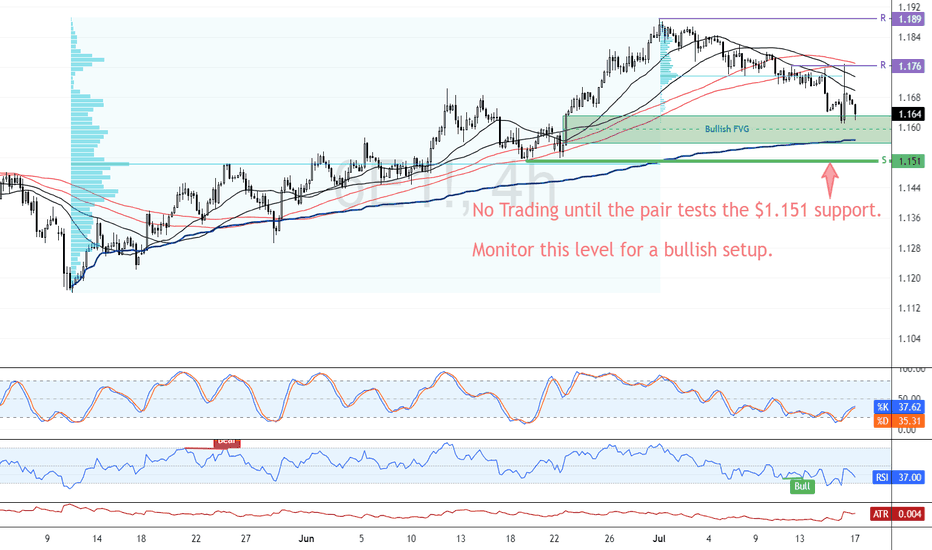

EUR/USD Resumes Bearish Trend Below $1.176FenzoFx—EUR/USD trades bearish, below the 100-SMA, and is currently testing the bullish FVG as support. Yesterday, Euro failed to pass the immediate resistance at $1.176; therefore, we expect the bearish bias to resume.

In this scenario, EUR/USD's downtrend could extend to the next support level at $1.151. Please note that the bearish outlook should be invalidated if Euro closes and stabilizes above $1.176.

Eurusdtechnicalanalysis

NFP Bears gathering their troops? or will the Bulls stampede...The past 9 days have been quite interesting for the EUR/USD which has been relentless. Price has been rising like a helium balloon let loose at the park...

Bulls have clearly been in control, not only the past 9 days but since the beginning of the year with the exception of the strong pullback in April & May only to bounce for another 700 pip run.

I am totally USD bearish across the board as I have been mentioning in my analysis videos for the past few months but like all macro moves, we always have pullbacks along the way and that is why I have been shorting the EUR/USD back from 1.1500+ - 1.1700+

I've given this a lot of room to breathe, more than usual but considering the following technical setup, I'm willing to give the Bears some leeway and potentially show me they'll come through.

•Rising Broadening pattern (Where two trendlines start close together only to divergence and expand) - This is a bearish pattern.

•Negative Divergence on the MACD, Linear Regression & the RSI.

•Price has made a run to the yearly R3 pivot level. (Rare extension)

•Last daily candle is a hanging man candlestick (Reversal candle)

•Weekly chart has the EUR/USD at the upper band of a polynomial regression channel which calculates for price extremities in the market.

There are a few more setups as well but it's too much to describe here and I'd have to show it in a video (Which I plan to do over the weekend)

With all of that said... It could all fail lol but seriously speaking... You just can't ask for a better probabilistic setup so whatever happens during NFP... happens.

Aside from the technical aspect... I know yearly R2 around 1.1600 was a hotspot for shorts because divergence was at the early stages and taking a short there wouldn't have been a bad idea but we know institutions are in play as well, so above 1.1600 could have been a huge area to run stop losses and margin calls before a potential reversal.

250 pips would be enough to run a large pool of stops and liquidation.

IF price is going to reverse here during NFP, I believe late longs and breakout/pullback traders are going to try and buy at the trendline at 1.1660ish but it wont hold and trap them on the other side of the trade.

Under that, I can see us pulling back towards 1.1200ish...

If the Bears give up and price continues to climb... the original macro target may very well be under way which was 1.2000 - 1.2200 (Based on a Monthly and 3-Month chart analysis)

As of this writing the EUR/USD is pretty much completely flat which is expected before the NFP fireworks ahead of July 4th.

