EURUSD Short Term Buy Idea Update!!!Hi Traders, on April 15th I shared this idea "EURUSD Short Term Buy Idea"

Expected retraces and further continuation higher until the strong support zone holds. You can read the full post using the link above.

Price is moving as per the plan!!!

Retraces happening as expected, my bullish view still remains the same here.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Eurusdforecast

EUR/USD Closing the Symmetrical Triangle PatternEURUSD is trading bullishly but has eased after hitting a high of $1.1470. Currently, it trades sideways near $1.1342. Despite the bullish trend, the pair is overbought and may dip below $1.1296 toward $1.1296 support.

If bulls close above $1.1470, a further rally could target $1.1710.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at F enzo F x Decentralized Forex Broker

GBPUSD and EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EUR/USD Hits Highest Level in Over Three YearsEUR/USD Hits Highest Level in Over Three Years

This morning, the euro surged above the 1.1300 mark against the US dollar for the first time since February 2022.

Throughout this week, the EUR/USD pair has broken through the highs of both 2023 and 2024.

Why Is EUR/USD Rising?

Amid the whirlwind of news surrounding the imposition and suspension of tariffs in US–EU trade, one dominant factor stands out — the sell-off of US bonds.

According to Reuters, long-term US Treasury bonds are being heavily sold this week. The yield on 10-year notes has jumped from 3.9% to around 4.4%, marking the steepest increase in yields since 2001. This may reflect a reaction by foreign holders of US debt to sanctions imposed by the White House, combined with growing uncertainty about the US economy — especially as recession fears gain more media attention.

As a result, the US dollar is showing weakness against a range of currencies, including the Japanese yen, Swiss franc, and the euro.

Technical Analysis of EUR/USD

The chart reveals a clear ascending channel (marked in blue), with the price repeatedly interacting with its upper, lower, and median boundaries — highlighted with markers and arrows.

Current bullish sentiment has pushed the pair towards the upper boundary of this channel. It’s possible this resistance line could halt further gains, potentially leading to a correction — perhaps down to the 1.11 level, which previously acted as a strong resistance point.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Analysis: EUR/USD Resumes IncreaseMarket Analysis: EUR/USD Resumes Increase

EUR/USD started a fresh increase above the 1.0950 resistance.

Important Takeaways for EUR/USD Analysis Today

- The Euro started a decent upward move from the 1.0880 zone against the US Dollar.

- There was a break above a key bearish trend line with resistance at 1.0955 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair started a fresh increase from the 1.0775 zone. The Euro cleared the 1.0950 resistance to move into a bullish zone against the US Dollar, as mentioned in the last analysis.

The bulls pushed the pair above the 50-hour simple moving average and 1.1000. Finally, the pair tested the 1.1150 resistance. A high was formed near 1.1146 before the pair corrected gains. It dipped below 1.1000 and tested 1.0880.

The pair is again rising from the 1.0880 zone. There was a break above a key bearish trend line with resistance at 1.0955. The pair climbed above the 50% Fib retracement level of the downward move from the 1.1146 swing high to the 1.0880 low.

Immediate resistance on the EUR/USD chart is near the 1.1045 zone and the 61.8% Fib retracement level of the downward move from the 1.1146 swing high to the 1.0880 low.

The first major resistance is near the 1.1080 level. An upside break above the 1.1080 level might send the pair toward the 1.1145 resistance. The next major resistance is near the 1.1165 level. Any more gains might open the doors for a move toward the 1.1200 level.

Immediate support on the downside is near the 1.0955 level. The next major support is the 1.0880 level. A downside break below the 1.0880 support could send the pair toward the 1.0830 level. Any more losses might send the pair into a bearish zone toward 1.0775.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURUSD Sell and Buy Trading Plan Update!!!Hi Traders, on March 19th I shared this "EURUSD Sell and Buy Trading Plan"

I expected short term bearish moves towards the Fibonacci support zones and then continuation higher. You can read the full post using the link above.

Price moved as per the plan here!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD Bear is here: Important Analysis on FX Pairs, Stock MarketIn this video I got over some important outlooks on the EUR/USD, GBP/USD and USD/JPY along with outlook on the stock market.

The U.S. Dollar has been getting absolutely crushed along with the stock market which usually has the opposite effect. Considering we may be into a stagflation scenario, this is not surprising.

Tariffs have spiked volatility and puts the Federal Reserve in a very tight spot of Interest Rate Policy. Interesting times ahead to say the least.

From a pure technical analysis point of view, the USD may be set for much further losses as monthly patterns suggest a big move may be on the horizon. Will be keeping a very close eye on these as we move forward in these stormy waters of the U.S. economy.

As always, Good Luck & Trade Safe.

EURUSD Short IdeaTrade entered. Entry rules met.

Confluences:

✅ Bearish overall bias

✅ Bearish demand zone

✅ Bearish impulse crab pattern

✅ Bearish divergence

✅ Bearish break of structure

✅ Entering London close zone

✅ Price is in entry zone

✅ Required risk:reward met

⭐ I shared this watch zone in my weekly forex outlook this week, you can subscribe by clicking the link in my bio.

EURUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

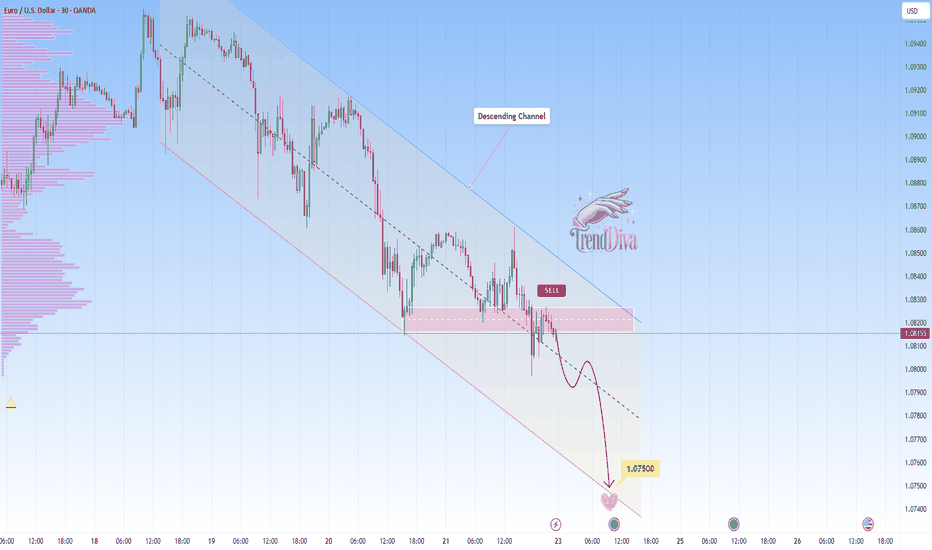

EURUSD Maintains Bearish Momentum - Is 1.07500 the Next Target?OANDA:EURUSD is trading within a well-defined descending channel, with price action consistently respecting both the upper and lower boundaries. Recently, the price rejected a key resistance zone, reinforcing bearish momentum and signaling a potential continuation toward lower levels.

The current price action suggests that if price continues to respect this resistance, we could see further downside toward 1.07500, aligning with the lower boundary of the channel. However, if price breaks above the channel and sustains above it, the bearish outlook may be invalidated, potentially signaling a shift in momentum. Monitoring price action and volume at this level will be essential for confirmation.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

Matador the EUR/USD Bull? - Bears about to jump in?After the previous 3 weeks of bullish havoc, the bears may have finally decided to pump the breaks on EUR/USD buyers.

As price continued to push higher, I held on to short positions that I began building up at 1.0851 & 1.0909 as I wanted to wait and see if the Pivot level R1 area (1.0935) was going to provide the wall to begin declining back down.

Once I saw the lack of advancement, I opened another strong short position at 1.0912 and now sitting at an overall average price of 1.0891.

I like this trade, however I am still staying cautious on that 1.0800 level. I want to see this price point clearly broken and trading below it, otherwise I will keep my stop at a close break-even point for risk protection. Overall, so far so good but we need to break through 1.0800.

From a purely technical analysis point of view, I see a small scale rising broadening pattern and this usually indicates a drop to the starting point of the pattern will take place however, If we drop aggressively, I may eye that 1.0600 level again which will lock in almost 300 pips but as I just said, these patterns usually return to their starting point so 1.0300 or below is not out of the question. I guess it depends on how the price action is looking whether I'd close or hold.

1.0600 is around the yearly pivot point so that is a good marker to shoot for IMO. Interestingly, the MACD and RSI show a rising broadening pattern as well so that gives me a little bit more conviction in this trade.

I see some other markers for this trade as well but I will share that in my next upcoming market preview video since it'd be too much to type.

As always, Good Luck & Trade Safe

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EURUSD Sell and Buy Trading PlanH4 - We had a strong bullish move with the price creating a series of higher highs, higher lows structure

This strong bullish move ended with a bearish Divergence

While measuring this strong bullish move using the Fibonacci retracement tool we have two key support zones that has formed (marked in green)

So based on this I expect potential short term bearish moves now towards the key support zones and then potential continuation higher.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

---------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.-

EURUSD analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD,GBPUSD and EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EURUSD -Weekly forecast, Technical Analysis & Trading Ideas💡 Daily Timeframe:

EURUSD has been in a Range Bound recently. It touched and reject from 1.0528 major resistance today.

A peak is formed in daily chart at 1.05285 on 02/26/2025, so more losses to support(s) 1.03570, 1.02920 and minimum to Major Support (1.01779) is expected.

💡 Four-hour Timeframe:

The uptrend is broken, and price is in an impulse wave.

The bearish wave is expected to continue as long as the price is below the strong resistance at 1.0528

A strong bearish divergence has also formed in the RSI.

💡 One-hour Timeframe:

1.0457 support is broken now. It will act as a Resistance now!

Forecast:

1- Correction wave toward the Sell Zone

2- Another Downward Impulse wave toward Lower TPs

SL: Above 1.0528

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.