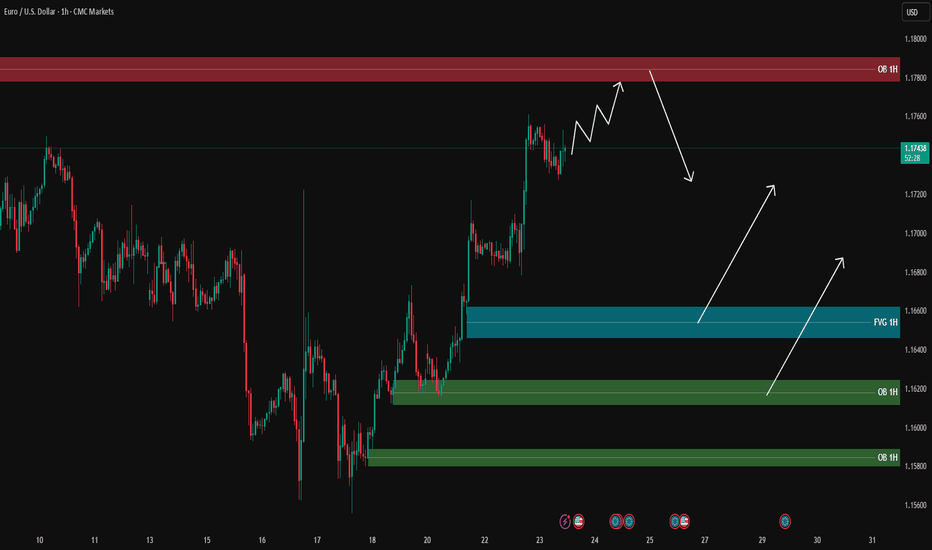

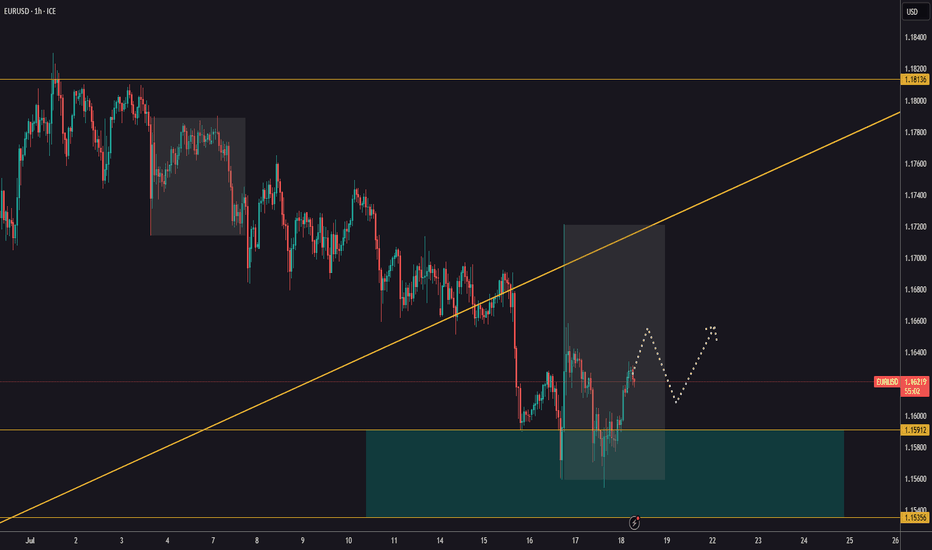

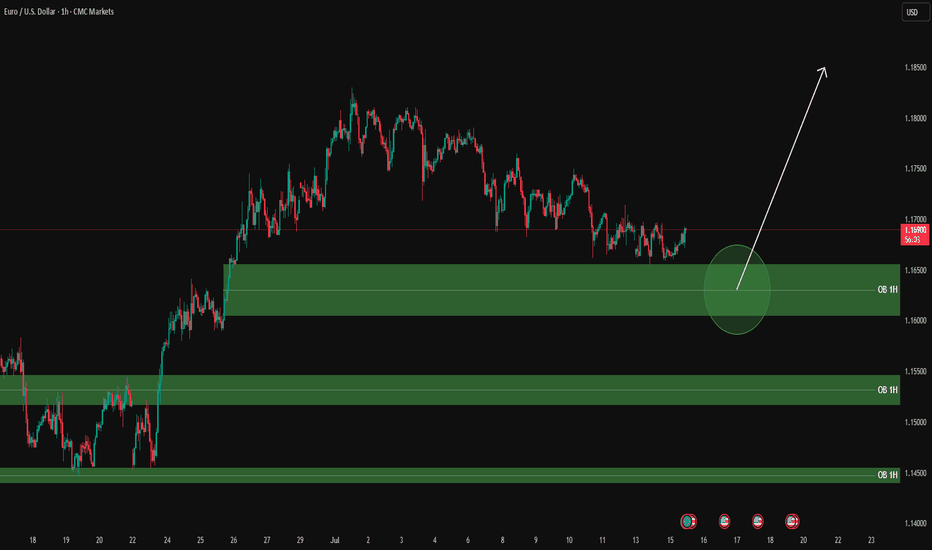

EURUSD analysis - 1H FVG and OB setupsOn the 1H timeframe, price is moving strongly towards the 1H supply zone (around 1.1780), and it is likely to reach this area first before pulling back.

During the pullback, the blue FVG and green OB zones below are key areas for potential long entries:

🔹 FVG 1H around 1.1660

🔹 OB 1H around 1.1620

🔹 OB 1H around 1.1580

📌 Plan:

1️⃣ If the price reaches the upper supply zone, we will look for short scalps with confirmation on the lower timeframe (5M/3M).

2️⃣ After the pullback to lower zones, we will look for long opportunities with PA confirmation.

🎯 Long targets after pullback: 1.1700 – 1.1720, potentially 1.1750.

❌ No entry without confirmation.

Eurusdlongsetup

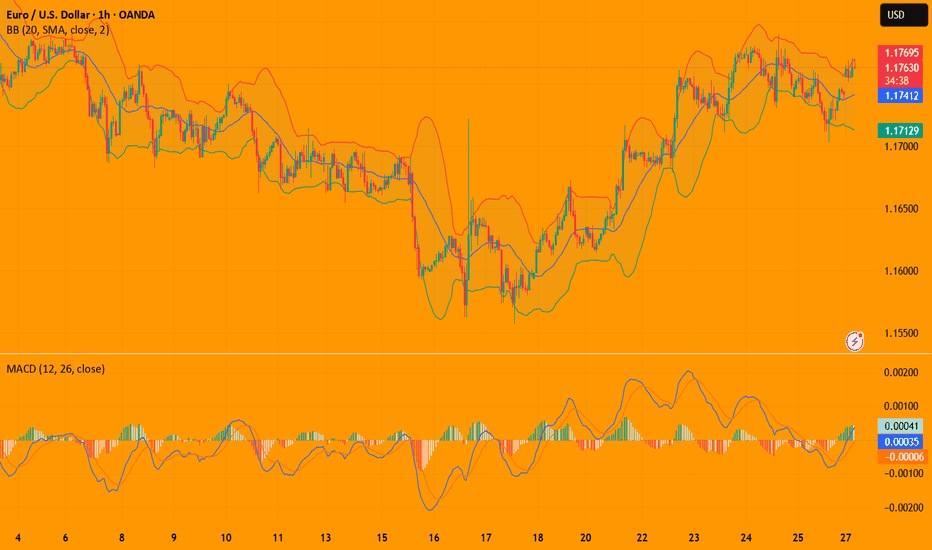

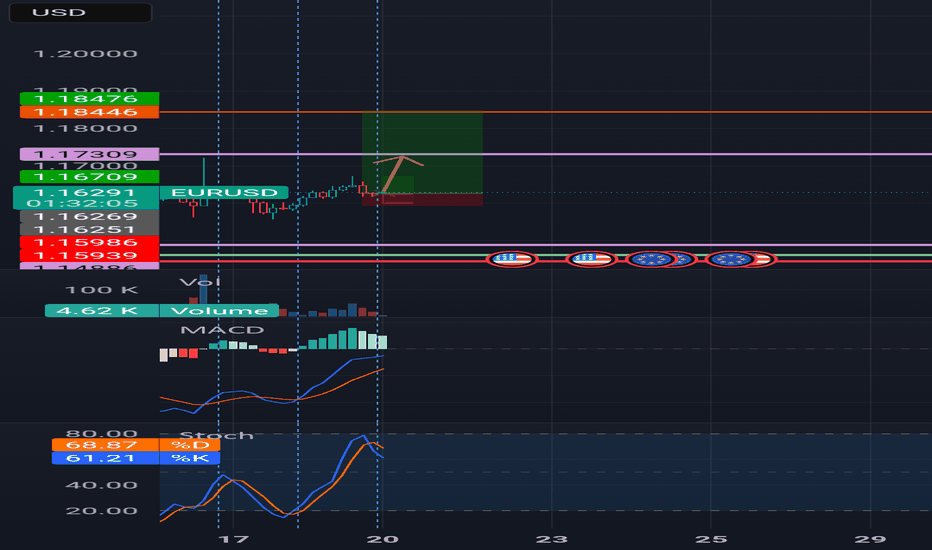

EURUSD(20250728) Today's AnalysisMarket news:

Trump announced that the US and Europe reached a trade agreement: 15% tariffs on the EU, $600 billion in investment in the US, zero tariffs on the US by EU countries, the EU will purchase US military equipment, and will purchase US energy products worth $750 billion. However, the US and Europe have different opinions on whether the 15% tariff agreement covers medicines and steel and aluminum. Von der Leyen: 15% tariff rate is the best result that the European Commission can achieve.

US Secretary of Commerce: The deadline for tariff increase on August 1 will not be extended. The United States will determine the tariff policy on chips within two weeks.

Technical analysis:

Today's buying and selling boundaries:

1.1735

Support and resistance levels:

1.1792

1.1771

1.1757

1.1712

1.1698

1.1677

Trading strategy:

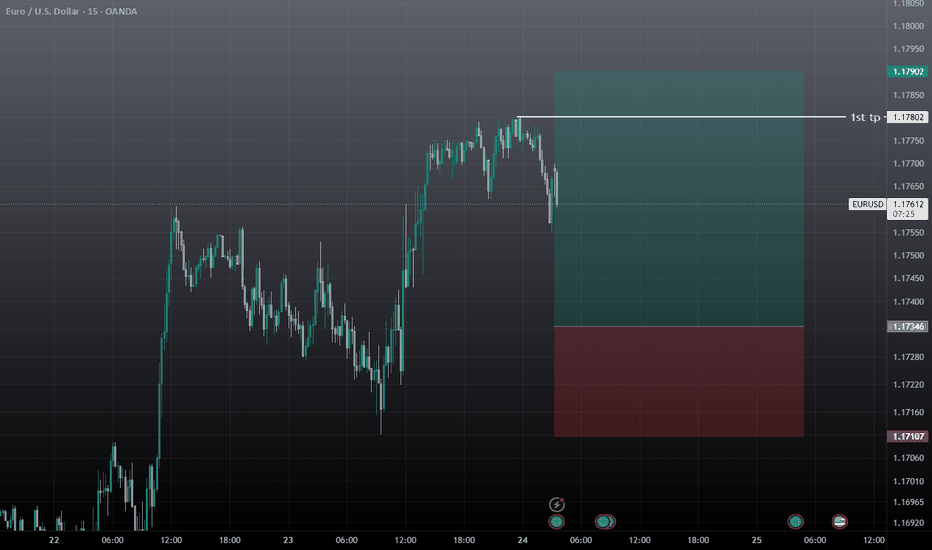

If the price breaks through 1.1757, consider buying, the first target price is 1.1771

If the price breaks through 1.1735, consider selling, the first target price is 1.1712

EURUSD is Ready for a Bullish MoveHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

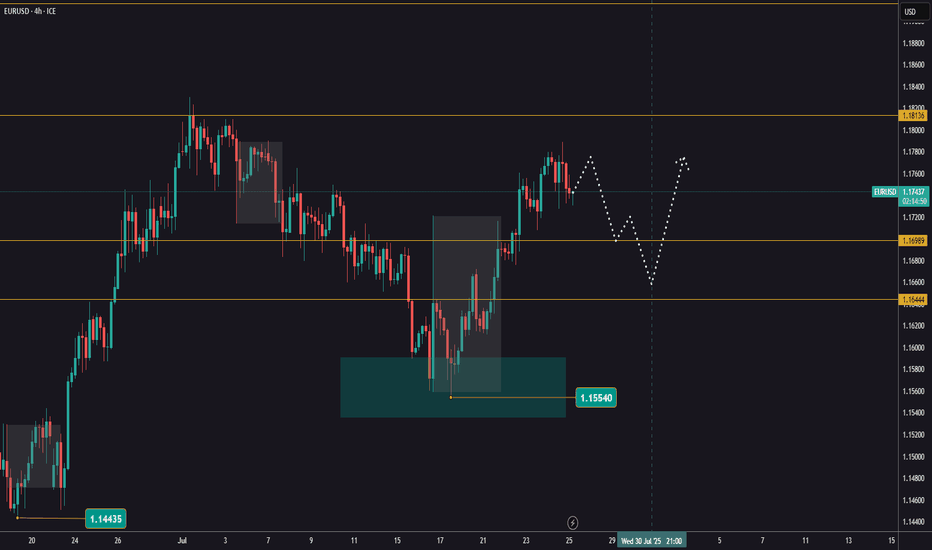

EURUSD pullbackYesterday, EURUSD attempted to continue its bullish move but was rejected at 1,1788.

Keep an eye on whether it has the strength for another push higher. If it fails again, a correction is more likely to follow.

The first support levels to watch are 1,1699 and 1,1644.

Next week, the FED’s interest rate decision is due.

That news will likely determine both the direction and timing for entry.

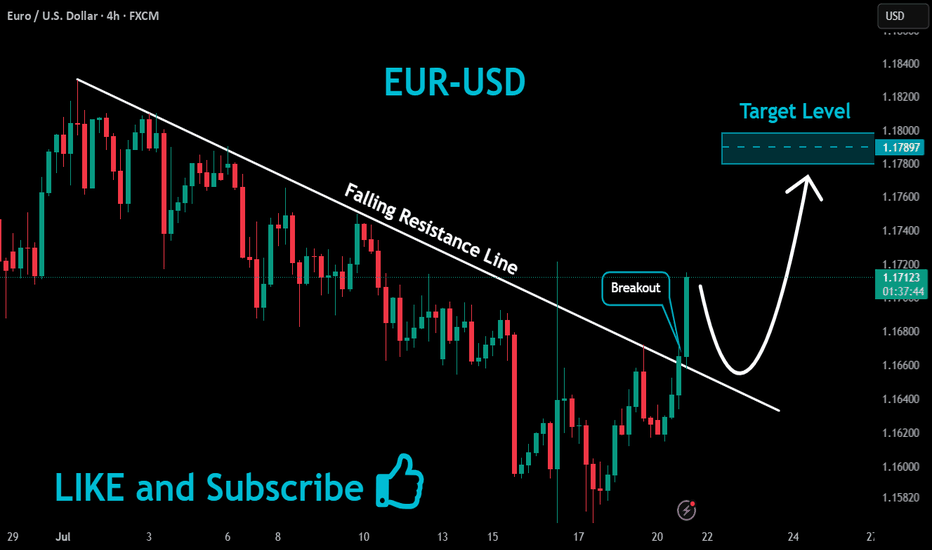

EURUSD Massive Bullish Breakout!

HI,Traders !

#EURUSD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

EURUSD Bearish Ahead as US Resilience Meets Eurozone FragilityEURUSD has shifted into bearish territory, pressured by growing divergence between a resilient US economy and a struggling Eurozone. The pair recently rejected the 1.1700 zone, forming multiple bearish structures on the 4H chart. With sticky US inflation, Trump’s renewed tariff agenda, and a dovish ECB, EUR/USD appears poised for a deeper move toward 1.1527 and possibly 1.1445 in the coming sessions. This setup is both technically and fundamentally aligned, but key event risk remains.

🔸 Technical Structure (4H)

Clear rejection from the 1.1700–1.1710 zone.

Bearish pennants and wedge patterns confirm continuation lower.

Downside targets:

🔹 First: 1.1637

🔹 Second: 1.1527

🔹 Final: 1.1445

Risk zone: Above 1.1785 (invalidates short bias if broken cleanly).

🧭 Key Fundamentals

🇺🇸 Dollar Strength: Sticky inflation, stable labor market, and geopolitical risk all favor USD demand.

🇪🇺 Euro Weakness: ECB dovish tone persists amid weak data, soft PMIs, and stagnating growth.

Yield Spread: US-Euro real yield spread supports further EUR/USD downside.

Tariff Pressure: Trump’s 50% tariff plan and tensions with the EU weigh on EUR.

⚠️ Risks to Watch

A surprise dovish pivot from the Fed.

Weak US CPI or disappointing retail sales.

Major risk-on flows that trigger broad USD weakness.

New EU fiscal stimulus or Germany/France recovery surprises.

📆 Key Events Ahead

🇺🇸 US Core CPI – A hot print supports USD strength.

🇺🇸 Retail Sales & Powell testimony – Watch tone on rate cuts.

🇪🇺 German ZEW Sentiment, Eurozone HICP inflation – Weak readings would further drag EUR.

🔄 Leader or Lagger?

EUR/USD is a lagger to GBP/USD, often following UK-driven USD moves.

Acts as a leader for EUR/JPY, EUR/AUD, EUR/CHF – weakness here cascades across EUR crosses.

Tracks broad USD sentiment – dovish Fed pricing boosts EURUSD, while rate hike fears drag it.

✅ Summary: Bias and Watchpoints

EUR/USD is bearish below 1.1700 as economic divergence, sticky US inflation, and rising geopolitical tensions favor the dollar. ECB policy remains soft, offering little support to the euro. Key risk lies in a dovish Fed pivot or softer US data. Watch US CPI and Powell for clues. This pair is likely to lag GBP/USD moves, but will lead EUR crosses lower if the downside momentum continues.

EURUSDHello traders,

I've been closely monitoring the **EURUSD** pair for a while, and it’s now offering an ideal entry opportunity. It has presented several great setups for swing trading, and I’d like to share one of them with you today.

🔍 **Trade Details**

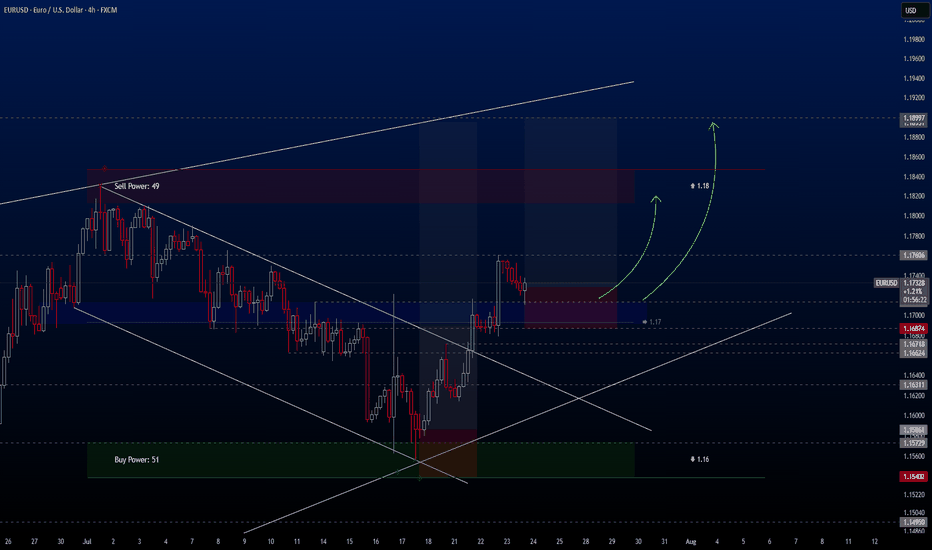

✔️ **Timeframe**: H4/D

✔️ **Risk-to-Reward Ratio**: 1:4.22

✔️ **Trade Direction**: Buy

✔️ **Entry Price**: 1.17281

✔️ **Take Profit**: 1.18997

✔️ **Stop Loss**: 1.16874

🔔 **Disclaimer**: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

Key resistance for EURUSDYesterday, EURUSD moved higher and reached a key resistance level at 1,1720.

Watch closely to see if there’s enough momentum for a breakout and further upside.

If the price gets rejected, we could see a deeper correction.

Increased volatility is likely on Thursday following the ECB decision.

At the current levels, there’s no clear reason to enter a trade.

