bonjour! Hallo! Marhaba! 🤑

🔥 Thief Trading Strategy Activated! 🔥

Our bullish heist on EUR/USD is LIVE—time to swipe the loot before the bears set their trap! 🎯💸

📈 Entry (Vault is OPEN!):

Buy Limit Orders preferred (15M/30M swing levels).

Alert up! Don’t miss the breakout.

🛑 Stop Loss (Escape Route):

Nearest Swing Low (1.15200) on 30M TF.

Adjust for your risk & lot size—no reckless robberies!

🎯 Target (Profit Hideout): 1.16400

Scalpers: Stick to LONG only—trail your SL to lock gold!

Swing Traders: Ride the wave or split the haul.

⚡ Why This Heist?

Bullish momentum + weak bears = perfect robbery conditions.

Overbought? Yes. Risky? Absolutely. But thieves thrive in chaos!

📢 Pro Tip:

Avoid news spikes (volatility = jail time for unprepared traders).

Trailing SL = Your Getaway Car.

💥 BOOST THIS PLAN!

Hit 👍, share 🔄, and let’s drain this market together! More heists coming—stay tuned! 🚀🐱👤

(Disclaimer: Trade smart. We’re thieves, not gambleers.)

"STOXX50/EURO50" Trading Plan: Ride the Wave or Get Trapped?🚨 EUROPEAN INDEX HEIST: STOXX50 Breakout Robbery Plan (Long Setup) 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Market Bandits & Index Robbers! 🏦💶💸

Using 🔥Thief Trading tactics🔥, we're targeting the STOXX50/EURO50 for a clean breakout heist. The plan? Go long and escape before the MA trap snaps shut. Overbought? Yes. Risky? Absolutely. But real thieves profit when weak hands panic. Take your cut and run! 🏆💰

📈 ENTRY: TIME TO STRIKE!

Wait for MA breakout at 5460.00 → Then move fast!

Buy Stop Orders: Place above Moving Average

Buy Limit Orders: Sneak in on 15M/30M pullbacks

Pro Tip: Set a BREAKOUT ALARM - don't miss the action!

🛑 STOP LOSS: DON'T GET CAUGHT!

For Buy Stop Orders: Never set SL pre-breakout - amateurs get burned!

Thief's Safe Zone: Recent swing low (5300.00 on 4H chart)

Rebels: Place SL wherever... but don't cry later! 😈

🏴☠️ TARGET: 5680.00 (OR ESCAPE EARLY!)

Scalpers: Long only! Trail your SL like a pro

Swing Traders: Ride this heist for max gains

💶 MARKET CONTEXT: BULLISH BUT TRAPPY

Fundamentals: Macro data, COT reports, Quant analysis

Market Sentiment: Intermarket flows, positioning

Full Analysis: Check our bio0 linkss 👉🔗 (Don't trade blind!)

⚠️ WARNING: NEWS = VOLATILITY TRAP!

Avoid new trades during high-impact news

Lock profits with trailing stops - greed gets you caught!

💥 SUPPORT THE HEIST!

Smash that Boost Button 💖→ Stronger crew = bigger scores!

Steal profits daily with the Thief Trading Style 🎯🚀

Next heist coming soon... stay sharp! 🤑🐱👤🔥

"STOXX50/EURO50" Index Market Money Heist (Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "STOXX50/EURO50" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Moving Average Line area. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (4900) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 5370

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"STOXX50/EURO50" Index Market Heist Plan (Swing/Day Trade) is currently experiencing a Bullish trend.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

STOXX INTRADAY bullish trend supported at 5225Key Support and Resistance Levels

Resistance Level 1: 5345

Resistance Level 2: 5375

Resistance Level 3: 5411

Support Level 1: 5225

Support Level 2: 5193

Support Level 3: 5157

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

"STOXX50 / EURO 50" Indices Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "STOXX50 / EURO 50" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑: (5450) Thief SL placed at the recent/swing high or low level Using the 2H timeframe swing / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 5200 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"STOXX50 / EURO 50" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 🔎👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Stock Markets Decline Amid Trump Tariff NewsStock Markets Decline Amid Trump Tariff News

Comparing the approximate difference between last week's opening and closing prices on stock index charts:

➝ The US S&P 500 (US SPX 500 mini on FXOpen) fell by 2.4%.

