EURUSD – DAILY FORECAST Q3 | W31 | D29 | Y25📊 EURUSD – DAILY FORECAST

Q3 | W31 | D29 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURUSD

EURUSD-2

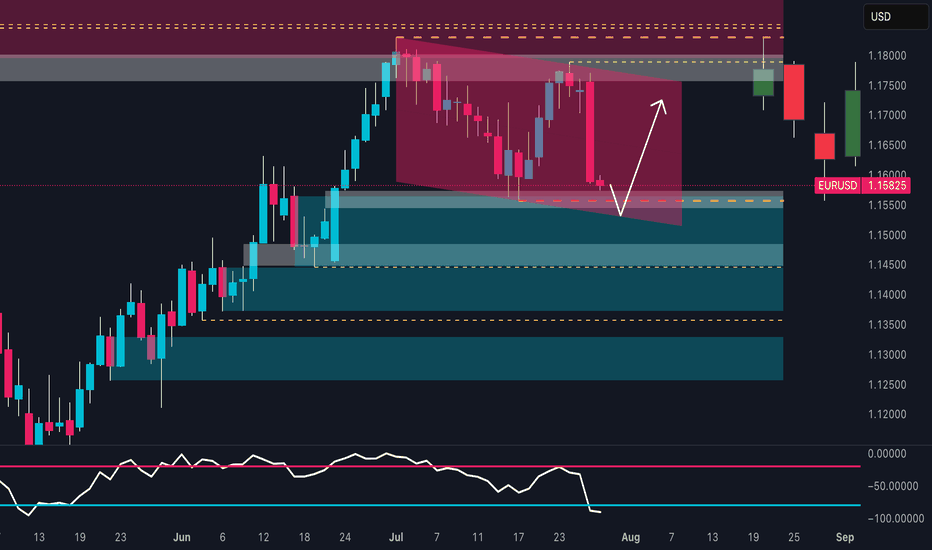

EURUSD Is Bearish! Short!

Take a look at our analysis for EURUSD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 1.166.

Considering the today's price action, probabilities will be high to see a movement to 1.159.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

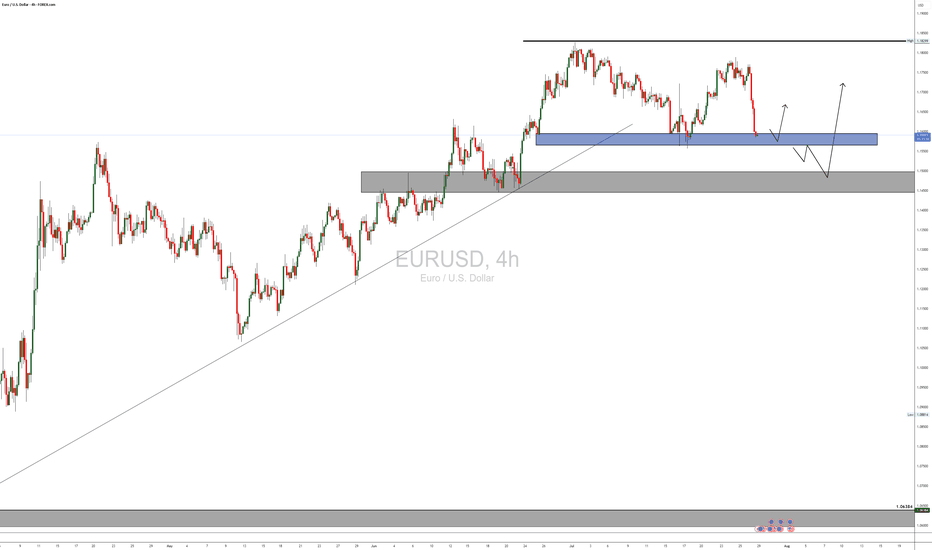

EURUSD Analysis : Rejection at Demand – Institutional Buy Setup🔍 Technical Storyline – What the Chart Tells Us:

