FAZ

FAZ / FAS a demonstration of ratio-tradingHere on a daily chart the ratio of the Bearish Leveraged Financial ETF to its Bullish counterpart

is showing to be in a descending parallel channel. The chart is marked with comments about

trading considerations of these ratios at a given time. At present, the FAZ is undervalued

and should be bought. On the other hand, Bullish FAS, should be either sold if positions are

held.

FAS bullish leveraged EFT on the financial sectorFAS is one of the Direxion leveraged ETFs focused on the financial sector. As can be seen on

the 15 minute the price action has had increasing volatility in the past month. Increasing

volatility is the hallmark of the megaphone pattern ( a megaphone is a cone like hand held

plastic device used in the old days before bullhorns and other things to amplify voice for

cheers). FAS may have increasing volatility because of federal actions related to rate hikes,

some bank failures and the banking industry adjusting to the " new normal" as higher rates

become increasingly integrated into the financial system while still remaining viligent

regarding a recession and its own set of complications.

To play a megaphone traders will typically set a plan to buy on the lower support trendline

hold for a short period and then sell at the upper resistance trendline. I will open a long

trade on FAS given that it is presently near to support making for a suitable risk to reward

ratio if putting a stop loss immediately below the support trendline.

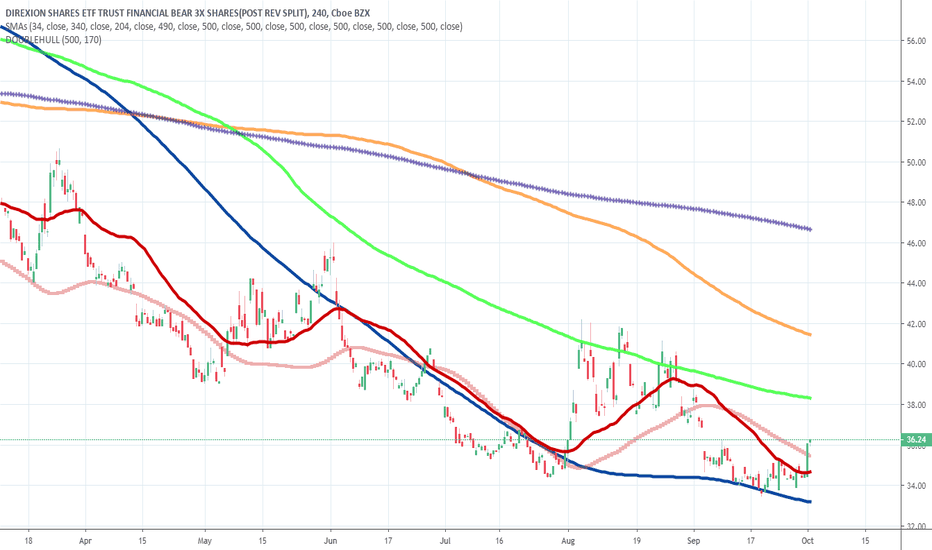

FAZ Bear Leveraged Financial Economy ETF LongAs the fed raises rates to try to throttled down inflation, the economy and the financial sector

suffer. FAZ got its catalyst today in the federal news. It is a bearish fund that will go up

while the FAS ETF will go down.

On the 2-hour chart, the price can be seen rising to crossover the VWAP anchored a month back.

It is nearly crossing over the POC line of the intermediate-term volume profile.

These are both bullish moves confirmed by a dramatic increase in trading volumes perhaps

4-5X of the moving average volume.

The overall picture is a long trade setup either with stock or strategic but more risky

call options which could 10X.

Bullish Cypher target $37Looking at this trading range, I've spotted a previous bearish cypher, a current bullish cypher. Price Action has retrace back to the Previous (B) leg of the Bearish Cypher. The Previous resistances, is currently acting as support for the D leg of the present bullish cypher.

We can confirm this w/ the bottom of the Stoch RSI.

I'm looking to buy put options on $faz ( the financial 3x bear ETF ) near the open bell Monday Morning.. I can also buy shares in the premarket of $xlf or call options. It will depend on the price action of both at that time.

Wells Fargo: Diamond Top Bearish BreakdownSInce Reversing at the PCZ of a Bearish Shark WFC has formed a very clear and defined Diamond Structure. I believe that this week we will confirmed a Bearish Breakdown of Structure and the Moving Averages in which that should mark the start of a Volatile Decline to around $20 or even lower.

FAZ Weekly - swan sighting?FAZ weekly chart presented and comparing last two price run ups to current condition.

AO appears to want to go positive. See chart for price reaction last two times this occurred on the weekly.

RSI bouncing off 18 month low with harmonics generally supporting a turn soon. Plenty of upward room for the stoch, but it does appear to be faltering a little here.

Note large volume buying of FAZ starting mid-June 2021 and a lot of overall interest in this derivative since just before the COVI-crash.

This volume isn't retail.

They say you cant' predict a black swan event but FAZ seems to be sensing something wicked.

Not financial advice.

FAZ FLOORWalks like a bottom, lets see if it talks like a bottom tomorrow - last trading of day in May.

If Wave E and A end up approximately equal Wave E hits the lower Fib. My guess is Wave E won't complete until sometime next week, but you never know.

And Woodies CCI getting frisky with a couple recent pops over 250. Look out above FAZ.

FAZ in the Summer Dog Days Till August?Not much to say here except, the Fed and the PPT have done a masterful job at what they do best..."extend and pretend". Cycles analysts indicate that a crash window is in August. EW analysts also see the overall picture remaining bearish. Reality seems to underscore that as well. This chart may fit the August crash projection.

Easiest Trade, fundamental calls for pull backWe have artificially propped up market condition with high prices and low volumes on any matrix. Financial sector is not untouched by it. Recent rally in financial sector feels more like a speculation than value investment. But we're all allowed to speculate so power to all market participants.

However the rally calls for pullback and there's a easiest trade case to be made about FAZ which is 3X leveraged Financial Bears ETF. with great upside returns due to a pullback on fundamental levels. Be aware leveraged ETF is not a product to hold for a long time so quick returns enthusiast should understand risk before buying. Good Luck !

FAZ - bounceI see no reason why anyone would short this unless they are the market maker looking for a better entry price to flip long. Everyone else, it will either go up from here on, or at the very least it will bounce back to this price from any dips. This is a relatively quick trade only, long term moves do not work on these leveraged Etfs. Tighten trailing stop more and more as it goes up to lock profits. Target I want to say $33 to $43 , but these 3x vehicles are not exact science