EUR/USD Short Idea Analysis EUR/USD exhibits bearish potential on the daily timeframe, with the 1.17160–1.18070 zone acting as a key resistance area for a short setup.

Technical Analysis:

Price Action: Price is testing the 1.17160–1.18070 resistance zone, which aligns with prior highs and a rejection area. A bearish reversal pattern (e.g., shooting star or engulfing) could confirm the short.

Support/Target: Initial support at 1.1600, with a deeper target at 1.1500 if selling pressure accelerates.

Indicators: RSI is nearing overbought levels (above 65), suggesting a potential reversal. MACD shows weakening bullish momentum, supporting a bearish bias.

Fibonacci: The 1.17160–1.18070 zone aligns with the 78.6% Fibonacci retracement of the prior downmove, reinforcing resistance.

Risks: A break above 1.1820 could invalidate the setup. Watch for ECB policy updates or unexpected US data shifts.

Conclusion: The 1.17160–1.18070 resistance zone offers a compelling short opportunity for EUR/USD, backed by technical and fundamental factors. Use tight risk management due to potential volatility.

Eurusdshortidea

EUR/USD Daily Short SetupSetup: Retest of the former support zone (now supply) after the recent pullback from the mid-April highs

Entry: Short around 1.1336 (within the shaded resistance box)

Stop-Loss: Above the recent swing high at 1.1390

Take-Profit: Near the lower range support at 1.0735

Risk : Reward: ~1 : 5

Rationale:

Following a strong rally from early March to mid-April, EUR/USD has corrected sharply and is now back into the grey supply area that previously acted as support. This zone is likely to cap upside moves, making a short entry here attractive. The next major support lies around 1.0735, offering a high reward relative to risk. A break above 1.1390 would invalidate the setup.

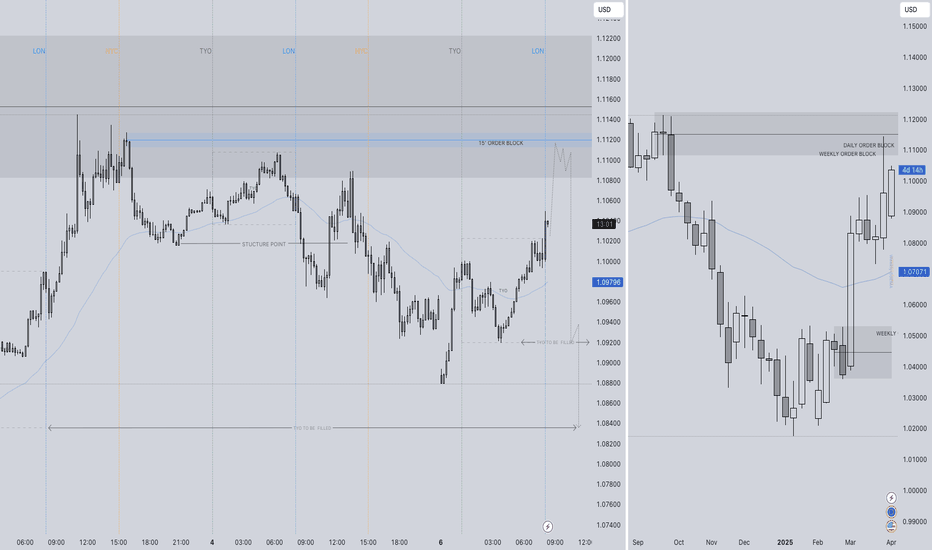

EURUSD SHORT POTENTIAL Q2 W15 Y25 MON 7TH APRIL 2025EURUSD SHORT POTENTIAL Q2 W15 Y25 MON 7TH APRIL 2025

An almost picture perfect setup. Let's take a look into why and what we forecast.

Take a look at the weekly chart. We have had a previous bearish close from the weekly order block. That's a tick in our book. The even better news is that weekly wick of rejection has also mitigated the daily order block up at the highs!

Another serious level of confluence that will in turn support out short forecast. Now what can we expect to happen next for price action. We shall not guess, we will wait to see how the market plays but I'll inform you of what FRGNT X would love to see.

