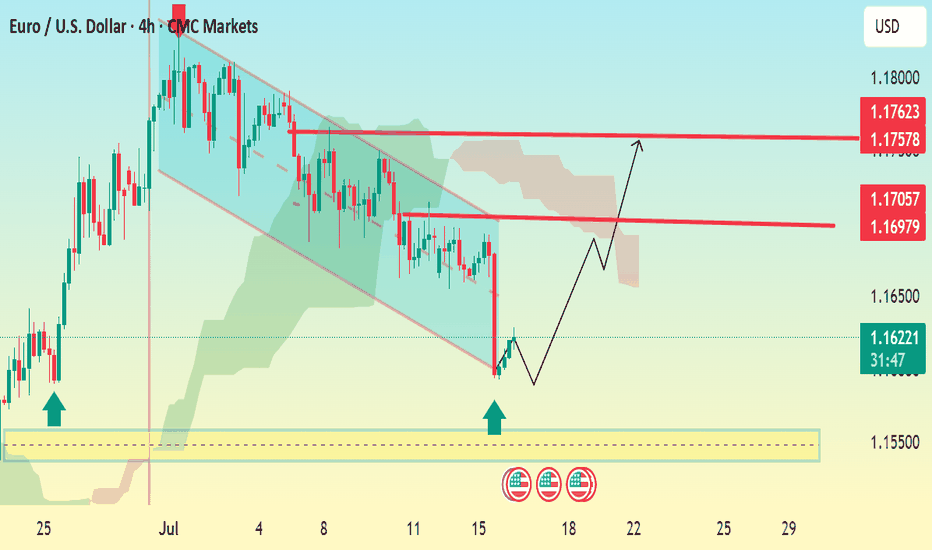

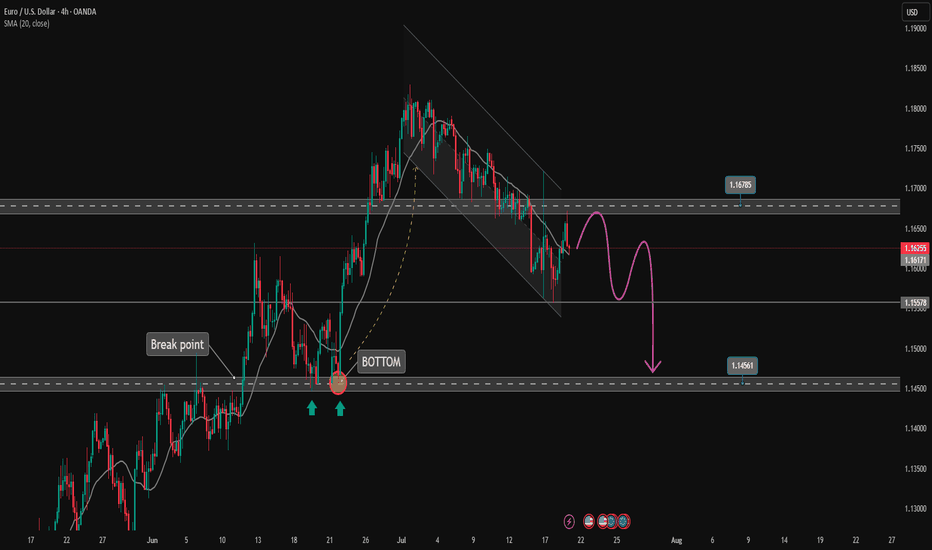

EUR/USD 4H Bullish Reversal Setup Analysis:The chart shows a falling wedge pattern, a typical bullish reversal signal.

Price has broken out of the wedge, suggesting a potential trend reversal to the upside.

Two strong demand zones (highlighted with blue arrows and yellow box) show strong buying pressure around 1.15500–1.15700.

The Ichimoku Cloud above indicates resistance, but a breakout above it would confirm continued bullish momentum.

Key Levels:

Current Price: 1.16171

Immediate Resistance: 1.16979

Next Targets (TP):

TP1: 1.17057

TP2: 1.17578

TP3: 1.17623

Support Zone: 1.15500 – 1.15700

Conclusion: If the price holds above the 1.15700 support zone and sustains momentum above the wedge breakout, expect bullish continuation toward 1.17500+. Ideal long setup on retracement with tight SL below 1.15500.

Eurusdlong

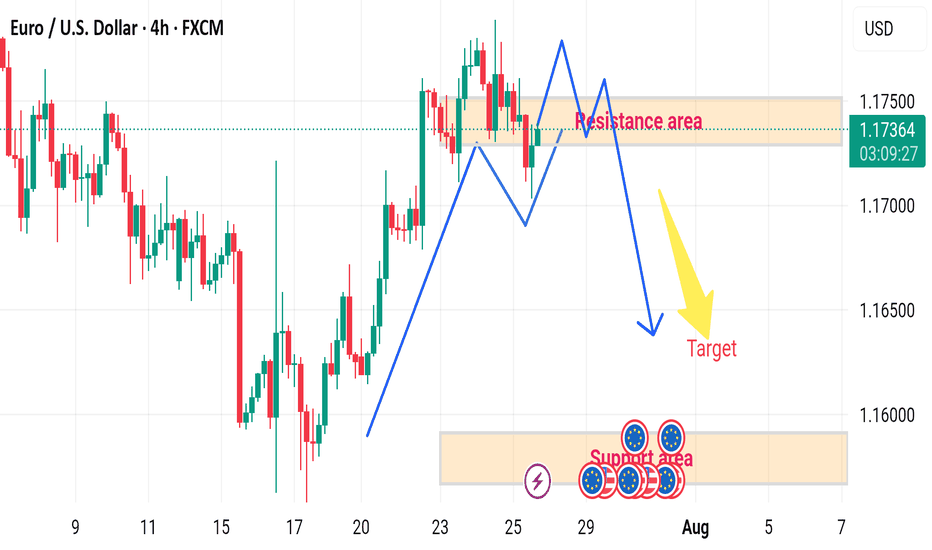

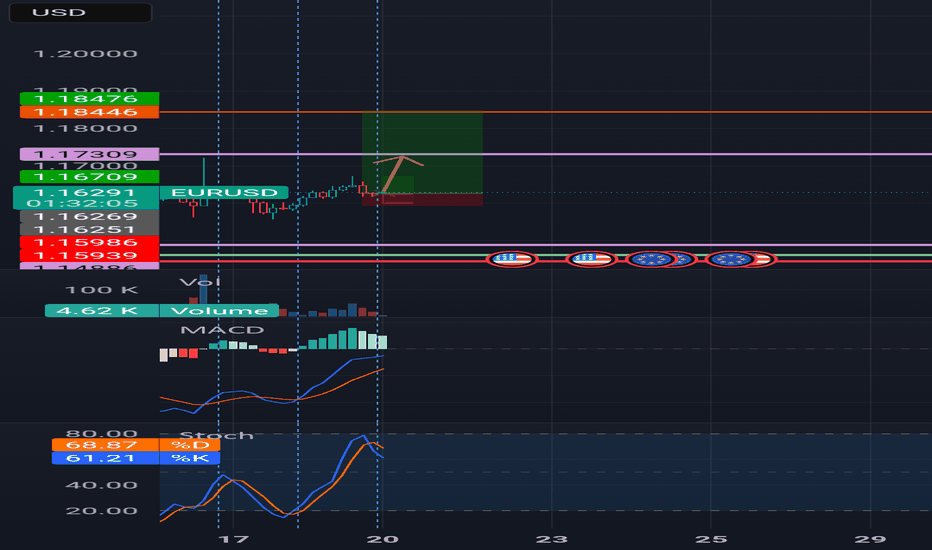

EUR/USD H4 DOWNWARD 🔄 Disrupted EUR/USD 4H Analysis

🟢 Current Context:

Price is currently at 1.17375, slightly below the resistance area (1.17400–1.17500).

Market shows a recent bullish impulse, followed by consolidation within the marked resistance zone.

Projection in the image suggests a double-top pattern forming at resistance, followed by a bearish reversal toward the target demand area (~1.15800–1.16000).

---

⚠️ Disruption Points:

1️⃣ Failed Double Top Scenario

Disruption Hypothesis: Instead of forming a clean double top and reversing, price may break above the resistance zone at 1.17500.

Reasoning: Strong bullish momentum and recent higher highs indicate potential for bullish continuation, invalidating the bearish target.

Disrupted Path: Price could break out → retest the resistance as new support → continue toward 1.18000–1.18300 zone.

2️⃣ Mid-Range Liquidity Trap

The current range may act as a liquidity trap:

Smart money could push the price slightly below support (fake breakdown), attract sellers, then reverse sharply upwards.

This would trap retail sellers targeting the 1.15800 zone.

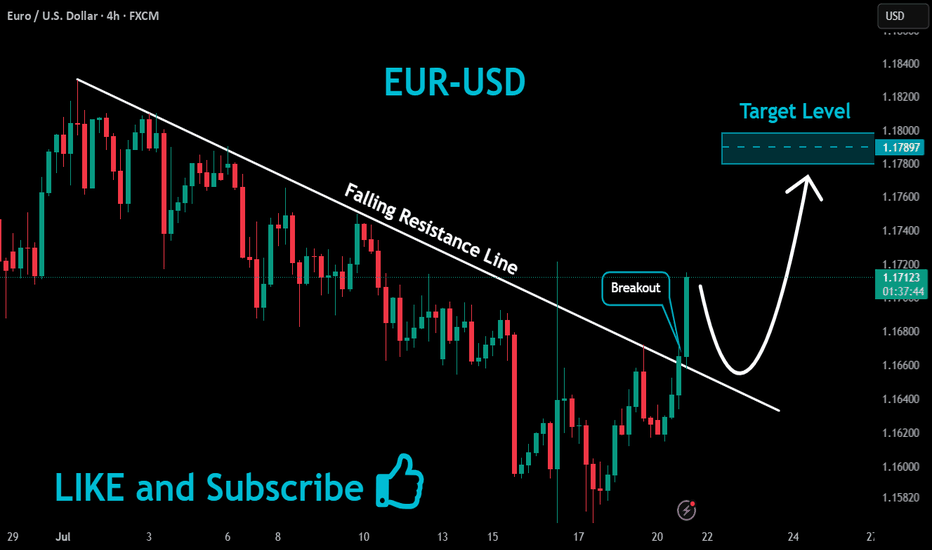

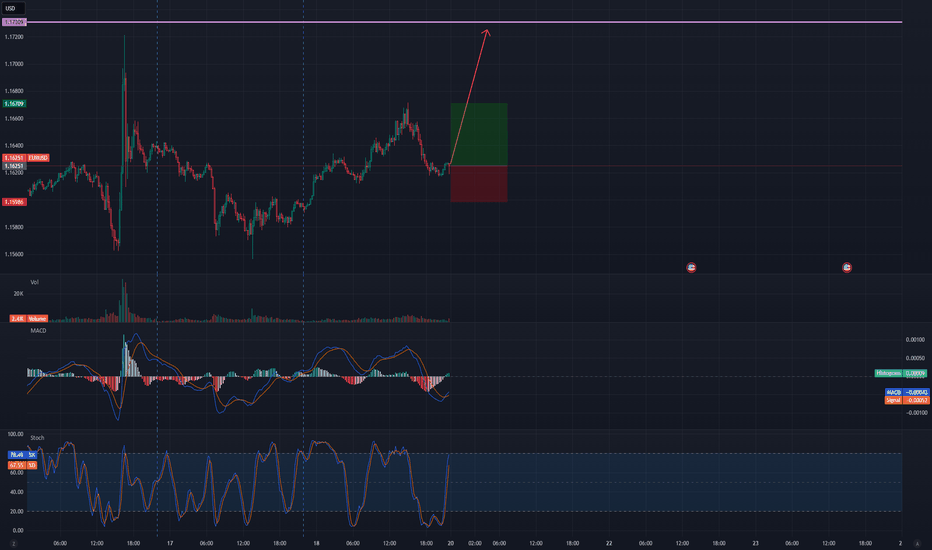

EURUSD Massive Bullish Breakout!

HI,Traders !

