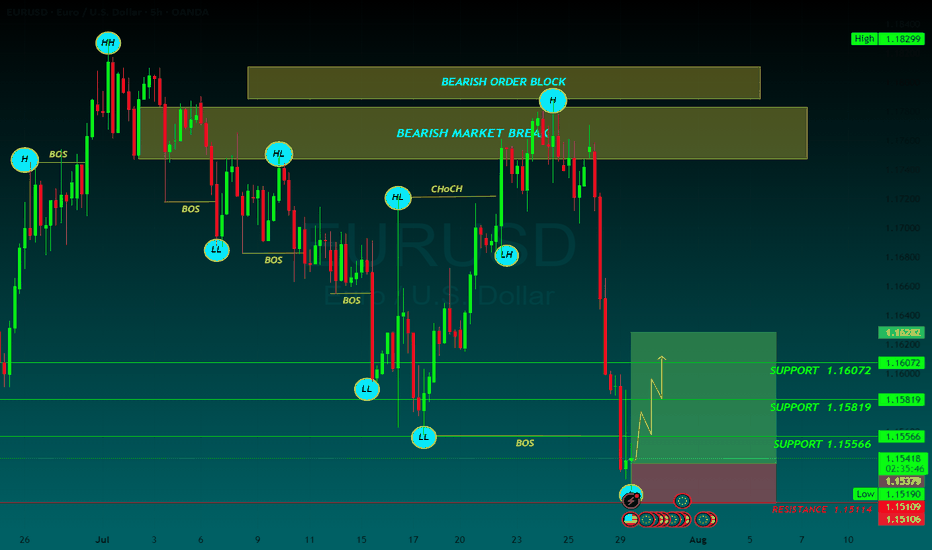

EURUSD BUYEUR/USD retreats below 1.1550 ahead of US data

EUR/USD finds it difficult to stage a rebound following Monday's sharp decline and trades in negative territory below 1.1550 on Tuesday. The US Dollar (USD) preserves its strength ahead of consumer sentiment and employment-related data releases, weighing on the pair.

From a technical point of view, the EUR/USD pair is poised to extend its slump. It keeps falling below a mildly bearish 20 Simple Moving Average (SMA), which provides dynamic resistance at around 1.1690. The 100 SMA, in the meantime, maintains its bullish slope, albeit partially losing its upward strength at around 1.1340. Finally, technical indicators keep heading south well below their midlines, and at multi-week lows, in line with a bearish extension ahead.

The near-term picture shows EUR/USD is oversold and may bounce or consolidate before the next directional move. In the 4-hour chart, technical indicators turned flat at extreme levels, yet it keeps developing below all its moving averages, which skews the risk to the downside. A firmly bearish 20 SMA is crossing below the 100 SMA and aims to extend its slide below a directionless 200 SMA, usually a sign of prevalent selling interest.

SUPPORT 1.15566

SUPPORT 1.15819

SUPPORT 1.15566

RESISTANCE 1.15114

Eurusdchart

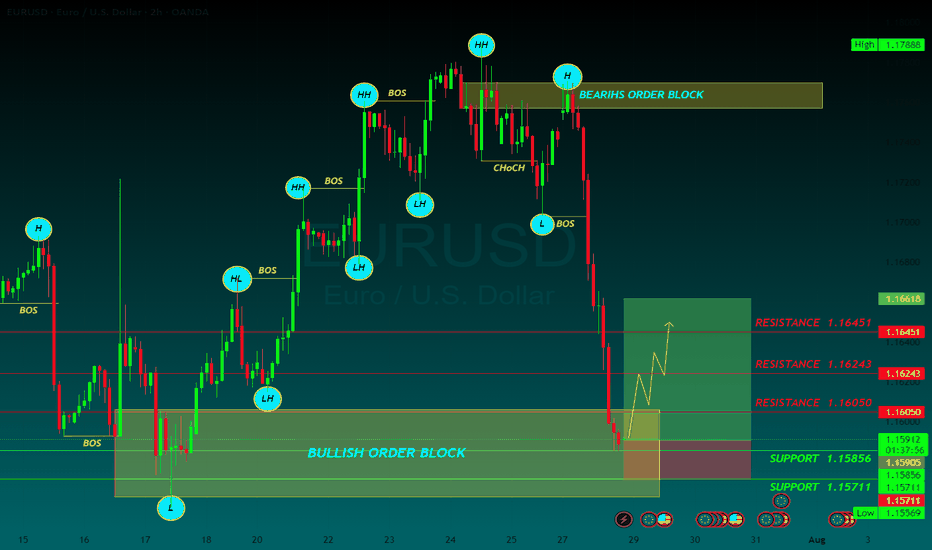

EURUSD BUYThe US Dollar (USD) gapped lower at the weekly opening amid optimism fueling demand for high-yielding assets, following news that the United States (US) and the European Union (EU) reached a trade deal.

The US and the EU agreed a 15% tariff on most European goods entering the US, much higher than the average 4.8% exporters face these days. No rates will apply to EU exports in important sectors, including aircraft parts, some chemicals, semiconductor equipment and some agricultural products.

The EU response to the headline was uneven. European Central Bank (ECB) policymaker Peter Kazimir said on Monday that the trade deal reduces uncertainty, but it is unclear for now how it impacts inflation. However, the French prime minister, François Bayrou, said the EU has capitulated to Donald Trump’s threats, adding it is a “dark day” for the EU. The trade focus now shifts to the US-China as officials from both countries resume talks in Stockholm.

The EUR/USD pair peaked at 1.1771 during Asian trading hours, but changed course early in Europe, with the USD surging across the FX board, resulting in the pair shedding over 100 pips.

The macroeconomic calendar had nothing relevant to offer at the beginning of the week, but will be flooded with first-tier releases, including US employment-related data ahead of the Nonfarm Payrolls report on Friday, the preliminary estimates of the Q2 Gross Domestic Product (GDP) for the US and the EU, and inflation updates. On top of that, the Federal Reserve (Fed) will announce its decision on monetary policy on Wednesday.

RESISTANCE 1.16050

RESISTANCE 1.16243

RESISTANCE 1.16451

SUPPORT 1.15856

SUPPORT 1.15711

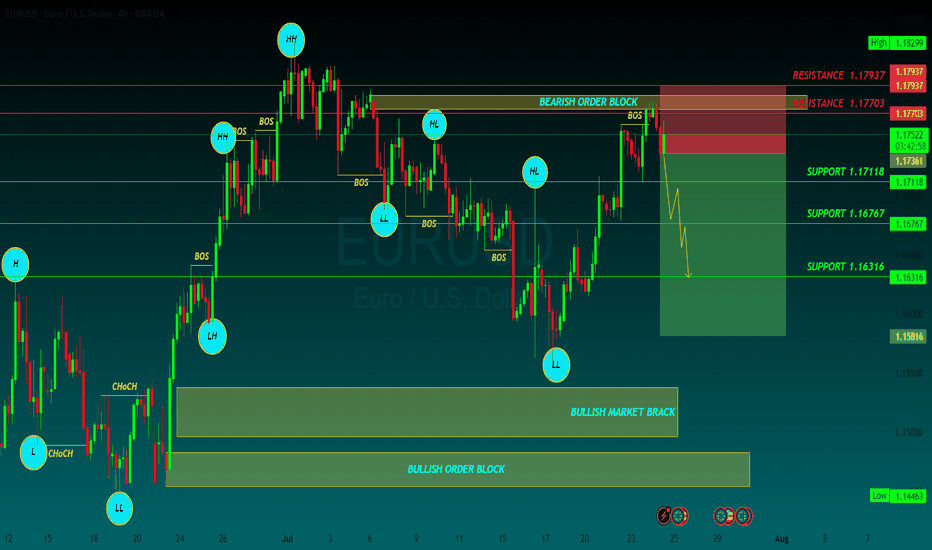

EURUSD SELLEUR/USD stays defensive below 1.1800 ahead of ECB decision

EUR/USD remains in a bullish consolidation mode below 1.1800 in European trading on Thursday. Traders refrain from placing fresh bets ahead of the European Central Bank policy announcements and the US preliminary PMI data. Mixed PMI data from Germany and the Eurozone failed to trigger a noticeable reaction.

The EUR/USD pair retreated from a fresh two-week peak at 1.1781 posted during Asian trading hours, hovering around 1.1750 ahead of the European Central Bank (ECB) monetary policy announcement. The US Dollar (USD) edged lower on the back of risk appetite, amid headlines indicating a trade deal between Japan and the United States (US).

US President Donald Trump announced in a post on social media a trade deal with Japan that sets "reciprocal" tariffs at 15% on Tuesday, while Japanese Prime Minister Shigeru Ishiba acknowledged the trade agreement on Wednesday, saying it would benefit both sides. Trump shifted his attention to the European Union (EU), noting that if the Union agrees to open up to US businesses, he will then charge lower levies.

Meanwhile, the Hamburg Commercial Bank (HCOB) published the preliminary estimates of the July Purchasing Managers’ Indexes (PMIs). European growth stands at its highest in almost a year according to the surveys, as the Composite PMI rose to 51.0 in July from 50.6 in Jun,e while beating expectations of 50.8.

As for the ECB, the central bank announced its decision to keep the benchmark rates on hold, as widely anticipated. The interest rate on the main refinancing operations, the interest rates on the marginal lending facility and the deposit facility stood at 2.15%, 2.4% and 2%, respectively. The headline had no impact on EUR/USD, which kept trading at around 1.1750.

Right afterwards, the US released Initial Jobless Claims for the week ended July 19, which improved to 217K from the 221K previously posted and the 227K anticipated. Coming up next is ECB President Christine Lagarde's press conference, and the US S&P Global preliminary July PMIs.

SUPPORT 1.17118

SUPPORT 1.16767

SUPPORT 1.16316

RESISTANCE 1.17937

RESISTANCE 1.17703

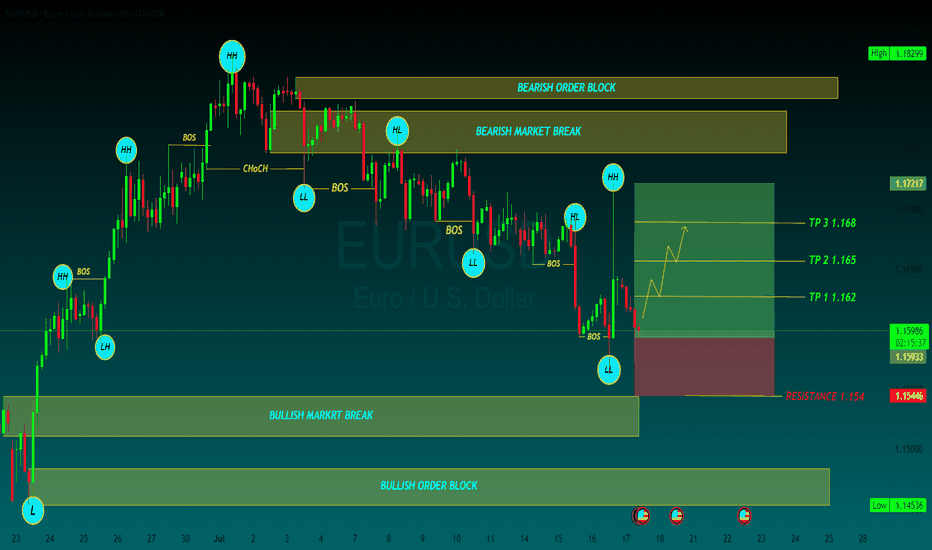

EURUSD BUYThe EUR/USD pair edged lower in the past week, settling a handful of pips below the 1.1700 mark, further retreating from the multi-year peak posted early in July at 1.1830. Financial markets kept revolving around the United States (US) President Donald Trump's targets. With geopolitical woes cooling down, Trump’s focus returned to tariffs, and the Federal Reserve’s (Fed) wait-and-see stance on monetary policy.

Trump fixated on tariffs and Powell

Since the week started, speculative interest kept their eyes on the July 9 tariffs deadline. Trump announced massive retaliatory levies on over 180 trading partners in May, quickly establishing a 90-day grace period afterwards. His goal was to clinch better trade deals with all these nations. But as the date loomed, deals were scarce. The US made some trade arrangements with some minor economies, such as Vietnam, but there were none with major counterparts, nor, of course, with China

TP 1 1.162

TP 2 1.165

TP 3 1.168

RESISTANCE 1.154

EUR/USD 2-Hour Chart Analysis2-hour performance of the Euro/U.S. Dollar (EUR/USD) currency pair, showing a recent decline with a change of -0.00134 (-0.12%) to a current value of 1.14676. The chart includes key levels such as a support zone around 1.14012-1.14457 and a resistance zone near 1.15000-1.15509. A breakout above the resistance could indicate a potential upward trend, as suggested by the highlighted area.

EUR/USD 4H Analysis – Bearish Breakdown Setup1. Market Structure & Trend

The EUR/USD chart shows a previous uptrend, confirmed by the ascending trendline, where the price made higher highs and higher lows. However, the trendline has now been broken, signaling a potential shift in market direction. The price is currently retracing from a key resistance zone, and a possible bearish continuation is expected.

2. Key Levels & Zones

✅ Resistance Zone (1.09563 - 1.1000):

This blue-shaded area represents a strong resistance level, where sellers have stepped in multiple times.

Price previously attempted to break this level but failed, forming a rejection.

This suggests buyers are losing strength, and sellers are likely to dominate.

✅ Support Level (1.0800 - 1.0780):

A critical support zone, which acted as a demand area in the past.

If price breaks below this level with strong bearish momentum, it confirms a trend reversal.

✅ Target Level (1.06870):

The next major downside target aligns with previous market structure and liquidity zones.

This area marks a key demand zone, where buyers might step in again.

3. Trade Setup & Execution Plan

🔹 Entry Strategy

A sell entry is ideal on a confirmed break and retest of the support zone at 1.0800.

If price retests this level and forms bearish rejection candles (such as pin bars or engulfing patterns), it strengthens the bearish bias.

🔹 Stop Loss & Risk Management

A stop loss should be placed above the resistance zone at 1.09563, ensuring a safe exit if the market reverses bullish.

Risk-to-Reward Ratio (RRR):

Entry: Below 1.0800 (after confirmation).

Stop Loss: Above 1.09563 (resistance zone).

Target: 1.06870 (support zone).

RRR: Around 1:3, meaning potential profit is three times the risk.

4. Confirmation Indicators & Confluences

✅ Bearish Trendline Break:

The ascending trendline has been broken, confirming a possible shift in trend.

✅ Support Flip:

If the price breaks support and retests it as resistance, it confirms bearish continuation.

✅ Price Action Candlestick Patterns:

Look for bearish engulfing candles, pin bars, or rejection wicks at key levels.

✅ Volume Analysis:

Increased selling pressure after support break indicates strong bearish momentum.

5. Final Thoughts & Bias

📉 Bias: Bearish (Unless resistance is reclaimed).

💡 Key Watch: Break and retest of 1.0800 support for confirmation.

⚠️ Risk Management: Always use a stop loss to manage risk effectively.

Conclusion

This setup presents a high-probability short trade with a clear entry, stop loss, and target. Traders should wait for confirmation signals before executing the trade. If price breaks above resistance, the bearish outlook is invalidated.

🔔 Stay cautious and trade with discipline! 🚀

EUR USD signal EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles. Confirm signal

EUR USD signal EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles. Confirm signal

EUR USD EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles.

eurusdEUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles

eurusd shortEUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles.

EUR/USD is recovering ground toward 1.0700 in the Asian session on Monday. The pair regains lost footing, as markets remain upbeat and weigh negatively on the safe-haven US Dollar. Markets reposition ahead of key Eurozone and US data due later this week.

EUR USD long Target This is the Forex quote for the Euro versus the Australian Dollar. In this quote, the value of one Euro ('base currency') is quoted in terms of the Australian Dollar ('counter currency'). EUR/AUD reached its lows in the midst of the European sovereign debt crisis in 2012, when it hit A$1.1619. Since mid-July 2012, the pair has recovered mainly due to the European Central Bank's policy of Outright Monetary Transactions (OMT), the 'whatever it takes' measure that ECB President Draghi threatened in August 2012.

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

The Relative Strength Index (RSI) indicator on the 4-hour chart recovered toward 50, reflecting a loss of bearish momentum. On the upside, 1.0700 (50-period Simple Moving Average (SMA), static level) aligns as first resistance before 1.0730 (static level) and 1.0750 (100-period SMA).

Confirm long Target

eurusd sellEUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

The Relative Strength Index (RSI) indicator on the 4-hour chart recovered toward 50, reflecting a loss of bearish momentum. On the upside, 1.0700 (50-period Simple Moving Average (SMA), static level) aligns as first resistance before 1.0730 (static level) and 1.0750 (100-period SMA).

Supports are located at 1.0600 (psychological level, static level) before 1.0530 (static level from November).

EURUSD This is the Forex quote for the Euro versus the Australian Dollar. In this quote, the value of one Euro ('base currency') is quoted in terms of the Australian Dollar ('counter currency'). EUR/AUD reached its lows in the midst of the European sovereign debt crisis in 2012, when it hit A$1.1619. Since mid-July 2012, the pair has recovered mainly due to the European Central Bank's policy of Outright Monetary Transactions (OMT), the 'whatever it takes' measure that ECB President Draghi threatened in August 2012.

The EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session. The recovery of that major pair is bolstered by renewed selling pressure in the US Dollar and a risk-friendly environment.

Eurusd EUR/USD continues to lose ground for the sixth successive session, trading near 1.0610 during the Asian hours on Tuesday. The elevated US Dollar is exerting pressure on the pair, potentially influenced by the higher US Treasury yields.

On the upside, EUR/USD is projected to find early resistance at the key 200-day SMA of 1.0827, ahead of the April top of 1.0885 (April 9), followed by the March peak of 1.0981 (March 8) and the weekly high of 1.0998 (January 11), all preceding the psychological barrier of 1.1000. Further advances from here could challenge the December 2023 top of 1.1139 (December 28).

The breakdown of the 2024 low of 1.0621 (April 15) could put a probable visit to the November 2023 low of 1.0516 (November 1) back on the radar prior to the weekly low of 1.0495 (October 13, 2023), the 2023 bottom of 1.0448 (October 3), and the round milestone of 1.0400.

EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles.

Confirm Chart

Eurusd long Target EUR/USD stays under heavy bearish pressure and trades at its lowest level since November below 1.0650. Divergent ECB-Fed policy outlooks and the risk-averse market atmosphere keep the US Dollar strongly bid and weigh on the pair.

1.0700 (static level, former 2024-low support) aligns as first resistance for EUR/USD. In case the pair stabilizes above that level, 1.0730 (static level) and 1.0770 (static level) could be seen as next hurdles.

On the downside, 1.0660 (static level from

On the downside, 1.0660 (static level from November) could be seen as next support before 1.0600 (psychological level) and 1.0550 (static level from October).

EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles.

eurusd long EUR/USD managed to erase a portion of its daily losses after falling below 1.0800 with the immediate reaction to the US jobs report, which showed an increase of 303,000 in Nonfarm Payrolls in March.

EUR/USD erased its daily gains and closed flat on Thursday after climbing to its highest level since March 21 above 1.0870. The pair fluctuates in a tight channel below 1.0850 in the early European session on Friday as investors gear up for the US labor market data.

Hawkish comments from Federal Reserve (Fed) officials and the negative shift seen in risk mood helped the US Dollar (USD) stage a rebound in the American session on Thursday.

EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles. confirm signal eurusd

Eurusd sell confirm signal EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles.

Confirm Chart sell

Eurusd sell signal

Eurusd Short EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles. Confirm Chart sell

eurusd EUR/USD is trading near 1.0850, recovering ground in the early European session on Tuesday. A fresh leg down in the US Dollar exerts downside pressure on the pair amid an improvement in risk sentiment. Mid-tier US economic data and ECB-speak eyed.

he Relative Strength Index (RSI) indicator on the 4-hour chart recovered to 50, reflecting a loss of bearish momentum. On the upside, 1.0860 (Fibonacci 38.2% retracement of the latest uptrend) aligns as first resistance before 1.0890-1.0900, where the 100-period Simple Moving Average (SMA) and the Fibonacci 23.6% retracement level align.

Immediate support is located at 1.0840-1.0830 (200-period SMA, Fibonacci 50% retracement) ahead of 1.0800 (Fibonacci 61.8% retracement).

EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles.

Eurusd sell EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles.

EUR/USD preserves its recovery momentum and rises toward 1.0850 on Monday. In the absence of high-tier data releases, the US Dollar struggles to build on the previous week's gains and helps the pair edge higher as investors assess comments from central bankers.