EURUSD after the FedEURUSD continues to trade within the reversal zone highlighted in our previous analyses.

Following yesterday’s Fed decision, we’re seeing additional downside movement, though price hasn’t yet reached the support level at 1,1346.

Our outlook remains unchanged – we’re watching for the end of the pullback and will look for buying opportunities afterwards.

The H1 candle formed during the news release can serve as a reference. A break and close above it would signal a potential reversal to the upside.

Conversely, if price breaks and closes below that candle, it would suggest the correction is likely to continue toward lower levels.

Eurusdsetup

EURUSD ahead of the ECBYesterday, EURUSD continued its bullish movement, reaching 1,1780.

Today, the ECB will announce its decision on interest rates.

The news is scheduled for 1:15 PM, followed by a press conference 30 minutes later.

Expect possible sharp and misleading price movements — reduce your risk and avoid rushing into new positions!

Profit TakingYesterday, EURUSD continued its bullish move and reached 1,1747.

Currently, we focus more on reducing risk and taking profits rather than entering new positions.

We’re approaching the final days of the quarter, and next week brings key economic events.

New entries will be considered only if a favorable risk-reward setup presents itself.

The next resistance remains at 1,1778!

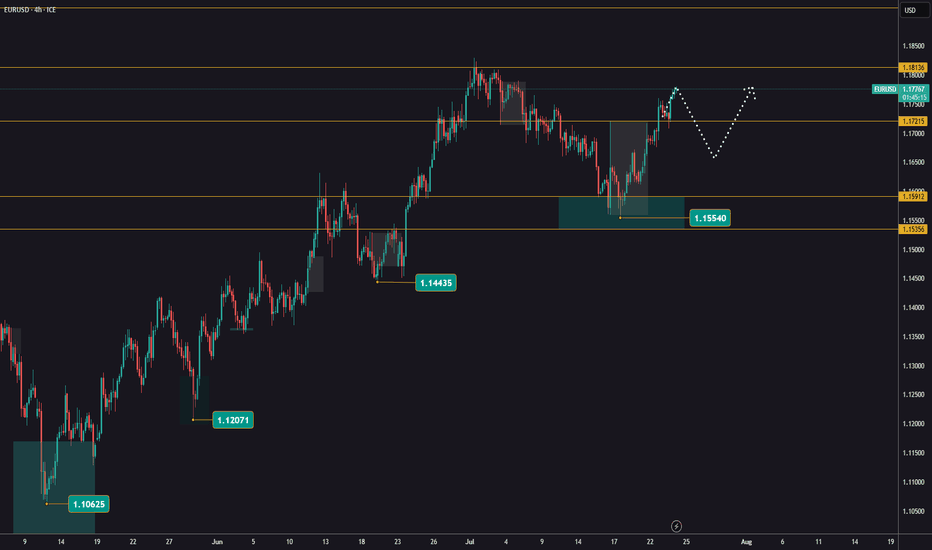

EUR/USD Best Place To Sell To Get 250 Pips , Don`t Miss It !Here is my EUR/USD Analysis and if you check the chart you will see that we have avery strong res area forced the price to go down hard last time , so i will sell this pair from the same res area , it will force the price to go down hard at least 250 pips , waiting the price to touch it and then we can sell it .

Bullish Breakout in EUR/USD: Key Levels to Watch This WeekHi everyone,

EUR/USD had a strong week, climbing higher from the May 12 low and further reinforcing our view of a potential long-term bullish trend.

We anticipate further upside towards the 1.13768–1.13940 zone, followed by a possible pullback toward the 1.1200 area. We’ll share more updates on the expected path for EUR/USD if and when price reaches that zone.

The longer-term outlook remains bullish, and we expect the rally to extend towards the 1.2000 level, as long as price holds above the 1.10649 support.

We’ll be keeping you updated throughout the week with how we’re managing our active ideas. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for the week ahead. Trade safe.

BluetonaFX

EURUSD - Expecting Bearish Continuation In The Short TermM15 - Clean bearish trend with the price creating series of lower highs, lower lows.

No opposite signs.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD - Expecting Bearish Continuation In The Short TermH1 - Clean bearish trend with the price creating series of lower highs, lower lows.

