BTC: Making sense of what's about to happen.))Hello eveyrone,

I hope you're all doing well.

This is tuned to long term investors or swing traders.

Btc has gone up incredibly. While I'm not invested in Btc for fundamental reasons, I want to share my understand of the technical analysis. We all know Btc halving is about to happen soon. I just wanted to see where bitcoin core might continue to go up or have a bearish army waiting.

Trendline 1, is from the ATH to previous big high. We need to see a few days in on how this will play out, including the halving.

Trendline 2, is the bottom after the ATH, it's only fair. I put a circle on how I determined the best trendline. I put an X near the latest low because of COVID19, so I'm not going to ruin my whole analysis because of a pandemic, and if you look closely it basically removes the wick of the candle. I'm willing to take the risk with Trendline 2, cause if I buy at trendline 2, id be better off than buying the breakout at Trendline 1 or 3.

Trendline 3, this is a more recent high trendline. Trendline 3 cuts through the recent $10,000 price, I think thats a good trendline, nothing in the market is perfect. This trendline breakout might be an indicator of an early fake breakout. I'm not lookng to be right or wrong, I am just trying to play out possible scenarios so I can be ready for as many scenarios as possible, insuring my investment is safe.

I also placed a fibonacci, you can see I removed the bottom lower lines because I don't like a cluttered chart. Most of my analysis is looking for the trend or reversals. Entry decisions are simple, enter in the dip. The trend or reversal point is my biggest point of interest. Entry is the simple part for long term investors.

Let's see what happens over the next few days, I can't wait for the halving.

Please like, share and follow, I'd really appreciate it. I hope you found value in this analysis.

I have also related my Bsv fakebreakout, and 'buy low, sell high' explanation.

Safe investing ))

Fakeout

POUND DOLLAR MARKET REVIEW (POST-MORTEM)Hi Traders! Before the market close this week, we can see strong bullish bias on the price action. But that's a good news for sell opportunity due to price already touched QML level and we have a fakeout signal which we can expect the price will slightly bearish next week. However, if the price break 1.26441, might be it will break our resistance level previous high and possible to make highest high. So let's take a break for public holidays and enjoy our time with family. We battle again next week!

EUR/JPY SELL SIGNALHey tradomaniacs,

welcome to another free trade-plan.

Important: This is meant to be a preparation for you. As always we will have to wait for a breakout and confirmation.

Market Sell: 116,210

Stop-Loss: 116,415

Target 1: 116,000

Target 2: 115,900

Target 3: 115,790

Stop-Loss: 20,5 pips

Risk: 1-2%

Risk-Reward: 2,0

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

EUR/USD H1: ready for a correction?After the fake breakout, I expect a further push up to the 1.1950, where I placed a sell limit order before the price goes down to test 38.2%/50%/61.8% level. (should happen during the next 1-2 days). After that I expect higher prices again.

Best Regards,

Becker Investments

AUD/JPY SELL SIGNALHey tradomaniacs,

welcome to another free trade-plan.

Important:

We are trading ahead the FOMC which begins in 1 hour!

Since the market is very news-driven any statement can CHANGE everything and cause a whipsaw in the market!

Technically we see a fakeout to the upside at a very strong key-resistance.

PLEASE do not enter this setup if you are not willing to trade with a high risk in a volatile market.

Type: Daytrade

Market-Order-Sell: 67,650

Stop-Loss: 68,070

Target 1: 67,210

Target 2: 66,950

Target 3: 66,540

Stop-Loss: 42 pips

Risk: 0,5-1%

Risk-Reward: 3,0

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

BTC/USD FAKEOUT TO ENTICE BUYING PRESSURE? 7-8K STILL POSSIBLE.Hello traders,

Spotted this pattern populating the 1 minute TF.

After all of this intense movement, expectation for a large manipulatory candlestick soon.

Possible breakout to 7-8k still in play.

Proceed with caution.