-Price action fill the previous weekly closed wick area.

- In doing so, can we reach the 15' Order block that was left behind.

- Can we grab a lower time from break of structure from that point of interest.

- Once the above occurs. We short the market doing to clear points of interest.

The plan for EURUSD is very very simple this Monday morning. Let's see how it plays out.

FRGNT X

EURUSD Potential Shorts (Technical Analysis)Overall Context:

The dollar's been flexing its muscles lately, and EURUSD is feeling the pressure. We saw some crazy gaps when the markets opened on Monday morning – a sign of shaky liquidity, which usually snaps back. But with the trade war rumbling on, who knows?

As traders, we've got to stay prepared, expecting a correction but ready with our contingency plans if it doesn't happen. Let's dive in -

Technical Outlook:

Failure of the previous accumulation cycle - Classic Wyckoff stuff, cycles run their course.

A re-distribution is likely on the horizon, especially if the lower timeframes agree with the bigger picture. (Fractally, we need to see the LTF accumulation fail and for distribution to align with the HTF sentiment and cycle).

Price has broken to the downside and has created multiple lower highs.

Trading below the 200 EMA and has recently tested and bounced of the 50 EMA (at a correlating level of supply)

Keep in mind that USDJPY and EURUSD are inversely correlated and are currently in line - While the inverse correlation is a significant factor, it's not the only thing that influences these currency pairs. Interest rates, economic data, and global events can also play a role and we know how that story looks at present so this is just additional confluence for us.

Potential Scenarios & Probabilities:

Scenario 1 (High Probability) - Price will pull back into the supply and drop from there.

Scenario 2 (Medium Probability) - Price will continue to plummet and break structure to the downside.

Trading Considerations:

If price fills the gap and reaches supply levels above, you should wait for bearish confirmations to get involved.

If price drops past the previous low, identify new levels of supply and trade accordingly. (I'll try to post an update if this happens).

Final Notes:

Strong technical picture but this week has a lot of upcoming economic events (NFP, anyone?).

With the Tariffs imposed so close to the NFP release one can only assume there will be a power play by the Trump administration which we may not see coming.

All we can do for now is follow the money flow to stay in the know!

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading involves substantial risk and may not be suitable for all investors. Conduct your own research and consult with a financial advisor before making any investment decisions.

OANDA:EURUSD TVC:DXY FX:USDJPY

Short Eurusd - Targeting 1.02211Eurusd has been making continuous strides further down in price. The recent pullback to 1.04500 was rejected and indicating for me more movement to the downside, there was divergence of the RSI & MFI on the 4hr at that rejection level of price. If price continues to slide, I'll be looking to target a price of 1.02211. I'm currently in a short position at 1.04077, a nice 187 pips I would be looking to grab if price hits target. Patience is key! If you see anything different, feel free to share!

EUR/USD Short Setup at Key Resistance LevelMy Short Idea Based on Downtrend Continuation

Short Entry: 1.0850

Stop Loss: 1.0900

Take Profit: 1.0800

The pair is in a downtrend, forming lower highs (LH) & lower lows (LL) and this retracement to 1.0850 resistance provides a solid short opportunity,

The RSI is nearing overbought levels adding confirmation to the bearish setup, The stop loss is safely above resistance to avoid false breakouts and take profit is at 1.0800, where strong support lies.

Good Luck!

EURUSD Shorts to 1.08500 (Possibly lower)My bias for this week's prediction is for EURUSD to move bearish, As it has tapped into a strong level of supply. I will be waiting for wyckoff distribution to play out in order for us to catch sells this week. Simultaneously, the dollar has also tapped in to a demand zone which is expected to initiate a bullish reaction hence why I am bearish for EU.

The 16hr supply hold a lot of precedence as not only its on the higher time frame but, it has also caused a BOS to the downside which continued the overall bearish trend. Not only that but, the zone has also swept liquidity which is a good sign that this zone will get respected.

Confluences for EURUSD Longs are as follows:

- Price tapped into a 16hr supply zone that has caused a BOS to the downside.

- Overall price trend is bearish on the EURUSD chart.

