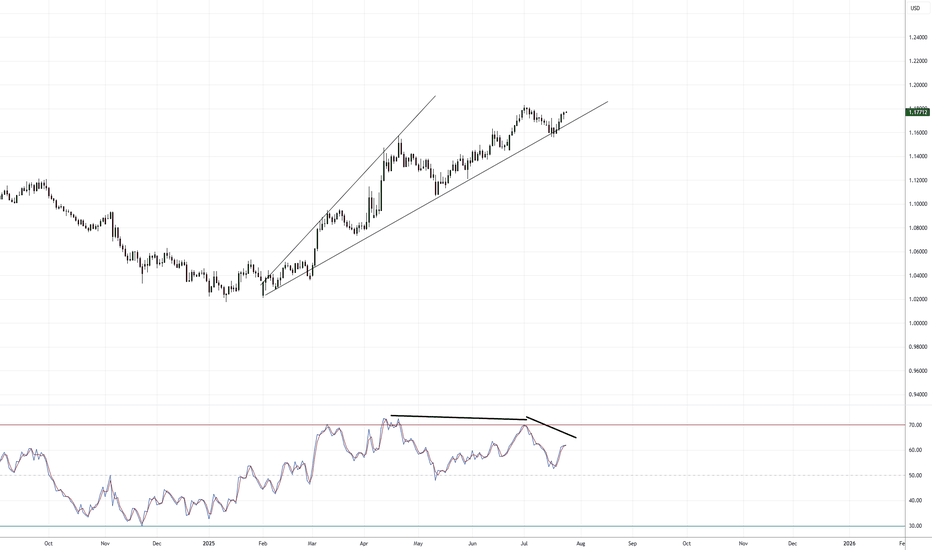

EUR/USD: The Last Bear Standing...As indicated on my previous EUR/USD idea ( that's still currently open ), I remain short EUR/USD given the technical aspect of things are still valid.

Divergences are still in play along with a rising broadening pattern and the fact that we're trading at the yearly R3 level ( which is rare ).

I suspect we will have some volatility with the ECB press conference tomorrow, so that should get things moving hopefully in the bearish direction. If we begin trading aggressively above 1.1800+, that will invalidate the short idea overall.

If we roll over, I'm still looking for 1.13000 - 1.12000 as the target range for Q3 going into Q4.

We'll see how this all develops.

As always, Good Luck & Trade Safe!

Eurusdbearish

EURUSD - Expecting Bearish Continuation In The Short TermM15 - Clean bearish trend with the price creating series of lower highs, lower lows.

No opposite signs.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/USD bearish outlookEUR/USD Weekly Outlook – Bearish Scenario in Play

This week’s outlook for EUR/USD is leaning towards a bearish continuation.

Price recently respected the 3H demand zone and gave a clean bullish reaction following the expected Asia low sweep. I didn’t manage to catch an entry as it happened quite late in the day. However, that same demand zone now looks to be weakening, potentially leading to another break of structure to the downside.

Alternatively, we could see price push higher from this demand zone and mitigate the 8H supply zone I’ve marked out — which is the origin of the last break of structure. It’s also a strong POI given its location away from liquidity and at an extreme structural point.

Confluences for EUR/USD Sells:

- Multiple breaks of structure to the downside (pro-trend setup)

- Failing 3H demand zone already mitigated

- Liquidity resting below current price

- Strong 8H supply zone sitting above the Asia highs

- DXY is showing short-term bullish momentum, aligning with EUR/USD bearish movement

P.S. If price doesn’t push higher into the 8H supply zone, I’ll be watching for a new supply zone to form mid-week for a more immediate short opportunity.

Will keep this updated — have a great trading week everyone!

EURUSD - Expecting Short Term RetracesH4 - Strong bullish move ended with a bearish divergence.

While measuring this strong bullish move using the Fibonacci retracement tool we have two key support zones that has formed (marked in green).

So based on this I expect short term bearish moves now towards the Fibonacci support zones.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/USD Short from 1.03000 (Supply Zone 6hr)My analysis for EUR/USD (EU) this week aligns with my view on other pairs, as the Dollar continues to strengthen. The bearish trend remains strong, and I plan to stay aligned with this pro-trend movement.

