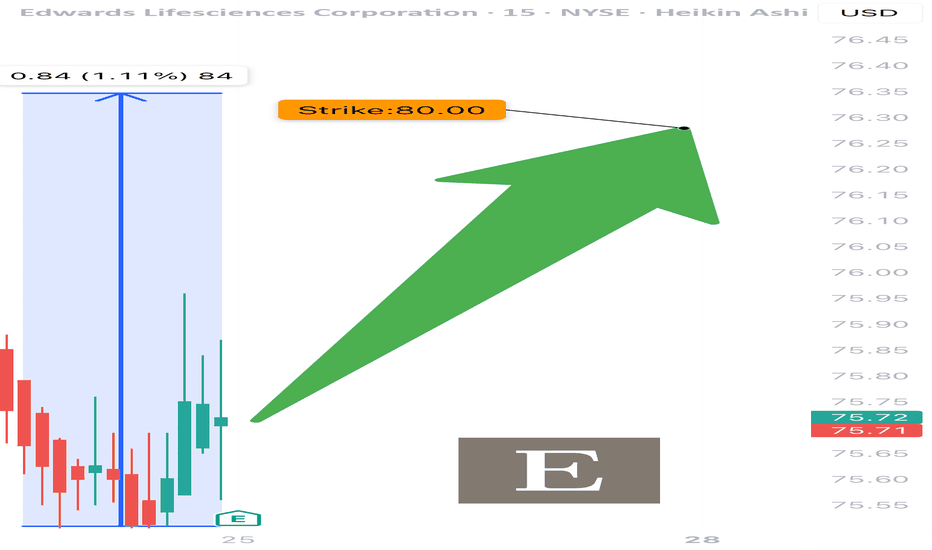

EW EARNINGS TRADE SETUP

📈 EW EARNINGS TRADE SETUP (07/24) 📈

💥 Quiet stock, loud opportunity. Fundamentals strong. Market asleep. We’re not.

🧠 Quick Read:

• Beat rate: 88% over 8 quarters

• Margins elite (OP Margin: 29%, Net: 75.7%)

• RSI 43 → Neutral setup with room to run

• Big OI at $80 calls (6.7k+) 💪

• IV not bloated → low crush risk ✅

🎯 TRADE IDEA

🟢 Buy EW $80 Call exp 8/15

💰 Entry: $1.55

🎯 Target: $4.65

🛑 Stop: $0.77

📈 Confidence: 70%

📊 Why it works:

• Medical device demand + aging population = macro tailwind

• Market ignoring it = opportunity

• Risk-on tape + IV sweet spot

#EW #OptionsAlert #MedicalTechStocks #EarningsSetup #LongCall #RiskReward #OptionsTrading #StockAlert #SwingTrade #TradingView #SmartMoneyFlow

EW

9-Up Waves—Extended Bullish Impulse—Bitcoin's 2025 Bull MarketIn Elliot Wave Theory, a bullish impulse has a total count of 5 waves but this isn't all. There is something called an "extension." Extensions can lead not only to 9 total waves but even 13 waves.

We can easily see this happen if we consider Bitcoin's bull market based on the long-term chart structure, starting in November 2022, see the chart above.

A bull market is defined as a sequence of higher highs and higher lows. This is perfectly visible on this chart. Contrary to many Altcoins, Bitcoin is in a long-term bull market.

If we consider even some of the big Altcoins projects, we can see that no long-term bull market is present, many are producing lower lows, but at the same time, others are producing long-term uptrends like Tron. So there are variations.

Seeing a perfect long-term 5 waves pattern completed when Bitcoin hit $110,000 in January 2025, seeing a strong higher low and the continuation of this trend, we can easily conclude that an extension is taking place.

Will this extension end at 9 waves or 13 waves?

Bitcoin is going up. It is already happening. There will be more.

Thank you for reading.

Namaste.

Long-Term Buy On The AussieThe most straightforward interpretation is that the down move that started back in February 2021 (red rectangle) was a correction of the previous rally (green rectangle) and ended at 0.5914. If this is correct, then we are in the early stages of a large upward move on the Aussie in the long-term that should reach at least the previous highs of 2021. This view will be in jeopardy if we break back below the previously mentioned support and will be completely negated on a break of the 2020 lows at 0.5510.

