EUR/PLN 4H SHORT Selling Opportunity

Hello, I am Trader Andrea Russo and today I want to show you a SHORT investment opportunity on EUR/PLN. We are currently in a 4-hour chart (4H) and my indicator "WaveTrend + Multi-Timeframe Alerts", published in the SCRIPT section of my TradingView profile, signals an overbought situation both at 4H and 8H. In addition, we are also in a downtrend phase, so we have more signals that support this opportunity.

In the attached chart we can observe the following details:

The current price is around 4.62400.

There is a SELL signal with a target price set at 4.61400, corresponding to a TP of 1.06%.

The stop loss is set at 4.63400, corresponding to a SL of 0.32%.

The suggested short position has a favorable risk/reward ratio.

These combined signals indicate a potential downtrend reversal, making this setup particularly interesting for investors looking for short selling opportunities on EUR/PLN.

I encourage you to monitor this setup closely and act prudently, always considering risk management in your trading plan. Happy trading!

EURPLN

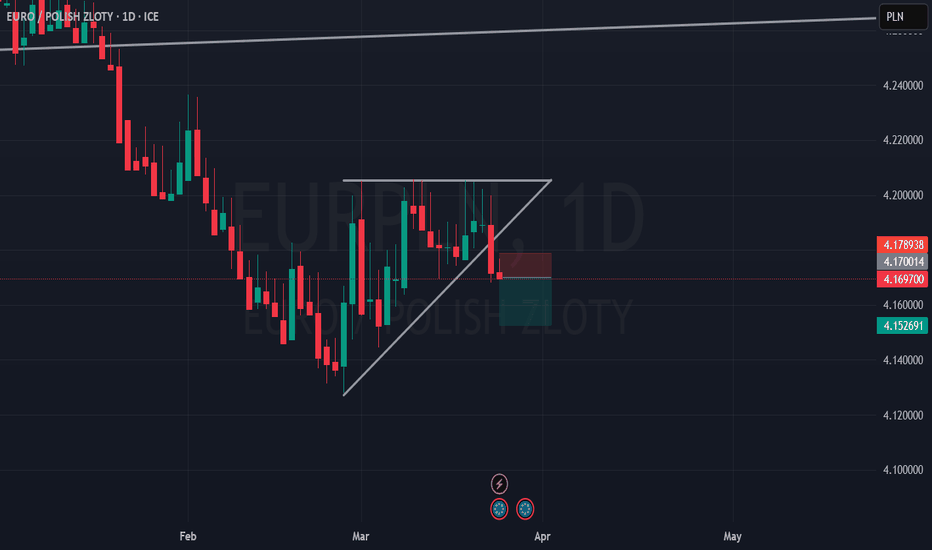

EURPLN Short Trade SetupAfter conducting an analysis on EURPLN, we are excited to present our trade setup.

This opportunity boasts a favorable risk/reward ratio, although it does require patience due to a longer waiting period.

Nevertheless, swing traders may find this setup intriguing and worth considering.

EUR/PLN Bearish Momentum Building Below 200 EMA

⚫Back in April 2024, the EUR/PLN pair tested the 4.2500 support zone, where a triple bottom was established. Over the past five months, the price has consistently failed to break below this level. Simultaneously, we can identify a resistance area near 4.3750, where a double top was formed, indicating a clear trading range between 4.2500 support and 4.3750 resistance—a classic example of range trading.

⚫Looking at the broader picture, in January 2024, the 4.4100 area, previously a support level, flipped to become resistance, confirming the continuation of a long-term bearish trend. Additionally, EUR/PLN remains below the 200 Exponential Moving Average, further reinforcing the likelihood of continued downward movement.

⚫Recent price action, particularly from an Elliott Wave perspective, suggests the formation of an ABC corrective pattern, which was halted at the 4.3311 resistance level, precisely aligning with the Volume Profile. (For those unfamiliar, the Volume Profile highlights the price level where the most trading volume occurred.)

⚫Analyzing the potential Elliott Wave count, EUR/PLN appears to be progressing into the strongest downward wave—wave 3. Overall, the technical outlook remains exceptionally bearish for the long term. As a downside target and potential final support for the 5-wave decline, we can consider the double 227.2% Fibonacci support, located around the 4.1425 area.

⚫While the odds strongly favor the downtrend, it's crucial for traders to remain vigilant. In the event that the price breaks above the 4.3750 resistance, it could signal the beginning of a shift from a bearish to a bullish trend.

Time to short the Polish ZlotyThe idea is very simple... Despite it having a significantly higher interest rate than the US, capital isn't flowing in the country. Poland is in a very tough place right now, as it has a relatively small economy and doesn't have a currency that is widely used. Europe overall is a big mess, and the PLN is affected by the EUR too. The ECB still has rates at -0.5% and Poland has rates at 6%, yet EURPLN is near its ATHs. In the charts below you can see how bad EURUSD looks, which I think will go below 1.03 to sweep the lows and then maybe bounce for a while, and how EURPLN might have formed a massive top. Therefore it might be a better idea to short EURUSD than going long USDPLN (short PLNUSD), as it will have a lower carry.

Yet the structure of USDPLN is much cleaner, and a breakout could be massive. I definitely expect to see the USDPLN highs swept, then a pullback and then continuation higher. This consolidation looks very bullish, and a breakout would potentially lead to a major expansion over time. The main fundamentals behind this is that Poland can't sustain such high rates with such high energy prices as the economy will collapse, and at the same time it does look like Poland would be one of the next countries that Russia will attack. Unfortunately it feels like a matter of time until Russia fully conquers Ukraine, something that will hurt Poland very badly due to its ties with Ukraine, and then it feels like a matter of time until they begin their next war.