The price has broken structure to the downside and left a clean 6-hour supply zone that is yet to be mitigated. Once the price retraces to this supply zone, I’ll be looking for potential sell opportunities. I’ll wait for a redistribution pattern to confirm my entry before taking shorts. If the price continues to drop without retracing, I’ll monitor for a closer supply zone to form and adjust my setup accordingly.

Confluences for EU Sells:

- The price remains strongly bearish on higher time frames.

- The DXY is bullish, supporting the bearish trend for EU.

- A clean supply zone caused a Break of Structure (BOS) to the downside.

- The market is consistently forming lower lows and lower highs.

- A significant imbalance below still needs to be filled.

Note: If the price reaches the 7-hour demand zone below or the imbalance, I anticipate a potential bullish reaction, possibly leading to a retracement.

EUR/USD Shorts from 1.03600 back down?My analysis for EUR/USD (EU) this week closely mirrors my expectations for GBP/USD (GU), as both pairs share similar points of interest (POIs). I’ll be focusing on capitalizing on the bearish trend evident in the formation of lower lows and lower highs.

With the recent break of structure to the downside, new supply zones have been created. I’ll be waiting for a retest of these zones to catch sell opportunities in alignment with the overall trend. Once the price sweeps liquidity and forms a clear schematic, I’ll enter sell trades targeting the demand zone below.

Confluences for EU Sells:

- The price has shown a Change of Character (CHOCH) and multiple Breaks of Structure (BOS) to the downside.

- A few unmitigated supply zones remain, which are likely to be tapped.

- Lots of liquidity below, alongside imbalances that need to be filled.

- The Dollar Index (DXY) is bullish, strengthening the bearish case for EU through correlation.

Note: If the price continues dropping, I’ll wait for a new supply zone to form or look for counter-trend buy opportunities from a valid demand zone.

EUR/USD Shorts from 1.05600 back downThis week, my analysis for EUR/USD aligns closely with GBP/USD, as both pairs have exhibited bearish momentum. However, there are subtle differences in price action as we approach the final month of the year. A key focus is the 4-hour supply zone around 1.05600, which initiated a break of structure to the downside.

Once price reaches this area, I’ll look for redistribution on the lower timeframes to confirm a potential sell. If the price moves higher, the 2-hour supply zone just above offers an even better opportunity for shorts.

Confluences for EUR/USD Sells:

- Liquidity Below: Significant downside liquidity remains untapped.

- Bearish Momentum: The pair has been bearish for the past two weeks.

- Break of Structure: Key levels have broken to the downside on the higher timeframe.

- DXY Correlation: The dollar index (DXY) supports this bearish setup.

- Key Supply Zone: The 4-hour supply zone caused the initial bearish move.

Note: If price mitigates the 5-hour demand zone, I may consider a counter-trend buy to take price back up toward the supply zone. However, if this demand zone fails, it will trigger another break of structure (BOS), prompting me to identify a new supply zone for potential shorts.

Stay disciplined and have a strong trading week—let’s close Q4 on a high note!

EUR/USD Shorts from 1.05200 or 1.05800 back downI expect price to continue its bearish trend, providing potential shorting opportunities. My focus is on the supply zones I’ve marked at the 19-hour and 17-hour timeframes. I’ll wait for price to reach one of these zones and observe if it respects these structural points.

If price breaks above these zones, it would indicate a shift in market sentiment to the upside. However, as long as these zones hold, they remain valid levels for the trend to continue.

Confluences for EU Sells:

- Price has broken structure to the downside, leaving a clean supply zone.

- A corrective move has formed, likely preceding a continuation of the bearish trend.

- Significant liquidity resides below, presenting clear downside targets.

- Overall market structure remains bearish, making this a pro-trend trade idea.

- DXY shows strong bullish momentum, supporting the bearish outlook for EU.

P.S. If price breaks structure further to the downside without tapping into my zones, I’ll wait for a new supply zone to form after the next structural break. Have a great trading week, everyone!

EUR/USD Shorts from 1.09600 back down This week’s EUR/USD (EU) outlook is quite similar to my GU analysis, with the market continuing its bearish trend. I’ll be waiting for price to retrace back to the 16-hour supply zone, where I’ll look for entry opportunities on the lower time frames.

My target will be around the demand zone I've marked, which is near some liquidity. Depending on the confluences, I may consider a temporary counter-trend buy, but we’ll see which point of interest (POI) price reacts to first.

Confluences for EU Sells:

Structure Break: Price has broken to the downside, leaving a clear supply zone.

Bearish Market Structure: Overall market structure remains bearish, supporting this pro-trend idea.

Bullish DXY: The dollar (DXY) is gaining strength again, increasing the likelihood of stronger bearish pressure on EU.

Liquidity: Significant downside liquidity in the form of swing lows and engineered liquidity.

P.S. If price breaks through my supply zone and fills the imbalance above, I’ll shift my focus to the 15-hour supply zone to evaluate further sell opportunities.

EURUSD Analysis: Slight Bearish Bias Expected (25/09/2024)The EURUSD pair continues to show signs of a slight bearish bias this week, in line with market conditions and fundamental factors. In this article, we will break down the key drivers influencing EURUSD as of 25/09/2024, along with a technical outlook. This analysis provides insights for traders and investors aiming to position themselves for potential downside movement in the EURUSD market.

Fundamental Analysis: Factors Pressuring EURUSD

1. U.S. Dollar Strength

The U.S. dollar has maintained its strength due to a series of factors, including recent hawkish remarks from the Federal Reserve. Fed officials have continued to emphasize the possibility of keeping interest rates higher for longer to combat inflation. This has provided significant support for the dollar, making it an attractive safe-haven asset, while simultaneously putting pressure on the euro.

2. Diverging Central Bank Policies

The European Central Bank (ECB) has recently adopted a more cautious tone regarding future rate hikes. With inflation in the eurozone stabilizing, the ECB may opt for a wait-and-see approach, potentially slowing the pace of tightening or halting rate hikes altogether. This divergence in monetary policy between the ECB and the Fed is expected to contribute to further downside pressure on the EURUSD.

3. Weak Eurozone Economic Data

Economic data from the eurozone remains relatively soft. The latest PMI data showed a contraction in the manufacturing and services sectors, further weakening the euro. Lower-than-expected growth forecasts and potential deflationary pressures also undermine the euro's strength.

4. Geopolitical Uncertainty

Ongoing geopolitical risks, such as tensions in Eastern Europe and concerns over energy security, continue to cloud the eurozone’s economic outlook. These factors have led to capital outflows from Europe, with investors seeking the safety of the U.S. dollar.

Technical Analysis: EURUSD Price Action

On the technical front, EURUSD has struggled to break above key resistance levels near 1.10700, confirming the bearish sentiment. The pair has been trading in a downward channel since mid-September, and with recent price action rejecting the 50-day moving average, momentum indicators signal further downside potential.

- Support Level: 1.09000 is a crucial support level to watch for EURUSD this week. A break below this could accelerate the bearish move, potentially targeting the 1.08500 level.

- Resistance Level: The 1.10700 level remains a key resistance, and a move above this could invalidate the bearish outlook, though this seems unlikely given the fundamental backdrop.

Outlook for the Week: Slight Bearish Bias for EURUSD

Given the combination of strong U.S. dollar fundamentals, the divergence in central bank policies, weak eurozone economic data, and technical resistance, the EURUSD is likely to maintain a slightly bearish bias through the remainder of this week.

Keywords for SEO: EURUSD analysis, EURUSD today, EURUSD forecast, EURUSD bearish, euro dollar, forex trading, U.S. dollar strength, ECB monetary policy, Fed rate hikes, forex market analysis, EURUSD price action, technical analysis EURUSD, eurozone economy.

Conclusion

EURUSD is likely to continue on its bearish trajectory, with potential downside towards key support levels this week. Traders should closely monitor U.S. dollar fundamentals, especially any new developments from the Federal Reserve, as these will play a crucial role in shaping EURUSD’s movement. Keep an eye on eurozone data releases and geopolitical headlines for any shifts in market sentiment that could impact this currency pair.