#EURUSD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

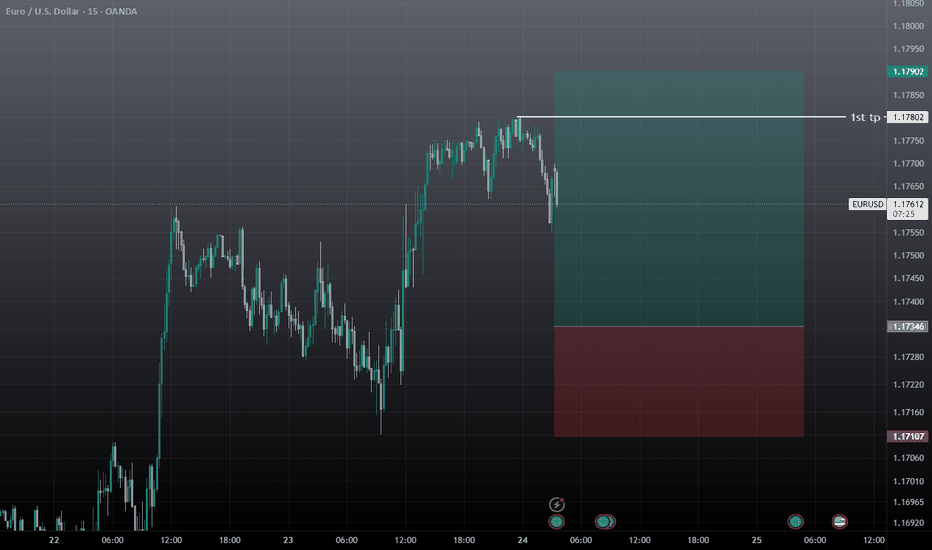

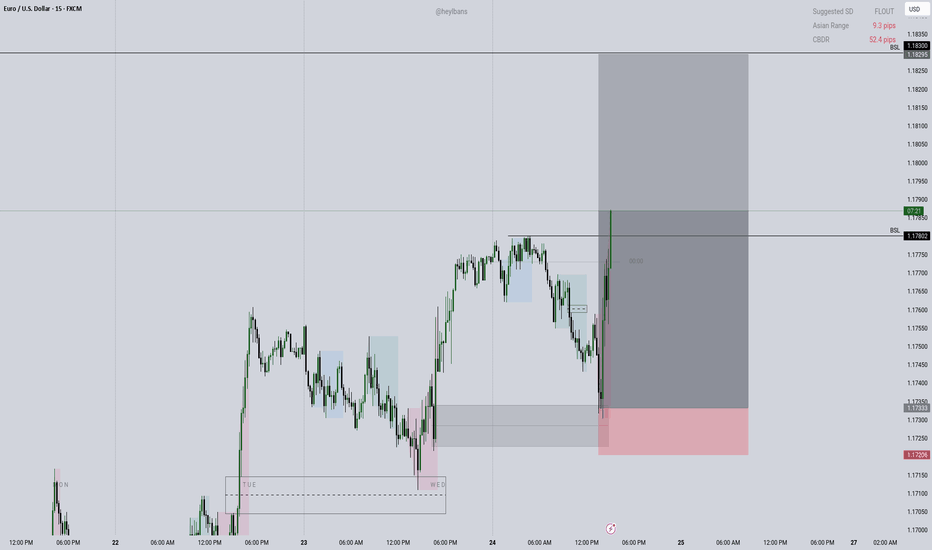

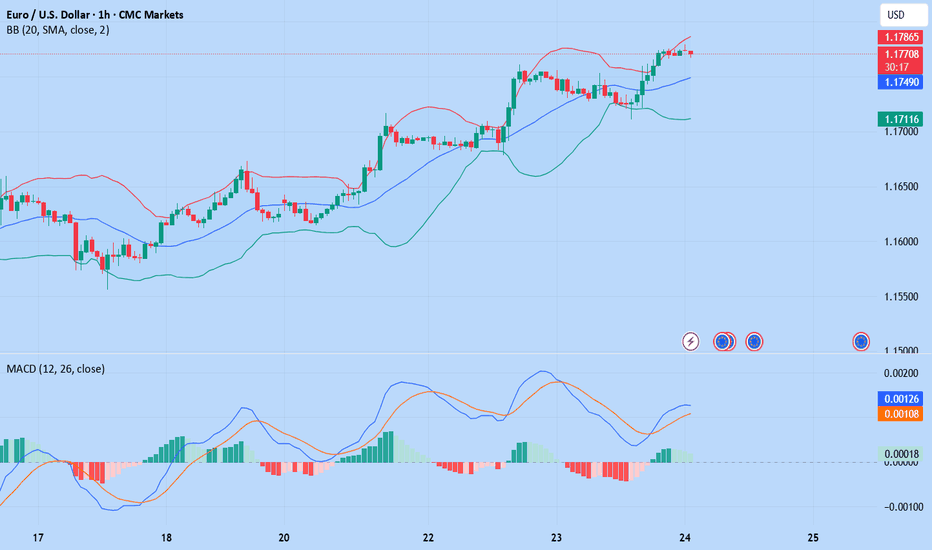

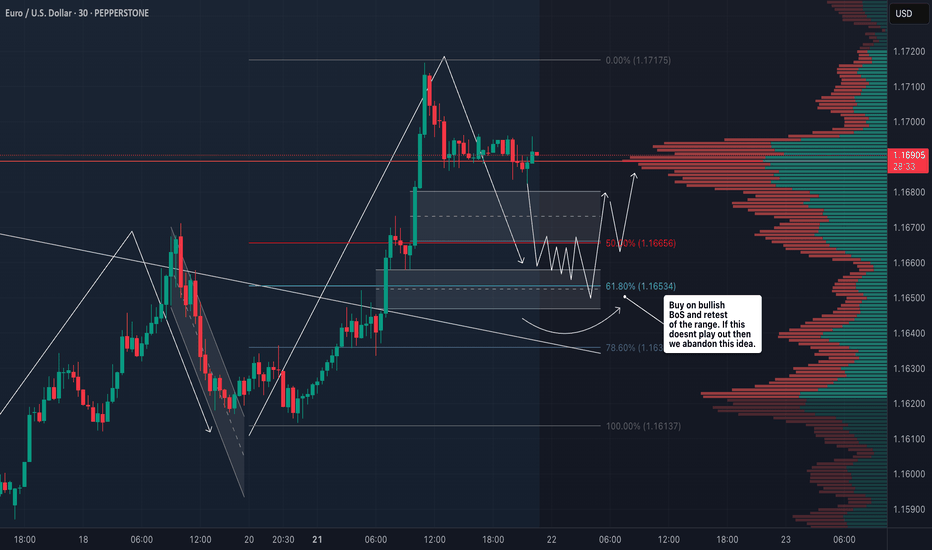

EURUSD analysis - 1H FVG and OB setupsOn the 1H timeframe, price is moving strongly towards the 1H supply zone (around 1.1780), and it is likely to reach this area first before pulling back.