➝ The European Euro Stoxx 50 (Europe 50 on FXOpen) dropped by 2%.

Why Are Stocks Falling?

The bearish sentiment in stock markets is largely driven by news surrounding White House tariff policies, as reflected in Federal Reserve statements late last week:

➝ Boston Fed President Susan Collins stated that tariffs will "inevitably" fuel inflation, at least in the short term.

➝ Richmond Fed President Thomas Barkin noted that rapid shifts in US trade policy have created uncertainty for businesses.

US developments are also weighing on European stock markets, which were already under pressure following President Donald Trump’s announcement of a 25% tariff on foreign cars. Trump has also threatened further tariffs on the EU and Canada, heightening trade tensions.

Today, the Euro Stoxx 50 index opened with a bearish gap, hitting its lowest level since early 2025, falling below the previous yearly low of 5,292. This reflects growing market concerns ahead of 2 April, when Trump is expected to confirm the implementation of new tariffs.

Technical Analysis of the Euro Stoxx 50 Index (Europe 50 on FXOpen)

Since late 2024, the price has been moving within an ascending channel (marked in blue), but today, it has fallen below the lower boundary—suggesting the channel is losing relevance. Bearish dominance is evident through the following signals:

➝ The 5,550 level proved to be an insurmountable resistance for bulls.

➝ The median of the blue channel acted as resistance (marked by a red arrow).

➝ The 5,406 level shifted from support to resistance (marked by black arrows).

If the bearish trend persists, the Euro Stoxx 50 index (Europe 50 on FXOpen) could continue fluctuating within a descending channel (outlined in red).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURO50 / STOXX 50 Indices CFD Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🚀

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EURO50 / STOXX 50 Indices CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (5400) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (5450) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 5300 (or) Escape Before the Target

Secondary Target - 5130 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Index-Specific Analysis, Sentimental Outlook, Intermarket Analysis, Future Prediction:

EURO50 / STOXX 50 Indices CFD Market is currently experiencing a Neutral trend., driven by several key factors.

🔴Fundamental Analysis

Fundamental factors assess intrinsic drivers:

Economic Growth:

Eurozone GDP at 1.2% (Q4 2024, ECB projection)—modest growth supports equities—mildly bullish.

Corporate Earnings:

STOXX50 firms report 8% year-over-year growth, led by consumer goods and industrials—bullish, though energy lags.

Interest Rates:

ECB at 2.5%, no immediate cuts—real yields (~0.5%) pressure equities—bearish short-term.

Inflation:

HICP at 2.8%—above ECB’s 2% target, aids exporters but squeezes margins—mixed.

Trade Environment:

U.S. tariffs (10% on China) shift trade to Europe—bullish long-term for exporters.

Explanation: Fundamentals lean bullish with earnings and trade gains, but ECB rates and inflation temper short-term upside.

⚪Macroeconomic Factors

Macroeconomic influences on the STOXX50:

Eurozone:

PMI 46.2 (Eurostat)—stagnation persists—bearish.

ECB’s 2.5% rate and stimulus talks—bullish offset.

U.S.:

Fed at 3-3.5%, PCE 2.6%—USD softening (DXY ~105) boosts exports—bullish.

Tariffs disrupt trade—mixed, Eurozone benefits relatively.

Global:

China 4.5%, Japan 1%—slow growth curbs demand—bearish.

Oil $70.44—stable, neutral.

Geopolitical Risk:

Russia-Ukraine tensions—bearish sentiment, bullish for defense stocks.

Explanation: Macro factors are mixed—USD weakness and tariffs favor Europe, but global slowdown and stagnation limit gains.

🟠Commitments of Traders (COT) Data

COT data reflects futures positioning:

Speculators:

Net long ~35,000 contracts (down from 45,000)—cautious bullishness—bullish.