Beans looking to drop hard, after all... Beans have been looking weak lately, and all this current and near future trade war fundamentals and uncertainty aren't going to help at all. Volatility is likely to go up this week across a lot of markets, and the ag commodities will certainly be part of that, with emotional fears from the last market crashing during the last Trump term. Beans especially didn't fair well during that time, and the corn-to-bean ratio was out of wack to where us farmers didn't want to plant beans period. We all thought (and were told) they might go to $7 or less! All while corn was poor, but much more palatable with the breakevens. Farmers, as a rule, certainly prefer to plant corn over beans anyway, if they live where they can choose as such.

But back to the bean chart, I've been thinking there was a decent enough chance we could chop around in here and bounce off of any short term weakness and key support, to make new highs for the move. A lot of guys were looking to target the high 10s and even around $11, before expecting a notable correction. Well, unfortunately, I think we've already recently peaked and are more likely to now keep correcting down, potentially quite violently.

On Friday, the 20 day EMA gave us bounce off support, but if we get a confirmation close Monday below that (likely), my opinion is we confirm we're in a larger scale wave 3 down already, and should eventually target the 9.47 and likely even lower ultimately, before we bottom in February or March, before spring seasonality and US planting weather premium allows for us to rise again.

Longterm, for this summer and beyond into 2026, I am quite bullish grains and ultimately, expect to see new all time highs, but it's not gonna be this year. Mostly due to the likelihood of a major cycle drought of our lifetime, which could happen this year but not truly affect the supply issue drastically until new crop turns into "old crop".

APTOS, DO NOT MISS THIS ONE 600%+Absolutely beautiful leading diagonal on APTOS formed which will be the wave 1 of the second scale of the macro wave 1.

This will be a huge move triggering the first wave 3. I'm expecting a minimal target for the completed wave of $48+!

I'm scaling in heavily starting from the unlikely to hold fib 0.382 (probably a strong bounce) but hitting hard at 0.5 & golden zone.

If it actually starts holding above the wave 1 high & golden zone and we get a very rare shallow wave 1 correction, i'll ape in also.

See you at $48 boys!

MATH - This is how you REALLY use Elliott WaveThis is a great example of a beautiful setup and how to lay out a low risk, high reward trade, especially for those that are still learning and wondering how to apply Elliott Wave. Or maybe you are unfamiliar with Elliott Wave or someone who thinks it's nonsense. Well let me show you how I do it and hopefully help you learn the best technical strategy. These are the setups I salivate on. And I don't care if I lose 8 out of 10, because the 2 that hit will more than pay off the losers.

Support box is clear. Below the September low and I'd be out as we'd be below the reliable 61.8% retracement. Breaking that fib retracement level means that it can do anything from bullish, to diagonal, to sideways, to bearish moves. And we don't want to waste our time with stocks that aren't trending. Nothing is reliable anymore - therefore, we don't want to trade it below that. Toss it away. Move on to the next one.

For this play, you could accumulate shares under $2.25 which is the previous high. I have it labeled as a Wave (1) but it could easily just be an (A) wave. As a quick refresher, trending impulsive moves happen in 5-wave moves. Since we don't know for 100% certainty that this will become that, we have to prepare for the other likely scenarios. We are already protected from significant downside with our stop below the 61.8% retracement, so I just don't care what might happen in a bearish count. So for bullish, I want to accumulate under the last high and catch the breakout. Once broken out, minimum target is $4.25. That's the 100% extension of (1) from the bottom of (2), the first resistance. If this ends up being a 3-wave (A)(B)(C), it would top out there at the 100%, so we want to make sure we have all of our money back by then. A full bullish follow through could take it anywhere between $12 (161.8% fib) and $22.50 (200% fib, which is where a standard impulsive 5-wave rally is expected to end with no extensions).

