EUR/USD Short Idea Analysis EUR/USD exhibits bearish potential on the daily timeframe, with the 1.17160–1.18070 zone acting as a key resistance area for a short setup.

Technical Analysis:

Price Action: Price is testing the 1.17160–1.18070 resistance zone, which aligns with prior highs and a rejection area. A bearish reversal pattern (e.g., shooting star or engulfing) could confirm the short.

Support/Target: Initial support at 1.1600, with a deeper target at 1.1500 if selling pressure accelerates.

Indicators: RSI is nearing overbought levels (above 65), suggesting a potential reversal. MACD shows weakening bullish momentum, supporting a bearish bias.

Fibonacci: The 1.17160–1.18070 zone aligns with the 78.6% Fibonacci retracement of the prior downmove, reinforcing resistance.

Risks: A break above 1.1820 could invalidate the setup. Watch for ECB policy updates or unexpected US data shifts.

Conclusion: The 1.17160–1.18070 resistance zone offers a compelling short opportunity for EUR/USD, backed by technical and fundamental factors. Use tight risk management due to potential volatility.

Eurusdshortsetup

EURUSD SHORT FORECAST Q2 W25 D20 Y25EURUSD SHORT FORECAST Q2 W25 D20 Y25

Professional Risk Managers👋

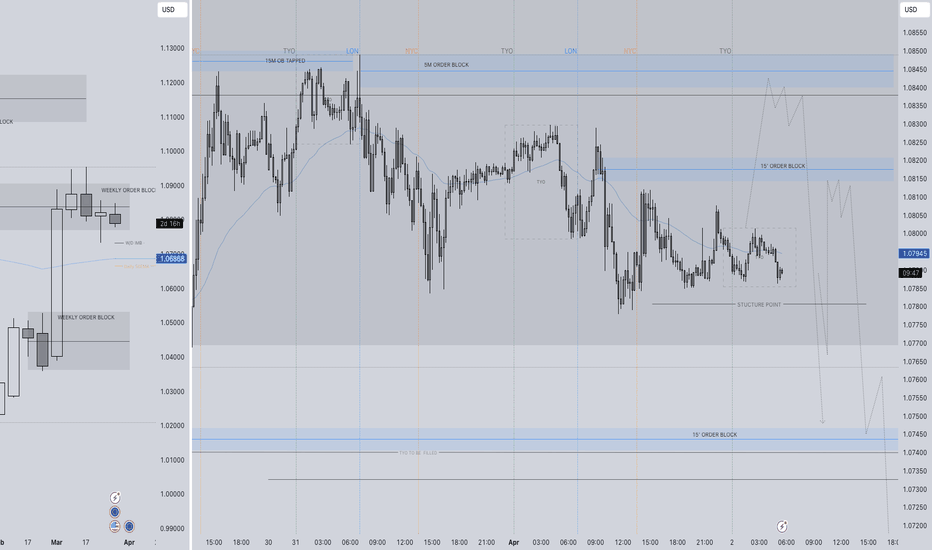

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅15' order block

✅4 hour order block identified

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURUSD SHORT FORECAST Q2 W25 D16 Y25EURUSD SHORT FORECAST Q2 W25 D16 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block

✅15' order block

✅1 hour order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURUSD HOURLY UPDATES Hello folks, EU/ EUR/USD Updates, since this idea working on higher timeframe/daily. I will be shorting above, see the sl zone.

The targets see below.

Good luck.

My idea is on daily, if price goes down hard, I will update for entries at 4h.

Idea here is continuation pattern on a weekly basis. So if price goes down it might retrace only.

Pewwpeww.

This is not a financial advice, use stop loss for your protection, just a like a condom. lol

Good luck fellas, Writing more ideas base only my trading style.

EURUSD SHORTS Q2 W14 Y25 WED 2ND APRIL 2025EURUSD SHORTS Q2 W14 Y25 WED 2ND APRIL 2025

The higher time frame is pushing this narrative. Take a look at the weekly time frame. Price actions is indication a bearish reaction from the weekly Order Block. For this reason, ALL long positions are off the table until further notice. That of course makes out job as risk managers a lot easier. We can now focus our bias on looking for high probability short set ups.

So what do we have-

The current weekly candle, we can anticipate has makes it high, creating our perfect area to short from once an indication of price slow down and bullish turn around has occurred. We have our weekly and daily50 exponential moving average to short toward. Add that to the bag of confluences.

internal 15' market structure and price action. There some work to be done and a potentially a period of sitting on hands whilst we wait for price to show its hands.

We have two 15' points of interests that a short could present itself from however we must be mindful of the internal structure so a clear turn around of price once the areas have been touched is required. Ideally I will first need to see a break of structure post London open, leaving Tokyo highs, that will be our confluence for price returning to our area. If 15' structure does not break post London open, I will await for the higher 15' point of interest. knowing this higher area is almost the last resort for the short set up, my confluences for price turn around will be reduced. 1' breaks of structure, followed by bearish engulfing candles and or 1' imbalance candle fill will be more than sufficient for a position to be executed.

In summery, EURUSD SHORTS.

Closest 15' OB- need to see a break below structure first to indicate selling pressure leading Toyko untouched. await the pull back into the 15'- await a turn around in price and short to the close 50 EMA.

Higher 15' OB, lets see how price arrives, slow and steady, showing signs of slow down, lets entertain lower time frame breaks of struture for a short down to Tokyo lows on the assumption not mitigated post session close.

Lets see how it plays.

FRGNT X

EURUSD – Rising Wedge Breakdown | FVG in PlayEURUSD has broken down from a Rising Wedge pattern on the 1H timeframe, suggesting a bearish momentum shift after a strong rally. The current price action indicates a likely continuation lower, targeting the Fair Value Gap (FVG) zone and major support near 1.07047.

📊 Technical Breakdown

1. Rising Wedge Pattern

A clean bearish rising wedge formed during the uptrend, with price contracting upward and volatility drying.

The breakdown from this wedge came with strong bearish momentum, confirming the pattern's bearish bias.

2. Fair Value Gaps (FVGs) as Draws on Liquidity

Two unmitigated FVGs lie below current price:

First zone near 1.0780

Second deeper zone near 1.07047, aligning with the projected measured move of the wedge breakdown.

These zones act as magnetic targets for price to fill inefficiencies and collect liquidity.

3. Bearish Retest Structure

Price is currently forming a potential retest of the broken wedge structure, which could provide an ideal short entry opportunity.

Expected continuation downward upon rejection from this retest zone.

🧠 Trade Idea

Entry Zone: After confirmation of rejection near 1.0850 (retest of wedge)

Target: 1.07047 (FVG & measured move confluence)

Stop Loss: Above 1.0885 (above wedge structure)

Risk-Reward: Solid setup with FVG and structure confluence

⚠️ Key Levels to Watch

Resistance: 1.0850–1.0880 (wedge retest)

Support/Target: 1.07047 (FVG fill + structure)

Break back above 1.0900 invalidates the short setup.

EURUSD H1 12/12/2024 - Bearish Momentum and key supports testedMulti-Timeframe Analysis

D1 (Daily Chart)

Trend: Strong bearish trend with price below the 200 SMA and inside the Ichimoku cloud. The overall bias remains bearish.

Indicators:

RSI: At 40, close to oversold territory but still with room for downside continuation.

Stochastic: Near the mid-level (54), indicating a neutral stance with potential for further downside.

MACD: Below the signal line, signaling bearish momentum.

Key Levels:

Support: 1.0480, 1.0450.

Resistance: 1.0510, 1.0540.

H4 (4-Hour Chart)

Trend: Bearish consolidation, with price below the 200 SMA and hugging the lower Bollinger Band.

Indicators:

RSI: At 42, showing weak momentum but not yet oversold.

Stochastic: 28, nearing oversold levels.

MACD: Below the signal line with bearish momentum but showing a flattening histogram, suggesting potential consolidation.

Key Levels:

Support: 1.0485, 1.0460.

Resistance: 1.0515, 1.0540.

H1 (Hourly Chart)

Trend: Downtrend remains intact with price trading below all major moving averages and below the Ichimoku cloud.

Indicators:

RSI: At 45, confirming weak bearish momentum.

Stochastic: 23, indicating oversold conditions and possible pullback.

MACD: Slightly bearish, with price momentum losing steam.

ATR (14): At 10 pips, reflecting moderate volatility.

Key Levels:

Support: 1.0485, 1.0460.

Resistance: 1.0510, 1.0535.

M30 (30-Minute Chart)

Trend: Bearish but consolidating at key support levels near 1.0490.

Indicators:

RSI: At 43, close to oversold.

Stochastic: 20, signaling a possible short-term pullback.

MACD: Flat, reflecting indecision.

Correlated Financial Instruments

DXY (US Dollar Index):

Continues to rise above 106.50, confirming USD strength and adding downward pressure on EUR/USD.

Gold (XAU/USD):

Declining due to USD strength, supporting a bearish bias for EUR/USD.

Trade Plan for EUR/USD (H1)

Trade Setup 1: Bearish Continuation After Pullback

Rationale: EUR/USD remains in a downtrend, and any retracement to key resistance levels provides a selling opportunity.

Trade Details:

Entry Price: 1.0510–1.0515 (on a retracement).

Stop-Loss: 1.0535 (above recent resistance).

Take-Profit Levels:

TP1: 1.0485.

TP2: 1.0460.

Risk/Reward Ratio: ~1:2.

Trade Setup 2: Aggressive Breakout Short

Rationale: A break below 1.0485 confirms bearish continuation toward lower support levels.

Trade Details:

Entry Price: 1.0480 (on breakout).

Stop-Loss: 1.0505 (above the breakout level).

Take-Profit Levels:

TP1: 1.0460.

TP2: 1.0435.

Risk/Reward Ratio: ~1:2.

Trade Setup 3: Short-Term Scalping (Intraday Pullback to Resistance)

Rationale: A minor retracement to intraday resistance levels could offer a short-term short trade with reduced risk.

Trade Details:

Entry Price: 1.0505.

Stop-Loss: 1.0520.

Take-Profit Levels:

TP1: 1.0490.

TP2: 1.0480.

Risk/Reward Ratio: ~1:1.5.

EURUSD H1 11/12/2024 - SELL below 1.0525/1.0530 , Reversal 1.054Multi-Timeframe Analysis

D1 (Daily Chart)

Trend: Strong bearish bias, with price below the 200 SMA and Ichimoku cloud.

Indicators: RSI at 40 and MACD signaling downside momentum.

Support/Resistance:

Support: 1.0490 and 1.0450.

Resistance: 1.0540 and 1.0570.

H4 (4-Hour Chart)

Trend: Downtrend continues, with price consolidating near the lower Bollinger Band.

Indicators:

Stochastic is in the oversold zone (17.87), indicating potential short-term pullback.

MACD suggests bearish momentum but losing strength.

Support/Resistance:

Support: 1.0495 and 1.0450.

Resistance: 1.0530 and 1.0550.

H1 (Hourly Chart)

Trend: Price is below all major moving averages and Ichimoku cloud, confirming bearish structure.

Indicators:

RSI at 40, indicating continued bearish bias but with room for a pullback.

Stochastic is oversold (23.76) and turning up, suggesting a potential retracement.

ATR (14) at 10 pips, reflecting moderate volatility.

Key Levels:

Support: 1.0495, followed by 1.0450.

Resistance: 1.0530 and 1.0545.

M30 (30-Minute Chart)

Trend: Intraday bearish trend intact, with consolidation near key support levels.

Indicators:

MACD turning slightly neutral.

Stochastic oversold (28.47), indicating potential for minor correction.

Revised Trade Plan for EUR/USD (H1)

Trade Setup 1: Bearish Continuation After Pullback

Rationale:

EUR/USD remains in a bearish trend, and any pullback toward 1.0530–1.0540 provides an optimal sell opportunity.

Trade Details:

Entry Price: 1.0525–1.0530 (on a retracement to resistance).

Stop-Loss: 1.0555 (above the intraday resistance).

Take-Profit Levels:

TP1: 1.0495 (current support).

TP2: 1.0450 (next key support).

Risk/Reward Ratio: ~1:2.

Trade Setup 2: Aggressive Breakout Short

Rationale:

A clean break below 1.0495 would confirm bearish continuation, targeting lower levels.

Trade Details:

Entry Price: 1.0490 (on a confirmed breakout).

Stop-Loss: 1.0515 (above the breakout level).

Take-Profit Levels:

TP1: 1.0470.

TP2: 1.0450.

Risk/Reward Ratio: ~1:2.

Trade Setup 3: Intraday Scalping on Reversal

Rationale:

If price breaks above 1.0535, it may trigger short-term buy momentum, targeting a retracement to the next resistance.

Trade Details:

Entry Price: 1.0540.

Stop-Loss: 1.0525.

Take-Profit Levels:

TP1: 1.0555.

TP2: 1.0570.

Risk/Reward Ratio: ~1:1.5.

Key Considerations

News Impact:

Watch for the 13:30 GMT US inflation data release, which could spike volatility. Avoid placing trades right before the release.

Correlated Instruments:

DXY: A rise above 106.75 may further pressure EUR/USD.

Treasury Yields: A spike in yields could add USD strength.

30/10/2024 - EUR/USD - Short Trade Plan30/10/2024 - EUR/USD - Short Trade Plan

Trade Details:

Entry: 1.08200 (15min Order Block with 4H OB Confluence)

Stop Loss: 1.08407

Take Profit 1: Based on 1:1 Risk-Reward Ratio

Take Profit 2: 1.07733

Reason for Trade:

Short entry is based on a 15-minute Order Block (OB) aligned with a higher timeframe (4H) OB, adding confluence to the setup.

Aiming for an initial 1:1 Risk-Reward (RR) on TP1, with TP2 set at a lower target.

Disclaimer: This trade plan is for educational purposes only and is not financial advice. Please conduct your own analysis before trading.

EURUSD: 1-Hour Set upMoving Averages:

20-period EMA (green), 50-period EMA (orange), and 200-period EMA (red) show a clearer short, mid, and long-term trend direction.

The price is currently trading below the 200 EMA, which indicates that the overall trend is bearish.

The price has moved above the 20 EMA and is challenging the 50 EMA, suggesting a short-term bullish reversal or retracement.

RSI:

The RSI is at 65.20, showing that the asset is approaching overbought territory. This indicates caution for buying positions but could also signal momentum for further upside.

MACD:

The MACD is showing a potential bullish momentum as the MACD line has crossed above the signal line. This suggests a possible continuation of the current bullish momentum.

Resistance Zones:

1.1060: This is near the 200 EMA and could act as a strong resistance, especially considering that it aligns with previous price peaks.

1.1100–1.1120: The next key resistance area is visible, where the price previously stalled before making a sharp move down.

Support Levels:

1.1020: This support aligns with the recent bounce, where the price reacted positively. If the price drops below this level, it could signal a further downside.

1.1000: A psychological round number and previous consolidation area, adding significance to this support.

Buy Strategy (Pullback and Trend Continuation):

Entry:

Consider entering a buy trade if the price retraces towards 1.1020 (just above the recent support) and holds above the 20 EMA.

Confirmation of a bullish entry could come from the MACD crossover (bullish), or a bounce from the RSI if it stays above 50.

Stop Loss:

Place a stop loss slightly below 1.1000 (around 1.0990) in case the price breaks down.

Take Profit:

First target: 1.1060 (near the 200 EMA).

Second target: 1.1100–1.1120, if the price manages to break through the 200 EMA resistance.

Risk Management:

Since RSI is approaching overbought levels, enter cautiously and monitor the price reaction at the 1.1060 resistance zone. If the price breaks above the 200 EMA with strong momentum, hold on to the trade for a potential further move up.

Sell Strategy (Trend Reversal):

Entry:

Enter a short position if the price fails to break through 1.1060 or stalls at the 200 EMA. This would confirm that the bearish trend is resuming after a retracement.