Hedgers:

Net short ~40,000 contracts—stable, profit-taking—neutral.

Open Interest:

~85,000 contracts—steady interest—neutral to bullish.

Explanation: COT shows a market with room for upside, not overbought, supporting a cautiously bullish stance.

🟡Index-Specific Analysis

Factors unique to the STOXX50:

Technical Levels:

50-day SMA ~5,500, 200-day SMA ~5,300—price below 50-day, above 200-day—neutral consolidation.

Support at 5,450, resistance at 5,600—price near support.

Sector Composition:

Financials (20%), industrials (18%), consumer goods (15%)—trade shifts boost financials/industrials—bullish tilt.

Volatility Index (VSTOXX):

18%—±65-point daily swings—neutral risk perception.

Market Breadth:

65% of stocks above 200-day MA—broad participation—mildly bullish.

Explanation: Technicals suggest consolidation, with sectoral strength offering resilience.

🟢Market Sentiment Analysis

Investor and trader mood:

Retail Sentiment:

60% short at 5,480 (social media)—contrarian upside—bullish signal.

Institutional:

J.P. Morgan targets 5,700 by Q4 2025, Citi flags volatility—neutral to bullish.

Corporate:

Hedging at 5,500-5,600—neutral, awaiting clarity.

Social Media:

Bearish short-term (tariff fears), bullish long-term (recovery)—mixed.

Explanation: Sentiment is cautious—retail shorts suggest a potential squeeze, institutional views support longer-term gains.

🔵Geopolitical and News Analysis

Geopolitical events and news:

U.S.-China Trade Tensions:

Trump’s 10% tariff on China (Mar 6)—shifts trade to Europe—bullish for exporters, bearish short-term volatility (Reuters).

Russia-Ukraine Conflict:

Escalation risks (e.g., energy disruptions)—bearish sentiment, bullish for defense (e.g., Airbus)—mixed (Bloomberg, Mar 7).

EU Policy:

ECB projections (Mar 6) cite geopolitical drag—bearish. Defense spending talks—bullish for industrials (ECB.europa.eu).

France-Germany:

Stable coalition aids EU integration—mildly bullish.

Explanation: Geopolitics add volatility—tariffs and conflicts weigh short-term, trade benefits and defense spending lift long-term prospects.

🟣Intermarket Analysis

Relationships with other markets:

EUR/USD:

Below 1.0500—weaker euro aids exports—bullish.

DAX:

~19,500—strong correlation, similar dynamics—bullish alignment.

S&P 500:

~5,990—stable, neutral; U.S. risk-off lifts STOXX50—mildly bullish.

Commodities:

Oil $70.44—neutral; gold $2,930 (risk-off)—bullish for Eurozone as hedge market.

Bond Yields:

Eurozone 2.2% vs. U.S. 3.8%—yield gap attracts capital—bullish.

Explanation: Intermarket signals are bullish—EUR/USD, bonds, and gold favor STOXX50, with equities providing cautious support.

🟤Next Trend Move

Projected price movements:

Short-Term (1-2 Weeks):

Range: 5,450-5,600.

Dip to 5,450 if tariff fears grow; up to 5,600 if ECB signals dovishness or trade data beats.

Medium-Term (1-3 Months):

Range: 5,400-5,700.

Below 5,450 targets 5,400; above 5,600 aims for 5,700, tied to earnings/policy.

Catalysts: ECB statements, PMI (Mar 10), U.S. trade updates.

Explanation: Short-term consolidation is likely, with downside risks from geopolitics and upside from policy support.

⚫Overall Summary Outlook

The STOXX50 at 5,480.00 faces bearish short-term pressures (geopolitical uncertainty, stagnation, tariff fears) offset by bullish drivers (earnings, trade shifts, USD softness). COT and intermarket signals suggest cautious optimism, technicals indicate consolidation, and sentiment balances short-term caution with long-term hope. A short-term dip to 5,450 is probable, with medium-term upside to 5,700 if fundamentals hold.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NETH25/NL25 "Netherland 25" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NETH25/NL25 "Netherland 25" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (936.00) swing Trade Basis Using the 3H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 900.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Sentimental Outlook:

NETH25/NL25 "Netherland 25" Indices Market is currently experiencing a Neutral trend (Slightly Bearishness)., driven by several key factors.