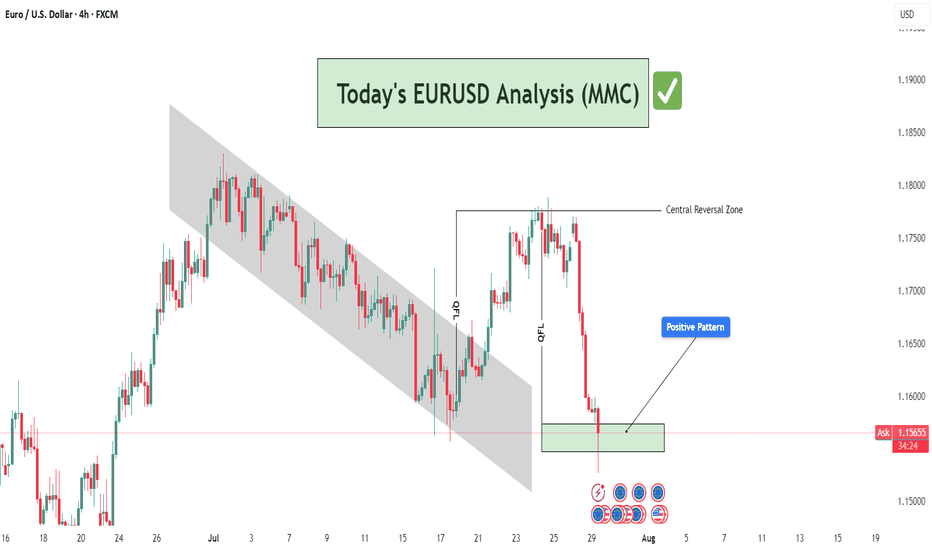

🔸 1. Previous Bearish Structure – Descending Channel:

Price has been moving within a well-respected bearish channel, signifying structured sell-side liquidity control.

This channel served as a trap zone, where retail sellers were induced while institutions accumulated buy-side positions below the range.

The controlled movement inside the channel ended with a breakout to the upside, signaling a disruption in bearish control.

🔸 2. QFL Zone Formation – Manipulation & Liquidity Grab:

QFL (Quasimodo Failure Level) is evident in two phases here:

The first QFL acts as a reaction point where the market dropped to test demand and rallied aggressively.

The second QFL near the highs shows price swept previous liquidity before dumping, hinting at institutional profit-taking and possible redistribution into discount areas.

🔸 3. Central Reversal Zone (CRZ):

Price reversed sharply from this CRZ, which acted as a major supply level. The CRZ marks the top of the manipulation range.

This was a liquidity sweep targeting trapped long positions that entered too late at the highs.

🔸 4. Demand Revisit + Positive Rejection Pattern (Current Phase):

Price has now reached the MMC-validated demand zone, which previously launched a strong bullish move.

The long lower wick in the latest candle shows buyer absorption, suggesting early signs of a Positive Reversal Pattern.

This area is marked with high probability for bullish continuation, as it aligns with both technical support and smart money logic.

💡 Trading Plan & Market Mindset:

🔸 📈 Bullish Scenario (High-Probability Play):

Wait for bullish confirmation, such as:

Bullish engulfing on 1H/4H

Break of minor intraday structure (e.g., break of internal LH)

Strong volume surge from the zone

Entry zone: Within the demand block – 1.15500 to 1.15750

Stop-loss: Just below the demand zone (1.15250)

Target 1 (TP1): 1.16500 – minor intraday resistance

Target 2 (TP2): 1.17500–1.18000 – retest of QFL high and Central Reversal Zone

🔸 ❌ Bearish Invalidator:

A 4H candle close below 1.15250 would break the demand zone structure.

Invalidation of MMC reversal – move toward deeper liquidity (1.14500–1.14800)

🧠 Trader’s Psychology & Institutional Mindset:

Institutions often induce price spikes to trap both buyers and sellers.

This entire structure reflects classic accumulation → manipulation → distribution → reaccumulation.

The retest of the original demand zone allows institutions to re-enter at discount before pushing price back toward the highs.

“In MMC, patterns are not just shapes – they are footprints of institutional intent.”

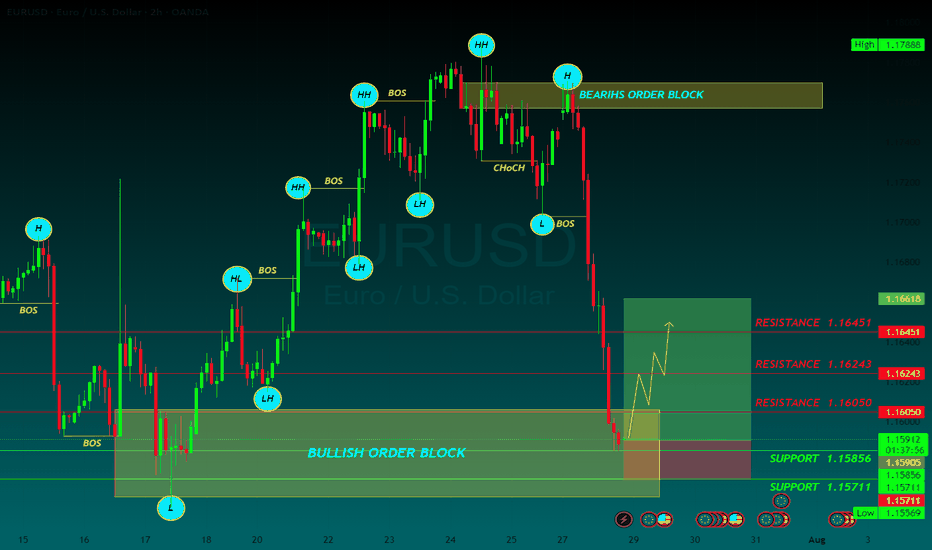

EURUSD Breakdown Bearish Trend Continues or Demand Zone Reversal🔍 Chart Breakdown: EUR/USD (30-min TF)

