THE WEEK AHEAD: MU, FDX EARNINGS; XOP, IWM, EWZEARNINGS:

MU (36/64/11.7%) announces earnings on Monday after the close. Pictured here is a 19 delta short strangle in the July expiry, paying 1.55.

FDX (46/59/11.4%) announces Tuesday after the close, with the 20 delta July 17th 115/147 paying 4.56.

EXCHANGE-TRADED FUNDS ORDERED BY RANK AND SCREENED FOR 30-DAY >35%:

EWW (59/44/12.6%)

EWZ (47/63/17.7%)

XLE (45/52/16.0%)

GDXJ (43/60/17.7%)

SMH (37/42/12.0%)

GDX (36/45/14.5%)

XOP (32/70/20.2%)

USO (13/67/16.7%)

Would probably go out to August here (54 days) ... . Looked at through the lens of what the short straddle is paying as a function of share price, it looks like I should be selling premium in XOP (20.2%), followed by EWZ (17.7%) and/or GDXJ (17.7%).

BROAD MARKET ORDERED BY RANK:

IWM (57/45/12.7%)

QQQ (38/32/<10%)

EFA (37/29/<10%)

SPY (37/34/<10%)

Small caps continue to be where the juice is at.

IRA DIVIDEND-GENERATORS

IYR (53/40/11.7%)

XLU (50/33/<10%)

EWZ (47/63/17.7%)

EWA (46/40/11.2%)

EFA (37/29/<10%)

SPY (37/34/<10%)

HYG (35/20/<10%)

EMB (20/18/<10%)

TLT (20/19/<10%)

EWZ offers both better better premium as a function of stock price than IYR at the moment, as well as slightly higher yield (3.66% for the former; 3.50% for the latter). Since I've already laddered out IYR, I may dip at the EWZ well with the 16 delta short put paying .70 in August at the 22 strike, .84 in September at the 21 ... .

FDX

FedEx: Coronavirus Aggravated Growing Competitiveness IssuesFedEx faced sharp drop in international operations in 2019 after China’s claim that the courier delivered Huawei’s correspondence elsewhere. As Trump policy induced international trade issues impacting FedEx amplified by new disaster for FedEx, coronavirus , FedEx will grossly disappoint by its March 18, 2020 earnings report

$FDX is in an Important Zone $FDX has had a harsh year:

-From ATH of 274.66 in Jan 2018

-To a short term low of 137.78 in Oct 2019

As you can see, on the monthly chart, we have now touched the (almost) 11-year trend line from 2009:

Transports have been getting the worse end of the stick for a while, and it is right around the holidays - when a lot of shipping happens. I don't want to have a bias either way here yet - but, I can tell you that this is an important zone. You can either expect large buyers to start refueling in this zone, or at least testing the waters.

However, from a fundamental standpoint, $FDX has gotten worse in this time frame - and if large buyers don't step in here, you're likely to see another large down wave.

To zoom in a bit, here is where we are on the weekly:

As you can see, we have touched the (almost) 11-year trend line in a tweezer bottom ever so slightly, and have been looking for direction since in this rectangle.

From this chart, I think it's important to note:

-All 3 of the last large red weekly candles have had the highest volume since 2009 ,

-2 of these weeks recorded all-time high volumes

I do not think this has shown enough strength yet at these levels to warrant a long, however, I am eying this level to show strength by gapping back up into this rectangle, or getting rejected - probably having to retest the (almost) 11-year trend line again:

Will continue to add to this as time goes on...

Feel free to let me know your thoughts, or share any input you have on the fundamental or technical side of things - love to learn and grow with everyone!

This will likely take 2-3 months to pan out, but it could be a once in a decade setup, whichever way the market decides to push it. Keep your eyes open on this one.

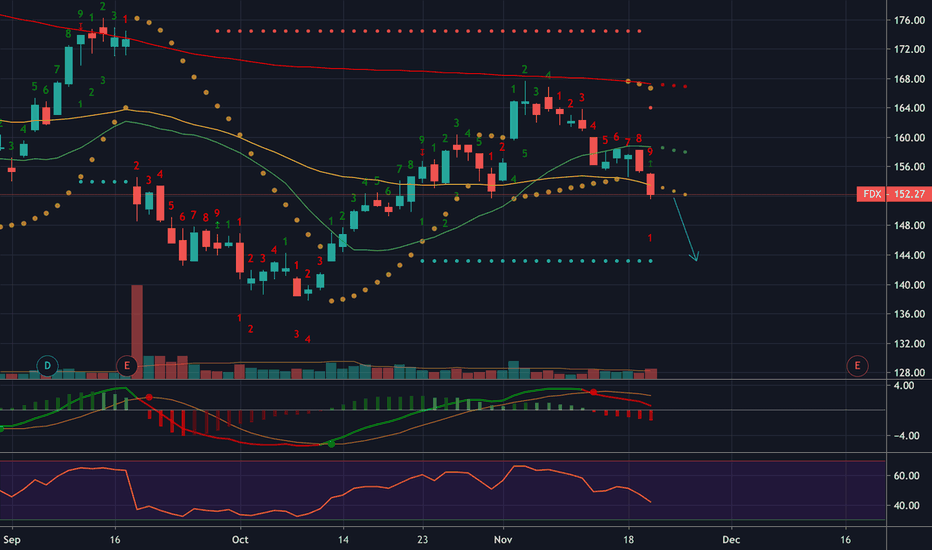

FDX - DAILY CHARTHi, today we are going to talk about FedEx and its current landscape.

