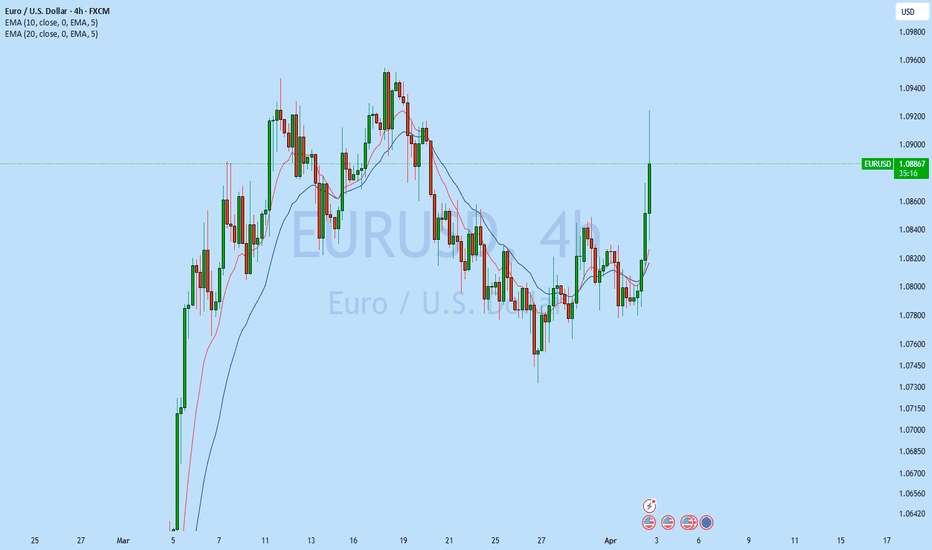

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Eurusdprediction

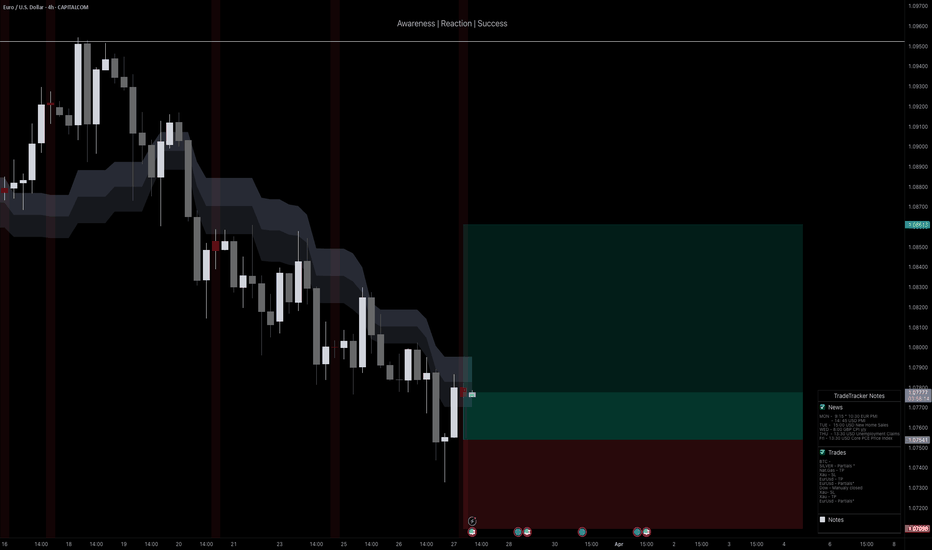

EUR/USD Holds Neutral Bias After NFPThe U.S. dollar has managed to regain some ground in the short term after several sessions of gains in EUR/USD. Currently, the pair is showing a downward move of just over 1%, following the NFP report, which showed 228,000 new jobs versus the 137,000 expected. This has slightly increased demand for the U.S. dollar in recent hours, as the market anticipates the possibility of higher inflation and, consequently, more restrictive Fed policy in upcoming decisions.