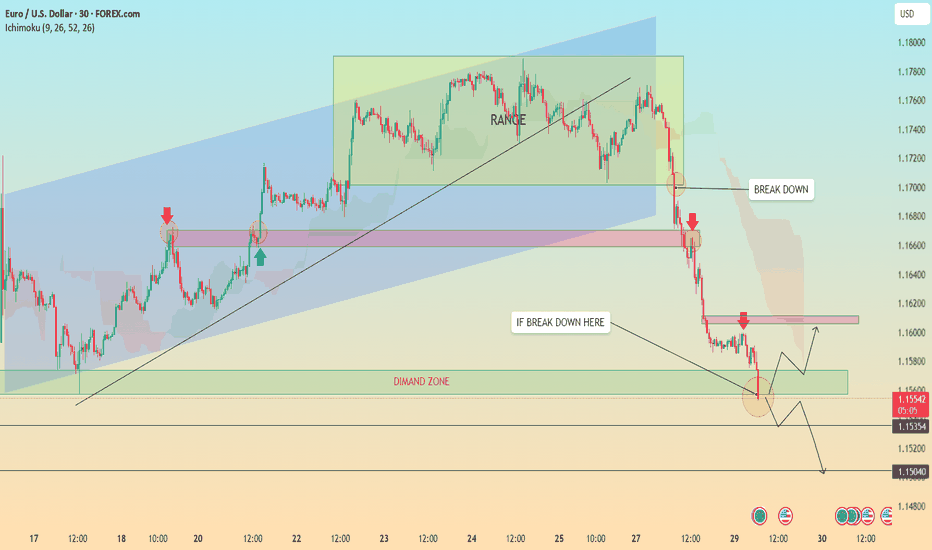

Trend Overview:

Previous Trend: Bullish channel structure (highlighted in blue).

Current Momentum: Strong bearish breakdown following a clear range phase.

The chart shifted from consolidation → breakdown → aggressive bearish continuation.

🧱 Key Technical Highlights:

1. Bearish Breakout:

Price broke below the ascending trendline and exited the ranging box, confirming a bearish shift.

Multiple Breakdown Retests (highlighted with red arrows) confirming structure failures and validating resistance zones.

2. Range Zone (Distribution Phase):

Price moved sideways within the green rectangle (“RANGE”), indicating accumulation/distribution before the selloff.

The breakdown from this range confirmed bearish momentum.

3. Demand Zone Test (Now in Play):

Price is approaching/hovering around a demand zone (green box) marked as a critical support.

Buyers may react here, offering two key scenarios:

Bounce back to retest resistance around 1.1600 (highlighted).

Breakdown below demand, leading to further decline toward next major support zones (1.15354 and 1.15040).

4. Price Reaction Zones:

🔴 Resistance zones are clearly marked where breakdown retests occurred.

🟢 Demand zone with bounce-or-break logic provides directional bias.

🧭 Potential Scenarios (Marked on Chart):

✅ Bullish Case:

If demand zone holds, expect:

A corrective rally toward 1.1600–1.1620.

Watch for rejection signals here (could be ideal for re-entering shorts).

❌ Bearish Case:

If breakdown below green demand zone occurs, targets:

1.1535 (local structure support)

1.1504 (next confluence level; possible long-term bounce area)

📈 Indicators:

Ichimoku Cloud: Price is well below the cloud, confirming bearish control.

Structure: Lower highs & lower lows = confirmed bearish trend.