---Amateur Speculator---

Live long and profit

-zm

Adam & Eve Double top pattern testing the neckline; Fakeout zoneThis is starting to look really ugly for bitcoin now as we are testing the neckline of what appears to be an upward slanted adam and eve double top. If we are to trigger the breakdown here we have a target of 4600-4700 which would be a horrible sign for btc as it would suggest a lower low from are most recent bottom is in store for price action. However we must remember it was this same time of year in 2018 where we were charting an adam and eve double bottom and it too went all the way to the neckline acted like it was goign to complete only to fakeout at the very last minute and destroy countless longs positions along the way....so learnign from recent history, there is still a very real possibility this pattern could be trying to accumulate as many shorts as possible here at the neckline in order to confirm a fakeout out the last minute and wreck a ton of shorts like it rekt all those longs in 2018...for this reason we must remain level headed here not buy into the FUD and wait for clear confirmation of either the breakdown or the fakeout. the eve portion of this potential double top is also an upward slanted 4hr chart inverse cup and handle so if only that portion of the double top pattern were to validate it in itself has a breakdown target of 5k. I personally think however it is either going to validate the entire double top or nothing at all if it confirms the fakeout. If it confirms breakdown target = 4.6k. For now we are still in the fakeout zone.

SPX500 SELL SIGNALHey tradomaniacs,

welcome to another free trade-plan.

SPX500: Daytrade-Execution

Market-Order-Sell: 2593,0

Stop-Loss: 2680,0

Target 1: 2505,0

Target 2: 2456,0

Target 3: 2400,0

Stop-Loss: 83 pips

Risk: 1-2%

Risk-Reward: 2,52

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

FAKEOUT? ... Could be. Buy zones in the chart.

Always keep your eyes out for a BULL TRAP on the way up. REMEMBER. Bitcoin could retrace to new lows out of no where. Wouldn't be the first time, and it wont be the last.

Keep your STOPS tight on the way up, especially if we drop down to B2 and B3.

Keep em tight until we candle above the NECKLINE.

GOOD LUCK

Market Overview #eurusd EurUsd has had a 2 consecutive weeks of bullishness, price breaking through some major levels of structures without a proper retest. The current level which was currently broken 1.123 zone which is the highest it has been since late 2019.

Price triggered an order block at 1.125 which gave a fake-out of the 1.123 mark, taking out stop orders or retailers. I'm expecting price to cool off, break back into structure with a retest of 1.123 mark, would take a short entry to 1.091 zone where price failed to do a retest of cartel candle which would as well give an inverse heads and shoulder pattern, then i'll be looking to take a long position at that entry back to equal highs.

EUR/GBP - ShortEUR/GBP is showing that there is still potential strength for the EURO, with only corrective moves at the moment nothing big enough to take any trades.

I will be watching to see if we can come up and retest the 50% area which lines up with monthly resistance of 0.8700 before taking a trade back down.

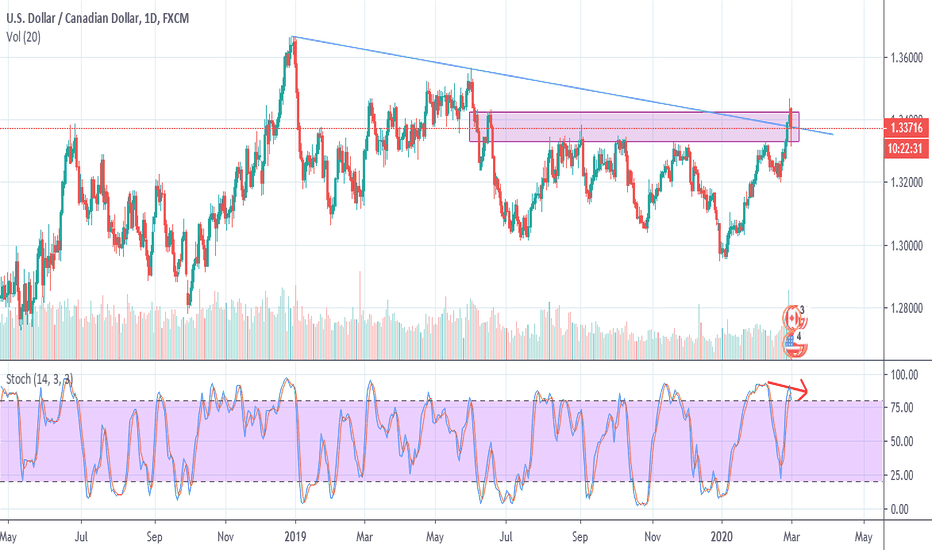

FAKEOUT: Markets are deceiving usUSDCAD is under a trendline in daily chart, on Friday price broke the resistance area and the trendline but today it has come back again under that area, so it is clearly a price manipulation. Stochastic shows a divergence and I think price will have an ABC CORRECTION till wave 4 bottom in h4 ( I m talking about 1.3200 area).