🎇🎆Fundamental Analysis

Earnings: Q4 2024 strong for Dutch firms (ASML, Shell), reported Jan 2025; Q1 2025 prelims suggest tech/energy resilience—bullish.

Rates: ECB at 2.5% (ECB Data Portal)—low yields support equities—bullish.

Inflation: Eurozone 2.8% (Eurostat, Jan 2025)—above target, mixed impact.

Growth: Netherlands GDP ~1.5% (Eurostat Q4 est.)—steady, mildly bullish.

Geopolitics: U.S.-China tariffs shift trade to Europe (ECB projections)—bullish.

🎇🎆Macroeconomic Factors

U.S.: PMI 50.4, Fed 3-3.5%—USD softness aids Eurozone equities—bullish.

Eurozone: PMI 46.2 (Eurostat, Feb 2025)—stagnation, bearish; ECB easing helps—bullish.

Global: China 4.5%, Japan 1% (ECB forecasts)—slowdown, risk-off—bearish.

Commodities: Oil $70.44—stable, neutral

Trump Policies: Tariffs (25% Mexico/Canada, 10% China)—trade benefits Europe—bullish.

🎇🎆Commitments of Traders (COT) Data

Speculators: Net long ~25,000 contracts (down from 30,000)—cautious bullishness.

Hedgers: Net short ~30,000—stable, locking in gains.

Open Interest: ~60,000 contracts—steady global interest, neutral.

🎇🎆Market Sentiment Analysis

Retail: 50% short (global X posts)—balanced, mild upside risk—neutral.

Institutional: Bullish on tech (ASML), cautious on growth (ECB forecasts)—neutral.

Corporate: Dutch firms hedge at 935-940—neutral.

Social Media Trends: Mixed—bullish to 950, bearish to 910—neutral.

🎇🎆Positioning Analysis

Speculative: Longs target 940-950, shorts aim for 910-900 (global consensus).

Retail: Shorts at 930-935—squeeze risk if price rises.

Institutional: Balanced, tech-driven optimism.

🎇🎆Quantitative Analysis

SMAs: 50-day ~885, 200-day ~860—price above both, bullish.

RSI: 58 (daily)—bullish momentum, not overbought.

Bollinger: 910-930—price at upper band, breakout potential.

Fibonacci: 61.8% from 950-800 at 900—support below holds.

Volatility: 1-month IV 13%—±10-point daily range.

🎇🎆Intermarket Analysis

EUR/USD: Below 1.0500—EUR weakness, neutral for AEX.

DXY: 106.00, softening—supports equities—bullish.

XAU/USD: 2910—gold rise, risk-off—bearish.

DAX: ~19,000, stable—correlated support—neutral.

Bonds: Eurozone 2.2% (ECB)—low yields aid equities—bullish.

🎇🎆News and Events Analysis

Recent: Eurozone GDP flat (Eurostat Q4 2024)—bearish; tariffs shift trade (ECB)—bullish.

Upcoming: U.S. PCE (Feb 28)—hot data lifts USD/yields, pressures AEX; soft data rallies equities—mixed.

Impact: Bullish short-term, PCE reaction key.

🎇🎆Next Trend Move

Technical: Support 910-900, resistance 940-950. Below 910 targets 900; above 940 aims for 960.

Short-Term (1-2 Weeks): Up to 940-950 if risk-off eases; dip to 900 if PCE strengthens USD.

Medium-Term (1-3 Months): Range 900-970, tariff-driven.

🎇🎆Future Prediction

Bullish: 950-970 by Q2 2025 if USD softens (DXY to 105), tariffs boost exports, or risk-on strengthens.

Bearish: 900-890 if PCE lifts USD (DXY to 107), growth stalls, or risk-off intensifies.

Prediction: Bullish short-term to 950, then sustained to 970 by mid-2025.

