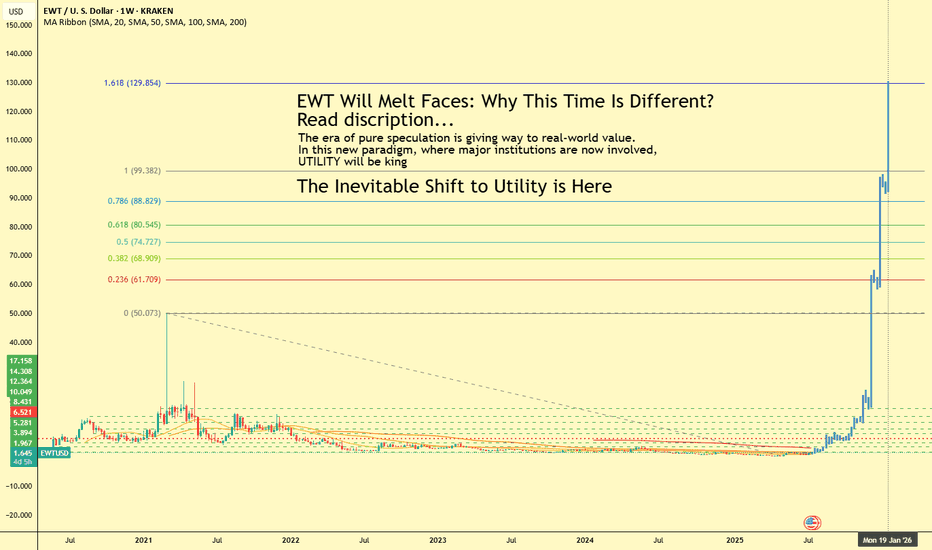

EWT Will Melt Faces: Why This Time Is DifferentThe crypto market is maturing. The era of pure speculation is giving way to real-world value. In this new paradigm, where major institutions are now involved, UTILITY will be king. One project is perfectly positioned to dominate this new age: Energy Web Token (EWT). As the world scrambles for sustainable energy solutions and the energy transition accelerates, Energy Web is building the digital backbone to make it all happen.

The attached chart isn't wishful thinking; it's a visualization of an inevitable shift. The accumulation phase is over. The explosive, utility-driven growth is about to begin.

The Indispensable Role in the Energy Transition

The urgency of the energy transition is undeniable. We face rising energy needs and the critical imperative to reduce our environmental footprint. Energy Web is at the forefront, offering an open-source, decentralized technology stack to fast-track the move to a low-carbon, customer-centric energy system.

Their mission is to decarbonize the global electricity system using blockchain. They achieve this by enabling distributed energy resources—from rooftop solar panels to electric vehicles and large-scale batteries—to be managed on the grid in a decentralized way. This creates a more flexible, participatory energy market where every user can be both a producer and a consumer.

An Ecosystem of Heavyweights

What truly sets Energy Web apart is its staggering ecosystem of over 100 partners, including titans of industry like Shell, Vodafone, Volkswagen, and Siemens. These aren't just names on a website; they are active collaborators, including major grid operators like Elia in Belgium and Stedin in the Netherlands, all working to implement and accelerate the commercial adoption of Energy Web's technology. These global partnerships underscore the immense trust and conviction that the biggest players in the energy market have in Energy Web's solutions.

Live Products with Real-World Impact

Energy Web isn't selling a dream; it's delivering live products that form the core of its ecosystem:

Energy Web Chain (EWC): An enterprise-grade public blockchain tailored for the energy sector. Since its launch in 2019, it has processed millions of transactions for groundbreaking applications.

Energy Web Decentralized Operating System (EW-DOS): A full stack of open-source software and standards designed to connect and manage the billions of low-carbon assets that will make up the grid of the future.

Green Proofs and Data Exchange: Solutions that bring deep transparency and verifiability to emerging green product supply chains, such as Sustainable Aviation Fuel (SAF). Companies like United Airlines and Amazon are already using this technology.

Energy Web X (EWX): Leveraging Polkadot's powerful and flexible infrastructure, EWX is the next generation of Energy Web's technology. This migration enables customized, enterprise-grade solutions with enhanced security and interoperability, allowing partners to accelerate their decarbonization strategies.

The Numbers: Market Cap and Price Roadmap

As of July 16, 2025, Energy Web Token (EWT) has a market capitalization of approximately $49.7 million USD, with a price of around $1.65 USD. The circulating supply is about 30 million EWT out of a maximum of 100 million.