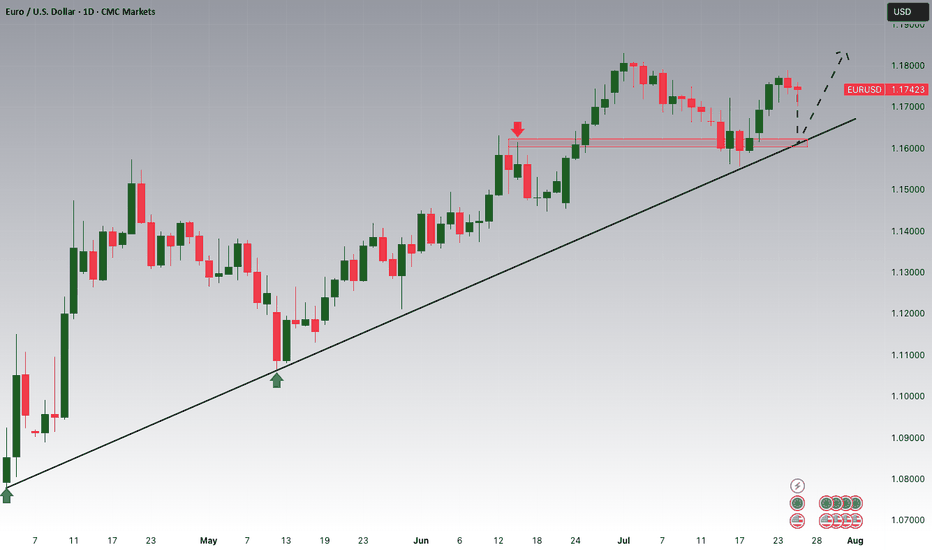

DeGRAM | EURUSD breakout📊 Technical Analysis

● Two successive rejections at the upper-channel/long-term trend-cap (red arrows) printed bearish engulfings; price has slipped back under 1.1687 minor support, breaking the July micro up-trend.

● Momentum now points to the channel mid-line ≈1.1650; clearing it exposes the lower rail / May pivot 1.1594, in line with the projected swing depth.

💡 Fundamental Analysis

● Hot US Q2-GDP and an upside surprise in core-PCE lifted 2-yr Treasury yields, reviving dollar demand, while ECB sources signalled no urgency to hike further after soft July PMIs.

✨ Summary

Short 1.1680-1.1700; hold below 1.1687 targets 1.1650 ▶ 1.1595. Invalidate on a 4 h close above 1.1750.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

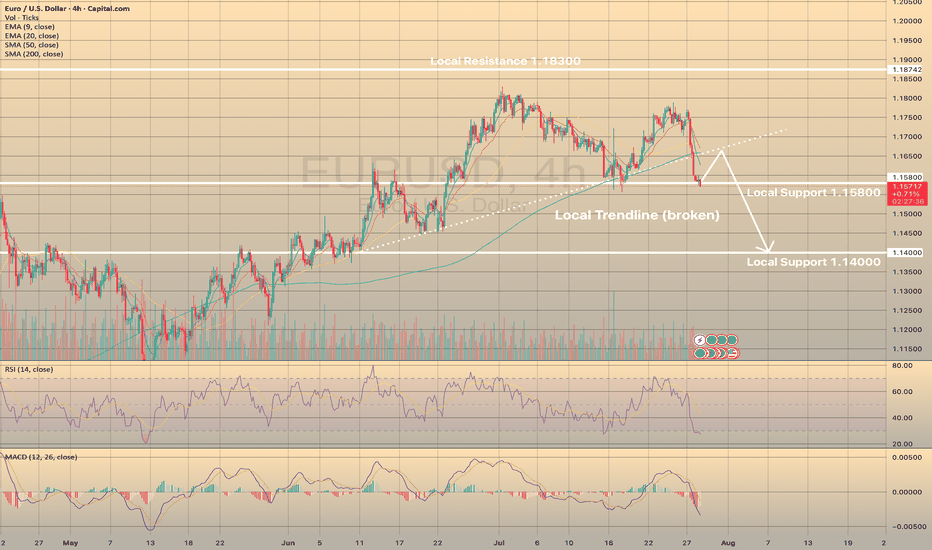

EURUSD - STRONGEST DECLINE FOR THE LAST COUPLE OF MONTHSEURUSD - STRONGEST DECLINE FOR THE LAST COUPLE OF MONTHS

EURUSD has lost 1.32% yesterday on the U.S. - E.U. trade deal. Experts suggest that the relief felt by the United States and the European Union upon reaching a trade agreement has been overshadowed by worries about the potential economic harm caused by a 15% tariff on EU imports. The dollar has recently experienced a positive trend, and this trend could continue if U.S. economic data, including Friday's employment figures, indicates a strong economy. The investors who had previously made substantial bets on the euro's appreciation are now reversing their positions, causing the euro to weaken.

Technically, the asset broke down the local trendline and is currently trying to rebound from the local support level of 1.15800. RSI tells us that the asset is oversold, so the most possible outcome here is the EURUSD to rebound from current level, retest former trendline and continues downwards movement.