🎇🎆Overall Summary Outlook

Netherlands 25 at 928.00 rides bullish fundamentals (tech earnings, ECB support, trade shifts) against bearish risks (Eurozone stagnation, PCE-driven USD strength). COT shows cautious longs, quant signals bullish momentum, and intermarket trends (DXY softness) support gains. Short-term rise to 940-950 likely, medium-term to 970 if PCE softens and trade benefits grow.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

STOXX50 Expanding Triangle in playCurrent Trend: Bullish (Long-term Uptrend)

Pattern Formation: Expanding Triangle (Sideways Consolidation)

Key Support Level: 5283

Key Resistance Levels: 5470, 5527, 5570

Bullish Scenario:

The STOXX 50 remains within a long-term uptrend, with recent price action consolidating in an expanding triangle pattern.

A pullback from current levels could find support at 5283, a key swing low.

A strong bullish bounce from 5283 would confirm the continuation of the uptrend, targeting 5470 as the next resistance level.

A breakout above 5470 could lead to further upside momentum towards 5527, followed by 5570 over the longer term.

Bearish Scenario:

A confirmed breakdown below 5283 with a daily close below this level would invalidate the bullish outlook.

In this scenario, increased selling pressure could push prices lower, with 5200 as the next key support level.

A further decline below 5200 could open the door for an extended retracement towards 5140.

Conclusion:

The STOXX 50 remains in a bullish trend but is consolidating within an expanding triangle. Holding above 5283 keeps the upside bias intact, with potential targets at 5470 and beyond. However, a breakdown below 5283 would shift the sentiment to bearish, signaling further downside risk towards 5200 and 5140. Traders should monitor price action around the 5283 level for confirmation of either scenario.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURO STOXX 50 celebrates new ATH, due to Ukraine war abateThe European stock rally is beginning as investors have gotten optimistic about a potential ceasefire in Ukraine.

The end of the 3-years conflict was always a wild card for European equity markets. Now investors are starting to prepare for this scenario, aggressively buying energy-intensive sectors and European laggards.

While a lot of upside potential remains for some sectors, the path ahead is likely to be rapid. The benchmark Euro Stoxx 50 has rarely been this overbought in the past four years.

Some investors have been aggressively buying back their shorts on Europe, while others are diversifying out of expensive and heavily concentrated US equities. The region trades at about a 40% discount to the US and this gap has the potential to narrow. There’s also room for gains within the Stoxx Europe 600 to broaden, with just 20% of its members in overbought territory.

With the prospect of an eventual ceasefire on investors’ minds after the US and Russian leaders agreed to start negotiations, stocks geared to the reconstruction of Ukraine are in focus, like construction stocks Heidelberg Materials AG and Holcim AG as well as chemicals company BASF SE.

The strategists at Barclays Plc are overweight chemicals but are more cautious on autos, partly due to the US tariffs threat. They say construction materials have had a strong run already, while mining and steel may have more catch-up potential, along with transport and leisure.

Rebuilding Ukraine would be one of the largest construction undertakings in recent years, with total costs of nearly $500 billion, according to the World Bank. This would be highly commodity-intensive, especially for steel and cement, to restore buildings and infrastructure.

It is clearly unequivocally good news for European markets.

The EURO STOXX 50 is a stock index that represents 50 of the largest and most liquid stocks in the Eurozone. It is designed to represent blue-chip companies considered leaders in their respective sectors. The EURO STOXX 50 is one of the most liquid indices for the Eurozone.

Key facts about the EURO STOXX 50:

The index includes shares from various Eurozone countries, including Belgium, France, Finland, Germany, Italy, the Netherlands, and Spain.

France and Germany contribute to over 66% of the index.

The technology, industrial goods and services, and consumer products and services sectors account for more than 45% of the index.

The EURO STOXX 50 was introduced on February 26, 1998. Prices were calculated retroactively to 1986, with a base value of 1000 points on December 31, 1991.

The index captures about 60% of the free-float market capitalization of the EURO STOXX Total Market Index (TMI), which covers about 95% of the free-float market capitalization of the countries represented.