Uptrend

Since February 28, a strong upward trend has been in place, showing a clear buying bias in EUR/USD. So far, selling corrections have not been strong enough to break key trendline levels, making this the dominant formation to watch in the short term.

RSI

In the case of the RSI, oscillations have started to approach the overbought zone near the 70 level. Additionally, it is important to note that while EUR/USD has posted higher highs, the RSI has shown lower highs, reflecting a bearish divergence and signaling a potential imbalance driven by strong short-term buying pressure. This could eventually lead to downward corrections in the sessions ahead.

Key Levels:

1.1000 – Major resistance: This level remains the most relevant round-number resistance on the chart. Sustained price action above this level could reinforce bullish momentum in the short term.

1.07911 – Near-term barrier: This level is located near the 200-period moving average and could serve as a tentative zone for future selling corrections.

1.06132 – Distant support: Positioned around the 38.2% Fibonacci retracement, this level marks a key breakpoint that, if reached, could invalidate the current bullish structure.

By Julian Pineda, CFA – Market Analyst

EUR/USD Long to Short idea (1.08500 up to 1.10500)EUR/USD (EU) Analysis – This Week

This week, EUR/USD looks promising, similar to GBP/USD, with multiple key points of interest (POIs) in close proximity.

A clean, unmitigated 2-hour demand zone sits nearby, which could trigger a bullish rally if price reacts from this level. At the same time, price has been bearish over the past few days, forming a valid 9-hour supply zone from the recent downward push. I’ll be watching to see where price slows down and which liquidity level it targets first.

Confluences for EU Buys:

EU has been bullish for weeks, and this move could be a healthy correction before further upside.

The U.S. dollar remains bearish, aligning with this bullish bias.

A clean 2-hour demand zone has formed, which previously caused a break of structure to the upside.

Imbalances and untapped Asia session highs still need to be taken.

Note: If price breaks below this structural low, I will shift my focus toward sell opportunities. However, if that happens, we’ll know exactly where the ideal entry points for shorts will be.

EUR USD Weekly Timeframe Outlook EUR USD Trade Setup weekly timeframe

On the weekly timeframe EUR USD has tapped on a strong supply level.

this level has also acted as a strong resistance level in the past.

So we will be looking for selling opportunities from the lower timeframe.

Patterns to watch out for.

1. Double Top

2. Head and shoulders pattern

3. Bearish break and retest + it must align with the 0.50 - 0.618 Fib Retracement level for stronger confirmation.

4. Lower timeframe supply levels.

Check next post to see the pattern i found.

Elliott Wave Forecast: EUR/USD Prepares for Next Bullish Leg!This EUR/USD 4H chart presents an Elliott Wave analysis, showing the market’s movement within a five-wave structure. The price has completed Wave 3 and is currently in a corrective Wave 4, finding support around Fibonacci retracement levels of 38.2%

• Wave 3: A sharp rally forming an extended third wave.

• Wave 4: An ABC correction is currently in progress and is expected to be completed around levels of 1.07456

If the market respects the proper Fibonacci levels, the target for wave 5 could be 1.09504 .

EUR/USD Ready to Soar? Bullish Setup Unfolding!Hi traders! Analyzing EUR/USD on the 1H timeframe, spotting a potential entry:

🔹 Entry: 1.0831 USD

🔹 TP: 1.0983 USD

🔹 SL: 1.0672 USD

EUR/USD is respecting a key trendline support, suggesting a potential bullish continuation. RSI is holding above 60, and MACD shows signs of bullish momentum. If the price remains above the support line, we could see a push toward 1.0983 USD. Keep an eye on price action!

⚠️ DISCLAIMER: This is not financial advice. Trade responsibly.

EUR/USD Technical Analysis: Bullish Reversal Setup with Key SuppThis chart appears to show a technical analysis of the EUR/USD currency pair on a 30-minute timeframe. Here’s a breakdown of the key elements:

Key Observations:

1. Support & Resistance:

A support zone is marked in purple around 1.07679 - 1.07845.

A resistance level is marked at 1.07895, suggesting a potential breakout.