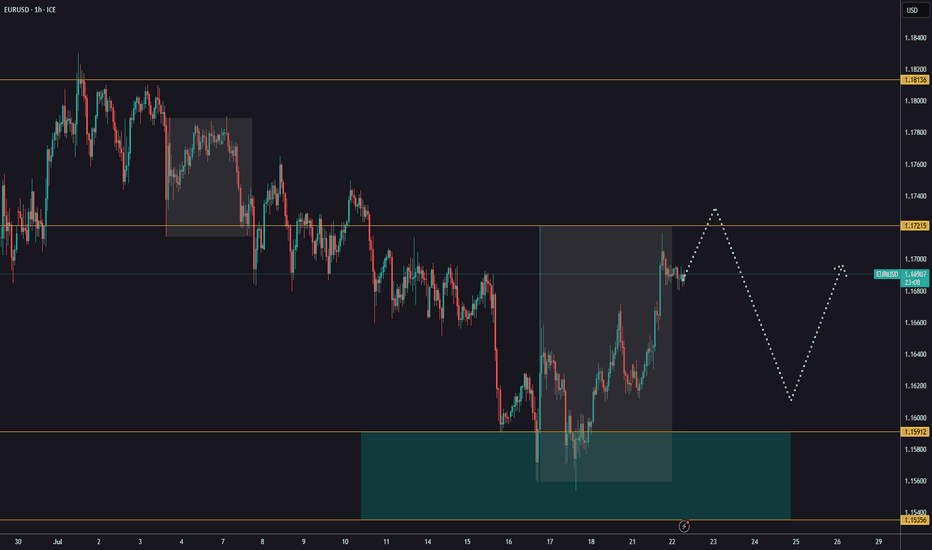

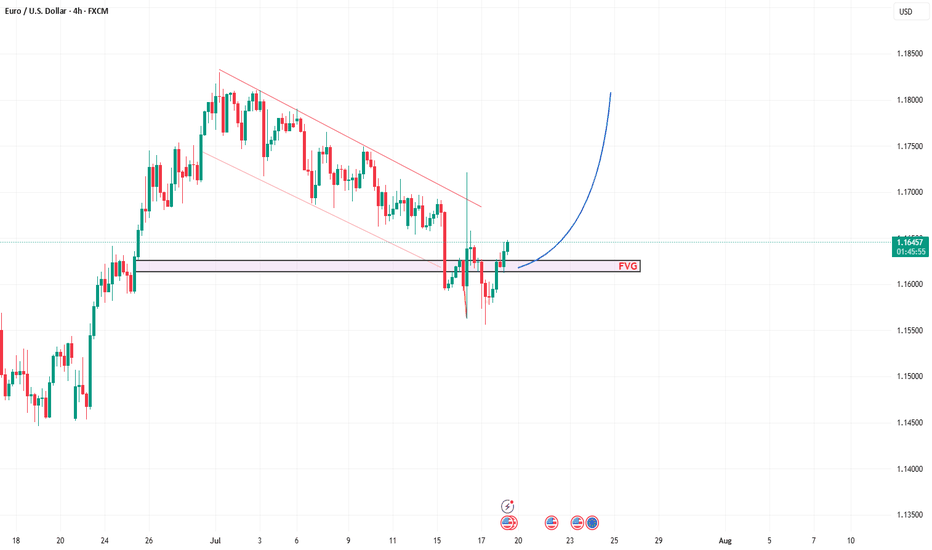

EURUSD Breaks Bullish Structure – Here’s My Trade Plan📍 Watching EURUSD closely—it's recently broken bullish (market structure) on the daily timeframe 📈.

I’m now waiting for a retrace into a fair value gap, watching for the rebalance and a possible support zone touch before the next leg up 🔄🟢.

🎥 In this idea, I walk you through:

🔍 Price action

🧱 Market structure

📊 Trend direction

📋 And my personal trade plan for this setup

Not financial advice ❌💼

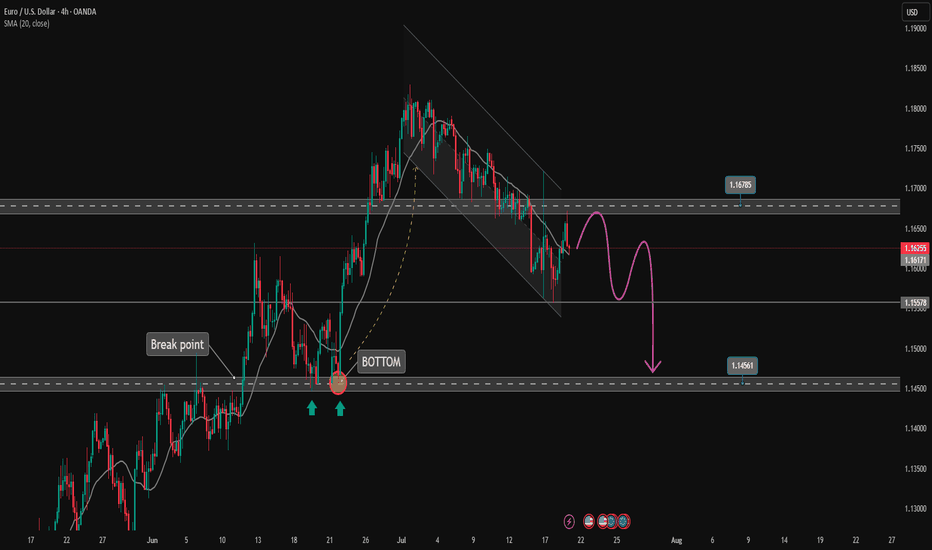

EURUSD Trading Price Channel, SELL Strategy✏️ OANDA:EURUSD H4 Timeframe EURUSD is trading in a bearish channel. This bearish channel may extend to the important support at 1.145. A break of this important support will form a Downtrend. Further upside recovery will remain limited by the channel, with the notable upper boundary at 1.16800.

📉 Key Levels

Sell trigger: rejection from 1.168 with bearish confirmation

Sell DCA: Break 1.155

Target: 1.145

Leave your comments on the idea. I am happy to read your views.

Eurusd changing trendPrepeair Ur selv to see euro against US dollar with a kinda big or minimum huge profit, going 2 cents above, from 1.1620 to 1.1840, ofc this is only in my POV.

Keep Ur investment safe and use lways a stop loss under wht you can lose, and I don't mean this trade, but all I mean, is that it need to be after Ur analista and Ur own Point of View.

Keep Ur trade simple

Abd do your own research, always.