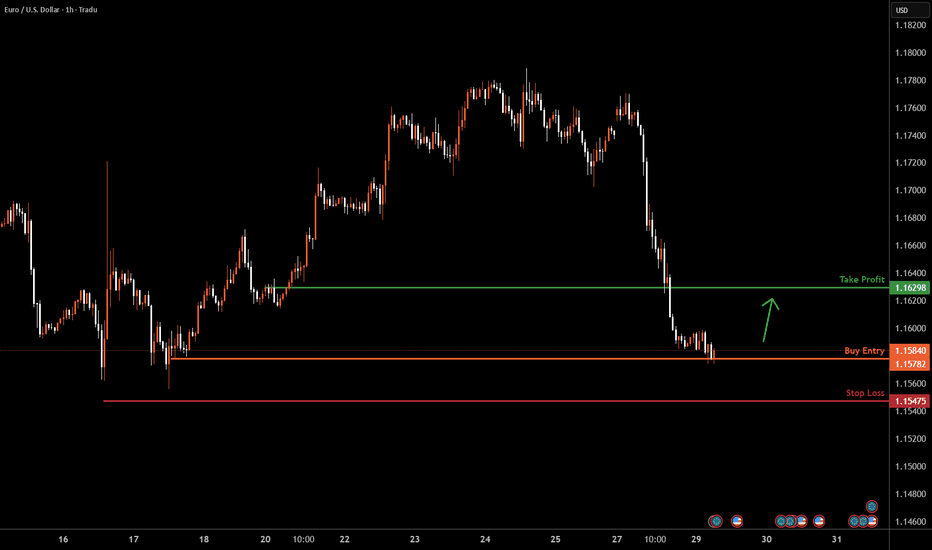

EURUSD H1 I Bullish Bounce Off Based on the H4 chart analysis, we can see that the price is testing our buy entry at 1.15782, which is a swing low support.

Our take profit will be at 1.1629, which is a pullback resistance level.

The stop loss will be placed at 1.1547, below the swing low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

EUR/USD at a Turning Point:Rally or Trap for the Bulls?📉 Technical Analysis

Price has decisively broken out of the descending channel highlighted in recent weeks. The weekly support zone between 1.1540 – 1.1580 is holding, triggering a significant technical reaction. The weekly RSI has entered oversold territory, suggesting a potential short-term reversal.

Key Support: 1.1530–1.1580 (currently reacting)

Key Resistance: 1.1720–1.1780 (inefficiency & supply zone)

Base Case: Potential rebound toward 1.1720–1.1750 before next structural decision

🧠 Sentiment Analysis

82% of retail traders are long, with an average entry at 1.1635

Only 18% are short, a clear minority

This extreme imbalance suggests downside pressure may persist to flush out weak long hands before a genuine reversal takes place.

📊 COT (Commitment of Traders)

USD Index:

Non-Commercials increased both long (+663) and short (+449) positions → uncertain stance but slight USD strengthening

EUR Futures:

Non-Commercials increased long (+6,284) and short (+8,990) positions, but net increase favors the bears

This shift signals a bearish turn in sentiment among large speculators, indicating short-term downward pressure.

📈 Seasonality

In July, EUR/USD historically tends to rise, but:

This year’s price action is underperforming the seasonal pattern, showing relative weakness

August is historically flat to slightly bearish

Seasonality does not currently support a strong bullish continuation

✅ Strategic Conclusion

Current Bias: Bearish-neutral (with short-term bullish bounce expected)

A technical rebound toward 1.1720–1.1750 is likely (liquidity void + RSI bounce + retail imbalance)

However, 1.1720–1.1750 is a key supply zone to monitor for fresh shorts, in line with:

Dollar-supportive COT data

Overcrowded long retail positioning

Weak seasonal context

🧭 Operational Plan:

Avoid holding longs above 1.1750 without macro confirmation

Monitor price action between 1.1720–1.1750 for potential short re-entry

Clean breakout above 1.1780 → shift bias to neutral/bullish

GBPUSD BUY TIGER SETUP LOOOOOOOOOOOONGwelcome

we have strong mitigation order block on time frame weekly and daily

and on 4H we have break downtrend and retest on it

and we in well discount area

and we have demand on high time frame

so this is good idea for buying

Don't forget to follow me

so that get refresh analysis

Elliott Wave Update: EURUSD Favors Weakness In To Support ZoneThe EURUSD favors upside in 3 swings from September-2022 low & should extend towards 1.1929 or higher against 1.13.2025 low. In 4-hour, it favors double correction lower from 7.01.2025 high to correct 5.12.2025 low. It favors short term pullback into 1.1512 – 1.1340 area in 7 swing pullbacks before continue rally in cycle from 1.13.2025 low. Above January-2025 low, it ended (1) at 1.0533 high, (2) at 1.0210 low, (3) at 1.1573 high, (4) at 1.1065 low & favors higher in (5). Within 4-hour, it placed 1 at 1.1830 high & correcting in 2 as double three correction before two more highs. It placed ((w)) at 1.1559 low in 3 swings zigzag correction. In ((w)), it ended (a) at 1.1659 low, (b) at 1.1714 high & (c) at 1.1559 low of 7.16.2025. Later, it unfolded expanded flat correction in ((x)) that ended at 1.1788 high of 7.24.2025. Within ((x)), it placed (a) at 1.1721 high, (b) at 1.1554 low & (c) in 5 swings at 1.1788 high.

Currently, it favors downside in ((y)) of 2 & expect sideways to lower in to support zone. It favors zigzag correction lower in ((y)) to finish 2 into extreme area before resume rally. Short term, it favors downside in (a) of ((y)) since 7.24.2025 high. In (a), it placed i at 1.1700 low, ii at 1.1771 high & favors downside in iii of (a) towards 1.1576 – 1.1569 area before bounce in iv. It expects a bounce soon in iv followed by one more push lower in v to finish (a) in 5 swings. Wave (a) of ((w)) should end near 1.1578 before bounce in (b) in 3 or 7 swings connector. The bounce in (b) should fail below 1.1788 high to extend lower in (c) into 1.1512 – 1.1340 area to finish correction. It should find next support into that area to rally higher as the part of daily sequence targeting 1.1929 or higher. We like to buy in to that area for next leg higher or at least 3 swings bounce. If it breaks above 7.01.2025 high, it expects two more highs to finish cycle from January-2025 before next pullback start.

Bullish bounce off pullback support?The Fiber (EUR/USD) is falling towards the pivot, which is a pullback support and could bounce to the 1st resistance.

Pivot: 1.1537

1st Support: 1.1456

1st Resistance: 1.1655

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURUSD POSSIBLE TRADE SETUP💶 Potential Trade Setup on EURUSD

Overview:

Since March, EURUSD has shown consistent bullish momentum, especially after breaking through the key 1.0600 supply zone.

The pair has maintained higher highs and higher lows, suggesting continued strength in the medium term.

That said, I am still quite anticipating for a possible continuation of the bullish momentum that started a long time ago, and moving forward, I will anticipate for a clear retest of the 50% fib at the 1.1425 region, then I go in for the kill.

Alternatively, there is a clear short opportunity, provided that, the bullish trendline is broken and the 1.1370 region is broken to the downside, this is a bit far a stretch, but it is in play. "IF" the DXY keeps the bullish momentum going.

🧭 Trading Plan:

✅ BUY Bias (Primary Plan):

Look for a retest of the 50% Fibonacci retracement zone around 1.1425. This aligns with the ongoing momentum on the 4H timeframe.

🔻 SELL Bias (Alternative Scenario):

If price breaks the bullish trendline and the 1.1370 support zone, a short opportunity opens up.

This is only valid if DXY continues to strengthen, shifting sentiment.

🎯 Targets & Risk Management: Targeting 1:2 R:R on both setups.

Ensure entries are backed by price action signals and confluences.

EURUSD BUYThe US Dollar (USD) gapped lower at the weekly opening amid optimism fueling demand for high-yielding assets, following news that the United States (US) and the European Union (EU) reached a trade deal.

The US and the EU agreed a 15% tariff on most European goods entering the US, much higher than the average 4.8% exporters face these days. No rates will apply to EU exports in important sectors, including aircraft parts, some chemicals, semiconductor equipment and some agricultural products.

The EU response to the headline was uneven. European Central Bank (ECB) policymaker Peter Kazimir said on Monday that the trade deal reduces uncertainty, but it is unclear for now how it impacts inflation. However, the French prime minister, François Bayrou, said the EU has capitulated to Donald Trump’s threats, adding it is a “dark day” for the EU. The trade focus now shifts to the US-China as officials from both countries resume talks in Stockholm.

The EUR/USD pair peaked at 1.1771 during Asian trading hours, but changed course early in Europe, with the USD surging across the FX board, resulting in the pair shedding over 100 pips.

The macroeconomic calendar had nothing relevant to offer at the beginning of the week, but will be flooded with first-tier releases, including US employment-related data ahead of the Nonfarm Payrolls report on Friday, the preliminary estimates of the Q2 Gross Domestic Product (GDP) for the US and the EU, and inflation updates. On top of that, the Federal Reserve (Fed) will announce its decision on monetary policy on Wednesday.

