EWZ

BUY SNSL3 On double bottom and breakout from negative trend lineBUY SNSL3 On double bottom and breakout from negative trend line. MACD highly divergent.

THE WEEK AHEAD: DAL, C, JPM, WFC EARNINGS; EWZ, TLT/TBTAlthough the earnings season has already kicked off modestly, a bevvy of financials announce next week: C, JPM, and WFC (all on Friday). I generally don't play these underlyings for volatility contraction around earnings primarily because the implied volatility just doesn't ramp up to the degree I'd like to see for a play. I thought I'd mention them here since there will be possible broad sector (XLF) impact depending on how these earnings go -- i.e., there could be a play that develops in one of these underlyings post-announcement or in the sector as a whole that may be worth playing.

Other Earnings: DAL (rank 41/30-day 32) announces earnings on Thursday before market open. The metrics don't look promising here for a directionally neutral premium selling play, but I could see going for something bullish if earnings experience engine failure and crash into the 52-week low around 48 and implied volatility remains high such that a bullish assumption play would be productive (e.g., short puts, Jade Lizard, etc.).

Although there are some other single names that are "ripe" for a volatility contraction play right here (TSLA (earnings in 31) comes to mind), my general tendency is to resist the urge to put plays on in single name with earnings announcements that are near the monthly and instead wait until the eve of the announcement. With a rank of 99 and implied of >100%, though, it's understandably tough to sit on one's hands and wait.

On the Exchange-Trade Fund Front:

Brazil is voting today, so it's likely that you're too late to get into a volatility contraction play that may evolve after the results are finalized (the time to have put that play on was last week). That being said, it's also possible that EWZ gets even more volatile depending on the outcome, even though implied volatility is at the top of its 52-week range at 56.2%.

The financial media has returned to covering 10-year T note yield hand-wringing and/or the spiking of bond yields in general as a general, explanatory theme of why the broad market gave some up last week. TLT broke through long-term support at 116 last week, cratering to 113. I was previously shorting TLT from the 122 level via put diagonals, but it appears that play may have temporarily played out in the absence of some risk-off event that drives treasuries back up. I will continue to short TLT on retrace, but there is little that sticks out to me in terms of horizontal resistance other than 122 and 116, and I'm hesitant to short from 116, since it literally just broke that level "seconds ago" in the scheme of things.

Extremes Prime Prospects for Market Bounce, Oversold LoomsAT40 = 33.8% of stocks are trading above their respective 40-day moving averages (DMAs) (was as low 31.9%)

AT200 = 47.8% of stocks are trading above their respective 200DMAs

VIX = 14.0 (was as high as 15.8)

Short-term Trading Call: neutral

Commentary

The S&P 500 is only 1.0% off its all-time high, yet extremes and critical tests of support abound.

AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), dropped to a fresh 6-month low and closed at 33.8%. AT40 has warned of underlying weakness in the stock market since it sliced through 40% and broke the lower bound of a multi-month range. At the time, I was more focused on the potential bullish implications of the S&P 500’s ability to hold 20DMA support at the same time AT40 slipped…

“So on a relative basis, the S&P 500 (SPY) is not likely to go much lower from here without a specific and very bearish catalyst. The S&P 500’s ability to levitate above its uptrending 20DMA adds to the impression that support will hold.”

The S&P 500 is only a mere 0.4% lower from that point BUT 20DMA support gave way. It was a rare down day on which the S&P 500 lost more than 1% at one point. Buyers stepped in at the lows and closed the index with a 0.8% loss. The S&P 500 even came close to recovering its 20DMA support.

The Invesco QQQ Trust (QQQ) DID break through 50DMA support but buyers managed to close the index right on top of it.

The S&P 500 managed to bounce away from 50DMA support, and the Invesco QQQ Trust (QQQ) held 50DMA support, yet the NASDAQ was not so fortunate.

These major indices effectively created a cascade toward critical 50DMA support. Along the way, small caps continue to roll over with 50DMA resistance fading away in the rear view mirror. The iShares Russell 2000 ETF (IWM) lost another 1.4% and closed at a 3+ month low. A test of 200DMA support seems imminent.

Together, this selling looks like a recipe for a larger sell-off with small caps and now the NASDAQ leading the way lower. However, AT40 closed at 33.8% and was as low as 31.8%. For the last two years in particular, these levels have represented “close enough” to oversold with two important exceptions from the February swoon and the election related sell-off in 2016 (see longer-term chart at the bottom of this post).