The EURO STOXX 50 serves as a benchmark for the Eurozone's stock market performance.

Eurex trades futures and options on the EURO STOXX 50, which are among the most liquid products in Europe and worldwide.

Technical challenge

The main 6-month graph for EURO STOXX 50 futures indicates the epic all time high (1st time over past 25 years), with a potential further upside price action.

$NIFTY in a bearish pattern but downturn still not completeThe international markets like ICMARKETS:STOXX50 and IG:HANGSENG are experiencing a positive momentum and 20-Day is above the 50-Day, 100-Day SMA and 200-Day SMA. This indicates a bullish momentum in European and Chinese stock market. In contrast Indian index NSE:NIFTY which was a favorite trade in 2023 and 2024 has been underperforming with all the SMA below the 200-Day SMA indicating a bearish pattern.

In the chart we have plotted an upward sloping Fib retracement level with Covid Lows as the bottom and prior to Covid as the top. In this upward sloping FIB retracement levels, we see that the index has very much stayed within the upper and the lower bound of the upward sloe. The recent crash has also not violated the lower bound. But the NSE:NIFTY is 3.618 Fib Level which is exactly @ 22796. If index levels respect the FIB Channel then there is some more downside to the index left until it reaches 22000 at the bottom of the range. My opinion we should be long NSE:NIFTY @22000. What are your thoughts?

Long NSE:NIFTY @ 22000 level.

European Stocks Rise for Sixth Consecutive WeekEuropean Stocks Rise for Sixth Consecutive Week

According to the Eurostoxx 50 index (Europe 50 on FXOpen) chart:

→ The index has gained over 6% since early February.

→ It is now trading at an all-time high.

Factors driving market optimism:

→ Expectations of a ceasefire in Ukraine.

→ Trump’s decision to delay tariff implementation until April, signalling room for trade negotiations.

Technical Analysis of the Eurostoxx 50 Index (Europe 50 on FXOpen)

Price movements outline an ascending channel (blue), with key observations:

→ The index remains in the upper half of the channel, reflecting strong demand.

→ February’s sharp rally has formed a steeper rising channel (purple).

→ After breaking above resistance at 5,370, a retest (indicated by an arrow) confirmed this level as support.

With the RSI indicator in overbought territory, a potential pullback is plausible—perhaps as investors look to secure profits before the weekend amid a busy news cycle.

In this scenario, the 5,444 level, where the lower purple trendline intersects the blue channel’s median, could act as a support zone.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Your Vote Counts - Help Build the Ultimate Index Watchlist!Hey, I need your help again - this will only take a minute!

I’ve said it before, here and to my Substackers: I want to be your reminder to invest . Because let’s be honest, steadily growing your wealth might not be thrilling but it should be your goal!

Yes, individual stocks have their place (and I’ll keep sharing ideas on those too), but indexes should be a key part of a solid portfolio. Today’s focus? Maximizing your index purchases.

📊 Proven strategy: A few weeks ago, I ran an experiment comparing QQQ (Nasdaq-100 ETF), SPY (S&P 500 ETF), and IWM (Russell 2000 ETF). Using technical analysis, I outperformed two of them. The tests showed that blind purchasing could be costly: for instance, regular SPY purchases would have left $100,000 on the table, and IWM even more.

But here’s the point: this isn’t about blindly picking an index - it’s about timing, risk optimization, and smart diversification.

💡 Now, it’s YOUR turn! Drop two indexes in the comments that you want me to analyze every single month.

You decide the final list (likely 4-5 indexes), and I’ll cover them consistently. Whether it’s S&P 500, Nasdaq-100, DAX, Euro Stoxx 50, Russell 2000, or others - you pick, I deliver.

📈 How this helps YOU?

