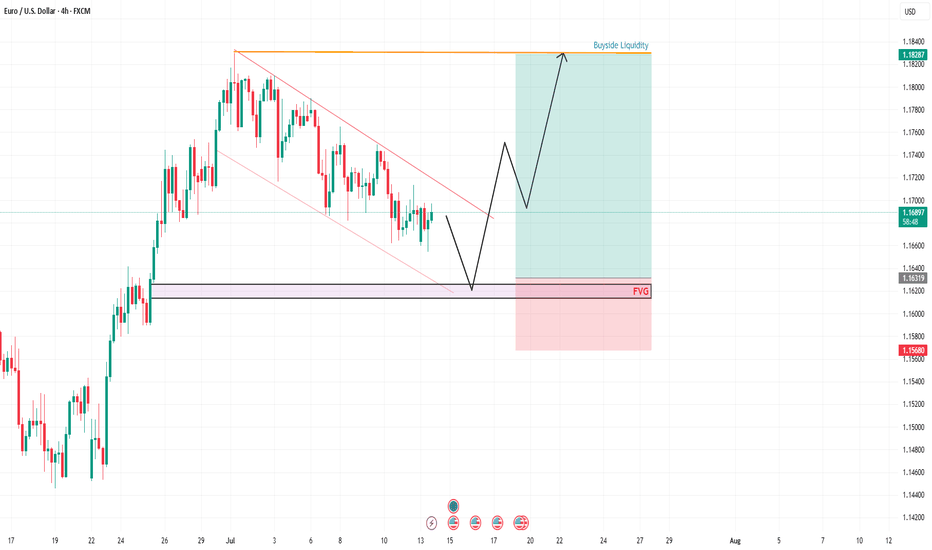

EURUSD POTENTIAL BUY SETUP 4HLooking at EURUSD, Price is moving in a descending channel. EU on the high timeframe is bullish as Dollar is weak. I am expecting EU to fall into the marked FVG to clear the lows and take internal liquidity from the marked FVG before moving higher and take the Buyside Liquidity as marked.

Potential Entry= 1.6350

Stop loss= 1.15650

Take Profit = 1.18250

Please wait for price to come into the marked potential area to take this trade and manage your risk accordingly. Follow me for more updates and trades.

Eurusdprediction

EUR/USD –Bullish Flag After Long Term Trend Shift: Is 1.20 Next?📌 In my previous EUR/USD analysis, I mentioned that the long-term trend likely reversed, and we could see a move toward the 1.23 zone in the medium to longer term.

That view is playing out.

Recently, the pair printed a new local high above 1.18, confirming the trend change.

📉 After this rise, EUR/USD pulled back –but the structure is clearly corrective: overlapping and a classic bullish flag formation.

What's next?

This correction looks close to completion, and bulls may soon return to push toward the key 1.20 level.

Trading Plan:

The 1.1620–1.1650 area stands out as a strong confluence zone – ideal for looking for buying opportunities.

The trend has changed. The setup is forming. Now it’s about timing.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

EURUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

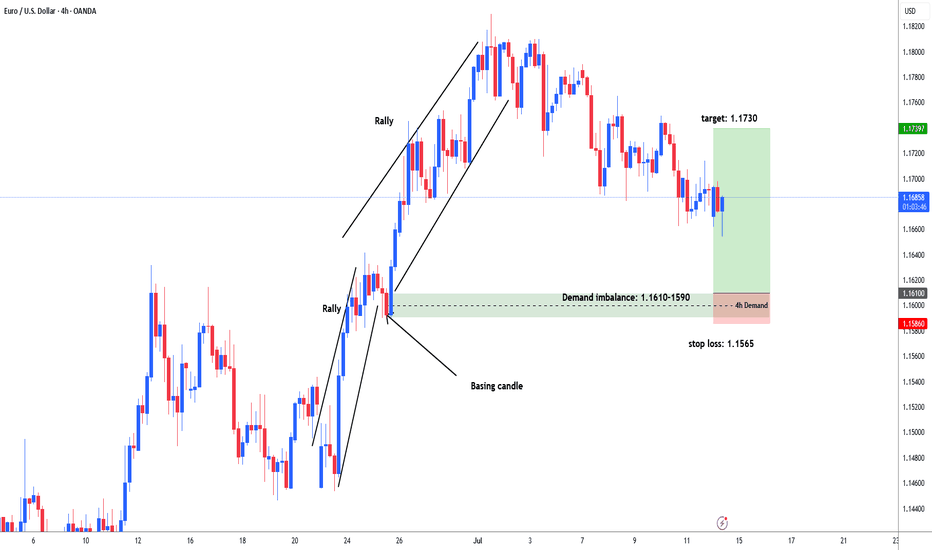

EURUSD possible long from 1.1610 area for 1.1730#eurusd market rallied 1.1450 - 1.1640. then consolidation between 1.1580-1640 area. Institutions put more buy orders and price rallied again after bases out and reached upto 1.1830 area. Now market sell off / retracement to test demand area to fill the remaining unfilled order for another leg higher. Demand zone: 1.1610-1.1590. stop loss: 1.1565, target: 1.1730. in weekly and daily chart market forming distribution shape for big sell opportunity.

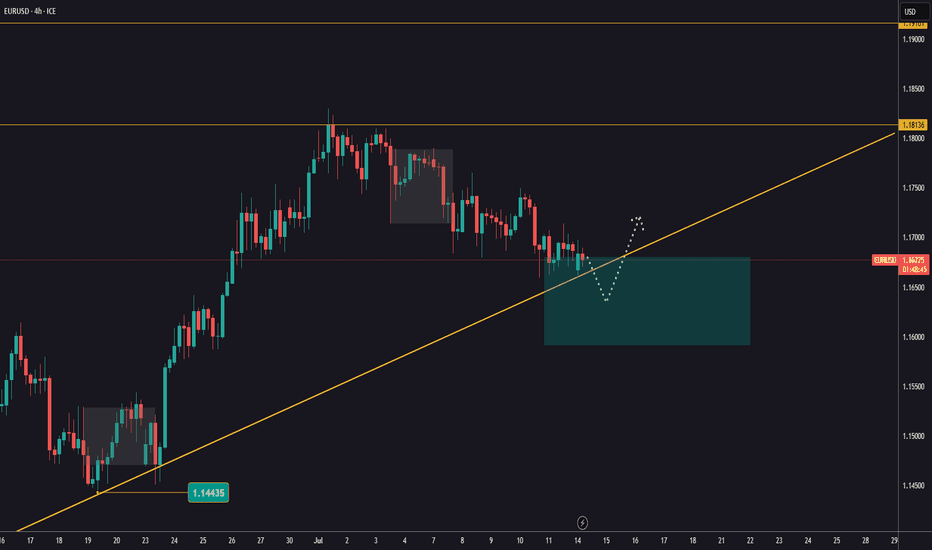

EURUSD buy zoneEURUSD is holding around levels just below 1,1700.

Tomorrow, U.S. inflation data is expected, which could trigger bigger moves.

The key zone to watch for a reaction is between 1,1591 and 1,1682.

Look for a bounce and potential buying opportunities in that area.

Next resistance levels to keep in mind are 1,1813 and 1,1916!