The volatility index, the VIX, added to the case for an imminent bounce. The VIX soared as much as an extreme 36.4% before volatility faders stepped in to push the fear gauge to a 20.7% close underneath the 15.35 pivot. If recent patterns hold, this move suggests the latest surge in fear has already exhausted itself. In deference to the volatility faders, I quickly took profits on my latest tranche of call options on ProShares Ultra VIX Short-Term Futures (UVXY). I also did not want to make a bet on the jobs report delivering news strong enough to sustain higher volatility.

Noted VIX expert Bill Luby also thought the market hit extremes and called for a bottom. I agree with Luby that a bottom here is very likely, but I do not think it will be a sustainable bottom.

Soaring interest rates have made me more circumspect. I think financial markets need to adjust to an environment where the 10-year U.S. Treasury stays above 3% and continues higher. That is, more fear needs to appear. As long as the market leaders are able to keep the S&P 500 levitating above 50DMA support, I am doubtful such fear can get exorcised.

Thursday’s spike in rates cut iShares 20+ Year Treasury Bond ETF (TLT) by 0.7% and sent it to a 4-year low. The weekly chart below shows the speed of recent losses.

This move seemed quite extreme, so I decided to triple down on my TLT call options in anticipation of a potential snap back bounce. Friday’s jobs report should play an important role in determining whether rate fears take a break or not. Any strength pointing toward higher inflation will grease more skids across the market.

If the jobs report stays out of the way, then the technicals have the market set up for a bounce. The market just needs an excuse. Beaten down stocks are likely to benefit greatly from a bounce whereas the S&P 500 could be tightly capped by its recent all-time high. In other words, I suspect that a rally from here will be short-lived and the ultimate destination for the market is a true oversold reading (AT40 below 20%). I left the short-term trading call at neutral to reflect my expectation for a small bounce. Assuming AT40 rebounds sharply enough to at least 50%, I will likely look for fades at or near the S&P 500’s all-time high and downgrade the short-term trading call accordingly.

THE WEEK AHEAD: PEP, COST EARNINGS; EWZ, CRON, NIO, IQ, MJPEP announces earnings on Tuesday before market open; COST, on Thursday, after. Neither presents a particularly compelling earnings announcement-related volatility contraction play, with PEP's rank/30-day implied coming in at 30/18, and COST's at 35/23.

With Brazilian elections taking place a week from today (October 7th), it seems to me that an EWZ play is in order if you haven't already got something on: the November 16th 29/39 short strangle is paying 1.59 at the mid with break evens around one standard deevy -- 27.41/40.59. You can naturally go with an October setup, but implied was over 20% higher out in November (44.0% versus 53.2%) as of Friday close, so you're likely to get a little more juice if you go a touch farther out in time.

On the exchange-traded fund side of things, EWZ comes in at the top of the board, with a rank/30-day implied at 79/50, followed by USO at 65/28, and GDX at 50/27.

Non-earnings high implied: CRON: 71/124; NIO: ~/106; MJ: ~/68.0, and IQ: -/61.4.*

Broad Market Majors Background 30-Day: QQQ: 17.2%; IWM: 15.0%; DIA: 13.6%; EFA: 13.3%; SPY: 11.8%.

* -- Neither NIO, MJ, nor IQ have been around for 52-weeks, so they don't currently have a 52-week range to evaluate. I would note that the options liquidity for MJ isn't the greatest, but figured I would throw it in there since weed is hot, and not everyone enjoys paying the single name roller coaster. The MJ November 16th 40 short straddle is paying a whopping 7.45 at the mid, with break evens at 32.55 and 47.45 ... .

THE WEEK AHEAD: NKE EARNINGS; CRON, IQ, NTNX, EWZThis post is going to be short work, since there aren't many earnings in play for next week, and non-earnings premium selling is somewhat limited ... .

NKE is the only earnings that comes up on my radar for next week (announces on Tuesday after market close). While it has an implied volatility rank of 72, its 30-day isn't exactly "doing it" at 29%. That being said, the slightly short delta, 68% probability of profit, Oct 19th 80/90 short strangle pays 1.72/contract at the mid.

Other top implied volatility underlyings include CRON at 140%, IQ at 60%, and NTNX at 54%, but these underlyings aren't the best in terms of expiry and strike availability, which can make for headaches if you need to roll. I've already experienced some of this in a CRON play; there was no November available after the October monthly, so had to roll all the way out to January, which can be a drag if you're less than the patient type ... . I pretty much knew that it could be a headache going in because of oddball expiry availability, but couldn't pass on the juiciness.

On the non-earnings front: "The Brazilian" -- EWZ continues to be frisky (but not quite as frisky as it was) with a rank of 69 and a 30-day of 47%. The November 29/40 short strangle camped out at the 21 delta has a probability of profit of 70%, break evens of 27.35/41.62, and pays 1.65 -- not bad for an extremely liquid $34 underlying.

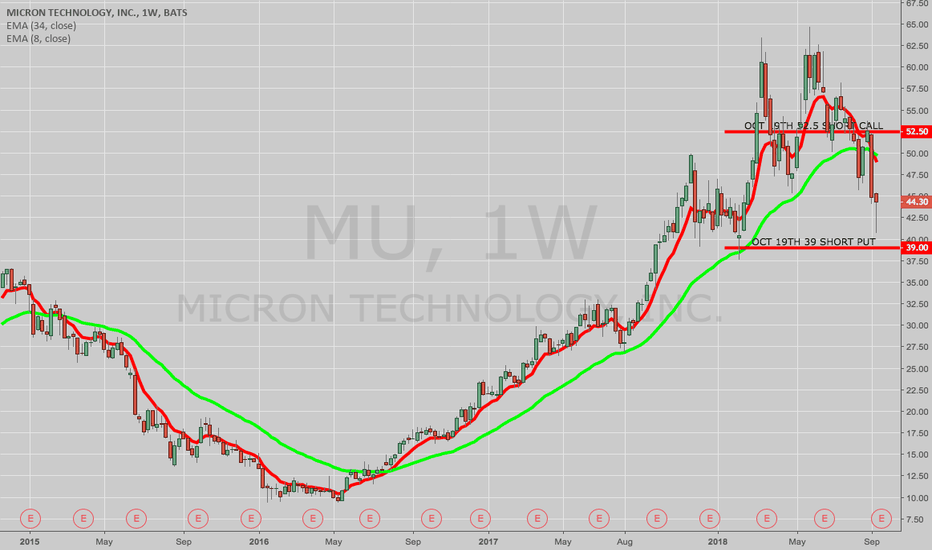

THE WEEK AHEAD: MU EARNINGS; EWZ, GDX, USOAlthough both FDX and ORCL announce earnings tomorrow (Monday) after market close, the underlying with the implied volatility metrics I generally look for in a volatility contraction play are present in MU, which announces Thursday after market close.

With a rank of 82 and a 30-day of 60%, the 70% probability of profit 39/52.5 20-delta short strangle is paying 1.66 at the mid-price. Since it's been beaten down a bit recently, I could see skewing that setup a bit to the bullish side, and or capping off call side risk via a Jade Lizard (the October 19th 39/49/50 would do the trick -- it's paying 1.13 at the mid with no upside risk above 37.87).

As far as non-earnings are concerned, implied volatility is present where it's been for a bit -- in EWZ (rank 99/implied 55) (the Brazilian exchange-traded fund), PBR (88/72) (Brazilian petro), CRON (76/124) (cannabis), GDX (66/30) (gold miners), and USO (58/27) (oil). Naturally, there's also TSLA (69/54), but with earnings in 52, you might as well wait for the full-on, earnings related volatility expansion/contraction ... .

THE WEEK AHEAD: ORCL, KR EARNINGS: EWZ, TSLA, CRONEarnings:

ORCL: Announces Thursday after market. Rank/IV: 74/31. Sept 21st 68% Probability of Profit 20 delta 45/50.5 short strangle: .79 credit.

KR: Announces Thursday before market. Rank/IV: 54/37. Sept 21st 72% Probability of Profit 20 delta 30/35 short strangles: .60 credit.

Non-Earnings:

EWZ: Rank/IV: 97/48

TSLA: Rank/IV: 95/57

GDX: Rank/IV: 68/30

USO: Rank/IV: 62/26

FXE: Rank/IV: 53/8

Others of Note:

CRON: Background IV at 138% on volume of 24.1 million shares. Oct 19th 70% Probability of Profit 9/19 short strangle: 1.30 credit.

See also (for other cannabis-related underlyings):

TLRY: Background IV at 135% on volume of 9.02 million shares.

CGC: Background IV at 98.5% on volume of 13.1 million shares.

THE WEEK AHEAD: AVGO EARNINGS; EWZ, GDX, XLooking at what's left of the trading week post-Labor Day ... .

AVGO (announcing earnings on Thursday after market close) is the only fairly liquid underlying that interests me for an earnings-related volatility contraction play (rank 57/30-day 37). The 63% probability of profit Sept 21st 200/205/235/240 iron condor pictured here is preliminarily going for 1.65 with a theta of 5.17 and a net delta of .67 with wide bid/ask showing in the off hours. Unfortunately, those 5-wides aren't available in the October monthly at the moment, so be mindful of the fact that you may experience difficulty or have to adjust on roll out if you have to since there aren't any 205's or 235's in the October yet.

EWZ is still in a state of high anxiety with a 52-week rank in the 90's and the 30-day above 40%. The 72% probability of profit October 19th 28/38 short strangle camped out around the 20 delta is still paying over a buck (1.28), which is nice in a sub-$35 underlying.

GDX (rank 44/30-day 26): Gold and silver have had the bejesus beaten out of them, so it's no surprise that the implied is relatively high here. Given the beat-down: October 19th 19 short straddle, 1.37 credit, 18.21 delta (bullish assumption). Alternatively, October 19th 19 short put (synthetic covered call), .87 credit, 59.74 delta.

Lastly: another underlying that's gotten a smack-down -- X (earnings announced 31 days ago). The October 19th 27/33 neutral assumption short strangle is paying 1.06, but I could also see going plain Jane 30-delta short put (bullish assumption) -- the October 19th 28's paying .83; going 70 delta synthetic covered call -- the October 19th 32's paying 2.94; or going skewed short straddle -- the 40 delta October 19th 32 short straddle's paying 3.67, with the strategy selected matching the strength of your assumption ... .

THE WEEK AHEAD: M EARNINGS, TWTR, X, EWZThe only volatility contraction earnings play I'm looking at for this coming week is in Macy's, which announces earnings on Wednesday before market open, since it has the implied volatility rank and 30-day metrics I'm looking for (76/56).

Here are some Macy's preliminary setups, with the short strangles set up around the 20 delta strikes:

August 17th 36/44 short strangle, 1.21 credit at the mid, break evens at 34.79/45.21.

September 21st 35/46 short strangle, 1.60 credit at the mid, 33.40/47.60 break evens. (The reason why I'd go with this one over the August is that there isn't much time to manage the August setup if it goes awry).

September 21st 40 short straddle, 5.42 credit at the mid, 34.58/45.42 break evens

Other underlyings with earnings in the rear view/exchange-traded funds:

TSLA (rank 61/30-day 66). I am unsure of whether I will touch this underlying any longer given private equity discussions. These can ruin an options trade if they go through, as well as ruin one if they don't. (See, RAD, like, more than once ... ).

TWTR. The rank isn't great, but there is still some background implied to mine there (41.7%). The Sept 21st 29/36 short strangle is paying 1.06, which isn't shabby for a 32 clam underlying.

X. With a 30-day at 41.4%, the September 21st 27/34's paying .87, the 30 short straddle, 3.06.

EWZ. I've been short straddling this high implied exchange-traded fund, but the 30/38's paying .82 in the Sept cycle if you just can't stand the kind of skewing out the short straddle enjoys every other day with this one ... .

Other Major Food Groups:

TLT: Waiting for 122.50-ish for another bearish assumption setup.

EWZ - (Short Premium) Selling straddle into high IVRThere is no real clear price action direction, this chart has even room to run in both directions, and the 'IVR is high which makes it a good candidate for a short premium trade. I am selling a straddle as I can collect 10% of the underlying in premium in just 46 days.

EWZ: Likely bottomed or bottoming here...Brazil is extremely washed out, but it has held a long term support level so far. I think odds are the market turns up from here.

I'm long $PBR in particular, since it is showing tremendous relative strength vs the brazilian market, and it has a long way to go to catch up to oil, closing the gigantic spread it now has. The situation with the CEO resigning caused further headwinds in the stock, but it has now stabilized and coiling against overhead supply...over time it will break above it following the earnings report most likely -as long as the fundamental story doesn't change and debt continues to be tackled effectively...-.

As for the $EWZ chart, we have hit a monthly low volume support, and also the lowest point of the last time they almost impeach Temer, this was a huge capitulation day for many investors and it is where most stocks bottomed back then. I'd look into finding interesting brazilian companies rather than buying the index directly, but it gives us a good reference point here. Another interesting chart is $EEM, and the Chinese stock market, both of which are also affected by the rally in the dollar that we had so far.

Best of luck,

Ivan Labrie.

UPDATE: Brazil (EWZ) up another 4% todayHi guys, thank you for the support! I will have this analysis out each weekend as well as daily updates throughout the week, if you guys like what I'm doing hit the "follow" button and you will get a notification each time I post a video or chart!

Have a great day everyone!