We'll see what happens tomorrow morning! buckle up!

As always, Good luck and Trade Safe! See you post NFP.

EUR/USD Consolidates: What's Next? FenzoFx—EUR/USD declined from $1.1571, as anticipated, due to overbought signals from the Stochastic and RSI 14 indicators. The pair now trades below the 50-period simple moving average, near $1.1350.

The Stochastic Oscillator has dropped below 20, suggesting the U.S. dollar is overvalued short-term. As long as the price remains above the $1.1259 support, the bullish outlook holds. Potential upside targets include $1.147 and $1.1571.

Bearish Scenario: If the price falls below $1.1259, bearish momentum may drive EUR/USD toward the next support at $1.1146.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at FenzoFx Decentralized Forex Broker

EURUSD: Detailed Support & Resistance Analysis 🇪🇺🇺🇸

Here is my latest support and resistance analysis for

EURUSD for the week ahead.

Resistance 1: 1.1456 - 1.1552 area

Resistance 2: 1.1640 - 1.1700 area

Resistance 3: 1.1860 - 1.1915 area

Support 1: 1.1150 - 1.1280 area

Support 2: 1.0730 - 1.0900 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD Found Support at $1.0992FenzoFx—EUR/USD trades bullish above the immediate support level of $1.0992, in conjunction with the 50-period simple moving average.

The bullish trend remains valid above this level. In this scenario, the price can potentially revisit $1.1090, followed by $1.1147.

>>> Trade EUR/USD with low spread, and no swap at FenzoFx Decentralized Forex Broker.

FX Pre Market Analysis - Is the EUR/USD explosion slowing down?In this week's pre market analysis video, I go over the completed EUR/USD trade and what I'm looking for moving forward. The EUR/USD had an explosive bullish move last week however, there could be indications of momentum slow down.

Currently holding short at 1.0815 and would like to see us stay below 1.0900 - 1.9500 max for a pullback towards 1.06000.

The long term perspective could indicate a pullback out of a large triangle formation, followed by equal or new lows below 1.0000.

Good Luck and Trade Safe.

Will EUR/JPY Clear the 166 Resistance Zone? EUR/JPY daily chart shows a bullish breakout above a descending trendline, with the price now approaching the key resistance zone at 165.500–166.000.

A successful breakout above this level could push the pair higher, targeting 168.000 or beyond. However, if the resistance holds, a pullback toward the support zone at 161.500–162.000 is likely, offering potential re-entry opportunities.

Bearish Bias Amid Current Market Conditions on 04/10/2024 on EU.EUR/USD Analysis: Bearish Bias Amid Current Market Conditions on 04/10/2024

The EUR/USD currency pair remains under pressure today, displaying a potential bearish bias as it reacts to a variety of fundamental factors. Given the recent economic data releases, geopolitical tensions, and shifts in central bank policy expectations, traders and analysts alike are paying close attention to the euro's response to the ongoing USD strength. Below, I outline the key drivers influencing this potential downward movement and assess why EUR/USD could sustain a bearish outlook in today's market.

1. Strengthening US Dollar Amid Robust Economic Data

The USD continues to strengthen, supported by a robust US economic backdrop. Recent reports on US employment data, consumer spending, and manufacturing growth have exceeded expectations, suggesting sustained resilience in the American economy. This string of positive data adds further weight to the Federal Reserve's hawkish stance on interest rates, which has been a key factor driving USD demand. For EUR/USD, this USD strength puts downward pressure on the pair as investors seek USD exposure.

2. ECB's Cautious Approach to Rate Hikes

In contrast, the European Central Bank (ECB) has adopted a more cautious tone in its recent policy communications. With slowing inflation in some Eurozone regions and subdued growth forecasts, ECB officials have hinted that the cycle of aggressive rate hikes may be nearing an end. This dovish stance from the ECB decreases the attractiveness of the euro in the EUR/USD pair as markets adjust to lower expectations of rate hikes in Europe, adding to bearish sentiment.

3. Geopolitical Risks Impacting Euro Sentiment

Geopolitical concerns are another significant factor influencing the EUR/USD pair. Energy dependency and rising costs within the Eurozone, exacerbated by ongoing geopolitical tensions, add to the challenges facing the euro. As these concerns heighten risk aversion, market participants are inclined to favor the safer USD over the euro, further contributing to the bearish outlook on EUR/USD.

