EUR/USD Breaks Daily Lows as Consolidation DeepensFenzoFx—EUR/USD consolidates after the impulsive bullish momentum. The uptrend initiated after the price swept below the monthly lows at $1.1400. In the current trading session, the price dipped below the previous day's low, meaning the consolidation period will likely extend to a lower support level.

The immediate resistance is at the previous day's high, the $1.159 resistance. From a technical perspective, we expect the currency pair to trade lower, near the support at $1.146, the bullish break of structure.

This level can provide a discounted price to join the dominant trend, which is bullish. We expect the Euro to rise toward $1.169 after the end of the consolidation period.

Eurusdforecast

EURUSD possible bearish for 1.1490#EURUSD failed to form higher high and higher low to continue bullish trend. eurusd made a high on 1st July 1.1830, then price started retrace downside. 7th July daily bearish engulfing candle formed , early indication for selling. 23rd July price moved up side to test supply zone. Price did not break high of bearish engulfing candle and fall back. Price started heavily fall and broke recent supply level 1.1557 and form Lower High that is indication for trend reversal.

1.1738-70 ideal level for selling which is daily supply zone. stop loss above 1.1770 i.e. 1780-1.1800. target: 1.1490 and even may expect further down.

EUR/USD at Discount Level: Bullish Setup in FocusFenzoFx—EUR/USD bearish momentum extended to $1.154, the lower line of the flag. This is a support area backed by the Bullish FVG.

The immediate resistance is at $1.157. From a technical perspective, a close above this level can trigger an uptrend, targeting the bearish FVG at approximately $1.170 to $1.175.

Please note that the bullish outlook should be invalidated if EUR/USD falls below the main support level at $1.145.

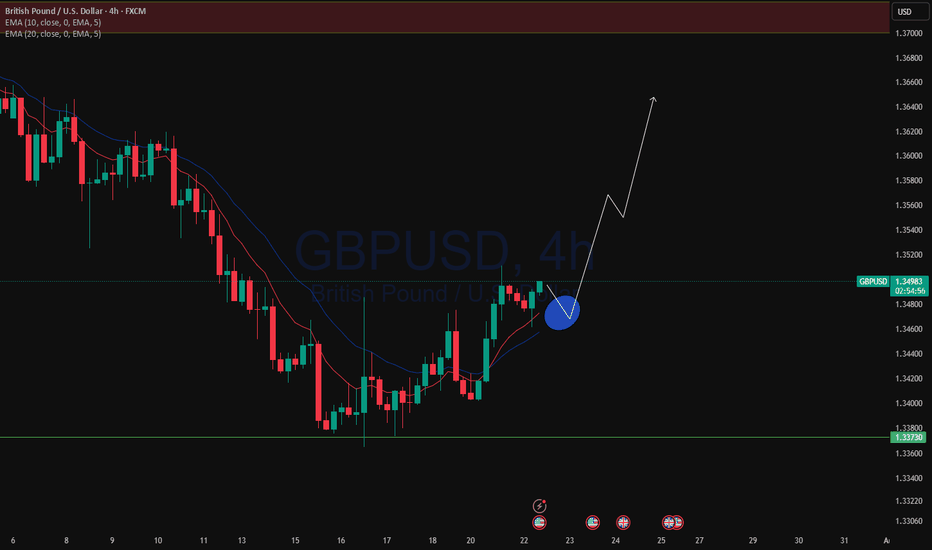

EURUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

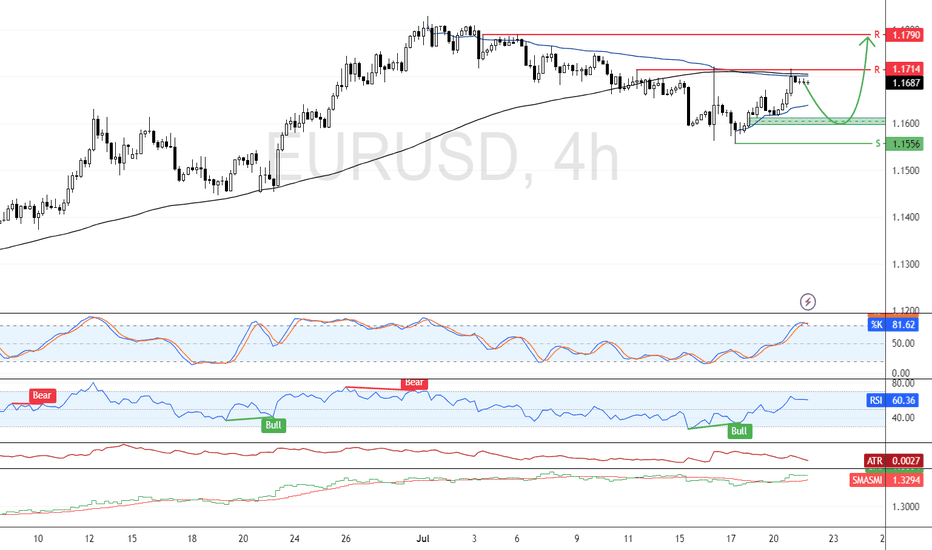

EUR/USD Eyes $1.179 If Resistance BreaksFenzoFx—EUR/USD is testing the 100-day moving average as resistance, a supply zone backed by VWAP at $1.171. The Stochastic Oscillator depicts 81.0 in the description, meaning the Euro is overpriced in the short term.

