FedEx: Balancing Act or Precarious Gamble?Recent market activity highlights significant pressure on FedEx, as the logistics giant grapples with prevailing economic uncertainty. A notable drop in its stock price followed the company's decision to lower its revenue and profit outlook for fiscal year 2025. Management attributes this revision to weakening shipping demand, particularly in the crucial business-to-business sector, stemming from softness in the US industrial economy and persistent inflationary pressures. This development reflects broader economic concerns that are also impacting consumer spending and prompting caution across the corporate landscape.

In response to these domestic headwinds, FedEx has adopted a more conservative operational stance, evidenced by a reduced planned capital spending for the upcoming fiscal year. This move signals an emphasis on cost management and efficiency as the company navigates the current economic climate within its established markets. It suggests a strategic adjustment to align spending with the revised, more cautious revenue expectations.

However, this domestic caution contrasts sharply with FedEx's concurrent and ambitious expansion strategy in China. Despite geopolitical complexities, the company is making substantial investments to enlarge its footprint, building new operational centers, upgrading existing gateways, and increasing flight frequencies to enhance connectivity. This dual approach underscores the central challenge facing FedEx: balancing immediate economic pressures and operational adjustments at home while pursuing a long-term, high-stakes growth initiative in a critical international market, all within an uncertain global environment.

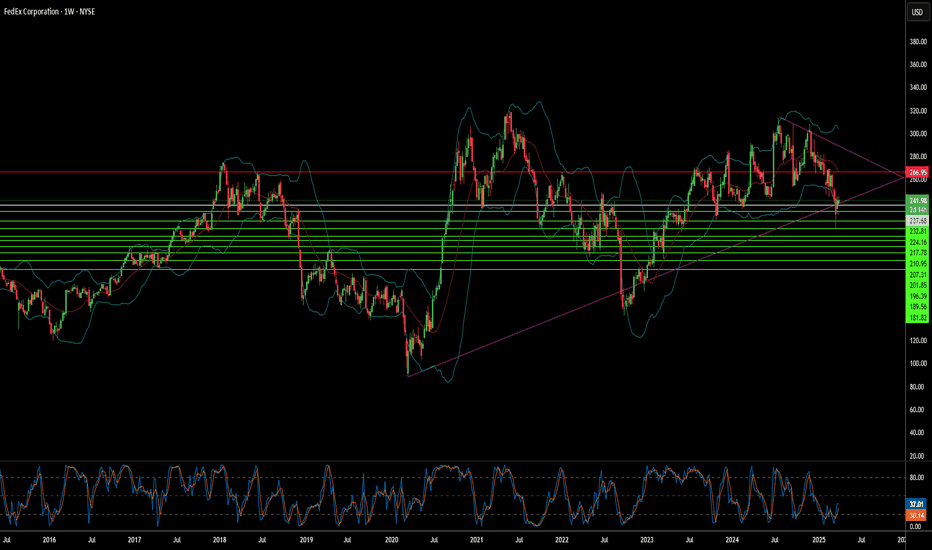

FDX

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t sold FDX before the previous earnings:

Now analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 240usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $12.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FEDEX AT MY LEVEL DEC17 2024Last post about FEDEX when it was trading around 284 was to wait for 275s. Here we are at 275 &expect to hit all time high or at least 315 asap.

I don't trade news so I am not worried about earnings.

I am a price action trader.

Trade safely as per you RR & risk tolerance levels.

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t bought FDX before the previous earnings:

Now analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 270usd strike price Puts with

an expiration date of 2024-9-20,

for a premium of approximately $4.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t bought FDX calls ahead of the previous earnings:

Now analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 260usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $19.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FedEx Stock Soars on Strong Results, Potential SpinoffFedEx's (FDX) fiscal Q4 results exceeded analyst expectations, propelling its stock towards a potential all-time high. This momentum is driven by several key factors:

Margin Expansion via DRIVE Program: Despite tepid revenue growth, FedEx's DRIVE program delivered significant cost reductions, leading to margin improvement across segments.

Cautiously Optimistic Guidance: The company forecasts low-to-mid single-digit revenue growth for fiscal 2025, accompanied by continued margin expansion. This cautious optimism reflects strategic initiatives aimed at maximizing profitability.

Analyst Revisions and Price Target Increases: The success of the DRIVE program and FedEx's shift toward profitable growth have garnered positive analyst revisions, including price target increases.

Potential Spinoff of FedEx Freight: The company's ongoing evaluation of FedEx Freight's role within its portfolio has sparked speculation about a potential spinoff. This scenario has the potential to unlock significant shareholder value.

Looking forward, FedEx's fiscal 2025 outlook remains optimistic. The company projects low-to-mid single-digit revenue growth and adjusted EPS of $20.00-$22.00. Furthermore, FedEx plans to repurchase $2.5 billion in stock and achieve its $4 billion cost-cutting target through the DRIVE program.

In conclusion, FedEx's strategic focus on operational efficiency, the success of the DRIVE program, and the potential for a FedEx Freight spinoff combine to create a compelling investment opportunity. This confluence of factors positions FDX for a strong year with the potential to reach new highs.

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t bought FDX ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 250usd strike price Calls with

an expiration date of 2024-6-21,

for a premium of approximately $16.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FedEx Surprises Wall Street with Strong EarningsFedEx ( NYSE:FDX ) astounded Wall Street with better-than-expected third-quarter earnings for fiscal 2024, despite revenue falling slightly short of expectations. The shipping giant's robust performance comes amidst a backdrop of economic uncertainty and volatile macroeconomic conditions. As FedEx ( NYSE:FDX ) maintains its outlook for the remainder of the fiscal year, investors are closely monitoring the company's negotiations with the United Postal Service (USPS) and its positioning within the competitive parcel delivery landscape.

FedEx ( NYSE:FDX ) delivered a pleasant surprise to investors as it announced its third-quarter earnings for fiscal 2024, surpassing analysts' expectations despite challenges in the global economy. The company reported earnings of $3.86 per share, marking a significant 13% increase compared to the same period last year. However, revenue dipped by 2% to $21.74 billion, slightly missing Wall Street's projections of $21.95 billion.

The decline in revenue was primarily attributed to lower fuel surcharges across all transportation segments and reduced volumes in FedEx Express and FedEx Freight divisions. Despite these headwinds, FedEx's package delivery business saw a marginal increase in revenue, while the freight segment experienced a modest decline.

Looking ahead, FedEx ( NYSE:FDX ) remains cautious about the economic landscape, anticipating ongoing volatility that could affect customer demand and yield growth. The company expects revenue to face pressure from macroeconomic conditions, prompting it to narrow its earnings outlook for the full fiscal year to $17.25-$18.25 per share. Additionally, FedEx ( NYSE:FDX ) is in the midst of negotiating a new multi-year contract agreement with the USPS, underscoring its commitment to strategic partnerships and operational efficiency.

Investors welcomed the positive earnings surprise, driving NYSE:FDX stock up by 7.75% during Friday's trading session. The stock's performance in March indicates a potential upward trajectory, as FedEx ( NYSE:FDX ) seeks to consolidate gains and navigate through market uncertainties. Analyst sentiment remains mixed, with some expressing caution while others highlight the company's resilience amidst competitive pressures and evolving consumer preferences.

FedEx's ( NYSE:FDX ) strong earnings report contrasts with the challenges faced by its rival UPS, which recently announced workforce reductions and provided guidance below analyst expectations. Both FedEx and UPS are grappling with increasing competition from e-commerce behemoth Amazon, which has emerged as a formidable player in the parcel delivery space.

FedEx has posted a double top.FedEx Corporation - 30d expiry - We look to Sell at 269.78 (stop at 277.78)

Posted a Double Top formation.

We look for a temporary move higher.

The trend of lower lows is located at 270.

270.46 has been pivotal.

We are trading at overbought extremes.

Our profit targets will be 249.78 and 245.78

Resistance: 250.00 / 258.00 / 270.95

Support: 241.04 / 234.00 / 230.00

Please be advised that the in formation presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group

FDX primed to reward traders 20%FedEx Corp. (FDX) presently testing meaningful support, able to absorb weekly selling pressures.

From here, (FDX) can gain bullish momentum and turn higher into later year, eliciting gains of 20% over the following 3-5 months.