While no price forecast is a guarantee, the outlook is incredibly bullish. Some analyses suggest potential prices of 40.63 or even more.

These predictions are rooted in the fundamental growth of the network. The 2025 roadmap is packed with milestones, including the rollout of fiat payment integration, the launch of SmartFlow 2.0 and 3.0, the implementation of EVM support on EWX, and the execution of numerous customer and EU-level projects.

The Inevitable Shift to Utility is Here

The chart attached to this idea shows a classic pattern: a long consolidation period followed by a parabolic rise. This is not a coincidence. The market is maturing. The days of projects with no substance are numbered. Large institutional players, now entering the space, are seeking sustainable, fundamentally sound investments.

EWT is precisely that. It solves a real-world, global problem. It has a working product, an unparalleled network of partners, and a clear vision for the future. The shift to utility is the next great wave in the crypto market, and Energy Web Token is poised to ride it to unprecedented heights.

The great separation is coming. Projects built on hype will fade. Projects that create tangible value, like Energy Web, will not only survive—they will dominate. Get ready, because EWT is poised to melt faces. This time, it's different.

EWT

Energy Web Token—EWT—Triple Recovery: 1000% PP (TAC-S7)All right, here we are.

I appreciate the insistence and support, I like people who never give up. It is a stressful work but I will always comeback and give you what you want. I hope you enjoy the analysis.

Energy Web Token produced a bearish impulse starting May 2024, it ended in April 2025, almost an entire year. This is the last ABC on the chart. The market was sideways and then we have this correction.

Now that the correction is over, we can expect a change of trend.

Current action for EWTUSDT is happening above the August 2024 low. Also above the November 2024 low.

The correction was strong but even stronger where the last two weeks. EWT recovered almost six months of bearish action in just two weeks. This strong bullish momentum gives us a clue of huge rising potential in 2025.

The week before last, 5-May, EWT started trading around $0.687. It went full blown bullish and broke its November 2024 low resistance. The week that followed, 12-May (last week), started red and this resistance was tested as support and holds. Then again, strong bullish momentum and EWTUSDT moved above its August 2024 low. This is a major, major bullish development.

The current weekly session/candle, while pretty young is also good. It started red and wicked lower. The wick did not reach the August 2024 low support but reversed sooner. This is another strongly bullish development and can signal that there will be additional growth this week, next week, and so on.

Trading volume becomes really high in October and November last year and this is also really good because the action is happening above those prices. So the market went through a final full flush, removing all the stop-loss orders and weak hands and is now ready for long-term growth.

The signals here are very, very strong. We don't need to consider the bottom dynamics, the rounded bottom and such because prices are the same now as back in September 2024, which is exceedingly good.

The market dropping for years on end, it seemed like forever, means that there is no need for this Altcoin to move back down again. Don't get me wrong, there can be corrections and retraces based on the short-term, but, when it comes to the bigger picture, we are going up.

I plotted several targets for you on the chart. The main one goes to 1,000%. If you were to calculate this same target coming from the market low, total growth potential amounts to ~2,900%, really strong.

This is it for now. Thanks again for your continued support.

Namaste.

PYPL Long OpportunitySimple EWT in play -- finally retested the top of the previous lower range, finishing the formation of the broader inverse H&S pattern.

Will update with more fundamentals as I continue research, but feel the e-commerce competition is overblown and the company is generally undervalued.

Energy Web - This cycles Energy sector playIm going to be breaking-down what I feel are the best long-term holds in each sector/category of crypto. Starting with the energy sector. I will tell you the pros and cons of each project.

Energy Web

EWT can beak out of this 4 year long downward trend/channel. There is a ton of upside potential. EWT has many strategic partnertships and completely flown under the radar. Once long term disgruntled holders are out. This project could definitely fly. Especially once the energy narrative begins to pick up. I took a postion around $1.32. I think that this project definitely has $20+ potential. One of the major downsides to the project is that the CEO has esentially been missing in action for a while with no explanantion. Even without the CEO is appears the team has been consistently builing.

The price action of this token has been pretty stagnant but that can all change in a blink of an eye. In my opinion this project has bottomed out and offers much more reward than risk at this level.

None of this is financial advice. This is just all my opinion.

Thanks for viewing my post! Best of luck to all traders!!!

FET/USDT Long: Did you take it? See linked chartsIf you like these posts please remember to give me a boost and a FOLLOW! Any questions please ask away.

FET/USDT Long signal. Did you take it? Bullish order flow was there. We have our targets, and stops are at entry.

FET has been lagging compared to the rest of the market, especially in AI. Recent developments in their EARN & BURN mechanism look to be bringing excitement back and I believe there's plenty of catching up to do!

Bullish Orderflow:

EWT analysis & macro forecasting:

$NIO Coming to terms with new primary elliot wave count..The weekly RSI on NIO and the structure of the HSI over the past few years have had me worried since the $7.78 top, and what we have seen since then supports this as my new primary count, unfortunately. I had been stubbornly holding on, but now I need to consider cutting some of the position after the approaching bounce on smaller timeframes. However, if I must hold all of it and go scuba diving, I will.

Bitcoin Market Outlook Elliot Wave Theory (W42/2024) // AlgoFyreThe market shows a bullish scenario with potential for an impulse wave up after a correction, possibly surpassing the all-time high post-election. However, two bearish scenarios suggest a major drop to 20K in the long term, highlighting significant downside risk.

🟢 Short-Term Outlook (Next Few Weeks to Months) - Bullish Scenario

🔸 Leading Diagonal (Green) Complete : The green lines on the chart represent the completion of the leading diagonal, which is the first wave of a larger impulse (wave 1). Leading diagonals often occur in the first wave of a new trend, indicating that a bullish trend is beginning. This is particularly important because it sets the foundation for a stronger upward movement that could follow after a corrective phase.

🔸 Corrective Phase (Red ABC) : After completing the first wave, we are now expecting a corrective structure. The red lines represent a potential ABC correction, a typical 3-wave corrective pattern in Elliott Wave theory. This correction could retrace some of the gains made in the leading diagonal, potentially finding support near key Fibonacci retracement levels (like the 0.25, 0.5, or 0.75 levels) drawn in orange on the chart.

🔸 Timing Around the US Election : The chart indicates that this ABC correction may take place leading into the US election, which is often a period of increased market uncertainty and volatility. It seems that the correction is expected to conclude before or around this event, setting the stage for the next major move.

🔸 Bullish Impulse (Wave 3) : After the correction, the chart projects a strong bullish impulse (the large green arrow), which would be the beginning of wave 3. In Elliott Wave theory, wave 3 is typically the most powerful and extended wave in an impulsive structure, often leading to significant gains. The breakout above previous highs around the 67,000-68,000 level (marked by the green wave 5 in the diagonal) would confirm the start of this impulsive wave, which could target much higher levels, possibly into the 70,000+ range.

🔸 Bullish Summary (TLDR):

The leading diagonal in green (wave 1) suggests that a new bullish cycle is underway.

We are currently expecting a 3-wave corrective move (ABC) before the next leg up.

The correction could end around key Fibonacci levels, potentially coinciding with the US election.

After the correction, a powerful wave 3 impulse is expected, likely driving prices significantly higher.

🔴 Short-Term Outlook (Next Few Weeks to Months) - Bearish Scenario

🔸 Bigger ABC Correction : The market is in the midst of a larger corrective pattern. The current movement is within the B-wave of this ABC structure.

🔸 Flat Pattern for B-Wave : The B-wave is forming a flat correction, which typically indicates a sideways consolidation with a final leg up before a downward movement.

🔸 C-Wave to 52K Area : After completing the B-wave, we expect a C-wave to the downside, targeting around the 52K level. This drop represents the completion of the B-wave within the larger ABC pattern.

🔸 Larger C-Wave Up : Following this drop, the final C-wave to the upside is projected. While this wave could potentially retest or even exceed the all-time high (ATH), it's not guaranteed. The key idea is that a significant rally is expected after the corrective B-wave down.

🔸 Major Downtrend Next Year : After this anticipated rally, a substantial downtrend is expected in the following year, potentially driving the price down to 20K or lower.

🔸 Bearish Summary (TLDR):

Completing a B-wave flat correction within a larger ABC structure.

Expecting a C-wave down to around 52K before a potential larger rally.

After the larger C-wave up, a significant decline is expected, leading to 20K or lower in the following year.

🔴 Mid-Term Outlook (Next Few Months to Year) - Bearish Scenario

🔸 Leading Diagonal Completed (Red) : The red structure shows the formation of a large leading diagonal to the downside, suggesting that a strong downtrend has already been established.

