EUR TRY

EURTRY setup-EURTRY short term RSI (H4 chart) is in oversold zone

-The price is at support level

-Long on short term and close near 6.37

-The best place to entry short position is near 6.37

-The short position is good for short and long term too.

-In long term the price can go completely to February low near 5.9

EURTRY | EURO/LIRA Short on CorrectionSelling Lira because the overnight funding you sometimes get is just insanity! On my broker I get 0.05% on my LEVERAGED position... PER NIGHT! That's 1% in just three weeks!

For example I sell a position for $1000 which is leveraged x100 = $100,000. I get $1000 in just three weeks which is my initial investment, this means I make 100% ROE in three weeks if market moves sideways.

The technical analysis actually says it probably goes down. Insane.

To the technical analysis: Wait for correction to next weeks central pivot point or 21/34 EMAs then SELL and HODL.

Analysis of EURTRY 26.07.2019The price is below the moving average of 20 MA and MA 200, indicating the downward trend.

MACD is below the zero level.

The oscillator Force Index is below the zero levels.

If the level of support is broken, you shall follow the recommendations below:

• Timeframe: H4

• Recommendation: Short Position

• Entry Level: Short Position 6.2900

• Take Profit Level: 6.2200 (700 pips)

If the price rebound from a support level, you shall follow the recommendations below:

• Timeframe: H4

• Recommendation: Long Position

• Entry Level: Long Position 6.3900

• Take Profit Level: 6.4100 (200 pips)

GOLD

A possible long position at the breakout of the level 1426.00

USDCHF

A possible long position at the breakout of the level 0.9920

GBPUSD

A possible short position in the breakdown of the level 1.2410

USDJPY

A possible long position at the breakout of the level 108.80

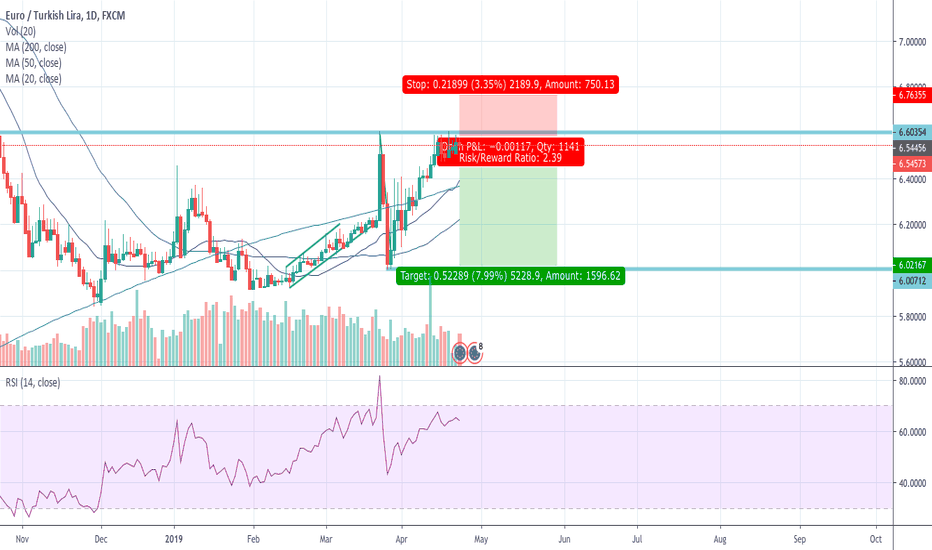

EURTRY setting up nicely for a leg upOne of my favourite pairs this weekend. So much confluence for an upside leg. Let's break it down.

1) Price printed a doji on the last trading day. That is a somewhat sign of reversal.

2) Price printed the doji at a strong area of support . We can see how many times the price has jumped from this area in the past (green circles)

3) Price printed the doji at a strong area of support and right at the 200MA. Now, this is a strong sign for a reversal. Price is supported by horizontal support and the 200MA.

4) Price printed the doji at a strong area of support, right at the 200MA and right at the ascending trendline (red trendline) dating from beginning of this year. This is extremely strong

5) Double bottom. The price of the pair is rejecting the same area it rejected on 5th of July.

6) RSI divergence. We see that the price made a low on 5th of June and 5th of July but the RSI didnt go lower, instead it stayed neutral. On this new low the RSI has actually won strength. Another sign of reversal.