Lower lows on the moving averages of the MACD indicator.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/USD W Closure Very Bearish , Best 2 Places For Sell Cleared Here is my opinion on EUR/USD , If we checked weekly time frame , we will see that we have a great bearish price action , and on lower time frames we have avery good bearish price action also , so i think we can sell this pair from the places i mentioned with small sl , and target will be from 100 to 250 pips .

EURUSD - Expecting Short Term RetracesH4 - Strong bullish move ended with a bearish divergence.

While measuring this strong bullish move using the Fibonacci retracement tool we have two key support zones that has formed (marked in green).

So based on this I expect short term bearish moves now towards the Fibonacci support zones.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD Short Term Buy Idea Update!!!Hi Traders, on April 15th I shared this idea "EURUSD Short Term Buy Idea"

Expected retraces and further continuation higher until the strong support zone holds. You can read the full post using the link above.

Price is moving as per the plan!!!

Retraces happening as expected, my bullish view still remains the same here.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/USD Short Setup – Entry at Resistance, Targeting 1.08942"Entry Point: Around 1.10456

Stop Loss: Around 1.10833

Take Profit (EA Target Point): Around 1.08942

Risk-Reward Ratio: Appears favorable (approximately 1:2)

🔍 Key Observations:

Resistance Zone (Supply Area):

Price hit a strong resistance (marked with a purple zone) and showed signs of rejection with wicks.

The resistance aligns with the entry zone, suggesting a potential reversal area.

Moving Averages:

EMA 30 (Red) ≈ 1.09966 and EMA 200 (Blue) ≈ 1.09607

Price is currently above both EMAs, which is typically bullish, but the setup anticipates a pullback or correction.

Bearish Engulfing Pattern:

A possible bearish engulfing candlestick appears near the entry zone, indicating seller strength.

Break of Minor Support (RESISTANCE POINT):

If price breaks below this level, it would likely confirm the short setup toward the target.

✅ Confirmation Needed:

A clean break and close below the support (resistance point) to confirm entry.

Momentum indicators (RSI, MACD) could provide additional confidence if available.

⚠️ Risk Notes:

Since the price is still above both EMAs, this trade counters the short-term trend, so proper stop management is key.

Watch for news events, especially since this pair reacts strongly to economic data (note the calendar icon at the bottom right).

EURUSD Short IdeaTrade entered. Entry rules met.

Confluences:

✅ Bearish overall bias

✅ Bearish demand zone

✅ Bearish impulse crab pattern

✅ Bearish divergence

✅ Bearish break of structure

✅ Entering London close zone

✅ Price is in entry zone

✅ Required risk:reward met

⭐ I shared this watch zone in my weekly forex outlook this week, you can subscribe by clicking the link in my bio.

GBP/USD Channel Breakout (14.03.2025)The GBP/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.2890

2nd Support – 1.2862

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

EURUSDEURUSD has gotten to the Daily OB where we are looking for possible reversal confirmations. And here on the 15mins - price has Changed Character and also confirmed with a new BOS, before the BOS, we can see how price has reacted, creating even more liquidity - equal highs close to our entry zone which is above 50% fib retracement. I am looking to short price from the 1.09048 zone targeting the 1.08416 zone where we have a possible roadblock for price to stop and continue the buys on the 1H TF, or sell all the way to the 1.06068 zone to facilitate a new buys.

EUR/USD Very Near Buying Area , Don`t Miss This Chance !Here we have a very good new up trend line on 4H Time Frame , and the price touch it 2 times , and now we are waiting For third touch and it will be the best one , so i`m waiting for the price to touch it and give me a good bullish price action and then we can enter a buy trade .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

EUR/USD: Are We Crashing Through Parity?Well, well, well, EUR/USD, you sly dog. Just when we thought the pair might catch a break, it doubles down on its favorite hobby—going DOWN. 📉 Since late September, this thing has been in a nosedive so steep it makes roller coasters look tame. 🎢

And now? It’s giving us not one but TWO glorious bearish flags. That’s the market’s way of saying, “Hold my beer, I’ve got more downside to cover.” 🍺 So, buckle up as we break down what’s happening with EUR/USD, why it’s acting like a currency in free fall, and just how low it might go. Spoiler alert: Parity might not be far enough. 😏

The Downtrend Diaries: EUR/USD’s Love Affair with Lows

Okay, let’s rewind to late September. What happened? Oh, just EUR/USD deciding it was time to swap its bull costume for a full-blown bear suit. 🐻 We’re talking lower highs, lower lows, and every technical analyst’s favorite phrase: "the trend is your friend" (until it’s not, of course).

