Eurusdnews

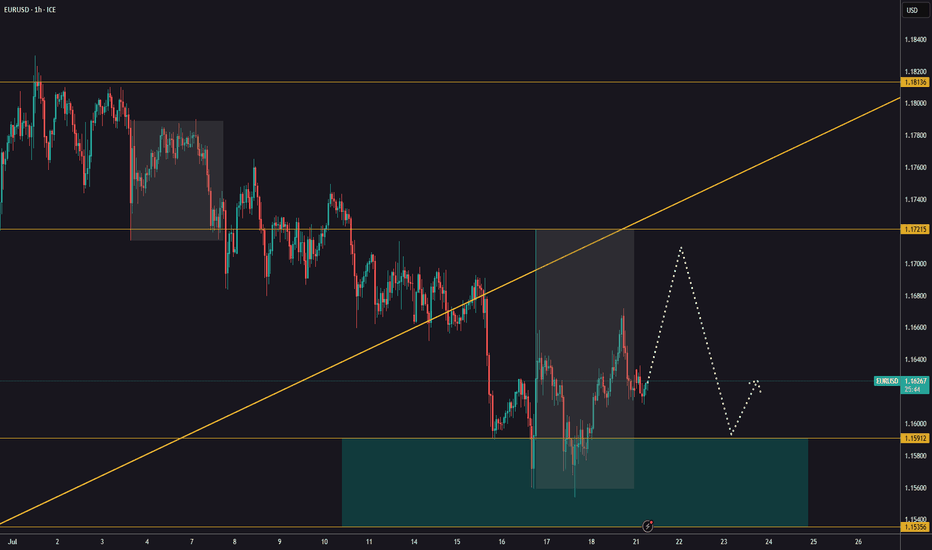

EURUSD on the riseAfter Wednesday’s volatile spike, the market calmed down yesterday, with EURUSD holding above the support zone.

We’re seeing signs of a potential bottom forming — confirmation of this could open the door for a fresh move higher.

The goal remains to follow the bullish trend, but keep an eye out for signs of exhaustion and a possible pullback.

Stay flexible and ready to adapt!

EUR/USD : US Dollar Strengthens Following Inflation ReportEUR/USD Analysis: US Dollar Strengthens Following Inflation Report

Yesterday, the US Consumer Price Index (CPI) report was released, showing an increase in consumer prices. According to Forex Factory, annual CPI rose from 2.4% to 2.7%, exceeding analysts' expectations of a 2.6% rise.

As reported by Reuters, the data supports the stance of Federal Reserve Chair Jerome Powell, who has repeatedly stated that the anticipated inflationary pressure—driven in part by tariffs—is a reason to refrain from further interest rate cuts.

However, President Donald Trump interpreted the data differently. On his Truth Social platform, he posted that consumer prices remain low and called for an immediate rate cut.

The market responded with a stronger US dollar—indicating that participants believe interest rates are likely to remain at current levels in the near term. Notably, the EUR/USD exchange rate fell to the 1.1600 level for the first time since late June (as indicated by the arrow).

Technical Analysis of the EUR/USD Chart

Analysing the EUR/USD chart as of 7 July, we identified:

→ A long-term ascending channel

→ A potential downward trajectory (marked by red lines)

Since then, the pair has followed the outlined path and declined by more than 1%.

It is worth noting that today, the EUR/USD price is near the lower boundary of a key trend channel, which may offer significant support — traders may look for a technical rebound from this level.

Additionally, attention should be paid to the upcoming release of the US Producer Price Index (PPI) at 15:30 GMT+3. These figures carry particular weight in light of potential renewed inflationary pressures. This and other upcoming data may prove decisive for the near-term direction of EUR/USD.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURUSD LONG TERM UPEURUSD Live Trading Session/ EURUSD analysis #forex #forextraining #forexHello Traders

In This Video EURUSD HOURLY Forecast By World of Forex

today EURUSD Analysis

This Video includes_ (EURUSD market update)

EURUSD Analysis today | Technical and Order Flow

#usdjpy #usdchftechnicalanalysis #usdjpytoday #gold

What is The Next Opportunity on EURUSD Market

how to Enter to the Valid Entry With Assurance Profit?

This Video is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts.

Disclaimer: Financial Trading Has Large Potential Rewards, But Also Large Potential Risk. You must be aware of the Risk and Be Welling to Accept Them in order to Trade the Financial Market . Please be Carefully With Your Money.

We are talking about future market, anything can Happen,Markets are Always like that.dnt Risky more Than 2% of your account

Now you can join with our "vip premium" service

Join us and let's make trading together

EUR/USD Analysis: US Dollar Strengthens at the Start of the WeekEUR/USD Analysis: US Dollar Strengthens at the Start of the Week

On 2 July, on the EUR/USD chart, we noted that the rally—during which the pair had gained more than 6% since mid-May—was under threat, citing several technical signals, including:

→ proximity of the price to the upper boundary of the ascending channel;

→ overbought conditions on the RSI indicator;

→ nearby resistance from the Fibonacci Extension levels, around 1.18500.

Trading at the start of the week points to renewed US dollar strength. This became particularly evident with the opening of the European session, which triggered a decline in EUR/USD to the 1.17500 area.

It is reasonable to assume that the dollar’s strength against the euro is linked to early-week positioning by traders, who are anticipating news regarding US trade agreements.

According to Reuters, the United States is close to finalising several trade deals in the coming days and is expected to notify 12 other countries today about higher tariffs.

EUR/USD Technical Chart Analysis

The ascending channel established last week remains in play, with the following developments:

→ a dashed midline within the upper half of the channel has been breached by bearish pressure (as indicated by the arrow);

→ a series of lower highs in recent sessions suggests the formation of a downward trajectory, within which the price could move towards the channel median—or potentially test its lower boundary.

P.S. In the longer term, analysts at Morgan Stanley maintain a bullish outlook, forecasting that EUR/USD could rise to 1.2700 by the end of 2027.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

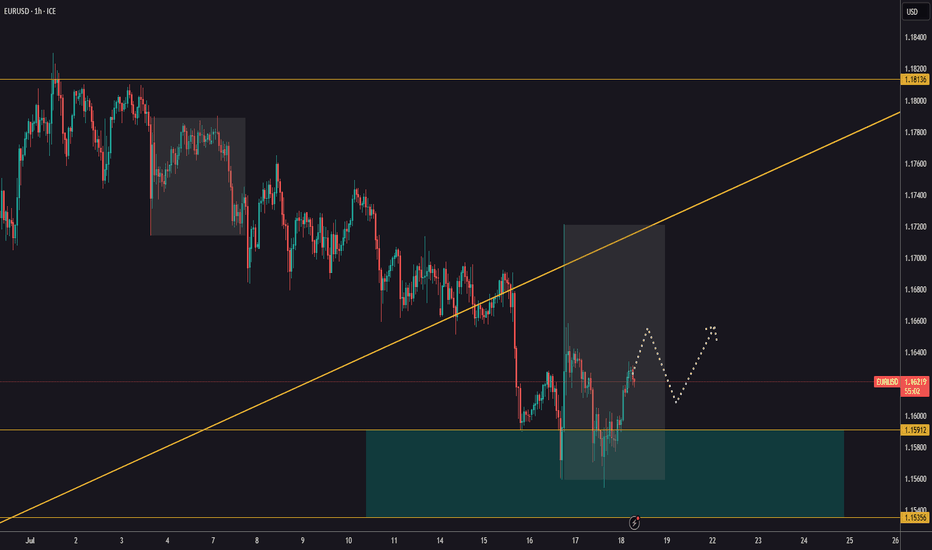

EURUSD on the riseYesterday, EURUSD failed to continue its pullback and has already recovered the drop caused by the news.

This suggests the correction might be over, and we could be seeing the start of a new bullish move.

The target is a breakout above the previous highs, aiming for 1,1706.

All positions we’re looking for are only in the direction of the main trend.

Market Analysis: EUR/USD Faces RejectionMarket Analysis: EUR/USD Faces Rejection

EUR/USD declined from the 1.1640 resistance and traded below 1.1550.

Important Takeaways for EUR/USD Analysis Today

- The Euro started a fresh decline after a strong surge above the 1.1600 zone.

- There is a connecting bearish trend line forming with resistance at 1.1545 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair rallied above the 1.1600 resistance zone before the bears appeared, as discussed in the previous analysis. The Euro started a fresh decline and traded below the 1.1550 support zone against the US Dollar.

The pair declined below 1.1520 and tested the 1.1475 zone. A low was formed near 1.1475 and the pair started a consolidation phase. There was a minor recovery wave above the 1.1495 level.

The pair tested the 23.6% Fib retracement level of the downward move from the 1.1614 swing high to the 1.1475 low. EUR/USD is now trading below 1.1550 and the 50-hour simple moving average. On the upside, the pair is now facing resistance near the 1.1505 level.

The next key resistance is at 1.1545 and the 50% Fib retracement level of the downward move from the 1.1614 swing high to the 1.1475 low. There is also a connecting bearish trend line forming with resistance at 1.1545.

The main resistance is near the 1.1580 level. A clear move above the 1.1580 level could send the pair toward the 1.1615 resistance. An upside break above 1.1615 could set the pace for another increase. In the stated case, the pair might rise toward 1.1650.

If not, the pair might resume its decline. The first major support on the EUR/USD chart is near 1.1475. The next key support is at 1.1450. If there is a downside break below 1.1450, the pair could drop toward 1.1400. The next support is near 1.1350, below which the pair could start a major decline.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Today's EUR/USD Trend Analysis and Trading RecommendationsThe EUR/USD is trading at the upper end of its recent range, having hit an intraday high of around 1.1440 and remaining near that level. The US Dollar strengthened in the early session due to optimism about the easing of Sino-US trade tensions, but later declined as European stocks fluctuated. Technically, the daily chart shows bulls remain in control, with the 20-day SMA rising gently at 1.1330. In the short term, the pair is range-bound around the 20-day SMA, yet to confirm a bullish breakout, while the 100-day and 200-day SMAs support the overall upward trend.

EUR/USD

buy@1.14200-1.14300

tp:1.14600-1.14900

EUR/USD Hits Key Resistance LevelEUR/USD Hits Key Resistance Level

Although financial markets in both the US and the UK are closed for a public holiday today, Donald Trump is keeping traders on their toes. According to a fresh Reuters report, the US President has backed down from his threat to impose 50% tariffs on EU goods from 1 June, following a phone call from European Commission President Ursula von der Leyen, who urged him to allow time to “reach a mutually beneficial deal”.

This development has boosted the euro while weighing on the US dollar.

As today's EUR/USD chart shows, the euro has risen to its highest level against the dollar since early May. But can the upward trend continue?

EUR/USD Technical Analysis

The ascending trend channel (highlighted in blue) confirms that bullish sentiment currently dominates. However, the EUR/USD chart also presents two bearish arguments worth noting:

→ The price has reached the upper boundary of the channel, which may act as resistance.

→ The 1.1400 level could also serve as resistance. Note how aggressively bears resisted upward movement in April: even when it appeared that the level had been clearly broken from below, the price failed to hold above it for long.

Given this, it is reasonable to suggest that EUR/USD bears may once again become active — particularly if the fundamental backdrop supports them.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURUSD SHORT FORECAST Q2 W20 D13 Y25EURUSD SHORT FORECAST Q2 W20 D13 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Gap fill

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURUSD SHORT FORECAST Q2 W20 D12 Y25EURUSD SHORT FORECAST Q2 W20 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Weekly imbalance

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Market Analysis: EUR/USD Trims GainsMarket Analysis: EUR/USD Trims Gains

EUR/USD extended losses and traded below the 1.1250 support.

Important Takeaways for EUR/USD Analysis Today

- The Euro struggled to clear the 1.1380 resistance and declined against the US Dollar.

- There is a key bearish trend line forming with resistance at 1.1240 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair failed to clear the 1.1380 resistance. The Euro started a fresh decline below the 1.1300 support against the US Dollar.

The pair declined below the 1.1250 support and the 50-hour simple moving average. Finally, the pair tested the 1.1200 level. A low was formed at 1.1196 and the pair is now consolidating losses. The pair is showing bearish signs, and the upsides might remain capped.

There was a minor increase toward the 23.6% Fib retracement level of the downward move from the 1.1381 swing high to the 1.1196 low. Immediate resistance on the upside is near the 1.1240 level.

There is also a key bearish trend line forming with resistance at 1.1240. The next major resistance is near the 1.1290 zone and the 50-hour simple moving average or the 50% Fib retracement level of the downward move from the 1.1381 swing high to the 1.1196 low.

The main resistance sits near the 1.1335 level. An upside break above the 1.1335 level might send the pair toward the 1.1380 resistance. Any more gains might open the doors for a move toward the 1.1420 level.

On the downside, immediate support on the EUR/USD chart is seen near 1.1200. The next major support is near the 1.1165 level. A downside break below the 1.1165 support could send the pair toward the 1.1120 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURUSD: The range is compressing in the sideway zone. Waiting foThe Relative Strength Index (RSI) indicator on the 4-hour chart stays below 50 and EUR/USD failed to make a 4-hour close above the 20-period and 50-period Simple Moving Averages (SMA), reflecting a lack of buyer interest.

On the downside, 1.1300 (static level) aligns as interim support before 1.1270-1.1260 (Fibonacci 238.2% retracement of the latest uptrend, 100-period SMA) and 1.1180 (Fibonacci 50% retracement).

EUR/USD could face strong resistance at 1.1380, where the Fibonacci 23.6% retracement level converge with the 20-period and 50-period SMAs. In case EUR/USD manages to stabilize above this resistance, 1.1450 (static level) and 1.1500 (static level, round level) could be seen as next hurdles.

EURUSD Trading: Unveiling the Precise Strategy GuideAfter last week's decline, the euro against the US dollar started to recover at the beginning of this week and is currently trading within the positive range around 1.0850.

According to the Wall Street Journal, the White House is adjusting its tariff policy set to take effect on April 2nd. It may cancel a series of tariffs targeting specific industries and instead impose reciprocal tariffs on countries with significant trade relations with the US. Affected by this news, during the European morning session, US stock index futures rose by 0.8% to 1.0%.

On the 4 - hour chart in the European morning session on Monday, the Relative Strength Index (RSI) indicator climbed to 50, indicating that the recent bearish momentum has dissipated to some extent.

In terms of the upward direction, the 50 - period Simple Moving Average (SMA) forms an interim resistance level at 1.0880, followed by 1.0900. If the euro - US dollar pair can firmly stand above this level, the next resistance level may be at 1.0950.

EURUSD Trading Strategy:

buy@1.08200-1.08500

tp:1.08900-1.09300

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EUR/USD: Key Levels and Short-Term OutlookRecently, although inflation data in the United States has declined, it remains elevated, and the labour market continues to be tight. The Federal Reserve may maintain a hawkish stance, which is supportive of the US dollar. Meanwhile, the economic recovery in the eurozone has slowed. Weak manufacturing PMI data has dampened business and consumer confidence, exerting downward pressure on the euro.

From the 4-hour candlestick chart, EUR/USD is currently in a triangular consolidation pattern, with the price hovering around 1.08343. The resistance zone lies between 1.08760 and 1.09090, whilst the first support level is at 1.08067 and the second at 1.07528. In this context, EUR/USD is more likely to test the support levels in the short term.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EURUSD - FOMC Prep - These 2 scenarios to anticipateMarket is overall uptrend after previous low showed the reversal point to head higher.

Bias is for the Buy

However, FOMC can produce volatility so we can have spikes in both direction.

There's a Sell scenario off an H4 gap.

But the preferred idea is to head lower, getting a better price on the HTF, then continue to the Equal Highs / Double top, taking out the liquidity target eventually.

Be aware, if it's not clear this week, we may have a clearer picture on next week's news and the move could also happen then if there's a delay/ranging market.

The D1 timeframe usually provides the smoother outlook. I mostly base my ideas on that.

Leave your comments below if you have any questions. Thanks

EURUSD Will Keep Growing!

HI,Traders !

EURUSD broke the key

Horizontal level of 1.05153

While trading in an uptrend

And the breakout is confirmed

So we are bullish biased and

After a potential correction

And a retest of the new support

We will be expecting a

Further bullish move up !

Comment and subscribe to help us grow !

EURUSD Shor-term SellMy Analysis on EURUSD

Based on my technical evaluation of this currency pair, the price action appears to be retesting the key resistance level within the current market structure. This phase is critical, as resistance zones often act as barriers where selling pressure may intensify.

To optimize risk-reward dynamics, I recommend exercising patience and awaiting confirmation of a bearish reversal signal—such as a rejection candlestick pattern, loss of momentum, or a decisive close below the resistance line I’ve identified. A validated bounce from this zone could serve as a high-probability sell signal for traders looking to capitalize on a potential downward move. Additionally, monitoring volume trends and broader market context would further strengthen the conviction in this setup. As always, prudent risk management, including stop-loss placement above the resistance, remains essential.

What are your thoughts, everyone? Does this align with your technical outlook, or are there alternative factors you’d consider in this scenario?

EUR/USD "The Fiber" Forex Market Heist Plan on Bearish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Fiber" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a Bearish trade at any point.

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 1h period, the recent / nearest high level.

Goal 🎯: 1.01200 (OR) Before escape in the bank

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Based on the fundamental analysis, the EUR/USD is expected to move in a bearish direction. Here are some key factors that support this prediction:

Interest Rate Divergence: The European Central Bank (ECB) is expected to maintain its dovish stance, while the US Federal Reserve is expected to maintain its hawkish stance. This interest rate divergence is expected to support the US dollar and weigh on the euro.

US Economic Data: The upcoming US economic data, including the Non-Farm Payroll and GDP growth rate, is expected to be strong, which could boost the US dollar and weigh on the euro.

European Economic Data: The upcoming European economic data, including the GDP growth rate and inflation rate, is expected to be weak, which could weigh on the euro.

Trade Tensions: The ongoing trade tensions between the US and Europe could lead to a decline in the euro, as European companies are heavily reliant on exports to the US.

The upcoming events that could impact the EUR/USD include:

ECB Meeting: The ECB is expected to maintain its dovish stance, which could lead to a weaker euro.

US Federal Reserve Meeting: The US Federal Reserve is expected to maintain its hawkish stance, which could lead to a stronger US dollar.

US-Europe Trade Talks: The ongoing trade talks between the US and Europe could lead to a decline in the euro, as European companies are heavily reliant on exports to the US.

Overall, the fundamental analysis suggests that the EUR/USD is likely to move in a bearish direction.

Upcoming Fundamental Indicators:

ECB Interest Rate Decision: 0.0% (expected)

US Federal Reserve Interest Rate Decision: 2.0% (expected)

US Non-Farm Payroll: 200,000 (expected)

US GDP Growth Rate: 2.5% (expected)

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