During the pullback, the blue FVG and green OB zones below are key areas for potential long entries:

🔹 FVG 1H around 1.1660

🔹 OB 1H around 1.1620

🔹 OB 1H around 1.1580

📌 Plan:

1️⃣ If the price reaches the upper supply zone, we will look for short scalps with confirmation on the lower timeframe (5M/3M).

2️⃣ After the pullback to lower zones, we will look for long opportunities with PA confirmation.

🎯 Long targets after pullback: 1.1700 – 1.1720, potentially 1.1750.

❌ No entry without confirmation.

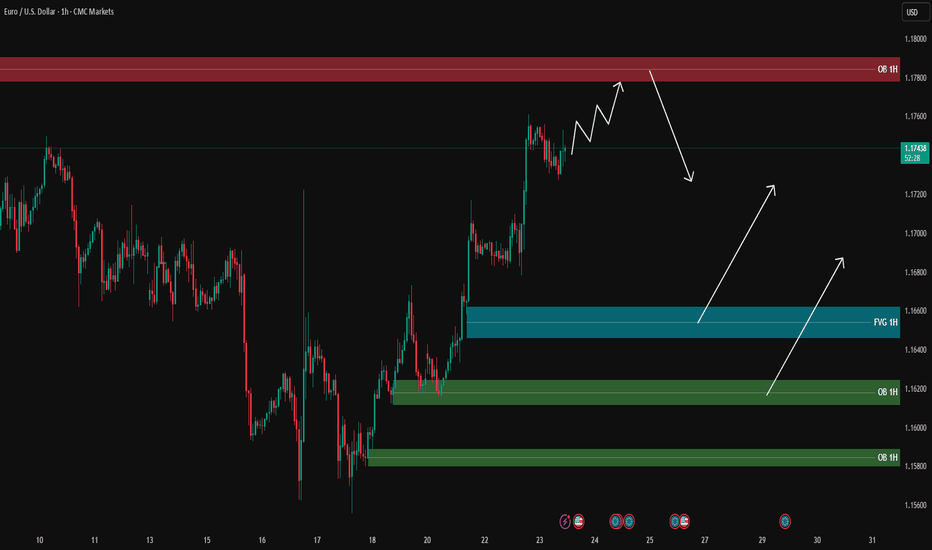

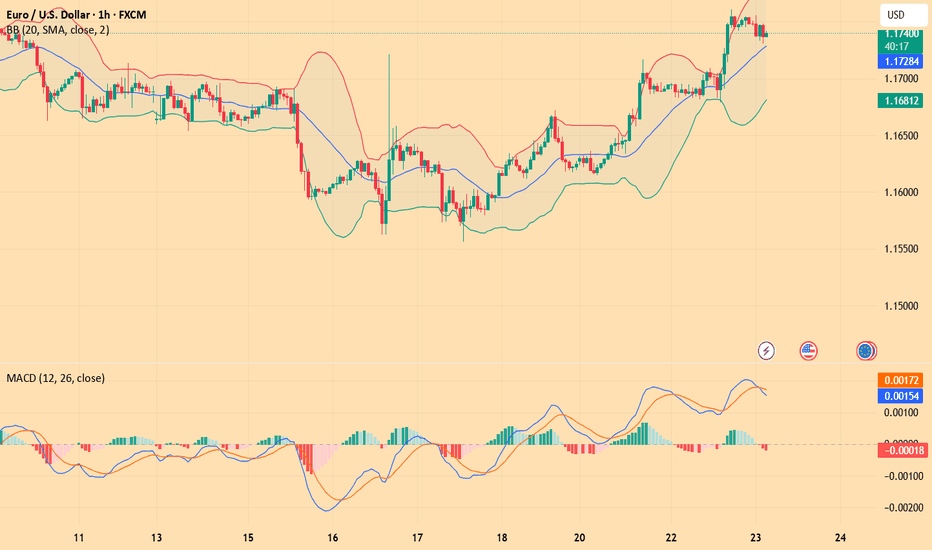

EUR/USD – Buy Setup Analysis (1H Chart)EUR/USD – Buy Setup Analysis (1H Chart)

📈 **Trend**: Uptrend

The pair is respecting the ascending trendline and is trading above both the EMA 7 and EMA 21, indicating bullish momentum.

**🔹 Long Setup**

* **Entry:** Around 1.1774 (current price)

* **Stop-Loss (SL):** 1.1731 (below trendline & EMAs)

* **Take-Profit (TP):** 1.1872 (based on recent swing high)

**🔎 Technical Signals**

* Price is forming higher highs and higher lows.

* Strong volume surge on bullish candles.

* EMA crossover (7 > 21) supports continuation.

**Conclusion**

As long as EUR/USD holds above the trendline and the EMAs, the bullish setup remains valid. A break below 1.1730 would invalidate this outlook.

