EUR/USD Hits Highest Level in Over Three YearsEUR/USD Hits Highest Level in Over Three Years

This morning, the euro surged above the 1.1300 mark against the US dollar for the first time since February 2022.

Throughout this week, the EUR/USD pair has broken through the highs of both 2023 and 2024.

Why Is EUR/USD Rising?

Amid the whirlwind of news surrounding the imposition and suspension of tariffs in US–EU trade, one dominant factor stands out — the sell-off of US bonds.

According to Reuters, long-term US Treasury bonds are being heavily sold this week. The yield on 10-year notes has jumped from 3.9% to around 4.4%, marking the steepest increase in yields since 2001. This may reflect a reaction by foreign holders of US debt to sanctions imposed by the White House, combined with growing uncertainty about the US economy — especially as recession fears gain more media attention.

As a result, the US dollar is showing weakness against a range of currencies, including the Japanese yen, Swiss franc, and the euro.

Technical Analysis of EUR/USD

The chart reveals a clear ascending channel (marked in blue), with the price repeatedly interacting with its upper, lower, and median boundaries — highlighted with markers and arrows.

Current bullish sentiment has pushed the pair towards the upper boundary of this channel. It’s possible this resistance line could halt further gains, potentially leading to a correction — perhaps down to the 1.11 level, which previously acted as a strong resistance point.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Eurusdoutlook

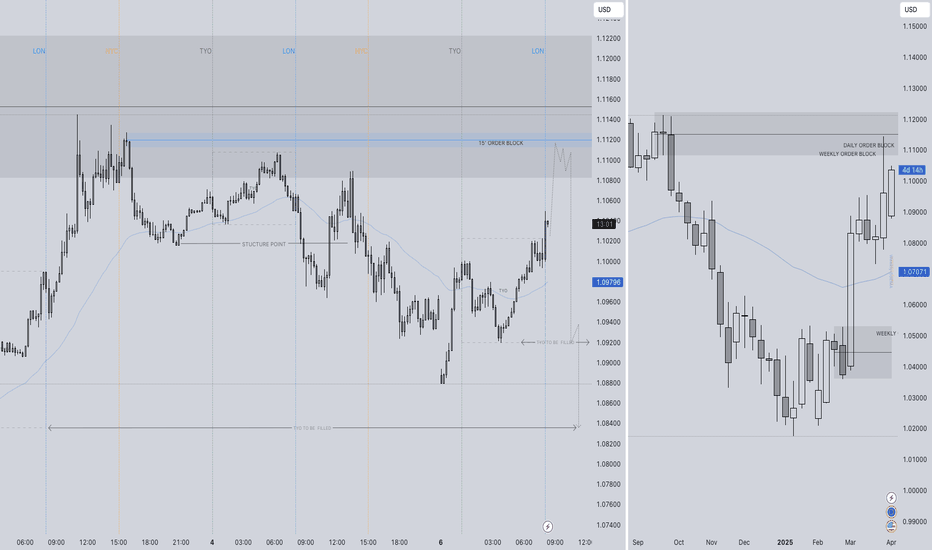

EURUSD SHORT FORECAST Q2 W15 D11 Y25EURUSD SHORT FORECAST Q2 W15 D11 Y25

Happy Friday Traders!

Let's see how the weekly candle continues to reject the weekly order block. The bearish pressure will in turn break structure on the 15'. We simply can not buy into the higher time frame order block. Not to be stuck with a bias but we must trade in line with the higher time frames.

More info to come.

Trade Well.

FRGNT X

EURUSD SHORT UPDATED Q2 W15 D9 Y25EURUSD SHORT UPDATED Q2 W15 D9 Y25

Welcome Traders! Let's be dynamic. Here an image of my updated thoughts regarding EURUSD short position. Can price action snap the lows of Asia, creating bearish price actions, Leaving a point of interest for us to short from?

Lets see how it plays!

Until then !

FRGNT X

Market Analysis: EUR/USD Resumes IncreaseMarket Analysis: EUR/USD Resumes Increase

EUR/USD started a fresh increase above the 1.0950 resistance.

Important Takeaways for EUR/USD Analysis Today

- The Euro started a decent upward move from the 1.0880 zone against the US Dollar.

- There was a break above a key bearish trend line with resistance at 1.0955 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair started a fresh increase from the 1.0775 zone. The Euro cleared the 1.0950 resistance to move into a bullish zone against the US Dollar, as mentioned in the last analysis.

The bulls pushed the pair above the 50-hour simple moving average and 1.1000. Finally, the pair tested the 1.1150 resistance. A high was formed near 1.1146 before the pair corrected gains. It dipped below 1.1000 and tested 1.0880.

The pair is again rising from the 1.0880 zone. There was a break above a key bearish trend line with resistance at 1.0955. The pair climbed above the 50% Fib retracement level of the downward move from the 1.1146 swing high to the 1.0880 low.

Immediate resistance on the EUR/USD chart is near the 1.1045 zone and the 61.8% Fib retracement level of the downward move from the 1.1146 swing high to the 1.0880 low.

The first major resistance is near the 1.1080 level. An upside break above the 1.1080 level might send the pair toward the 1.1145 resistance. The next major resistance is near the 1.1165 level. Any more gains might open the doors for a move toward the 1.1200 level.

Immediate support on the downside is near the 1.0955 level. The next major support is the 1.0880 level. A downside break below the 1.0880 support could send the pair toward the 1.0830 level. Any more losses might send the pair into a bearish zone toward 1.0775.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURUSD SHORT FORECAST Q2 W15 Y25 TUESDAY 8TH APRIL 2025EURUSD SHORT FORECAST Q2 W15 Y25 TUESDAY 8TH APRIL 2025

Welcome back if you're returning, Welcome if you're new here!

Let's take a long into a much unchanged EUERUSD short analysis. The weekly time frame in particular is setting the short scene here. The weekly order block created in September 2024 is providing the valid short point of interest and we have witnessed rejection from that area.

It is also worth mentioning risk management. It does not really feel like a change in dynamic, the majority of us have seen similar price action movements during financial global shifts. My only take away is RISK MANAGEMENT during those/ these periods. One thing I have noticed being a trader is I can always find a position, the question is, BUT... "what position are you going to execute"

This was the difference between FRGNT now and FRGNT then.

Take EURUSD, we have alerts set just below our points of interest. Once that alert sounds, we are aware that our high probability set up is to be looked at closer.

EURUSD short forecast in that case remains 100% unchanged at this time and I shall link the EURUSD short forecast from week 15 beginning.

You may feel that there is no need to read but I hope this reenforces that at times there are trading periods in which there simply is no position to execute. Our job at professional risk managers is to ensure that when our set up does materialise, we are there ready with out account balance intact to bank the full rewards.

FRGNT X

Bulls Take Control – Can EURUSD Reach 1.1150 Again?1. What happened (recap):

Last week, EURUSD reached the 1.1150 zone, a level that hasn't been touched since August-September last year. After that, the pair started a correction. Although the week started with a gap down yesterday, bulls took control and pushed the pair higher.

2. Key Question:

Has EURUSD completed its correction, or is another drop coming?

3. Why I expect further upside:

• 🔑 A retest of the formed support at 1.09 occurred during yesterday’s New York session, followed by a fresh rebound.

• 📊 The drop from 1.1150 appears corrective in nature, suggesting the possibility of a new leg up.

• 🎯 As long as 1.09 holds, my strategy is to buy dips with the primary target being a retest of the 1.1150 resistance zone.

4. Trading Plan:

📌 I’m looking for buying opportunities on dips, aiming to retest the 1.1150 resistance area. This scenario is invalidated only by a daily close below 1.09.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

EURUSD Sell and Buy Trading Plan Update!!!Hi Traders, on March 19th I shared this "EURUSD Sell and Buy Trading Plan"

I expected short term bearish moves towards the Fibonacci support zones and then continuation higher. You can read the full post using the link above.

Price moved as per the plan here!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD SHORT POTENTIAL Q2 W15 Y25 MON 7TH APRIL 2025EURUSD SHORT POTENTIAL Q2 W15 Y25 MON 7TH APRIL 2025

An almost picture perfect setup. Let's take a look into why and what we forecast.

Take a look at the weekly chart. We have had a previous bearish close from the weekly order block. That's a tick in our book. The even better news is that weekly wick of rejection has also mitigated the daily order block up at the highs!