Not everything is perfect though:

1) Price is capped by a descending trendline (blue trendline) that has been respected since May. A break of this trendline will totally confirm the leg up.

2) Price is capped by 50MA before it could reach the horizontal resistance. So we will use 50MA as PT1 as it could send the price lower again.

Lets look at the 4H chart to get a trading plan :

We clearly see the double bottom and the same RSI divergence than on D chart (purple lines). The Price Action is not very clean but we can make 2 different plans.

- Plan A: Blue arrows -> Price recovers to the descending trendline where it will also hit the MA50, retraces a bit before continuing higher.

- Plan B: Red arrows -> Price breaks the descending trendline and keeps going higher until hitting the 4H resistance area that will also be the 200MA. Price could retrace back to the trendline, it will be also the MA50, before continuing higher.

I will wait to see how the pair wakes up on Monday morning but if not much of a change I will buy straight away and exit the trade if a 4H candle breaks and closes below the support and lows of 5th of June.

If I am missing anything let me know in the comments!

Istanbul defended democracy, but Erdogan is still in powerHello dear Turkish Lira traders, merhaba arkadaslar! ;)

Istanbul clearly defended democracy on Sunday, giving the counterpart of the AKP, Ekrem Imamoglu, the majority of the votes, even in districts where the AKP had previously a stronghold. Even though Erdogan was not directly up for election, it was a clear message to the government: If you do not count our votes in the election, we will not stand still . The Istanbul mayoral election, which had closed almost 50:50 in the previous election, now went clearly 54 to 46 towards the CHP in the reelection.

What does it now mean for the Lira?

=> While it is clear that the CHP won Istanbul now -and with it almost one third of Turkey's economy- Erdogan is still the man in the land . He controls almost all political institutions, even up to the legislature. While people are on the streets dancing, at the same time the trials against the Gezi Park supporters like Osman Kavala have started.

So, it's back to usual, esp. if the the government intervened before the election to hold the Lira stable: We're currently building a nice Double Bottom on the Daily, which needs to see a break above the Pullback High 'neckline' to see a confirmation.

If we see a breakout here above 5,9 TRY, we could easily reach 6 and above, which would make the green line of my big time-frame analysis from Friday the most likely scenario:

You can check it out if you want, I'll link it under the description.

Selamlar, Deniz from Edgy

Can you read the chart yourself, or are you still dependent on other people like myself to read it for you? Are you an 'illiterate in charting'? Do you have a trading plan with sheets, or are you trading from your head? Are you already making gains over the long-term, like a casino, or are you losing over the long-term, because you have no idea what your strategy is? => Those are all important questions, where are I can help you with. I wish you a good trading! :)

Edgy is providing online mentorship & trading metrics only. We are not a financial advisor, nor do we hold any formal qualifications in this area. You're trading at your own risk. No matter what you do, please set your stop loss. Please be aware, that you can lose all your money on the online exchanges.

Disaster cooking in Turkey=> For those who believe in the bearish Turkey story, we are in the early stages of a 5th wave which we mentioned in our previous ideas... it can be seen clearly here and shows how the floodgates for the highs are wide open.

From a technical perspective the 5th wave target, the first major target is 7.85 (assuming wave 5 is a 1.00 ratio in length of wave 1).

Given the nature of this rally so far there is a very large chance this can extend well beyond the initial targets as far as the 2.168 extension above the highs.

It is also worth noting for those following EW that the 5th wave usually marks new highs... confidence in this view will increase above the 161.8% so for those wanting a less aggressive entry you can sit tight and watch closely and good luck to those wanting to pull the trigger early for the next few Quarters in 2019.

This is going to be a monstrous move and worth tracking for those interested in watching the EM collapse continue.

USDTRY Double bottom, Part 2 In my previous analysis i showed a potential double bottom on the daily chart which has been playing out so far. The ideal entry, when the triangle would break on the low side, didn't happen. It simply broke upwards and continued the rally since. However, this rally has been very slow so far. It's not always bad, but at this point it needs to accelerate a big more. Like it has been doing the past week or so. Bulls need to show they want to attack the neckline of that double bottom (red zone on the left). So ideally we see a good move up this week, into the resistance zone and make a good bull flag there for a few days. If we see that happen, it will become more likely to see a continuation up for the coming few months.

Previous analysis: