Elliott Wave Outlook (Wave C in Progress?)Key Technical Zones:

Demand Zone: 0.9750 – 1.0350 (Support from Wave B low)

Supply Zone: 1.1600 – 1.2000 (Potential Wave C target)

Current Price: 1.0959

Support Levels: 1.0730, 1.0350

Resistance Levels: 1.1250, 1.1600

Outlook:

Bullish bias remains intact for Wave C as long as the pair holds above 1.0730. Any deeper pullback into the demand zone could still be part of a healthy correction, offering long opportunities on confirmation. Keep an eye on macroeconomic data, especially from the U.S. (FOMC, CPI) and EU (ECB stance), as they may heavily influence EUR/USD sentiment in the coming weeks.

Conclusion:

Watch for bullish continuation setups toward the supply zone, but remain cautious of a mid-term rejection pattern, which could trigger a deeper correction. Trade safely, and always use proper risk management.

Current Scenario:

Price is now trading near 1.0950, suggesting a potential Wave C rally in progress.

If Wave C unfolds as anticipated, EUR/USD could approach the supply zone marked between 1.1600–1.2000, which aligns with previous structural resistance and Fibonacci retracement levels.

However, a false breakout or early rejection from current levels could lead to a sharp retracement, possibly retesting the demand zone before any major upside continuation.

Eurusdbuy

Cup & Handle Pattern on EUR/USD – Bullish Breakout Setup🏗️ 1. Pattern Structure Breakdown

🔵 Cup Formation:

The left side of the chart illustrates a steep decline beginning around mid-October 2024, forming the left lip of the cup.

The bottom of the cup was established between late December 2024 and early February 2025, where the market found a strong support level near 1.0220.

A rounded bottom formed, which indicates accumulation and decreasing bearish momentum.

The right side of the cup shows a strong bullish reversal from the support zone, gradually returning to the previous highs around 1.1050–1.1100, completing the cup shape.

⚫ Handle Formation:

A slight pullback or consolidation occurred after reaching the resistance zone, forming the handle between late March and early April 2025.

This handle appears as a small descending channel or flag, which is typical for this pattern.

Price remained above the support trendline, showing strength in the handle without breaking the overall bullish structure.

🔍 2. Key Technical Zones

📌 Resistance Level (Breakout Zone): 1.1050 – 1.1100

Marked by prior price rejection and the top of the cup.

The successful breakout above this zone confirms the cup and handle breakout.

📌 Support Level: 1.0220 – 1.0300

This zone provided a base during the cup’s rounding bottom and serves as a critical demand area.

📌 Stop Loss: 1.07380

Positioned below the recent swing low (handle low), providing a safe buffer.

This placement respects both market structure and risk management.

🎯 3. Target Projection

✅ Price Target: 1.14780

Based on the measured move technique:

Measure the depth of the cup (approx. 1.1100 - 1.0220 = 880 pips).

Project that distance above the breakout point (around 1.1050).

Target = 1.1050 + 0.0880 = 1.1930 (but a conservative target of 1.14780 is used here).

This target aligns with a previous resistance level from mid-2023, adding confluence.

📈 4. Trade Setup Summary

Component Description

Pattern Cup and Handle (Bullish Continuation)

Entry Point Breakout above 1.1050 resistance

Stop Loss Below 1.0738 (recent low)

Target 1.1478 (based on measured move)

Risk/Reward Ratio Approx. 1:2.5 or better

💡 5. Technical Insights and Confluence

Volume Consideration (if available): Typically, volume decreases during the cup and increases during the breakout. Although volume is not shown here, this pattern suggests accumulation.

Handle Behavior: The handle did not breach the mid-point of the cup, maintaining a strong bullish structure.

Market Sentiment: Given the steady incline and the bullish breakout, it suggests buyers are in control.

🏁 Conclusion

This is a textbook Cup and Handle breakout setup on the EUR/USD daily chart. The structure shows a clear transition from bearish to bullish sentiment, accumulation at support, and a confirmed breakout with strong potential upside.