🔸 Corrective ABC (Green) : After the diagonal, a corrective ABC pattern has formed. This correction has reached the 0.786 Fibonacci retracement level, which is a common level for corrections to complete before resuming the primary trend.

🔸 Major Move to the Downside : Following the completion of this corrective phase, the chart is signaling the beginning of a significant bearish move, potentially leading to a price target near the 20K level. This aligns with the broader bearish outlook.

🔸 Bearish Summary (TLDR):

Finished a leading diagonal to the downside, followed by a corrective ABC pattern.

Correction reached the 0.786 Fibonacci retracement level.

Expecting a major bearish move from this point, with a potential target of 20K.

🔶 Key Takeaway

The market presents both bullish and bearish possibilities. The bullish scenario suggests that after a leading diagonal (wave 1) completes, a short-term ABC correction will occur, followed by a powerful wave 3 impulse to the upside, potentially pushing prices beyond the all-time high after the US election. On the other hand, the bearish scenarios indicate a significant downturn: one expects a C-wave drop to around 52K before a larger rally, followed by a steep decline to 20K or lower next year, while the other points to a completed leading diagonal with a corrective ABC reaching the 0.786 Fibonacci level, signaling the start of a major move down to 20K. Despite the potential short-term upside, both bearish scenarios ultimately point to a substantial long-term decline.

Bitcoin Market Outlook Elliot Wave Theory (W40/2024) // AlgoFyre🔶 Short-Term Outlook (Next Few Weeks to Months) - Bullish Scenario

🟢 In the bullish case, Bitcoin is currently in the third wave of an Elliot Wave structure, which typically signals a strong upward movement. Over the next few weeks, this wave could drive Bitcoin’s price to targets between $120k and $140k, based on Fibonacci extensions.

🟢 For this scenario to play out, Bitcoin needs to break through key resistance levels and trendlines. If it does, we could see a significant and rapid rally toward the projected price targets.

🟢 In this scenario, even if Bitcoin encounters minor pullbacks or consolidations, the overall momentum would remain upward. Any brief corrections would likely be seen as opportunities for further upward moves, with Bitcoin maintaining its bullish structure.

🔶 Short-Term Outlook (Next Few Weeks to Months) - Bearish Scenario

🔴 In the bearish scenario, Bitcoin could fail to break the critical resistance levels and trendlines. If Bitcoin shows weakness or rejects off these key areas, we may see a period of consolidation or a pullback instead of a rally.

🔴 In this case, Bitcoin could begin to test lower support levels, which might result in a short-term correction. If the support holds, Bitcoin could continue to range-bound between key levels, but if it breaks down, the price could head lower before finding new support.

🔴 A short-term correction could see Bitcoin retest previous lows or critical support areas. While this wouldn’t necessarily lead to a long-term bearish trend, it would delay the upward movement for the coming weeks.

🔶 Key Takeaway

In the bullish scenario, Bitcoin could rally to $120k to $140k over the next few weeks to months if it breaks key resistance levels. In the bearish scenario, failure to break resistance could lead to a consolidation or short-term pullback as the price tests lower support levels before making any significant upward moves. The next few weeks will be crucial in determining whether Bitcoin follows through on its bullish momentum or takes a step back.

The Painful Years of Doomscrolling Are Coming to an End: UpdateMade a throw in the 5th wave. Most likely a reversal.

Virgin Galactic's Arguments:

Virgin Galactic claims that Boeing performed substandard work and did not provide all the required data. The company also asserts that it has rights to use the transferred trade secrets according to the contract. If Virgin Galactic can convincingly prove that Boeing indeed performed inadequately and that the transferred information rightfully belongs to Virgin Galactic or is used legally, the court may rule in their favor.

Chances of Success:

Quality of Evidence: Strong documentary evidence of Boeing's poor performance and confirmation of intellectual property rights.

Legal Strategy: Skillful legal defense and counterarguments that can persuade the judge of Virgin Galactic's position.

History of Lawsuits: If Boeing has a history of losing similar cases, this could strengthen Virgin Galactic's position.

Impact of Recent Events: The results of the CST-100 Starliner's mission to the ISS, which began on June 5 and was supposed to last eight days until June 13, 2024, will also significantly influence the outcome of the legal case.

Forecast:

Predicting the exact chances is difficult without a detailed analysis of all the case materials. However, if Virgin Galactic's evidence and arguments are convincing, the company has a real chance of success.