Fundamentals suggests a probable rate cut for FED on 18th of march due to Coronavirus, instead on 4th of march Bank of Canada could even avoid a rate cut (analysts say that the chance is about 40%).

If you open a short trade set a stop loss about 50 pips over the high of today and a first take profit at 1.3200.

Bitcoin Buy Signal? Price Action Favors Fake Out.#Bitcoin establishes another higher low off of the 9250 minor support, and has even offered a new buy signal relative to our LONG only swing trade strategy. This time, we are stepping aside because the probability and reward/risk are not attractive. It may be hard to understand for newer investors and traders, but not all signals are created equal. Context plays a big part in shaping the variable probability that is not obvious on the surface of a typical setup. In this video I further explain the elements that we consider in order to filter out such a setup, even though there is a small chance price breaks higher. The following are key points contained in the video so that you do not have to watch the whole thing.

1. Probability of the location: 9564 to 10168 is a proven resistance zone relative to the 14K peak established in June. Order flow has clearly defined a corrective structure which is in line with the probability. This is an area that is more attractive to sell or lock in profits, NOT put on more risk. Even in the face of the broader bullish momentum.

2. Reward/Risk Not favorable: Before all of the chart experts start sharing there 4 hour charts with arrows to 12K or 3K, this element is SPECIFIC to the rules of OUR strategy. Even if we took an aggressive buy signal here, reasonable targets are around 10,400 and 10,850, and the chance of reaching them at the moment appears low. Meanwhile we would have to risk at LEAST 750 points. Although we have taken trades with a minimum of 1:1 reward/risk, probability weighs against taking this particular setup.

3. What does probability favor? A fake out, a lower high, or a more complex corrective structure. Price can test the 8950 level while still maintaining its broader bullish momentum. A more attractive trade idea would be a reversal pattern that develops around the 9250 or 8950 areas.

For our decision making process, probability and risk come first, NOT "how much" we can make. This defensive philosophy has minimized negative trades when the environment was not as favorable, and has put us in a position to capitalize on the better quality setups that have appeared recently. For the reactive participant, this process that we follow is very unpopular because it goes against the grain of the herd (just look at what is popular in this community). We follow rules, not news, not opinions, or reactive price movements and either the market will conform, or it won't. Yes, we will miss moves, but we don't lose money missing moves. All we have to do is wait for the next one. Rules are what produce consistent returns in a highly random environment and until you can put that idea into practice, your results will be random as well.

EURUSD will melt down with taken liquidity FOREXCOM:EURUSD has taken everyone's attention on Friday by making an impulse move to the upside. A lot of people believed it was a reversal due to many reasons: gap filled, impulse with breaking the previous lower high, but actually this move was just to get some money liquidity to melt down. So now traders got a very good R/R opportunity to sell FOREXCOM:EURUSD .

*Big players buy to sell and visa versa... ;)

LTCBTC/USD Resistance broken!!!Hey there,

Altcoins have been outperforming Bitcoin lately and seem to continue to do so.

Litecoin is currently looking very bullish with a break of resistance on the BTC

and USD chart.

The USD chart is sitting at a 9 on the TD Sequential and could signal a reversal rather soon.

Also other cryptos like Ethereum and Bitcoin are sitting at 8s and 9s, which could

start reversals, consolidations or continuations.

You should definitely keep and eye out for the big altcoin players like ETH, LTC, BCH since

they are on the verge of starting strong bull ralleys (after corrections),

since key resistance has been broken.

On Litecoin we now have to see follow through on the daily timeframe and need

it to close well above resistance to confirm its breakout. There is still a chance for

a fakeout and the confirmation of a small ascending channel on LTCBTC.

Sadly LTCUSD is a bit extended currently so that gives a warning sign for a

possilbe fakeout.

Definitely stay tuned over the next days in crypto and keep and eye for altcoin plays.

Follow me on Tradingview and leave a like .

Also check out my YouTube channel: Enlightened Trading

a nd my Instagram : enlightened_trading_

if you don't want to miss out on key information.

Cheers,

Konrad