EURUSD SHORT FORECAST Q2 W17 D22 Y25EURUSD SHORT FORECAST Q2 W17 D22 Y25

Summary

- Weekly Order Block

- Daily Order Block

- 15' Order Block

- Break of 15' structure

Requirements

- Setup A) Continued 15' breaks of structure. Price action pull back to point of interest.

- Setup B) Lower time frame break of structure via current 15' order block for immediate short.

FRGNT X

IG - JCFRGNT

Eurusdoutlook

How Smart Money is Positioning in EUR/USD – 5 Scenarios UnfoldedLiquidity Maps & Trap Zones: EUR/USD 1H Breakdown

EUR/USD SMC Analysis – Scenarios Overview

1. Case 1 – Immediate Pump:

The market may pump directly from the current market price (CMP) and take out the external range liquidity resting above the current highs.

2. Case 2 – 15-Min Demand Reaction:

The market could react to the 15-minute demand zone , showing a bullish response and pushing higher toward the 1H supply zone .

3. Case 3 – Inducement & Distribution:

Combined with Case 2, the market may first mitigate the 15-minute demand , then take out the inducement (IdM ) near the 1H supply zone . From there, distribution may begin within that supply range, leading to a drop toward the discount zone .

This would likely involve a fake breakout to the upside (liquidity sweep), trapping buyers and hitting the stop-losses of early sellers before reversing sharply.

4. Case 4 – 1H CHoCH and Triangle Breakdown:

A Change of Character (CHoCH) may occur on the 1H timeframe directly from the current price, leading to a downside move. This scenario would also break the rising triangle pattern , triggering entries from price action traders and increasing market volatility as liquidity accelerates the move downward.

5. Case 5 – 1H Supply Rejection & Free Fall:

The market may react from the 1H supply zone and reject aggressively, resulting in a free fall all the way down to the previous CHoCH level , confirming strong bearish intent from premium to discount.

Thanks for your time..

EUR/USD Shorts from 1.5500 back down My analysis this week is quite similar to GU. I’ll be looking for short opportunities to target a demand zone below current price. We’ve seen consolidation over the past week, which has built liquidity on both sides—and it's only a matter of time before that liquidity is swept.

What I’ll be watching for is a reaction at the current supply, where I’ll wait for price to slow down and distribute, giving us an opportunity to catch a retracement down toward a key area of interest for buys. If price reaches 1.12000 or lower, I’ll be looking for signs of accumulation and potential longs from there.

Confluences for EUR/USD Sells:

- The DXY has been bearish, but is approaching a demand zone, which could cause a reversal—aligning with EU shorts.

- A strong weekly supply zone is in play, which could trigger a bearish reaction.

- Plenty of liquidity and imbalances lie to the downside, ready to be cleared.

- A retracement is likely, considering the extended bullish momentum recently.

- Current consolidation suggests a breakout is near, and this supply zone is my nearest POI for shorts.

P.S. Stay flexible—once the consolidation breaks, assess how price behaves. Don’t lock yourself into one bias; always be prepared to adapt to what the market shows you.

EUR/USD "The Fiber" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Fiber" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 4H timeframe (1.08500) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1.13000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

EUR/USD "The Fiber" Forex Market Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

Detailed Explanation 📝✨

Point 1: Fundamentals = tug-of-war ⚔️; U.S. strength 💪 offset by tariffs 🌧️, Eurozone weakness 🇪🇺 mitigated by ECB stability 🌟.

Point 2: Macro shows U.S. resilience cracking 😟, euro holding ground ⚖️.

Point 3: Global markets mixed 🌐, no clear winner, EUR/USD in range 🔄.

Point 4: COT cautious 📑, speculators less bullish 😐, hedgers bearish 📉.

Point 5: Intermarket neutral ⚖️; dollar-yield link key 📈, equity dips cap extremes 📉.

Point 6: 1.0950 pivot 🎯, breakout or breakdown ahead 🚀📉.

Point 7: Sentiment balanced 😊, retail buys 📈 vs. institutional caution 😐.

Point 8: Trends hinge on 1.0950 🔮; bullish needs breakout 📈, bearish risks below support 📉.

Point 9: Neutral outlook ⚖️, breakout potential either way 🌟📉.

Accurate as of April 7, 2025 ⏰, based on trends & projections. Watch U.S. CPI & Eurozone news 👀!

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD remains weak across the board. EUR, GBP & JPY Bullish.Not much action due to the extended market break and Easter weekend but I expect more USD selling across the board in the coming weeks ahead.

Long positions are sitting tight but two areas I am keeping an eye on are 1.1200 as a base support and 1.1500 as the resistance hurdle we need to clear in order to open up the gates to 1.2000+

GBP/USD is still a bullish case for me as the short term resistance may be cracking and I'm still expecting for the JPY to advance against the USD.

It's good to get a break from the market volatility but I surely expect it to resume in the coming week!

Good Luck & Trade Safe!

#EURUSD: 1545+ PIPS Swing Sell Idea Concept! Comment Your Views!Hey there everyone! 👋

I’ve got some insights into the EURUSD currency pair. It’s been on a wild ride lately, with the USD taking a nosedive. But guess what? The EURUSD is on a bullish streak and it’s not stopping anytime soon, and it is very likely it will reach our entry point.

Now, I know what you’re thinking. “Is this a good time to jump in?” Well, let me tell you, it’s all about your risk tolerance. We’ve identified three potential entry points for the EURUSD pair, so you can decide if it’s time to make a move. 📈

Remember, trading involves risks, so it’s important to be cautious and stick to your risk management plan. 🛡️

Good luck with your trading journey 😊

Much Love❤️

Team Setupsfx_

EURUSD SHORT FORECAST Q2 W16 D18 Y25EURUSD SHORT FORECAST Q2 W16 D18 Y25

Fun Coupon Friday.

Summary

- STILL with HTF Order block (weekly)

- All long positions invalid until weekly close above weekly order block

- Short positions charted

- The more breaks of 15' structure the more confluence for bearish pressure

- Lower time frame turn around in price action REQUIRED in all short positions.

FRGNT X

EURUSD SHORT FORECAST Q2 W16 D17 Y25EURUSD SHORT FORECAST Q2 W16 D17 Y25

GM GM!

SUMMARY

- Weekly order block short

- Unconvincing bearish move via the order block therefore 15' break of structure required. MINIMUM

- Tap entry via the 15' order block only valid if major 15' structure levels broken. In turn we will see a turn around in higher time frame price action support the short from the weekly order block

- A + short would be to await all of the above prior short

Trade well.

FRGNT X

EURUSD IDEA BY ICT 4+ ConfirmationIn my analysis of EURUSD using ICT concepts, I identified several confirmations, including: Fair Value Gap (FVG), Discount & Premium levels, Breaker Block, and Optimal Trade Entry (OTE). For each of the mentioned PD Arrays, I used the 50% level of the range as a key reference point.

Based on this approach, my point of view is that there is potential for EURUSD to move upward during the Asia/European session.

Note: This is only analysis, not financial advice

The Euro Bull sharpening it's horns against the USD?After further analysis on the weekly and monthly chart, I have identified what looks like a much larger broadening bottom pattern which signals the possibility of much further U.S. Dollar weakness.

Based on my previous video analysis, my original target for the EUR/USD was 1.2000 however 1.2500 – 1.3000 is not out of the question now. We haven’t traded in that price range since 2014.

In the immediate term, we could see a bullish acceleration if we begin trading cleanly above 1.1500.

I will expand on this analysis in my next upcoming weekly video.

Good Luck & Trade Safe.

EURUSD SHORT FORECAST Q2 W16 D16 Y25EURUSD SHORT FORECAST Q2 W16 D16 Y25

GM.

This play could well materialise sooner rather than later.

The weekly higher time frame order block previously provided an incredible sell off. We have arrived and simply looking to get involved in the short party.

15' order block identified.

But a tap In London short? NO. We will await for 1' break of structure alongside bearish candle stick formations.

FRGNT X

EURUSD TA: Fibonacci, Bull Flags, and Data-Driven Entry StrategyTechnical Analysis: EURUSD (Euro/US Dollar)

📈 The EURUSD pair is demonstrating strong bullish momentum on the 4-hour timeframe, with price action currently trading at 1.13638, well above the key 50% Fibonacci retracement level drawn from the previous range low to high.

🔍 The chart reveals a series of bull flags forming during the recent uptrend, suggesting continued buying pressure despite the pair trading at premium levels. This pattern typically indicates brief consolidation before further upside movement.

💹 From a Fibonacci perspective, the current price position above the 50% retracement level indicates strength in the Euro against the Dollar. However, this elevated position also creates potential for a healthy pullback to retest support before continuing higher.

⏱️ Today's upcoming US Retail Sales data release represents a significant market catalyst. Interestingly, this high-impact event could trigger a pullback regardless of the outcome:

If actual figures come in below forecast: Dollar weakness could prompt profit-taking after the recent rally

If actual figures exceed forecast: Dollar strength could naturally push EURUSD lower

🎯 Trade Idea: Monitor for a potential retracement toward the 50% Fibonacci level, followed by a bullish break of market structure on the 30-minute timeframe. This would provide a higher-probability entry point for long positions with a more favorable risk-to-reward ratio.

🔄 The presence of multiple bull flags suggests that any pullback may be temporary, potentially offering an excellent opportunity to enter with the prevailing trend at a better price point.

⚠️ DISCLAIMER: This analysis is provided solely for informational purposes and should not be construed as financial advice.

EURUSD Short Term Buy IdeaH4 - Strong bullish momentum

Higher highs on the moving averages of the MACD

No opposite signs

Expecting retraces and further continuation higher until the strong support zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/USD Holds Steady Near 1.15000The EUR/USD has gained more than 4% over the past three trading sessions, with bullish momentum remaining strong, as markets fear that a continued escalation in the trade war may keep heavy selling pressure on the U.S. dollar. With tariff-related uncertainty persisting, the euro continues to attract capital fleeing the dollar in search of a temporary safe haven.

Bullish Trend

Currently, the most relevant formation on the chart is a short-term bullish trend, which began in early March. Price action has continued to show consistent upward momentum, moving steadily toward the next psychological resistance at 1.15000, which has further reinforced buying pressure in the near term.

However, it's important to note that the volatility seen in recent sessions has been significant, which could open the door to short-term corrective pullbacks.

RSI Indicator

The RSI line has started to oscillate above the overbought level at 70. Additionally, a relevant divergence has begun to emerge: while the RSI continues to post flat highs, the price of EUR/USD is printing higher highs.

These signals suggest a possible imbalance between buying and selling strength, indicating that a short-term correction could be on the horizon.

Key Levels to Watch:

1.15000: A tentative resistance level aligned with a key psychological threshold. Sustained bullish moves above this zone could strengthen the current upward bias and lead to a more pronounced uptrend.

1.11549: A nearby support level, which could act as the first zone of interest if a short-term correction unfolds.

1.09513: A key support area, representing the most important neutral zone tested in recent weeks. A break below this level could put the current bullish structure at risk.

By Julian Pineda, CFA – Market Analyst

EURUSD TECHNICALS & FUNDAMENTALS🧱 Wave Structure & Pattern

Wave (1)–(5) structure is complete with strong impulse.

Wave (5) looks extended with a steep angle — could mean temporary exhaustion before a pullback or sideways correction.

Volume surged heavily during Wave (5), suggesting high participation and buying climax potential.

✏️ Key Levels:

Current Price: ~1.1394

Support Zone: Around 1.1300–1.1250 (previous resistance = now support)

Next Resistance Levels:

Minor: 1.1450

Major: 1.1600 (psychological and historical)

📈 Trendlines:

Clear rising trendline support from late January — keep an eye on any break below for early reversal signs.

A healthy retest of the 1.1300 zone could offer a long re-entry if bullish structure holds.

⚠️ Risk Watch:

After a 5-wave move, expect either an ABC corrective phase or a consolidation range.

Don’t get faked out by small pullbacks — corrections are normal after strong impulses.

🧠 Fundamental Analysis

📰 Key Drivers Today:

🇺🇸 U.S. Data / Sentiment:

Retail Sales (March) — stronger data could push the USD higher, putting pressure on EUR/USD.

Fed’s rate outlook: any hawkish hints from FOMC speakers or stronger data can boost USD.

🇪🇺 Eurozone Factors:

ECB’s recent dovish pivot is in focus.

German ZEW Economic Sentiment release is coming — a major sentiment mover.

Slower EU inflation data may keep ECB from tightening further, limiting euro upside unless the dollar weakens.

💸 Bond Yields & Dollar Index (DXY):

Rising U.S. yields or a DXY bounce could be a headwind.

DXY is hovering at key support — a rebound could stall EUR/USD's rally.

📊 Sentiment Overview:

Short-term: Bullish, but approaching overbought.

Medium-term: Cautious bullish — possible retest of support before continuation.

Macro: Dependent on U.S. data surprises and ECB tone.

🔍 Summary & Strategy Thoughts:

Bias Levels to Watch Trigger Idea

⚡ Bullish Break above 1.1450 Target 1.1600 if dollar weakens further

⚠️ Neutral / Pullback Retest of 1.1300–1.1250 support Buy-the-dip zone if trendline holds

🐻 Bearish (Short-Term) Break below 1.1250 Possible deeper correction toward 1.1100–1.1050

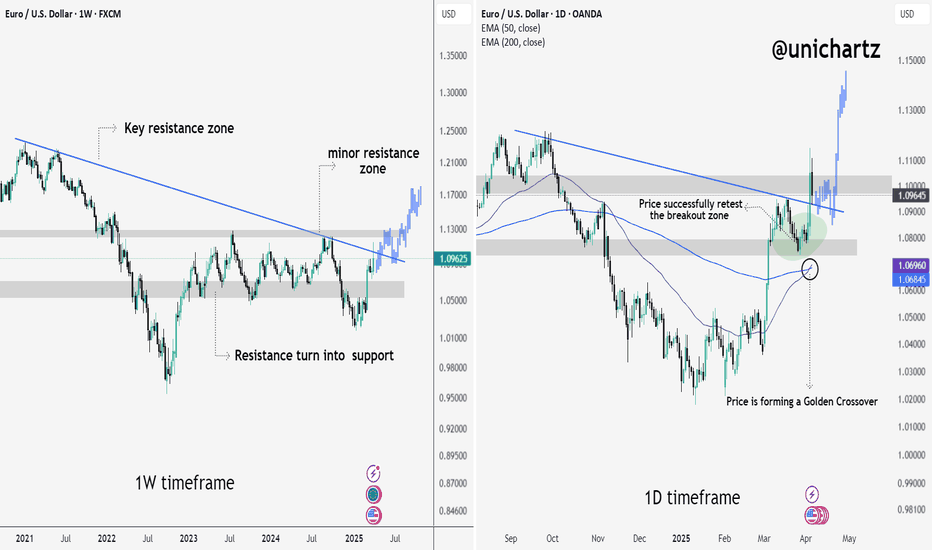

EUR/USD – Golden Crossover & Breakout Confirmation (Multi-T.F)EUR/USD is showing strong bullish signs across both the weekly and daily timeframes, suggesting a potential macro trend reversal in the making. After being trapped below a long-term descending trendline for nearly two years, price has not only broken out but also successfully retested the breakout zone — a key validation for trend continuation.