4. Technical Indicators Signal Downward Momentum

Technical analysis supports the fundamental view of a bearish bias for EUR/USD today. The currency pair has recently broken through key support levels, and technical indicators such as the Relative Strength Index (RSI) and moving averages are reflecting continued downward pressure. The current trend, coupled with these bearish technical indicators, suggests further declines may be on the horizon.

Conclusion: Bearish Bias for EUR/USD on 04/10/2024

In conclusion, today’s EUR/USD analysis reflects a bearish bias based on robust US economic performance, a cautious ECB, geopolitical factors, and technical indicators that support downward momentum. As market participants remain focused on these driving factors, EUR/USD is likely to encounter increased selling pressure, favoring a bearish outlook. Traders should continue monitoring these developments as they impact EUR/USD dynamics throughout the day.

Keywords:

EUR/USD analysis, bearish bias, US Dollar strength, Federal Reserve hawkish stance, European Central Bank rate hike, euro sentiment, EUR/USD technical analysis, EUR/USD 04/10/2024, EUR/USD bearish today, forex trading, forex market analysis.

EURUSD Daily Outlook: Slight Bearish Bias Expected on 30/09/2024EURUSD Daily Outlook: Slight Bearish Bias Expected on 30/09/2024

As of today, 30/09/2024, the EURUSD pair appears to be trending towards a slightly bearish bias, driven by a mix of fundamental and technical factors. Traders should be aware of the potential downside risks, particularly given the current market environment. Let’s dive into the key drivers behind this forecast.

1. Eurozone Economic Weakness

One of the primary reasons for the expected bearish bias on EURUSD is the ongoing economic challenges within the Eurozone. Recent economic data, including declining manufacturing output and weaker-than-expected consumer confidence figures, has contributed to a gloomy outlook for the Euro. The European Central Bank (ECB) has remained cautious, avoiding any strong hawkish stance, which continues to weigh on the Euro's performance. The lack of aggressive monetary tightening by the ECB, compared to the Federal Reserve, places further pressure on the currency.

2. Federal Reserve Hawkish Stance

On the other side of the equation, the US Dollar (USD) remains supported by the Federal Reserve's hawkish monetary policy. Jerome Powell’s recent statements highlight the possibility of further interest rate hikes in the near term to combat inflation. This is a strong bullish factor for the USD, making the EURUSD pair more vulnerable to downward pressure. The market anticipates that the Fed will continue to outpace the ECB in terms of tightening monetary conditions, widening the interest rate differential.

3. US Economic Strength

Recent US economic data has reinforced the Dollar’s strength. Strong retail sales, robust employment figures, and better-than-expected GDP growth have all contributed to a more resilient USD. In contrast, the Eurozone struggles with stagnation, providing further evidence that the EURUSD pair is likely to face headwinds today. The divergent economic outlooks between the US and the Eurozone will likely push EURUSD lower.

4. Technicals Support Bearish Sentiment

From a technical perspective, EURUSD is currently testing support levels around 1.0850. A break below this could signal further downside movement. The 50-day moving average has also started to slope downward, reinforcing the short-term bearish outlook. Momentum indicators such as the RSI (Relative Strength Index) are approaching oversold levels, but there’s still room for further declines before a potential rebound.

5. Geopolitical Uncertainty

Geopolitical uncertainty in Europe, particularly around energy security and trade tensions, adds to the Euro’s vulnerability. Investors are seeking safe-haven assets, including the USD, amid these risks, which is another reason for the slight bearish bias on EURUSD today.

Conclusion

Based on the latest fundamental factors and current market conditions, EURUSD is expected to experience a slight bearish bias on 30/09/2024. The combination of Eurozone economic weakness, the Fed's hawkish stance, strong US economic data, technical indicators, and geopolitical risks all contribute to this outlook. Traders should watch key support levels and any developments in economic data to confirm or adjust their positions.

Keywords for SEO Optimization:

EURUSD analysis, EURUSD forecast, EURUSD bearish bias, Euro to USD forecast, Forex analysis, EURUSD technical analysis, 30/09/2024 EURUSD, Eurozone economy, Federal Reserve policy, USD strength, Forex trading, EURUSD support levels, Forex technical indicators, Euro dollar analysis September 2024, Forex trading signals, EURUSD market outlook.