Inversely, if a weekly settlement below this support level occurs, (FDX) would be placed into a sell signal where losses of 20% would be expected over the same time horizon.

FEDEX ignoring the market jitters & offers a strong opportunityFedex opened higher today following the favorable fundamentals, ignoring the overall weakness on the market in the Fed aftermath.

Two days ago it achieved a rebound on the MA100 (1d), exactly at the bottom of the Channel Up that started exactly 1 year ago.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 292.00 (-0.382 Fibonacci extension, same as the April 6th High).

Tips:

1. The MACD (1d) just formed a Buy Cross. Every such formation inside the Channel Up has started a rally to a Higher High.

Please like, follow and comment!!

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t bought FDX here:

or ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of FDX FedEx prior to the earnings report this week,

I would consider purchasing the 220usd strike price Puts with

an expiration date of 2023-11-17,

for a premium of approximately $1.96.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Buying FedEx at previous resistance.FedEx Corporation - 30d expiry - We look to Buy at 232.11 (stop at 224.61)

Daily signals are bullish.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

A lower correction is expected.

Bespoke support is located at 232.

This stock has seen good sales growth.

Our profit targets will be 250.11 and 253.11

Resistance: 250.08 / 255.00 / 260.00

Support: 245.09 / 238.00 / 232.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t sold FDX here:

Then analyzing the options chain of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 250usd strike price Calls with

an expiration date of 2023-7-21

for a premium of approximately $3.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it!

4/6 Watchlist + NotesInitial Thoughts: Incredible day, markets closed friday, minimal inside day setups

SPY - Mentioned yesterday that we were bearish going into today for a number of reasons. Early on in the session we saw SPY push up slightly only to be rejected by a downward trend line created in premarket. We hit our downside target at the mid 406 level and even pushed lower than that before making an afternoon reversal. We also hit our lower trend line on the broadening formation created yesterday on the daily. Overall played out perfectly, only could have asked for more downside to 404 if anything

TOMORROW: Due to how we closed and previous daily patterns similar to the one we're in now, I am still slightly bearish going into tomorrow, but I think we need to be cautious. With this week being a 4 day trading week, and being at the beginning of a potential daily/weekly reversal point, I think we could see some consolidation just as easily as we could see more downside. Full disclosure, I am not extremely confident in us seeing more downside tomorrow, but it makes the most sense based on our situation. Ideally I would like to see a move lower to the 404 area before consolidating. OVERALL BIAS: Cautiously Bearish

Watchlist + Bias:

BABA 2-1 Daily: Slightly Bearish (Only inside day to show up on the scanner)

SQ - 3-1 Weekly: Neutral (Still has not broken out)

DOCU - 1-1-2D Weekly: Bearish (Finally broke out of inside week setup. Watching for continuation going into tomorrow and next week)

SHOP - 50% Rule Weekly: Bearish (Finally saw the downside we wanted the other day due to a failed 2U reversal today. Looking to see SHOP hit 44.01 between tomorrow and next week)

Main Watch:

SQ - Not a crazy good setup, but definitely interested with the weekly chart. We still remain within our inside week setup. I am watching tomorrow to see if we can breakout in either direction to pick up a swing position for next week. I would prefer downside due to my bias with SPY, but I will be open to playing upside as well since SQ is set up to do well in either direction. It is worth noting we made a failed 2D on the daily, which gives us a small bullish bias for tomorrow on SQ, but the past 4 days have been failed 2s, so that may be irrelevant. Entry Long: above 68.24. Upside Targets: 69.74, 70.53, 72.64. Entry Short: Under 66.62 Downside Targets: 65.81, 64.56, 63.51, 61.55

Yesterday's Main Watch:

DOCU: What a solid trade. Opened at our short entry, and then dropped steadily throughout the day until reversing with SPY. Cons ran well over 400% from entry (.21 -> 1.06 If I remember correctly). I hope you all can take this play and learn from it, specifically how powerful trades can be if you have a crazy setup like we did with the double inside week. Hope everyone was able to make some money on this one.

