FCX

Opening (IRA): FCX July 18th 25/March 21st 39 Long Call Diagonal... for an 11.02 debit.

Comments: Taking a directional shot post-earnings on weakness, buying the back month 90 delta call and selling the front month 30 delta that pays for all of the extrinsic in the long, resulting in a break even that is slightly below where the underlying is currently trading.

Metrics:

Buying Power Effect: 11.02

Break Even: 36.02/share

Max Profit: 2.98

ROC at Max: 27.04%

With these, I generally look to take profit at 110% of what I put them on for and/or look to roll out the short call to reduce my cost basis/downside break even should that not be hit.

FCX Freeport-McMoRan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FCX Freeport-McMoRan prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $1.94.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FCX Freeport-McMoRan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FCX Freeport-McMoRan prior to the earnings report this week,

I would consider purchasing the 50usd strike price Calls with

an expiration date of 2024-11-15,

for a premium of approximately $1.49.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

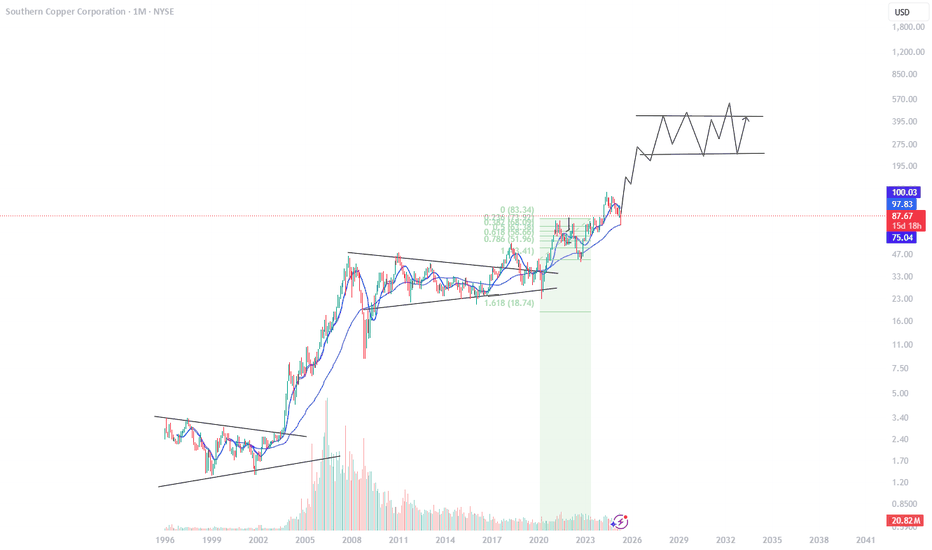

Copper & Oil : Are commodities about to surge? Copper is showing great pattern consolidation.

it appears to be putting in a daily bull flag pattern that looks poised to breakout.

If copper follows some of the other recent price action in the commodity space it makes it even more likely to surge.,

You're seeing #gold #uranium #oil and other all performing well.

Will this dampen and slow down the dis inflation expectations? Perhaps.

I am long SCCO with members and have already secured some profits today with members.

I do think there is more strength to come in copper.

Technical Analysis of Freeport-McMoRanLong Position

Entry Point: Consider entering a long position if the stock breaks above the resistance level of $51 with significant volume.

Price Target: Initial target at $55.98 (11.80% upside), with a potential extension to $60 if the bullish momentum continues.

Stop Loss: Place a stop loss below the recent support level at $47 to mitigate downside risk.

Short Position

Entry Point: Consider a short position if the stock falls below $48, indicating a break of the consolidation phase on the downside.

Price Target: Short-term target at $45, with a possible further decline to $42 if bearish momentum gains strength.

Stop Loss: Place a stop loss above the resistance level at $51 to protect against a potential bullish breakout.

The MACD level is positive at 0.21, suggesting bullish momentum.

Stochastic RSI: At 58.78, it remains neutral but is edging closer to the overbought territory, indicating potential for a slight upward move before any significant correction.

Commodity Channel Index (CCI): Neutral at -8.41, showing no significant overbought or oversold conditions.

Given the current neutral stance of various technical indicators, the market seems to be in a wait-and-see mode. Investors should keep a close watch on upcoming earnings reports and any significant news in the commodities market, particularly concerning copper and gold prices. A breakthrough in either direction from the current consolidation range could provide a clear trading signal.

MEGA TRADE: Copper Short SqueezeCopper has had a monster run to the upside.

Its clearly going to affect aspects in the economy by applying upward pressure on inflation and downward pressure on home builders and construction.

Copper surging shows resilience in the global economy but simultaneously high copper prices could cure this rushing demand.

Copper technicals are screaming a pullback, a short setup is looming.

COPPER Commodity or Junior Miner trade LONGCopper prices rise when the economy is thought to be growing and needing more electrical

infrastructure while they fall when bearish indicators might project a recession. I am

at the aluminum and finished steel subsectors as well. FCX is under consideration but as a

large cap it does not have the volatility of the junior miners. In the meanwhile COPJ, CPER and

COPX look like they are worth considering given the trend up since mid-February. The chosen

strength and trend indicators confirm the trend. This is a long trade and sector rotation play for

those to consider that are tired of tech stocks and earnings plays.