If you buy a stock like this with stop below the 61.8%, you can go net free (return of original equity) by selling however many shares are needed to get your original money back at the previous high around $2.25 which should reject at first try (as it is the most likely landing spot for Wave 1 inside of Wave (3). Once a higher low forms from there (Wave 2 of (3)) between $1.20 and $1.75, you could go in even harder, buying more shares, and moving your stop on all shares to that higher low, providing a very low risk scenario. By the time $4.25 is hit, you should be completely net free with plenty of shares left and maybe even take some good profits.

Remember, this is an outline NOT A PREDICTION. That's why we have a stop, a plan, and multiple targets. As it plays out, we gain more clarity and update our outline. Probably even find a trend channel. This is Elliott Wave. This is Fibonacci Pinball (the creation of Avi Gilburt at elliottwavetrader,net). It's not telling you what's going to happen. It's telling you what could happen, laying out the most probable path, limiting your risk, and telling you when it might be wrong and how to pivot. And don't go thinking this will happen all at once. Keep good notes of your entry and all sales. This likely takes 1-3 years.

Standard disclosures:

1. This is 100% my idea. It was not sourced from any other avenue.

2. I am not invested in this company, though I am likely buying shares soon.

3. I am not paid to post content nor do I receive any contributions of any kind.

4. While this is outlining a potential profitable setup, this article is not investment advice. You should do your own due diligence on any company you invest in and apply your own trading strategies.

5. I know nothing about the fundamentals of this company. I suggest doing your due diligence if fundamentals are important to you.

6. Readers should always remember that markets are their own creature made up of millions of individuals and institutions each following some combo of inherent bullishness, inherent bearishness, fundamentals, technicals, stupidity, and pure emotion. Elliott Wave, and specifically Fibonacci Pinball (developed by Avi Gilburt at elliottwavetrader.net and prominent Seeking Alpha author), merely provide a framework based on the observed price action to date. 7. I know that while my wave outline is based on years and years of data and application from not only me, but some of the best in the game, I also know that markets do not follow a set path and that sentiment can remain irrational far longer than I can remain rational. That is why you MUST consider the alternatives and manage risk appropriately. Know the pivot zones that could lead to the primary path failing.

I warrant that the information created and published by me on TradingView is not prohibited, doesn't constitute investment advice, and isn't created solely for qualified investors. My analysis is not a recommendation for a specific trade. My analysis outlines a potential scenario and provides risk assessments for multiple alternate scenarios. My analysis is purely educational.

ELLIOTT WAVES CHEAT SHEET 🏄♂️ 10 RulesHello, here is a cheat sheet for Elliott Waves for top 10 Rules, so you can print this out and keep on your desk.

The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves, or simply waves. Elliott published his theory of market behavior in the book The Wave Principle in 1938, summarized it in a series of articles in Financial World magazine in 1939, and covered it most comprehensively in his final major work, Nature's Laws: The Secret of the Universe in 1946. Elliott stated that "because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable." The empirical validity of the Elliott wave principle remains the subject of debate.

Caution: Expect FI (Fiserv) to Sell OffThe fundamentals are looking great for FI no denying that. However, we have a text book 4th wave triangle you can see on the chart then with a thrust into a 5th wave. We have met the measured target of Wave A of the triangle = Wave 5. It's also interested to note a lot of top insiders have been selling at these prices. Also, not shown is monthly divergence, which is expected in a 5th wave. Expect prices to move to at least below Wave 4 around $109 or lower. Once a wave A sell off happens we can project for a wave C projection before prices could move up.

Bajaj Finance Flat CorrectionBajaj FInance is in a long term flat correction which started from late 2021 & it can continue for few more months.

It loks like in Wave C where it can make a 5 wave fall. Minimum target should be 6443 of this pattern but seeing the impulsive wave it shouldn't stop here & we can see straight fall to 5800 levels then later on 5200-5300 levels. This pattern can go in till April May 2024

As per Ichimoku too it has broken weekly cloud & next monthly cloud support appears near 5900 levels

Buying otm puts for march or April is not a bad option right now.. Risk reward is good with small risk & can hedge this trade too if you want

Tesla : After the rain comes sunshineTesla had a nice rally from 100 to 300 in an impulsive wave up after an ABC corrective wave from the all time high. Since hitting 300 price has moved down in a corrective wave lower. This move is a wave 2 and could go to 180 ( 76.4% of wave a of 2 + 61.8% retracement of wave 1 ) or even to 150 ( equal legs inside wave 2 + 76.4% retracement of wave 2 ).