RESISTANCE 1.16050

RESISTANCE 1.16243

RESISTANCE 1.16451

SUPPORT 1.15856

SUPPORT 1.15711

EUR-USD Support Ahead! Buy!

Hello,Traders!

EUR-USD is making a massive

Bearish correction and the pair

Is already locally oversold

So after it hits a horizontal

Support level below at 1.1568

We will be expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD Will the 1D MA50 hold?The EURUSD pair has been trading within a Channel Up pattern since the April 21 2025 High. The price is right now on a strong pull-back and is about to test the 1D MA50 (blue trend-line) for the first time since May 12.

As long as the 1D candle closes above the 1D MA50, it will be a buy signal, targeting 1.19250 (a standard +3.20% rise).

If the candle closes below the 1D MA50, the buy will be invalidated and we will switch to a sell, targeting the 1D MA100 (green trend-line) at 1.14100.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

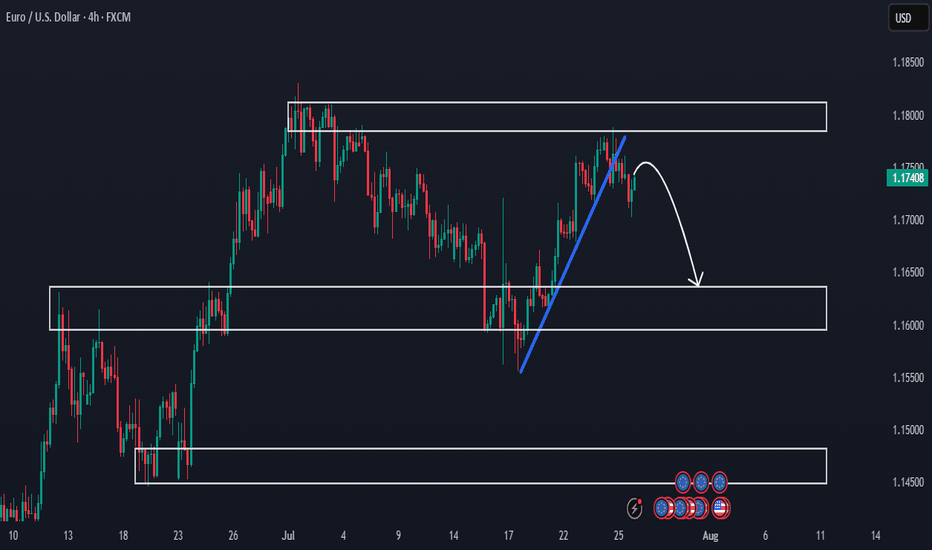

Premarket Analysis - Will Price Head Lower?Hello everybody!

We’re looking at three key areas on the chart.

Price has been rejected from a supply zone.

The clean upward trendline has been broken, and we expect the price to move lower this week.

If the drop continues, we’ll look to sell and aim for the more likely target around 1.16400.

Then we’ll see whether this first demand/support area holds or not.

Have a good trading week ahead!

EUR/USD Analysis: Potential Reversal at Key Support📉 Day 3 of 100: EUR/USD Breaks Structure!

Today’s market gave us a lesson! 📚

✅ SL Hit due to news

✅ 61% order block broken

✅ NY session may go bullish after Asia+London trap

.

Are you seeing the pattern unfold?

👇 Comment “Wave Watcher 🌊” if you use Elliott Wave!

Day 3/100 - EUR/USD Breakdown! | Forex Analysis | Elliott Wave | Order Block Strategy

In today’s update: 📌 SL hit due to major fundamental shift

📌 Break of 61% order block; heading to 78% zone

📌 Similar pattern in Tokyo/London sessions—bullish setup possible for NY session

.

💬 Drop a comment if you're also using Elliott Wave price action!

👍 Like | 🔁 Share | 🔔 Subscribe for more daily updates!

🚀 Join the 100-Day EUR/USD Challenge — Let’s decode the market together!

#forex #eurusd #elliottwave #orderblock #forextrader #forexeducation #smartmoneyconcepts #priceaction #forexchallenge #newyorksession #technicalanalysis #forexstrategy