✔️ No overthinking : "What should I buy this month?" - just wait for my post and see the TOP picks

✔️ Keeps you engaged and active in the market

✔️ Builds consistency in your investing

✔️ Ensures every allocation works harder for you

⬇️ Comment your picks below, and let’s make every move count! 🚀

Cheers,

Vaido

$FESX1! EURO STOXX 50: 7 WEEKS OF GAINSEUREX:FESX1! EURO STOXX 50: 7 WEEKS OF GAINS

1/7

The EURO STOXX 50 is on track for its seventh consecutive weekly gain! 📈⚡️

This winning streak continues despite global trade war jitters and shifting market sentiment.

2/7

Why the optimism? 🤔

Investors appear cautiously confident about U.S. trade policy developments, with Europe seen as a more stable option amidst American economic uncertainties.

3/7

Key influences to watch:

• U.S. Jobs Data: Friday’s payroll numbers may affect overall risk sentiment.

• Trade War: Trump’s tariff talk + a one-month reprieve for Mexico & Canada = a temporary sigh of relief?

4/7

Currency factors also play a role. 💱

The Yen’s strength due to expected BoJ rate hikes could affect export-related optimism if the Euro shifts in tandem.

5/7

Commodities?

Gold remains steady near record peaks, signaling some investors are still seeking safe havens—even as equities rally.

6/7 What’s driving the EURO STOXX 50’s resilience?

1️⃣ Diversified European economy

2️⃣ Stable/dovish monetary policy

3️⃣ Shift to Europe as a “safer” bet

4️⃣ Combination of factors

Vote below! 👇✅

7/7

Market watchers see Europe’s diverse economic base 🏭🛍️ shielding stocks from U.S. volatility. Plus, the possibility of more accommodative European monetary policy adds extra support.

STOXX50 "EURO STOCK 50" Indices Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the STOXX50 "EURO STOCK 50" Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade after the breakout of MA level 5000.00

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 30min period, the recent / nearest low or high level.

Goal 🎯: 5130.00 (or) escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Considering these factors, the STOXX50 / EURO STOCK 50 index may experience a Bullish trend in the short-term, driven by:

Strong European economic growth, driven by strong consumer spending and investment.

Low interest rates and negative real interest rates, which can increase demand for stocks and reduce demand for bonds.

Potential for a rebound in corporate earnings, driven by strong profit margins and cost-cutting measures.

Bullish Factors:

Strong European economic growth, driven by strong consumer spending and investment.

Low interest rates and negative real interest rates, which can increase demand for stocks and reduce demand for bonds.

Potential for a rebound in corporate earnings, driven by strong profit margins and cost-cutting measures.

Growing investment demand for European stocks, driven by their potential for long-term growth and dividend yields.

Diversification benefits of investing in the European market, which can reduce portfolio risk and increase returns.

Some of the key stocks that make up the STOXX50 / EURO STOCK 50 index include:

SAP SE: A leading software company

Sanofi SA: A leading pharmaceutical company

Total SA: A leading energy company

Bayer AG: A leading pharmaceutical company

Deutsche Telekom AG: A leading telecommunications company

These stocks can have a significant impact on the performance of the STOXX50 / EURO STOCK 50 index, and investors should keep a close eye on their earnings and valuations when making investment decisions.

Market Sentiment:

Bullish sentiment: 70%

Bearish sentiment: 30%

Neutral sentiment: 0%

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

Eurostoxx 50 Index Rises Above 5000Eurostoxx 50 Index Rises Above 5000

As indicated by the chart of the Eurostoxx 50 index (Europe 50 on FXOpen), its value climbed above the psychological level of 5000 points in early 2025.

The strength of demand may be driven by portfolio rebalancing or long-term investor expectations, as today’s news for the European stock market was negative. According to ForexFactory:

→ industrial orders in Germany dropped by 5.1% month-on-month (expected: -0.3%);

→ retail sales in Germany fell by 0.6% month-on-month (expected: +0.5%);

→ France reported a worsening government budget balance.

A technical analysis of the Eurostoxx 50 index (Europe 50 on FXOpen) chart shows that:

→ the current value is above a resistance line (shown in red), which dates back to spring 2024;

→ since then, bulls have made two attempts to break above this line (marked with arrows) but failed to sustain the gains.