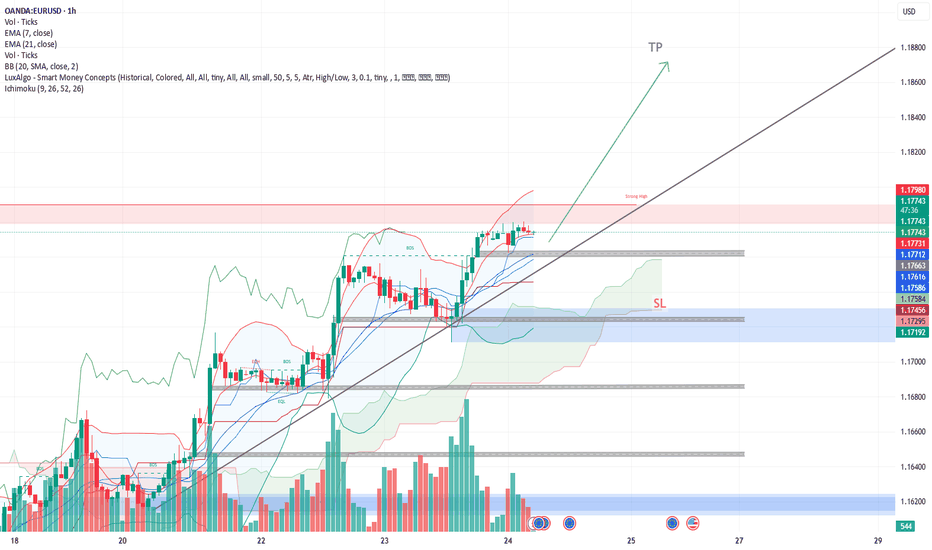

EUR/USD Recovery in Play — Eyes on ResistanceHi Everyone,

Since our last update, EUR/USD briefly dipped below the 1.16000 level but quickly reclaimed the key 1.16450 zone — a level that continues to serve as an important structural pivot.

Price has since stabilised above this support and is now moving back toward the highlighted resistance area around 1.17450. A sustained push toward 1.18000 in the coming sessions would further reinforce the presence of renewed buying interest.

Our broader outlook remains unchanged: we continue to anticipate the pair building momentum for another move higher. A decisive break above 1.18350 could open the path toward the 1.19290 area and ultimately the 1.20000 handle.

We’ll be watching closely to see whether this recovery gains traction and if buyers can sustain momentum through resistance. The longer-term view remains bullish, as long as price continues to hold above the key support zone.

We’ll continue to provide updates throughout the week as the structure develops and share how we’re managing our active positions.

Thanks again for all the likes, boosts, comments, and follows — we really appreciate the support!

All the best for the rest of the week.

Trade safe.

BluetonaFX

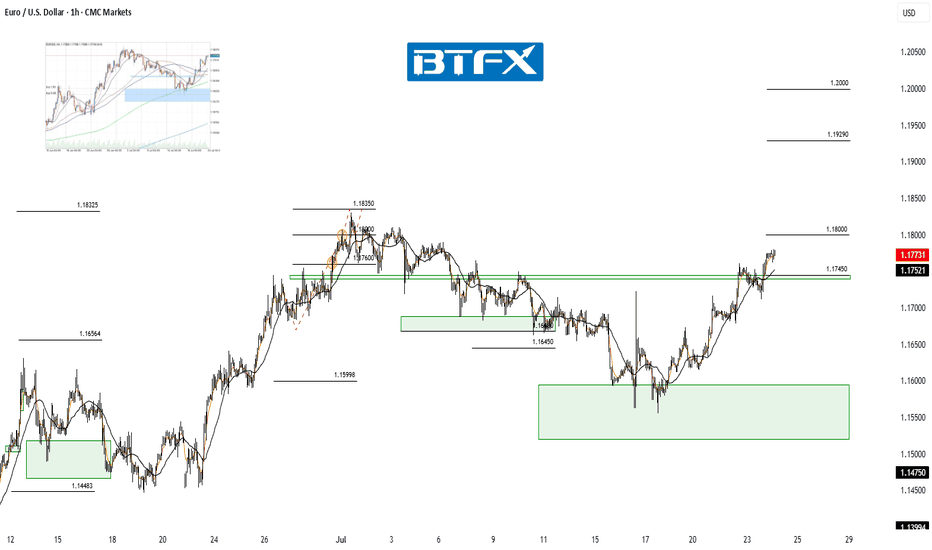

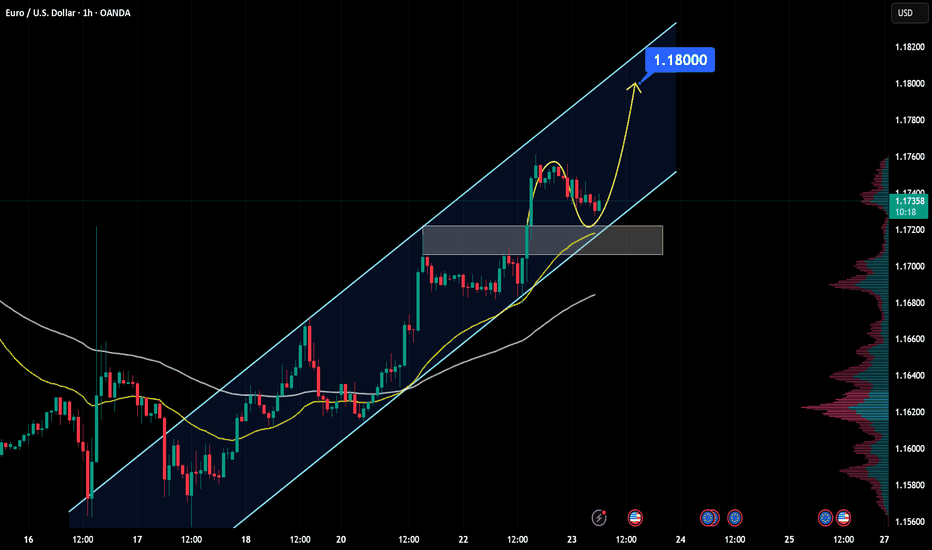

EURUSD Analysis - Can Buyers Push Price To $1.18000?Hello all dear traders!

EURUSD is trading within a clear bullish channel, with price action consistently respecting both the upper and lower boundaries. The recent bullish momentum shows that buyers are in control, suggesting further upside.

The price recently broke above a key resistance zone and is now coming back to retest it. If this level holds as support, it will consolidate the bullish structure and increase the likelihood of a move towards the 1.18000 target, which is in line with the upper boundary of the channel.

As long as the price remains above this support zone, the bullish outlook remains intact. However, a failure to hold this level could invalidate the bullish scenario and increase the likelihood of a deeper pullback.

Remember, always validate your setups and use appropriate risk management.

EURUSD(20250724) Today's AnalysisMarket news:

U.S. President Trump continued to lash out at the Federal Reserve on Tuesday, but seemed to back off from the remaining plan to fire Chairman Powell. "I think he's doing a bad job, but he's going to be out of office soon anyway," Trump said in an exchange with reporters at the White House. "In eight months, he'll be out of office."

Technical analysis:

Today's buying and selling boundaries:

1.1751

Support and resistance levels:

1.1814

1.1791

1.1775

1.1726

1.1711

1.1687

Trading strategy:

If the price breaks through 1.1775, consider buying in, with the first target price at 1.1791

If the price breaks through 1.1751, consider selling in, with the first target price at 1.1726

EURUSD Bearish Ahead as US Resilience Meets Eurozone FragilityEURUSD has shifted into bearish territory, pressured by growing divergence between a resilient US economy and a struggling Eurozone. The pair recently rejected the 1.1700 zone, forming multiple bearish structures on the 4H chart. With sticky US inflation, Trump’s renewed tariff agenda, and a dovish ECB, EUR/USD appears poised for a deeper move toward 1.1527 and possibly 1.1445 in the coming sessions. This setup is both technically and fundamentally aligned, but key event risk remains.

🔸 Technical Structure (4H)

Clear rejection from the 1.1700–1.1710 zone.

Bearish pennants and wedge patterns confirm continuation lower.

Downside targets:

🔹 First: 1.1637

🔹 Second: 1.1527

🔹 Final: 1.1445

Risk zone: Above 1.1785 (invalidates short bias if broken cleanly).

🧭 Key Fundamentals

🇺🇸 Dollar Strength: Sticky inflation, stable labor market, and geopolitical risk all favor USD demand.

🇪🇺 Euro Weakness: ECB dovish tone persists amid weak data, soft PMIs, and stagnating growth.

Yield Spread: US-Euro real yield spread supports further EUR/USD downside.

Tariff Pressure: Trump’s 50% tariff plan and tensions with the EU weigh on EUR.

⚠️ Risks to Watch

A surprise dovish pivot from the Fed.

Weak US CPI or disappointing retail sales.

Major risk-on flows that trigger broad USD weakness.

New EU fiscal stimulus or Germany/France recovery surprises.

📆 Key Events Ahead

🇺🇸 US Core CPI – A hot print supports USD strength.

🇺🇸 Retail Sales & Powell testimony – Watch tone on rate cuts.

🇪🇺 German ZEW Sentiment, Eurozone HICP inflation – Weak readings would further drag EUR.

🔄 Leader or Lagger?

EUR/USD is a lagger to GBP/USD, often following UK-driven USD moves.

Acts as a leader for EUR/JPY, EUR/AUD, EUR/CHF – weakness here cascades across EUR crosses.

Tracks broad USD sentiment – dovish Fed pricing boosts EURUSD, while rate hike fears drag it.

✅ Summary: Bias and Watchpoints

EUR/USD is bearish below 1.1700 as economic divergence, sticky US inflation, and rising geopolitical tensions favor the dollar. ECB policy remains soft, offering little support to the euro. Key risk lies in a dovish Fed pivot or softer US data. Watch US CPI and Powell for clues. This pair is likely to lag GBP/USD moves, but will lead EUR crosses lower if the downside momentum continues.

EUR/USD Set to Fly – Don’t Miss This Perfect Channel Breakout!Hi traders!, Analyzing EUR/USD on the 30-minute timeframe, we can observe that price is respecting the ascending channel and reacting to the dynamic trendline support (green dashed lines). A recent bounce suggests a potential bullish continuation within this structure.

🔹 Entry: 1.17399

🔹 Take Profit (TP): 1.17640

🔹 Stop Loss (SL): 1.17056

Price remains above the 200 EMA, confirming a bullish environment. The bounce aligns with the lower boundary of the channel and follows a short consolidation period, indicating buying pressure. The RSI also shows signs of recovery after approaching oversold levels, supporting the idea of upward momentum.

This long setup offers a favorable risk/reward ratio and aims to capture continuation toward upper channel resistance.

⚠️ DISCLAIMER: This is not financial advice. Trade at your own risk and always use proper risk management.

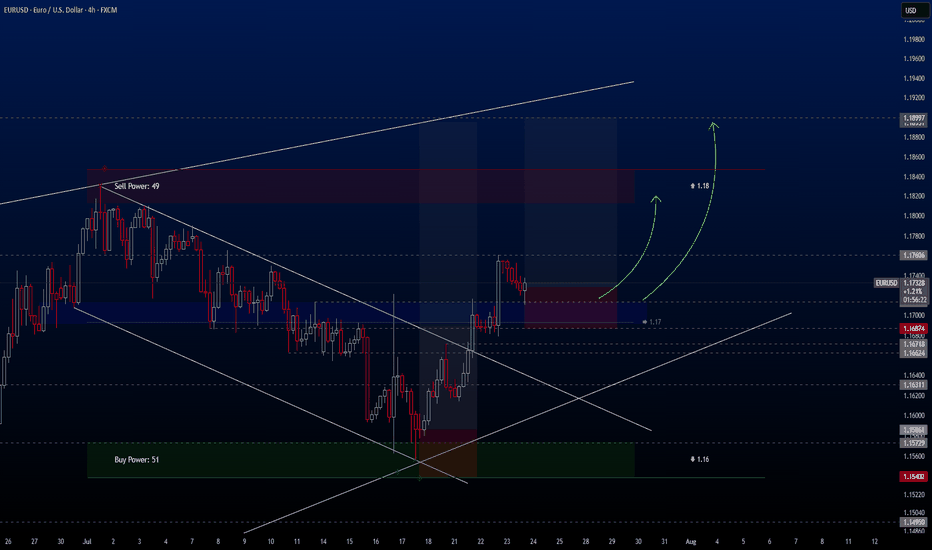

EURUSDHello traders,

I've been closely monitoring the **EURUSD** pair for a while, and it’s now offering an ideal entry opportunity. It has presented several great setups for swing trading, and I’d like to share one of them with you today.

🔍 **Trade Details**

✔️ **Timeframe**: H4/D

✔️ **Risk-to-Reward Ratio**: 1:4.22

✔️ **Trade Direction**: Buy

✔️ **Entry Price**: 1.17281

✔️ **Take Profit**: 1.18997

✔️ **Stop Loss**: 1.16874

🔔 **Disclaimer**: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

EURUSD(20250723) Today's AnalysisMarket news:

White House officials plan to visit the Federal Reserve headquarters on Thursday local time.