On the daily chart, a Golden Crossover is now forming, which historically precedes major uptrends in forex pairs. Combined with reclaiming key structural levels and building higher lows, EUR/USD could be positioning for a powerful upside move in Q2 2025.

Let’s dive into the multi-timeframe analysis to understand why this setup could be one of the cleanest trend reversals on the board.

1W Timeframe – Macro Breakout in Progress

EUR/USD has officially broken out of a long-standing descending resistance trendline. This breakout occurred from a structurally important zone that had acted as a ceiling for over 2 years.

📌 Key Observations:

🔹 Price reclaimed and held above the key resistance zone, turning it into strong support.

🔹 Minor resistance zones lie ahead, but structure favors further upside.

🔹 Projection shows potential continuation toward 1.16+ if momentum sustains.

1D Timeframe – Bullish Retest + Golden Cross Forming

Zooming into the daily chart, we see:

✅ A successful retest of the breakout zone, which held as support (bullish confirmation).

✅ Price is now forming a Golden Crossover – where the 50 EMA is crossing above the 200 EMA. This is typically seen as a strong bullish signal in trending markets.

📌 What’s Bullish:

Clean breakout ✔️

Retest with strength ✔️

Momentum crossover ✔️

EUR/USD is now in a strong bullish structure, backed by a confirmed breakout on the weekly and a golden crossover on the daily. If price holds above 1.09, we may see continued upside toward 1.13–1.16 levels in the coming weeks.

Thank you for reading and supporting @unichartz. If you found this analysis helpful, don’t forget to like, follow, and share! 💙

EURUSD SHORT FORECAST Q2 W16 D14 Y25EURUSD SHORT FORECAST Q2 W16 D14 Y25

- Weekly Order Block rejection

Setup 1

-15' break of structure

- Tokyo low range remains

- Pull back into 15' order block

- Lower time frame shift in price action from bullish to bearish

Setup 2

- Lower time frame break of structure

- Lower time frame bearish candle formation

Let's see how EURUSD short set up plays.

Certainly short potential but as always. We await price action to present itself to us.

It is far too easy to find a position once we have noticed potential. Sit back and await the play!

EURUSD SHORT FORECAST Q2 W16 D14 Y25

FRGNT X

EUR/JPY Eyes Breakout — Can Bulls Push Through Resistance?EUR/JPY Weekly Chart Analysis

EUR/JPY is holding strong above a rising trendline that’s acted as support since 2022. The pair recently bounced from a key support zone and is now testing a major resistance area.

A breakout above this zone could trigger a bullish continuation, while rejection may lead to another pullback toward the trendline.

Key Levels:

Support: 153.5–155.0

Resistance: 163.5–165.0

Watch for: Weekly close above resistance for bullish confirmation.

Structure remains bullish as long as the trendline holds.

Expecting more USD selling overall: Weekly Market PreviewIn this video I go over last week's epic volatility and what I am looking for going forward.

Long positions on EUR/USD at 1.0980 will remain in tact and still eyeing a target of 1.2000 out of the falling wedge displayed on both the monthly and quarterly charts.

I do expect some pullback after a massive move to the upside to end the week however, the bull can become relentless and continue it's strength due to the U.S. Dollar weakness across the board.

USD/JPY is another one I am watching and initiated a short position at 143.31 with a target at 133. If the large weekly broadening pattern runs it's course, I expect for that target to get hit.

Tech may get relief after Trump announced over the weekend that there will be exemptions but the market can remain irrational and continue overall weakness especially since the U.S. economy as a whole is not well.

Hope you enjoy the video and we'll see what we get this upcoming week, especially with Federal Reserve Powell set to speak on Wednesday.

As always, Good Luck & Trade Safe.