It offers an excellent long opportunity with favorable risk-reward, clear invalidation, and a historically reliable price pattern.

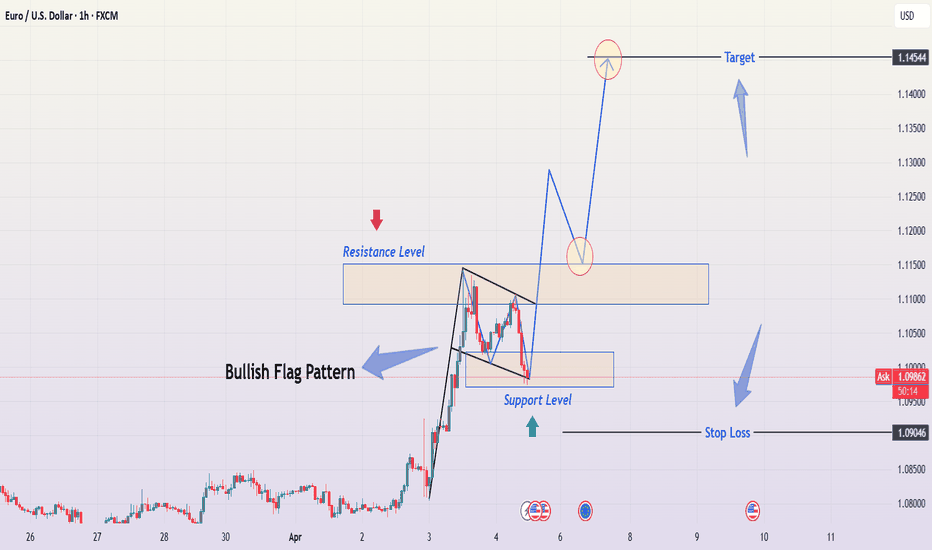

EUR/USD – Bullish Flag Pattern & Trade SetupTechnical Analysis & Trade Plan for TradingView Idea

This chart illustrates a Bullish Flag Pattern on the EUR/USD 1-hour timeframe, suggesting a potential continuation of the prevailing uptrend. Below is a detailed breakdown of the market structure, key levels, and a professional trading strategy.

📌 Chart Pattern: Bullish Flag Formation

The Bullish Flag is a continuation pattern that forms after a strong upward price movement, followed by a short period of consolidation within a downward-sloping channel. It signals a brief pause before the trend resumes.

Flagpole: The sharp price increase before the consolidation.

Flag: The corrective downward movement forming a small parallel channel.

Breakout Potential: A confirmed breakout above resistance could lead to a further bullish rally.

🔍 Key Technical Levels & Market Structure

🔵 Resistance Level (Supply Zone)

The upper boundary of the flag pattern acts as resistance.

A breakout above this level could trigger a strong buying opportunity.

🟢 Support Level (Demand Zone)

The lower boundary of the flag provides support.

Price is currently testing this zone, which is a critical decision point.

🎯 Target Price: 1.14544 (Projected Move)

The price target is calculated based on the height of the flagpole added to the breakout point.

This aligns with a previous significant resistance area.

📈 Trading Strategy & Execution Plan

✅ Entry Criteria:

A confirmed breakout above the flag's resistance level with a strong bullish candlestick.

Increased trading volume supporting the breakout.

🚨 Risk Management:

Stop Loss: Placed below the support zone of the flag to manage risk in case of a false breakout.

Take Profit Target: At 1.14544, aligning with the measured move of the flag pattern.

📊 Trade Confirmation Indicators:

RSI (Relative Strength Index): A reading above 50 confirms bullish momentum.

Moving Averages (50 EMA/200 EMA): A bullish crossover would strengthen the buying signal.

Volume Analysis: A breakout should be accompanied by high trading volume for confirmation.

⚠️ Potential Risks & Alternative Scenarios

Fake Breakout: If the price breaks out but lacks volume, it could be a false signal.

Bearish Reversal: If price breaks below the support zone, the bullish flag setup becomes invalid.