Updates:

Starliner's Extended Stay:

NASA reported that the Starliner's stay at the ISS has been extended and it will not leave the station before June 22. This extension may impact the ongoing legal proceedings between the companies.

Potential Boeing Scandal:

American astronauts are stranded on the ISS due to a malfunction of the Boeing Starliner spacecraft. During the flight, four engines failed simultaneously, and before the departure to Earth, the astronauts discovered a significant helium leak, which is essential for the fuel system's operation. NASA is currently exploring the possibility of a rescue operation; however, the astronauts have limited time: the spacecraft can remain docked to the station for only 45 days.

These issues with the spacecraft could negatively impact Boeing's position in the legal case and improve Virgin Galactic's chances of success.

The limits of silicon have been reachedNASDAQ:AMD

The limits of silicon have been reached, and computing machines have hit their maximum potential for many decades. There have been no real achievements since 1984; that was the year when the ceiling was reached. The supposed development has ended. Ray tracing and all sorts of AI crap based on thrice-recycled garbage are no longer suitable for consumption.

Advancements in computing technology have stalled, and innovation seems to have plateaued. Despite the hype around new technologies like AI and ray tracing, these developments rely on rehashed concepts and fail to deliver groundbreaking results. The industry needs a fundamental shift to overcome these limitations and achieve true progress.

EWT/USDT Major trend. Channel -93% US Energy Sector 11 2023Logarithm. Time frame 1 week.

Cryptocurrency in coinmarketcap: Energy Web Token.

Of the liquid exchanges, it is traded on KuCoin, Kraken (USA), Gate.io.

Downward channel. At the zone of its meridian a descending wedge has formed in the secondary trend. The percentages to the key zones of support/resistance levels are shown on the chart. It is more rational to work from the average buy/sell price, as we are already in the first capitulation zone.

Decline from the low (liquidity) -93%.

We are in the first so-called capitulation zone.

This is not the maximum value for altcoins of such liquidity.

The range of the maximum capitulation zone is shown on the price chart, which is the range of the downward volatility channel and understanding of market cycles and chart logic, i.e. price movement.

Also shown on the chart are conventionally maximum averaged (from the average price) potential market phase targets (not "one-step" pump/dump due to low liquidity at good times, but specifically trends):

1) "participation" (bullish trend development towards the reset zone, i.e. distribution).

2) distribution. .

Capitalization is low. There is no HYIP (the project and the meaning is different), it is not a one-step profit from nothing. Suitable for investment if you understand "who and for what", will or will not be able to realize the intended (not speculation, because it is easier to simply under the "hamster time" given the liquidity) is another matter.

Fundamental basis . That is, what it is and what it is for.

This is a so-called real project. It is not created for cryptocurrency hype and speculation (money from nothing). Until everything is ready, then the price does not matter. In the project previously invested a large capital not speculative, but more far-sighted direction, which is interested exactly in the development of the project's intent in the field of energy and control in the United States in the first place, and not in speculation.

The Energy Web Token (EWT) is the operating token underlying the Energy Web Chain, a blockchain-based virtual machine designed to support and further develop applications for the energy sector. In times of blackout, it will be relevant.

The Energy Web Token is a joint project between Rocky Mountain Institute (RMI) and Grid Singularity (GSy).

Rocky Mountain Institute (RMI) is a leader in research and development in the energy sector. As a renowned think tank, RMI has been involved in many groundbreaking projects in the energy sector. By creating the Energy Web Chain, RMI wanted to harness the decentralized power of blockchain technology to enable participants in the energy sector to develop new decentralized solutions.

Grid Singularity ( GSy ) brought blockchain expertise to the project. As a blockchain developer, GSy was the driving force behind the creation of the Energy Web Chain. Together with renowned experts, key Ethereum blockchain developers, experienced energy executives and energy regulators, GSy was an integral part of the EWT launch.

Given that the Energy Web Chain network is designed for enterprise use , it supports state-of-the-art scalability and data privacy. The Foundation also recently released a comprehensive technology solution called the Energy Web Decentralized Operating System (EW-DOS). This allows users to monitor and manage their electrical systems online.

Line chart to visualize this downward channel and the logic of the wedges in it.

Secondary trend. Downward wedge zone. Time frame 3 days.

EWT/USDT Secondary trend. Downward wedge zone. 4 11 2023Logarithm. Downward wedge zone. Time frame 3 days.

A descending wedge is forming in the descending channel (the main trend). Almost in the final phase of its formation.