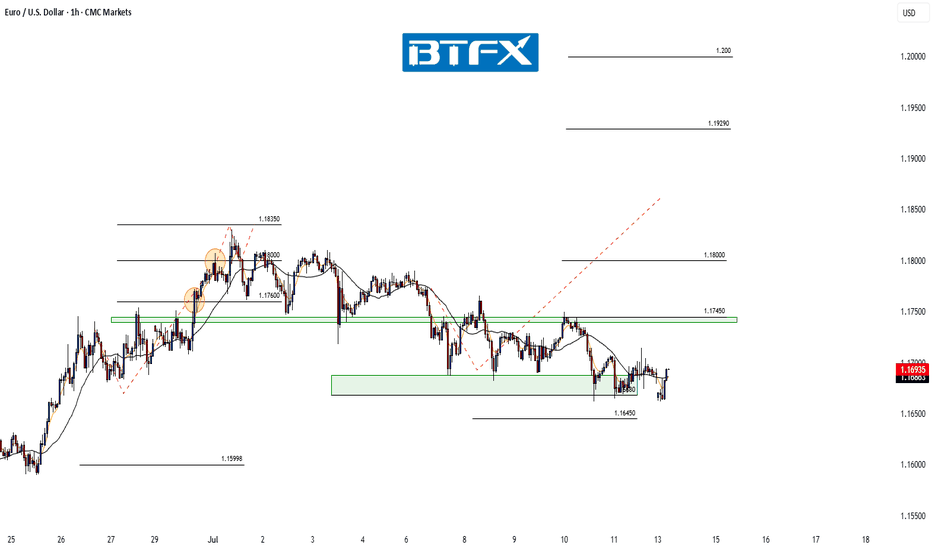

EUR/USD Holding Support — Watching for Bullish ReactionHi Everyone,

Since our last update, EUR/USD continues to range near the 1.16680 support level. We’re watching for buying interest to emerge above the key 1.16450 zone, which has acted as a critical level for the broader structure.

Should price manage to stabilise and form a base here, there’s potential for a move back towards the highlighted resistance area around 1.17450. A clear reaction from support could confirm renewed buying interest and set the stage for a retest of last week’s highs.

Our broader outlook remains unchanged: as long as price holds above 1.16450, we continue to look for the pair to build momentum for another move higher in the coming sessions. A decisive break above last week’s high could attract fresh buying interest, paving the way for a push towards the 1.19290 area and ultimately 1.20000.

We'll be watching closely to see if this recovery gains traction and whether buyers can sustain the move above resistance. The longer-term view remains bullish, provided price continues to respect the key support zone.

We’ll keep updating you through the week as the structure unfolds and share how we’re managing our active positions.

Thanks again for all the likes/boosts, comments and follows — we really appreciate the support!

All the best for the rest of the week. Trade safe.

