EURUSD road map !!!The Euro will increase two cents and reach to the top of the wedge in the coming weeks.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

EURUSDT

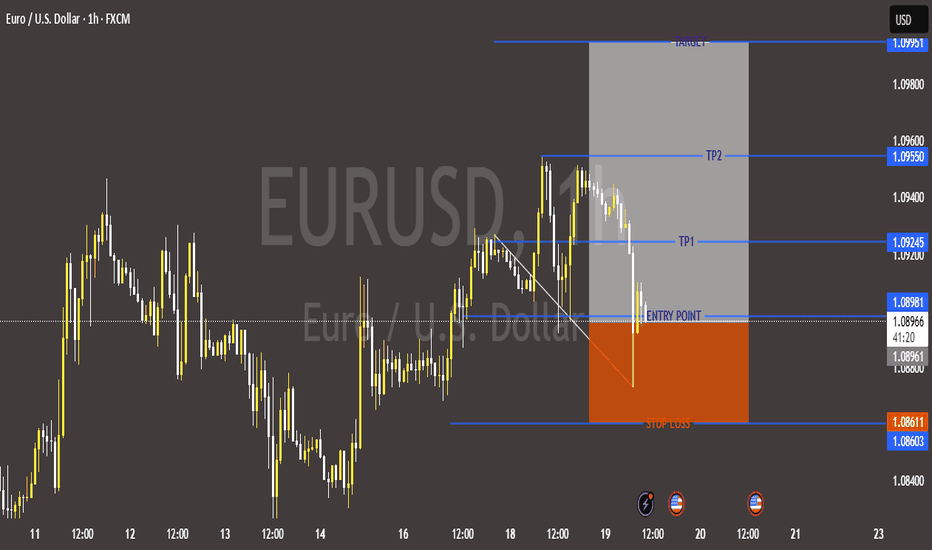

EUR/USD Bullish Trade Setup – Key Levels & Analysis EUR/USD Analysis (1H Chart)

📍 Entry Point: 1.08981 🟢

📉 Stop Loss: 1.08611 ❌

🎯 Take Profit Levels:

▪️ TP1: 1.09245 ✅

▪️ TP2: 1.09550 ✅

▪️ Final Target: 1.09951 🎯

📊 Market Overview:

🔸 Price broke a trendline before entry. 📈

🔸 Setup favors a bullish move. 🚀

🔸 Risk-to-reward ratio looks favorable. ⚖️

⚠️ Watch for:

🔹 Further retracement risks. 🔄

🔹 Confirmation of bullish momentum before entry. 📊

🔥 Conclusion: If price holds above entry and gains momentum, TP levels could be hit. If it breaks below the stop loss, the setup is invalid. 🚦

BULLRUN FOR EURO 2024📣 Hello everyone!

I believe that the former bull market of the EURUSD currency pair will last until the end of 2024, probably the top will be formed in the first quarter of 2025.

TA:

After a long consolidation, the “Diamond” is broken upward; in rare cases, when it breaks upward, this bearish pattern can act as a trend continuation figure.

Fundamentally:

The Fed will move to lower interest rates in September, we will probably see 2-3 cuts at subsequent FOMC meetings, which will put bearish pressure on the US dollar (DXY) and will be a tailwind for the EURUSD currency pair

______________________________________________________

🎯 Intermediate target 1.18$, final target 1.22

______________________________________________________

⚠️ That's all for today, I wish you good luck in making independent trading decisions and profit. Please analyze the information received from me, always think only with your own head!

Goodbye! ✊

EURUSD 1h Reversion Zone Fill ExpectedReturn and fill into the reversion zone range is expected.

Reversion zone range: 1.10801 - 1.10625

Key Resistance level: 1.10921

Key Support level: 1.10167

⚠️ Reversion Zone is an area on the chart where the price often returns after deviating. Some zones will be covered by nearby candlesticks, while others may take more time. Also the zone may never be filled, be careful.

EURUSD is bullish now and many Traders don't see it 👀!!!EURUSDT is in an ascending triangle which means the price is about to do a good bullish movement. The price can increase as much as the measured price movement ( AB=CD ) .The break out needed for increasing further has not happened but it should happen pretty soon.

Also, hidden bullish divergence makes this analysis more accurate.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

#Euro Rejects Bear Pressure, Will Bulls Break $1.1000?Past Performance

The Euro remains bullish but consolidating inside a tight trading range. Overall, the path of least resistance, at least from the top-down preview, is northwards. Technically, the March to May 2023 uptrend shapes the current preview. Therefore, while there were elements of weakness, the Euro remains bullish above $1.0800.

#EURUSD Technical Analysis

From the daily chart, Euro buyers are upbeat, and this holds considering the failure of sellers to push prices below $1.0800, unwinding gains and confirming the drawdown of June 23. For now, buyers are struggling to maintain the upswing, and every low could be entries for buyers. In the current consolidation, optimistic traders can wait for a conclusive close above $1.1000 before riding the emerging trend, targeting $1.1100. Conversely, losses below $1.0800, confirming the sellers of June 23, may see prices drop to $1.0650, or June lows.

What to Expect?

Even though there was a welcomed recovery in June, there must be more gains above last month's highs for trend continuation. Buyers have the upper hand, but there must be confirmation at the back of increasing volumes for this preview to stand.

Resistance level to watch: $1.1000

Support level to watch: $1.0800

Disclaimer: Opinions expressed are not investment advice. Do your research.

#Euro prices flat-line above $1.0660, Bear Run Likely OverPast Performance

Euro prices remain in consolidation within a tight range. From the daily chart, the least path of resistance is southwards, especially as long as prices are below $1.0770. Presently, USD bulls' momentum seems to be fading while Euro is finding strength above $1.0600. The results are balanced candlesticks with long upper and lower wicks, suggesting equilibrium.

#EURUSD Technical Analysis

EUR prices are inside the June 1 bull bar, an indicator of strength. From an effort-versus-result perspective, traders can find entries on every dip above $1.0660, targeting $1.0770 in the short term. However, for conservative, risk-on bulls, a close above the high of the high-volume, bullish engulfing bar of June 1 can offer better entries. Notably, the bar forms as EUR candlesticks print higher highs relative to the lower BB, suggesting that the downside momentum is waning. Still, as mentioned, a comprehensive breakout above the minor bear flag at $1.0770 can anchor the leg up toward $1.0850 in subsequent sessions.

What to Expect?

Buyers are confident as the downside momentum fades. Overall, traders are bullish, but this can only be confirmed once there is a follow-through, confirming buyers of June 1. As a result, the $1.0770 liquidation level is a vital buy trigger for optimistic Euro bulls.

Resistance level to watch: $1.0770

Support level to watch: $1.0660

Disclaimer: Opinions expressed are not investment advice. Do your research.

#Euro bulls slow down, Buyers Have A Chance above $1.0670Past Performance

Euro prices edged lower on June 2, reversing most gains posted the previous day. However, while USD bulls appeared to have the upper hand, trading volumes were lower, solidifying the bullish outlook. Therefore, while bears are optimistic, June 2 losses could be reversed should Euro bulls step in today.

#EURUSD Technical Analysis

The path of least resistance is southwards, at least looking at the performance in the daily chart. After a near 3.6% drop from April peaks, there could be hints of strength in the near term. For now, the immediate reaction points for traders should be at $1.0780 and $1.0670, defining the June 2 trade range. For the uptrend to take shape, there must be an expansion above last week's highs, ideally with rising volumes. This would open up the Euro for a possible retest of $1.0850 in the medium term. Conversely, trend continuation favoring USD bulls will only be confirmed if there are losses below $1.0670 with high participation.

What to Expect?

Euro bulls are optimistic, but whether the reversal initiated from the second half of last week would continue depends on if there is a conclusive close above $1.0780. If not, USD bulls would likely press on, heaping more pressure on the Euro.

Resistance level to watch: $1.0780

Support level to watch: $1.0670

Disclaimer: Opinions expressed are not investment advice. Do your research.

EURUSD long now but totally bearish!Hi dear traders!

As you see, the main trend in EURUSD is bearish. For completing the trend, it needs a correction to 0.5% of 30 min trend. As we see good news, we can take profit from long position.

But Be careful of main bearish trend!

Targets are shown in chart! Be healthy and wealthy!

DYDXUSDT...study the chartBINANCE:DYDXUSDT

looking at the chart, as a pure Minimalist Chart Analysis Trader, could see the good up-trend pattern

u need to know now that the pair has brokeout the 0%FIB-Chan.

we just need this current bar to close as green bar to consider it as a confi-bar (confirmation bar)

and then, i am balls-deep in it

Disclaimer: DO NOT FOLLOW ME

#STOP_BEING_POOR

NEW INDICATORI just published a new script about FIBONACCI drawing tool

i write it my-self, u might recognise it as laim, but i don't give a FUK

use it on your own risk

how to:

go to indicators tab on your chart

paste this name : MEEZ_Fib_new

use it only on 4h-chart

remember this is a script, you should do your own analysis before entering a trade

this script is for newbies only (oldies gonna hate)

#stop_being_poor

EUR/USD is going to do some Huge Movements soonEUR/USD is in a Symmetrical Triangle. The Price will Increase or will decrease Depending on the Break out which will happen soon. The Price Has not done any Break out Yet,so we shall wait and see what will happen. Resistance,Support and Target are shown on the Picture.

-EUR/USD is in a Symmetrical Triangle

-(AB=CD)

-No break out Yet. wait for it.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

🌍Thank you for seeing idea .

Have a nice day and Good luck

EURO - Trade Setup ✅Let's see how EURO is behaving.

This is a 1H chart. (Short Term)

There are two resistance areas on the way up, pushing down on value.

Two support areas are holding the price up.

If the price crosses the local resistance, you can put the solid resistance as the target.

The marker is showing sell volumes for EURUSD.

The RSI shows that EURO is above the 50 levels, the center.

If you want to know how the RSI indicator works, take a look at this Educational Idea. It'll help you have better readings:

Current Market Price: $1.07349

Let me know your ideas.

Good luck.

us10y goes up btc goes down ? this is garbage lookhi all bro..

If us10y and btc are rising on the same monthly candles. The thesis that us10y goes up, btc goes down, it's garbage for me..

%100 no reverse correlation

see marked candles . sometimes together

btc 4 hours ..

never forget my indicator auto fibonacci draws

Selling in the fall below the thin line.

Buying in the rises above the thin line

first atack +46666 second atack 510000

stop line 41450

good luck..

fallow ,comments. like and share pls ..

(Update) EUR/USD: The way to the top of the Wedge + ResistancesHi every one

Euro / U.S. Dollar

EUR/USD has Managed to break the falling wedge that we talked about Last time and we should expect a Bull run all the way to the top of the wedge again! but there are Resistance on the Way as well! so For Now the Price should be able to touch the First Resistance and after the Break out Happens The price can reach Higher levels after Doing a Pullback

summery:

-EUR/USD has broken the Falling wedge

-there are a lot of resistances

-Price will touch the first Resistance and IF it manages to break it the way to the Top of the wedge becomes Easier

PREVIOUS ANALYSIS:

💎Traders, if you liked this idea or have your opinion on it, write in the comments, We will be glad.

Thank you for seeing idea .

Have a nice day and Good luck

EURUSD-4hr's ( Expecting Bullish From 1.21350 ) Dont miss 🇺🇸 EUR/USD Setup / Analysis

🕐 4hr's Chart

Large Scale / Small Scale

➕ Key Technical / Reason's Long

———————————

➕Bullish Area's

1.21350 Break Area

1) 3 Bounce Trend Break

2) Month High Area

3) Value Area / POC

4) liquidity Zone

5) Fixed Volume Break

➕Bearish Reversal

1.23150

1) Liquidity Zone

2) Pattern Target

3) Year High

4) Ultra High Volume

Be in Touch Fore Next Update's

Please follow the analysis very carefully and every detail of the chart means a lot. And always analysis depends on many reasons carefully studied

Always enter into deals when there are more than 5 reasons

combined