Another serious level of confluence that will in turn support out short forecast. Now what can we expect to happen next for price action. We shall not guess, we will wait to see how the market plays but I'll inform you of what FRGNT X would love to see.

-Price action fill the previous weekly closed wick area.

- In doing so, can we reach the 15' Order block that was left behind.

- Can we grab a lower time from break of structure from that point of interest.

- Once the above occurs. We short the market doing to clear points of interest.

The plan for EURUSD is very very simple this Monday morning. Let's see how it plays out.

FRGNT X

EUR/USD Holds Neutral Bias After NFPThe U.S. dollar has managed to regain some ground in the short term after several sessions of gains in EUR/USD. Currently, the pair is showing a downward move of just over 1%, following the NFP report, which showed 228,000 new jobs versus the 137,000 expected. This has slightly increased demand for the U.S. dollar in recent hours, as the market anticipates the possibility of higher inflation and, consequently, more restrictive Fed policy in upcoming decisions.

Uptrend

Since February 28, a strong upward trend has been in place, showing a clear buying bias in EUR/USD. So far, selling corrections have not been strong enough to break key trendline levels, making this the dominant formation to watch in the short term.

RSI

In the case of the RSI, oscillations have started to approach the overbought zone near the 70 level. Additionally, it is important to note that while EUR/USD has posted higher highs, the RSI has shown lower highs, reflecting a bearish divergence and signaling a potential imbalance driven by strong short-term buying pressure. This could eventually lead to downward corrections in the sessions ahead.

Key Levels:

1.1000 – Major resistance: This level remains the most relevant round-number resistance on the chart. Sustained price action above this level could reinforce bullish momentum in the short term.

1.07911 – Near-term barrier: This level is located near the 200-period moving average and could serve as a tentative zone for future selling corrections.

1.06132 – Distant support: Positioned around the 38.2% Fibonacci retracement, this level marks a key breakpoint that, if reached, could invalidate the current bullish structure.

By Julian Pineda, CFA – Market Analyst

EUR/USD Long to Short idea (1.08500 up to 1.10500)EUR/USD (EU) Analysis – This Week

This week, EUR/USD looks promising, similar to GBP/USD, with multiple key points of interest (POIs) in close proximity.

A clean, unmitigated 2-hour demand zone sits nearby, which could trigger a bullish rally if price reacts from this level. At the same time, price has been bearish over the past few days, forming a valid 9-hour supply zone from the recent downward push. I’ll be watching to see where price slows down and which liquidity level it targets first.

Confluences for EU Buys:

EU has been bullish for weeks, and this move could be a healthy correction before further upside.

The U.S. dollar remains bearish, aligning with this bullish bias.

A clean 2-hour demand zone has formed, which previously caused a break of structure to the upside.

Imbalances and untapped Asia session highs still need to be taken.

Note: If price breaks below this structural low, I will shift my focus toward sell opportunities. However, if that happens, we’ll know exactly where the ideal entry points for shorts will be.

Euro Rises Above $1.09 Despite Tariff ThreatsThe euro climbed above $1.09, showing unexpected strength after President Trump announced 20% tariffs on all EU imports.

◉ Fundamental Rationale

● The currency got a boost because the U.S. dollar weakened. Trump’s tariffs made trade tensions worse and worried people about slower economic growth.

● Also, new numbers showed Eurozone inflation fell to 2.2% in March, the lowest since November 2024.

● This lower inflation means the European Central Bank doesn’t need to raise interest rates, making the euro more appealing to investors.

◉ Technical Observation

● From a technical perspective, an inverse head and shoulders pattern has formed, hinting at a possible trend reversal.

● A breakout above $1.095 could pave the way for stronger bullish momentum.

#EURUSD: Two Opportunities In One Chart, What do you see? Price has shown bullish behaviour exhaustion, and it's at a point where we see a total meltdown in prices. This is an excellent scenario for traders who trade on what the chart shows us rather than selling or buying only. We can utilise both these entries when prices do show a strong indication at either of our levels.

If you like our work, then do like and comment on the idea, which will boost us to post more such ideas. ❤️🚀

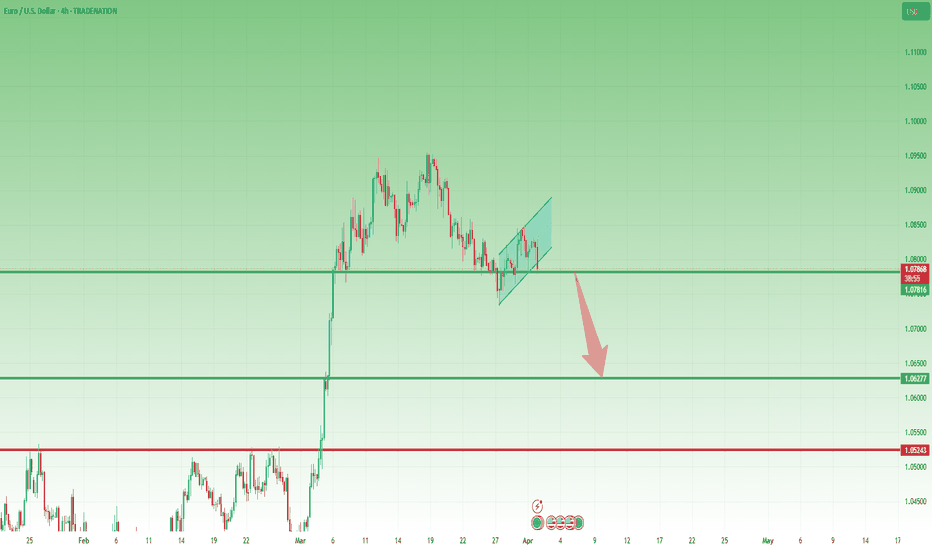

EurUsd could continue to the downsideTwo weeks ago, I mentioned that while a new high was possible, the bigger move in EUR/USD should be to the downside.

Indeed, the pair dropped from above 1.0900 and recently found support around the 1.0730 zone.

The recent recovery appears corrective, unfolding in a flag pattern, and I expect another leg down toward 1.0600.

Bearish confirmation comes with a daily close below 1.0750, and my preferred strategy is to sell rallies.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

EURUSD Weekly FOREX Forecast: BUY IT!In this video, we will analyze EURUSD and EUR Futures for the week of March 31 - April 4th. We'll determine the bias for the upcoming week, and look for the best potential setups.

The bias is bullish for now, but the April 2nd tariffs can flip the markets upside down. Be careful. Let the market tell you which direction it's going, and trade accordingly. Allow the markets to settle on a bias before you jump in.

NFP on Friday, btw.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

EUR/USD Long setup from the 3hr demand zoneSimilar to GBP/USD, I’m looking for long opportunities on EU. My key area of interest is the 3-hour demand zone, where I will wait for price to mitigate and accumulate before entering a position.

Price has also changed character to the upside, further validating this demand zone as a strong point of interest. Additionally, there is a significant amount of liquidity to the upside that needs to be taken.

The next major supply zone I have marked out is the 23-hour supply zone, which is further away. For now, my focus remains on the demand zone—unless price breaks below, creating a new supply level.

Confluences for EU Buys:

- Bullish market structure shift, with a clean demand zone left behind.

- Unmitigated 3-hour demand zone, making it a strong area of interest.

- Liquidity resting above, which price is likely to target.

- DXY has been bearish, aligning with a bullish outlook for EU.

Note: If price breaks structure to the upside without tapping my nearby demand zone, I will either wait for a new demand zone to form or look for a sell-to-buy opportunity from supply.

EURUSD:Analysis of the Profit-making Strategies for Next WeekThe euro against the US dollar once retraced to around 1.0765. Subsequently, it stabilized slightly after the release of the US core Personal Consumption Expenditures (PCE) inflation data for February. Since the year-on-year growth rate of this data exceeded expectations, the market's expectation that the Federal Reserve will maintain the current interest rate range of 4.25%-4.50% for a longer time has intensified. Moreover, the United States is set to impose an additional 25% tariff on imported automobiles starting from April 2nd, which adds more uncertainties to the outlook of the euro.

We can focus on the initial resistance level of 1.0850 above. If this level is not breached, one can attempt to short at high levels.

Trading strategy:

Sell@1.0850

TP:1.0750

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!