Mastering HTF Analysis: DXY & EURUSD Weekly to Monthly Forecast!Greetings, traders, and welcome back to today's video!

In this session, we'll be conducting a higher timeframe outlook on the DXY and EURUSD. Our goal is to understand what we can anticipate in this week's and this month's trading sessions.

This video will also provide insight into how I approach my trading, focusing on different logs for various aspects of my analysis:

Higher Timeframe Analysis : Monthly, weekly, and daily analysis conducted at the beginning of each week. (Primary Focus In Todays Video)

Interest Rate Logs: Tracking changes and impacts of interest rates.

Intraday Trading Layouts: Used daily to keep my charts organized and clutter-free.

Analyzing these layouts separately at different times helps me stay organized and maintain a clear perspective.

Let's discuss the market structure. Markets are driven by smart money, also known as the banks. They are the liquidity providers, while we are the spectators. Central banks own the currencies and set their trading values. Understanding that markets are liquidity-based—it's us against the banks—we see that banks move prices toward liquidity to pair and book against it.

So, where does the most liquidity reside? The higher timeframes. The higher the timeframe, the larger the sponsorship. That's why we'll be analyzing the higher timeframes today to gain a strategic edge.

Let's dive into the charts and uncover these crucial insights together.

Premium & Discount Price Delivery in Institutional Trading:

If you have any questions, please leave them in the comments section below.

Happy Trading,

The_Architect

EUR/USD Shorts to Long idea My bias for EURUSD is similar to GBPUSD, as I'm seeking selling opportunities towards a demand zone. There's a 10-hour supply zone that I'm eyeing for potential sells to continue the downtrend. I'll be waiting for a high to be swept during a Wyckoff distribution before entering my sell positions.

Following this, I anticipate price to decline towards the 3-hour demand zone, which coincides with the 3-hour demand area for GBPUSD. I'll then look for a Wyckoff accumulation phase to ride price back up and fill in the major imbalances left from the upside.

Confluences for EU Sells are as follows:

- Price has been very bearish recently and confirms this via continuous break of structures.

- Good 10hr supply that has recently been created which also caused a BOS.

- Theres an imbalance below that needs to get filled as well as lots of liquidity to be taken.

- The overall trend of the market on the higher time frame is bearish as well.

- DXY also looking bullish as well and it's aligning very well with EU's Zones.

P.S. If the demand zone fails, it will break a significant level of structure, making selling positions more favorable. Currently, bearish momentum remains strong, and I anticipate further downside movement.

Have a great trading week remember risk accordingly and maintain emotional discipline!

EUR/USD Bearish outlook and potential sells from 1.08200My perspective on EU is to anticipate its bearish trajectory. With recent downward structure breaks and its arrival at a demand zone, I foresee potential failure to breach deeper levels or ideally a retracement to touch either of the two newly marked zones at points (A) and (B). Following this, I'll be on the lookout for a wyckoff distribution to initiate selling to sustain this trend, as my bias for this pair remains bearish.

While there's a similarity between EU and GU, EU is already within the demand zone, where I expect a bullish response, unlike GU. Therefore, I anticipate GU to rise before a drop, similar to this pair. It's worth noting that immediate buys might not be ideal, especially considering Monday's bank holiday for EUR.

Confluences for EU Sells are as follows:

- Price broke structure again on the higher time frames.

- Overall market trend is bearish so this aligns with the overall bias.

- Two new supply zones emerged near current price in which we can expect a bearish reaction to take place.

- Lots of liquidity still left to the downside that needs to be taken in the form of asian lows.

- Price might currently undergo a retracement back to an area of supply as its in a demand right now.

P.S. It wouldn't be unexpected if the price continues its ascent and reaches the 4-hour demand zone adjacent to the imbalance, a significant area I'm closely monitoring. However, I am anticipating a bearish descent from the recently established supply levels.

Have a great trading week guys!

