Eurusddaily

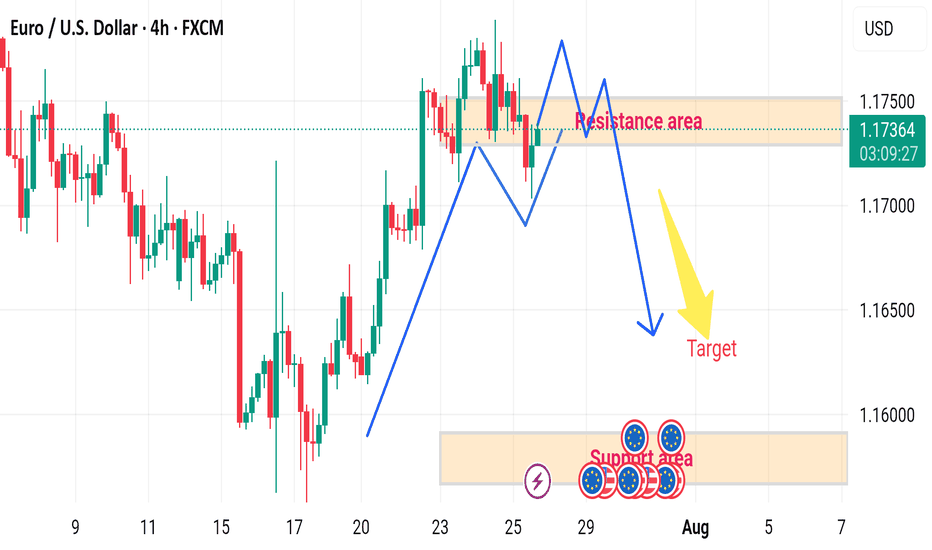

EUR/USD H4 DOWNWARD 🔄 Disrupted EUR/USD 4H Analysis

🟢 Current Context:

Price is currently at 1.17375, slightly below the resistance area (1.17400–1.17500).

Market shows a recent bullish impulse, followed by consolidation within the marked resistance zone.

Projection in the image suggests a double-top pattern forming at resistance, followed by a bearish reversal toward the target demand area (~1.15800–1.16000).

---

⚠️ Disruption Points:

1️⃣ Failed Double Top Scenario

Disruption Hypothesis: Instead of forming a clean double top and reversing, price may break above the resistance zone at 1.17500.

Reasoning: Strong bullish momentum and recent higher highs indicate potential for bullish continuation, invalidating the bearish target.

Disrupted Path: Price could break out → retest the resistance as new support → continue toward 1.18000–1.18300 zone.

2️⃣ Mid-Range Liquidity Trap

The current range may act as a liquidity trap:

Smart money could push the price slightly below support (fake breakdown), attract sellers, then reverse sharply upwards.

This would trap retail sellers targeting the 1.15800 zone.

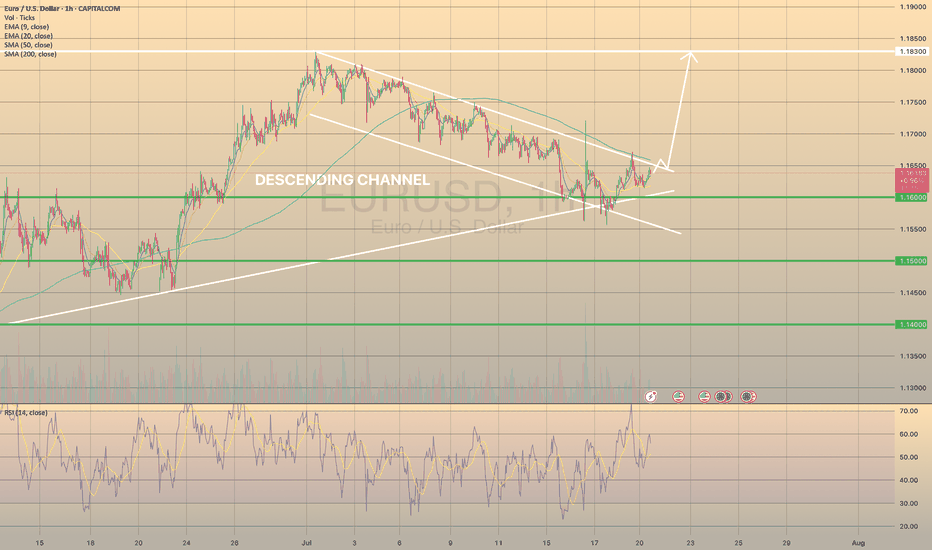

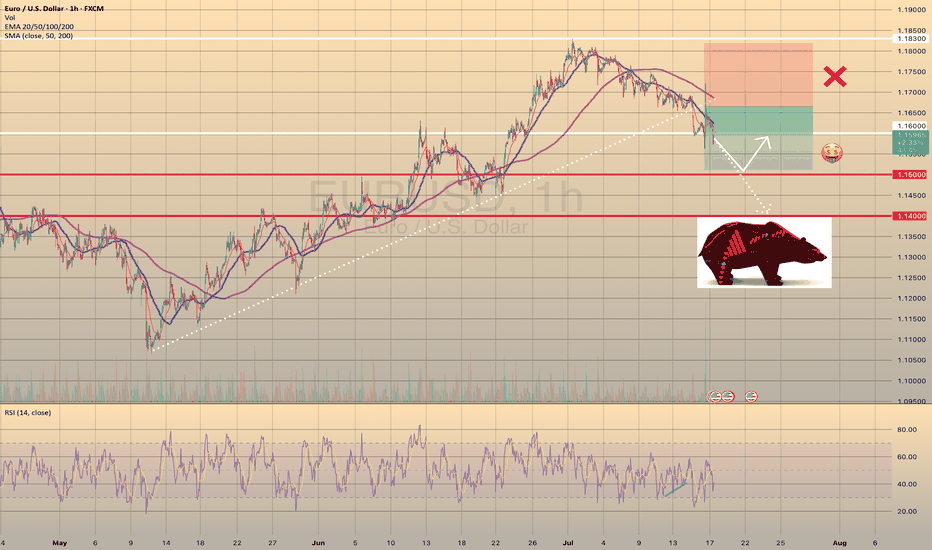

EURUSD FOUND SUPPORT, READY TO BREAK THE CHANNELEURUSD FOUND SUPPORT, READY TO BREAK THE CHANNEL🔥

EURUSD has been trading within the descending channel since the beginning of the descending channel. Recently the price reached the major trendline, graph started to show the bullish divergence on the RSI .

What is a bullish divergence?

A technical analysis pattern where the price makes lower lows, but a momentum indicator (e.g., RSI, MACD) forms higher lows, signaling weakening bearish momentum and a potential trend reversal upward.

So, another hike in this pair is expected. Possible direction: spike towards the SMA200, minor pullback and a further development of the bullish impulse.

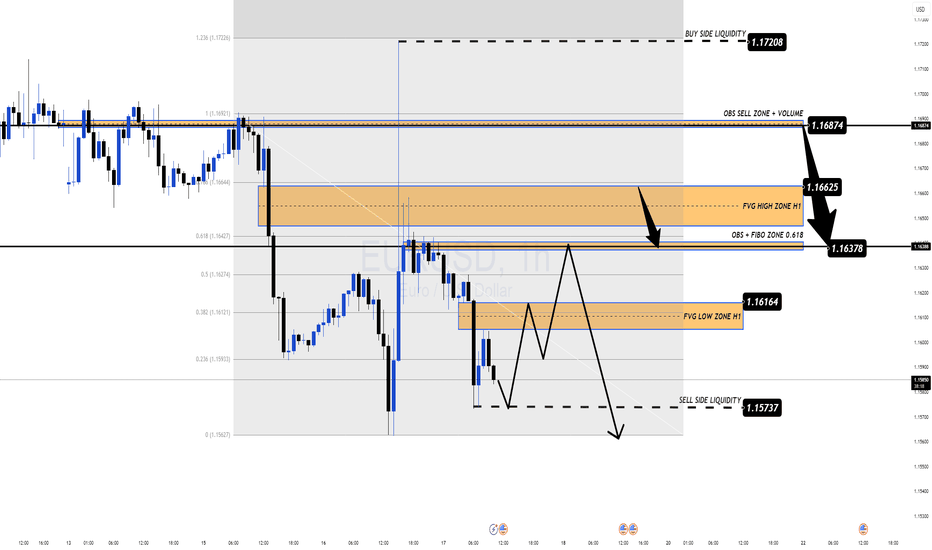

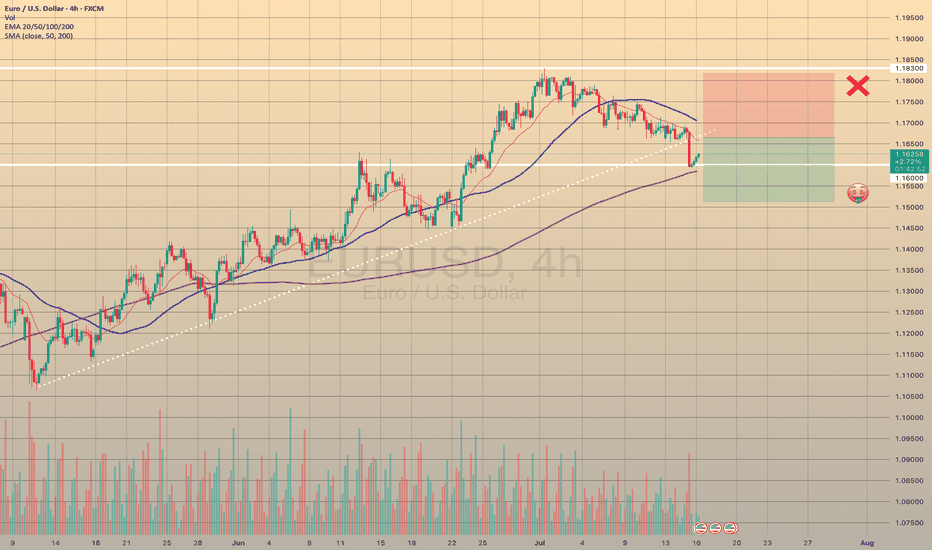

EUR/USD Forecast – Bears in Control Ahead of US Jobless DataEUR/USD Forecast – Bears in Control Ahead of US Jobless Data

🌐 Macro View: Dollar Regains Strength Amid Uncertainty

EUR/USD remains under selling pressure as the greenback finds renewed strength following midweek weakness. The market is bracing for fresh U.S. jobless claims data, expected to show a slight rise to 235K. A print below 220K could reignite USD demand, while a surprise above 240K may offer a temporary lifeline for the euro.

Amid geopolitical and economic turbulence, the euro continues to underperform as investors shift to the dollar for safety and yield advantage.

📉 Technical Outlook – MMF & Smart Money Perspective

The recent breakdown below 1.1600 confirms the bearish momentum. Based on the MMF (Market Momentum Flow) methodology, price action is currently moving within a controlled distribution structure, suggesting further downside potential.

Key zones identified from H1 structure:

OBS + FVG High Zone (1.1662 – 1.1687): Strong supply zone + volume imbalance.

1.1637: Mid-key level and possible liquidity magnet.

1.1616 – 1.1573: Ideal area for sweeping sell-side liquidity before any sustainable bounce.

If price reclaims 1.1662, intraday bullish correction may be in play. However, as long as 1.1687 holds, bears remain in control.

🧭 Trade Plan for Today

🔴 SELL ZONE: 1.1662 – 1.1687 (FVG + OBS Volume Zone)

SL: 1.1710

TP: 1.1637 → 1.1616 → 1.1590 → 1.1573

✅ Preferred entry zone aligned with high-volume imbalance & MMF rejection pattern.

🟢 BUY ZONE (Scalp Only): 1.1575 – 1.1580 (Sell-side Liquidity Zone)

SL: 1.1550

TP: 1.1612 → 1.1630 → 1.1645

⚠️ Use with caution — only upon clear price reaction at lower liquidity sweep area.

🔍 Strategy Insight

This is a classic scenario of a controlled pullback within a larger bearish structure. Patience is key — let price tap into imbalanced zones before executing. Given today's U.S. data, volatility may spike during the New York session, so risk management is crucial.

💬 What’s Your Take?

Do you expect EUR/USD to retest the 1.1550s zone, or could a surprise from U.S. job data flip the narrative?

👇 Drop your analysis below & follow for more MMF-based setups.

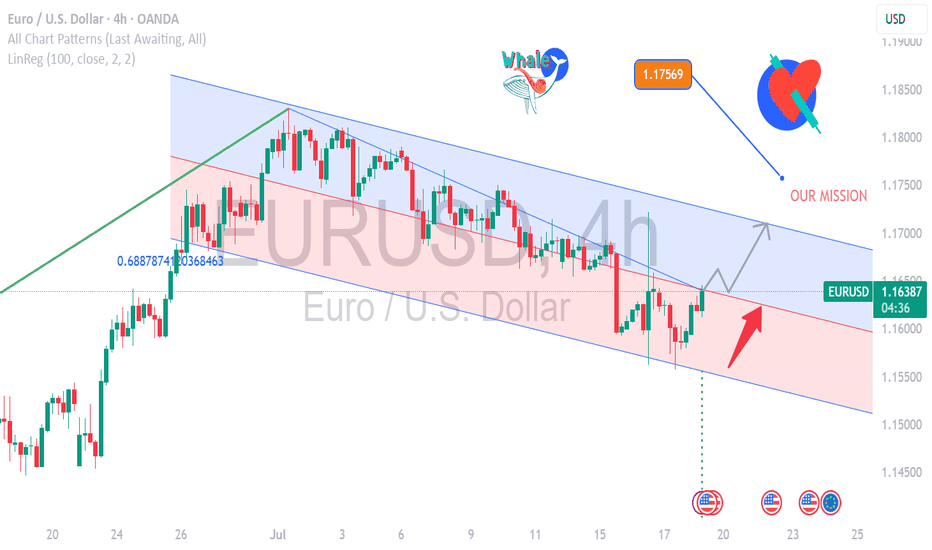

EUR/USD Flexing Strength- Is the Next Big Coming? EUR/USD Market Update – Bullish Setup at 1.16440

EUR/USD is trading around 1.16440, maintaining its bullish momentum in the current uptrend.

🔹 Current Price: 1.16440

🔹 Support Zone: 1.1600 – 1.1620

🔹 Resistance Zone: 1.1680 – 1.1700

🔹 Trend: Strong bullish structure with clear upward momentum

The pair is holding above key support and aiming for the next resistance at 1.1700. A breakout above this level could open the door to further upside. Traders watching for a retest near support or breakout entry above resistance.

🎯 Trading Plan:

Buy on dips above 1.1620 or wait for a confirmed breakout above 1.1680 with volume.

#EURUSD #ForexAnalysis #BullishSetup #ResistanceSupport #TechnicalAnalysis #PriceAction #TrendTrading #SmartTrader #FXSignals

EURUSD - BEARISH TREND CONTINUESEURUSD - BEARISH TREND CONTINUES📉

On Tuesday, despite the bullish divergence (highlighted as green on RSI), the price broke through the trendline, formed since the beginning of May. Yesterday this trendline got retested on Bloomberg's rumor that Powell may resign. Currently the price is going through the support level of 1.16000.

I see the major way is to go towards 1.15000 support level with a further rebound and possible target of 1.16000. Another option is to go straight towards 1.14000. Will see.

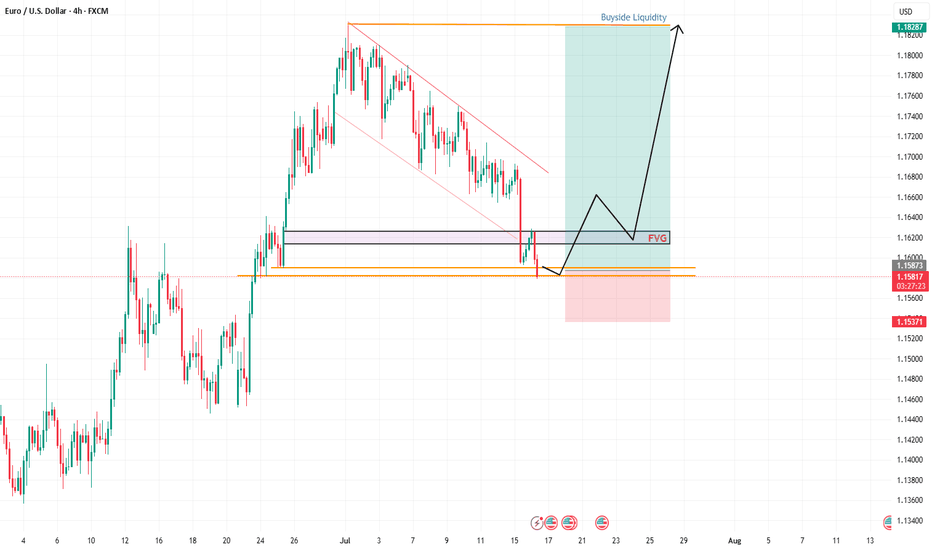

EU's Wild Drop: A Sneaky Trap or Reversal Time?Hey Fellow Traders! 😎

What a ride yesterday, right? The EUR/USD took a massive plunge, smashing through the descending channel like a wrecking ball and sweeping up all that liquidity. 💥 But hold up—was that just a clever market manipulation to shake out the bulls? I think so! 🧠

Right now, the price is chilling in a Daily Fair Value Gap (FVG), and I’m expecting some serious action here. This could be the perfect setup for a reversal! The market makers pulled a fast one—tricking bullish traders into flipping bearish after that dramatic drop. But guess what? That’s the trap! 🕸️ Don’t fall for it.

I’m eyeing a long entry right at this level. Here’s the plan:

Entry: Right now—let’s catch this wave! 🌊

Stop Loss: Set it tight around 1.15360 to keep risk in check.

Take Profit: Aiming for those juicy highs (check the chart I shared in my last post for the exact levels). 📈

This setup is screaming opportunity, so let’s talk about it! 💬 What’s your take—are we reversing or is the market still playing games? Drop your thoughts below, smash that Like button if you’re with me, and Follow for more trade ideas! 🚀 Let’s keep the community buzzing. 🐝

#Trading #EURUSD #MarketAnalysis #ReversalSetup

EURUSD TRIGGERED STOP LOSSTRADING IDEA UPDATE - EURUSD TRIGGERED STOP LOSS

The U.S. CPI report data came out right what the market expected (2.7% vs. 2.7% annually). After this report the pair went downwards on increased volume, triggering my stop loss and found the support only on 4-h sma200 and 1.16000 level.

What will be the possible scenario next?

I assume that the asset will go testing the trendline at 1.16650. If the test is successful, I will consider opening a

🔽 a pending sell stop order at 1.16651 with

❌a stop loss at 1.18180 and

🤑a take profit at 1.15122

Only if the retest is successful, not earlier! Let's observe first. Additionally, today is the U.S. PPI report coming out at 12:30 p.m. UTC, so got to be careful around this time

EURUSD SEEMS TO FIND SUPPORT

TRADING IDEA UPDATE - EURUSD SEEMS TO FIND SUPPORT🦾

EURUSD seems to find support on a trendline and shows us divergence on RSI on 1-h timeframe. So, I decided to close my trade in advance before my stop loss gets triggered and open long position with a

🔼 a market buy order at 1.16833 with

❌a stop loss at 1.16324 and

🤑a take profit at 1.18266

Additionally, today is the U.S. CPI report data coming out. Market expects the annual inflation to be around 2.7%. Me, personally, think that actual June inflation will be a bit lower, which may provide some fundamental support to the EURUSD. Will see.

EURUSD - OPPORTUNITY TO PLAY BOTH SIDES OF DESCENDING CHANNEL CMCMARKETS:EURUSD

TRADING IDEA - EURUSD MOVES WITHIN A DESCENDING CHANNEL - OPPORTUNITY TO PLAY BOTH SIDES

EURUSD has been trading within a descending channel since the beginning of the month. Nearby the upper border of the channel there is SMA200 on a 30-m timeframe, pushing on the pair. Generally speaking, all major moving averages are pushing on the EURUSD, the short-term bearish trend continues, so I decided to open

🔽 a market sell order at 1.16688 with

❌a stop loss at 1.16985 and

🤑a take profit at 1.16324

Later I expect a rebound from the lower border with a potential uprise towards upper border of the descending channel.

EURUSD H4 RISES 🔄 Disrupted EUR/USD Analysis (4H)

📉 Current Structure:

Price is hovering around 1.17298, showing hesitation at the resistance of a potential bearish flag.

While the chart labels this zone as “bullish,” there are signs of market indecision, possibly a fakeout trap.

⚠️ Key Disruptions:

1. Bullish Trap Risk:

The price formed a short-term M-pattern (double top inside the orange circle), indicating bearish exhaustion rather than continuation.

The expected breakout to the upside may fail if bulls don’t sustain volume.

2. Support Area Weakness:

The support zone around 1.17000 has been tested multiple times. If it breaks, it could turn into a strong resistance, flipping the sentiment.

3. Macro Influence:

Upcoming EUR and USD economic events (noted by icons) could cause high volatility and break structure unexpectedly.

A strong USD report could reverse bullish momentum, sending EUR/USD toward 1.16500 or lower.

4. Bearish Continuation Scenario:

If the market breaks down from the current consolidation, expect targets at:

Buying opportunities on EURUSDYesterday, EURUSD touched the support level at 1,1683 and bounced off it.

This opens up the potential for a new bullish move and buying opportunities.

We may see another test of the support zone, but the overall trend remains unchanged.

The next resistance levels are 1,1813 and 1,1916!

EUR/JPY Potential Bullish ContinuationEUR/JPY Potential Bullish Continuation 📈🔍

📊 Technical Overview:

The EUR/JPY chart presents a bullish channel structure, indicating an overall upward trend. Price action respected the channel boundaries with multiple confirmations before the latest bearish correction.

🔹 Structure Highlights:

🔵 Ascending Channel: Price moved steadily within an upward-sloping channel.

🟠 Support Rebound: A strong bullish candle formed on June 20th after touching the lower boundary — a clear support confirmation.

🔴 Recent Rejection: On July 1st, price tested the upper channel resistance and faced rejection, forming a bearish engulfing candle.

🟫 Support Zone Marked: Around the 167.800 level, this zone has been tested multiple times, indicating a possible demand area.

🔁 Current Scenario:

The pair has broken down from the internal trendline (light brown line) and is heading toward the support zone. A bullish bounce from this area may lead to a rally toward the Target Point at ~172.000 🎯.

📌 Key Levels:

Support Zone: 167.600 – 168.000

Resistance Zone: 170.500 – 172.000

Current Price: 168.994

📈 Outlook:

If support holds and bullish momentum returns, there's potential for a move toward the target area at the top of the channel. However, a break below the support zone could invalidate the bullish scenario and suggest a deeper correction.

🧠 Conclusion:

Wait for bullish confirmation near support before considering long positions. A clean break and retest of the support zone could signal a continuation of the upward trend.