---

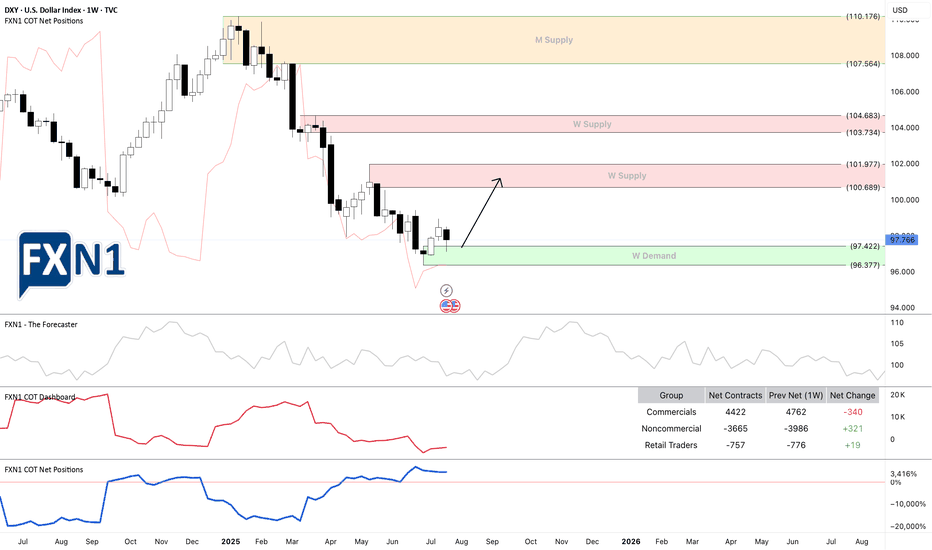

DXY: USD Flexes Muscle - Pairs SlideFriday, July 25, 2025

The foreign exchange markets are experiencing a pronounced USD bullish session this morning, with the US Dollar Index (DXY) showing robust gains of +0.35% while simultaneously pressuring all major currency pairs into negative territory. The Japanese Yen (JPY) is bearing the brunt of this dollar strength, currently registering losses between -0.4% to -0.66% across JPY pairs. This market behavior suggests traders should pay particularly close attention to DXY dynamics, as its movements will likely dictate price action across all major currency pairs in today's session.

Technical Perspective: DXY at Critical Inflection Point

A detailed examination of the Dollar Index reveals several compelling technical factors that market participants should consider:

1. Weekly Demand Zone Reaction

- The DXY has demonstrated a strong rejection from a significant weekly demand area

- The subsequent bullish spike indicates potential continuation of upward momentum

- This price action suggests institutional buyers are defending this key level

2. Commitment of Traders (COT) Report Insights

Non-commercial traders (typically hedge funds and speculators) have increased their positions from a bottom level not seen since June 2021 meanwhile the Commercial traders (often corporations hedging FX exposure) show opposing extreme positioning. This stark divergence between trader categories often precedes significant market moves

3. Seasonal Patterns Favor USD Strength

- Historical seasonal analysis indicates the current period typically supports dollar appreciation

- The combination of technical and seasonal factors creates a potentially powerful bullish setup

✅ Please share your thoughts about DXY in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

EURUSD: Will Go Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.15996 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 1.15562..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

EURUSD Supply Rejection – Bearish Move ExpectedOn the 1-hour chart, EURUSD tapped into the 4hr Supply + OB zone 🟧 and failed to hold above previous structure.

- BoS (Break of Structure) shows weakness at highs

- ChoCh (Change of Character) confirms bearish shift

- Price rejected from 0.236 Fib level (1.17400) and is moving lower

Plan:

- Expecting price to move toward 1.16200 (≈ 120 pips from current level) 🎯

- Bearish momentum remains valid as long as price stays below supply zone

- Confirmation candles & retests strengthen short bias

Reasoning:

- Supply zone rejection + failed breakout

- Clear structure shift (ChoCh) toward lower lows

- Fib retracement confluence (0.5 – 0.618 zone) aligning with sell pressure

(Not financial advice – only a personal observation)

EUR/USD: Breakdown From Key Fib Confluence Threatens UptrendEUR/USD has snapped a key confluence zone after rejecting the 78.6% Fibonacci retracement level near 1.1745. The latest daily candle shows a sharp bearish engulfing bar that sliced below both the ascending trendline and the 50-day SMA (1.1565), signaling a potential trend reversal or deeper correction.

This breakdown follows a multi-week uptrend, and momentum indicators are starting to confirm the bearish shift:

MACD is showing a bearish crossover below the signal line.

RSI has dropped below 50 (currently around 45.8), reflecting weakening bullish momentum.

The pair has now settled just above horizontal support near 1.1586. A decisive close below this level could open the door toward the next support zone around 1.1450–1.1500, where prior consolidation and the rising 200-day SMA (1.0929) may act as stronger demand.

Bulls will need to reclaim the 1.1650–1.1700 zone and see a bullish crossover on momentum indicators to regain control. Until then, the path of least resistance appears tilted to the downside, especially with trendline and Fib support now breached.

Bias: Bearish while below 1.1700. Watch for continuation lower if 1.1586 fails to hold.

-MW