BluetonaFX

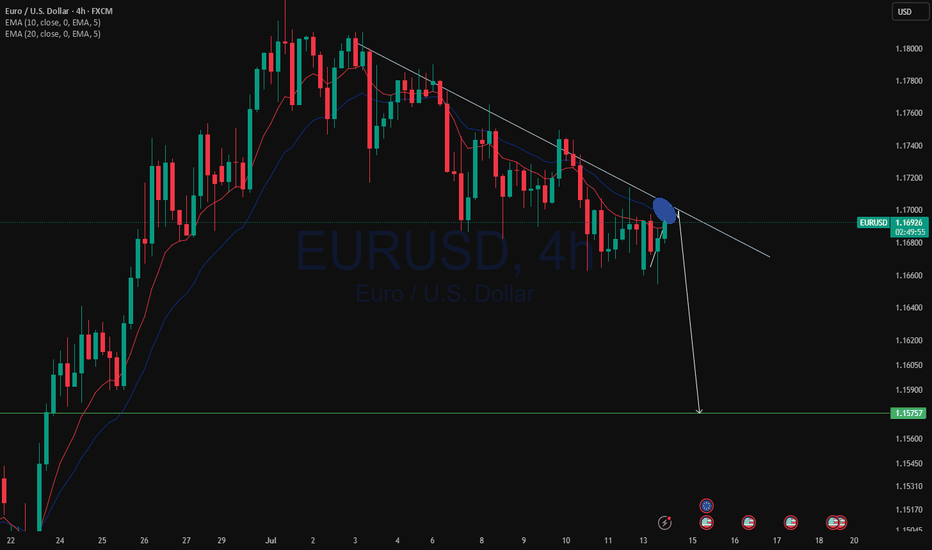

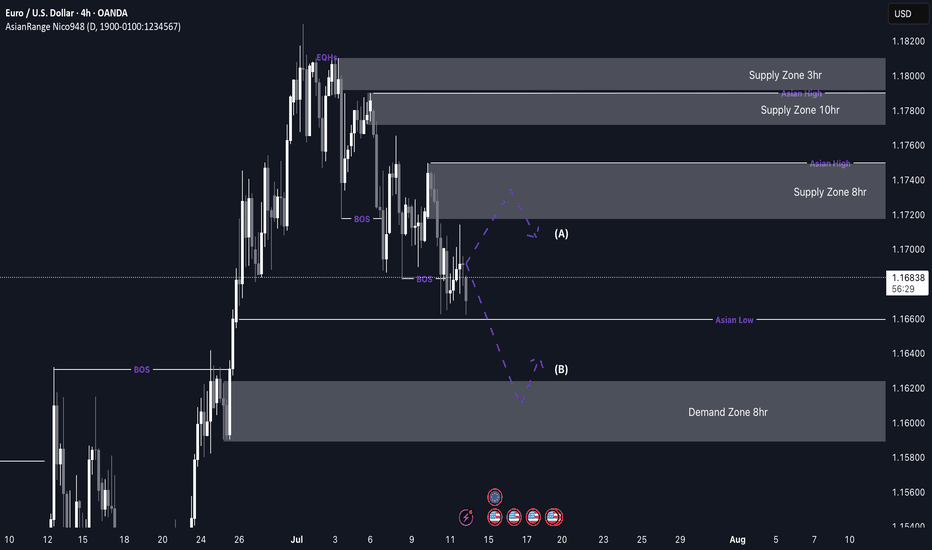

EUR/USD Sells from 1.17200 back downWeekly Outlook: EUR/USD (EU)

This week, my bias on EUR/USD is similar to GBP/USD, as both pairs have been following a consistent bearish trend. Based on this structure, I’ll be watching to see if price begins a retracement back into an area of supply.

I’ve marked out the 8-hour supply zone, which sits at a premium level and was responsible for the last break of structure to the downside. If price retraces into this zone, I’ll look for potential sell confirmations on the lower time frames.

If price doesn’t tap into the supply zone first, I’ll then shift my focus to the 8-hour demand zone below. In that case, I’ll watch closely for signs of accumulation and a bullish reaction from this level, which could signal the start of a rally.

Confluences for EUR/USD Sells:

✅ Bearish trend has been consistent for the past few weeks.

✅ Breaks of structure have formed new supply zones to trade from.

✅ Liquidity exists below current price, which may be targeted first.

✅ The lower demand zone remains unmitigated, suggesting further downside movement.

📌 On the way down toward demand, I expect price to form another break of structure to the downside. The plan is to ride the sells down into demand, then look for potential buy opportunities if price begins to accumulate and react.

Let’s stay sharp and disciplined — have a solid trading week, everyone! 📊

Ready to Swipe the Pips? | EUR/USD Heist Blueprint Unlocked🏴☠️💸 EUR/USD "Fiber Heist Plan" – Thief Trader Style 💸🏴☠️

The Vault is Open – Swipe the Bullish Bags! 🚀📈💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Welcome, Money Makers & Market Robbers! 🤑✨

Here’s the latest masterstroke based on our Thief Trading Style™—a tactical breakdown of EUR/USD primed for a bullish breakout robbery. We’re targeting the red zone 🎯—where the weak hands panic, and the real players win.

🔓 Entry Plan (Buy Setup):

🟢 "The vault is wide open!" — We’re planning bullish entries using 15m–30m timeframe swing levels.

✅ Buy Limit Orders: Plot them smartly around most recent swing lows/highs.

⚠️ Chart Alert Suggested: Eyes on the prize, don’t miss the break-in.

🛑 Risk Guard (SL Setup):

💼 Stop-Loss: Set at nearest 30-min swing low (based on your risk appetite).

Remember, it’s about preserving your loot, not just grabbing it.

🎯 Target Area:

🎯 Primary Target: 1.19000

🎯 Optional Trailing SL: Ride the wave, lock the profits as price moves.

🧲 Scalpers' Notice:

Only scalp long. Got big pockets? Jump in. Smaller bags? Swing along.

💡 Trailing stop advised—don’t let the market steal your gains.

💹 Current Market Outlook:

EUR/USD is moving bullish—supported by technical signals, macro news, COT insights, and intermarket vibes.

🧠 Use all tools: Fundamental 📊 + Sentiment 🧭 + Quant + Bias Score 📈.

📎 Want the full breakdown? Check the 👉.Liinkk.🔗

(Keep updated, conditions shift fast!)

⚠️ News Risk Alert:

🚨 Stay alert during news drops—avoid fresh trades then.

Use trailing SLs to lock profits & guard against reversal raids.

💖 Support the Robbery Plan!

💥 Hit that Boost Button 💥 if you're riding with the Thief Team!

We steal smart, we trade sharp — every day’s a new heist in this market.

See you on the next plan! Stay legendary 🐱👤💸🤑🔥

EURUSD LONG TERM UPEURUSD Live Trading Session/ EURUSD analysis #forex #forextraining #forexHello Traders

In This Video EURUSD HOURLY Forecast By World of Forex

today EURUSD Analysis

This Video includes_ (EURUSD market update)

EURUSD Analysis today | Technical and Order Flow

#usdjpy #usdchftechnicalanalysis #usdjpytoday #gold

What is The Next Opportunity on EURUSD Market

how to Enter to the Valid Entry With Assurance Profit?

This Video is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts.

Disclaimer: Financial Trading Has Large Potential Rewards, But Also Large Potential Risk. You must be aware of the Risk and Be Welling to Accept Them in order to Trade the Financial Market . Please be Carefully With Your Money.

We are talking about future market, anything can Happen,Markets are Always like that.dnt Risky more Than 2% of your account

Now you can join with our "vip premium" service

Join us and let's make trading together

EURUSD NEW HIGHS?The 1h timeframe reminds me of this book, LIQUIDITY AND MANIPULATION.

"The markets need to generate liquidity in order to move, so if liquidity isn´t

already there, it will be created. So when new traders come in to forex and

learn about it for the first time, what they usually do is gonna be retail based

trading.

So support and resistance, chart patterns which are extremely popular in the

industry, and things of that nature.

So what some brokers do is they offer free education for their clients once we

start trading. Now this education will usually be retail methods support and

resistance. "

Thanks for this idea.

here is the chart relative to this, see the price above it will clear?

I have more on this kind of idea.

This is not a financial advice.

Follow for more .

trade it or see it.

Goodluck

EURUSD is ready to break supportCMCMARKETS:EURUSD

The Euro fell to 1.1670 on Friday, positioning for nearly a 1% weekly loss 📊, as investors recalibrated risk exposure amid escalating trade tensions ⚔️ and shifting monetary policy signals 🏦.

📉 Market Structure:

🔻 EURUSD has traded in a bearish trend since July 1.

🔹 Support levels: 1.1680 and 1.1590.

🔹 Retested the 1.1680 support zone on Friday.

💡 How to Trade This:

✅ If the pair rebounds from support 🔄, consider BUYING with a Take Profit near the next resistance level.

❌ If the support breaks with confirmation 🩻, consider SELLING to target lower support zones.

📰 What’s Driving the Move?