FCX potential buy setupReasons for bullish bias:

- Price has given triangle breakout

- Previously a bullish trend, it most likely would continue

- No divergence

Here are the recommended trading levels:

Entry Level(CMP): 43.46

Stop Loss Level: 35.72

Take Profit Level 1: 51.2

Take Profit Level 2: 58.94

Take Profit Level 3: Open

EXK will run as long as silver moves higher LONGEXK is a junior miner. With fixed expenses in its mining operations for the most part, margins

rise dramatically when silver is rising and the opposite is likewise applicable. This is the crux

of using junior miners as a means to profit from trending in precious metals. As a penny stock

EXK has hieghtened volatility as compared with Barrock Gold or the GLD ETF. there are other

junior miners. EXK has added 40% to its market cap in two weeks. Until the momentum of spot

silver fades, EXK will continue its momentum. I will add to my long position here and fortify

the call option position as well.

Freeport-McMoRan's Golden Surge: A Deep Dive into Q4 Earnings

Freeport-McMoRan (NYSE: NYSE:FCX ) has recently reported a robust performance in its fourth-quarter earnings, surpassing Wall Street estimates and revealing a 10% increase in gold production for the year 2023. This article explores the key highlights from Freeport's financial report, analyzes the factors contributing to its success, and delves into the company's outlook for the future.

Strong Financial Performance:

Freeport-McMoRan's Q4 net income of $388 million or $0.27 per share exceeded analysts' expectations, showcasing a resilient performance despite challenging market conditions. The company's adjusted net income of $393 million further underlines its financial strength.

Revenue Growth and Production Boost:

The company reported a revenue of $5.905 billion for the October to December period, marking a notable increase from the previous year. Freeport attributes this growth to a substantial increase in copper production, with 1.095 billion pounds mined in Q4 2023 compared to 1.070 billion pounds in the same quarter of 2022.

Gold Production Surge:

Freeport's gold production witnessed a remarkable surge, with 573,000 ounces produced in Q4 2023 compared to 472,000 ounces in the same period of 2022. The annual gold production of 1.993 million ounces in 2023 reflects a strategic focus on diversification and capitalizing on the robust gold market.

CEO's Optimistic Outlook:

Freeport-McMoRan's ( NYSE:FCX ) CEO, Richard Adkerson, expressed optimism about the company's future, emphasizing a focus on operational excellence and investment plans. Adkerson highlighted the team's success in 2023 and outlined strategic initiatives for 2024, with a commitment to enhancing the long-term value of the company's assets.

2024 Projections and Market Impact:

The company projects consistent copper production in 2024 and anticipates further growth in gold. Consolidated sales volumes are expected to reach 4.1 billion pounds of copper and 2.0 million ounces of gold. The positive outlook has contributed to a rally in NYSE:FCX stock, with a 5.9% gain and a breach above key moving averages.

Cost Management and Capital Expenditure:

Freeport-McMoRan remains committed to cost discipline, projecting an average cost of $1.60 per pound of copper in 2024. Additionally, capital expenditures are expected to decrease to $4.6 billion, reflecting prudent financial management and the nearing completion of the Indonesia smelter.

Technical Analysis and Investor Sentiment:

NYSE:FCX stock's impressive rally, reaching a 5.9% gain, indicates positive investor sentiment. NYSE:FCX is in a potential bullish trend, with the stock surpassing the converged 50- and 200-day moving averages. The emergence of a handle with a buy point at 43.42 further adds to the intrigue for potential investors.

Conclusion:

Freeport-McMoRan's ( NYSE:FCX ) stellar Q4 performance, driven by increased copper and gold production, sets the stage for a promising 2024. CEO Richard Adkerson's optimistic outlook, coupled with prudent cost management and strategic initiatives, positions the company for sustained growth. As global economic conditions evolve, Freeport-McMoRan's success becomes not only a testament to its operational excellence but also a beacon for investors seeking opportunities in the mining sector.

FCX Freeport-McMoRan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FCX Freeport-McMoRan prior to the earnings report this week,

I would consider purchasing the 38usd strike price at the money Puts with

an expiration date of 2024-2-2,

for a premium of approximately $1.29.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Copper Equities Breaking Down, Is tthe economy?Copper is very close to losing criyical support.

If this daily chart trendline breaks, there is a big move down into the next support.

Copper Equity stocks are already teing us aa likely breakdown in the commodity is coming.

Is this base metal signaling weaker economic demand & growth?

FCXThe technical pattern is easy to understand the initial shock to lower prices in the $34 area bottom and the bounce off the bottom and now we must digest.

The fundamental analysis is also very easy to understand, with recession we see lower copper demand and hence prices.

B ut we are dealing with the largest copper miner in the world and we should have expected the drop and when the turn came we should have bought. We should ride the trend until the MA crosses over.

FCX:longterm upchannel & shortterm downchannel; bounce soonFCX is the largest copper producer & copper is very impt to the economy. It is making a longterm upchannel & a shortterm downchannel & the 2 will cross path soon at their lows somewhere below 40.

Below 40 will be a great place to start accumulating & then trade the range between 40 & 50.

Geopolitical tensions & China lockdown may drive price below 40 temporarily but demand will soon kick in.not trading advice

FCX: Cup and Handle BreakoutFCX: Original setup for "cup and handle" pattern shared on February 11, 2022 (see previous ideas) is now engaged with price action crossing threshold of 46.25. FCX has been basing on intraday and daily time frames with bull flags consistent in price action. Expect strong buying action as copper has become a sector where liquidity has seen benefits due to commodity price inflation. Sentiment: Bullish continuation// ATR: 1.85, Beta 1.99