Decrease from the price minimum in the main trend -93%.

We are in the first zone of so-called capitulation.

This is not the maximum value for altcoins of such liquidity.

The range of the maximum capitulation zone is shown on the price chart, which is the range of the downward channel (main trend) of volatility.

Cryptocurrency in coinmarketcap: Energy Web Token.

From liquid exchanges traded on KuCoin, Kraken (USA), Gate.io.

Repeatability of fractal wedge logic (secondary trend) in the downward channel (primary trend).

Local resistance zones in the realization of the figure's goals after breaking through the resistance of the wedge (breaking the downward trend of price movement). Fractal projection on identical zones now.

Main trend (to understand the given zone of the wedge in it).

EWT/USDT Major trend. Channel -93% US Energy Sector 11 2023

$EWT Energy Web Token in a Falling Wedge ...Low risk Buy!AMEX:EWT Energy Web Token Price action has been in a falling wedge for over two years!

Current price: $2.6

Currently a very low risk buy! At its all time high, AMEX:EWT price action reached a height of approximately $23.

A break out of falling wedge will lead to resistances above: 3.1, 5.2, 7.7, 10.9, 14, 17, 19.5, 23.4

We might be at middle of cycleBased on elliot wave theory we are at middle of 3rd wave.

Which is most profitable wave. The news is positive /ETFs approved, halving is coming in 2 months everything is good right?/ fundamental analysts starts raise targets. Prices rise quickly, corrections are short-lived and shallow. Anyone looking to "get in on a pullback" will likely miss the boat. As wave 3 starts the news probably still bearish and most market players remain negative but by wave 3 midpoint, "the crowd" will often join the new bullish trend.

Wave 4

Wave 4 is typically clearly corrective. Prices may meander sideways for an extended period, and wave 4 typically retraces less than 38.2% of wave 3. Volume is well below than that of wave 3. This is good place to buy a pullback if you understand the potiental ahead for wave 5. Still, 4th waves are often frustrating because of their lack of progress in the larger trend.

Wave 5

Wave 5 is the final leg in the direction of the dominant trend. The news is almost universally positive and everyone is bullish. Unfortunately, this is when many average investors finally buy in, right before the top. Volume is often lower in wave 5 than in wave 3 nad many momentum indicators start to show divergences, prices reach new highs but the indicators do not reach new peak. At the end of major bull run, bears may very well ridiculed, recall how forecast for a top in the market during 2007 and 2020 were all rejected.

People gonna say "There is no way we are at already middle of cycle. "Halving bull run" is not started yet. ETFs approved big moneys are coming MIL:1M per BTC is possible" etc. Yup maybe youre right, bull run is just starting or maybe ure wrong.

Yes, crypto market is crazy place, when it pumps it doesnt care about anything just prints big green candles and some alts make 100-1000x. Place with full of potiental and opportunity.

But, you gotta stay woke. Dont listen big medias, dont let fake influencers manipulate you. Set your targets and goals. Dont be too greedy. Have a realistic look. WAGMI

Love and Peace <3

BTC Correction Incoming: ICT Unicorn Model?This resembles an ICT Unicorn model (not sure if this is what you call it tho): Price obtained liquidity above, accompanied by a robust volume push-down to 38.5k, forming a breaker block coinciding with a Daily FVG. It's noteworthy that the current Breaker block level constitutes 50% of the present range, validating the corrective wave. Anticipating a price retracement to the daily FVG above 38k or completion of the corrective wave in the range of 32k-36k, where liquidity and an unfilled daily FVG are apparent.

Please manage your risk because price can still go higher around that premium zone.

Risk Mitigation Post | Possible BTC TopThis post presents a potential top for BTC Price Action (PA) for your confluence and Risk Mitigation.

I do not care if I am wrong, and invite constructive comments to improve the count and enable everyone a more holistic understanding of BTC PA, rather than destructive comments that do not achieve anything other than show the community the type of person your are.

The primary rationale for this count lies within the retracement on completion of the initial 5-Wave move up on completion of Primary WA.

From my perspective, this retracement exhibited insufficient depth to be counted as a W2.

Reverting to what I call the Elliott Wave Theory paradox, if it is not a W2, it must be a WB.

The targets presented in this chart may overshoot, however, I feel more confident in a new low, than an ATH on this move.

CRYPTOCAP:TOTAL was used to confirm this count.

Trade Safe.

TOTAL Chart: