Eurusdtoday

EURUSD I Technical & Fundamental Forecast Welcome back! Let me know your thoughts in the comments!

** EURUSD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

EURUSD bearish idea📊 Chart Analysis: EUR/USD – Bearish Bias

🔍 Structure Overview:

:Timeframe: 1 Hour (H1)

: Current Price Area: Around 1.1112

: Market Structure: Bearish overall, with a potential pullback in progress before continuation to the downside.

🟪 Key Zones:

🔺 Resistance Zone (Purple Area around 1.1370–1.1415):

: Price previously rejected this zone strongly.

: Significant supply area; a strong reversal occurred here.

🔰 Sell Entry Zone: 1.1199 (Marked)

: A lower high is expected to form here.

Label: “Sell can be expected from this area.”

: This is a potential pullback entry point aligning with bearish continuation.

🟩 Support Zone: 1.1086–1.1064

:Watch for breakout of this zone. A break below it confirms bearish continuation.

: Label: "Wait for the breakout of this support.

📉 Sell Trade Plan:

Trigger: If price reaches ~1.1199 and forms a rejection or bearish pattern → enter short.

: Confirmation: Break of support at 1.1064–1.1086.

🎯 Targets:

1: TP1: 1.0950 – Logical support zone

2: Final TP: 1.0810 – Strong historical support

✅ Summary:

Bias: Bearish

Trade Type: Pullback sell followed by trend continuation

Conditions:

> Wait for pullback near 1.1199 (sell zone)

> Confirm break below 1.1086 support

> Target 1.0950 (TP1), 1.0810 (final target)

EURUSD:Beware of the retest of the daily chart resistanceYesterday, the price of EUR/USD generally declined as expected. The intraday price dropped to a minimum of 1.0776, rose to a maximum of 1.0829, and closed at 1.0789.

Currently, the overall EUR/USD remains below the daily chart resistance level of 1.0860. Therefore, for the time being, a bearish stance is still appropriate for the medium-term trend. From the perspective of the four-hour chart, the price is in a fluctuating decline and is supported at the 1.0770 area, while the resistance of the four-hour chart is at the 1.0805 area. For now, it is advisable to be cautious about chasing short positions, and beware of an upward price correction. In terms of price levels, pay attention to the daily chart resistance to observe further performance of downward pressure.

Trading strategy:

Sell@1.0850-1.0860

TP:1.0810-1.0770

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

EUR/USD Analysis: Next Week's Downward - Swing ProspectsDuring this week, the exchange rate once dipped to 1.0820 and then rebounded. Technically speaking, 1.0880 is a key resistance level. If this level cannot be broken through, the downward risk will intensify. In the short term, the euro-dollar pair is under downward pressure and may fall below 1.0820. The options market shows that the ranges of 1.0745 - 1.0755 and 1.0900 - 1.0910 will be the focus next week. Overall, the euro-dollar pair is likely to show a downward trend with fluctuations next week.

I firmly believe realized profit and a high win - rate are the best measures of trading skill. Daily, I share highly precise trading signals. These include clear entry points, stop - loss levels for risk control, and profit - taking targets from in - depth analysis. Follow me for big financial market returns. Click my profile for a trading guide on trends, strategies, and risk management.

EUR/USD "The Fiber" Forex Market Bank Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Fiber" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (1.04000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 1.06700 (or) Escape Before the Target

Secondary Target - 1.08000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

EUR/USD "The Fiber" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

⭐🌟⭐Fundamental Analysis

Fundamental analysis evaluates the economic indicators of the Eurozone and the United States, which directly influence the EUR/USD pair.

🌟Eurozone Economic Indicators:

GDP growth is reported at 0.5% for Q4 2024, with recent data suggesting an expected increase to 0.8% for Q1 2025, indicating a potential recovery Euro Area Indicators.

Inflation rate is at 3.0% for February 2025, expected to decrease to 2.2% by year-end, reflecting easing price pressures Euro Area Inflation Rate.

Interest rates are at 2.5%, with the European Central Bank (ECB) likely to hold steady, given mixed inflation signals Euro Area Interest Rate.

Trade balance shows a surplus of €10 billion in January 2025, driven by exports, though not sufficient to offset economic challenges Euro Area Balance of Trade.