Technical analysis:

Today's buying and selling boundaries:

1.1730

Support and resistance levels:

1.1811

1.1781

1.1761

1.1699

1.1679

1.1649

Trading strategy:

If the price breaks through 1.1761, consider buying, the first target price is 1.1781

If the price breaks through 1.1730, consider selling, the first target price is 1.1699

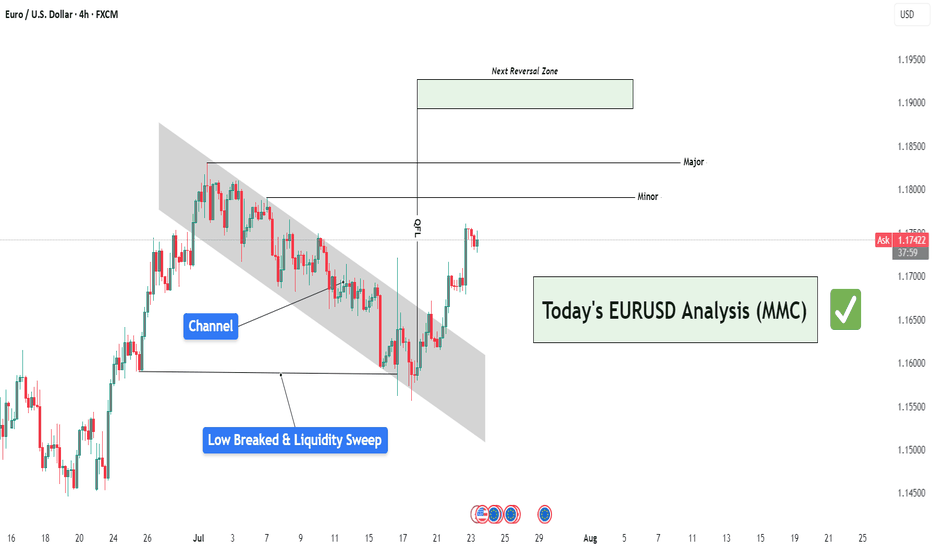

EURUSD Analysis : Liquidity Sweep – EURUSD Targets TO Reversal🧠 Institutional Context & Big Picture

EURUSD has been in a tightly controlled descending channel for several weeks—a classic sign of a market being engineered for liquidity collection. Rather than a naturally trending bearish market, this price action reflects stealth accumulation and market maker manipulation.

The channel structure was used to:

Establish a visible bearish trend (to trap sellers)

Trigger emotional bias for continued shorting

Build up stop orders below swing lows

This phase was about building energy, not continuation.

🔍 Detailed Breakdown of the Chart Elements

📌 1. Descending Channel – Controlled Manipulation

The pair moved within a well-defined bearish channel for multiple weeks.

Each touch respected the top and bottom perfectly—not random, but institutional structure.

It fostered retail confidence in the downtrend while market makers prepared for a reversal.

💥 2. Liquidity Sweep & Trap (Low Breaked & Liquidity Grabbed)

Price spiked below the previous low, clearly sweeping liquidity on July 21.

This is the "engineered breakdown", meant to trigger breakout sellers and stop out early longs.

Immediately after the sweep, the price violently reversed—clear evidence of a liquidity trap.

This is classic MMC logic: induce, trap, reverse.

🟩 3. QFL Base Formed – Bullish Engine Ignited

At the point of reversal, the chart shows the formation of a QFL (Qualified Liquidation Failure) zone.

This QFL base is the core of smart money accumulation—price broke below a base, then quickly reclaimed it.

It's not just support—it’s the true origin of the reversal and an optimal entry point.

📈 4. Breakout from the Channel – Structure Shift Confirmed

Price broke out of the descending channel with strong momentum, confirming:

Structure shift from lower lows → higher highs

Momentum shift in favor of bulls

Entry confirmation for MMC-based long setups

This breakout invalidates the bearish trend and signals a fresh leg up, likely toward unmitigated supply zones.

🟨 5. Current Price Action – Healthy Bullish Consolidation

After the breakout, price is consolidating just above the broken channel, forming a mini-flag or base.

This indicates:

Smart money is accumulating more

No significant selling pressure

Likely continuation toward next supply

🎯 6. Next Targets – Reversal Zones

Minor Resistance: ~1.1800

Major Resistance: ~1.1850 – 1.1880

Next Reversal Zone: 1.1900–1.1950

This zone is highlighted as a potential sell-off area where institutions may offload positions or create new traps.

Watch for signs of exhaustion or redistribution here.

📌 Trade Plan Based on MMC Structure

✅ Bullish Scenario (Currently Active)

Entry Area: Ideally at QFL base or breakout retest (~1.1700–1.1720 zone)

Confirmation: Bullish price action (engulfing, flag break, or liquidity wick)

Targets:

🎯 TP1: 1.1800

🎯 TP2: 1.1850

🎯 TP3: 1.1950 (Reversal Supply Zone)

❌ Invalidation:

A break below the QFL base (~1.1670) with bearish volume would invalidate the bullish MMC structure.

🧠 Smart Money Insight & Logic Recap

This entire move reflects a classic Market Maker Strategy:

Build a trend (descending channel) to shape trader bias

Trigger liquidity events (false breakdown)

Accumulate at the lows via QFL logic

Shift structure (channel breakout)

Target unfilled institutional supply (1.1850–1.1950)

This isn’t random—it’s engineered movement. Your job as a trader is to identify footprints, not follow the crowd.