Therefore, we expect the pair to test the $1.160 demand zone before the uptrend resumes. Furthermore, the bullish outlook remains valid above $1.155, and a break above resistance at $1.171 can trigger the uptrend, targeting $1.179.

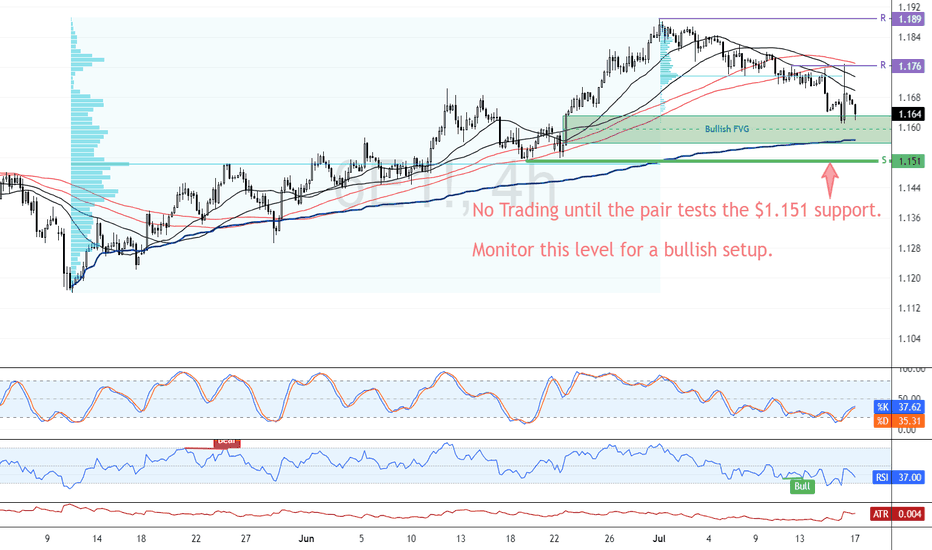

EUR/USD Resumes Bearish Trend Below $1.176FenzoFx—EUR/USD trades bearish, below the 100-SMA, and is currently testing the bullish FVG as support. Yesterday, Euro failed to pass the immediate resistance at $1.176; therefore, we expect the bearish bias to resume.

In this scenario, EUR/USD's downtrend could extend to the next support level at $1.151. Please note that the bearish outlook should be invalidated if Euro closes and stabilizes above $1.176.

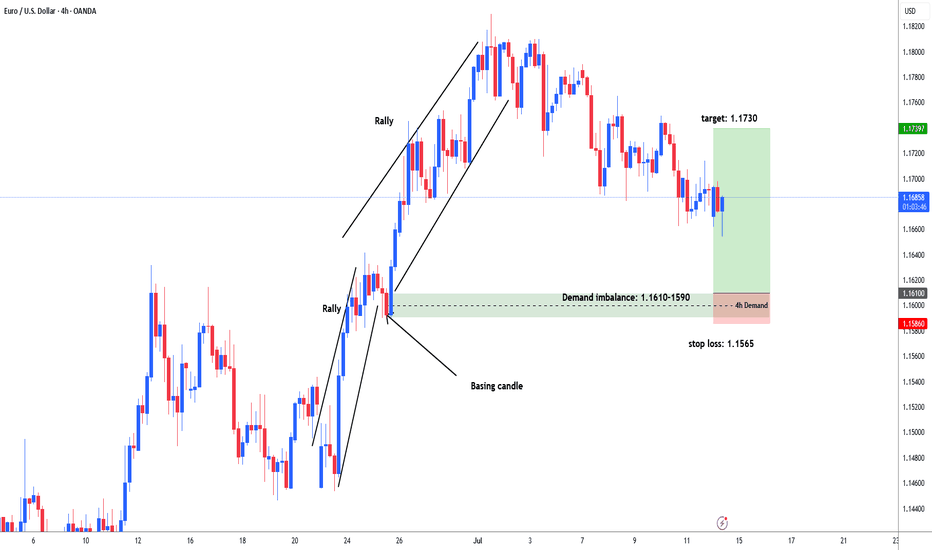

EURUSD possible long from 1.1610 area for 1.1730#eurusd market rallied 1.1450 - 1.1640. then consolidation between 1.1580-1640 area. Institutions put more buy orders and price rallied again after bases out and reached upto 1.1830 area. Now market sell off / retracement to test demand area to fill the remaining unfilled order for another leg higher. Demand zone: 1.1610-1.1590. stop loss: 1.1565, target: 1.1730. in weekly and daily chart market forming distribution shape for big sell opportunity.