🌟United States Economic Indicators:

GDP growth is strong at 2.5% for Q4 2024, though recent projections suggest a slowdown to 2.0% for Q1 2025 United States Indicators.

Inflation is stable at 2.0% for February 2025, within target ranges, but recent data shows slight upward pressure United States Inflation Rate.

Interest rates are at 4.5%, with expectations of a 0.25% rate cut in September 2025, reflecting a dovish shift United States Interest Rate.

Trade balance shows a deficit of $50 billion in January 2025, a persistent challenge but manageable with strong economic growth United States Balance of Trade.

The narrowing interest rate differential, with potential Fed rate cuts and stable ECB policy, could support EUR strength, though US economic resilience remains a counterforce.

⭐🌟⭐Macroeconomics

Macroeconomics encompasses broader economic factors influencing the pair:

Global GDP growth is projected at 3.0% for 2025, according to recent forecasts, with mixed regional performances World Economic Outlook.

Commodity prices are stable, with oil at $80 per barrel, impacting EUR due to the Eurozone's energy import reliance Commodity Markets Outlook.

Stock markets show positive performance, with the S&P 500 up 5% YTD and Euro Stoxx 50 up 3% YTD, supporting risk-sensitive currencies like the EUR Global Stock Market Performance.

Bond yields are declining, with the US 10-year yield at 3.5%, down from 4.0% earlier, suggesting lower USD appeal Global Economic Outlook.

⭐🌟⭐Global Market Analysis

Global economic conditions play a significant role in currency movements:

Geopolitical events, such as potential tensions, could boost USD as a safe-haven currency, though no major events are currently noted.

Central bank policies are diverging, with the Fed expected to cut rates and the ECB holding steady, narrowing the interest rate differential Central Bank Policies.

Commodity trends, with stable oil prices, have a muted direct impact, though energy costs affect Eurozone inflation.

Stock market performance, with global indices up, suggests risk-on sentiment, potentially supporting EUR over USD Market Performance Analysis.

⭐🌟⭐COT Data and Positioning

COT data provides insights into large trader positions, with recent reports showing:

For euro futures, large speculators are net short, but recent data indicates a reduction in short positions, suggesting emerging bullish sentiment CFTC COT Report.

Positioning shows that institutional traders are cautiously optimistic, with some covering shorts as the price approaches support levels.

Key Insight: Reducing short positions in euro futures align with potential bullish momentum, supporting an upward move.

⭐🌟⭐Intermarket Analysis

Intermarket relationships influence currency valuation:

EUR/USD is positively correlated with stock markets; with global indices performing well, the EUR could benefit from risk-on sentiment Intermarket Correlations.

Gold, trading at $1900 per ounce, slightly up, suggests a weaker USD, supporting EUR strength Gold Price Trends.

Bond yields, with declining US yields, indicate lower USD appeal, potentially boosting EUR/USD Bond Market Insights.

Key Insight: Positive correlations with stocks and gold suggest EUR could strengthen, while declining US yields support this trend.

⭐🌟⭐Quantitative Analysis

Technical analysis provides insights into price trends:

At 1.05000, EUR/USD is approaching key support at 1.0450, with resistance at 1.0600, based on recent charts EUR/USD Technical Analysis.

Moving averages show the 50-day MA at 1.0550 and the 200-day MA at 1.0700, with the price below both, indicating a downtrend TradingView Analysis.

RSI (Relative Strength Index) is at 45, neutral, suggesting potential for a bounce if support holds Technical Indicators Guide.

Key Insight: The pair is at a crucial support level, with technicals suggesting a possible upward reversal.

⭐🌟⭐Market Sentimental Analysis

Market sentiment reflects trader positioning and expectations:

Recent data shows mixed sentiment, with some traders expecting USD strength to continue, while others see potential for EUR recovery due to improving fundamentals Forex Sentiment EURUSD.

Bank forecasts predict EUR/USD rising to 1.08 by year-end, citing Eurozone recovery and expected Fed rate cuts Currency Forecasts.

Key Insight: Emerging optimism about the euro supports a bullish outlook, though caution remains due to recent USD strength.

⭐🌟⭐Next Trend Move

Combining all factors, the next trend move for EUR/USD is likely upward:

The pair is at a key support level (1.0450), and if it holds, could bounce back to test resistance at 1.0800.

Potential catalysts include better-than-expected Eurozone data and Fed rate cut expectations, supporting EUR strength.

Key Insight: The next move favors an upward continuation, with risks of further downside if support breaks.

⭐🌟⭐Overall Summary Outlook

The EUR/USD pair, at 1.05000 on March 4, 2025, exhibits a cautiously bullish outlook. Key drivers include improving Eurozone fundamentals, with GDP growth expected to rise to 0.8% in Q1 2025 and declining inflation, narrowing the interest rate differential as the Fed is expected to cut rates by 0.25% in September 2025. Technical indicators suggest the pair is at a crucial support level, with potential for a bounce, supported by reducing short positions in euro futures and positive intermarket correlations with stocks and gold. Risks include persistent USD strength if US data remains robust or global risk-off sentiment boosts the USD. However, the prevailing trend points to a potential EUR appreciation in the near term.

⭐🌟⭐Future Prediction

Trend: Bullish

Details: The pair is likely to see an upward move, testing resistance at 1.0800 in the near term, driven by Eurozone recovery and expected Fed rate cuts. Risks include stronger-than-expected US data maintaining USD dominance, but current indicators suggest a reversal is imminent.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

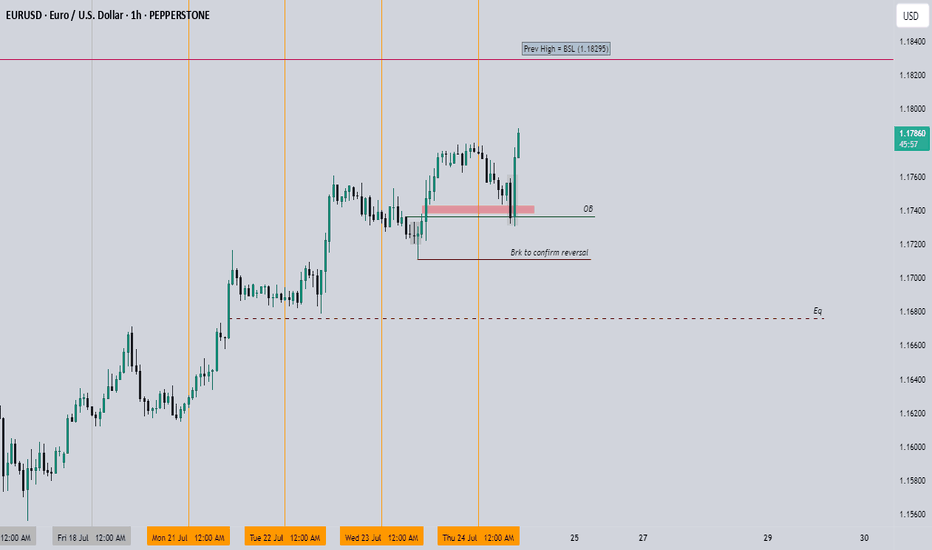

EURUSD - FOMC Prep - These 2 scenarios to anticipateMarket is overall uptrend after previous low showed the reversal point to head higher.

Bias is for the Buy

However, FOMC can produce volatility so we can have spikes in both direction.

There's a Sell scenario off an H4 gap.

But the preferred idea is to head lower, getting a better price on the HTF, then continue to the Equal Highs / Double top, taking out the liquidity target eventually.

Be aware, if it's not clear this week, we may have a clearer picture on next week's news and the move could also happen then if there's a delay/ranging market.

The D1 timeframe usually provides the smoother outlook. I mostly base my ideas on that.

Leave your comments below if you have any questions. Thanks

EURUSD - Swing Buy on MidWeek Reversal & USD News (CPI)Reasons for this setup being higher probability:

HTF is bullish because of the doji on Monthly and momentum on Weekly chart.

We've created a protected low, confirmed by Divergence with GBPUSD.

Market created momentum higher.

We're now in a retracement phase.

Looking for the market to flip up with a reversal pattern on the LTF before entering.

Continuing in the bullish HTF idea.

EUR/USD "The Fiber" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the EUR/USD "The Fiber" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a short trade at any point,

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high/low level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest high level.

