Eurusdidea

EUR/USD Finally Closed Above Strong Res , Long Setup Valid HereThis is an educational + analytic content that will teach why and how to enter a trade

Make sure you watch the price action closely in each analysis as this is a very important part of our method

Disclaimer : this analysis can change at anytime without notice and it is only for the purpose of assisting traders to make independent investments decisions

EURUSDThe euro initially tried to rally on Friday but gave back gains to show signs of hesitation. The 1.06 level continues to be a massive barrier that traders cannot get beyond, and even if we did break above there, it is likely that we will find plenty of reasons to short this market.

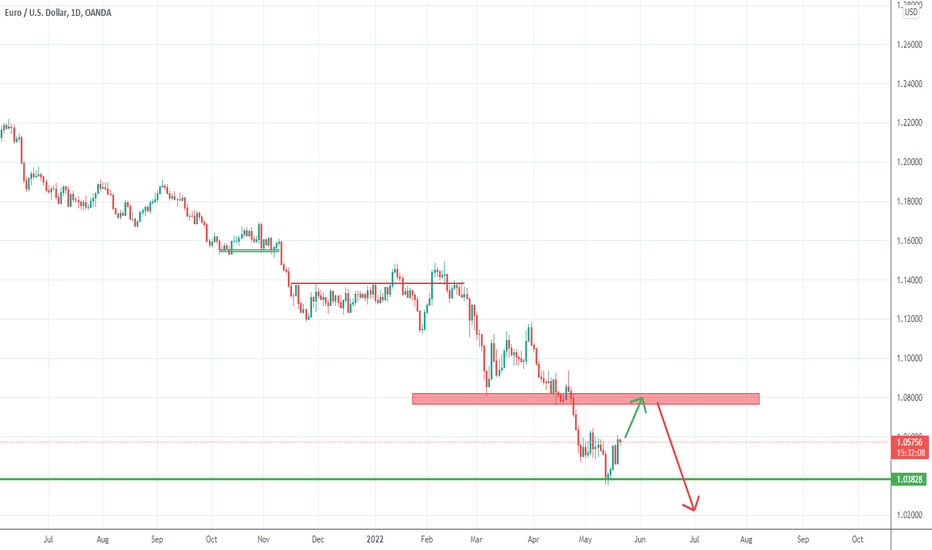

If we can break above the 1.06 level, then it is likely that we will go looking to reach the 50-day EMA. After that, the 1.08 level would be massive resistance as it was significant support previously. The “market memory” attached to this level will attract a lot of attention. That being said, I do not think that we will go that high in the euro, as there are plenty of reasons to believe this market will continue to drop.

The overall downtrend continues to be strong, and I think will accelerate given enough time. After all, the European Central Bank is in no position to tighten monetary policy, especially as we are already starting to see signs of a potential German recession. Because of this, I think that it is only a matter of time before the euro falls, due to the fact that the ECB will have to keep monetary policy loose for quite some time.

The 1.05 level would attract a certain amount of attention, as it had previously been supported. However, if we break down below there it is likely that the euro will go looking to the lows again, near the 1.0350 level. If we break down below there, then it is likely that we will continue to go much lower, based upon the overall trend and the bearish flag that we had formed previously. In fact, we are retesting this area, so one has to take a look at that as a potential reason to short the market as well.

Based on the “measured move” of the bearish flag, it is likely that we will go looking to the 1.01 level. After that, we could go looking to the parity level. This is a market that will continue to fade rallies and push lower, especially as Jerome Powell has made it abundantly clear that the Federal Reserve is perfectly fine with the markets being broken, meaning that they will stay tight for quite some time.

EURUSD is getting closer to the Supply Zone! Don't Miss It!WATCH EURUSD IN THE UPCOMING WEEKS!

EURUSD has been pushing down breaking the previous lows during COVID-19 issues on March 2020. The major trend has shifted, we are looking forward to a pullback made by the EURUSD and the continuation will proceed as planned.

Let me know what you guys think about this trade! Stay safe!

EUR/USD IDEAHello Everyone this is my update on Next week, on the chart we might have a head and shoulder pattern which will help sellers to gain more strength and push market downward,

Other Information you can see on the chart with my possible entries.

NB; Im a Beginner More comments will help me very much. hank you

EurUsd- Best place to sell for joining the trendYesterday I've written that I expect EurUsd to drop towards parity (and even lower in fact).

As we can see from the daily posted chart, after reaching the 1.0350 low, the pair is on the rise.

In my opinion, this is just a correction and can offer bears a good selling opportunity to join the downtrend.

1.0750-1.0800 is a clear horizontal resistance and here I will look to sell.

EurUsd back above 1.10 would negate my bearish outlook

EurUsd- Slowly-Slowly towards parityLast week, EurUsd broke under 1.05 support and has made a low at 1.0350.

Afterward, the pair recovered and has risen above 1.05.

Although we have this recovery from the low, looking at the daily posted chart, we can see that the price is under 20d SMA and this is pointing down, indicating still a strong bear trend.

I expect USD bulls to remain in control in the future and the pair to continue its drop to parity in the medium term.

1.0650 is resistance now, followed by the strong 1.0750-1.08 one and in these zones, we can look for selling opportunities for a great risk: reward for swing traders.

Best Regards!

Mihai Iacob

P.S: Please share your opinion or your charts in the comments section below!