🏦 Monetary Policy:

Chicago Fed President Austan Goolsbee pushed back against calls for aggressive rate cuts 🗣️, reaffirming the Fed’s focus on its dual mandate of maximum employment and price stability ⚖️. His cautious stance adds uncertainty 🤔 to the policy outlook for the second half of the year as markets weigh inflation risks vs. growth slowdown signals.

💼 Economic Data:

The labor market remains solid 💪, but recent jobless claims data show early signs of cooling 🧊, following last week’s strong NFP report.

💵 Dollar Strength:

The dollar advanced sharply against the euro 🚀, driven by risk aversion, relative yield advantages, and investor positioning ahead of upcoming inflation data and the Fed’s next policy signals 📈.

🚨 Watch for:

🔸 A confirmed breakout or rebound at 1.1680 to guide trade entries.

🔸 Upcoming U.S. inflation data 🪙 for direction on Fed policy and USD strength.

🔸 Further developments in trade tensions 🌐, which could drive risk sentiment.

EUR/USD Holding the Line: Bullish Channel Setup!Hi traders! Analyzing EUR/USD on the 30-min timeframe, price is currently reacting near the bottom of a well-defined ascending channel, signaling a potential bullish continuation within the trend:

🔹 Entry: 1.17071

🔹 Take Profit: 1.17423

🔹 Stop Loss: 1.16825

After a corrective move downwards, price tapped into a key trendline support, aligning with prior structure and psychological level near 1.1700. The RSI is showing a bullish divergence near oversold levels, adding confluence to a possible reversal.

As long as price holds above the lower boundary of the channel, bulls may look to target the mid-to-upper region of the range, aligning with previous highs and dynamic resistance.

🟢 The trend remains intact as long as higher lows are respected.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for managing their own risk and strategy.

EUR/USD Testing Support — Will Buyers Step In Again?Hi Everyone,

Since our last update, EUR/USD is currently testing the 1.16680 support level. We’re watching for buying interest to emerge above the key 1.16450 zone; if price can stabilise here, we could see a retest of the highlighted resistance area around 1.17450.

Our broader outlook remains unchanged: as long as price holds above 1.16450, we continue to look for the pair to build momentum for another move higher in the coming sessions. A decisive break above last week’s high could attract fresh buying interest, paving the way for a push towards the 1.19290 area and ultimately 1.20000.

We'll be watching closely to see if this recovery gains traction and whether buyers can sustain the move above resistance. The longer-term view remains bullish, provided price continues to respect the key support zone.

We’ll keep updating you through the week as the structure unfolds and share how we’re managing our active positions.

Thanks again for all the likes/boosts, comments and follows — we really appreciate the support!

All the best for the rest of the week. Trade safe.

BluetonaFX

EURUSD is in a Downside DirectionHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURUSD Technical Analysis**Chart Overview:**

* **Pair:** EUR/USD

* **Timeframe:** 30-minute

* **Trend:** Bearish (Confirmed by lower highs, lower lows, and downward-sloping trendline)

---

🔍 **Technical Analysis :**

**1. Downtrend Structure**

* Price is consistently making **lower highs and lower lows**, confirming a **strong downtrend**.

* A clear **descending trendline** is respected multiple times as resistance.

**2. EMAs (7, 21, 50)**

* All EMAs (blue, purple, black) are sloping downward.

* Price is trading **below all EMAs**, signaling continued bearish momentum.

* EMA 50 (\~1.1716) acts as a **dynamic resistance** zone.

**3. Key Resistance Zones (Marked as R1 & R2)**

* **R1 Zone (\~1.1710–1.1720):** Previous support now turned resistance. Could see rejection here.

**R2 Zone (\~1.1730+):** Higher resistance, possibly tested if R1 breaks. Also aligns with EMA confluence.

**4. Volume Analysis**

* Volume shows **spikes on bearish candles**, which suggests **strong selling interest** at lower highs.

* No significant bullish volume breakout so far.