EURUSD Analysis week 30🌐Fundamental Analysis

The USD rose after June retail sales beat expectations and initial jobless claims fell to 221,000. However, the USD's gains were limited as US stocks rebounded late in the session.

On Friday morning, US stock index futures rose 0.2%, indicating that risk sentiment remains dominant. If this trend continues, EUR/USD could hold support.

The next focus is on the Consumer Sentiment and Inflation Expectations Index data from the University of Michigan. If the data is positive, the USD could regain support and put pressure on EUR/USD.

🕯Technical Analysis

EURUSD is in a corrective downtrend towards the 1.145 support. If this support zone is broken, the EURUSD trend will turn to a Downtrend. Currently, the main trading strategy will be to look for SELL points. After price reacted at EMA and trendline and headed to temporary bottom 1.156 and hit important support soon.

📈📉Trading Signals

SELL EURUSD 1.17500-1.17700 Stoploss 1.18000

BUY EURUSD 1.14500-1.14300 Stoploss 1.14000

#EURUSD: Last Bullish Price Extension! Get Ready! EURUSD is approaching our buying zone, a key level, which suggests a smooth bullish reversal. As this is a swing trade, we advise keeping stop losses larger. There are two targets to keep an eye on. Remember, this is not a guaranteed move, and this is just our overview. Good luck and trade safely.

Team Setupsfx_

EURUSD Buy Trade Idea: Reversal Rocket Ready to Launch!Hey Fellow Traders! 👋

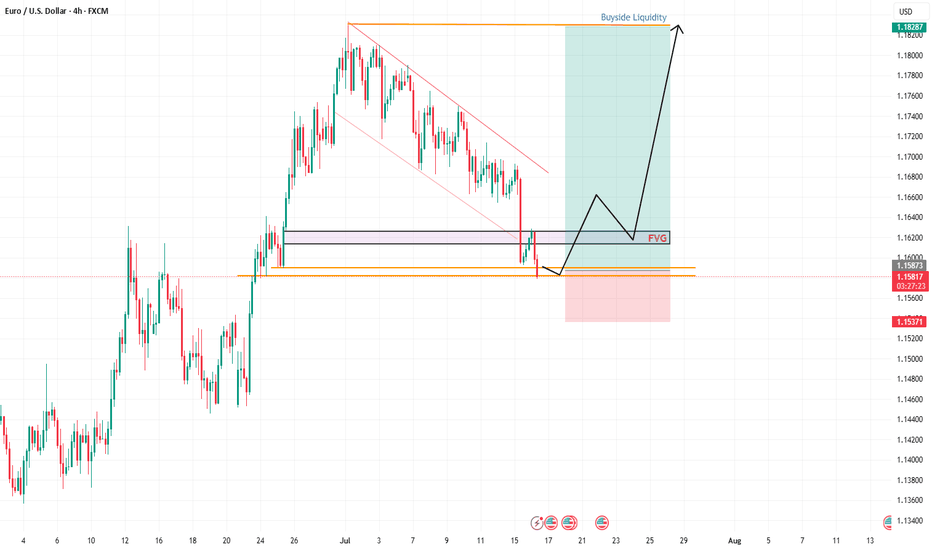

The EURUSD (EU) is setting up for a massive reversal that’s got me hyped! 🚀 After nailing the lows of that descending channel like a pro, price has retraced to our expected zone and is now bouncing hard. It’s time to gear up for a potential buy trade targeting the Buyside Liquidity! Let’s break down this fire setup and get ready to ride the wave! 🌊

📈 The Setup: Reversal in the Making!

EU hit the descending channel lows as predicted, and now it’s showing some serious bullish vibes with a strong bounce off a key weekly trendline support. This isn’t just a random move—price is reacting to a weekly demand zone and a trendline that’s holding like a fortress. 🏰 I’m expecting a reversal to kick in, aiming for that juicy Buyside Liquidity up top. But hold up—don’t just dive in blindly! Let’s talk strategy. 😎

🎯 Trade Details: How to Play It Smart

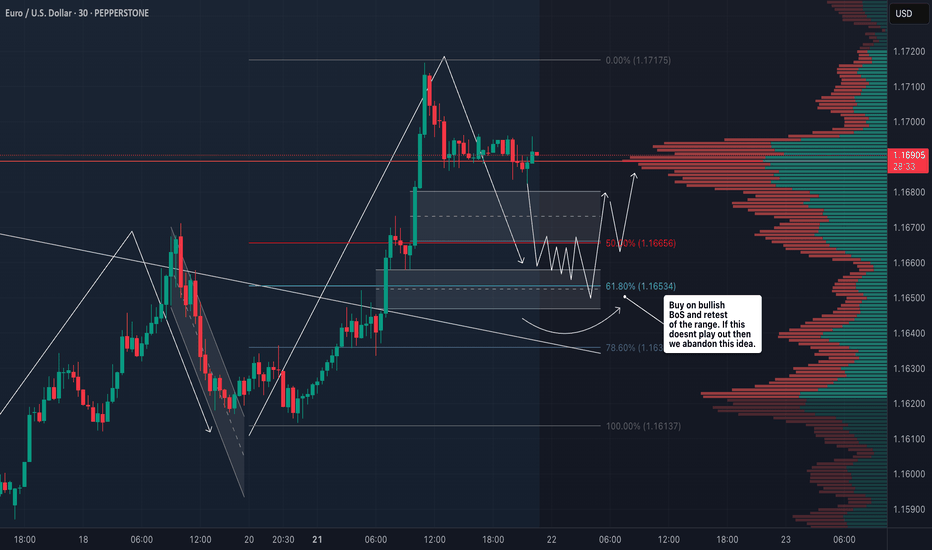

Entry Zone: Look for a calculated entry in this bounce area. Key setups to watch for:

FVG (Fair Value Gap) or IFVG (Imbalance Fair Value Gap) for precision entries.

Order Blocks (OB) for high-probability setups.

Trendlines/Support Zones: Use these for confluence, as EU is respecting that weekly trendline support.

Target: We’re gunning for the Buyside Liquidity—a high-probability target where price loves to gravitate.

Stop Loss: Place your stops below the recent lows or your chosen setup (FVG/OB) to keep risk tight.

👀 Keep an Eye on DXY for Confluence

The Dollar Index (DXY) is a key player here. A weakening DXY could supercharge this EU reversal, so monitor it closely for extra confirmation. If DXY starts to roll over, it’s like pouring rocket fuel on this trade! 🚀

🧠 Why This Reversal Makes Sense

Weekly Trendline Support: Price kissed this level and is bouncing like it means business.

Weekly Demand Zone: This area has historical strength, making it a prime reversal spot.

Channel Lows Conquered: EU smashed through the descending channel lows and is now retracing for the next leg up.

⚠️ Risk Management Reminder

Don’t YOLO this one! Use proper risk management—calculate your position size, set tight stops, and only enter when your setup aligns. Whether you’re using FVGs, OBs, trendlines, or classic support/resistance, make sure your entry is calculated to avoid getting caught in a fakeout. 💪

💬 Let’s Talk Trades!

What’s your take on this EU reversal? Are you jumping in with an FVG, OB, or something else? Drop your thoughts, setups, or questions in the comments below! 👇 If this idea gets you pumped, smash that LIKE button ❤️, follow for more banger trade ideas, and share your charts with the community! Let’s keep the vibes high and the profits higher! 💰

#EURUSD #ForexTrading #BuyTrade #Reversal #TradingView

EURUSD on the riseAfter Wednesday’s volatile spike, the market calmed down yesterday, with EURUSD holding above the support zone.

We’re seeing signs of a potential bottom forming — confirmation of this could open the door for a fresh move higher.

The goal remains to follow the bullish trend, but keep an eye out for signs of exhaustion and a possible pullback.

Stay flexible and ready to adapt!

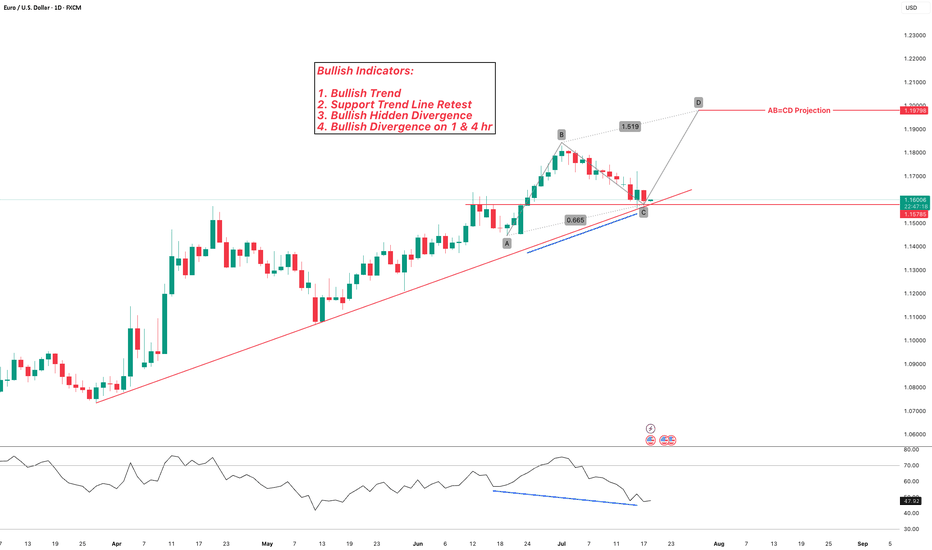

EURUSD Bullish Continuation OutlookFX:EURUSD has been trading in a bullish trend. Currently price is retesting the previous resistance level, as well as 0.618 fib. Hidden bullish divergence can be observed on the chart, in addition to regular bullish divergence on lower timeframes (1 & 4 hour).

I am expecting bullish continuation from here to complete the price projections!

#EURUSD: Still Extremely Bullish! Let's see how it goes! EURUSD is currently making minor correction and it is likely to reverse in coming days. We have to area from where price could reverse from. we advise you to read the chart and also do your analysis before making any decision.

Like and Comment For More!

Team Setupsfx_

EURUSD analysis – 1H OB Setup

✅ Green zones = 1H Buy Order Blocks

Clean plan:

Wait for price to reach the green circle zone (1.1600 – 1.1650 OB).

Once there:

✅ Drop to LTF (5M / 3M) and wait for:

Price reaction to the OB zone

BOS / CHoCH structure confirmation

Strong bullish candle for clean entry

Then, enter with stop below the OB zone.

🎯 Targets:

First TP: 1.1690 – 1.1700

Second TP: higher previous highs if momentum continues

⚠️ Let price enter your zone, get your LTF confirmations, and then take your entry with discipline.

📊 ProfitaminFX | Gold, BTC & EUR/USD

📚 Daily setups & educational trades

Buying opportunities on EURUSDYesterday, EURUSD saw a sharp spike after reports that Trump might fire the Federal Reserve Chair.

Although this wasn’t confirmed, the news triggered short-term volatility before the market settled down again.

At the moment, EURUSD is reacting to key support levels. Watch for the formation of a higher low and potential signs of a new bullish move.

The goal remains a breakout above the previous high and continuation of the main uptrend.

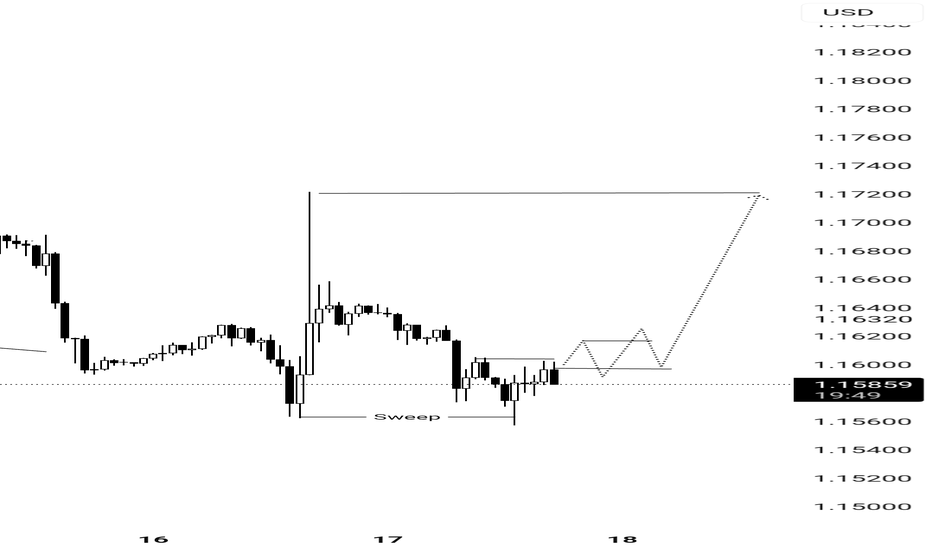

EU's Wild Drop: A Sneaky Trap or Reversal Time?Hey Fellow Traders! 😎

What a ride yesterday, right? The EUR/USD took a massive plunge, smashing through the descending channel like a wrecking ball and sweeping up all that liquidity. 💥 But hold up—was that just a clever market manipulation to shake out the bulls? I think so! 🧠

Right now, the price is chilling in a Daily Fair Value Gap (FVG), and I’m expecting some serious action here. This could be the perfect setup for a reversal! The market makers pulled a fast one—tricking bullish traders into flipping bearish after that dramatic drop. But guess what? That’s the trap! 🕸️ Don’t fall for it.

I’m eyeing a long entry right at this level. Here’s the plan:

Entry: Right now—let’s catch this wave! 🌊

Stop Loss: Set it tight around 1.15360 to keep risk in check.

Take Profit: Aiming for those juicy highs (check the chart I shared in my last post for the exact levels). 📈

This setup is screaming opportunity, so let’s talk about it! 💬 What’s your take—are we reversing or is the market still playing games? Drop your thoughts below, smash that Like button if you’re with me, and Follow for more trade ideas! 🚀 Let’s keep the community buzzing. 🐝

#Trading #EURUSD #MarketAnalysis #ReversalSetup

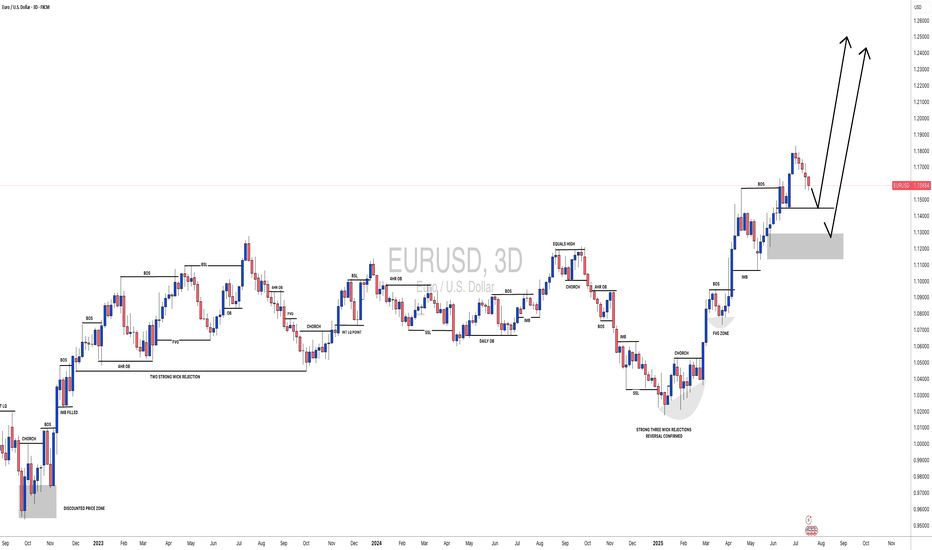

EUR/USD Retracement Into Demand ZoneHello guys!

EUR/USD is currently undergoing a healthy retracement after an extended bullish trend within the ascending channel. The price is now approaching a key demand zone, which aligns perfectly with the mid-line of the channel structure.

This zone previously acted as a strong resistance area and is now expected to serve as support, confirming a classic flip in market structure. The reaction around the 1.16288 - 1.15774 area will be crucial.

If buyers step in here, the bullish momentum is likely to resume with the next major target being the upper resistance zone near 1.20000 , as projected by the upward arrow. The overall structure remains bullish as long as the price holds above the channel support and doesn't close below the last demand zone.