Eurusdshortsell

EUR/USD Short Idea Analysis EUR/USD exhibits bearish potential on the daily timeframe, with the 1.17160–1.18070 zone acting as a key resistance area for a short setup.

Technical Analysis:

Price Action: Price is testing the 1.17160–1.18070 resistance zone, which aligns with prior highs and a rejection area. A bearish reversal pattern (e.g., shooting star or engulfing) could confirm the short.

Support/Target: Initial support at 1.1600, with a deeper target at 1.1500 if selling pressure accelerates.

Indicators: RSI is nearing overbought levels (above 65), suggesting a potential reversal. MACD shows weakening bullish momentum, supporting a bearish bias.

Fibonacci: The 1.17160–1.18070 zone aligns with the 78.6% Fibonacci retracement of the prior downmove, reinforcing resistance.

Risks: A break above 1.1820 could invalidate the setup. Watch for ECB policy updates or unexpected US data shifts.

Conclusion: The 1.17160–1.18070 resistance zone offers a compelling short opportunity for EUR/USD, backed by technical and fundamental factors. Use tight risk management due to potential volatility.

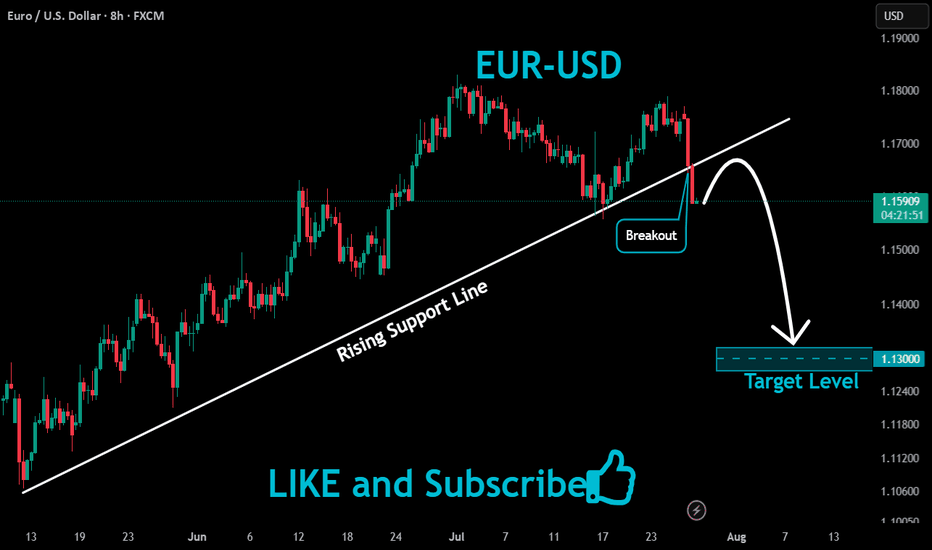

EURUSD - Look for Short (SWING) 1:2.5!Price has formed an ascending channel on the higher time frame, currently consolidating before potentially entering a distribution phase. A breakout could occur in either direction, but if the chart pattern plays out as expected, we may see a break below the key support level. Let’s aim for at least TP1.

Disclaimer:

This is simply my personal technical analysis, and you're free to consider it as a reference or disregard it. No obligation! Emphasizing the importance of proper risk management—it can make a significant difference. Wishing you a successful and happy trading experience!

What's your view ( scenerio 1 or 2 )

---

📈 EUR/USD Weekly Chart – Wave 4 in Progress?

Wave 3 looks complete and price is now hovering in a key correction zone, hinting at the start of Wave 4.

Two possible paths are unfolding:

🔴 Scenario 1: Shallow Wave 4 correction → breakout to Wave 5, targeting 1.16667 and beyond.

🔵 Scenario 2: Deeper Wave 4 correction → retest of demand zone near 1.08, followed by a strong Wave 5 rally.

🧠 Elliott Wave traders, it’s time to stay sharp!

The reaction near the mid-box and support zone could define the next major move for the Euro.

💬 What’s your bias here — is this the start of Wave 5 or a fakeout before a deeper drop?

Comment your view 👇

#EURUSD #ElliottWave #ForexWeekly #GreenFireForex #WaveAnalysis #TechnicalAnalysis #SupplyAndDemand

---

EURUSD SHORT FORECAST Q2 W15 Y25 TUESDAY 8TH APRIL 2025EURUSD SHORT FORECAST Q2 W15 Y25 TUESDAY 8TH APRIL 2025

Welcome back if you're returning, Welcome if you're new here!