2. Exponential Moving Averages (EMAs):

200 EMA (blue): 1.08069 – This acts as a longer-term trend indicator.

30 EMA (red): 1.08008 – This provides short-term trend guidance.

3. Trade Setup:

Entry Point: Around the support zone (1.07845).

Stop Loss: Below 1.07679.

Target: 1.08481, implying a potential upward move of 63 pips (0.58%).

4. Price Action Expectation:

The analysis suggests a potential bullish reversal from the support zone

Euro Rises Above $1.09 Despite Tariff ThreatsThe euro climbed above $1.09, showing unexpected strength after President Trump announced 20% tariffs on all EU imports.

◉ Fundamental Rationale

● The currency got a boost because the U.S. dollar weakened. Trump’s tariffs made trade tensions worse and worried people about slower economic growth.

● Also, new numbers showed Eurozone inflation fell to 2.2% in March, the lowest since November 2024.

● This lower inflation means the European Central Bank doesn’t need to raise interest rates, making the euro more appealing to investors.

◉ Technical Observation

● From a technical perspective, an inverse head and shoulders pattern has formed, hinting at a possible trend reversal.

● A breakout above $1.095 could pave the way for stronger bullish momentum.

EURUSD HOURLY UPDATES Hello folks, EU/ EUR/USD Updates, since this idea working on higher timeframe/daily. I will be shorting above, see the sl zone.

The targets see below.

Good luck.

My idea is on daily, if price goes down hard, I will update for entries at 4h.

Idea here is continuation pattern on a weekly basis. So if price goes down it might retrace only.

Pewwpeww.

This is not a financial advice, use stop loss for your protection, just a like a condom. lol

Good luck fellas, Writing more ideas base only my trading style.

#EURUSD: Two Opportunities In One Chart, What do you see? Price has shown bullish behaviour exhaustion, and it's at a point where we see a total meltdown in prices. This is an excellent scenario for traders who trade on what the chart shows us rather than selling or buying only. We can utilise both these entries when prices do show a strong indication at either of our levels.

If you like our work, then do like and comment on the idea, which will boost us to post more such ideas. ❤️🚀

EURUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EUR/USD: Bullish Falling Wedge Breakout Towards TargetLet’s analyze the 1-hour candlestick chart of EUR/USD (Euro / U.S. Dollar) on TradingView, published by GoldMasterTraders on April 2, 2025, at 19:04 UTC. The chart highlights a trading setup based on a Falling Wedge pattern, indicating a potential bullish breakout. I’ll describe the chart pattern and the trading setup in detail.

Chart Pattern: Falling Wedge

Pattern Description

Type: The chart identifies a Falling Wedge pattern, which is a bullish chart pattern that typically signals a reversal or continuation of an uptrend. A Falling Wedge forms when the price consolidates between two downward-sloping trendlines that converge over time, with the upper trendline (resistance) sloping more steeply than the lower trendline (support).

Appearance on the Chart:

The Falling Wedge is clearly marked with two converging trendlines:

Upper Trendline (Resistance): Connects the lower highs, sloping downward.

Lower Trendline (Support): Connects the lower lows, also sloping downward but at a less steep angle.

The pattern began forming around March 19, after a sharp decline from 1.9400 to 1.8700, and continued until the breakout on April 2, 2025.

Breakout Direction:

Falling Wedges are typically bullish, meaning the price is expected to break out to the upside. The chart shows the price breaking above the upper trendline of the wedge around April 2, 2025, with a strong bullish candle, confirming the breakout.

The breakout level is around 1.90840, and the price has moved slightly above this level, closing at 1.90864 at the time of the chart.

Key Levels and Trading Setup

1. Support Level

A horizontal support zone is marked around 1.90730 (approximately 1.9070–1.9080).

This level acted as a base during the wedge formation, with the price bouncing off this zone multiple times (e.g., on March 23 and March 30).

The support level aligns with the lower boundary of the wedge, reinforcing its significance as a key area of buying interest.

2. Resistance Level

A resistance zone is marked around 1.92000 (approximately 1.9190–1.9210).