FedEx is poised to receive increasing attention from the market as relevant events are taking place, the company reports its earnings on Tuesday after the market had closed. Despite the slow year, this report could be FedEx's chance to gain some momentum, also after it didn't renew its contract with Amazon early this year is likely looking for partnerships with large retailers like Walmart and Target, which could drive a change of landscape for the company.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

THE WEEK AHEAD: FDX, MU, NKE EARNINGS; CHWY, /NG, VIXEARNINGS:

FDX (57/37): Tuesday, After Market Close.

MU (23/46): Wednesday, After Market Close.

NKE (24/25): Thursday, After Market Close.

Pictured here is an MU January 17th 46/57.5 short strangle paying 1.53 (.76 at 50% max) with 1 standard deviation break evens and a delta/theta metrics of .32/5.34.

Alternatively: a defined risk play collecting one-third the width of the wings: the January 17th 42/47/55/60, paying 1.69.

Neither FDX nor NKE are paying as well premium-wise relative to the cost of their shares, but the FDX 150/180 18 delta put/21 delta call short strangle in the January cycle is paying 3.88; the NKE 90/105 14 delta put/18 delta call short strangle, 1.15.

Alternative defined risk plays: the FDX January 17th 145/150/180/185 iron condor, 1.50 credit (not quite one-third the width of the wings, but you have to deal with some lack of granularity in the strikes with five-wides); the NKE January 17th 85/95/100/110 "forced goofy" iron condor, 3.30 credit (one-third the width, but a "forced goofy,"* again due to lack of strike granularity).

CHWY (--/50) gets an honorable mention due to lockup expiration on Wednesday. With it finishing on Friday above the $22 initial public offering price and approximately 87% of float subject to lockup, it could make for an interesting premium selling play and/or directional shot, particularly since 30-day remains high after earnings.

EXCHANGE-TRADED FUNDS:

TLT (31/12)

EEM (28/16)

FXI (19/18)

SMH (15/25)

USO (14/29)

Expiries in Which At-the-Money Short Straddle Pays Greater than 10% of the Value of the Underlying:

TLT: January '21

EEM: June

FXI: June

SMH: May

USO: February

BROAD MARKET:

SPY (7/12)

IWM (0/15)

QQQ (0/15)

Expiries in which the at-the-money short straddle pays greater than 10% of the underlying are all out in September. Ugh. No bueno.

FUTURES:

/NG (58/57)

/ZS (36/16)

/ZC (25/21)

/6C (23/5)

/6B (22/11)

With /NG 30-day at 57 and trading at a seasonal low, this may be a second opportunity to take a dip at a bullish assumption shot, assuming peak seasonality in January or February.

VIX/VIX DERIVATIVES:

VIX closed Friday at 12.63, with the /VX futures contracts trading at 15.22 in January, 16.70 in February, 17.07 in March, and 17.60 in April. Consequently, term structure trades remain viable for the February, March, and April, generally using spreads with a break even at or near where the futures contract is currently trading (e.g., VIX February 19th 16/18 short call vertical, .65, break even of 16.65 versus February /VX at 16.70).

* -- A "forced goofy." Strike selection is "forced" to get one-third of the width in credit, "goofy" because forcing the short option strikes leads to bigger risk than you might ordinarily want to devote to the play. There is nothing particularly wrong with a "forced goofy," as long as you understand that it's a risk 6.70/reward 3.30 play versus your usual play which might be risk 3.33/reward 1.67 play, for example.

EMA200 Daily will send Fedex down!!!!The last cross of EMA200 was almost one year ago. Since then everytime price went close the EMA it decreased importantly. RSI levels as well are getting high and MACD stopped going up, all of them together suggest a decrease in price in the upcoming days. I will expect to see FEDEX at least at 160 by October 2019, with a Stop Loss in 181 with a R:R of 2:1 for this trade.

Good luck traders!!!!

FDX buy setupFDX’s innovation outlook is trending up based on a current score of 73 out of 99, outperforming sector average. Jobs growth over the past year has decreased and insiders sentiment is negative. FDX is an Average Performer in terms of sustainability. It is most exposed to Airbus SE as its supplier. Over the past 4 quarters FDX beat earnings estimates 2 times and it pays dividend lower than its peers.

For more analysis and articles visit our website .

FDX approaching support, potential for a bounce!

FDX is expected to drop to 1st support at 169.76 where it could potentially react off and up to 1st resistance at 159.20.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully

understand the risks.