Goal 🎯: 1.02500 (or) Escape before the goal

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

Scenario on EURUSD 11.12.24In this analysis, I think there are two possible scenarios and that is a long set up if we stay above the price range around 1.06100-1.06400, but if we do not break through this price range, then I would rather focus on some short set up, we will see the situation is not very visible at the moment.

EURUSD Nearest Target: SHORT before LONGOn the 5-minute timeframe, we can see a Market Structure Shift (MSS) around 1.05126, and the imbalance (iFVG) at 1.05171 has already been filled. While the weekly timeframe bias remains bullish, targeting 1.05952, this is a quick short-term move, so it won’t take much time.

That’s why I call it "SHORT before LONG." My target is at 1.04925, as there’s a high probability the price will bounce upwards from that level. That’s where I’ll set my take profit (TP).

Weekly Forex Forecast: EURUSD May Pullback This Week!EUR Futures has printed a bullish Inside Bar on the Weekly TF. This potentially shows a shift in the market from a bearish to bullish bias. A pullback may be starting. This makes sense, as price has traded through the Swing Low, and a significant retracement is a bit overdue.

Check the comments section below for updates regarding this analysis throughout the week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Anticipating a Slightly Bearish Bias on EURUSD for 02/10/2024.EURUSD Analysis for October 2, 2024: Anticipating a Slightly Bearish Bias

As we head into October 2, 2024, the EURUSD currency pair is showing potential for a slightly bearish bias based on the latest fundamental factors and current market conditions. Traders and investors are keeping a close eye on several key drivers that could influence the pair today. In this article, we'll delve into the core reasons for this bearish outlook and highlight the critical elements that may impact the EURUSD price movement.

1. Diverging Economic Data Between the Eurozone and the U.S.

One of the primary factors contributing to the slightly bearish sentiment for EURUSD today is the divergence in economic performance between the Eurozone and the U.S. economy. Recent data from the Eurozone, particularly weaker-than-expected manufacturing PMI figures and concerns about stagnation in key economies like Germany, have cast doubt on the region’s growth prospects. This has added pressure on the Euro, potentially pushing it lower against the U.S. Dollar.

On the other hand, the U.S. economy continues to show resilience, supported by stronger-than-expected GDP growth and robust labor market performance. This economic divergence favors the U.S. Dollar, strengthening it against the Euro.

2. Monetary Policy Divergence: ECB vs. Federal Reserve

The monetary policy stance of the European Central Bank (ECB) versus the Federal Reserve is another important factor driving the bearish outlook for EURUSD. The ECB has recently adopted a more cautious stance, signaling that further rate hikes may be limited due to concerns over economic growth. This dovish tone is weighing on the Euro as market participants anticipate a slower pace of tightening.

In contrast, the Federal Reserve has maintained a more hawkish approach, with hints of further rate hikes if inflationary pressures persist. This divergence in policy direction increases the appeal of the U.S. Dollar, adding to the downward pressure on EURUSD.

3. Geopolitical Risks in Europe

Geopolitical tensions in Europe, including ongoing uncertainty surrounding energy security and the war in Ukraine, continue to weigh on investor sentiment. These factors are likely to keep the Euro under pressure, as risk-averse investors may flock to safe-haven assets like the U.S. Dollar. Any escalation in these tensions could exacerbate the bearish trend for EURUSD.

4. Market Sentiment and Technical Analysis

From a technical perspective, EURUSD appears to be trading below key resistance levels, reinforcing the bearish outlook. The pair has struggled to break above the 1.0600 level, and the downward trendline remains intact. Short-term momentum indicators, such as the Relative Strength Index (RSI), suggest bearish momentum is building, supporting a case for a further decline.

Additionally, with risk sentiment favoring the U.S. Dollar amid global uncertainty, the Euro may struggle to find strong support unless positive economic data or ECB intervention changes the narrative.

Conclusion: EURUSD to Maintain a Slightly Bearish Bias Today

Given the combination of weaker Eurozone economic data, diverging monetary policies, geopolitical risks, and bearish technical indicators, EURUSD is likely to face a slightly bearish bias on October 2, 2024. Traders should closely monitor developments in Eurozone economic reports and any potential statements from ECB officials for further clues on the pair’s direction.

