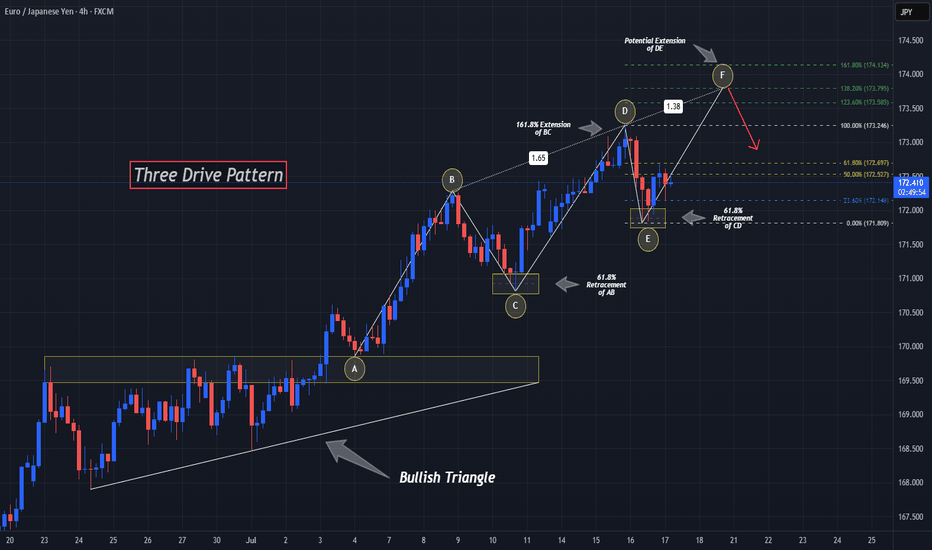

"Three Drives" And EURJPY Bulls Could Be Out!!OANDA:EURJPY has potentially been forming quite a rare Reversal Pattern, the Three Drives Pattern, after making a Bullish Breakout of the Triangle, lets break it down!

Three Drive Patterns are very similar to ABCD patterns except for one thing, a Retracement instead of a Reversal after the CD Leg is finished!

In the CD Leg, Price creates quite a Trading Volume Gap between 172.1 - 171.8 and after Price declines from Point D (normally a Short Opportunity on an ABCD Pattern), Price actually makes a 61.8% Retracement of CD, creating Point E in that very Price Range and moves up, which "drives" a strong case that we potentially could be looking at a Three Drive Pattern!

Now that we have Point E, we can use the Fibonacci Retracement Tool to help give us an idea on where the Extension of the EF Leg could potentially end and the Fibonacci Levels suspected are:

123.6% --> 173.585

138.2% --> 173.795

161.8% --> 174.134

Once Price has made an Extension, shows Reaction, and moves Down from these levels; this could generate a great Short Opportunity!

Extension

Algorand Consolidation "Pointing" To An End??Here we can see COINBASE:ALGOUSD is about finished forming a Continuation Pattern, the Bullish Wedge!

Price has made an impressive .50 increase since Trump taking office but has slipped into quite a steep Consolidation Phase where Price has made run for the 88.6% Retracement and seems to be filling out the rest of the "Point" of the Wedge!

Accompanying the Chart Pattern is a Decrease in Volume as well, signaling the tight Consolidation could be looking to make a break soon!

*With a True Breakout, we will want to be vigilant of multiple factors coming into play with Increase of Volume to Validate the Break of Pattern!

Once the Pattern is Confirmed and a Breakout Validated, based on the "Flagpole" of the Pattern, we could expect a potential extension of price to go behind the current Swing High of .6133 and up into the .70 area!

Could Cardano Bulls Push Past Pennant To $2 Resistance?!Cardano made an impressive 315% gain from the Low on Nov. 4th/5th @ .32 to the High on Dec. 3rd @ $1.32 following the Pro-Crypto Republican won Presidential Debate with not only BINANCE:ADAUSD seeing this kind of Rally but across the entire Crypto Market!

Since that High, Price on Cardano has slipped into a Consolidation of what seems to be a Pennant Pattern with Lower Highs working into Higher Lows.

Both Legs of this Triangle still need a 3rd Touch to Validate the Integrity and Existence of both Trend-lines. I would like to see Price make a 3rd Touch of the Rising Support around the ( .95 - .93 ) Range before moving back up to test the Falling Resistance.

If Bulls are able to gain enough Support from the Rising Support, it could be enough to give them momentum to make a Bullish Break to the Falling Resistance and based from the Pattern Statistics:

- Generate an Extension of the same size of Trend move that came prior to the formation of the Pattern called the "Flagpole" putting the Potential Extension of Price into the $2 Resistance Zone!

**Caution: Triangle Patterns are known to fail 1/3 of the time so a Bearish Breakdown of this pattern is still possible. Watch for False Breaks/Breakouts!

Bullish movementEnglish

First of all, we have a bearish structure on monthly timeframe, on weekly and daily is the same, but looking at it on 1h and 4h looks bullish with HH and HL, I believe the price is going up because of its structure and I´ll be waiting for it to get in the 200% extension and then have a retrocement in the 1.27 level, the market usually does those kind of movements.

Let´s see how the market continues.

*THIS IT NOT INVESTMENT RECOMMENDATION OR SOMETHING LIKE THAT, THIS IS ONLY FOR ANALYSIS AND EDUCATION PURPOSE*

Español

Primero que todo, tenemos una estructura bajista en mensual, semanal y diario, pero viendo el precio en 1hr y en 4h tiene una estructura alcista con altos más altos y bajos más altos, creo que el precio irá arriba debido a su estructura y estaré esperando a que llegue al nivel 200% de la extensión del Fibo y luego agarrar su retroceso hasta el nivel 1.27, el mercado suele hacer ese tipo de movimientos.

Veremos cómo continúa el mercado.

*ESTO NO ES RECOMENDACIÓN DE INVERSIÓN NI NADA QUE SE LE PAREZCA, ESTO ES SOLO PARA ANÁLISIS Y EDUCACIÓN*

MoscowExchange is prone to take a rest soonRecord new account openings on MoscowExchange during 2023, has played its role in almost 90% stock advance since the year start.

The stock and volume dynamics show strong uptrend with good signs of accumulation on a weekly chart.

My chart analysis shows, that price has reached an important resistance zone of its strongest uptrend wave 3 at around 182 area and is now to be expected to re-base again, correcting ideally to its mid-term area of support: 155-166 area.

We may also notice that price looks extended from its 10w MA, that is a historical cautious sign for continuation of short and mid-term advance. We may also notice, that in Mar23 once price went above 50D MA by 18% that led to 2 months of correction.

Despite my bearish leaning short-term, my analysis still has room for price to extend to higher resistance targets to 195-200 area as an alt. wave 3 target.

Trading thesis : if price breaks bellow 21ema, preferably with volume pick-up, I would expect a move down to 166-155 area. If price decides to instead move above 185, I expect it to find resistance in 195-200.

Dive into the Coolest Blue Vibe: Unveiling TradingView Skin! 🎉✨Hey there! 🌟

Guess what? I've just whipped up my very first skin for TradingView, and it's got this super chill blue vibe! 🌊 Not only is it a treat for the eyes, but it's also packed with snazzy animations and color pops. 🎨✨ I'm super curious - what do y'all think? Got any cool suggestions or tweaks in mind?

Fancy using this theme? Drop your email in the comments and I'll buzz you soon! 💌 And don't sweat, setting it up is a breeze on any browser. 🌬️

Catch ya soon! 😄🚀

BTC ANALYSIS 23/06/23BYBIT:BTCUSDT.P

Okay so what I'm looking for in this swing up is the extension, so the last 2 extensions have been a 50%+ move and right now we have had about a 25% swing up I also have a potential resistance zone where we could consolidate for a while but the real resistance level that interests me is the 35k mark which would make this swing very similar to the last and would take that to about a 40% move I mean it could even move up more but this is my thoughts for now.

Stay patient.

Keep wondering.

Thanks guys.

CRUDEOIL CORRECTION from the RESISTANCE LEVEL!!!The price perfectly fulfills my last idea. The market dropped from the resistance zone by making a impulse leg and hit the target and taken support at the given level. The price respected the support level and persisted itself at the support level . The market is pulling back after testing the resistance and impulse move. I expected growth from the support level , price also respected the support level .

After Pullback price again respected the weekly strong resistance zone and again dropping towards the support zone .

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad.

SPY Setting up for a bounce soonOnce there was a guy who talked about an outcome that nobody believed in. He was laughed at and ridiculed for his ideas. He tried to explain his point of view, but people dismissed him and thought he was foolish. However, he remained persistent in his beliefs and continued to speak about his theory. Then one day, something happened that proved him right, and suddenly, nobody was laughing anymore. They realized that they had been wrong and that the guy had been right all along. The guy's persistence and belief in his ideas had paid off, and he was now recognized for his unique and innovative thinking.

Oh wait. That guy is me.

We're likely going to bounce soon, though. Look at the fib measurements I'm providing in this chart. We tapped the 100% extension perfectly. This does look wave 3-ish so be cautiously optimistic. I discussed 3900 in a recent video as well. Well, here we are. Almost 150 points lower from my previous idea that I shared here that was laughed at.

But seriously - look at that perfect bounce off the 100. Probably just a bounce, but a bounce will come overnight, then tomorrow when NFP is released... we'll see if this is a wave 3 or not.

SQQQ daily bullish hammer at Fibonacci 50% retracement RSI diverOrder BUY SQQQ NASDAQ.NMS Stop 53.97 LMT 53.97 will be automatically canceled at 20230401 01:00:00 EST

SQQQ daily bullish hammer at Fibonacci 50% retracement RSI divergence. Stop loss below 68% take profit into fib extension 1. Wave 5 uptrend.

Intermediate ABC Extension in Minor 3 Complex Correction in 4Bitcoin has been in a corrective pattern from the low of 17,500 on June 18th and is beginning to exhibit signs that it could either be a reverse expanding triangle or a WXYXZ pattern.

Case for the triangle:

Each side subdivides into a zig-zag

C is 123.6 of A

A and C made higher highs while B and soon D will be making higher lows

1H

30mn

15mn

Case for WXYXZ:

X is between 61.8% and 76.4% of W

Y is less than 123.6% of W

X is on target to be around 61.8% of W

Alternate WXYXZ

Finally, as a bullish alternative this could also be a leading diagonal in a wave 1 since the rules for leading diagonals are that each wave 1-5 subdivides as a zig-zag although this feels less likely due to the way the pattern starts contracted and then expands as the correction continues.

BTCUSD, weekly strategy, target 19390 soon!hey traders, BTC might go down at 19390, but firstly might bounce until Weekly S2 23805. The market is strongly bearish

Fibonacci extension bands are shown in the chart with pivot point levels.

The analysis is considering 100% of the correction price.

The market has the last word.

How to use different types of Fibonacci in TradingViewWave Relationships and their relation by Fibonacci Ratios are among the most helpful tools for target prediction.

There are different types of Fibonacci and different tools with different names in different software packages. This may make users somehow confused . Here, we try to shed some light on various mostly used Fibonacci types and explain their usage for target prediction. Also we explain their related tool in TradingView and their way of implementations.

As shown on the chart, there are four main types of Fibonacci :

1- Internal Retracement

2. External Retracement (Extension)

3. Expansion

4. Projection

Before going through details, it is worth to mention that knowing wave relationships is a key to implement Fibonacci tools accurately. Different types of wave relationships is beyond the scope of this publication. Here, for simplification, we show most simple type of wave cycle which is ascending complete cycle with one 5 leg up impulse and one abc form of correction . Also, we try to explain more typical Fibonacci Ratios for target prediction and skip less often ones.

1. Internal Retracement:

This is simply for calculation of the amount of correction in the main trend. It means we can predict where a counter trend correction may end.

As shown on the chart, it can be used for target prediction of wave 2 and 4 in an up trend and also wave B in a down trend. It can also be used for calculation of end of wave C which is the end of correction of whole up going wave. Green arrows on the picture show the direction of using this tool which is "Fib Reracement" in TradinView. For example, we put first point at the start of wave 1 and second point at the end of this wave for obtaining possible targets for wave 2 and so on.

Wave 2 can end at 0.382, 0.5, 0.618 and 0.786 Fibonacci Retracement levels of wave 1. Fibonacci levels at which wave 2 ends can send us a signal about the amount of next waves. This is again beyond the scope of this publication.

Wave 4 can typically end at 0.382 or 0.5 Retracement of wave 3. Less and more amount of Retracements are also possible, but those make wave relations more complicated and does not match with our simple shown example.

Wave B typically corrects 0.382 , 0.5 and 0.618 of wave A in a simple zigzag correction. More Retracements signals for more complicated corrections e.g a flat correction.

Wave C Retracement levels are similar to wave 2 in shown wave cycle since it is end of a larger degree wave 2.

2. External Retracement:

This Fibonacci which is also called " Extension" can be used for calculation of end of wave 3 or 5 in an up trend and end of wave C ( which is end of whole correction) in a down trend.

We have same tool as internal retracement in TradingView however ,unlike internal Retracement, an extension should be drawn from a high to a low in an up trend and vice versa as shown by green arrows on the related figure.

Wave 3 Fibonacci Ratios by extension depends on the amount of wave 2 correction. For example, 1.618 or 2.618 extension of wave 2 can be the target for wave 3. Robert. C. Miner has proposed a very useful table for targets using external retracement.

Wave 5 typical targets are 1.272, 1.414 and 1.618 extensions of wave 4. This ratios are also the same for calculation of end of wave C.

3. Expansion:

Based on my experience, Fibo expansion is most useful when we have over extended waves for example over extended wave 3. In this case , 1.618 or even 2.618 Fibo levels can be the typical targets.

Related tool in TradingView is Trend-Based Fib Extension. Please note that this tool in TradingView is a three point Fibonacci while expansion is two point Fibonacci tool. Therefore, Implementing this tool for obtaining Expansion levels is a little tricky. For example, for calculation of wave 3 we should put first point at the start of wave 1 and double click on end of wave 1.

There are also more details in implementing Fibo expansion for example we have different types of Fibo expansion. We can skip details here to keep this publication as simple as possible.

4. Projection:

This is the only 3 points Fibonacci that we have. Some software packages call this Fibonacci as Expansion !!. Its related tool in TradingView is Trend-Based Fibo Extension. It is a very useful tool for calculation of end of wave 3, 5 and C.

Again green arrows show how to use this tool . For example, For wave 3 target calculation we set first point at the start of wave 1, second point at end of wave 1 and third point at the end of wave 2 or start of wave 3.

1.618 and 2.618 Fibo levels are typical for end of an extended wave 3 when using Fibo projection.

100 % Projection of wave 1 from low of wave 4 is a typical one for end of wave 5 target. Also 0.382 or 0.618 projection of wave 1-3 from low of wave 4 is a helpful ratio for wave 5 target calculation.

For a wave C, most common projection is 100 % of wave A from top of wave B.

How to make a Potential Reversal Zone ( PRZ) :

We can make our potential reversal zone stronger by combining all proposed tools . Take another look at the figures. What can we see? yes. We know four tools now for calculation of end of wave C. Suppose how strong a possible buy zone can be when 4 different tools suggest it as potential reversal target !

Hope this to be helpful. Please do not hesitate to ask questions if you feel need to ask.

Good luck every one.

IOTX has broken out, next target 0.15On daily chart

BINANCE:IOTXUSDT is retesting around 0.09 to prepare pump up

We have a short-term target at 0.15 that's a previous ATM on Aug 2021 and long-term target at 0.3 that price is 1.0 Fib at 0.048.

If you like my ideas, hit a button like to give motivation to me. Thanks!

Before you trade, DYOR plz.