It is possible that further negative economic news from Europe could trigger bearish activity—if so, we may witness a third unsuccessful attempt to hold above the red resistance line, potentially resulting in the formation of a false breakout pattern.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EUROSTOXX broke the DownTrend Line.The EURO STOXX 50, which serves as a benchmark for major eurozone companies, has been trading sideways in recent months, fluctuating between a strong support level at 4,730 and resistance at 5,099. After multiple tests of the support, the price has formed candles with long lower shadows, indicating a rejection of lower prices and buyer interest in maintaining levels above this critical point.

Recently, the index provided a significant technical signal by breaking the Downtrend Line that had been in place since previous peaks. This breakout is a strong indicator of potential short-term growth.

Main Scenario: Bullish

With the Downtrend line broken, the price now has the potential to target higher levels on the daily chart. The 5,000.00 area is the first key resistance to watch, followed by the previous peak at 5,099, which would confirm a stronger bullish trend.

Potential Bullish Movement:

Ideal Entry: A pullback to around 4,830.00 (near the broken downtrend line), followed by a bullish candle in that area, could signal a buying opportunity.

Primary Target: 5,015.00.

Secondary Target: 5,099.17.

Stop Loss: Below 4,740, with a more conservative option at 4,727.00 (indicating loss of support).

Important Indicators: Monitoring volume during the rally is crucial; low volume could indicate weakness in the breakout.

Alternative Bearish Scenario

Despite the bullish technical scenario, the market may reverse if the support region at 4,727.48 is broken. A consistent daily close below this level, accompanied by significant volume, would invalidate the bullish structure and could attract strong selling pressure.

In this case, a possible Sell Opportunity could appear if a daily candle closes below the 4,727.00 level. Possible targets would be:

4,500.00: Intermediate psychological and technical support. About 22700 points.

4,400.00: Next relevant support, observed in previous months. About 33700 points.

A Stop Loss could be put around 4,770.00, about 4300 points.

Warning Signs: Heightened global risk aversion, a declining macroeconomic situation in Europe, and ongoing weakness in industrial and consumer sectors could intensify selling pressure.

Macroeconomic Context

Europe faces a tough landscape. Germany, the region's primary economic driver, is grappling with an industrial slowdown and reduced consumption, impacting the competitiveness of its companies. These issues have lowered growth projections for the eurozone.

Additionally, escalating tensions with Russia present a significant geopolitical risk. As the European Central Bank seeks to balance inflation control with growth stimulation, uncertainty in both geopolitical and economic spheres continues to affect the markets.

The upcoming interest rate decision on December 12 may provide clearer guidance on the European Central Bank's future actions.

Disclaimer

74% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you understand how CFDs work and if you can afford the high risk of losing your money. Past performance is not indicative of future results. Investment values may fluctuate, and you may not recover your initial investment. This content is not intended for residents of the UK.

Another European stock in trouble? Double top on #LOREAL #LOR

seems to be in progress

and a further weakening of the eurozone

By the time this massive double top has confirmed with a breakout

a 1/3 of the stocks's value would have been shed

Ultimately if we get a major downturn

Loreal could be down to 150 zone

STOXX50 / EURO STOXX50 Bullish Robbery PlanMy Dear Robbers / Traders,

This is our master plan to Heist Bullish side of EURO STOXX50 based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned with target in the chart focus on Long entry, Our target is Red Zone that is High risk Dangerous area market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic resistance level, Once it is cleared we can continue our heist plan to next target.

support our robbery plan we can make money & take money 💰💵 Join your hands with US. Loot Everything in this market everyday.

EURO STOXX 50 Already at Target 1. On Way to over 11 thousand.Euro Stonks are raging higher

Euro zone growth has been terrible ever since the inception of the #EU and especially with the introduction of the common currency.

(common currency but uncommon debts)

Why are they going up now

Are they simply playing catch up

Is the ECB going to engage in FED like stimulus and PPT activities?

Currency devaluation

or actual economic goodtimes?

IDK

All I know all the European Bourses have major room to the upsides

#CAC

#DAX

#FTSE

and all the minor index's are positively positioned like I have been saying for quite some time now.