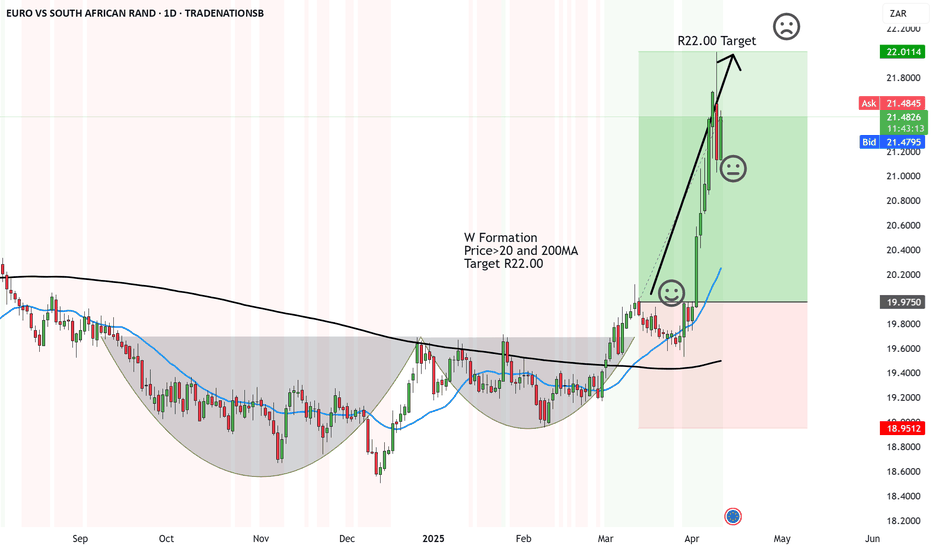

I wish I was wrong with this but now it's looking better EUR/ZAROk so this was painful.

The W Formation neckline broke above and since then headed to the target at R22.00 a EURO!

For someone who travels to Europe a lot, it's not easy on the rands.

But since it hit the target, it turned down and hopefully will stay down for now.

We are currently at R20.34 with a first target at R20.00.

And if it breaks below that we COULD see R19.00 again.

But you'll be the first to know and I'll send the analysis.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Eurzar!

UPDATE Target Reached EURZAR - R22.00 - Next R25?Nothing to celebrate here.

It was one analysis I wish I was wrong and yet, here we are.

The Cup and Handle was text book, the Tarrifs hit SA hard.

And the sad thing out of all of this is that South African rand will probably hurt more than what will happen to the US Dollar.

So what now? Now I think we will see R22.00 again. And we could even see R25.00 in the next two months.

But we will have to wait for a solid pattern to form first before we get the next set of bad news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/ZAR is going up to R22.00 and I hate to tell you this! Here's an analysis I really don't want to do.

The EUR/ZAR is showing strong upside to come. Great for the EURO, great for Europe, Great for South African exports.

Not great for the South AFrican consumer who was planning on sailing to Mykonos this year.

Anyways, here are some reasons for the EURO strength and why we could see the ZAR come down a bit.

Economic Woes:

South Africa's economic struggles and political uncertainty are weakening the Rand, pushing the EUR higher 😟💔

Commodity Concerns:

Falling commodity prices hit South Africa hard, making the Rand lose steam against the euro 📉⛏️

Monetary Policy Gap:

Divergent monetary policies—stable ECB rates vs. easing in South Africa—favor a stronger euro 💶🔄

Global Risk Aversion:

Investors seek safe havens during uncertain times, boosting the euro over emerging market currencies like the Rand 🌍🛡️

Capital Outflows:

Local capital is fleeing South Africa amid domestic worries, further devaluing the Rand and lifting the EUR/ZAR pair 🚀💸

TECHNICALS

What can I say. W FOrmation with the price breaking above 20 and 200MA.

The target is on the way to R22.00 if the uptrend continues.

I hope I am wrong.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURZAR Approaching Demand Zone – Bullish Bounce ExpectedOANDA:EURZAR is approaching a key demand zone. Previously, this area has acted as strong support, leading to bullish reversals. The current price action suggests buyers might step in again, potentially driving the price higher.

A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would increase the probability of a rebound. If buyers regain control, the price could move toward the 19.39600 level.

However, a break below this demand zone could invalidate the bullish outlook, potentially opening the door for further downside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Please boost this post, every like and comment drives me to bring you more ideas! I’d love to hear your perspective in the comments.

Best of luck , TrendDiva

EURO showing strong downside against ZAR to R17.85M Formation has formed over the last few months with the EUR/ZAR.

The price broke below the support which has become the resistance. ANd the price has been coming down on a trajectory to the psychological level of R19.00.

Now, if it breaks down further, I might be too optimistic but it looks like the next target could hit is R17.85.

What are your thoughts?

EUR/ZAR: A New Currency Pair for Trading on FXOpenEUR/ZAR: A New Currency Pair for Trading on FXOpen

Traders using FXOpen can now incorporate the EUR/ZAR currency pair into their strategies.

The EUR/ZAR pair is known for its volatility, making it suitable for trend trading within a single day. On the other hand, as the daily chart (below) shows, the exchange rate remains within a range, which supports swing trading around key support and resistance levels.

What Influences the EUR/ZAR Exchange Rate?

Key factors affecting the value of the South African rand (ZAR) in 2024 include:

→ High Inflation: In January, inflation was 5.4%, but by July it had decreased to 4.6% due to high interest rates set by the South African Reserve Bank, which strengthen the rand.

→ Prices of Exported Commodities: Gold, platinum, and diamonds.

→ Political Instability: Domestic political events and reforms can trigger spikes in volatility.

Technical Analysis of EUR/ZAR

Analysis of the EUR/ZAR chart for 2024 reveals that:

→ The price is moving in a weak downtrend, as indicated by the grey linear regression channel.

→ At the end of 2023, the price was supported by a trendline (in red), but after a bearish breakout in March 2024, the breakout zone (around 20.4) started to show signs of resistance.

→ Conversely, the level of 19.4 appears as significant support. It is possible that the price may test this level for resilience later this year. Currently, bearish pressure is held at the support level of 19.57.

EUR/ZAR Forecasts

Using global macroeconomic forecasting models, Trading Economics analysts predict that the EUR/ZAR rate could be 19.9468 in one year.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GO LONG EURZARGiven the current weakness in the South African economy coupled with the robust economic growth in Europe, this presents a great buying opportunity to gain in the Euro (EUR). Taking advantage of this economic disparity can yield favorable returns as the EUR strengthens relative to the South African rand (ZAR).

EUR/ZAR showing strong upside to come - OUCH!This analysis hurts my pocket.

Travelling around and living in Europe means we pay in Euros. Hotels, flights, costs, etc...

And I unpleasantly am doing an analysis showing how the Euro looks like more upside is to come.

It's this kind of analysis I really hope I am 100% wrong.

Anyway, upside is to come bease on the Reverse Cup and Handle.

The price bounced on the 200MA and said, nope we are going up. Let's go euros!

And now, it looks like the next target is to a gloomy R22.44

EURZAR continuation to the upsideSince last week, EURZAR has been in a strong uptrend from the 19.40000 level. Recently, we have broken out of the descending channel that was maintening it inside a bearish structure. What we are seeing now in my opinion in simply a re-test of the 20.6500 level that was a resistance and is about to turn into a support to continue higher up to 21.3000 probably next week.

EURZAR still in a bearish structureEURZAR has been in a bearish market structure for the past few days. The pair created lower than previous highs and lower than previous lows confirming the trend all the way. Right now we have been testing a key support which if broken will accelerate the new bearish leg. More details in the video...

EUR/ZAR C&H to R17.32 - with a warningCup and Handle has formed over the last few months with EUR/ZAR.

We got a break down below R19.65.

Now it looks like there is further downside to come for the EUR which is good for the rand.

21>7

Price >200

RSI<50

Target R17.32

The big warning technically is that the EUR/ZAR is flirting with the 200MA. Until the price breaks down, then I'll feel more comfortable with this analysis.

Bullish Momentum Building on EUR/ZARStarting with the price structure, EUR/ZAR has been forming a series of higher highs and higher lows, indicating an uptrend in progress. This pattern suggests that buyers have been gaining strength, consistently pushing the price higher after each pullback. This type of price action often reflects a shift in market sentiment towards bullishness.

Adding to the bullish case is the presence of a trend line, which acts as a dynamic support level for the price. This trend line connects the higher lows and confirms the upward trajectory. As long as the price remains above this trend line, the bullish bias remains intact.

Furthermore, the recent breakout above a significant resistance level adds further weight to the bullish scenario. A break above resistance signifies that buyers have overwhelmed sellers, potentially opening the door for further upward movement. This breakout could also attract additional market participants who were waiting on the sidelines, thereby amplifying the buying pressure.

TARGET 1 : 20.9321

TARGET 2 : 212674