This week? The pair is snuggled nicely inside its second bearish flag, like a bear hibernating before its next big move. For those of you wondering, a bearish flag is when the market pauses, catches its breath, and says, “Alright, time to drop some more.” And let me tell you, these flags aren’t subtle. They’re practically screaming, “Hey, the trend’s still bearish—don’t get any ideas!”

Why So Bearish? Let’s Blame the Usual Suspects

The Almighty Dollar Flexing Again 💪

The USD is out here reminding everyone why it’s called the safe-haven king. Interest rates? Still high. Risk-off sentiment? Very much alive. Meanwhile, the euro’s like that one kid who forgot to study for the test—it’s just not prepared to fight back. 🤷♂️

Eurozone: Where’s the Mojo?

Between slowing growth, sticky inflation, and the French government imploding (because why not?), the euro is struggling to convince anyone it’s worth a rally. Even the promise of €500 billion in defense spending couldn’t lift its spirits for long. If fiscal spending can’t save the day, what can?

Bearish Flags Don’t Lie 🚩

These flags are the cherry on top of the downtrend sundae. First, we had one around 1.0650, which broke lower like clockwork. Now we’re staring down another flag that’s coiled tighter than my jeans after Thanksgiving dinner. Once this breaks, well... let’s just say the floor is looking mighty inviting.

How Low Can It Go? Let’s Talk Targets 🔭

Now, if this flag plays out like the textbook says, EUR/USD could easily revisit 1.0450. And if that level doesn’t hold? Get ready to dust off those parity memes. Yes, I’m talking 1.0000, the big, scary, psychological level where everyone suddenly remembers how to panic. 😱

But hey, let’s not stop there. The lower boundary of the larger downtrend is lurking below 0.9900, and if the bears get really hungry, that’s where they’ll feast. 🍴

The Sarcastic Silver Lining: What Would It Take to Flip Bullish?

Oh, you want bullish scenarios? That’s cute. 😏 Here’s what would need to happen:

The euro suddenly gets a personality transplant and decides it’s worth something.

The USD forgets it’s the global reserve currency and takes a nap.

A miracle. Like, divine intervention-level miracle.

But seriously, unless EUR/USD breaks above 1.0600 with conviction (and by conviction, I mean a rally that doesn’t immediately fall apart), the bears are still in charge.

Final Thoughts: Trade Smart or Get Wrecked 💀

Look, the writing’s on the wall. EUR/USD is in a downtrend, the flags are flapping, and the bears are sharpening their claws. This isn’t the time to play hero and try to catch a bottom. Instead, let the trend do its thing, wait for the flag to break, and ride the wave lower. 🌊

And hey, if it does hit parity, at least we’ll have something to talk about at the next market meltdown party. 🎉 Until then, keep those stop-losses tight, and don’t forget: the trend might be your friend, but it’s also got a dark sense of humor.

Catch you next time, traders. George out. 🎤

EURUSD - INTRADAY IDEAThis EURUSD chart is according to the H1 timeframe - GOLDEN FIB ZONE ALONG WITH THE DEMAND.

Execute the price at the exact price mentioned, NO FOMO.

💡KEEP IN MIND💡

I am not a financial advisor and do not contribute to any of your losses or profits. To be safe, I recommend that you risk only 0.1 - 0.2% for the first week or 10 days, as no one can predict the market.

🚀Follow, I will drop daily 2-5 Intraday Charts🚀

EURUSD Trade SetupCurrently in a long on EU looking for taking some profits on point A and let the rest ride.

On HTF I still see more potential to come LOWER so I will look in trouble area to short or above (I'll probably publish another idea).

All I want to see here is some strength and volume behind this push, if not I'll treat it as a minor pullback of HTF bearish trend.

EURUSD Area of interest & Potential movementsActively looking for buys inside the grey box (1), is a relatively risky trade because of the dollar index looks bullish. To play safe i just want to see an invalidation of some kind of supply. Something like market structure break(2). And then look for buys (3).Sweeping the area of intereset above does not change the long BIAS. İ'll be actively looking for longs from here aswell (4). If we loose the arrow (5) chart need upate.