Eurusdtrend

"EUR/USD Bearish Setup – Supply Zone Sniper Entry🔵 Supply Zone (Resistance Area):

📍 Between 1.13755 – 1.14258

🚫 Expecting sellers to dominate here

🧱 Acts like a ceiling that price struggles to break

🔽 Sell Setup:

🎯 Entry Point: 1.13755

🔥 Stop Loss: 1.14258 (above zone — protection!)

💰 Target Point: 1.11611

📉 Expecting price to drop after entering this zone

📏 Risk vs Reward:

⚠️ Risk: ~50 pips

🏆 Reward: ~210 pips

✅ RR Ratio: ~1:4.2 (very favorable)

📊 EMA (7, close):

🟠 Current price is hovering around EMA

⏳ Suggests consolidation or a potential reversal soon

🔁 Scenario Plan:

1. 📈 Price moves into supply zone

2. 🚨 Triggers entry (Sell) at 1.13755

3. 🚀 If wrong, hits Stop Loss at 1.14258

4. ✅ If correct, drops to Take Profit at 1.11611

Summary:

✍️ Bearish outlook

🛑 Strong supply/resistance expected

📉 Good setup for a short position with low risk and high reward

EURUSD SHORT FORECAST Q2 W16 D14 Y25EURUSD SHORT FORECAST Q2 W16 D14 Y25

- Weekly Order Block rejection

Setup 1

-15' break of structure

- Tokyo low range remains

- Pull back into 15' order block

- Lower time frame shift in price action from bullish to bearish

Setup 2

- Lower time frame break of structure

- Lower time frame bearish candle formation

Let's see how EURUSD short set up plays.

Certainly short potential but as always. We await price action to present itself to us.

It is far too easy to find a position once we have noticed potential. Sit back and await the play!

EURUSD SHORT FORECAST Q2 W16 D14 Y25

FRGNT X

EURUSD(20250414) Today's AnalysisMarket news:

Fed Collins: It is currently expected that the Fed will need to keep interest rates unchanged for a longer period of time. If necessary, the Fed is "absolutely" ready to help stabilize the market; Kashkari: No serious chaos has been seen yet, and the Fed should intervene cautiously only in truly urgent situations; Musallem: The Fed should be wary of continued inflation driven by tariffs.

Technical analysis:

Today's buying and selling boundaries:

1.1339

Support and resistance levels:

1.1624

1.1517

1.1448

1.1229

1.1160

1.1054

Trading strategy:

If the price breaks through 1.1339, consider buying, the first target price is 1.1448

If the price breaks through 1.1229, consider selling, the first target price is 1.1160

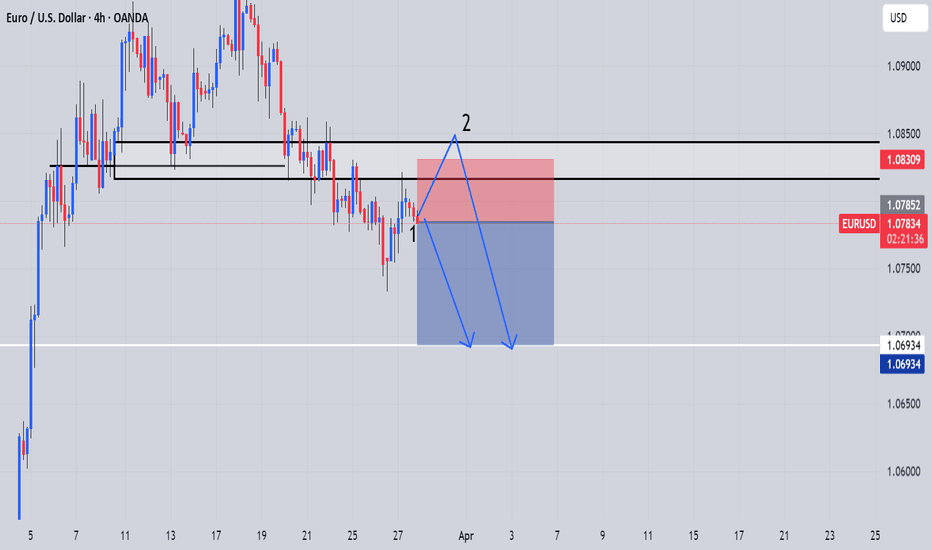

EuroDollar : When Does the Dust Settle? Tariffs 25'Rather quiet to begin the week as the EuroDollar remains unchanged during the Initial 3 sessions of the week. A "Doji" Daily Candle printed, informing us those of us more technically minded to write off the day's price behavior and look to preceding candles for indication of future direction. It is important to note the longer top wick of 38.5 pips versus the 23.5 pips bottom wick. We can observe yet another daily candle wicking into the Weekly level 1.087. This Price remains very important in the short term because it may facilitate a pullback on EurUsd to the downside. This follows a historic Week of volatility for the EuroDollar as Trumps Tariffs shook the markets to say the least.

If we are considering Bullish targets for the week, Daily Level 1.093 , or even Daily Level 1.098 which would be the most generous for buyers. When fundamentals are this strong, it's more difficult to discount those larger, irrational moves that you see in the markets sometimes. So although one could argue how over-extended the EuroDollar is, we must remember the game we are playing.

In Considering Bearish targets, a retest of Daily Support level 1.0786 seems reasonable. A Deeper retracement could see price around 1.0694 , the beginning of Last Tuesdays very clean bullish NY session. A pullback seems technically sound, considering the outlier and extent of last weeks upside move.

Job Openings on Tuesday is the appetizer to the

Inflation CPI data on Wednesday which will surely see some volatility rock these already rattled markets.

CPI/Inflation is forecasted to Cool for the Dollar which technically supports more strength for the Euro and a further upside push for this pair.

Please Leave a rocket or comment if you enjoyed this Analysis. Have a good trading week !

EUR/USD Bullish Breakout & Retest Setup – Targeting 1.10955Instrument: EUR/USD

Timeframe: 30-Minute

Indicators Used:

EMA 30 (Red): 1.09821

EMA 200 (Blue): 1.09698

Key Levels Identified:

Entry Point: 1.09695

Stop Loss: Around 1.09067

Resistance Zone: ~1.09911

Target Zone: ~1.10918 to 1.10955

Projected Gain: ~147.3 pips (1.35%)

Price Action Analysis:

Bullish Breakout:

The price broke out from a consolidation zone (marked in purple).

A bullish trend is forming as price moves above the 200 EMA.

EMAs Alignment:

The 30 EMA is currently above the 200 EMA, indicating a potential bullish trend continuation.

However, price is slightly below the 30 EMA now, suggesting some short-term pullback or resistance.

Retest at Entry Zone:

Price retested the entry zone at 1.09695 after the breakout and is now hovering near it.

This retest is healthy for confirming support before another move up.

Trade Setup Insight:

Entry Strategy: A long (buy) entry at or around 1.09695.

Stop Loss Placement: Below the previous support zone near 1.09067 to manage risk.

Target Strategy: Aiming for the resistance zone around 1.10918–1.10955 for profit booking.

Conclusion:

This looks like a bullish continuation setup with a favorable risk-reward ratio. The confluence of:

EMA support,

Price structure (breakout & retest),

and defined resistance/target zone

EURUSD(20250410) Today's AnalysisMarket news:

Only 13 hours after it came into effect, Trump announced the suspension of the reciprocal tariff policy for most economies for 90 days for negotiations. Trump also said that he had been considering the suspension in the past few days. He now suspends the reciprocal measures because he feels that everyone has overreacted, and seems a bit panicked and a bit scared. He will consider exempting some American companies; the White House said that a 10% global tariff will still be imposed during the negotiations, and previously announced industry tariffs such as automobiles, steel and aluminum are not included in the suspension.

Technical analysis:

Today's buying and selling boundaries:

1.0985

Support and resistance levels:

1.1165

1.1098

1.1054

1.0916

1.0873

1.0806

Trading strategy:

If the price breaks through 1.0985, consider buying, the first target price is 1.1054

If the price breaks through 1.0916, consider selling, the first target price is 1.0873

EURUSD(20250408) Today's AnalysisToday's buying and selling boundaries:

1.0944

Support and resistance levels

1.1113

1.1050

1.1009

1.0879

1.0838

1.0775

Trading strategy:

If the price breaks through 1.0944, consider buying, the first target price is 1.1009

If the price breaks through 1.0879, consider selling, the first target price is 1.0838

EURUSD(20250407) Today's AnalysisMarket news:

Fed Chairman Powell: Wait for clearer news before considering adjusting policy stance. One year later, as the impact of Trump's policies becomes clearer, uncertainty should be greatly reduced. Intends to complete the entire term. Potential tariffs may have a lasting impact on inflation. The impact of tariffs on the economy may be greater than expected. Downside risks have increased, but the economy is still in good shape.

Technical analysis:

Today's buying and selling boundaries:

1.0995

Support and resistance levels:

1.1177

1.1109

1.1065

1.0926

1.0882

1.0814

Trading strategy:

If the price breaks through 1.0995, consider buying, the first target price is 1.1065

If the price breaks through 1.0926, consider selling, the first target price is 1.0882

#EURUSD: Two Opportunities In One Chart, What do you see? Price has shown bullish behaviour exhaustion, and it's at a point where we see a total meltdown in prices. This is an excellent scenario for traders who trade on what the chart shows us rather than selling or buying only. We can utilise both these entries when prices do show a strong indication at either of our levels.

If you like our work, then do like and comment on the idea, which will boost us to post more such ideas. ❤️🚀

EURUSD(20250402) Today's AnalysisToday's buying and selling boundaries:

1.0799

Support and resistance levels

1.0851

1.0832

1.0819

1.0780

1.0767

1.0748

Trading strategy:

If the price breaks through 1.0799, consider buying, the first target price is 1.0819

If the price breaks through 1.0780, consider selling, the first target price is 1.0767

EURUSD Breakout ?Hi Traders, coming up EURUSD German Prelim CPI may make this pair volatile. As with the increased volatility we could see EURUSD moving back to the upside. Expecting EURUSD to give us significant opportunity with market opens.4H has formed a doji that may give high probability trade setup

EURUSD:Analysis of the Profit-making Strategies for Next WeekThe euro against the US dollar once retraced to around 1.0765. Subsequently, it stabilized slightly after the release of the US core Personal Consumption Expenditures (PCE) inflation data for February. Since the year-on-year growth rate of this data exceeded expectations, the market's expectation that the Federal Reserve will maintain the current interest rate range of 4.25%-4.50% for a longer time has intensified. Moreover, the United States is set to impose an additional 25% tariff on imported automobiles starting from April 2nd, which adds more uncertainties to the outlook of the euro.

We can focus on the initial resistance level of 1.0850 above. If this level is not breached, one can attempt to short at high levels.

Trading strategy:

Sell@1.0850

TP:1.0750

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

EUR/USD: Uncertain Trajectory Amid Tariff - Induced JittersThe EUR/USD is trading at 1.0796. After a Thursday rebound from 1.0733 due to a weakening USD, it's now pressured at the intraday high of 1.0799.

US President Donald Trump's new 25% import taxes on cars and car parts, with potential additional levies on the eurozone and Canada, have stoked risk - off sentiment. This has led to a temporary dip in the US dollar's appeal.

On the daily chart, it's found buyers near the non - directional 200 - day SMA, with 1.0730 as dynamic support. It's attempting to break the bullish 20 - day SMA, while the 100 - day SMA is non - directional below the current level. The momentum indicator is flat below 100, and the RSI at 56 hints at upward risk, yet unconfirmed. Bulls should be cautious short - term.

In the 4 - hour chart, technicals are rising but below the mid - line. EUR/USD is fighting a bearish 20 - day SMA, and the 100 - day SMA has lost upward steam around 1.0840. A break above 1.0840 could bring back the bulls.

EURUSD

buy@1.08200-1.08500

tp:1.08900-1.09300

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EURUSD Trading: Unveiling the Precise Strategy GuideAfter last week's decline, the euro against the US dollar started to recover at the beginning of this week and is currently trading within the positive range around 1.0850.

According to the Wall Street Journal, the White House is adjusting its tariff policy set to take effect on April 2nd. It may cancel a series of tariffs targeting specific industries and instead impose reciprocal tariffs on countries with significant trade relations with the US. Affected by this news, during the European morning session, US stock index futures rose by 0.8% to 1.0%.

On the 4 - hour chart in the European morning session on Monday, the Relative Strength Index (RSI) indicator climbed to 50, indicating that the recent bearish momentum has dissipated to some extent.

In terms of the upward direction, the 50 - period Simple Moving Average (SMA) forms an interim resistance level at 1.0880, followed by 1.0900. If the euro - US dollar pair can firmly stand above this level, the next resistance level may be at 1.0950.

EURUSD Trading Strategy:

buy@1.08200-1.08500

tp:1.08900-1.09300

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.