Line in the sand for this wave 2 is the 101.81 low, anything below this invalidates this count.

Look for price to move higher in an impulsive wave as wave 3 will start after hitting the wave 2 low. Eventually price will break the trendline from the all time high, move above 300 again and hunt for the all time high.

Alternative count would have price in a wave C instead of wave 3. This would still break 300 but will turn around down before hitting all time highs. This would also mean that price will break the 100 low, or ...more rain ahead...

GNFC 5th WaveGnfc did a 3 wave decline * held support at daily ichimoku cloud.

Now if id doesn't breaks the low of 712 we may see levels as mentioned in blue line atleast highs of 3rd wave which are 815..

Risk reward is more than 1:6..

Enter anywhere in range of 715-728

Stop loss 712

Target 815 to 888

🅱️ Bitcoin Is The Dow Jones In 1968 | Elliot Wave TheoryBack in 1968 the two major proponents of the Elliot Wave theory concept where divided as to the wave count of the DJIA.

While AJ Frost would consider the 1966 peak as Wave B of an irregular top in a flat correction, Hamilton Bolton was looking at it as the 5th wave of a bullish impulse.

One thing is certain, while they disagreed on the count they both agreed that what should follow was a new bull-market regardless of the count and they were right.

We ended up with a triple zig-zag followed by a new bull-market:

We have the same situation today with Bitcoin, people are divided between the third and fifth waves.

One interpretation calls for the top to be April 2021 with the low in November 2022 being Wave C of a flat and Wave 4 of the impulse in a higher degree:

While some others are calling for new lows taking the November 2021 irregular top as Wave 5 of the bigger impulse:

Well, there is actually a big difference with the Dow Jones forecasters from the past.

While they had a different count as to the irregular top, both agreed that what would be now equivalent to the November 2022 low in Bitcoin was the bottom in the Dow Jones before a new major leg up or bull market, our Cryptocurrency analysts, some, are still divided between new lows and a new bull-market.

Now, let me offer you my count, it is pretty simple.

The 2017 peak is definitely the end of a major 5-up wave, no doubt about that, we can easily draw a 5-up wave pattern with multiple extensions.

What follows is a correction, you can draw it in any way you like and here we have an A-B-C or Zig-Zag from Dec. '17 to Dec. '18.

The next wave can be either an inverted Zig-Zag or another 5-up wave, makes no difference, from Dec. '18 through June '19.

This is followed by another correction ending in March 2020 and here a new 5-up wave pattern starts.

From March 2020 through April 2021 we have another impulse and April 2021 marks the orthodox end of this bull market.

What follows is a correction, classic EW theory and you can see it on this chart.

If you want to be conservative or lets just say not bullish, you can say that another correction can follow after the Nov. 2022 low, this is possible and you can draw an upward Zig-Zag or whatever you like, we can only really confirm the wave count in retrospect.

But, if you consider go past market action and the way Elliot Wave theory works, we are set for a new 5 waves up impulse.

Which is really just the fifth wave of a higher degree since the correction from April 2021 through November 2022 is only Wave 4, which tends to be complex, hard to read and long. We have all these characteristics here...

Bitcoin is going bullish... Can any Elliotter confirm/comment if I am right or wrong?

Namaste.

Looking for potentially $21k Bitcoin in the coming weeks.Hello,

Been a while since i Have posted, but it has equally been as long since Bitcoin did anything tremendous. Overall, I think this move up is a part of an internal corrective zigzag structure that could lead to FWB:21K on the daily tf.

After that, I would look to potentially FWB:42K area as a potentially higher tf zigzag structure on the Weekly. There is nice confluence if that target is to be acheived.

Trade safe.