- Imbalances left below to target which hasn't been filled yet.

- Lots of trendline liquidity to the downside and asian lows that's been left.

- Dollar (DXY) is inside a 5hr demand which I'm anticipating a bullish reaction from.

- Price has steadily approached the zone with weaker bullish candles indicating that bullish pressure is exhausted and over bought.

P.S. I would love to see the asian high inside the zone get swept first in the form of a UTAD for a better confirmation of a sell but we will see what price does on Monday. Usually its a slow day however, I will be waiting for a clean CHOH on the lower time frame to give me a better insight of when price wants to expand to the downside.

EURUSD SHORT I'm looking for short opportunities on EURUSD at the moment. We've been downtrending since mid July, the market has been working its way down taking out lows from July, June and May. I see one more prominent target EURUSD would push for if the downtrend continues and that would be the bottom seen in mid March around the 1.05200 area. Thats where I'll be looking to take profits after price retraces back into the 1.06900 zone. Good luck traders, let me know you thoughts on EU!

EurUSD short Swing Idea (updated)Key Resistance Level: This zone marked on chart historically acted as a significant resistance level in the EUR/USD pair. While the overall trend might be upwards, targeting a reversal from this resistance level can be a viable strategy. Price action near this level could trigger a bearish reversal or increased selling pressure.

Overbought Conditions: Assessing the overbought conditions on technical indicators like the Relative Strength Index (RSI) can provide insights into potential reversals. If the RSI is in overbought territory (above 70), it suggests that the market may be due for a correction or reversal.

Bearish Candlestick Patterns: Monitoring bearish candlestick patterns, such as shooting stars, bearish engulfing patterns, or evening stars, can provide additional confirmation of a potential reversal. These patterns indicate that selling pressure is increasing and a reversal could be imminent.

Fibonacci Retracement: 61.8% Fibonacci levels often act as resistance during reversals and may present opportunities for short positions.

Fundamental Analysis:

Economic Data: Keeping an eye on economic data releases from both the Eurozone and the United States is essential. Positive economic indicators from the United States, such as strong GDP growth or better-than-expected employment figures, could strengthen the US dollar and potentially trigger a reversal in the EUR/USD pair.

Central Bank Policy: Monitoring statements or actions by the European Central Bank (ECB) and the Federal Reserve (Fed) is crucial. Any indications of a shift towards tighter monetary policy by the Fed or looser policy by the ECB could influence market sentiment and potentially contribute to a reversal in the EUR/USD pair.

Sentiment and Risk Appetite: Market sentiment and risk appetite play a significant role in currency movements. Any changes in global risk sentiment, driven by factors like geopolitical tensions or economic uncertainties, could lead to a shift towards safe-haven currencies such as the US dollar, potentially favoring a reversal in the EUR/USD pair.

Conclusion:

While the overall trend of the EUR/USD pair might be upwards, a short position from 1.12747 to 1.13420 can be considered as a potential reversal opportunity. Monitoring key resistance levels, overbought conditions, bearish candlestick patterns, and employing Fibonacci retracement levels can help identify potential entry points for a short position. Additionally, keeping an eye on economic data, central bank policies, and market sentiment is crucial for assessing the probability of a reversal. Remember to manage risk effectively and adjust your strategy if market conditions change.

eurusd shortDear friends and companions:

In the 4-hour time frame, the price has hit the ceiling of the ascending channel, and the divergence between the price chart and the RSI indicator is quite evident, and from here I give the possibility of falling to the specified range.

If you like my analysis, please like and follow me.

EUR/USD SELL IDEAHey tradomaniacs,

EUR/USD has shown another strong fakeout at the MONTHLY Key-Resistance which could give us a great chance to short the peek.

Another retest of the intradays High-Volume-Note should show us whether this is a likely scenario or not.

EUR/USD: Daytrade-Preparation

Sell-Limit: 1,21175

Stop-Loss: 1,21420

Point-Of-Risk-Reduction: 1,21000

Take-Profit: 1,20720

Stop-Loss: 25 pips

Risk: 0,5% - 1%

Risk-Reward: 1,86

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)