A strong bearish candle at or near the 200 EMA can confirm the sell signal, especially if accompanied by a bearish crossover on the MACD or RSI turning lower from overbought levels.

Stop Loss:

Set a stop loss above 1.1100 (preferably around 1.1110) to cover any false breakout above the resistance level.

Take Profit:

First target: 1.1020 (short-term support).

Second target: 1.1000, and potentially further down if the bearish momentum strengthens.

Risk Management:

The sell strategy works well in a continuation of the overall bearish trend, but always look for confirmation signals like price rejection at the 200 EMA or bearish divergence on the RSI and MACD.

Buy Setup: Buy near 1.1020 with targets at 1.1060 and 1.1100, especially if price remains above the 20 and 50 EMAs.

Sell Setup: Look for a short near 1.1060 or below 1.1100 with a stop above, targeting 1.1020 and potentially 1.1000.

EURUSD Analysis : Daily/H4

Moving Averages:

The 20-period EMA (green line) and 50-period EMA (orange line) are closer to the price and show short to mid-term trend directions.

The 200-period EMA (red line) represents the longer-term trend.

Currently, the price is above the 200 EMA, indicating a bullish long-term trend.

Relative Strength Index (RSI):

RSI is slightly below 50 (48.05), indicating a neutral or weakening momentum. This suggests a period of consolidation or a potential reversal.

MACD:

The MACD line is crossing below the signal line, hinting at a possible bearish signal.

Resistance Levels:

The nearest resistance zone appears to be around 1.1150, where the price was recently rejected. This level aligns with the recent peak.

The next significant resistance is around 1.1250, which is a key level from past market behavior.

Support Levels:

Immediate support is found near 1.0950, close to where the 50-period EMA (orange line) is.

A stronger support lies around 1.0850, where the 200-period EMA (red line) aligns, and where price found support previously.

Buy Opportunity: If the price pulls back to the 1.0950 or 1.0850 support area and holds, it could be a good opportunity to buy, especially if confirmed by a reversal pattern (e.g., a bullish engulfing candle) and a positive crossover on the MACD.

Sell Opportunity: Given the weakening momentum on the MACD and RSI below 50, a break below 1.0950 could signal a selling opportunity. In that case, targeting 1.0850 for short-term profit would make sense.

Trend Following (Pullback Strategy):

If the price pulls back to 1.0950 or 1.0850, wait for confirmation (e.g., a bullish candle pattern) and enter a buy trade.

Set the stop loss below 1.0850 (preferably around 1.0800) in case of a false breakout.

First target would be 1.1150, with the second target around 1.1250 if the uptrend continues.

This strategy aligns with the long-term bullish trend indicated by the 200 EMA.

MACD + EMA Strategy:

Enter a short position if the price breaks below 1.0950, with MACD confirming a bearish signal (negative crossover).

Set the stop loss above the 50 EMA (around 1.1000).

First target would be 1.0850, with a potential extension to 1.0750 if bearish momentum increases.

EurUsd formed a Triangle pattern. (Swing Setup)Looking for Impulse Down.

EurUsd getting ready to move down. It completed leg 4 with a triangle pattern. It's important to have your own rules on RR and adhere to them. This trading idea is intended to assist you and enhance your knowledge. If you have any questions, please ask me in the comments.

Learn & Earn!

Wave Trader Pro

EURUSD SELL INCOMINGWe’re bouncing within a channel and a wedge. Price is close to an area of confluence plus there’s been a down trend for some time now. With this particular trade I see it being valid if these few things happen: it must respect the channel and 4 hr order block that was created, a 15 minute has to be created in that premium zone & triggered during NY Session and lastly I’d only go for 1:2 RR. There must be confirmations because there is still a possibility that there can be a trend line breakout. Considering all the multiple confirmations will increase the chances of the trade being successful. Good luck to everyone trading!

EURUSD, ICT Short setup, Swing Trade👋Hello Traders,

Our 🖥️ AI system detected that there is an ICT Short setup in EURUSD for scalping and Swing trade.

Please refer to the details Stop loss, FVG(Supply Zone),open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!