EUR/USD Bullish Continuation Analysis EUR/USD Bullish Continuation Analysis 🚀💶

📊 Chart Summary:

The EUR/USD pair is demonstrating a strong bullish structure with consistent higher highs and higher lows. Recent price action shows a breakout above the 1.16386 resistance level, now acting as support 🛡️. The market is currently retracing and might retest this new support zone before continuing its upward move toward the target.

🔍 Key Observations:

🔸 Bullish Structure:

Multiple bullish impulses have formed a clean staircase pattern (🔼⬆️), indicating sustained buying momentum.

🔸 Support Zone 🟦 (1.13200 - 1.14000):

This zone has been tested multiple times, confirming its strength and the base of this bullish rally.

🔸 Breakout & Retest 🟠:

Price broke above the 1.16386 resistance level, pulled back slightly (highlighted by the orange circle), and now looks ready for a potential continuation to the upside.

🔸 Target 🎯: 1.18010

A clear target has been set based on measured move or resistance projection. If the price respects the current structure, we may see a continuation toward this level.

✅ Trade Outlook:

Bias: Bullish 📈

Entry Zone: Around 1.16386 (upon bullish confirmation)

Target 🎯: 1.18010

Invalidation ❌: Break below 1.1600 with bearish momentum

🧠 Technical Tip:

Always wait for confirmation on the retest before entering. Wick rejections or bullish engulfing candles at the support zone can provide additional entry confidence. 🔍✅

EUR/USD 4-Hour Chart Analysis (ONDA)Euro/US Dollar (EUR/USD) exchange rate over a 4-hour interval, sourced from ONDA. The current rate is 1.16177, reflecting a 0.08% increase (+0.00093). The chart highlights a recent upward trend, with a resistance level around 1.16746 and a support zone between 1.15439 and 1.16000, as indicated by the shaded areas. The time frame covers late June to early July 2025.

EUR/USD 2-Hour Chart Analysis2-hour candlestick chart for the Euro/U.S. Dollar (EUR/USD) currency pair, sourced from OANDA, as of June 23, 2025. The current exchange rate is 1.14705, reflecting a 0.45% decrease (-0.00517). The chart highlights recent price movements, with a marked resistance zone around 1.15218 and a support zone near 1.14483. An upward trend is indicated with an arrow, suggesting potential price action toward the resistance level.

EURUSD -> Bullish Idea 22/06/2025(ICT x Volume Profile)OANDA:EURUSD 🎯 Bias: Bullish

🕒 Timeframe: H1 primary, H15 confirmation

Happy sunday traders!

Following President Trump’s strikes on Iran, I expect an initial bearish reaction in the Asian and London Sessions, then a bullish reaction in the NY sessions as sellers push the USD lower. However, the prevailing trend context remains bullish: the hourly chart has shifted structure (MSS) and broke structure to the upside. I anticipate a liquidity sweep below the recent lows, before a retracement into the 15-minute fair value gap (FVG) which aligns with the volume profile, then continuation higher to target the weak high and into the swing highs marked.

Chartanalyse: Der Chart zeigt eine Seitwärtskonsolidierung mitTechnical Overview:

The EUR/USD chart exhibits signs of a bearish reversal pattern forming near a key resistance zone (1.15800 - 1.16000), highlighted with repeated rejection wicks (🔴 red arrows). Price is currently trading at 1.15222, after failing to hold above the neckline of the rounded bottom pattern.

🔍 Key Observations:

🔺 Resistance Zone: Strong resistance has been confirmed multiple times (red arrows), indicating sellers are active at the top.

🟠 Double Top / Head & Shoulders Behavior: Price action shows topping formations (highlighted with orange circles), suggesting exhaustion of bullish momentum.

📉 Bearish Breakdown Possibility:

Price rejected near neckline and is showing bearish candle formations.

Breakdown from the current consolidation zone could push price toward the target zone at 1.14491, marked in purple.

This aligns with previous support structure, reinforcing a technical downside projection.

🔻 Support Zone: Around 1.13800 - 1.14000 is a strong area of demand and may act as the next bounce point if the bearish move continues.