EURUSD, GBPUSD and AUDUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Important Week for EURUSDOn Friday, EURUSD reached a support level and bounced off it.

This week, the market is waiting for the Fed’s decision on interest rates.

The trend remains bullish for now, and the upcoming news will likely determine the next major move.

Today and tomorrow, we might see some sideways movement ahead of the key announcement.

Don't rush into new trades and avoid using large position sizes!

Still keeping a close eye on a potential USD pop...Although the EUR/USD and GBP/USD popped higher late last week, I'm still keeping a close eye to stay short on the EUR/USD considering the bearish rising broadening pattern coupled with a yearly pivot point inter-median level and negative divergence on the MACD. This is all based on the daily chart.

Many factors are in play right now with what's going on between Israel and Iran along with FOMC this week and Tariffs still in play.

On a purely technical analysis point of view, I potentially expect a bullish retracement in the USD while remaining long term bearish across the board.

we'll see how this one develops.

Good Luck & Trade Safe.

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EURUSD - Expecting Bearish Continuation In The Short TermM15 - Clean bearish trend with the price creating series of lower highs, lower lows.

No opposite signs.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD - Expecting Bearish Continuation In The Short TermH1 - Clean bearish trend with the price creating series of lower highs, lower lows.

Lower lows on the moving averages of the MACD indicator.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD is set to move up?EURUSD 1h back to back 2 candle has got rejected from the support level with long wick which is smart money bullish order flow showing potential move back to the resistance line. As Daily trend is bullish we may see EURUSD continue to bounce back to the resistance with newly develop uptrend.

A buy trade is high probable

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EURUSD potential drop support?EURUSD has broken out of the daily support proceeding to daily 20EMA to swing high to retest as support. As with a head and shoulder on 4h price breaks out of support ( Daily ) with multiple liquidity grab it is a high probability for the price to potentially drop to support.

A sell trade is high probable

EURUS possible bearish reversal correction for 1.1100 & 1.1000#eurusd weekly key reversal bar, made a new high closed towards the low which is early indication for bearish reversal. better to wait for 61.8, 70.0 and 79.0 fib level for correction to short to manage drawdown. stop loss above key reversal bar high. initial target might be 1.1100 and next one 1.1000 if breaks below the 1.1100. use low risk in reversal trade.

EURUSD Short Term Buy Idea Update!!!Hi Traders, on April 15th I shared this idea "EURUSD Short Term Buy Idea"

Expected retraces and further continuation higher until the strong support zone holds. You can read the full post using the link above.

Price moved as per the plan!!!

Retraces happened as expected and then the price moved higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Market Analysis: EUR/USD Dips From HighsMarket Analysis: EUR/USD Dips From Highs

EUR/USD declined from the 1.1570 resistance and traded below 1.1470.

Important Takeaways for EUR/USD Analysis Today

- The Euro started a fresh decline after a strong surge above the 1.1500 zone.

- There was a break below a key bullish trend line with support at 1.1440 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair rallied above the 1.1500 resistance zone before the bears appeared. The Euro started a fresh decline and traded below the 1.1500 support zone against the US Dollar.

There was a break below a key bullish trend line with support at 1.1440. The pair declined below 1.1410 and tested the 1.1310 zone. A low was formed near 1.1308 and the pair started a consolidation phase. There was a minor recovery wave above the 1.1370 level.

The pair climbed above the 23.6% Fib retracement level of the downward move from the 1.1573 swing high to the 1.1308 low. EUR/USD is now trading below 1.1440 and the 50-hour simple moving average.

On the upside, the pair is now facing resistance near the 1.1410 level. The next key resistance is at 1.1440 and the 50% Fib retracement level of the downward move from the 1.1573 swing high to the 1.1308 low.

The main resistance is near the 1.1470 level. A clear move above the 1.1470 level could send the pair toward the 1.1570 resistance. An upside break above 1.1570 could set the pace for another increase. In the stated case, the pair might rise toward 1.1650.

If not, the pair might resume its decline. The first major support on the EUR/USD chart is near 1.1335. The next key support is at 1.1310. If there is a downside break below 1.1310, the pair could drop toward 1.1265. The next support is near 1.1220, below which the pair could start a major decline.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.