EURUSD Analysis: Slight Bearish Bias Expected for Next Week !EURUSD Analysis: Slight Bearish Bias Expected for Next Week (28/09/2024)

As we step into the final days of September, EURUSD appears to be setting up for a slightly bearish bias in the week ahead. This article explores the fundamental and technical factors driving the anticipated movement, providing insights for traders looking to navigate the upcoming week with precision.

Fundamental Drivers for EURUSD

1. Diverging Central Bank Policies:

The European Central Bank (ECB) continues to signal a more dovish stance as it grapples with stagnating growth and persistent inflation. Recent comments from ECB officials suggest that further tightening could be off the table for the time being. Meanwhile, the Federal Reserve remains steadfast, projecting a higher-for-longer interest rate environment. This divergence is increasing pressure on the Euro while strengthening the Dollar, a key driver behind the expected bearish bias in EURUSD.

2. Eurozone Economic Weakness:

The Eurozone's economic performance continues to lag behind, with PMI figures showing contraction in both manufacturing and services sectors. Weak growth and the increasing risk of recession will likely keep the Euro under pressure next week. Lower-than-expected GDP growth for Q3 2024, released this week, solidifies the case for EURUSD to remain under bearish control.

3. US Economic Resilience:

In contrast, the U.S. economy has shown remarkable resilience. The latest U.S. GDP data for Q3 2024 was revised higher, driven by robust consumer spending and job growth. Jobless claims remain low, highlighting the strength of the U.S. labor market, which supports the Fed’s hawkish stance. As a result, the U.S. dollar continues to benefit from positive fundamentals, which could push EURUSD lower.

4. Geopolitical Risks:

With continued uncertainties in Eastern Europe and growing tensions between the EU and Russia over energy supplies, there are lingering risks that could dampen investor sentiment towards the Euro. Any escalation in geopolitical concerns could further weaken the EUR, making it susceptible to a bearish bias against a stronger USD.

Technical Outlook for EURUSD

On the technical front, EURUSD has struggled to break above key resistance levels. Last week, the pair failed to close above the 1.0900 mark, indicating strong selling pressure around this zone. As we approach next week, the pair remains below its 200-day moving average (MA), further supporting the bearish outlook.

Key technical levels to watch include:

- Support: 1.0800, 1.0750, and 1.0700

- Resistance: 1.0900, 1.0950, and 1.1000

If EURUSD breaks below the 1.0800 support, it could open the door for further downside, potentially targeting the 1.0700 level in the near term.

Conclusion: Slight Bearish Bias for EURUSD

In conclusion, EURUSD is expected to maintain a slightly bearish bias next week, driven by fundamental factors such as diverging central bank policies, Eurozone economic weakness, and geopolitical risks. Technically, the pair faces strong resistance, making it difficult to challenge key levels unless significant fundamental shifts occur.

For traders, keeping a close eye on U.S. labor market data and Eurozone inflation reports next week will be essential in confirming or adjusting this outlook. Stay tuned to real-time updates to refine your strategy and capitalize on this bearish trend in EURUSD.

Keywords for SEO:

- EURUSD forecast

- EURUSD analysis

- Euro to USD prediction

- EURUSD bearish bias

- ECB and Fed policies

- EURUSD trading strategy

- Eurozone economic weakness

- EURUSD technical analysis

- EURUSD support and resistance

- EURUSD weekly outlook

- Forex trading analysis

- EURUSD 2024 outlook

EURUSD Analysis: Am never ever wrong in the direction !!EURUSD Analysis: Anticipating a Slight Bearish Bias for the Week of 27/09/2024

The EURUSD pair has been at the center of market discussions, with traders carefully watching the latest developments in the global financial landscape. As of 27/09/2024, fundamental and technical factors seem to suggest a slightly bearish bias for the EURUSD this week. In this analysis, we will explore the key drivers behind this potential downward trend, helping traders better understand the currency pair's movements and formulate informed trading strategies.

Key Fundamental Factors Impacting EURUSD This Week

1. Divergence in Monetary Policy

The European Central Bank (ECB) has maintained a more cautious stance in recent policy meetings. While inflation pressures persist in the Eurozone, growth concerns have prompted the ECB to hold off on aggressive rate hikes. In contrast, the U.S. Federal Reserve has reiterated its hawkish stance, signaling potential rate hikes to combat persistent inflationary pressures in the U.S. economy. This divergence in monetary policy favors a stronger U.S. dollar, exerting downward pressure on EURUSD.