📐 Chart Pattern Structure:

Rounded bottom formed earlier, but the failure to continue higher and breakout suggests a false breakout trap for buyers.

Downward sloping trendline broke, but now price is struggling to sustain above previous highs.

📌 Conclusion:

⚠️ Caution for bulls as price shows signs of weakness at resistance. A move below 1.15000 may initiate further downside toward 1.14491 and possibly lower. Short-term traders can watch for confirmation candles near this zone for entries.

📅 Short-Term Bias: Bearish

🎯 Target: 1.14491

⛔️ Invalidation: Strong breakout above 1.16000

EUR/USD Bullish Reversal Breakout Pattern Technical Analysis Summary:

The chart illustrates a strong bullish reversal pattern forming on the EUR/USD pair:

🔹 Double Bottom Formation (🔶🔶):

Two clear bottom zones are marked with orange circles near the 1.14400–1.14500 area, indicating strong buying interest and support.

The second bottom confirms the double bottom pattern, often a precursor to an upward trend.

🔹 Support Zone (📉):

Firm support around 1.14450, as highlighted on the chart.

Price has respected this zone twice, bouncing back with bullish momentum each time.

🔹 Neckline Breakout (🔼):

Price is approaching the neckline zone at 1.16087, which acts as the bullish target.

A break and close above this neckline will confirm the reversal and open the way toward the resistance zone around 1.16500.

🔹 Projected Move (🎯):

If the neckline breaks, price is expected to surge towards 1.16500, aligning with the historical resistance.

This move completes the measured target projection from the double bottom structure.

🔹 Bullish Structure:

Higher lows and strong bullish candles are reinforcing the uptrend momentum.

Curved trajectory shows accumulation followed by a breakout phase.

📌 Key Levels to Watch:

Support: 1.14450 – 1.14500

Neckline/Target: 1.16087

Resistance: 1.16500

🛑 Invalidation:

A strong breakdown below support (1.14450) would invalidate this bullish setup.

EUR/USD Potential Reversal from Resistance Zone –Bearish OutlookThe EUR/USD pair has been trading within a well-defined ascending channel for several weeks. Price recently tested a strong resistance zone near 1.15850 – 1.16000, which aligns with the upper boundary of the channel and a previously marked supply area.

Key observations:

The price action shows signs of rejection from the resistance zone with a potential double-top or fakeout pattern forming.

A projected bearish trajectory is marked, suggesting a possible break below the channel support.

Immediate bearish targets are set at key demand zones around 1.14500, 1.12500, and further down to 1.10500.

A large red arrow indicates the strong downside bias if the price confirms the breakdown.

Conclusion:

If EUR/USD fails to sustain above the 1.15850 resistance zone and breaks below the ascending channel, a strong bearish correction is anticipated. Traders should watch for confirmation of the breakdown before entering short positions.

EUR/USD Bearish Reversal AnalysisEUR/USD Bearish Reversal Analysis 📉🧭

🔍 Technical Breakdown:

Trend Structure:

EUR/USD was trading inside an ascending channel, respecting both support and resistance trendlines.

🔴 Double Rejection at Resistance:

Price action faced strong rejection near the upper boundary of the channel and resistance zone (~1.16500), forming a lower high, suggesting bearish exhaustion.

🟠 Key Breakdown Zone:

A critical horizontal support around 1.13560 has been identified as a short-term target zone. This level previously acted as a demand zone and now may be retested.

🔽 Forecast Path:

A projected bearish wave is anticipated:

A potential pullback or consolidation may occur before resuming the downtrend.

Once 1.13560 is broken, price could drop further toward the major support zone around 1.12000, marked by the previous accumulation area.

🟦 Support Zone:

This final target aligns with a major structural support from late May, strengthening the bearish outlook if the breakdown continues.

📌 Conclusion:

EUR/USD is showing signs of a bearish reversal after failing to sustain above resistance. As long as it remains below the mid-channel region, further downside toward 1.12000 is likely, with 1.13560 as the key short-term level to watch.