Market Sentiment Shift: Unexpected news events can impact price movement.

📝 Summary

The EUR/USD pair has formed a Bullish Flag Pattern, signaling a possible continuation of the uptrend.

A breakout above the resistance level would confirm the pattern and provide a strong buying opportunity.

Risk management is essential, with a stop loss placed below the support level.

Final Target: 1.14544, based on the flagpole’s measured move.

💡 Conclusion: A well-structured breakout above resistance could lead to a bullish rally toward 1.14544. However, patience and confirmation are key before entering the trade.

EUR/USD Analysis Ascending Triangle Breakout – Bullish TargetOverview of the Chart:

The chart represents the EUR/USD (Euro to U.S. Dollar) pair on a 1-hour timeframe, showcasing a bullish ascending triangle breakout. The pattern indicates an upward continuation in the trend after a period of consolidation. This analysis will break down the key elements of the chart, the technical structure, and the potential trading strategy.

1. Market Structure & Key Zones

A. Market Curve Area (Early Trend Development)

The price started with a strong bullish trend leading up to the formation of the triangle.

The curved trendline suggests a gradual increase in buying pressure, indicating that the market was preparing for a larger breakout.

B. Resistance and Support Levels

Resistance Level (Red Arrow & Blue Box):

This level acted as a price ceiling where sellers previously dominated.

The market attempted multiple times to break this resistance before successfully breaching it.

Support Level (Green Arrow & Yellow Zone):

The price consistently found buyers at this level, reinforcing a higher low structure.

The rising support line within the triangle indicated strong accumulation by buyers.

2. Chart Pattern: Ascending Triangle Formation

The price action formed an ascending triangle, which is a well-known bullish continuation pattern.

The higher lows (trendline support) indicated buyers were gaining control, gradually pushing the price toward the resistance.

Eventually, the resistance was broken with strong bullish momentum, confirming a valid breakout.

3. Breakout Confirmation & Retest

The breakout above the resistance level came with high volume, indicating strong market participation.

After the breakout, a minor pullback (retest) occurred, confirming previous resistance as new support.

The price surged upward after the retest, validating the bullish trade setup.

4. Trade Setup & Risk Management

A. Entry Strategy

A trader would enter a buy (long) position after confirming the breakout.

Entry Trigger:

Either at breakout (high-risk, early entry)

Or after a successful retest (safer entry)

B. Stop Loss Placement

A stop loss is placed below the previous support level at 1.07276, ensuring risk is limited in case of a false breakout.

C. Target Projection

The target price is measured using the height of the triangle added to the breakout level.

Based on this calculation, the projected target is around 1.12838.

5. Conclusion & Trading Plan

The EUR/USD pair has executed a clean ascending triangle breakout, signaling further bullish movement.

The trading plan suggests:

✅ Entry: Buy after breakout confirmation or retest.

✅ Stop Loss: Placed below 1.07276 for risk management.

✅ Take Profit: Targeting 1.12838, based on the pattern’s height projection.

This setup presents a high-probability long opportunity in a trending market, with proper risk management to protect against potential reversals.

Euro Rises Above $1.09 Despite Tariff ThreatsThe euro climbed above $1.09, showing unexpected strength after President Trump announced 20% tariffs on all EU imports.

◉ Fundamental Rationale

● The currency got a boost because the U.S. dollar weakened. Trump’s tariffs made trade tensions worse and worried people about slower economic growth.

● Also, new numbers showed Eurozone inflation fell to 2.2% in March, the lowest since November 2024.

● This lower inflation means the European Central Bank doesn’t need to raise interest rates, making the euro more appealing to investors.

◉ Technical Observation

● From a technical perspective, an inverse head and shoulders pattern has formed, hinting at a possible trend reversal.

● A breakout above $1.095 could pave the way for stronger bullish momentum.

EUR/USD BuyHello dear traders

I try to guide you in trading and creating trading positions and share my trading ideas with you so that if I make a profit, you can also make a profit with me.

These analyzes are done with great complexity and all technical parameters are taken into account as much as possible.

