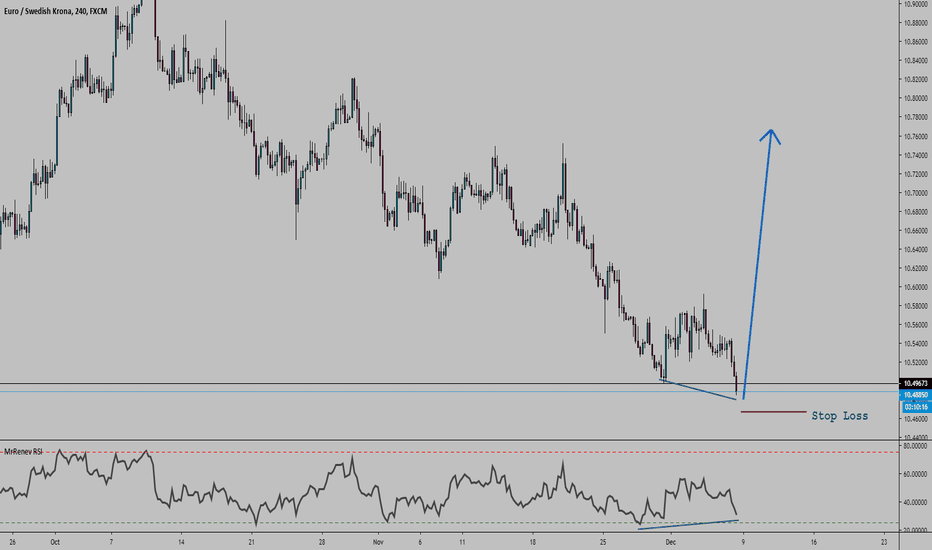

EURSEK SFP reaction. Still bearish on the SEK.More people in the country than there are houses. Sweden is not really socialist but they really on an inevitable course to self destruction.

Not going to go into too much details.

Good entry to short this failing currency.

I think this is my best currency this year. I have good hopes.

1/3 or more of my good trades I had to enter on friday afternoon -.-

So I don't even care anymore (also I have account protection and guarenteed stops).

EURSEK

USDSEK Reversal Pattern after All Time New Highs!USDSEK has been on my watchlist for quite sometime after we made new all time highs and then produced large red candles showing no momentum in the break.

You can see we tried to create another higher high, but price was rejected and reversed at 9.7280.

You can see the head and shoulders pattern which has occurred after making multiple higher lows and higher highs in an uptrend. This is ideal as we want to see an established trend before a reversal pattern.

We did break the neckline yesterday and have seemed to retest the breakout zone with todays daily candle, with the wick retesting the zone and indicating sellers stepping in.

I do not use trendlines very much, but also shows a break of the trend so adds some more confluence.

EURSEK was a trade I covered and took a few weeks back, and it can still make another lower high. Perhaps there is still ways downward for the Swedish Krona.

I am looking to take profits at the flip zone of 9.30 in the long term, although I would expect to see some reaction at 9.45.

EURSEK approaching resistance, look out for potential reversal!

EURSEK is approaching its resistance at 10.58175 where it is could reverse down to its support at 10.48990.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully

understand the risks.

EURSEK 2.93 R-MultipleEURSEK Reward:Risk = 2.93R

Stop Loss: 286.6 Pips

Target: 838.5 Pips

Entry at price level: 10.64975

Note: Price Level 10.64975 was retested and EURSEK continued into its intended direction.

Note: Price Level 10.60763 was broken and retested. Entry comes in at the retest of level 10.60763. Target is the next horizontal support resistance level at price 10.56657.

EUR/SEK Short Trade: Goldman is also BearishGoldman Sachs : "Stay short EUR/SEK; target: 10.30, stop loss: 10.90.

Sweden, the most open economy in the G10,

stands to benefit from improving global growth and lower recession risk in the Euro area.

SEK tends to outperform in relatively benign growth scenarios with a modestly stronger Euro ,

which is close to our baseline scenario of a better—but not stellar—global environment.

The trade should also benefit from asymmetric monetary policy reaction functions.

While a number of global central banks (including the ECB) appear to have a lower hurdle for cuts than hikes,

the Riksbank has shown a strong desire to get out of negative territory.

We therefore think that it is highly likely to hike in December, and will then be reluctant to cut even if data deteriorate further."

Source: Sorry, No links in Ideas section ( violating House Rules ).

Comment on their Stop Loss: I would not recommend it to my worst enemies.

Disclaimer:

We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature,

and are therefore are unqualified to give investment recommendations.

Always do your own research and consult with a licensed investment professional before investing.

This communication is never to be used as the basis of making investment decisions, and it is for entertainment purposes only.

EURSEK Target Price 10.60763 (After Action Report)This Parallel Channel is different from my usual channel trade set ups. See the positioning of the Red EMA 10 and Blue EMA 20. The 10-Day Exponential Moving Average is below the 20-Day Exponential Moving Average. A great indication that this a sell opportunity. Candlestick wick intersects the horizontal support resistance line and both EMAs. Wick did not intersect or retest channel support resistance diagonal line.

Next horizontal support resistance is at 10.56657

EURSEK approaching support, potential for a bounce!

EURSEK is expected to drop to 1st support at 10.61569 where it could potentially react off and up to 1st resistance at 10.74378.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully

understand the risks.