This level corresponds to a previous high reached on March 19, before the wedge formation began. It represents a significant barrier where selling pressure previously emerged.

After the breakout, the price is expected to test this resistance as part of the bullish move.

3. Target

The target for the breakout is projected at 1.92110.

This target is likely calculated by measuring the height of the wedge at its widest point (from the highest high to the lowest low within the pattern) and projecting that distance upward from the breakout point.

The chart indicates a potential move of 0.00435 (0.40%), which aligns with the distance from the breakout level (around 1.90840) to the target (1.92110).

4. Stop Loss

A stop loss is suggested below the support level at 1.90730.

This placement ensures that if the breakout fails and the price falls back into the wedge, the trade is exited with a manageable loss.

The stop loss is just below the breakout level (1.90840), with a distance of approximately 0.00110, representing the risk on the trade.

Trading Setup Summary

Entry:

The setup suggests entering a long (buy) position after the price breaks out above the upper trendline of the Falling Wedge, which occurred around April 2, 2025. The breakout is confirmed by a strong bullish candle closing above the trendline at approximately 1.90840.

Stop Loss:

Place a stop loss below the support level at 1.90730 to protect against a false breakout or reversal. The distance from the breakout level (1.90840) to the stop loss (1.90730) is 0.00110, or about 0.06% of the entry price.

Take Profit/Target:

Aim for the target at 1.92110, which is near the next significant resistance level. The distance from the breakout level to the target is 0.01270, or a 0.40% move.

Risk-Reward Ratio:

The risk is 0.00110 (from 1.90840 to 1.90730), and the reward is 0.01270 (from 1.90840 to 1.92110), giving a risk-reward ratio of approximately 11.55:1 (0.01270 / 0.00110). This is an exceptionally high risk-reward ratio, making the setup very attractive, though traders should ensure the breakout is well-confirmed due to the tight stop loss.

Additional Observations

Price Action Context:

Before the wedge formed, the price experienced a sharp decline from 1.9400 (March 13) to 1.8700 (March 19), indicating a strong bearish trend.

The Falling Wedge represents a consolidation phase within this downtrend, and the upside breakout suggests a potential reversal or at least a corrective move higher.

Volume and Momentum:

The chart doesn’t display volume or momentum indicators (e.g., RSI, MACD). However, a typical confirmation of a Falling Wedge breakout would include:

An increase in volume on the breakout candle, indicating strong buying interest.

Bullish momentum signals, such as an RSI above 50 or a bullish MACD crossover.

Traders might want to check these indicators for additional confirmation of the breakout’s strength.

Timeframe:

This is a 1-hour chart, so the setup is intended for short-term trading, with the target potentially being reached within a few hours to a day.

Market Context:

EUR/USD is influenced by factors like U.S. dollar strength, Eurozone economic data, and interest rate differentials. A bullish move in EUR/USD could be driven by a weaker dollar (e.g., due to dovish U.S. economic data) or positive Eurozone developments.

Conclusion

The TradingView idea presents a bullish setup for EUR/USD based on a Falling Wedge pattern on the 1-hour chart. The price has broken above the wedge’s upper trendline, confirming a bullish move with a target of 1.92110. The setup includes a stop loss at 1.90730 to manage risk, offering an impressive risk-reward ratio of 11.55:1. Key levels to watch include the support at 1.90730 and the resistance at 1.92000. Traders should consider additional confirmation from volume and momentum indicators, as well as broader market conditions, before executing the trade. Since this chart is from April 2, 2025, market conditions may have evolved, and I can assist with searching for more recent data if needed!

EURUSD:The euro is facing a "battle at key resistance levels"The EURUSD exchange rate continues its rebound momentum. Although the weak inflation data in the eurozone has strengthened the market's expectation of an interest rate cut by the ECB, the US dollar has weakened due to the risk - off sentiment triggered by Trump's tariff remarks, which has become a key factor supporting the short - term upward movement of the euro.