Watchlist Stats:

3/3 SPY predictions

3/4 Main Watch Plays

Top Winner: DOCU (400%+)

Personal Stats:

2/3 On The Week

Overall: Green

- Completely turned the week around for myself after being barely red from monday's session. I credit this to patience and discipline. Most traders would be super eager to start trading again after a losing day. Having patience and waiting for that right trade to turn things around is absolutely key to mastering emotions and being successful in trading. All it takes is 1 good trade per day. Don't overtrade (I know it is very easy to do, and I used to struggle with this), have patience, and most importantly, be comfortable with taking losses, not conditioned to taking losses.

Tomorrow will be tricky if I had to guess. Trade smart, and be careful as it is the end of the trading week. And if I am unable to make monday's watchlist until later this weekend, enjoy the holiday for those who celebrate it!

4/4 Watchlist + NotesSPY - We were spot on with our analysis going into today's session. Last night I mentioned that we had a strong close on the daily and weekly and that I wanted to see us push higher. We also stayed within a 1% range today as I had also hoped to see (.71% range total today). Didn't quite get the movement we were hoping for (Inside Day), but we still were accurate otherwise. We closed green on the day and made a smaller green candle than we did Friday, which signals a few things for me. Here are all the considerations I have currently for my prediction for tomorrow:

1) Slightly overextended on the daily + close to exhaustion risk, (Bearish)

2) Still have strong momentum on the daily and weekly, (Bullish)

3) We are nearing the top of a broadening formation created a few weeks back, (Slightly Bullish)

4) Finished green today with a healthy looking green candle (Bullish)

With all of this in mind, I think that we now need to target 412-413 range sometime this week. There is really nothing stopping SPY from continuing to run other than the fact that it is in extended territory. For tomorrow my prediction is simple: I am slightly bullish, but understand that we can move hard in either direction tomorrow. Tomorrow's movement will be heavily influenced by 2 things: Whether we gap up or down during PM, and whether we break today's high or low first. If we break today's high first (Not including PM movement) then I think 412.91 is our target for tomorrow. If we break the low first, then I believe we could see somewhere in the 406.50-407.50 range. The 3rd scenario I can see happening is we take out today's high and then proceed to dump and take out today's low, forming an engulfing day. I think the first two scenarios are the most realistic, but they are all valid scenarios I could see happening tomorrow. Overall: Skeptically Bullish

Watchlist + Bias:

SHOP - 3-1 Daily: Bullish

QQQ - 2-1 Daily: Neutral

MSFT - 2-1 Daily: Neutral

PYPL - 2-1 Daily and Weekly: Slightly Bullish

DOCU - 2-1 Daily and 3-1-1 Weekly: Neutral

Main Watch: SHOP and DOCU

SHOP - 3-1 Daily with a huge gap that is partially filled to the upside. I am hoping to break to break today's high tomorrow and push higher. I think it has really good momentum to keep pushing higher. Would love to target 48.57 tomorrow. Will maybe play downside too, but mostly just focused on the upside move

DOCU - This one still hasn't broken out of the inside week setup. it is now actively a 3-1-1-1, which is just unheard of for the weekly chart. Im open to playing either side. I think with this one being in a 2-1 daily, we will get to see which direction we will finally move in for the next few days/weeks. Considering swinging as well. Preferably want to play upside, but I will take what I can get.

Yesterday's Main Watch:

SQ - (Status:) Winner (Personally Trade?) Yes

we opened under our put entry, but the play was still valid from open in my opinion. Cons from my trade peaked around 23% and I actually ended up taking a small loss because I was looking for a better entry to swing puts, but ended up not liking the swing setup, so I just took a small loss on my starter position + the extra cons I added when averaging down. Overall was in for about 40% of my target position size, and took about a 12% loss on that which translates to a roughly 5% loss had it been a normal position for me. I still count this as a winner for the list because it saw solid gains from a very readable entry. Had I been day trading and not looking for a swing entry, I would have had a different outcome, but at the end of the day, I had a plan and followed it, which is something I can't and won't be upset over. Weekly is still not broken out of, so SQ remains on my personal watchlist for the rest of the week. I wanna see what tomorrow holds for SQ before considering a new position.

Watchlist Stats:

1/1 Spy Predictions

1/1 Main Watch Plays

Top Winner: SQ (23%+)

Personal Stats:

0/1 On Trades This Week

Overall Green/Red: Red (extremely small). Early in the week. Can easily come back from today's small loss.

Trade Smart Tomorrow!