📈 **Price Projection Path (Red Arrows)**

* The red path illustrates a **bearish price projection**:

* Price may pull back into **R1 or R2**

* Likely to face **resistance & rejection** from those levels

* Expected to make **lower highs and resume downside movement**

* Potential drop toward **1.1670, 1.1650, and lower**

🟢 **Bullish Invalidator**

* If price **breaks and holds above R2 (\~1.1735+)** with volume, it may indicate a **trend reversal or bullish correction**.

---

**Summary:**

* **Bias:** Bearish

* **Resistance Zones to Watch:**

* R1: 1.1710–1.1720

* R2: 1.1730–1.1740

* **Targets on Downside:**

* 1.1670

* 1.1650 or lower

* **Confirmation Needed:** Bearish rejection candles or failure to break R1/R2

NFP Bears gathering their troops? or will the Bulls stampede...The past 9 days have been quite interesting for the EUR/USD which has been relentless. Price has been rising like a helium balloon let loose at the park...

Bulls have clearly been in control, not only the past 9 days but since the beginning of the year with the exception of the strong pullback in April & May only to bounce for another 700 pip run.

I am totally USD bearish across the board as I have been mentioning in my analysis videos for the past few months but like all macro moves, we always have pullbacks along the way and that is why I have been shorting the EUR/USD back from 1.1500+ - 1.1700+

I've given this a lot of room to breathe, more than usual but considering the following technical setup, I'm willing to give the Bears some leeway and potentially show me they'll come through.

•Rising Broadening pattern (Where two trendlines start close together only to divergence and expand) - This is a bearish pattern.

•Negative Divergence on the MACD, Linear Regression & the RSI.

•Price has made a run to the yearly R3 pivot level. (Rare extension)

•Last daily candle is a hanging man candlestick (Reversal candle)

•Weekly chart has the EUR/USD at the upper band of a polynomial regression channel which calculates for price extremities in the market.

There are a few more setups as well but it's too much to describe here and I'd have to show it in a video (Which I plan to do over the weekend)

With all of that said... It could all fail lol but seriously speaking... You just can't ask for a better probabilistic setup so whatever happens during NFP... happens.

Aside from the technical aspect... I know yearly R2 around 1.1600 was a hotspot for shorts because divergence was at the early stages and taking a short there wouldn't have been a bad idea but we know institutions are in play as well, so above 1.1600 could have been a huge area to run stop losses and margin calls before a potential reversal.

250 pips would be enough to run a large pool of stops and liquidation.

IF price is going to reverse here during NFP, I believe late longs and breakout/pullback traders are going to try and buy at the trendline at 1.1660ish but it wont hold and trap them on the other side of the trade.

Under that, I can see us pulling back towards 1.1200ish...

If the Bears give up and price continues to climb... the original macro target may very well be under way which was 1.2000 - 1.2200 (Based on a Monthly and 3-Month chart analysis)

As of this writing the EUR/USD is pretty much completely flat which is expected before the NFP fireworks ahead of July 4th.

We'll see what happens tomorrow morning! buckle up!

As always, Good luck and Trade Safe! See you post NFP.

EURUSD Will Keep Growing!

HI,Traders !

#EURUSD is trading in an

Uptrend and the pair broke

The key horizontal level

Of 1.16370 and the breakout

Is confirmed so after a potential

Retest of the support cluster

Of the rising and horizontal

Support lines below we will

Be expecting a bullish continuation !

Comment and subscribe to help us grow !

EurUsd - This is the deadly breakout!EurUsd - FX:EURUSD - is about to fly:

(click chart above to see the in depth analysis👆🏻)

EurUsd has been rallying about +15% over the past couple of months. Additionally the breakout at the current resistance trendline is about to be confirmed. Subsequently EurUsd is setting up for another major move higher, which will be painful for all European traders.

Levels to watch: $1.23, $1.11

Keep your long term vision🙏🙏

Philip (BasicTrading)