We can focus on the initial resistance level of 1.0880 above. If this level is not breached, one can attempt to short at high levels.

Trading strategy:

Sell@1.0880

TP:1.0780

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

EURUSD(20250402) Today's AnalysisToday's buying and selling boundaries:

1.0799

Support and resistance levels

1.0851

1.0832

1.0819

1.0780

1.0767

1.0748

Trading strategy:

If the price breaks through 1.0799, consider buying, the first target price is 1.0819

If the price breaks through 1.0780, consider selling, the first target price is 1.0767

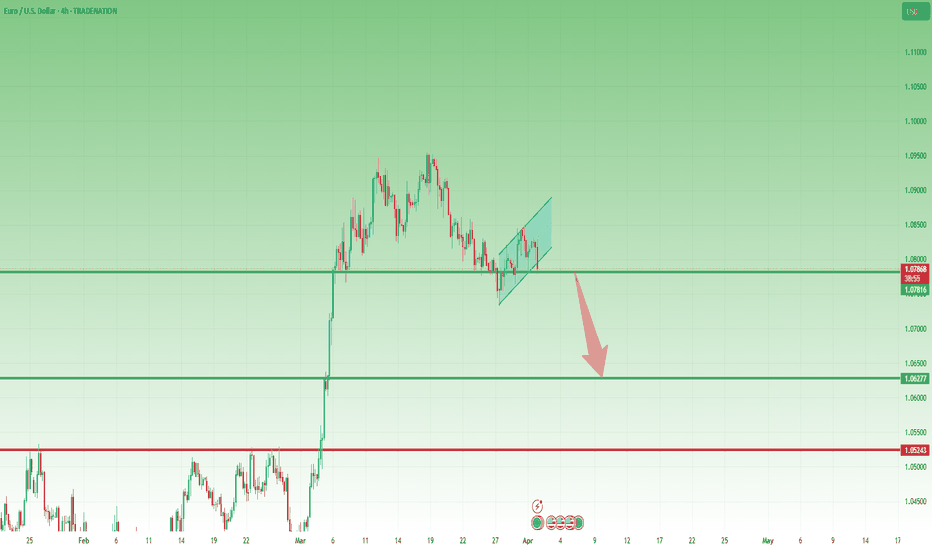

EurUsd could continue to the downsideTwo weeks ago, I mentioned that while a new high was possible, the bigger move in EUR/USD should be to the downside.

Indeed, the pair dropped from above 1.0900 and recently found support around the 1.0730 zone.

The recent recovery appears corrective, unfolding in a flag pattern, and I expect another leg down toward 1.0600.

Bearish confirmation comes with a daily close below 1.0750, and my preferred strategy is to sell rallies.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Euro at Critical Demand – Is the Trend About to Flip?Euro reached an important zone for my setup, triggering a long position. Although it’s still trending below the fibcloud on the 4H timeframe, we’ve seen a solid 0.5% recovery from the recent low. I’m looking for this area to hold as support, with defined risk in case the setup invalidates.

Technicals:

• Price tapped into a major 4H support level where liquidity historically steps in.

• The current move marks a 0.5% bounce from the low, showing early signs of demand.

• Still trading below the fibcloud, but a reclaim of that zone would open the path toward 1.0850.

• Setup includes a stop-loss below the most recent wick low, with a clear structure to build a higher low.

Fundamentals:

EUR-side strength:

• ECB maintains a slower pace of rate cuts compared to the Fed.

• Growth and inflation in the Eurozone are still challenges, but the ECB’s hawkish stance continues to support medium-term EUR strength.

• The ECB may hike another 150 bps to reach a 4% terminal rate, which favors EUR upside.

USD-side risks:

• Trump announced plans to impose a 25% tariff on all car imports, including from the EU-adding geopolitical and trade uncertainty.

• Traders remain cautious around further escalation in US-EU trade tensions.

• US Initial Jobless Claims later today could bring weakness to the dollar if the data disappoints.

In short, while the USD remains resilient, the EUR fundamentals and the current technical zone make this a compelling spot for a bounce.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.