EUR/USD Imminent Shorts towards 1.06800My analysis on EUR/USD mirrors that of GBP/USD, as it has entered a significant supply zone where I anticipate a bearish reaction. Given the abundance of liquidity and the temporary bullishness of the dollar, this scenario appears plausible. Therefore, I'll be monitoring for a redistribution pattern on Monday before considering initiating sell positions.

I acknowledge the presence of considerable imbalances above, which could prompt price to rise and potentially reach the supply zone in scenario (C). However, my overall expectation for EUR/USD is a downward movement towards 1.06800.

Confluences for EU Shorts are as follows:

- Price left a clean 3hr supply zone which price is currently re distributing inside.

- Price has been moving bearish regarding the recent break of structure to the downside.

- DXY is also been moving bullish so it backs the EU downtrend.

- Lots of liquidity to the downside like trendline Asian lows and swing lows.

- The overall trend of this market like the monthly still shows its a bearish trend.

P.S. I'm currently leaning towards a pro-trend stance with this idea, primarily because of the recent downward breaks in structure. Additionally, there are few demand zones in proximity to the current price, suggesting that price may decline to sweep that liquidity.

HAPPY TRADING AND REMEMBER ITS USD BANK HOLIDAY MONDAY!

EURUSD Shorts from 1.09400 down towards 1.08000EU is currently exhibiting a similar pattern to other pairs, and my current stance for this currency pair is bearish. I'm patiently waiting for the 12hr supply zone to be mitigated, considering it as the nearest opportunity of interest for me. This aligns with the overall higher time frame trend, which is bearish.

Upon the mitigation of this zone, my plan involves waiting for a Wyckoff distribution to unfold within the specified area. Ideally, I will be looking for the Asian high within the zone to be swept. Following this occurrence, I will then be looking for selling opportunities back down to address the imbalances left below.

Confluences for EU sells are as follows:

- 12hr Supply zone caused a BOS to the downside on the higher time frame

- Imbalances and liquidity below that needs to get taken as well as a demand zone that needs mitigating.

- Overall trend of the market is bearish on the higher time frame.

- We are currently witnessing a pullback and I'm looking for my POI to continue this trend.

P.S. While I maintain a bearish outlook, I acknowledge the presence of equal highs above my zone, which could potentially lead to a break beyond my supply. In such a scenario, I recognize that price might aim for higher levels to enter a more premium area.

HAVE A GREAT TRADING WEEK AHEAD!

EURUSD - Looking To Sell Pullbacks In The Short TermH4 - Bearish divergence.

Most recent uptrend line breakout.

Expecting short term bearish moves to happen here.

H1 - Bearish trend pattern.

Currently it looks like a pullback is happening.

Until the strong resistance zone holds my short term view remains bearish here.

EURUSD → Drop to 1.05? or Blast to 1.10? Lets Make it Clear.EURUSD is pushing toward the resistance zone which gives the bulls some tingly senses to take profit and run the price back to the downside. Will the Dollar show strength this week and keep EURUSD from breaking resistance?

How do we trade this?

The price is currently in a trading range between 1.05000 and 1.10000 and we're getting close to the resistance zone where the Weekly 200EMA resides. If you're not already in a trade, it's worth waiting to see what happens at the resistance zone. A bear signal bar closing on or near its low below the resistance line is a good indicator that the price will fail to rise above again and would be a reasonable short. Stop loss above the resistance zone top and take profit just above the Support Zone around 1.05000. The RSI is near 70.00, a weak indicator on its own, but supports the rest of the analysis for a soon-to-come short.

If the price finds its way above the resistance lines and closes a bull candle on or near its high, it would be reasonable to long with a protective stop just below the resistance zone. Target prices as high as 1.12500.

Key Takeaways

1. Trading Range after Bull Run, Bias to Long.

2. Near the Resistance Zone, Look for a Reversal Signal.

3. If Shorting, Watch the 200EMA for Support.

4. The Dollar Index may fall more, wait for the bottom.

5. RSI near 70.00, Bias to Short.

You are solely responsible for your trades, trade at your own risk!

If you found this analysis helpful, click the Boost button and let us know what you think in the comment section below!