Keywords for SEO:

EURUSD analysis, EURUSD forecast, EURUSD today, EURUSD October 2 2024, EURUSD bearish bias, Euro to USD forecast, Forex trading EURUSD, Eurozone economic data, ECB monetary policy, EURUSD technical analysis, EURUSD price action, EURUSD market sentiment, Forex strategy EURUSD, TradingView EURUSD article.

By staying informed of these key drivers, traders can better position themselves in the market and make informed decisions regarding the EURUSD pair today.

EURUSD Analysis: Slight Bearish Bias Expected (25/09/2024)The EURUSD pair continues to show signs of a slight bearish bias this week, in line with market conditions and fundamental factors. In this article, we will break down the key drivers influencing EURUSD as of 25/09/2024, along with a technical outlook. This analysis provides insights for traders and investors aiming to position themselves for potential downside movement in the EURUSD market.

Fundamental Analysis: Factors Pressuring EURUSD

1. U.S. Dollar Strength

The U.S. dollar has maintained its strength due to a series of factors, including recent hawkish remarks from the Federal Reserve. Fed officials have continued to emphasize the possibility of keeping interest rates higher for longer to combat inflation. This has provided significant support for the dollar, making it an attractive safe-haven asset, while simultaneously putting pressure on the euro.

2. Diverging Central Bank Policies

The European Central Bank (ECB) has recently adopted a more cautious tone regarding future rate hikes. With inflation in the eurozone stabilizing, the ECB may opt for a wait-and-see approach, potentially slowing the pace of tightening or halting rate hikes altogether. This divergence in monetary policy between the ECB and the Fed is expected to contribute to further downside pressure on the EURUSD.

3. Weak Eurozone Economic Data

Economic data from the eurozone remains relatively soft. The latest PMI data showed a contraction in the manufacturing and services sectors, further weakening the euro. Lower-than-expected growth forecasts and potential deflationary pressures also undermine the euro's strength.

4. Geopolitical Uncertainty

Ongoing geopolitical risks, such as tensions in Eastern Europe and concerns over energy security, continue to cloud the eurozone’s economic outlook. These factors have led to capital outflows from Europe, with investors seeking the safety of the U.S. dollar.

Technical Analysis: EURUSD Price Action

On the technical front, EURUSD has struggled to break above key resistance levels near 1.10700, confirming the bearish sentiment. The pair has been trading in a downward channel since mid-September, and with recent price action rejecting the 50-day moving average, momentum indicators signal further downside potential.

- Support Level: 1.09000 is a crucial support level to watch for EURUSD this week. A break below this could accelerate the bearish move, potentially targeting the 1.08500 level.

- Resistance Level: The 1.10700 level remains a key resistance, and a move above this could invalidate the bearish outlook, though this seems unlikely given the fundamental backdrop.

Outlook for the Week: Slight Bearish Bias for EURUSD

Given the combination of strong U.S. dollar fundamentals, the divergence in central bank policies, weak eurozone economic data, and technical resistance, the EURUSD is likely to maintain a slightly bearish bias through the remainder of this week.

Keywords for SEO: EURUSD analysis, EURUSD today, EURUSD forecast, EURUSD bearish, euro dollar, forex trading, U.S. dollar strength, ECB monetary policy, Fed rate hikes, forex market analysis, EURUSD price action, technical analysis EURUSD, eurozone economy.

Conclusion

EURUSD is likely to continue on its bearish trajectory, with potential downside towards key support levels this week. Traders should closely monitor U.S. dollar fundamentals, especially any new developments from the Federal Reserve, as these will play a crucial role in shaping EURUSD’s movement. Keep an eye on eurozone data releases and geopolitical headlines for any shifts in market sentiment that could impact this currency pair.

EURUSD I Potential long from demand zone Welcome back! Let me know your thoughts in the comments!

** EURUSD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

Dollar Weakness Equals EURUSD strengthHey friends, the dollar made a new low and the Euro is on the go up to the upside. Let's see if it can keep this strength.

If not and price pulls back on EURUSD a good buying price would be above 1.08525 as long as price doesn't close below it.

Let me know if you're following the dollar EURUSD.

Many blessings.

Shaquan