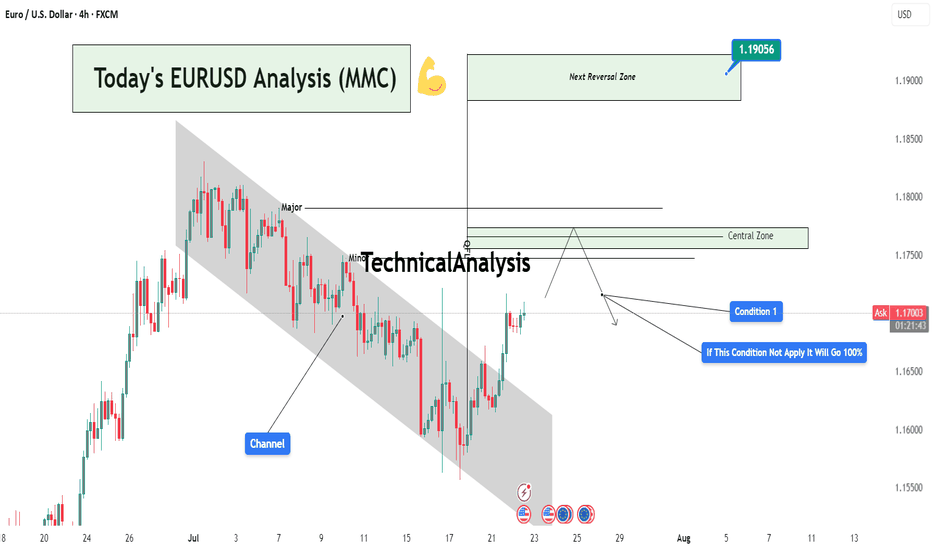

Today's EURUSD Analysis : Channel Break : EURUSD Eyes 1.19056Chart Overview:

The EURUSD pair has broken out of a well-defined descending channel, indicating a potential shift in momentum. Price has now approached a critical Central Zone that acts as a probable reaction or reversal area. This zone lies between minor and major supply levels.

🔍 Key Technical Highlights:

Descending Channel:

Price was previously trapped in a bearish channel. This channel was respected with multiple touches on both upper and lower bounds, showing controlled bearish structure.

Breakout & Momentum Shift:

The recent bullish breakout above the channel suggests buyers are gaining control. A strong candle has closed outside the structure, confirming the breakout.

Major & Minor Zones:

Two levels are marked just above the breakout:

Minor Resistance: First possible supply zone where price may pause.

Major Resistance: A stronger historical level and the top of the Central Zone.

Central Zone Reaction Area (CZRA):

This is the MMC's focus area — price is expected to react here. Either we see a rejection that could confirm a reversal setup, or price slices through, opening the door to the Next Reversal Zone around 1.19056.

📌 Strategic Condition (MMC Logic):

Condition 1:

If price respects the Central Zone and shows bearish signs (e.g., wick rejections, engulfing candles, divergence), we expect a strong pullback or reversal toward previous demand levels.

If Condition 1 Fails:

The annotation clearly states: “If this condition not apply, it will go 100%.”

Meaning: If price breaks and holds above the Central Zone, it confirms bullish strength, targeting 1.19056 — the Next Reversal Zone (NRZ).

📊 Trader's Mindset (MMC Application):

This setup is a classic MMC structure trap-break scenario:

The channel traps sellers,

The breakout invites buyers,

And the Central Zone becomes the battlefield.

Wait for confirmation, not assumption. Whether it's rejection or breakout, risk management and reaction-based trading are key.

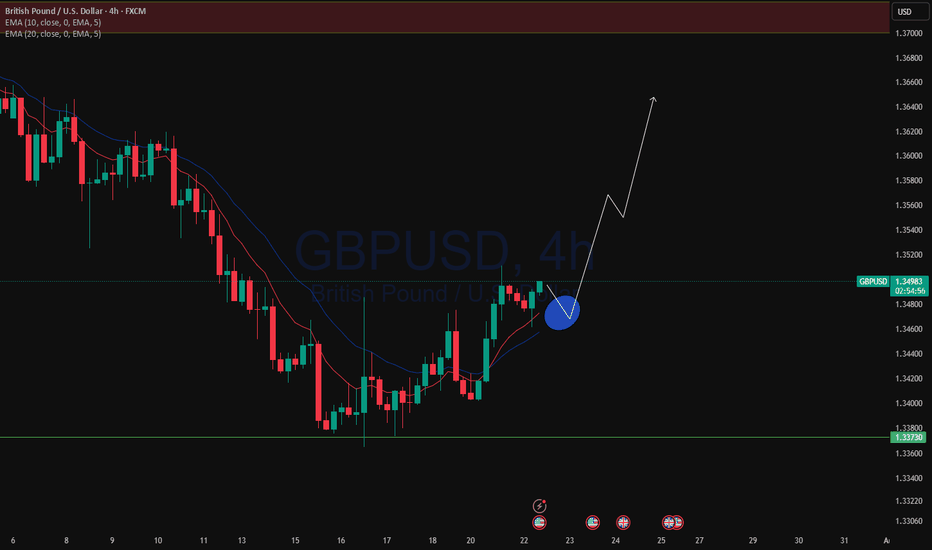

EURUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EURUSD Breaks Bullish Structure – Here’s My Trade Plan📍 Watching EURUSD closely—it's recently broken bullish (market structure) on the daily timeframe 📈.

I’m now waiting for a retrace into a fair value gap, watching for the rebalance and a possible support zone touch before the next leg up 🔄🟢.

🎥 In this idea, I walk you through:

🔍 Price action

🧱 Market structure

📊 Trend direction

📋 And my personal trade plan for this setup

Not financial advice ❌💼

EURUSD Trading Price Channel, SELL Strategy✏️ OANDA:EURUSD H4 Timeframe EURUSD is trading in a bearish channel. This bearish channel may extend to the important support at 1.145. A break of this important support will form a Downtrend. Further upside recovery will remain limited by the channel, with the notable upper boundary at 1.16800.

📉 Key Levels

Sell trigger: rejection from 1.168 with bearish confirmation

Sell DCA: Break 1.155

Target: 1.145

Leave your comments on the idea. I am happy to read your views.

Eurusd changing trendPrepeair Ur selv to see euro against US dollar with a kinda big or minimum huge profit, going 2 cents above, from 1.1620 to 1.1840, ofc this is only in my POV.

Keep Ur investment safe and use lways a stop loss under wht you can lose, and I don't mean this trade, but all I mean, is that it need to be after Ur analista and Ur own Point of View.

Keep Ur trade simple

Abd do your own research, always.

EURUSD – WEEKLY FORECAST Q3 | W30 | Y25📊 EURUSD – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

#EURUSD: Last Bullish Price Extension! Get Ready! EURUSD is approaching our buying zone, a key level, which suggests a smooth bullish reversal. As this is a swing trade, we advise keeping stop losses larger. There are two targets to keep an eye on. Remember, this is not a guaranteed move, and this is just our overview. Good luck and trade safely.

Team Setupsfx_