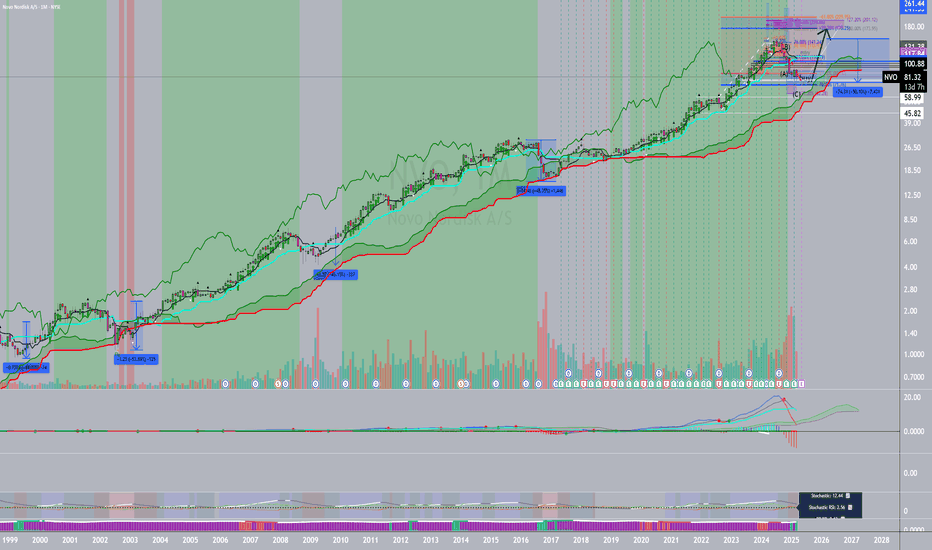

Novo Nordisk: 50% Drops Lead to Amazing GrowthFundamentals :

Take a look at NVO in 1999-2000, 2003, 2008, 2016 and June 20024-2025. Every time it dropped about 50%, that lead to a huge rally for years! NVO has secured contracts with Medicaid for their diabetes and other drugs. It is not going anywhere. It has fallen 50%. We either hold or buy more.

Technicals :

uHd + extreme indicator +u3 volume last month +horizontal support + a-b-c + key fib pb

Projection: 200 to 250 within two years, tentatively.

Extreme

RSI Trends and Extremes with Color-Fill

What is the RSI Color Extremes Script?

The RSI Color Extremes Script is a different take on the traditional RSI. With a shorter period setting, short-term trends and extremes can be detected.

How is RSI Color Extremes different from the traditional RSI and Connors RSI (CRSI)?

While the traditional RSI is 14 periods, the default setting for this script is 2 periods. The 2-period setting was borrowed from Connors RSI (CRSI) where 2 and 3 periods are used, however, the interpretation here is different. Credit goes to user fikira as this is a different take on his/her original script. The period setting is adjustable.

How to use the RSI Color Extremes Script

When the RSI(2) crosses above the 70 line, this is a buy signal, when it crosses below the 30 line, this is a sell signal. As the intensity of the green color increases this indicates a strengthening of an up-trend. As the intensity of the red increases, this indicates the a strengthening down-trend. Extremes of above 95, (the red dotted line), or below 5, (the green dotted line) are rarely reached and can be viewed as potential reversal points or proactive profit taking.

This script can be used with other indicators (Stochastic, moving averages, or MACD for examples) for confirmation or confluence of indicators.

Settings:

* The default setting is 2 periods

* color intensity increases as the indicator rises or falls

* The period setting is adjustable.

Observations:

* Not all signals lead to major moves. However, all major moves give this signal. it is important to use other indicators for confirmation.

* setting alerts on the indicator (crossing above 70 or crossing below 30) can be a good way to identify early potential trends.

* The script works on any security and in any timeframe.

The period setting is adjustable.

Apple Testing Support Ahead Of EarningsBack to the basics & a reminder that I am a swing trader and I have bought my puts for this dip

Trend Analysis:

Candlestick analysis shows a sideways trend.

Will the impulsive high continue or will we see a decline to a higher low?

I free handed some trend lines and as you can see, X^2's high gave me X^1's level of support which is shockingly the level of support shown by the Kurotoga cloud.

X^2's level of support is possible but highly unlikely

However we should expect to see X^1's level of support tested as the Kurotoga Cloud backs it up.

I am shocked by this because I put the cloud script in after I free handed and am pleased with the accuracy

Exciting and interesting moments. Some mid term scenario's: from extreme bullish to finding the last bottom:

Small triggers can be enough to create a fast break out, followed by an early FOMO reaction. We are really close. The other extremely scenario is a pull back to the down trend again. Not a very likely, but there is even a small change we need to finish the Eliot wave and find the very last bottom.

I really hope to something in between, so we can build up a strong fundamental base for a healthy bullrun in the next 1.5 year. A longer period for the bullrun is even better to give bitcoin and alts the change to improve their technology and acceptation by institutions and governments.

Lets see what comes folks!

Ultimate Chad style 60R scalp on btc [Gone Sexual]The ultimate FOMO inducing HL is forming.

Eventually it will lead the way out of disgustingly oversold 3k pricing and back to the just levels of 6k. where we will spend rest of the Q2.

Bears will cry the tears of thousand soys and their girlfriends will leave them for the chad bulls in new miatas - that'sa fact!

Bottom shorters won't be able to afford rope and CNBC will be seen posting 1k calls shortly before the first glorious impulse upwards, you better bet on it, nerds.

I have deployed debt and overleveraged all my assets in order to x50 this trade and make more money than man previously thought is possible, If you have a good offshore package to sell me dm!

Hold on to your tendies, boys!

SPX turning point soon?Hello traders,

Today we want to share with you our TVC:SPX perspective as it starts to flirt with a very decisive zone at around 2400-2450.

Currently market seems to be a very decisive level for the market weather bearish sentiment will kick in soon or not.

Current fundamental important facts to consider:

FED rate hike (rate odds jumped in previous days significant higher as they currently are in 79.7% ( CME FED watch) for a march rate hike of 25 basis points. As Yellen spoke on Friday she mentioned to watch very closely at next Fridays NFP. They might be significant for a March rate hike.

Of course another factor to mention is the huge influence of President Trumps policy as it may effect further gain within the stock market in several sectors. However, keep in mind that investors sentiment sometimes act before certain policies are taking place.

As we look at our intermarket indications we need to be careful, as they currently still warn for a potential downside moves.

We always mention the importance of intermarket flows, as we believe that investors only repark their money due to sentiment and global macro-economic conditions. Therefore, we always keep in mind the in-and outflows with the help of our intermarket indications that lead us towards better timing when making a trading decision. As you might know that timing is one of the most important things when it comes to trading together of course with risk/money management.

As seen in the chart, two of our three intermarket indications already moving in extreme areas territory which might indicate a soon outflow of capital to other asset classes. We always take into account the BIG 4: Currencies , Bonds, Stocks and Commodities. Only the SPX/Bonds ratio shows still more potential to the upside. Investor may still move their capital to indices from Bonds. This action has still not reversed to reach its extreme on the flip-side!

Looking at the technical perspective and current trading range, we have seen an extreme up-rally in the TVC:SPX throughout the whole year so far. It currently trades at 2383 with its all-time at 2401. If Yellen gets supported by +VE US NFP figures on Friday, we might see some volatile movements around that current trading range. Additionally, very important key factors to consider is the current policy of Trump. His tax plan, infrastructure plan and his borderline tax ideas could influence the TVC:SPX significantly. We will keep you updated with that!

So, summarizing everything together, we believe that TVC:SPX is currently at a very decisive zone and we need to take care. We will closely watch the actions of investors in terms of capital movements and the fundamental perspective within the FED rate probability. All these factors together we are currently at mid-term turning points where a move to the downside is also possible!

Either way we will keep you updated with possible trading setups!

As always, trading is a probability game nobody is 100% right and always use a stop-loss when trading. Trade with care.

We wish you much success,

The Secrets2Trade Team

High - Low Bollinger Bands These work better than the standard Bollinger Bands for setting extreme ranges.

What I use these for is to use an oscillator to find an buy / sell signal then take that to the H L Bollinger bands and mark the spot. Most of the time, you will find that the price does not exceed this spot for the duration (length) of the H L Bollinger bands.

This makes them good for doing Credit Spreads such as Put Vertical Spreads and Call Vertical Spreads. Since the price will normally not exceed the bands at the extreme point, the trader can profit from the time decay and other factors.

Great Way to draw Fibonacci levels using Gann,TZ, and TES Fibonacci levels can become powerful ways to find almost EXACT support and resistance levels and also time your trades. I have used them to predict turning points in markets on short time periods but they also are predictive in larger time frames.

How to Align Fibonacci Levels:

A very good and objective way to draw your Fibonacci levels is to use Gann Boxes, Transient Zones and the Temporal Extreme Spitter. All of these indicators are in the Public Library.

First start with the Temporal Extreme Splitter (TES) by Richard Santos. The extreme splitter will give you exact high and low places to place your gann boxes.

The Gann Boxes provide fibonacci in two dimensions- price and time. You can align the box ends with the TES. However, I have found one of the best ways is to align the Gann boxes is to set the 50% level on a long/strong TES line.

Next when you align the extremes up with either the center or one or both of the ends of TES lines; then you are ready to start aligning the Fib levels for time.

There is no exact science for doing this but a good way to do it is to try to match the highs and lows using Transient Zones. Transient Zones themselves give highs and lows and are also great places to align the boxes.

However, since TZ's can occur more often than the TES lines (if you use default settings), its good to align them with the Fibonacci time levels of the Gann box.

When watching your entry and exit points, it is also useful to include the concept of Divergence into them for even higher probability trades.

One of the best ways to see divergence is to use a stochastics oscillator. The 14,3,1 default setting is fine. There are also some other ones in the Public Library. I am really into fibonacci, so I will sometimes use a stochastic 55 or 21.

To see divergence, look at the highs and lows on the price chart and compare them to the highs and lows of the stochastic oscillator. If you do this correctly, you can sometimes see where the market is slowing down and turning.

The key word here is slowing down .

Divergence can be used as a confirmatory signal or a way to get out of a trade when it starts to go the other direction.

Good Luck in Your Trading

- Spread Eagle 71