And finally, it is presented to you in a completely simple and practical way to use them.

Be sure to follow the capital management.

Do not risk more than 1% of the capital in any of the positions.

Keep in mind that you are responsible for all trades.

(Good luck)

EURUSD - what’s next?Here is our in-depth view and update on EURUSD . Potential opportunities and what to look out for. This is a long-term overview on the pair sharing possible entries and important Key Levels .

Alright first, let’s take a step back and take a look at EURUSD from a bigger perspective.

After making such a huge upside move, we are expecting EURUSD to have some sort of a correction or a pullback to the downside. After that we got a sell off on EURUSD and just today we hit the 50% correction level at around 1.08442 . After failing to break to the upside we can expect more sells to be in play. Any breaks to the downside from the current price will confirm this. Although TVC:DXY is not as strong at the moment, it still is a global reserve currency . We seen that in play last week when we saw massive upside on OANDA:XAUUSD and on TVC:DXY . We must understand that investors are also pouring their money into DXY as it is a global reserve currency. I still personally believe TVC:DXY holds more strength against TVC:EXY hence why I am still looking to short the pair.

Scenario 1: SELLS from current price

With the instant sell, we are risking a possible pullback and continuations to the upside however, DXY is looking like it will reverse. Failing to break to the upside can also be taken as a confirmation for potential sells.

Scenario 2: BUYS at the break of the Key Level (around 1.085)

With the break to the upside, we can expect more buys to come in play possibly targeting previous highs on EURUSD at around 1.09444.

KEY NOTES

- DXY possible reversal to the upside.

- Breaks above the KL and to the upside would confirm higher highs.

- EURUSD has completed the 50% correction to the upside.

- DXY is the global reserve currency.

Happy trading!

FxPocket

EURUSD ANALYSIS OVER H1 CHARTDate : 31 March 2025

Momentum : Up

First Scenario : long positions above 1.08295 with targets at 1.08557, 1.08746 and 1.08970

Second Scenario : short positions below 1.08295 with targets at 1.08054, 1.07842 and 1.07644

Comment : There is no clear trend in the price movement.

Supports and resistances :

1.08970 **

1.08746 *

1.08557

1.08290 - Last price

1.08054

1.07842 *

1.07644 **

Looking for a long term buying trend in EU according to my analysis.

EURUSD Weekly Candle RangeTrading is hard but it's simple.

On the 1W, EURUSD traded into a key zone and ended with a long wick, indicating a strong rejection. I'm looking to find entries in the wick area and targeting CRH for the rest of the week. Do have a lovely weekend. For me, I'd be looking at ETHUSDT 😅

EUR/USD: Uncertain Trajectory Amid Tariff - Induced JittersThe EUR/USD is trading at 1.0796. After a Thursday rebound from 1.0733 due to a weakening USD, it's now pressured at the intraday high of 1.0799.

US President Donald Trump's new 25% import taxes on cars and car parts, with potential additional levies on the eurozone and Canada, have stoked risk - off sentiment. This has led to a temporary dip in the US dollar's appeal.

On the daily chart, it's found buyers near the non - directional 200 - day SMA, with 1.0730 as dynamic support. It's attempting to break the bullish 20 - day SMA, while the 100 - day SMA is non - directional below the current level. The momentum indicator is flat below 100, and the RSI at 56 hints at upward risk, yet unconfirmed. Bulls should be cautious short - term.

In the 4 - hour chart, technicals are rising but below the mid - line. EUR/USD is fighting a bearish 20 - day SMA, and the 100 - day SMA has lost upward steam around 1.0840. A break above 1.0840 could bring back the bulls.

EURUSD

buy@1.08200-1.08500

tp:1.08900-1.09300

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EUR/USD Triple Bottom Reversal | Bullish Breakout SetupChart Overview

This is a EUR/USD 1-hour chart showing a classic Triple Bottom Reversal Pattern, a strong bullish reversal signal. The price has tested a key support level multiple times, forming three distinct bottoms, indicating that sellers are losing momentum while buyers are stepping in.

This setup suggests an upcoming breakout, with well-defined entry, take profit, and stop-loss levels to capitalize on the potential upward move.

Technical Breakdown

1. Support & Resistance Zones

Support Zone (Highlighted in Beige)

The price has tested this zone multiple times without breaking below, confirming strong buying interest.

Each time the price touched this level, it rebounded, indicating accumulation by buyers.

Resistance Zone (Highlighted in Beige)

The price previously reversed from this level, making it a key area to watch for a breakout.

A confirmed breakout above this resistance could trigger strong upward momentum.

2. Triple Bottom Formation

A Triple Bottom is a strong bullish reversal pattern. It consists of:

Bottom 1: First rejection from support.

Bottom 2: A retest of support with buyers defending the level.

Bottom 3: The final touch before an upward move, confirming the pattern.

This pattern signals that selling pressure is diminishing and buyers are preparing for a strong breakout.

3. Bullish Reversal & Breakout Zone

A breakout above the neckline resistance (around 1.0843) will confirm the pattern.

Traders should wait for a confirmed candle close above the resistance before entering a long position.

A retest of the breakout zone can provide an additional entry opportunity.

Trade Setup & Key Levels

🔹 Entry Strategy

Aggressive Entry: Enter at the breakout level (above 1.0843) with volume confirmation.

Conservative Entry: Wait for a breakout retest before entering long.

🎯 Take Profit Targets

TP1: 1.08868 (First resistance zone)

TP2: 1.09642 (Major resistance zone, strong price reaction expected)

❌ Stop Loss Placement

Stop Loss: Below 1.06786, under the support zone.

This ensures that if the price breaks below the key level, the trade is invalidated.

Market Sentiment & Expected Move

If the price breaks the resistance → Expect a strong bullish move toward TP1 and TP2.

If the price fails to break out → It may consolidate further or retest support.

Watch for increased volume on the breakout to confirm strength.

📌 Final Thoughts

This is a high-probability bullish setup based on a well-formed Triple Bottom Reversal pattern. Traders should monitor price action near the breakout zone and manage risk effectively with proper stop-loss placement.

Attention! Key Signals in the EUR/USD Exchange Rate TrendThe EUR/USD pair has traded with a soft tone for five consecutive trading days, and the decline has expanded to 1.0776, the lowest level since March 6. However, the broad weakness of the US dollar in the middle of the European session pushed the currency pair to turn upward.

In the short term, according to the 4-hour chart, although the possibility of further upward movement is low, the downside potential also seems limited. The EUR/USD found buying support around the bullish 100-day moving average but failed to break through the bearish 20-day moving average. Finally, although technical indicators show an upward trend, they remain in negative territory.

EURUSD Trading Strategy:

buy@1.08200-1.08500

tp:1.08900-1.09300

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EUR/USD 1H Chart Analysis – Falling Wedge Breakout StrategyOverview of the Chart

The EUR/USD 1-hour chart is forming a falling wedge pattern, which is a bullish reversal setup. This indicates that although the price has been trending downward, the selling pressure is weakening, and a breakout to the upside is becoming more likely.

Currently, the price has broken above the wedge, signaling potential trend reversal. However, traders should watch for a retest of the breakout level to confirm whether the price holds above the resistance-turned-support area before further upward movement.

Key Components of the Chart

1️⃣ Falling Wedge Pattern (Bullish Reversal Signal)

A falling wedge consists of two downward-sloping trendlines that converge, showing a narrowing price range. This pattern is formed when:

The price makes lower highs and lower lows, indicating a downtrend.

The slope of the lower trendline is less steep than the upper one, meaning sellers are losing momentum.

Eventually, the price breaks out above the upper trendline, confirming a bullish reversal.

2️⃣ Support & Resistance Levels

✅ Support Zone (Key Demand Area)

The price recently tested a strong support level (highlighted in beige), where buyers aggressively entered the market.

This level has held multiple times, indicating that buyers are stepping in whenever the price reaches this zone.

The green upward arrow suggests that this is a key accumulation area, where demand is stronger than supply.

🚫 Resistance Zone (Profit Target)

The resistance zone near 1.09450 is the first major target for bulls.

Historically, price action has struggled to break through this level, making it a logical place to take profits.

3️⃣ Breakout Confirmation & Retest

The price has successfully broken out above the falling wedge, which is a strong buy signal.

However, a retest of the breakout level (marked by the yellow circle) might occur before further bullish continuation.

If the price retests and holds above the previous resistance (now support), this will confirm the breakout and provide an additional buying opportunity.

Trade Execution Strategy

📌 Entry Point:

Enter a long trade after the breakout confirmation.

For conservative traders, waiting for a successful retest before entering can reduce risk.

📌 Stop-Loss Placement:

Place a stop loss just below the recent swing low at 1.07541 to limit downside risk.

This ensures that if the breakout fails, the trade is exited with minimal loss.

📌 Profit Target:

The first take-profit target is at 1.09450, the key resistance level.

If bullish momentum continues, traders can look for higher targets based on price action.

📌 Risk-to-Reward Ratio:

This setup provides a favorable risk-to-reward ratio, meaning that potential profits outweigh the risk taken on the trade.

Technical Indicators Supporting the Trade

📈 Trend Reversal Signals

The market has been in a downtrend, but the falling wedge signals a potential reversal.

A higher low after the breakout would further confirm the uptrend.

📊 Volume Confirmation

Ideally, a breakout should be accompanied by increased volume, showing strong buying pressure.

If volume is low, a false breakout could occur, requiring careful trade management.

🔍 Retest & Price Action

A retest of the breakout level should hold above the wedge to confirm bullish momentum.

If the price fails to hold and falls back below, the breakout may have been a fakeout, meaning traders should exit or wait for re-entry.

Risk Management & Trade Considerations

Always use a stop-loss to manage risk.

If the price fails to stay above the breakout level, consider exiting early.

Watch for external market factors such as news events or economic data releases, which can impact EUR/USD volatility.

Conclusion: Bullish Momentum is Building 🚀

This falling wedge breakout on the EUR/USD chart provides a high-probability long trade setup. As long as price holds above the breakout level, bullish continuation toward 1.09450 is expected. Traders should monitor price action carefully and adjust their positions accordingly to maximize gains while managing risks.

EUR/USD Technical Analysis – Potential Reversal SetupThe EUR/USD 1-hour chart displays a recent downtrend with a series of lower highs and lower lows, forming a bearish market structure. The Harmonic patterns such as the Bat suggest potential areas of reversal, aligning with Fibonacci retracement levels.

A Change of Character (ChoCh) at the latest low (XA 0.7872) signals a possible shift in trend. The presence of bullish reaction points, marked by green triangles and yellow circles, suggests buying pressure is increasing. Additionally, the projected upward trendlines indicate possible price targets at 1.08476 (T1) and 1.08885 (T2) .

The oscillators at the bottom indicate oversold conditions, reinforcing the likelihood of a bullish correction. However, confirmation via price action and volume is necessary before entering long positions. A break above key resistance levels would further validate the upside potential.

EURUSD Trading: Unveiling the Precise Strategy GuideAfter last week's decline, the euro against the US dollar started to recover at the beginning of this week and is currently trading within the positive range around 1.0850.

According to the Wall Street Journal, the White House is adjusting its tariff policy set to take effect on April 2nd. It may cancel a series of tariffs targeting specific industries and instead impose reciprocal tariffs on countries with significant trade relations with the US. Affected by this news, during the European morning session, US stock index futures rose by 0.8% to 1.0%.

On the 4 - hour chart in the European morning session on Monday, the Relative Strength Index (RSI) indicator climbed to 50, indicating that the recent bearish momentum has dissipated to some extent.

In terms of the upward direction, the 50 - period Simple Moving Average (SMA) forms an interim resistance level at 1.0880, followed by 1.0900. If the euro - US dollar pair can firmly stand above this level, the next resistance level may be at 1.0950.

EURUSD Trading Strategy:

buy@1.08200-1.08500

tp:1.08900-1.09300

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EUR/USD Falling Wedge Breakout – Professional Chart AnalysisOverview of the Chart

The EUR/USD 1-hour chart presents a bullish trading setup, featuring a well-defined falling wedge pattern, a trendline breakout, and a retest phase, signaling a potential upward move. The chart is marked with key technical elements such as support and resistance zones, breakout confirmation, and risk management parameters.

This analysis will break down each component of the chart, explaining the logic behind the setup and how traders can approach this opportunity.

1. Identified Chart Patterns

Falling Wedge Formation (Bullish Reversal Signal)

The price action formed a falling wedge, characterized by lower highs and lower lows, creating a narrowing price channel.

This pattern is typically a bullish reversal structure, as it indicates weakening selling pressure before an expected breakout.

The wedge’s downward movement ended with a strong breakout to the upside, signaling buyers regaining control.

2. Key Technical Levels

Support & Resistance Zones

Support Level (Buyers’ Stronghold)

The horizontal support level is a price area where buyers have previously stepped in, preventing further declines.

This level has been tested multiple times, reinforcing its strength as a key demand zone.

Resistance Zone (Profit Target Area)

The highlighted resistance zone represents a supply area where the price has struggled to move past in previous sessions.

The target price level aligns with this resistance, making it a realistic profit target for the long position.

3. Trendline Breakout Confirmation

Before forming the wedge, the chart shows an uptrend with a breakout above a trendline.

This trendline breakout was an early signal of bullish strength, aligning with the later wedge breakout.

After the breakout, the price came back for a retest, which is a key confirmation before further upward movement.

4. Retesting Phase Before the Upward Move

After breaking out of the wedge, the price returned to the breakout level to confirm support.

Retesting is a crucial validation step—if the price holds above this level, it increases the probability of a continued bullish move.

This retesting action provides a potential entry point for traders looking to go long.

5. Trade Setup & Risk Management Strategy

Trade Entry:

A buy entry is considered after the retest is confirmed (price holding above the breakout level).

Stop Loss Placement (Risk Control):

The stop loss is placed below the previous low at 1.07790, ensuring protection against fake breakouts or unexpected reversals.

Take Profit Target (Projected Price Move):

The target price is set at 1.09698, which aligns with previous resistance levels and the measured move from the wedge breakout.

This provides a strong risk-to-reward ratio, making the setup favorable for bullish traders.

6. Risk-Reward Ratio & Trade Viability

Risk: The distance between the entry point and the stop loss is relatively small, making it a low-risk trade.

Reward: The potential upside move is significantly higher than the risk, creating a high reward-to-risk ratio trade.

This type of technical confluence increases the probability of a successful trade, making it an attractive opportunity.

7. Conclusion & Trading Strategy

📌 Key Takeaways:

✅ The falling wedge breakout signals a bullish reversal.

✅ The trendline breakout and retest add further confirmation to the trade setup.

✅ The support and resistance zones provide a clear risk management strategy.

✅ The risk-reward ratio makes this an attractive long trade setup.

💡 Trading Plan:

🔹 Enter Long after retest confirmation above the breakout level.

🔹 Stop Loss: 1.07790 (below previous low).

🔹 Take Profit: 1.09698 (previous resistance zone).

Final Thoughts

This EUR/USD setup is a textbook example of a bullish reversal following a falling wedge breakout. Traders who patiently wait for a confirmed retest can capitalize on this high-probability trade setup, aiming for a strong bullish continuation.

🔹 Tags: #EURUSD #ForexTrading #TechnicalAnalysis #Breakout #PriceAction #TradingSetup #SupportResistance

EURUSDMy Trade Idea

My trade idea was simple:

If EUR/USD breaks above a key level, I will look for a retest and enter a long position after confirming the entry with candlestick confirmation.

If it breaks below, I will wait for a retest, confirm with a candlestick pattern, and enter a short position.

This is a very short-term trade, so I’ll skip if the setup doesn’t align. Follow for faster updates! 🚀