2. Eurozone Economic Data

Recent data from the Eurozone points to slowing economic growth, particularly in key economies like Germany and France. Manufacturing and services PMIs have disappointed, signaling a potential slowdown in economic activity. Additionally, consumer confidence across the Eurozone has taken a hit, further raising concerns about a prolonged period of sluggish growth. These factors contribute to a weaker euro, supporting the bearish EURUSD narrative.

3. U.S. Economic Resilience

On the other side of the Atlantic, the U.S. economy continues to show signs of resilience. Strong labor market data and robust consumer spending have kept the U.S. economy on solid ground, even amid higher interest rates. This positive economic outlook reinforces the Fed's hawkish approach, keeping the U.S. dollar in high demand and applying bearish pressure on EURUSD.

4. Geopolitical Uncertainty

Ongoing geopolitical tensions, particularly in Eastern Europe, continue to weigh on the euro. As the market assesses the potential impacts of these tensions on Eurozone stability and energy security, the euro faces downward risks. Meanwhile, the U.S. dollar, as a global safe-haven currency, is likely to benefit from any escalation in geopolitical risks, further supporting a bearish EURUSD outlook.

Technical Analysis of EURUSD

From a technical perspective, EURUSD has recently struggled to break key resistance levels around 1.1050. The pair has shown weakening momentum on the daily chart, with the 50-day moving average trending lower, signaling a potential continuation of the bearish trend. Support levels around 1.0950 could be tested if the bearish momentum persists.

Additionally, key technical indicators such as the Relative Strength Index (RSI) and the MACD suggest that the pair is approaching oversold territory, indicating that further downside movement may be limited. However, the overall bias remains bearish unless the pair can reclaim higher resistance levels.

Conclusion: EURUSD Likely to See a Slight Bearish Bias

Based on the fundamental drivers—monetary policy divergence, Eurozone economic slowdown, U.S. economic strength, and geopolitical risks—along with technical analysis, it is reasonable to expect a slightly bearish bias for EURUSD this week (27/09/2024). Traders should keep a close eye on key economic data releases from both the Eurozone and the U.S. for any surprises that could shift the market sentiment.

For now, the bearish sentiment appears to have the upper hand, and those trading EURUSD should consider this in their strategies. Keep monitoring market updates for any changes in the macroeconomic landscape that could influence the pair’s trajectory.

Keywords: EURUSD analysis, EURUSD forecast, EURUSD bearish bias, EURUSD 27/09/2024, Eurozone economic data, U.S. monetary policy, trading EURUSD, EURUSD technical analysis, EURUSD trend, Euro to USD forecast

BUY TRADE PLAN ON EURUSDHey Trader,

Check out this analysis on EUR/USD.

The entry plan is best above the intraday resistance area.

Alternatively, a short trade can be considered if the price breaks below the intraday key zone (support), retests, and resists. A short trade can be considered.

Trade safe.

EURUSD I Potential long from demand zone Welcome back! Let me know your thoughts in the comments!

** EURUSD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

EURUSD Analysis for a Positional Trade with amazing Reward

We have a Fresh Weekly Demand and a Fresh Weekly Supply areas formed,

Now Price has just reacted to the Weekly Demand and post a Confirmation in lower timeframes in the Upward direction(In the direction of the Trend), we will buy with a defined risk.

We see that the previous High is violated and a potential 4H Demand has formed, now there are two possibilities either this 4H Demand will take the price till its Weekly Supply in the opposite or this 4H Demand will be violated. Lets check the Reward to Risk ratio of this 4H Demand, as per the statistic anything above 3:1 is a good opportunity and any FII wouldnt miss such Trades.

Here is the Trade with a Reward : Risk ratio of just a little more than 6:1.

Thank You and ENjoy the Ride ! ! !

EURUSD LONG TRADE SETUP in the starting of this week we should eyes on the majors pairs movement

in this chart you can see good bullish formation for medium term long trade

from the level 1.0800 you can take long for target 1.1050

the most important support range is looking as 1.0800 level and we can hold this trade for 150-200 pips