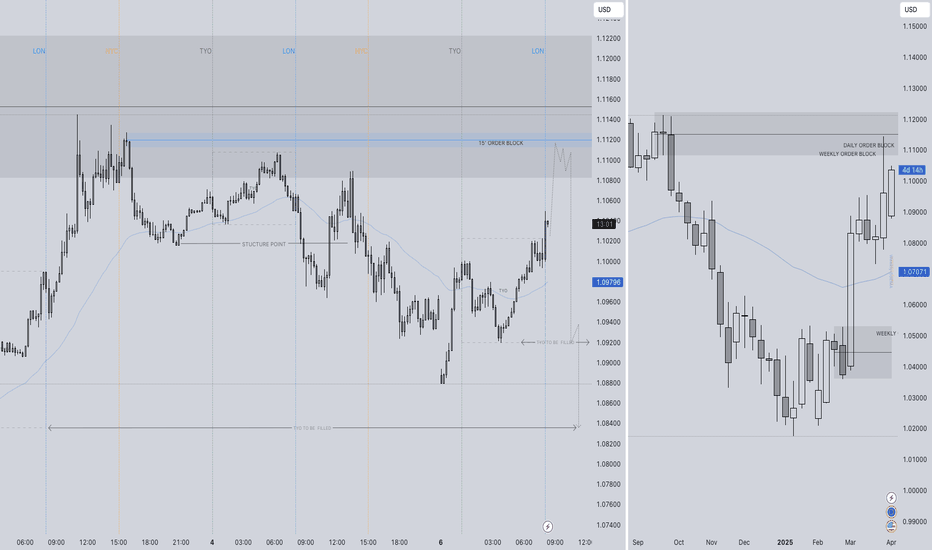

Let's take a long into a much unchanged EUERUSD short analysis. The weekly time frame in particular is setting the short scene here. The weekly order block created in September 2024 is providing the valid short point of interest and we have witnessed rejection from that area.

It is also worth mentioning risk management. It does not really feel like a change in dynamic, the majority of us have seen similar price action movements during financial global shifts. My only take away is RISK MANAGEMENT during those/ these periods. One thing I have noticed being a trader is I can always find a position, the question is, BUT... "what position are you going to execute"

This was the difference between FRGNT now and FRGNT then.

Take EURUSD, we have alerts set just below our points of interest. Once that alert sounds, we are aware that our high probability set up is to be looked at closer.

EURUSD short forecast in that case remains 100% unchanged at this time and I shall link the EURUSD short forecast from week 15 beginning.

You may feel that there is no need to read but I hope this reenforces that at times there are trading periods in which there simply is no position to execute. Our job at professional risk managers is to ensure that when our set up does materialise, we are there ready with out account balance intact to bank the full rewards.

FRGNT X

EURUSD SHORT POTENTIAL Q2 W15 Y25 MON 7TH APRIL 2025EURUSD SHORT POTENTIAL Q2 W15 Y25 MON 7TH APRIL 2025

An almost picture perfect setup. Let's take a look into why and what we forecast.

Take a look at the weekly chart. We have had a previous bearish close from the weekly order block. That's a tick in our book. The even better news is that weekly wick of rejection has also mitigated the daily order block up at the highs!

Another serious level of confluence that will in turn support out short forecast. Now what can we expect to happen next for price action. We shall not guess, we will wait to see how the market plays but I'll inform you of what FRGNT X would love to see.

-Price action fill the previous weekly closed wick area.

- In doing so, can we reach the 15' Order block that was left behind.

- Can we grab a lower time from break of structure from that point of interest.

- Once the above occurs. We short the market doing to clear points of interest.

The plan for EURUSD is very very simple this Monday morning. Let's see how it plays out.

FRGNT X

Short Order on EUR/USD: Targeting a PullbackHi Traders ! I've placed a sell limit order on the EUR/USD pair at the 1.04784 level, expecting a reversal from this resistance zone within the bullish channel. My stop loss is set at 1.05482 to limit risk in case the price continues to rise, while my take profit is at 1.04087, targeting a pullback towards the bottom of the channel. I trust that the price will respect the market structure and I'm taking advantage of this potential correction to make a profit.

Disclaimer:

This content is for informational purposes only and should not be considered as financial advice. Trading involves significant risk, and it is important to conduct thorough research and consider your risk tolerance before making any trading decisions. Past performance is not indicative of future results.

EUR/USD Short Setup at Key Resistance LevelMy Short Idea Based on Downtrend Continuation

Short Entry: 1.0850

Stop Loss: 1.0900

Take Profit: 1.0800

The pair is in a downtrend, forming lower highs (LH) & lower lows (LL) and this retracement to 1.0850 resistance provides a solid short opportunity,

The RSI is nearing overbought levels adding confirmation to the bearish setup, The stop loss is safely above resistance to avoid false breakouts and take profit is at 1.0800, where strong support lies.

Good Luck!

EURUSD - 4H - TECHNICAL ANALYSISHello friends,

A pullback has occurred on the 4-hour chart of the FX:EURUSD pair, and my target is at the 1.07408 level.

Best regards,

You can express your appreciation with a like for the analyses we have diligently prepared for you, investing time and effort.

Feel free to share your thoughts and questions in the comments section.

Good luck.

EURUSD SHORT I'm looking for short opportunities on EURUSD at the moment. We've been downtrending since mid July, the market has been working its way down taking out lows from July, June and May. I see one more prominent target EURUSD would push for if the downtrend continues and that would be the bottom seen in mid March around the 1.05200 area. Thats where I'll be looking to take profits after price retraces back into the 1.06900 zone. Good luck traders, let me know you thoughts on EU!

EurUSD short Swing Idea (updated)Key Resistance Level: This zone marked on chart historically acted as a significant resistance level in the EUR/USD pair. While the overall trend might be upwards, targeting a reversal from this resistance level can be a viable strategy. Price action near this level could trigger a bearish reversal or increased selling pressure.

Overbought Conditions: Assessing the overbought conditions on technical indicators like the Relative Strength Index (RSI) can provide insights into potential reversals. If the RSI is in overbought territory (above 70), it suggests that the market may be due for a correction or reversal.

Bearish Candlestick Patterns: Monitoring bearish candlestick patterns, such as shooting stars, bearish engulfing patterns, or evening stars, can provide additional confirmation of a potential reversal. These patterns indicate that selling pressure is increasing and a reversal could be imminent.

Fibonacci Retracement: 61.8% Fibonacci levels often act as resistance during reversals and may present opportunities for short positions.

Fundamental Analysis:

Economic Data: Keeping an eye on economic data releases from both the Eurozone and the United States is essential. Positive economic indicators from the United States, such as strong GDP growth or better-than-expected employment figures, could strengthen the US dollar and potentially trigger a reversal in the EUR/USD pair.

Central Bank Policy: Monitoring statements or actions by the European Central Bank (ECB) and the Federal Reserve (Fed) is crucial. Any indications of a shift towards tighter monetary policy by the Fed or looser policy by the ECB could influence market sentiment and potentially contribute to a reversal in the EUR/USD pair.

Sentiment and Risk Appetite: Market sentiment and risk appetite play a significant role in currency movements. Any changes in global risk sentiment, driven by factors like geopolitical tensions or economic uncertainties, could lead to a shift towards safe-haven currencies such as the US dollar, potentially favoring a reversal in the EUR/USD pair.

Conclusion:

While the overall trend of the EUR/USD pair might be upwards, a short position from 1.12747 to 1.13420 can be considered as a potential reversal opportunity. Monitoring key resistance levels, overbought conditions, bearish candlestick patterns, and employing Fibonacci retracement levels can help identify potential entry points for a short position. Additionally, keeping an eye on economic data, central bank policies, and market sentiment is crucial for assessing the probability of a reversal. Remember to manage risk effectively and adjust your strategy if market conditions change.

EURUSD WEEKLY ANALYSISFX:EURUSD

So as far as I see this pair for the week I am mainly bearish as we can see price broke below resistance and now has retested that same resistance so we could be seeing this pair selloff this week but due to recent events happening to the economy I will ask you all to please trade with proper risk management to avoid you loosing your account

EURUSD Potential DownsideA trade that cannot be missed when it drops. This pair has been making new lows, it is not ready to buy long term. We are anticipating a possible double bottom before it could even think of changing a trend. Overall we still believe this is a strong downtrend.

Trade with care.

Follow and like for more trade ideas.

EURUSD - Daily Trade Idea - 6-Jun-22EURUSD (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1, TP 2 , TP 3 and EXIT (SL) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session and only enter if we have the final confirmation for entry.

EUR USD 15 MIN SCALP SELLAs EUR continues to trend downwards, check out this possible trade idea to enter a short if prices pushes upward towards resistance levels. Take a small risk of 60 pips for a Potential gain of 260 pips.

Only enter this trade after price rejects the resistance zone and right after the next 15 minute sell candle closes above!

Stop Loss: 1.18236

Take Profit 1 = 1.17956

Take Profit 2 = 1.17916